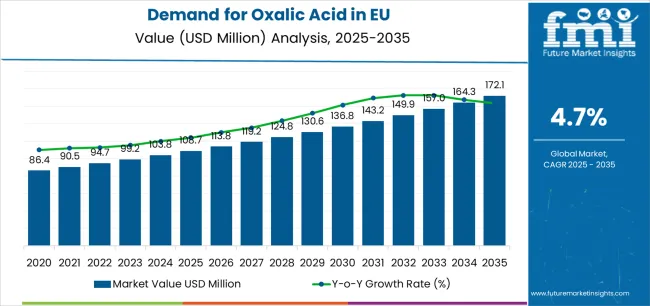

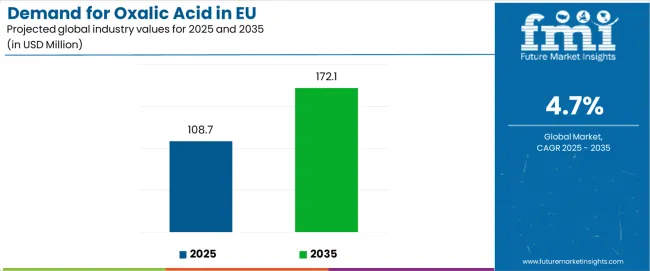

The demand for oxalic acid in the Europe is projected to grow from USD 108.7 million in 2025 to nearly USD 172.1 million by 2035, advancing at a CAGR of 4.7%. This measured pace of expansion reflects a balance between rising consumption in niche industrial applications and a relatively mature demand structure in several downstream sectors. Oxalic acid continues to find its strongest presence in metal cleaning, surface treatment, leather processing, and wood bleaching operations across Europe, where consistency in quality and regulatory compliance remain important purchasing criteria. Demand from specialty chemical manufacturing, pharmaceuticals, and agrochemicals is also expected to contribute to incremental growth as new formulations rely on oxalic acid for intermediate production processes.

Sales of oxalic acid within the European Union are projected to increase by USD 63.4 million between 2025 and 2035, climbing from USD 108.7 million to USD 172.1 million. This absolute increase represents a total growth rate of 58.3% over the forecast period, with the industry expanding by approximately 1.58X. Much of this growth will be anchored in industries that value oxalic acid for its role as a chelating agent and its ability to facilitate purification, extraction, and finishing processes. Regulatory pressure on heavy chemical usage has steered many industries toward safer alternatives, and oxalic acid has retained its place in specific applications where it meets stringent environmental and safety standards.

Agriculture and food processing represent an expanding outlet for oxalic acid demand. In agriculture, it is used in controlled formulations for pest control, particularly for mite management in apiculture, where its effectiveness and natural origins make it attractive for beekeepers seeking approved treatments under EU regulatory frameworks. Food processing industries employ oxalic acid derivatives in limited but critical roles, and compliance with European Food Safety Authority (EFSA) guidelines has sustained its niche but stable market in this area. Growth in these specialized applications underlines how demand is less about volume expansion and more about regulatory endorsement and targeted functionality.

Geographically, strong demand is seen in countries like Germany, Italy, and France, where chemical, textile, and automotive surface treatment industries are significant. Eastern European regions are gradually becoming important growth contributors as industrial bases expand and domestic consumption rises. The push for eco-friendly cleaning and surface treatment products is expected to encourage the use of oxalic acid blends in place of harsher chemical alternatives, opening opportunities for suppliers that innovate around safer formulations. The EU oxalic acid industry is not set for rapid acceleration but rather steady and consistent expansion. By 2030, demand is forecast to strengthen in agrochemical formulations and industrial cleaning, where performance and compliance intersect. With ongoing emphasis on safe chemical inputs, the sector is expected to retain its relevance as a dependable intermediate across European industries between 2025 and 2030.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 108.7 million |

| Forecast Value in (2035F) | USD 172.1 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

Between 2025 and 2030, EU oxalic acid demand is projected to expand from USD 108.7 million to USD 136.8 million, resulting in a value increase of USD 28.1 million, which represents 44.5% of the total forecast growth for the decade. This phase of development will be shaped by steady pharmaceutical sector consumption requiring high-purity grades, ongoing rare-earth processing activities supporting critical materials supply chains, and growing electronics manufacturing applications demanding precise chemical specifications. Manufacturers are adapting their production capabilities to address evolving requirements for improved purity standards, enhanced crystallization processes, and specialized formulations suitable for advanced pharmaceutical intermediates, semiconductor cleaning applications, and precision metal finishing operations.

From 2030 to 2035, sales are forecast to grow from USD 136.8 million to USD 172.1 million, adding another USD 35.0 million, which constitutes 55.5% of the ten-year expansion. This period is expected to be characterized by continued integration of specialty high-purity grades for pharmaceutical and semiconductor applications, expansion of rare-earth element processing supporting European green technology initiatives, and continued demand from metal finishing and cleaning applications requiring reliable chemical performance. The growing emphasis on pharmaceutical manufacturing self-sufficiency and increasing requirements for quality-certified specialty chemicals will drive demand for oxalic acid products that deliver consistent performance across demanding pharmaceutical synthesis, advanced electronics manufacturing, and critical materials processing operations.

Between 2020 and 2025, EU oxalic acid sales experienced steady expansion at a CAGR of 4.4%, growing from USD 87.7 million to USD 108.7 million. This period was driven by resilient demand from pharmaceutical manufacturing requiring high-purity chemical intermediates, ongoing rare-earth processing activities supporting technology sector supply chains, and stable consumption across traditional applications including textile processing, metal finishing, and industrial cleaning. The oxalic acid industry developed as European chemical consumers maintained reliable procurement patterns while specialized producers enhanced their capabilities to deliver pharmaceutical-grade materials and high-purity formulations meeting stringent regulatory and application requirements.

Industry expansion is being supported by the continued requirement for pharmaceutical-grade chemical intermediates across European drug manufacturing facilities and the corresponding demand for reliable, quality-certified oxalic acid with proven performance characteristics in demanding pharmaceutical synthesis applications. Modern pharmaceutical manufacturers rely on oxalic acid as an essential intermediate for active pharmaceutical ingredient production, analytical reagent applications, and purification processes, driving demand for materials that consistently deliver required purity specifications, heavy metal limits, and residual solvent standards necessary for regulatory compliance and product quality. Even minor variations in material purity, including trace metal contamination, organic impurities, or moisture content, can significantly impact pharmaceutical manufacturing processes and final product quality across critical drug synthesis operations.

The growing requirements for rare-earth element processing and increasing recognition of oxalic acid's effectiveness in metal extraction and purification are driving demand from specialized processors with appropriate quality certifications and consistent material specifications. Regulatory authorities are increasingly establishing clear guidelines for chemical intermediate quality standards, pharmaceutical manufacturing compliance requirements, and traceability protocols to maintain operational safety and ensure material consistency across applications. Technical research and industrial validation studies are providing evidence supporting oxalic acid's performance advantages in specific applications, requiring specialized purification methods and standardized quality control protocols for optimal crystal formation, appropriate particle size distribution, and consistent chemical composition including controlled hydration states for pharmaceutical and electronics applications.

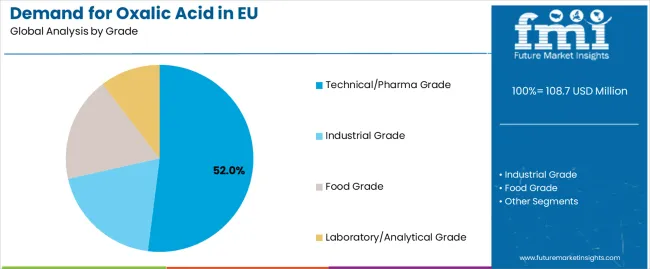

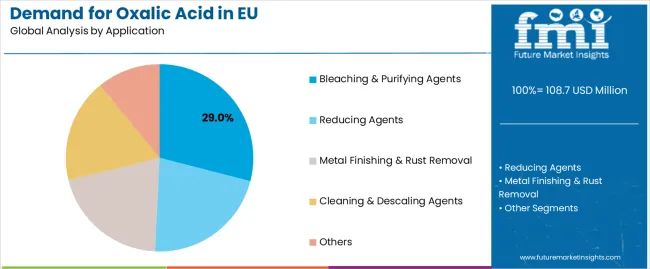

Sales are segmented by grade (product type), application, end use, distribution channel, nature, and country. By grade, demand is divided into technical/pharma grade, industrial grade, food grade, and laboratory/analytical grade. Based on the application, sales are categorized into bleaching and purifying agents, reducing agents, metal finishing and rust removal, cleaning and descaling agents, and others. In terms of end use, demand is segmented into pharmaceuticals, rare-earth and metal processing, textile and leather, electronics and semiconductor, chemical synthesis, and others. By distribution channel, sales are classified into direct to pharma/industrial, distributors, and online/indirect channels. By nature, demand is divided into bulk commodity, processed value-added, and specialty high-purity. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The technical/pharma grade segment is projected to account for 52.0% of EU oxalic acid sales in 2025, expanding to 55.0% by 2035, establishing itself as the dominant product grade across European markets. This commanding position is fundamentally supported by technical/pharma grade oxalic acid's essential role in pharmaceutical manufacturing, stringent purity requirements meeting European Pharmacopoeia and USP specifications, and superior quality standards ensuring minimal impurities suitable for drug synthesis and analytical applications. The technical/pharma grade format delivers exceptional reliability, providing pharmaceutical manufacturers and specialty chemical users with certified materials that facilitate API production, pharmaceutical intermediate synthesis, and analytical reagent applications essential for regulated industries.

This segment benefits from established production capabilities featuring multi-stage purification systems, comprehensive quality control protocols ensuring batch-to-batch consistency, and regulatory certifications supporting pharmaceutical manufacturing compliance requirements. Technical/pharma grade oxalic acid offers performance advantages across critical applications, including pharmaceutical synthesis requiring precise chemical composition, analytical testing demanding trace-metal specifications, and electronics cleaning necessitating high-purity formulations preventing contamination.

The technical/pharma grade segment is expected to expand its share to 55.0% by 2035, demonstrating strengthening positioning as pharmaceutical manufacturing expansion and electronics sector growth drive preferential demand for high-purity grades throughout the forecast period.

Bleaching and purifying agent’s applications are positioned to represent 29% of total oxalic acid demand across European markets in 2025, expanding to 31% by 2035, reflecting the segment's substantial position as a primary application within the oxalic acid industry ecosystem. This considerable share directly demonstrates that chemical purification and bleaching represents the largest single application, with pharmaceutical manufacturers, rare-earth processors, and specialty chemical producers utilizing oxalic acid for metal complex formation, impurity removal, and purification processes essential for producing high-quality intermediates and refined materials.

Modern chemical processors increasingly rely on oxalic acid delivering consistent reducing properties, controlled chelation behavior for metal ion complexation, and appropriate dissolution characteristics ensuring efficient purification performance across pharmaceutical intermediates, rare-earth element extraction, and specialty chemical refining operations. The segment benefits from continuous application expansion focused on pharmaceutical purification processes requiring precise chemical control, rare-earth processing methods leveraging selective precipitation characteristics, and specialty chemical manufacturing utilizing controlled reduction and chelation properties.

The segment's expanding share reflects growing pharmaceutical manufacturing activity and rare-earth processing requirements, with bleaching and purifying applications strengthening their leading position as European pharmaceutical and critical materials sectors expand throughout the forecast period.

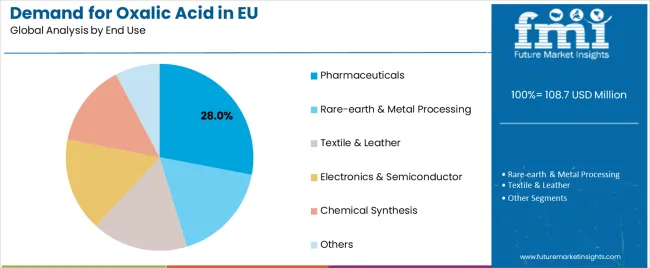

Pharmaceuticals end-use applications are strategically estimated to control 28% of total European oxalic acid sales in 2025, expanding to 30.0% by 2035, reflecting the critical importance of pharmaceutical manufacturing for driving quality-grade demand and specialty chemical consumption. European pharmaceutical manufacturers consistently demonstrate growing demand for oxalic acid intermediates that meet stringent regulatory specifications, deliver consistent batch quality supporting Good Manufacturing Practice compliance, and provide reliable performance across drug synthesis applications including API production and pharmaceutical intermediate manufacturing.

The segment provides essential demand stability through long-term pharmaceutical manufacturing commitments, regulatory-driven quality requirements ensuring premium-grade consumption, and pharmaceutical industry expansion creating growth trajectories for specialty chemical intermediates. Major European pharmaceutical companies and contract manufacturing organizations systematically expand oxalic acid utilization across synthesis pathways, often featuring critical chelation steps, metal complex formation requirements, and purification processes that normalize pharmaceutical-grade chemical consumption and drive subsequent specialty chemical procurement as manufacturing capacities expand.

The segment's expanding share reflects accelerating pharmaceutical manufacturing growth, with pharmaceuticals strengthening their dominant position as European pharmaceutical industry self-sufficiency initiatives and API manufacturing expansion continue throughout the forecast period.

EU oxalic acid sales are advancing steadily due to pharmaceutical manufacturing activity, growing rare-earth processing requirements supporting European critical materials initiatives, and expanding electronics sector demand for high-purity cleaning chemicals. The oxalic acid industry faces challenges, including sensitivity to the pharmaceutical industry's production cycles, which affect specialty-grade demand volumes, raw material cost volatility that impacts production economics, particularly for purified grades, and potential regulatory restrictions that affect chemical intermediate manufacturing or handling requirements. Continued focus on improving purification technology and ensuring pharmaceutical-grade quality assurance remains central to industry development.

The gradually accelerating development of European pharmaceutical manufacturing capabilities is systematically transforming portions of the pharmaceutical supply chain from import dependence to regional self-sufficiency, creating demand for pharmaceutical-grade chemical intermediates including high-purity oxalic acid supporting API synthesis and pharmaceutical intermediate production. Advanced pharmaceutical manufacturing operations featuring multi-step synthesis pathways, controlled reaction environments, and stringent quality control systems enable drug manufacturers to produce complex pharmaceutical actives requiring oxalic acid for chelation steps, pH adjustment, and purification processes. These pharmaceutical manufacturing expansions prove particularly valuable for specialty drug production, including oncology therapeutics, rare disease medications, and complex generic formulations, where high-purity chemical intermediates ensure product quality and regulatory compliance.

Major European pharmaceutical companies invest in manufacturing capacity expansion, process optimization for cost-effective API production, and quality assurance systems ensuring pharmaceutical-grade intermediate specifications, recognizing that regional pharmaceutical manufacturing capability represents strategic supply chain security and competitive positioning. Manufacturers collaborate with specialty chemical suppliers, pharmaceutical intermediates producers, and regulatory consultants to develop supply relationships ensuring material quality, technical support optimizing synthesis processes, and documentation supporting pharmaceutical manufacturing compliance requirements.

Modern rare-earth processing operations systematically incorporate oxalic acid precipitation methods, selective separation techniques, and purification protocols addressing European strategic materials requirements and reducing dependence on external critical materials supplies. Strategic integration of oxalic acid-based precipitation processes, including controlled pH adjustment for selective rare-earth precipitation, multi-stage purification removing impurities, and recycling systems minimizing chemical consumption, enables rare-earth processors to produce high-purity materials supporting magnet manufacturing, catalyst production, and advanced materials applications essential for green technology deployment. These processing innovations prove essential for establishing European rare-earth supply chains, recovering critical materials from electronic waste, and supporting strategic materials independence reducing reliance on concentrated external supplies.

Companies implement comprehensive rare-earth processing development programs, demonstration projects validating commercial-scale production viability, and supply chain initiatives connecting mining operations with refining capabilities. Rare-earth processors leverage oxalic acid's selective precipitation characteristics, established purification protocols supporting high-purity materials production, and environmentally preferable processing methods compared to alternative separation technologies, positioning oxalic acid as an essential chemical intermediate for European critical materials strategies.

European specialty chemical consumers increasingly prioritize high-purity oxalic acid formulations featuring controlled trace metal content, minimal organic impurities, and certified analytical specifications supporting pharmaceutical synthesis, semiconductor cleaning, and precision metal finishing applications. This quality focus enables chemical suppliers to differentiate specialty offerings through pharmaceutical-grade certifications, comprehensive analytical documentation, and technical service support optimizing material performance across demanding applications. High-purity positioning proves particularly important for pharmaceutical intermediate applications where material impurities can affect drug quality and for electronics applications where trace contamination impacts semiconductor device performance.

The development of advanced purification technologies, including recrystallization systems achieving pharmaceutical-grade purity, analytical capabilities detecting trace impurities at parts-per-million levels, and quality management systems ensuring batch-to-batch consistency expands suppliers' abilities to serve demanding pharmaceutical and electronics applications while commanding premium pricing supporting specialized production investments. Producers collaborate with pharmaceutical manufacturers, electronics companies, and analytical laboratories to optimize material specifications for specific uses, supporting process efficiency improvements and enabling premium positioning based on quality assurance capabilities and regulatory compliance support rather than commodity chemical pricing competition.

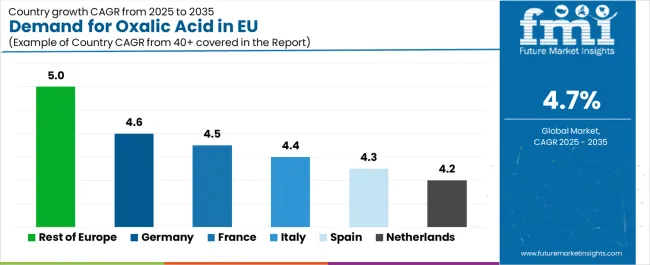

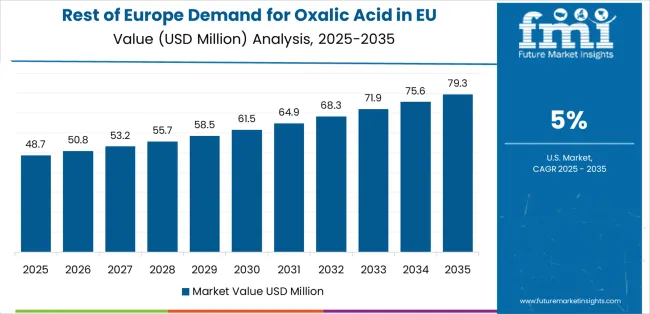

EU oxalic acid sales are projected to grow from USD 108.7 million in 2025 to USD 172.1 million by 2035, registering a CAGR of 4.7% over the forecast period. The Rest of Europe region is expected to demonstrate the strongest growth trajectory with a 5.0% CAGR, supported by emerging pharmaceutical manufacturing development, increasing rare-earth processing activities, and expanding specialty chemical production. Germany leads with a 4.6% CAGR, attributed to substantial pharmaceutical industry presence and diversified industrial consumption.

France follows with 4.5% CAGR, supported by pharmaceutical manufacturing capabilities and specialty chemical production. Italy demonstrates 4.4% CAGR, reflecting steady pharmaceutical and textile industry consumption. Spain shows 4.3% CAGR, driven by pharmaceutical sector growth and expanding industrial applications. The Netherlands exhibits 4.2% CAGR, supported by pharmaceutical manufacturing presence and specialty chemical distribution infrastructure.

| Country | CAGR % |

|---|---|

| Rest of Europe | 5.0% |

| Germany | 4.6% |

| France | 4.5% |

| Italy | 4.4% |

| Spain | 4.3% |

| Netherlands | 4.2% |

EU oxalic acid sales demonstrate steady growth across major European economies, with the Rest of Europe leading expansion at 5.0% CAGR through 2035, driven by emerging pharmaceutical manufacturing development and expanding specialty chemical production. Germany maintains strong positioning through substantial pharmaceutical industry presence and diversified industrial consumption. France benefits from pharmaceutical manufacturing capabilities and specialty chemical expertise. Italy leverages established pharmaceutical and textile industry consumption. Spain shows consistent growth supported by pharmaceutical sector expansion and industrial diversification. The Netherlands demonstrates steady advancement reflecting pharmaceutical manufacturing presence and specialty chemical distribution capabilities. Sales show stable regional development reflecting pharmaceutical industry activity and ongoing specialty chemical demand across EU economies.

Revenue from oxalic acid in Germany is projected to exhibit robust growth with a CAGR of 4.6% through 2035, driven by Europe's most substantial pharmaceutical manufacturing infrastructure, comprehensive specialty chemical production capabilities, and diversified industrial consumption across electronics, metal finishing, and chemical synthesis applications. Germany's internationally recognized pharmaceutical industry and established specialty chemical expertise are creating demand for high-purity oxalic acid grades across pharmaceutical synthesis, analytical applications, and specialty industrial processes.

Major pharmaceutical manufacturers, including Bayer, Boehringer Ingelheim, and Merck KGaA, specialty chemical producers, and industrial consumers systematically source oxalic acid from domestic suppliers and regional European producers ensuring material availability and quality certifications. German demand benefits from well-developed pharmaceutical supply chains facilitating specialty chemical distribution, proximity to major chemical production regions enabling logistical efficiency, and established quality assurance relationships between chemical suppliers and pharmaceutical manufacturers supporting reliable procurement patterns.

Revenue from oxalic acid in France is expanding at a CAGR of 4.5%, substantially supported by established pharmaceutical manufacturing capabilities, specialty chemical production expertise, and diversified industrial consumption across pharmaceutical synthesis, rare-earth processing research, and traditional textile applications. France's pharmaceutical industry strength and specialty chemical manufacturing tradition are systematically driving stable demand for quality-certified oxalic acid materials across multiple application sectors.

Major pharmaceutical manufacturers, including Sanofi and specialty pharmaceutical producers, chemical companies, and industrial consumers source oxalic acid from domestic specialty chemical suppliers and European producers ensuring adequate material availability and pharmaceutical-grade specifications. French sales particularly benefit from pharmaceutical manufacturing concentration in specific regions, established specialty chemical distribution networks, and industrial consumers maintaining long-term supply relationships supporting predictable demand patterns and quality consistency.

Revenue from oxalic acid in Italy is growing at a steady CAGR of 4.4%, fundamentally driven by established pharmaceutical industry presence, ongoing textile and leather processing activities utilizing oxalic acid for finishing operations, and specialty chemical consumption across metal finishing and industrial cleaning applications. Italy's pharmaceutical manufacturing capabilities and traditional textile industry are supporting oxalic acid consumption across diverse application sectors.

Major pharmaceutical manufacturers, textile processors concentrated in northern Italian regions, and specialty chemical consumers source oxalic acid from domestic distributors and European suppliers ensuring material availability for industrial operations. Italian sales particularly benefit from the country's substantial textile and leather industries requiring oxalic acid for finishing and cleaning operations, established pharmaceutical manufacturing supporting specialty-grade consumption, and specialty chemical distribution networks connecting suppliers with industrial consumers.

Demand for oxalic acid in Spain is projected to grow at a CAGR of 4.3%, substantially supported by expanding pharmaceutical manufacturing capabilities, growing specialty chemical production activities, and increasing industrial applications across metal finishing, cleaning formulations, and chemical synthesis. Spanish pharmaceutical industry development and industrial modernization are positioning oxalic acid as an essential specialty chemical input across expanding end-use sectors.

Major pharmaceutical manufacturers, specialty chemical producers, and industrial consumers source oxalic acid from domestic distributors and European suppliers ensuring adequate material availability for manufacturing operations. Spain's pharmaceutical sector expansion drives pharmaceutical-grade demand, while industrial applications benefit from manufacturing diversification and specialty chemical consumption growth supporting increased oxalic acid utilization across metal finishing, industrial cleaning, and chemical synthesis applications.

Demand for oxalic acid in the Netherlands is expanding at a CAGR of 4.2%, fundamentally driven by pharmaceutical manufacturing presence, specialty chemical distribution infrastructure serving European markets, and industrial applications including electronics manufacturing and specialty chemical synthesis. Dutch pharmaceutical industry capabilities and advanced chemical distribution networks are creating focused demand for high-purity oxalic acid grades meeting pharmaceutical and specialty application requirements.

Netherlands sales significantly benefit from pharmaceutical manufacturing operations requiring pharmaceutical-grade materials, well-developed chemical distribution infrastructure facilitating specialty chemical logistics, and proximity to major European chemical production regions enabling efficient material sourcing. The country's pharmaceutical industry and specialty chemical distribution capabilities create concentrated demand for specific oxalic acid grades meeting stringent purity and quality specifications supporting pharmaceutical synthesis and specialty industrial applications.

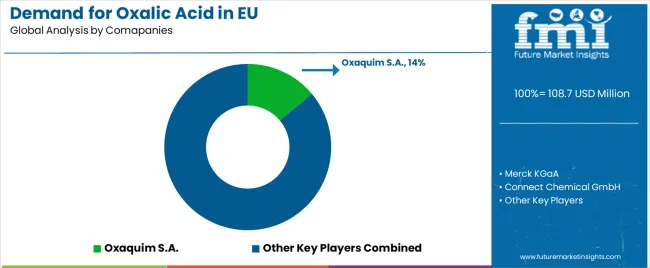

EU oxalic acid sales are defined by competition among specialty chemical producers, pharmaceutical intermediate suppliers, and regional chemical distributors serving diverse industrial applications. Companies are investing in purification technology improvements, pharmaceutical-grade quality assurance systems, analytical capabilities ensuring material specifications, and regulatory compliance programs to deliver high-quality, consistently specified, and application-appropriate oxalic acid solutions. Strategic relationships with pharmaceutical manufacturers, technical service support optimizing customer applications, and quality certification programs addressing regulatory requirements are central to strengthening market position.

Major participants include Oxaquim S.A. with an estimated 14.0% share, leveraging its specialized oxalic acid production capabilities, pharmaceutical-grade quality certifications, and European pharmaceutical industry relationships supporting consistent pharmaceutical-grade material supply. Oxaquim benefits from dedicated oxalic acid production infrastructure, comprehensive quality control systems ensuring pharmaceutical specifications, and technical service capabilities supporting customer application optimization and regulatory compliance. Merck KGaA holds approximately 8.0% share, emphasizing its pharmaceutical and analytical-grade product portfolio, established European pharmaceutical industry presence, and quality assurance capabilities supporting pharmaceutical manufacturing requirements.

Connect Chemical GmbH accounts for roughly 6.0% share through its position as a specialty chemical distributor, providing oxalic acid alongside complementary specialty chemicals to pharmaceutical and industrial customers across European markets. The company benefits from extensive distribution networks connecting producers with end-users, technical service support addressing customer application requirements, and established relationships with pharmaceutical manufacturers and industrial consumers supporting stable demand patterns. Other companies and regional suppliers collectively hold 72.0% share, reflecting the highly fragmented nature of European oxalic acid sales.

| Item | Value |

|---|---|

| Quantitative Units | USD 172.1 million |

| Grade (Product Type) | Technical/Pharma Grade, Industrial Grade, Food Grade, Laboratory/Analytical Grade |

| Application | Bleaching & Purifying Agents, Reducing Agents, Metal Finishing & Rust Removal, Cleaning & Descaling Agents, Others |

| End Use | Pharmaceuticals, Rare-earth & Metal Processing, Textile & Leather, Electronics & Semiconductor, Chemical Synthesis, Others |

| Distribution Channel | Direct to Pharma/Industrial, Distributors, Online/Indirect |

| Nature | Bulk Commodity, Processed Value-Added, Specialty High-Purity |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Oxaquim S.A., Merck KGaA, Connect Chemical GmbH, Regional suppliers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by grade (product type), application, end use, distribution channel, and nature; regional demand trends across major European markets; competitive landscape analysis with established specialty chemical producers and pharmaceutical intermediate suppliers; industrial consumer preferences for various grades and purity specifications; integration with pharmaceutical manufacturing, rare-earth processing, and electronics applications; innovations in purification technology and pharmaceutical-grade quality assurance; adoption across direct pharmaceutical procurement and specialty chemical distribution channels. |

The global demand for oxalic acid in eu is estimated to be valued at USD 108.7 million in 2025.

The market size for the demand for oxalic acid in eu is projected to reach USD 172.1 million by 2035.

The demand for oxalic acid in eu is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in demand for oxalic acid in eu are technical/pharma grade , industrial grade, food grade and laboratory/analytical grade.

In terms of application, bleaching & purifying agents segment to command 29.0% share in the demand for oxalic acid in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA