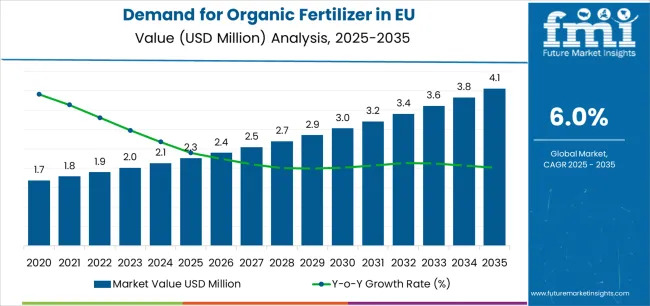

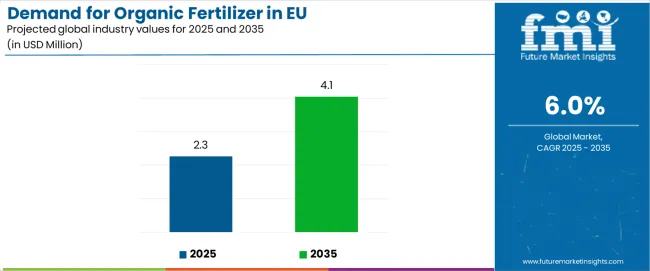

The demand for organic fertilizer in the EU is projected to grow from USD 2.3 million in 2025 to USD 4.1 million by 2035, advancing at a CAGR of 6.0%. This steady trajectory highlights a clear shift toward naturally derived fertilizers across the region, supported by rising organic farming practices and stricter standards around chemical-free agricultural inputs. Among the product categories, the plant-based segment is expected to lead with a 49.0% share in 2025, reflecting an expanding preference for plant-derived nutrition sources. In terms of application, the fruits and vegetables segment is anticipated to account for 39.0% of the overall crop type share, emphasizing the growing importance of organic fertilizers in high-value horticultural production.

Sales of organic fertilizers across the European Union are forecast to increase from USD 2.3 million in 2025 to USD 4.1 million by 2035, recording an absolute increase of USD 1.8 million. This represents a total growth of 78.3% during the forecast period, supported by consistent adoption of organic cultivation techniques and rising consumer inclination toward certified organic produce. With this expansion, the industry is set to grow by approximately 1.78X, showing how both mature and emerging farming regions within Europe are investing in sustainable soil management practices. Policies encouraging natural nutrient cycles and restrictions on chemical fertilizers are further strengthening the case for broader use of organic alternatives.

The demand outlook is also influenced by growing consumer awareness about health, nutrition, and transparency in food sourcing. European buyers increasingly favor produce cultivated without synthetic fertilizers, and this trend is expected to drive strong adoption of organic fertilizer inputs, particularly in fruits, vegetables, and specialty crops. Farmers across Western Europe, led by countries such as Germany, France, Italy, and Spain, are among the largest adopters, while Eastern European states are gradually increasing their reliance on organic inputs due to supportive funding initiatives under the Common Agricultural Policy. Soil degradation concerns, coupled with the need for long-term fertility restoration, have also positioned organic fertilizers as a critical part of farm-level nutrient strategies.

Product innovation in the sector is leaning toward enhanced nutrient-release efficiency, microbial enrichment, and compatibility with diverse soil conditions. Manufacturers are experimenting with plant-based raw materials to improve both nutrient content and application flexibility. The integration of bio-stimulants is further enhancing soil health, positioning organic fertilizers as more than just nutrient supplements but as long-term soil improvers. The use of organic fertilizers in vineyards, horticulture, and premium produce categories is becoming central to the premiumization of European agriculture.

By 2030, growth is expected to be particularly notable in horticulture and fruit crops, where organic labeling creates added market value. With regulatory backing, consumer demand, and innovation in plant-based blends, the EU organic fertilizer sector is expected to remain a critical enabler of resilient and naturally cultivated food production between 2025 and 2030.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.3 million |

| Forecast Value in (2035F) | USD 4.1 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

Between 2025 and 2030, EU organic fertilizer demand is projected to expand from USD 2,262.5 million to USD 3,004.7 million, resulting in a value increase of USD 742.2 million, which represents 42.0% of the total forecast growth for the decade. This phase of development will be shaped by accelerating organic farmland conversion, supporting increased organic input requirements, growing consumer preference for organic produce, driving farmer adoption, and expanding retail availability of organic fertilizers, enabling broader industry penetration. Manufacturers are expanding their production capabilities to address the evolving preferences for plant-based, organic fertilizers derived from crop residues and composted materials, as well as animal-based products that provide balanced nutrient profiles. Additionally, they and developing liquid formulations that enable precise application and rapid nutrient availability.

From 2030 to 2035, sales are forecast to grow from USD 3,004.7 million to USD 4,030.9 million, adding another USD 1,026.2 million, which constitutes 58.0% of the overall ten-year expansion. This period is expected to be characterized by further expansion of organic certification across additional crop types, integration of advanced composting and processing technologies improving product consistency, and development of specialized organic fertilizer blends targeting specific crop nutritional requirements. The growing emphasis on soil health and increasing regulatory support for organic agriculture will drive demand for diverse organic fertilizer products that deliver effective crop nutrition while supporting sustainable farming systems and environmental objectives.

Between 2020 and 2025, EU organic fertilizer sales experienced robust expansion at a CAGR of 6.0%, growing from USD 1,687.7 million to USD 2,262.5 million. This period was driven by increasing organic farmland area across European countries, rising consumer willingness to pay premium prices for organic produce, and growing farmer recognition of soil health benefits associated with organic fertilization practices. The industry developed as agricultural input suppliers and specialized organic fertilizer producers recognized the commercial potential of organic agriculture expansion. Product quality improvements, nutrient content standardization, and application technology advancements began establishing farmer confidence and mainstream acceptance of organic fertilizers as viable alternatives to synthetic options.

Industry expansion is being supported by the rapid increase in certified organic farmland across European countries and the corresponding demand for approved, effective, and environmentally sustainable fertilization solutions meeting organic certification standards. Modern organic farmers rely on organic fertilizers as essential nutrient sources for crop production, soil organic matter building, and biological activity enhancement, driving demand for products that deliver adequate nutrient availability, support gradual nutrient release patterns, and maintain organic certification compliance. Even moderate organic farming adoption, such as converting portions of conventional farmland, transitioning to organic vegetable production, or pursuing organic certification for specialty crops, drives comprehensive organic fertilizer utilization to maintain optimal crop yields and support certification requirements.

The growing awareness of soil health importance and increasing recognition of synthetic fertilizer environmental impacts are driving demand for organic fertilizers from certified suppliers with appropriate organic certification documentation and quality assurance capabilities. Regulatory authorities are increasingly establishing clear guidelines for organic input approval, nutrient content labeling requirements, and quality specifications to maintain agricultural productivity and ensure product consistency. Agricultural extension research and agronomic field trials are providing evidence supporting organic fertilizer effectiveness and soil health benefits, requiring specialized composting processes and standardized production protocols for consistent nutrient content, appropriate moisture levels, and minimal contaminant presence, including heavy metal testing and pathogen reduction validation.

Sales are segmented by source (origin), form (physical state), crop type (application), and country. By source, demand is divided into plant-based, animal-based, and mineral/organic-mineral. Based on form, sales are categorized into dry and liquid. In terms of crop type, demand is segmented into fruits and vegetables, cereals and grains, oilseeds and pulses, and other crops. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The plant-based segment is projected to account for 49% of EU organic fertilizer sales in 2025, establishing itself as the dominant source category across European industries. This commanding position is fundamentally supported by plant-based materials' widespread availability from agricultural residues and composting operations, regulatory acceptance across all organic certification programs, and favorable environmental profile avoiding animal agriculture associations. The plant-based format delivers exceptional sustainability credentials, providing farmers with renewable nutrient sources that facilitate carbon sequestration in soils, support circular economy principles through waste valorization, and deliver balanced organic matter enrichment supporting soil structure improvement.

This segment benefits from established composting infrastructure processing crop residues and municipal organic waste, well-developed quality standards ensuring consistent product characteristics, and extensive availability from multiple European producers who maintain organic certification and quality documentation. Additionally, plant-based organic fertilizers offer versatility across nutrient profiles, including composted plant materials providing balanced NPK ratios, specialized formulations targeting specific crops, and enriched products incorporating mineral supplements, supported by proven application methods accommodating diverse farm scales and crop types.

The segment is expected to increase share modestly to 50.0% through 2035, demonstrating continued growth as plant-based sources expand through improved collection infrastructure and processing capabilities throughout the forecast period.

.webp)

Dry form is positioned to represent 63% of total organic fertilizer demand across European industries in 2025, declining modestly to 60% by 2035, reflecting the segment's dominance as the traditional organic fertilizer format. This considerable share directly demonstrates that dry organic fertilizers including composted materials, pelleted formulations, and granulated products represent the predominant form, with farmers utilizing dry products for broadcast application, incorporation into soil, and long-term nutrient release supporting crop production cycles.

Modern organic farming operations increasingly rely on dry organic fertilizers for their convenience in handling and storage, driving demand for products optimized for mechanical spreading equipment, appropriate moisture content preventing handling issues, and consistent particle size enabling uniform field application. The segment benefits from established production infrastructure including composting facilities and pelletizing operations, proven application equipment compatibility supporting existing farm machinery, and cost-effective logistics enabling economic distribution across agricultural regions.

The segment's declining share reflects faster growth in liquid organic fertilizers offering precision application advantages and rapid nutrient availability, while dry products maintain substantial absolute volume growth supporting organic farming expansion throughout the forecast period.

EU organic fertilizer sales are advancing rapidly due to accelerating organic farmland expansion, growing consumer demand for organic food products, and increasing policy support for sustainable agriculture. However, the industry faces challenges, including supply inconsistency from seasonal production variations and raw material availability constraints, price premiums compared to synthetic fertilizers limiting adoption among cost-sensitive farmers, and logistics complexity associated with bulky, low-nutrient-density products. Continued innovation in processing technologies and nutrient enhancement remains central to industry development.

The rapidly accelerating conversion of conventional farmland to certified organic production across European agricultural regions is fundamentally transforming fertilizer industries from primarily synthetic to increasingly organic inputs, creating substantial growth opportunities for organic fertilizer suppliers serving expanding organic farm operations. Advanced organic farming systems requiring complete replacement of synthetic fertilizers with approved organic alternatives drive systematic increases in organic fertilizer consumption as each hectare converted requires appropriate organic nutrient management programs. These organic conversion programs prove particularly transformative for high-value crop production, including organic vegetables commanding premium retail prices, organic fruit orchards serving growing consumer demand, and organic specialty crops where certification provides significant industry differentiation.

Modern organic fertilizer producers systematically incorporate improved processing methods, including controlled composting systems ensuring pathogen reduction and consistent product quality, pelletization technologies improving handling characteristics and nutrient density, and enrichment processes incorporating approved mineral supplements enhancing nutrient profiles. Strategic integration of advanced processing capabilities enables manufacturers to differentiate products through consistent quality specifications, improved physical properties supporting mechanical application, and enhanced nutrient content reducing application volumes and transportation costs. These processing improvements prove essential for industry expansion, as product consistency and convenience directly influence farmer adoption decisions and application efficiency.

European farmers and agricultural policymakers increasingly prioritize soil health maintenance and regenerative agriculture practices featuring organic matter building, biological activity enhancement, and long-term soil fertility improvement aligning with sustainable farming objectives. This soil health emphasis enables organic fertilizers to differentiate beyond simple nutrient delivery through organic matter contributions, beneficial microorganism support, and gradual nutrient release patterns supporting soil biological processes. Soil health positioning proves particularly important for arable farming applications where long-term productivity depends on maintaining soil organic matter levels, permanent crop systems requiring sustained soil fertility, and degraded soils benefiting from organic matter additions.

| Country | CAGR % |

|---|---|

| Netherlands | 6.5% |

| Spain | 6.4% |

| Italy | 6.0% |

| Rest of Europe | 6.0% |

| France | 5.9% |

| Germany | 5.8% |

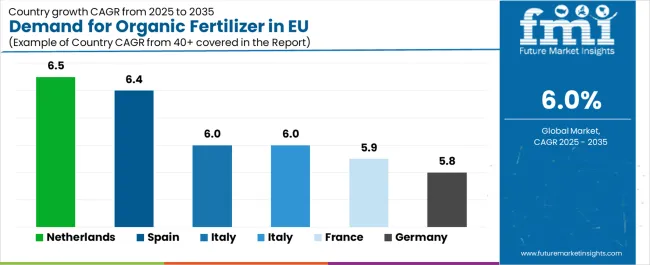

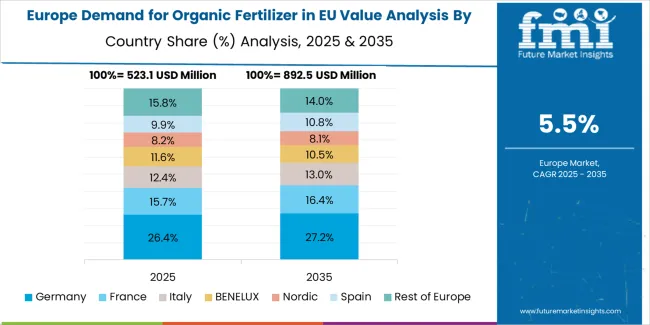

EU organic fertilizer sales demonstrate strong growth across major European economies, with the Netherlands leading expansion at 6.5% CAGR through 2035, driven by intensive greenhouse production and advanced organic horticulture. Germany maintains leadership through extensive organic farmland area and mature organic food industries. France benefits from diverse organic agriculture including cereals, viticulture, and livestock. Italy leverages Mediterranean organic production and strong organic food culture. Spain shows robust growth supported by export-oriented organic production and favorable growing conditions. The Netherlands emphasizes greenhouse organic production and horticultural specialization. Overall, sales show robust regional development reflecting EU-wide organic agriculture expansion and increasing organic food consumption.

Revenue from organic fertilizer in Germany is projected to exhibit steady growth with a CAGR of 5.8% through 2035, driven by exceptionally extensive certified organic farmland area including the largest organic agricultural base in Europe, comprehensive organic food retail infrastructure, and strong consumer commitment to organic products throughout the country. Germany's sophisticated organic farming sector and internationally recognized organic food industry development are creating substantial demand for diverse organic fertilizer products across crop types.

Major organic farming operations, including large-scale arable farms producing organic cereals, organic dairy operations requiring forage production, and specialized organic vegetable producers, systematically utilize organic fertilizers, often incorporating multiple products including composted manures, plant-based materials, and specialized formulations. German demand benefits from substantial organic farmland area requiring consistent organic input supplies, strong retail demand supporting farmer willingness to invest in organic certification and inputs, and technical sophistication among organic farmers supporting proper nutrient management practices.

Revenue from organic fertilizer in France is expanding at a CAGR of 5.9%, substantially supported by rapidly expanding organic farmland area across diverse agricultural sectors, growing consumer demand for French organic products, and increasing policy support for organic agriculture conversion. France's diverse agricultural production and substantial organic industry growth are systematically driving demand for organic fertilizer products across multiple crop types.

Major organic farming operations, including organic cereal producers in northern regions, organic viticulture producing premium wines, and organic livestock operations generating manure resources, are steadily expanding organic fertilizer utilization serving continuously growing organic production area. French sales particularly benefit from diverse crop production requiring varied organic fertilizer types, strong organic wine industry supporting vineyard conversion, and agricultural policy initiatives encouraging organic farming adoption through financial support programs.

Revenue from organic fertilizer in Italy is growing at a CAGR of 6.0%, fundamentally driven by substantial Mediterranean organic production, strong organic food culture supporting premium pricing, and growing organic export industries. Italy's traditional agricultural practices and established organic food appreciation are gradually increasing organic fertilizer requirements while maintaining quality standards for certified organic production.

Major organic farming operations, including organic fruit and vegetable production in southern regions, organic olive cultivation, and organic specialty crops, strategically utilize organic fertilizers supporting high-value organic production systems. Italian sales particularly benefit from Mediterranean crop production including tomatoes, olives, and citrus fruits commanding organic premiums, strong domestic organic food demand supporting local production, and export industries for Italian organic specialty products driving continued organic expansion.

Demand for organic fertilizer in Spain is projected to grow at a CAGR of 6.4%, substantially supported by rapidly expanding export-oriented organic production, favorable Mediterranean growing conditions, and increasing international demand for Spanish organic produce. Spanish organic agriculture's emphasis on export industries and advantageous climate position organic fertilizers as essential inputs supporting competitive organic production.

Major organic farming operations, expanding organic fruit and vegetable production serving northern European industries, organic olive operations, and organic almond cultivation systematically increase organic fertilizer consumption supporting intensive organic production systems. Spain's organic production growth creates increasing input demand, export focus requires consistent organic certification and quality, and Mediterranean climate enables year-round production benefiting from organic fertilizer applications.

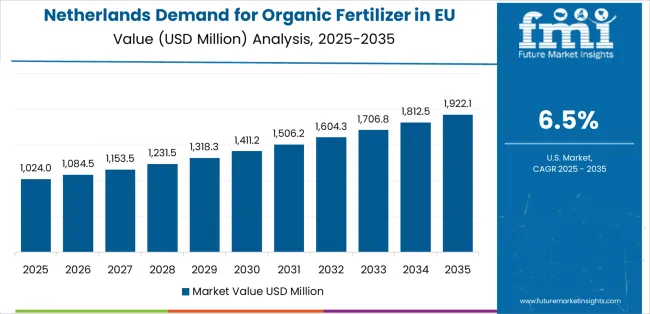

Demand for organic fertilizer in the Netherlands is expanding at the highest CAGR of 6.5%, fundamentally driven by intensive greenhouse horticultural production, advanced organic farming technology adoption, and strong organic specialty crop industries. Dutch horticultural sector's emphasis on high-value greenhouse production and technical sophistication positions organic fertilizers as critical inputs supporting intensive organic cultivation systems.

Netherlands sales significantly benefit from greenhouse organic production requiring intensive fertilization programs, horticultural specialization creating concentrated demand in specific regions, and technical expertise enabling optimized organic nutrient management in controlled environment agriculture. The country's greenhouse concentration creates substantial per-hectare consumption, while organic produce premium pricing justifies higher input costs, and technical innovation supports efficient organic fertilizer application in intensive production systems.

EU organic fertilizer sales are projected to grow from USD 2.2 million in 2025 to USD 4.1 million by 2035, registering a CAGR of 6.0% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with a 6.5% CAGR, supported by intensive horticultural production, advanced organic farming practices, and strong organic industry development. Spain follows with 6.4% CAGR, attributed to expanding organic agriculture and growing export-oriented organic production.

Germany, while maintaining the largest share at 22.3% in 2025, is expected to grow at a 5.8% CAGR, reflecting industry maturity and established organic farming infrastructure. France, Italy, and Rest of Europe demonstrate 5.9%, 6.0%, and 6.0% CAGR respectively, supported by diverse organic agriculture expansion and increasing consumer demand.

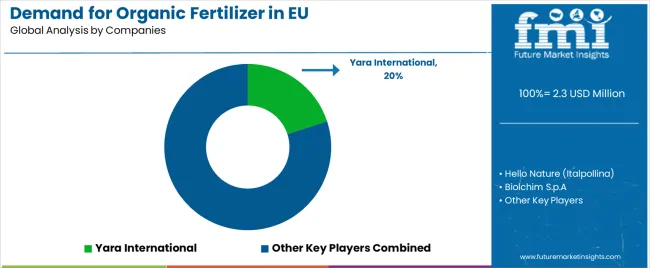

EU organic fertilizer sales are defined by competition among integrated agricultural input companies, specialized organic fertilizer producers, and regional composting operations. Companies are investing in processing technology improvements, organic certification maintenance, technical advisory services, and supply chain development to deliver consistent-quality, certification-compliant, and agronomically effective organic fertilizer solutions. Strategic relationships with organic farming cooperatives, retail distribution partnerships, and technical support programs are central to strengthening competitive position.

Major participants include Yara International with an estimated 20.0% share, leveraging its comprehensive agricultural input portfolio expansion into organic products, European distribution networks reaching farming cooperatives and retailers, and technical expertise supporting farmer nutrient management optimization. Yara benefits from established agricultural relationships providing industry access for organic product introduction, comprehensive product portfolio enabling integrated organic farming solutions, and the ability to provide agronomic support services helping farmers transition to and optimize organic production systems.

Hello Nature (Italpollina) holds approximately 15.0% share, emphasizing specialized bio-based input focus including organic fertilizers and biostimulants, Italian production heritage and Mediterranean agricultural expertise, and commitment to sustainable agricultural solutions. Hello Nature's success in developing effective organic fertilizer formulations and maintaining strong relationships with organic horticultural producers creates solid positioning across high-value crop applications, supported by technical service teams providing application recommendations and crop-specific formulation development.

Biolchim S.p.A accounts for roughly 10.0% share through its position as an organic fertilizer and biostimulant specialist, emphasizing horticultural applications, European industry focus particularly in Mediterranean regions, and technical innovation in organic input formulations. The company benefits from specialized horticultural expertise addressing intensive crop nutrition requirements, comprehensive organic product portfolio, and technical capabilities supporting customized formulation development for specific crop applications and growing conditions.

Other companies and regional producers collectively hold 55.0% share, reflecting substantial fragmentation in European organic fertilizer sales, where numerous regional composting facilities, agricultural cooperatives producing organic inputs, specialized organic fertilizer manufacturers, and local suppliers serve specific geographic industries, particular crop types, and individual farming operations. This fragmentation provides opportunities for differentiation through specialized formulations (crop-specific, enhanced nutrient content), local supply reliability reducing transportation costs, competitive pricing particularly for commodity organic fertilizers, and technical service excellence resonating with organic farmers seeking suppliers understanding organic production challenges and certification requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 million |

| Source (Origin) | Plant-Based, Animal-Based, Mineral/Organic-Mineral |

| Form (Physical State) | Dry, Liquid |

| Crop Type (Application) | Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses, Other Crops |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Yara International, Hello Nature (Italpollina), Biolchim S.p.A, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by source (origin), form (physical state), and crop type (application); regional demand trends across major European industries; competitive landscape analysis with integrated agricultural input companies and specialized organic fertilizer producers; farmer preferences for various organic fertilizer types and formulations; integration with organic farming systems and certification requirements; innovations in processing technologies including composting optimization and pelletization; adoption across horticultural, arable, and permanent crop production. |

The global demand for organic fertilizer in eu is estimated to be valued at USD 2.3 million in 2025.

The market size for the demand for organic fertilizer in eu is projected to reach USD 4.1 million by 2035.

The demand for organic fertilizer in eu is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in demand for organic fertilizer in eu are plant-based, animal-based and mineral/organic-mineral.

In terms of form (physical state), dry segment to command 63.0% share in the demand for organic fertilizer in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA