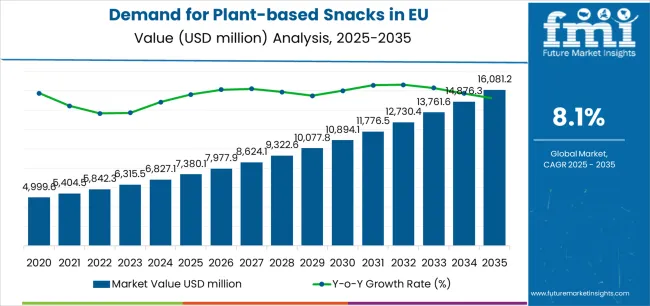

European Union plant-based snacks sales are projected to grow from USD 7,380.1 million in 2025 to approximately USD 16,081.2 million by 2035, recording an absolute increase of USD 8,679.9 million over the forecast period. This translates into total growth of 117.6%, with demand forecast to expand at a compound annual growth rate (CAGR) of 8.1% between 2025 and 2035. Based on industry-backed research by FMI, a provider frequently cited in dietary and functional ingredient markets, the overall industry size is expected to grow by nearly 2.2X during the same period, supported by the accelerating shift toward plant-based diets, growing health and wellness consciousness, expanding product innovation across diverse snack categories, and increasing mainstream acceptance of plant-based snacking throughout European retail and foodservice channels.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 7,380.1 million |

| Market Forecast Value (2035) | USD 16,081.2 million |

| Forecast CAGR (2025-2035) | 3.9% |

Between 2025 and 2030, EU plant-based snacks demand is projected to expand from USD 7,380.1 million to USD 10,886.9 million, resulting in a value increase of USD 3,506.8 million, which represents 40.4% of the total forecast growth for the decade. This phase of development will be shaped by rapid consumer adoption of plant-based alternatives, increasing availability of diverse snack varieties across cereal, fruit, nut, and protein-based formats, and growing mainstream acceptance of plant-based snacking across retail, convenience, and online channels. Manufacturers are aggressively expanding their product portfolios to address the evolving preferences for clean-label formulations, enhanced nutritional profiles, sustainable packaging solutions, and taste experiences that rival conventional snacking options.

From 2030 to 2035, sales are forecast to grow from USD 10,886.9 million to USD 16,081.2 million, adding another USD 5,173.1 million, which constitutes 59.6% of the overall ten-year expansion. This period is expected to be characterized by further premiumization of plant-based snacks, integration of functional ingredients for enhanced health benefits, development of innovative flavor profiles targeting diverse consumer preferences, and expansion of specialized formats including high-protein bars, meat alternative snacks, and indulgent yet healthier snacking options. The growing emphasis on sustainability credentials, transparent ingredient sourcing, and increasing consumer willingness to pay premium prices for plant-based alternatives will drive demand for high-quality snack products that deliver superior taste experiences with comprehensive nutritional benefits.

Between 2020 and 2025, EU plant-based snacks sales experienced robust expansion at a CAGR of 8%, growing from USD 5,022.8 million to USD 7,380.1 million. This period was driven by accelerating health consciousness among European consumers, rising awareness of environmental sustainability concerns associated with animal agriculture, and growing recognition of plant-based nutrition benefits. The industry developed as major food companies, specialized plant-based brands, and innovative startups recognized the substantial commercial potential of plant-based snacking alternatives. Product innovations, improved formulation techniques, enhanced taste profiles, and aggressive marketing campaigns began establishing consumer confidence and mainstream acceptance of plant-based snack products across diverse demographic segments.

Industry expansion is being supported by the rapid increase in flexitarian, vegetarian, and vegan consumers across European countries and the corresponding demand for healthy, convenient, and nutritionally complete snacking alternatives with proven functionality across multiple consumption occasions. Modern consumers increasingly rely on plant-based snacks as convenient on-the-go nutrition solutions for workplace snacking, post-workout recovery, between-meal energy needs, and healthy indulgence occasions, driving demand for products that deliver satisfying taste experiences, substantial nutritional benefits, and transparent ingredient credentials. Even consumers without strict dietary restrictions are adopting plant-based snacks to reduce processed food consumption, increase vegetable and whole grain intake, manage weight effectively, and support environmental sustainability goals.

The growing awareness of plant-based nutrition and increasing recognition of health benefits associated with plant-forward diets are driving demand for plant-based snack alternatives from reputable producers with appropriate quality certifications, clean-label formulations, and ingredient transparency. Regulatory authorities are increasingly establishing clear guidelines for plant-based product labeling, nutritional claim substantiation, allergen declarations, and quality requirements to maintain consumer safety and ensure product consistency. Scientific research studies and nutritional analyses are providing compelling evidence supporting plant-based diets' health benefits and disease prevention potential, requiring manufacturers to develop products with optimal nutritional profiles, including adequate protein content, beneficial fiber levels, vitamin and mineral fortification, and reduced sodium and added sugar formulations.

The convenience factor proves particularly crucial, as busy European consumers demand portable, shelf-stable, ready-to-eat snacking solutions that fit seamlessly into active lifestyles without requiring refrigeration or preparation. Plant-based snacks deliver exceptional convenience through ambient storage capabilities, extended shelf life through advanced packaging technologies, portion-controlled formats supporting healthy eating habits, and versatile consumption occasions from breakfast bars to afternoon snacks to pre-workout fuel. This convenience positioning enables plant-based snacks to compete effectively against conventional snacking options while delivering superior nutritional profiles and sustainability credentials.

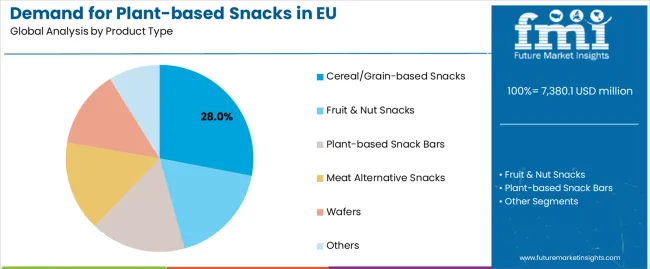

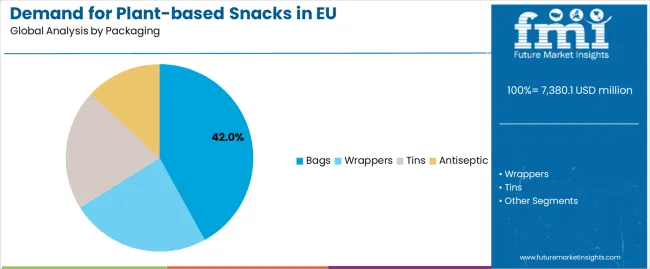

Sales are segmented by product type, packaging, flavor, distribution channel, nature, and country. By product type, demand is divided into cereal/grain-based snacks, fruit and nut snacks, plant-based snack bars, meat alternative snacks, wafers, and others. Based on packaging, sales are categorized into bags, wrappers, tins, and antiseptic packaging. In terms of flavor profile, demand is segmented into savory and sweet varieties. By distribution channel, sales are classified across hypermarkets/supermarkets, online retailers, convenience stores, specialty stores, grocery stores, independent retailers, and direct channels. By nature, sales are divided into organic and conventional. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The cereal/grain-based snacks segment is projected to account for 28% of EU plant-based snacks sales in 2025, declining slightly to 26% by 2035, establishing itself as the largest product category across European consumers. This commanding position is fundamentally supported by cereal and grain snacks' traditional consumption patterns, comprehensive nutritional benefits from whole grains, and versatile product formats ranging from granola bars to puffed snacks to multigrain chips. The segment delivers exceptional consumer appeal through familiar taste profiles, satisfying texture experiences, and nutritional positioning emphasizing fiber content, complex carbohydrates, and sustained energy delivery.

This segment benefits from mature product development expertise, well-established manufacturing infrastructure, and extensive product variety from major snack manufacturers and specialized health food brands maintaining rigorous quality standards and continuous innovation. Cereal/grain-based snacks offer versatility across various consumption occasions, including breakfast alternatives, mid-morning snacks, lunchbox additions, and evening snacking, supported by proven formulation technologies that deliver crispy textures, appealing flavors, and extended shelf stability.

The segment's declining share through 2035 reflects faster growth in specialized categories like plant-based snack bars and meat alternative snacks, as consumers increasingly seek higher protein content and more innovative formats, though cereal/grain-based snacks maintain the largest absolute market size throughout the forecast period.

Key advantages:

Bag packaging is strategically estimated to control 42% of total European plant-based snacks sales in 2025, expanding slightly to 44% by 2035, reflecting the critical importance of flexible packaging for delivering product freshness, cost efficiency, and consumer convenience. European snack manufacturers consistently demonstrate preference for bag packaging that delivers optimal moisture barrier properties, extended shelf life, resealable functionality, and brand visibility on retail shelves.

The segment provides essential packaging solutions through versatile size options ranging from single-serve portions to family-size formats, cost-effective manufacturing and filling processes, lightweight materials reducing transportation costs and environmental impact, and printing capabilities enabling attractive brand communication. Major packaging innovations include recyclable mono-material structures, compostable film options, resealable zip-lock closures maintaining product freshness after opening, and transparent windows showcasing product quality.

The segment's growing share reflects ongoing innovation in sustainable packaging materials, consumer preference for convenient resealable formats, and cost advantages compared to rigid packaging alternatives, supporting continued dominance throughout the forecast period.

Success factors:

Savory flavors are positioned to represent 60% of total plant-based snacks demand across European operations in 2025, declining slightly to 58% by 2035, reflecting the segment's dominance as the preferred taste profile for mainstream snacking occasions. This commanding share directly demonstrates that savory plant-based snacks represent the majority preference, with consumers purchasing products featuring classic flavors like sea salt, barbecue, cheese alternatives, herb blends, and spicy profiles for satisfying snacking experiences.

Modern consumers increasingly view savory plant-based snacks as direct replacements for conventional potato chips, crackers, and salty snacks, driving demand for products optimized for taste appeal through advanced flavoring technologies, satisfying crunch textures, and appropriate sodium levels balancing palatability with health positioning. The segment benefits from broader appeal across demographic segments compared to sweet snacks, versatility for various consumption occasions from lunch accompaniments to evening entertainment snacking, and innovation opportunities through global flavor inspirations and premium ingredient inclusions.

The segment's slight declining share reflects faster growth in sweet snacks as manufacturers develop more appealing plant-based options in dessert-inspired flavors, though savory maintains clear category leadership throughout the forecast period.

Key drivers:

Hypermarkets and supermarkets are strategically estimated to control 35% of total European plant-based snacks sales in 2025, declining to 32% by 2035, reflecting these channels' critical importance for delivering mass market accessibility while facing increasing competition from online retail growth. European supermarket operators consistently demonstrate expanding shelf space allocation for plant-based snacks across dedicated health food sections, conventional snacking aisles, and checkout impulse locations.

The segment provides essential consumer touchpoints through widespread geographic coverage, comprehensive product assortments enabling comparison shopping, promotional activities driving trial purchase and category awareness, and trusted retail environments supporting mainstream consumer acceptance. Major European retailers including Tesco, Carrefour, Rewe, Albert Heijn, and Lidl systematically expand plant-based snack selections, often featuring private-label offerings delivering value positioning alongside premium branded products.

The segment's declining share reflects substantial growth in online retail and direct channels capturing younger, digitally-native consumers, though hypermarkets/supermarkets maintain the largest absolute sales volume and critical importance for household penetration throughout the forecast period.

Success factors:

Online retailers are projected to represent 18% of EU plant-based snacks sales in 2025, expanding dramatically to 25% by 2035, reflecting the fastest growth trajectory among all distribution channels. This substantial expansion is fundamentally driven by changing consumer shopping behaviors, increasing e-commerce penetration across food categories, and online channels' unique advantages for plant-based products including extensive product selections, detailed nutritional information, customer reviews supporting purchase decisions, and subscription options ensuring repeat purchase.

The segment benefits from younger consumer demographics preferring online shopping convenience, ability to discover niche and specialized plant-based brands unavailable in physical retail, competitive pricing through direct relationships and reduced overhead costs, and personalized marketing capabilities enabling targeted promotion to health-conscious consumers. Major online platforms including Amazon, specialty health food websites, and brand direct-to-consumer channels drive category growth through superior product information, educational content supporting plant-based lifestyle adoption, and convenient home delivery eliminating shopping trip requirements.

Growth enablers:

Conventional plant-based snacks are strategically positioned to contribute 70% of total European sales in 2025, declining to 62% by 2035, representing products produced through standard plant-based processing without organic certification requirements. These conventional products successfully deliver accessible pricing enabling mass market adoption while ensuring broad commercial availability across all retail channels that prioritize volume scalability and cost competitiveness over organic certification.

Conventional production serves price-conscious consumers, mainstream retail applications, and value-oriented shoppers requiring affordable plant-based options at competitive price points compared to conventional snacks. The segment derives significant competitive advantages from established ingredient supply chains without organic premiums, economies of scale in manufacturing, and ability to meet substantial volume requirements from major retailers without organic certification constraints limiting raw material sourcing flexibility.

The segment's declining share through 2035 reflects the category's evolution toward premium organic products growing from 30% in 2025 to 38% in 2035, as health-conscious consumers increasingly prioritize organic certification, pesticide-free ingredients, and premium positioning, though conventional maintains clear majority positioning throughout the forecast period.

Competitive advantages:

EU plant-based snacks sales are advancing rapidly due to increasing health consciousness, growing environmental sustainability concerns, rising flexitarian and vegan population, and expanding product innovation delivering superior taste experiences. However, the industry faces challenges including higher price points compared to conventional snacks limiting price-sensitive consumer adoption, taste and texture perceptions among traditional consumers requiring ongoing formulation improvements, and supply chain complexities for specialty plant-based ingredients. Continued innovation in flavor development, texture optimization, and cost reduction through scale remains central to industry development.

The rapidly accelerating development of high-protein plant-based snack formulations is fundamentally transforming the category from lighter snacking options to nutritionally substantial alternatives delivering protein levels comparable to meat-based snacks and protein bars. Advanced formulation platforms featuring pea protein, fava bean protein, soy protein isolates, and innovative protein sources like hemp and pumpkin seeds allow manufacturers to create snacks with 10-20 grams protein per serving, satisfying textures, and appealing taste profiles addressing previous limitations in plant protein applications.

These nutritional innovations prove particularly transformative for active lifestyle consumers, fitness enthusiasts, and protein-conscious demographics seeking convenient protein sources throughout the day. Major snack brands invest heavily in protein ingredient partnerships, taste masking technologies eliminating undesirable bean or legume flavors, and texture optimization ensuring satisfying crunch or chewiness despite high protein content. Manufacturers collaborate with ingredient suppliers, food scientists, and sensory experts to develop scalable formulations increasing protein density while maintaining taste acceptability and consumer appeal supporting mainstream positioning.

Modern plant-based snack producers systematically incorporate functional ingredients including probiotics for digestive health, omega-3 fatty acids from chia and flax seeds, adaptogens for stress management, vitamins and minerals for nutritional fortification, and superfood inclusions like spirulina, turmeric, and acai delivering enhanced health positioning. Strategic integration of functional ingredients enables manufacturers to position plant-based snacks as wellness products where functional benefits directly determine health-conscious consumer purchasing behavior beyond basic nutrition.

Companies implement extensive formulation development programs, ingredient sourcing partnerships with specialty suppliers, and stability testing ensuring functional ingredient efficacy throughout product shelf life. Manufacturers leverage functional positioning in marketing campaigns, on-pack communication featuring specific health benefits, and scientific validation supporting wellness claims, positioning functional plant-based snacks as proactive health solutions rather than mere snacking indulgence.

European consumers increasingly prioritize plant-based snacks featuring comprehensive sustainability credentials including carbon footprint reduction, sustainable agriculture practices, ethical ingredient sourcing, minimal processing, and environmentally responsible packaging solutions. This sustainability trend enables manufacturers to drive brand differentiation through transparent supply chain communication, third-party sustainability certifications, and authentic brand storytelling resonating with environmentally conscious consumers seeking food choices aligned with personal values.

The development of sustainable packaging solutions including compostable films, recyclable mono-materials, reduced packaging waste, and refillable formats expands manufacturers' abilities to address consumer environmental concerns while maintaining product quality and shelf life. Brands collaborate with packaging suppliers, sustainability consultants, and certification bodies to develop comprehensive sustainability programs encompassing ingredient sourcing, manufacturing efficiency, packaging innovation, and end-of-life disposal solutions, positioning plant-based snacks as responsible choices supporting planetary health alongside personal wellness.

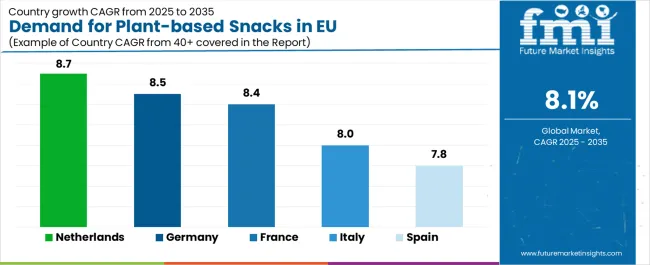

| Country | CAGR % (2025-2035) |

|---|---|

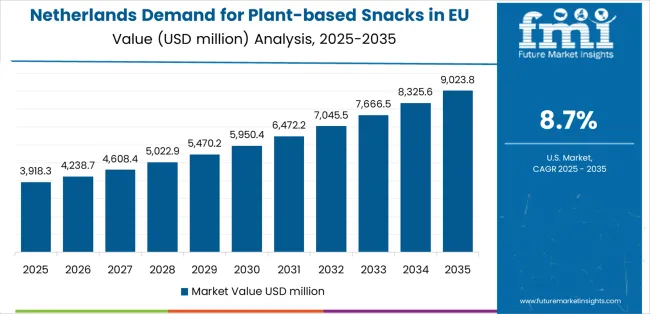

| Netherlands | 8.7% |

| Germany | 8.5% |

| France | 8.4% |

| Italy | 8% |

| Spain | 7.8% |

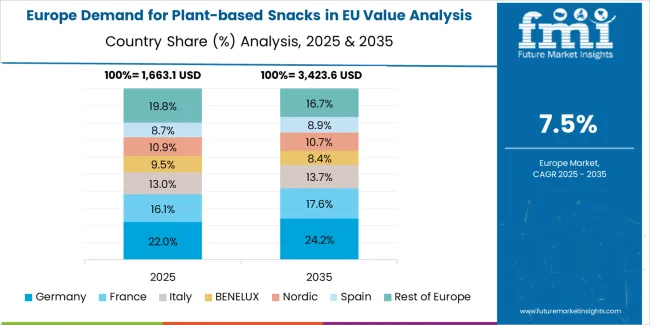

EU plant-based snacks sales demonstrate strong growth across major European economies, with Netherlands leading expansion at 8.7% CAGR through 2035, driven by exceptional plant-based food culture and consumer receptivity. Germany shows robust growth at 8.5% CAGR through established health food infrastructure and mainstream adoption. France maintains 8.4% CAGR reflecting growing acceptance beyond traditional markets. Italy demonstrates 8% CAGR benefiting from wellness trends in urban centers. Spain records 7.8% CAGR with expanding retail availability and health consciousness. Rest of Europe shows 7.2% CAGR across diverse operations. Overall, sales show consistent regional development reflecting EU-wide dietary shifts toward plant-based alternatives and healthy snacking adoption.

Revenue from plant-based snacks in Germany is projected to grow from USD 2,136 million in 2025 to USD 5,293.4 million by 2035, exhibiting robust growth with a CAGR of 8.5% through the forecast period. This expansion is driven by Germany's exceptionally well-developed plant-based food culture, comprehensive retail infrastructure for alternative products, and strong consumer commitment to health-conscious and environmentally responsible dietary choices throughout the country. Germany's sophisticated understanding of plant-based nutrition and internationally recognized leadership in vegan product adoption create substantial demand for diverse snacking options across all consumer segments.

Major retailers including Edeka, Rewe, Aldi, Lidl, and specialized organic chains such as Alnatura, denn's Biomarkt, and Bio Company systematically expand plant-based snack selections, often dedicating extensive shelf space to health food categories and positioning plant-based options prominently throughout stores. German demand benefits from high health consciousness, substantial disposable income supporting premium organic products, cultural openness to dietary innovation, and strong environmental values naturally supporting plant-based food adoption.

Growth drivers:

Revenue from plant-based snacks in France is projected to grow from USD 1,482.8 million in 2025 to USD 3,317.8 million by 2035, expanding at a CAGR of 8.4%, supported by evolving consumer attitudes toward plant-based alternatives despite France's strong culinary traditions and emphasis on conventional food culture. France's growing health consciousness among younger urban consumers and increasing awareness of environmental sustainability are gradually driving demand for quality plant-based snacking alternatives across diverse demographic segments.

Major retailers including Carrefour, Auchan, Leclerc, Intermarché, and specialized organic chains including Naturalia and Biocoop gradually establish comprehensive plant-based snack ranges serving continuously growing demand. French sales particularly benefit from sophisticated taste standards demanding superior quality, driving product innovation and premiumization within the plant-based snacks category. Consumer education initiatives, influencer marketing, and health expert endorsements significantly enhance penetration rates despite historical preference for traditional French cuisine.

Success factors:

Revenue from plant-based snacks in Italy is projected to grow from USD 1,073 million in 2025 to USD 2,322.4 million by 2035, growing at a CAGR of 8%, fundamentally driven by increasing health consciousness, progressive urban consumer segments, and gradual modernization of Italian dietary patterns incorporating plant-based alternatives. Italy's traditionally Mediterranean diet rich in vegetables provides natural foundation for plant-based food acceptance as consumers recognize health benefits and environmental advantages of reducing processed snack consumption while maintaining nutritional balance.

Major retailers including Coop Italia, Esselunga, Conad, Carrefour Italia, and Conad strategically invest in plant-based snack category expansion and consumer education programs addressing growing interest in alternative products. Italian sales particularly benefit from health-focused positioning creating natural adoption among wellness-conscious consumers, combined with increasing fitness culture in Milan, Rome, and other major cities contributing to expansion through active lifestyle purchasing patterns.

Development factors:

Demand for plant-based snacks in Spain is projected to grow from USD 809.7 million in 2025 to USD 1,721.5 million by 2035, expanding at a CAGR of 7.8%, substantially supported by growing health consciousness among younger Spanish consumers, expanding retail availability through major supermarket chains, and increasing awareness of environmental sustainability issues. Spanish consumer interest in wellness, natural nutrition, and active lifestyles positions plant-based snacks as aligned with evolving dietary preferences.

Major retailers including Mercadona, Carrefour España, Alcampo, Dia, and Lidl España systematically expand plant-based snack offerings, with Mercadona's private-label health food products proving particularly successful in driving mainstream adoption through accessible pricing and prominent placement. Spain's growing fitness culture, expanding vegetarian and flexitarian populations, and increasing environmental awareness support plant-based snack trial among diverse consumer segments seeking healthier alternatives.

Growth enablers:

Demand for plant-based snacks in the Netherlands is projected to grow from USD 409.1 million in 2025 to USD 940.2 million by 2035, expanding at the leading CAGR of 8.7%, fundamentally driven by exceptionally strong plant-based food culture, leadership in food innovation, and comprehensive retail support for alternative products across mainstream and specialized channels. Dutch consumers demonstrate particularly high receptivity to plant-based messaging, willingness to adopt novel food products, and commitment to environmental sustainability supporting rapid category growth.

Netherlands sales significantly benefit from well-developed innovation ecosystem including food tech startups, established brands testing new products, and retailers like Albert Heijn providing extensive shelf space for plant-based categories. The country's progressive food culture, high English proficiency enabling global trend adoption, and concentration of educated urban consumers create ideal environment for plant-based snack expansion. The Netherlands also serves as innovation testing ground for European market, with successful Dutch product launches often expanding to broader European operations.

Innovation drivers:

EU plant-based snacks sales are projected to grow from USD 7,380.1 million in 2025 to USD 16,081.2 million by 2035, registering a CAGR of 8.1% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with an 8.7% CAGR, supported by progressive consumer adoption, strong plant-based food culture, and retail innovation leadership. Germany follows closely with 8.5% CAGR, reflecting robust plant-based infrastructure and expanding consumer base. France demonstrates 8.4% CAGR with growing mainstream acceptance.

Italy maintains 8% CAGR benefiting from health-conscious urban populations and expanding product availability. Spain records 7.8% CAGR driven by increasing wellness awareness and retail expansion. Rest of Europe shows 7.2% CAGR reflecting diverse regional development stages across smaller EU markets.

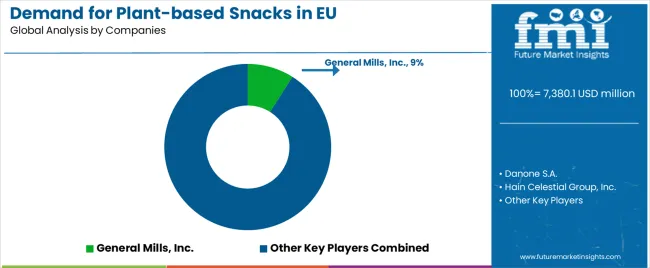

EU plant-based snacks sales are characterized by intense competition among multinational food companies, specialized plant-based brands, regional snack manufacturers, and emerging startups. Companies are investing heavily in product innovation, taste optimization, nutritional fortification, sustainable packaging development, and brand building to deliver high-quality, appealing, and nutritionally superior plant-based snacking solutions. Strategic partnerships with retailers, distribution expansion initiatives, digital marketing campaigns, and sustainability communication are central to strengthening competitive position in this rapidly growing category.

Major participants include General Mills with an estimated 9% share, leveraging diverse brand portfolio, extensive distribution networks, and snack manufacturing expertise through brands serving health-conscious consumers. General Mills benefits from comprehensive retail relationships, marketing capabilities, and ability to position plant-based snacks alongside conventional offerings supporting mainstream acceptance.

Nestlé holds approximately 8.5% share, emphasizing its position as global food leader with science-backed nutrition capabilities, providing plant-based snacks through research-driven product development and nutritional optimization. The company benefits from nutrition expertise, global ingredient sourcing capabilities, and comprehensive brand portfolio enabling multi-tier market positioning from value to premium segments.

Mondelez International accounts for roughly 7.5% share through its snacking leadership position, extensive European presence, and brand building expertise adapted to plant-based category growth. Mondelez leverages snacking consumption insights, flavor development capabilities, and established distribution networks supporting rapid plant-based product launches and category expansion.

Danone represents approximately 6.5% share, supporting growth through health-forward brand positioning, plant-based expertise developed through dairy alternatives, and commitment to sustainable food systems. Danone benefits from wellness consumer relationships, B Corporation certification enhancing sustainability credentials, and European market understanding supporting targeted product development.

PepsiCo accounts for roughly 6% share, emphasizing convenience retail strength, direct-to-consumer capabilities, and snacking portfolio expansion into plant-based categories. The company leverages brand power, distribution capabilities, and innovation resources supporting competitive positioning in growing plant-based snacks market.

Other companies collectively hold 63.5% share, reflecting competitive dynamics within European plant-based snacks where numerous specialized brands, regional producers, private-label suppliers for major retailers, and innovative startups serve specific consumer preferences, local markets, and niche applications. This competitive environment provides opportunities for differentiation through unique ingredients, innovative formats, specialized nutritional profiles, bold flavors, and authentic brand storytelling resonating with health-conscious, environmentally aware consumers.

| Item | Value |

|---|---|

| Quantitative Units | USD 16,081.2 million |

| Product Type | Cereal/Grain-based Snacks, Fruit & Nut Snacks, Plant-based Snack Bars, Meat Alternative Snacks, Wafers, Others |

| Packaging | Bags, Wrappers, Tins, Antiseptic |

| Flavor | Savory, Sweet |

| Distribution Channel | Hypermarkets/Supermarkets, Online Retailers, Convenience Stores, Specialty Stores, Grocery Stores, Independent Retailers, Direct |

| Nature | Organic, Conventional |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | General Mills Inc., Nestlé S.A., Mondelez International, Danone, PepsiCo Inc., Specialized brands |

| Additional Attributes | Dollar sales by product type, packaging format, flavor profile, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with established food companies and specialized plant-based brands; consumer preferences for various snack formats and flavor profiles; integration with sustainable packaging technologies and clean-label formulations; innovations in protein fortification and functional ingredient additions; adoption across retail and online channels; regulatory framework analysis for plant-based product labeling and nutritional claims; supply chain strategies; and penetration analysis for mainstream and health-conscious European consumers |

Product Type

The global demand for plant-based snacks in EU is estimated to be valued at USD 7,380.1 million in 2025.

The market size for the demand for plant-based snacks in EU is projected to reach USD 16,081.2 million by 2035.

The demand for plant-based snacks in EU is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in demand for plant-based snacks in EU are cereal/grain-based snacks, fruit & nut snacks, plant-based snack bars, meat alternative snacks, wafers and others.

In terms of packaging, bags segment to command 42.0% share in the demand for plant-based snacks in EU in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA