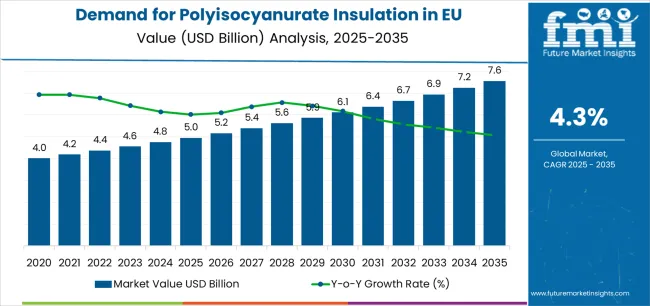

The demand for polyisocyanurate insulation in the European Union is projected to grow from USD 5.0 billion in 2025 to approximately USD 7.6 billion by 2035, recording an absolute increase of USD 2.6 billion over the forecast period. This translates into total growth of 52.9%, with demand forecast to expand at a compound annual growth rate (CAGR) of 4.3% between 2025 and 2035. FMI’s verified research on advanced composites and performance materials indicates that the overall industry size is expected to expand by nearly 1.5X during this period, supported by rising demand for energy-efficient building materials, expanding applications in commercial roofing and continuous insulation systems, and developing uses across residential sheathing, industrial facilities, and appliance insulation in European construction and renovation activities.

The industry is being strengthened by stricter building energy codes requiring higher thermal efficiency, escalating energy costs fueling insulation retrofit demand, and growing adoption of polyiso as a leading thermal insulation solution due to its superior R-value per inch, moisture resistance, and fire safety properties. Between 2025 and 2030, demand is projected to increase from USD 5.0 billion to USD 6.1 billion, adding USD 1.2 billion in value, which represents 44.3% of the total growth expected through 2035. This period will be shaped by increased demand for continuous insulation systems meeting thermal bridging standards, rising use of polyiso in commercial roof installations, and growing adoption of foil-faced rigid boards across residential and commercial wall applications replacing conventional cavity insulation. Manufacturers are advancing product portfolios with non-halogenated flame retardants, bio-circular polyiso formulations, and high-performance spray foams designed to comply with stricter European building directives.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 5 billion |

| Forecast Value in (2035F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

From 2030 to 2035, sales are forecast to expand from USD 6.1 billion to USD 7.6 billion, adding another USD 1.5 billion, which accounts for 55.7% of the total ten-year growth. This phase is expected to see faster adoption of TCPP-free formulations, greater integration of bio-based polyols in sustainable building projects, and the launch of hybrid insulation systems designed for below-grade waterproofing, cold storage, and zero-energy building envelopes. Growing emphasis on circular economy principles and stronger construction sector willingness to invest in premium insulation materials will further drive demand for polyiso products that deliver superior thermal performance while reducing environmental impact and supporting EU Green Deal efficiency and decarbonization objectives.

Between 2020 and 2025, EU polyisocyanurate insulation demand expanded at a CAGR of 3.8%, rising from USD 4.1 billion to USD 5.0 billion. Growth in this phase was supported by steady commercial construction activity, resilient renovation demand for energy-efficient upgrades, and broader recognition of polyiso’s performance advantages over alternative insulation materials. This period also marked increased acceptance of polyiso rigid boards in low-slope roofing, continuous insulation systems for eliminating thermal bridging, and high-R-value wall assemblies. Enhanced facer technologies, improved dimensional stability, and R-value optimization strengthened product reliability and helped establish contractor confidence, leading to broader adoption across commercial, residential, and industrial construction segments.

EU polyisocyanurate insulation sales are advancing steadily due to increasing building energy efficiency requirements across European countries and the corresponding demand for high-R-value, moisture-resistant, and space-efficient thermal insulation with proven effectiveness in commercial roofing applications, continuous insulation assemblies, and wall cavity thermal barrier systems. Modern building owners and contractors rely on polyiso insulation as an essential building material for consistent thermal performance, code compliance, and long-term energy savings, driving demand for products that deliver superior R-value per inch ranging from 6 to 6.5, exceptional compressive strength supporting structural loads, and excellent fire resistance compared to alternative foam plastics including EPS and XPS offering lower thermal efficiency and higher environmental impact.

The growing awareness of continuous insulation benefits and increasing recognition of polyiso's cost-effectiveness are driving demand for polyiso products from certified manufacturers with appropriate quality credentials and technical documentation. Regulatory authorities are increasingly establishing clear guidelines for building thermal performance standards, vapor barrier specifications, and insulation material fire ratings to maintain building safety and ensure energy efficiency consistency throughout European construction operations under EPBD recast and national building codes. Scientific research studies and building energy modeling are providing evidence supporting polyiso's lifecycle cost advantages and energy-saving benefits, requiring standardized testing methods including aged R-value determination, moisture resistance validation, and compressive strength verification for optimal building envelope performance, appropriate moisture management, and consistent thermal resistance across diverse commercial roofing, wall insulation, and below-grade waterproofing applications.

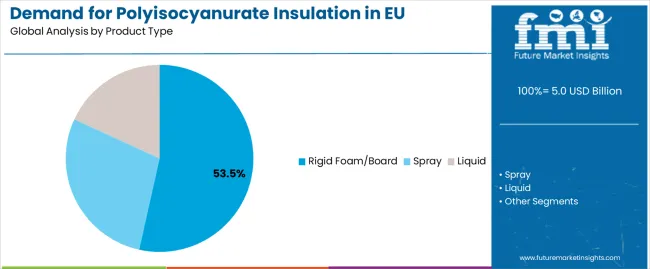

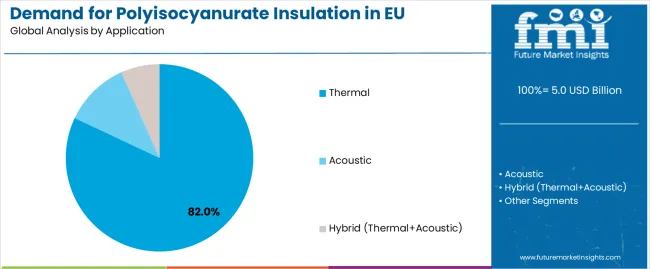

Sales are segmented by product type, application, end-user, distribution channel, nature, and country. By product type, demand is divided into rigid foam/board, spray foam, and liquid polyiso. Based on application, sales are categorized into thermal insulation, acoustic insulation, and hybrid thermal-acoustic applications. In terms of end-user, demand is segmented into building and construction, industrial facilities, automotive, and consumer goods and appliances. Regarding distribution channel, sales are divided into distributor/dealer networks, direct to contractor/specifier channels, and DIY/online platforms. By nature, sales are classified into standard (TCPP/conventional), TCPP-free/non-halogenated, and bio-circular content formulations. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The rigid foam/board segment is projected to account for 53.5% of EU polyiso insulation sales in 2025, expanding slightly to 54.5% by 2035, establishing itself as the dominant product form across European commercial roofing and continuous insulation applications. This commanding position is fundamentally supported by rigid board's ease of installation, excellent dimensional stability preventing warping, and proven suitability for low-slope commercial roofing systems requiring durable insulation with consistent R-value performance. The rigid foam format delivers exceptional construction appeal, providing contractors and specifiers with a product form that facilitates mechanized installation, simplified specification compliance, and reliable long-term thermal performance essential for commercial building energy codes. This segment benefits from mature manufacturing processes utilizing continuous lamination with foil or felt facers, well-established supply networks serving commercial roofing distributors, and extensive adoption by commercial contractors and architects who maintain confidence in product performance for specification-driven construction projects. The rigid foam segment's expanding share reflects growing continuous insulation requirements in building codes and increasing commercial construction activity throughout the forecast period.

Key advantages:

Thermal insulation applications are strategically positioned to represent 82% of total European polyiso insulation sales in 2025, declining slightly to 80% by 2035, reflecting the segment's dominance as the primary function category within the overall market. This substantial share directly demonstrates that thermal performance represents the dominant application driver, with polyiso utilized extensively in commercial roofing insulation, exterior wall continuous insulation, residential sheathing, and foundation insulation requiring exceptional heat flow resistance. Modern building professionals increasingly view polyiso as an essential thermal barrier material, driving demand for products optimized for R-value maximization, moisture management, and long-term thermal stability that supports energy code compliance and operational cost reduction. The segment benefits from continuous building energy code tightening, expanding retrofit insulation market, and green building standards demanding superior thermal performance across European construction markets. The segment's slight declining share reflects diversification into hybrid thermal-acoustic applications expanding throughout the forecast period.

Success factors:

Building and construction end uses are strategically positioned to represent 73.5% of total European polyiso insulation sales in 2025, expanding slightly to 74% by 2035, reflecting the segment's dominance as the primary consumption category within end-user applications. This substantial share directly demonstrates that building construction represents the dominant consumption driver, with polyiso utilized extensively in commercial low-slope roofing, residential and commercial wall insulation, metal building insulation, and foundation waterproofing requiring durable thermal barrier systems. Modern construction professionals increasingly view polyiso as essential building insulation, driving demand for products optimized for energy code compliance, moisture resistance, and installation efficiency that supports green building certification and lifecycle cost optimization. The segment benefits from continuous new construction activity, expanding building renovation market requiring energy efficiency upgrades, and sustainable building trends demanding high-performance insulation materials across European construction sectors. The segment's expanding share reflects accelerating building energy retrofit activity and increasing construction quality standards throughout the forecast period.

Success factors:

Distributor and dealer channels serving construction contractors are strategically estimated to control 48% of total European polyiso insulation sales in 2025, declining slightly to 47% by 2035, reflecting the critical importance of specialized building material distributors for commercial and residential construction markets. European polyiso distribution operations consistently demonstrate strong contractor relationships delivering local inventory availability, technical support services, and credit terms to roofing contractors, insulation installers, and general contractors requiring reliable material supply. The segment provides essential logistics services through regional distribution centers, just-in-time delivery systems, and technical training supporting construction project execution throughout building seasons. Major building material distributors systematically supply polyiso products through diverse facer options and thickness specifications, often providing value-added services including contractor training, specification assistance, and warranty support that facilitate product adoption and installation quality. The segment's slight declining share reflects growing direct-to-contractor channels as manufacturers expand specification programs throughout the forecast period.

Growth enablers:

Standard polyiso formulations featuring conventional TCPP (tris-chloropropyl phosphate) flame retardants are strategically positioned to contribute 67% of total European sales in 2025, declining dramatically to 55% by 2035, representing products meeting traditional flame retardancy requirements with established formulation chemistry. These standard products successfully deliver proven fire resistance and cost-competitive pricing while ensuring broad commercial availability across all distribution channels that prioritize performance reliability and economic accessibility over advanced sustainability credentials. Standard formulations serve cost-conscious commercial developers, traditional construction contractors, and value-oriented building owners that require effective polyiso insulation at competitive price points without premium non-halogenated flame retardant positioning. The segment derives significant competitive advantages from established production infrastructure, decades of field performance validation, and the ability to meet substantial volume requirements from major commercial roofing and insulation contractors without reformulation constraints limiting production flexibility. The segment's dramatic declining share through 2035 reflects the category's rapid evolution toward TCPP-free formulations, which grow from 23% in 2025 to 30% in 2035, as environmental regulations increasingly restrict halogenated flame retardants and sustainability-conscious architects and developers prioritize non-halogenated polyiso aligned with green building standards and occupant health objectives.

Competitive advantages:

EU polyiso insulation sales are advancing steadily due to increasing commercial construction activity in European markets, growing building energy retrofit requirements, and rising specification of continuous insulation systems. The industry faces challenges, including MDI and polyol feedstock price volatility affecting production costs, flame retardant regulations potentially restricting TCPP usage, and competitive pressure from alternative insulation materials including mineral wool and XPS. Continued innovation in non-halogenated flame retardants and bio-based polyol technologies remains central to industry development throughout the forecast period.

The rapidly accelerating development of TCPP-free and non-halogenated flame retardant polyiso formulations is fundamentally transforming insulation chemistry from traditional organohalogen flame retardants to environmentally responsible alternatives enabling effective fire protection with reduced environmental persistence and human health concerns, delivering sustainability credentials previously unattainable through conventional TCPP-based polyiso products. Advanced formulation platforms featuring phosphorus-based non-halogenated flame retardants, intumescent additives, and mineral filler systems allow producers to create sustainable polyiso with equivalent fire resistance, thermal performance, and building code compliance comparable to TCPP-containing products while meeting increasingly stringent European chemical regulations under REACH and addressing green building material requirements. These chemistry innovations prove particularly transformative for environmentally conscious building owners, LEED and BREEAM certified projects, and health-focused institutions where halogen-free materials prove essential for indoor air quality objectives and sustainable building certification supporting occupant wellness priorities.

Modern polyiso manufacturers systematically incorporate bio-based polyol feedstocks, recycled content MDI, and circular economy principles that deliver reduced carbon footprint, renewable content certification, and lifecycle environmental improvements comparable to traditional petroleum-derived polyiso formulations. Strategic integration of bio-polyols derived from vegetable oils, recycled PET polyols, and mass balance certified bio-circular MDI optimized for polyiso chemistry enables producers to position sustainable insulation products as legitimate low-carbon building materials where embodied carbon directly determines green building acceptance and lifecycle assessment performance. These sustainability improvements prove essential for premium market positioning, as net-zero building and embodied carbon reduction initiatives demand material transparency, renewable content documentation, and lifecycle carbon accounting supporting European Green Deal objectives and building sector decarbonization targets. Companies implement extensive sustainability assessment programs including environmental product declarations (EPDs), lifecycle carbon footprint studies, and renewable content verification targeting superior environmental performance including 10-15% bio-circular content, reduced GWP blowing agent adoption, and recyclability enhancement throughout product design and manufacturing operations.

European building codes and energy efficiency standards increasingly prioritize continuous insulation assemblies featuring unbroken thermal barriers with polyiso rigid boards eliminating thermal bridging through wall studs, structural elements, and cladding attachments that differentiate high-performance building envelopes through comprehensive heat flow control and energy code compliance. This continuous insulation trend enables manufacturers to drive market growth through exterior wall insulation, commercial roofing over metal decks, and below-grade foundation applications resonating with energy-conscious developers seeking code compliance without compromising building design flexibility. Polyiso applications prove particularly important for continuous insulation segments where high R-value per inch drives material selection, with polyiso's 6-6.5 R-value per inch enabling thinner wall assemblies compared to alternative insulation materials requiring greater thickness for equivalent thermal performance. The development of specialized continuous insulation systems, integrated air barrier technologies, and attachment methods minimizing thermal bridging expands manufacturers' abilities to create comprehensive building envelope solutions delivering consistent thermal performance with validated energy modeling through thermal imaging verification and whole-building energy simulation supporting architect specification.

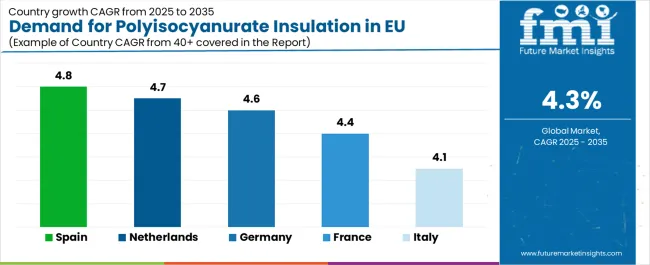

| Country | CAGR 2025-2035 |

|---|---|

| Spain | 4.8% |

| Netherlands | 4.7% |

| Germany | 4.6% |

| France | 4.4% |

| Italy | 4.1% |

EU polyiso insulation sales demonstrate robust growth across major European economies, with Spain leading expansion at 4.8% CAGR through 2035, driven by construction sector recovery and building energy code enforcement. Netherlands shows strong growth at 4.7% CAGR through sustainable building initiatives and green construction standards. Germany demonstrates 4.6% CAGR with construction industry strength and energy efficiency mandates. France records 4.4% CAGR reflecting RE2020 building regulation impact and renovation market growth. Italy demonstrates 4.1% CAGR with building renovation incentives and construction activity. Rest of Europe shows 3.8% CAGR with emerging market development patterns. Overall, sales show steady regional development reflecting EU-wide trends toward building energy efficiency and construction quality improvement.

Revenue from polyiso insulation in Germany is projected to exhibit strong growth with a CAGR of 4.6% through 2035, driven by well-developed construction industry, comprehensive energy efficiency standards, and strong commitment to building quality throughout the country. Germany's sophisticated construction market and internationally recognized building codes are creating substantial demand for high-performance polyiso across commercial and residential applications. Major insulation manufacturers including Kingspan and Recticel, combined with extensive commercial construction throughout German regions, systematically utilize polyiso for roofing and wall insulation, often prioritizing premium formulations to maintain energy performance. German demand benefits from stringent EnEV building energy standards, substantial renovation market requiring insulation upgrades, and technical sophistication that naturally supports continuous insulation adoption across construction operations.

Growth drivers:

Demand for polyiso insulation in Spain is projected to grow at the highest CAGR of 4.8%, substantially supported by construction sector recovery following economic downturn, implementation of updated building energy codes, and growing commercial construction activity throughout Spanish regions. Spanish construction modernization and energy efficiency awareness positions polyiso as increasingly essential for building thermal performance strategies. Major construction companies and insulation contractors systematically expand polyiso utilization, with commercial roofing applications and continuous insulation installations proving particularly successful in driving mainstream adoption supporting Spanish construction market evolution. Spain's expanding tourism infrastructure supports polyiso demand through hotel construction and commercial building development providing opportunities for high-performance insulation adoption.

Growth enablers:

Demand for polyiso insulation in the Netherlands is expanding at a CAGR of 4.7%, fundamentally driven by sustainable building leadership, green construction standards requiring high-performance materials, and quality-focused construction practices supporting advanced insulation adoption. Dutch construction operations demonstrate strong receptivity to premium polyiso products and non-halogenated formulations meeting stringent environmental standards. Netherlands sales significantly benefit from well-developed green building market, BREEAM certification prevalence requiring sustainable materials, and technical procurement standards driving quality insulation adoption across Dutch construction operations. The country's sustainable building positioning and construction innovation support consistent polyiso demand across commercial and residential applications.

Innovation drivers:

Revenue from polyiso insulation in France is expanding at a CAGR of 4.4%, supported by France's implementation of RE2020 building energy regulation, substantial renovation market, and established construction industry practices throughout major French regions. France's strong environmental commitment and building sector modernization are driving steady demand for quality polyiso across commercial and residential applications. Major construction companies and insulation contractors maintain comprehensive polyiso utilization to serve building energy efficiency requirements across new construction and renovation projects. French sales particularly benefit from RE2020 thermal performance mandates requiring high-R-value continuous insulation and government support for building energy retrofits driving polyiso adoption within the construction insulation category.

Success factors:

Revenue from polyiso insulation in Italy is growing at a CAGR of 4.1%, fundamentally driven by building renovation incentives, commercial construction activity, and quality-focused construction practices. Italy's traditionally aesthetic-conscious construction culture naturally accommodates premium insulation materials as builders recognize energy performance benefits and long-term value. Major construction companies strategically invest in polyiso utilization for thermal performance and building quality, supporting Italian construction excellence standards. Italian sales particularly benefit from renovation tax incentives, creating adoption among building owners, combined with commercial construction in Milan and other urban centers, contributing to expansion through quality-driven consumption.

Development factors:

EU polyiso insulation sales are projected to grow from USD 4,956 million in 2025 to USD 7.6 billion by 2035, registering a CAGR of 4.3% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory with a 4.8% CAGR, supported by expanding construction activity, building energy code implementation, and commercial roofing market development. The Netherlands follows with a 4.7% CAGR attributed to sustainable building leadership and continuous insulation adoption. Germany shows a 4.6% CAGR, reflecting a robust construction sector and energy efficiency focus. Germany maintains the largest share at 30.4% in 2025, driven by construction industry leadership and building quality standards supporting extensive polyiso utilization.

EU polyiso insulation sales are defined by competition among integrated building materials companies, specialized insulation manufacturers, and polyurethane systems suppliers serving diverse construction applications. Companies are investing in non-halogenated flame retardant technologies, bio-based polyol formulations, continuous insulation system development, and technical specification support to deliver high-quality, performance-validated, and environmentally responsible polyiso solutions meeting stringent European building codes. Strategic partnerships with roofing contractors and distribution network expansion initiatives, along with technical support programs emphasizing building envelope design and energy code compliance are central to strengthening competitive position throughout European construction markets.

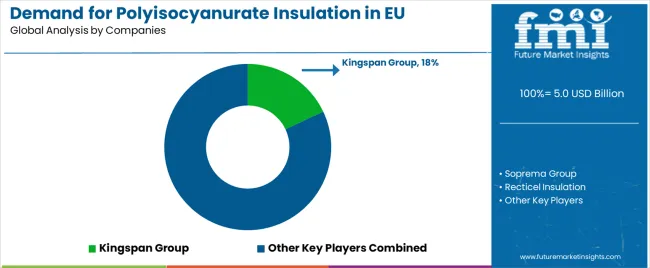

Major participants include Kingspan Group with an estimated 18% share, leveraging its broad EU manufacturing plant network, comprehensive insulated panel portfolio, and established presence through commercial construction specification channels across multiple countries. Kingspan benefits from vertical integration capabilities, deep building science expertise supporting architects and specifiers, and ability to serve diverse segments from commercial roofing to cold storage, supporting customer requirements through technical service excellence and comprehensive polyiso product programs. Soprema Group holds approximately 12% share, emphasizing strong renovation channel presence, European roofing system integration, and waterproofing expertise supporting polyiso positioning. Recticel Insulation accounts for roughly 10% share through its position as continental European producer with strong façade system relationships, providing diverse polyiso boards through construction expertise and regional manufacturing. Carlisle Construction Materials (EU) represents approximately 7% share, supporting growth through roofing systems integration, commercial contractor focus, and European market expansion.

Other companies collectively hold 53% share, reflecting competitive dynamics within European polyiso insulation sales, where numerous regional insulation manufacturers, polyurethane chemical suppliers including BASF and Dow, specialized continuous insulation providers, and emerging bio-based polyiso developers serve specific customer requirements, local markets, and niche applications. This competitive environment provides opportunities for differentiation through TCPP-free formulations, bio-circular content products, high-compressive-strength boards, and application-specific systems resonating with architects, contractors, and building owners seeking high-quality polyiso aligned with sustainability requirements and energy performance standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.6 billion |

| Product Type | Rigid Foam/Board, Spray, Liquid |

| Application | Thermal, Acoustic, Hybrid (Thermal+Acoustic) |

| End-User | Building & Construction, Industrial/Others, Automotive, Consumer Goods & Appliances |

| Distribution Channel | Distributor/Dealer, Direct to Contractor/Specifier, DIY/Online |

| Nature | Standard (TCPP/Conventional), TCPP-Free/Non-Halogenated, Bio-circular Content (≥5%) |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Kingspan, Soprema, Recticel, Carlisle, Specialized insulation manufacturers |

| Additional Attributes | Dollar sales by product type, application, end-user, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with established building materials companies and insulation manufacturers; customer preferences for various facer options and thickness specifications; integration with non-halogenated flame retardant technologies and bio-based polyol formulations; innovations in continuous insulation systems and high-compressive-strength boards; adoption across commercial roofing, residential wall insulation, and industrial facility channels; regulatory framework analysis for building energy codes, fire resistance standards, and chemical regulations. |

The global demand for polyisocyanurate insulation in EU is estimated to be valued at USD 5.0 billion in 2025.

The market size for the demand for polyisocyanurate insulation in EU is projected to reach USD 7.6 billion by 2035.

The demand for polyisocyanurate insulation in EU is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in demand for polyisocyanurate insulation in EU are rigid foam/board, spray and liquid.

In terms of application, thermal segment to command 82.0% share in the demand for polyisocyanurate insulation in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyisocyanurate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Demand for Thermal Insulation Materials in EU Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA