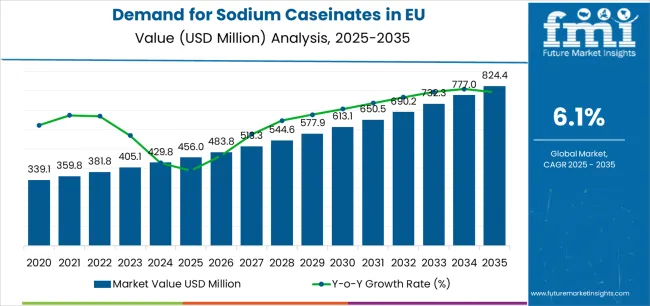

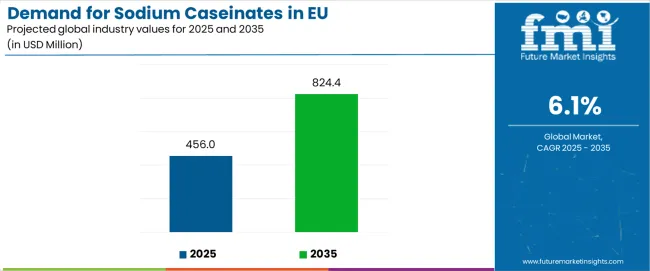

The EU sodium caseinates industry is projected to expand from USD 456.0 million in 2025 to USD 824.4 million by 2035, recording an absolute increase of USD 368.4 million at a CAGR of 6.1%. This trajectory highlights steady demand-side momentum supported by wider applications in food processing, nutritional products, pharmaceuticals, and industrial uses. From a demand perspective, bakery, confectionery, dairy alternatives, and processed meat segments generate the bulk of consumption due to the ingredient’s stabilizing and emulsifying capabilities. Nutraceuticals and sports nutrition are also strengthening uptake, as protein enrichment and clean-label formulations continue to influence consumer preferences. Pharmaceutical uses in controlled-release tablets and coating systems reinforce additional consumption. Collectively, these factors point toward consistent double-digit volume growth in specialized formulations through 2030, sustaining premium pricing opportunities in functional food and nutrition categories.

EU production capacity is expanding on the supply side, with only moderate upgrades in dairy processing facilities. Output of sodium caseinates is tied directly to casein extraction, which itself depends on milk production volumes and the allocation of raw milk toward competing end uses such as cheese, infant formula, and whey protein. This dependency creates structural limitations since fluctuations in raw milk availability or higher profitability in other dairy derivatives restrict rapid scaling of sodium caseinate output. Larger processors in the EU are channeling investment toward efficiency improvements and process modernization instead of large-scale capacity additions, in order to optimize milk utilization between food, feed, and industrial channels. Import flows from surplus producers in Oceania act as an important balancing mechanism, though global demand for dairy proteins is creating the risk of tighter supply and higher input prices.

Demand is forecast to consistently outpace supply expansion, sustaining upward pricing pressure across food-grade and pharmaceutical-grade sodium caseinates. Capacity utilization levels are likely to remain high, supported by advanced filtration methods and spray-drying processes that maximize yield. Rising energy costs, stricter regulatory requirements around dairy effluents, and environmental compliance obligations remain potential hurdles to scaling capacity. To mitigate these challenges, EU producers are expected to explore multi-sourcing strategies, invest in waste valorization, and adopt technologies aimed at improving casein recovery rates. These measures will help balance the widening demand-supply gap but the structural limits tied to raw milk allocation will continue to influence industry dynamics over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 456 million |

| Forecast Value in (2035F) | USD 824.4 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

Between 2025 and 2030, EU sodium caseinates demand is projected to expand from USD 456.0 million to USD 612.0 million, resulting in a value increase of USD 156.0 million, which represents 42.7% of the total forecast growth for the decade. This phase of development will be shaped by rising adoption of functional protein ingredients in food manufacturing, increasing availability of diverse product grades across food additives, emulsifiers, and stabilizer formats, and growing mainstream acceptance of sodium caseinates across processed food and beverage applications. Manufacturers are expanding their product portfolios to address the evolving preferences for improved emulsification properties, enhanced solubility profiles, and functionally optimized formulations comparable to conventional dairy protein ingredients.

From 2030 to 2035, sales are forecast to grow from USD 612.0 million to USD 824.4 million, adding another USD 209.0 million, which constitutes 57.3% of the ten-year expansion. This period is expected to be characterized by further expansion of clean-label formulations and premium applications, integration of advanced processing technologies for improved functional performance, and development of specialized sodium caseinate varieties targeting nutritional supplement and sports nutrition applications. The growing emphasis on protein fortification and increasing manufacturer willingness to invest in high-quality functional ingredients will drive demand for innovative sodium caseinate products that deliver superior functionality and nutritional profiles.

Between 2020 and 2025, EU sodium caseinates sales experienced steady expansion at a CAGR of 4.5%, growing from USD 365.9 million to USD 456.0 million. This period was driven by increasing protein fortification trends among European food manufacturers, rising awareness of functional ingredient benefits in processed foods, and growing recognition of sodium caseinates' versatile applications. The industry developed as major dairy protein suppliers and specialized ingredient companies recognized the commercial potential of sodium caseinates in food formulation. Product innovations, improved processing techniques, and functional property enhancements began establishing manufacturer confidence and mainstream acceptance of sodium caseinate ingredients.

Industry expansion is being supported by the rapid increase in processed food manufacturing across European countries and the corresponding demand for functional, versatile, and high-performance protein ingredients with proven functionality in food formulation applications. Modern food manufacturers rely on sodium caseinates as essential functional ingredients in emulsification systems, protein fortification, texture modification, and nutritional enhancement, driving demand for products that match or exceed alternative protein ingredients' functional properties, including emulsification capacity, water binding, and foaming characteristics. Even minor formulation requirements, such as texture improvement, protein standardization, or emulsion stabilization, can drive comprehensive adoption of sodium caseinates to maintain optimal product quality and support consistent manufacturing performance.

The growing awareness of protein nutrition and increasing recognition of functional ingredients' importance in processed food quality are driving demand for sodium caseinate ingredients from certified suppliers with appropriate quality credentials and consistent supply capabilities. Regulatory authorities are increasingly establishing clear guidelines for sodium caseinate specifications, food-grade standards, and quality requirements to maintain consumer safety and ensure product consistency. Scientific research studies and technical analyses are providing evidence supporting sodium caseinates' functional advantages and nutritional benefits, requiring specialized processing methods and standardized production protocols for optimal emulsification properties, appropriate solubility characteristics, and nutritional profiles, including high protein content and essential amino acid composition.

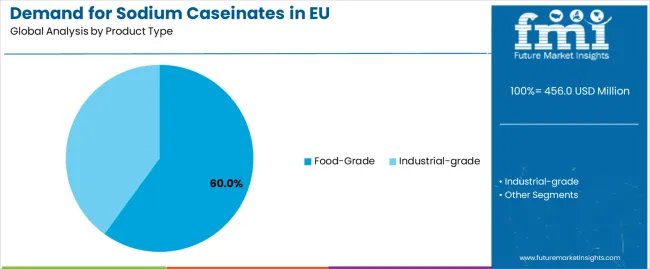

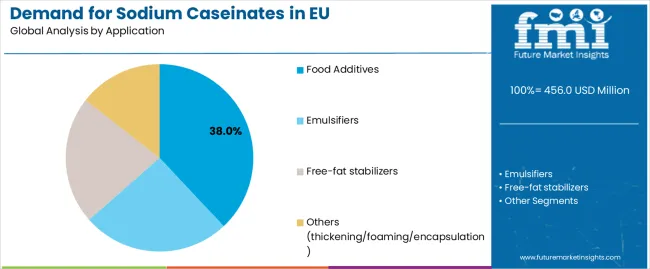

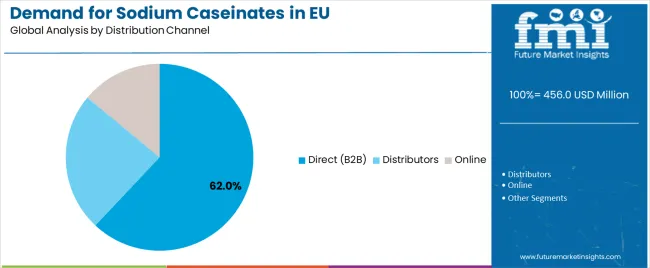

Sales are segmented by product type (grade), application (format), distribution channel, nature, and country. By product type, demand is divided into food-grade and industrial-grade. Based on the application, sales are categorized into food additives, emulsifiers, free-fat stabilizers, and others (thickening/foaming/encapsulation). In terms of distribution channel, demand is segmented into direct (B2B), distributors, and online. By nature, sales are classified into conventional and clean-label. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The food-grade segment is projected to account for 60% of EU sodium caseinates sales in 2025, establishing itself as the dominant product category across European markets. This commanding position is fundamentally supported by food-grade sodium caseinates' compliance with stringent European food safety standards, comprehensive nutritional profile featuring high protein content suitable for human consumption, and superior functional properties enabling texture development, emulsification, and nutritional fortification. The food-grade format delivers exceptional versatility, providing manufacturers with reliable protein ingredients that facilitate emulsification, foam stabilization, and nutritional enhancement properties essential for processed food applications.

This segment benefits from mature supply chains, well-established processing infrastructure, and extensive availability from multiple certified European dairy processors who maintain rigorous quality standards and food safety certifications. The food-grade sodium caseinates offer versatility across various formats, including food additives, emulsifiers, stabilizers, and specialty formulations, supported by proven manufacturing technologies that address traditional challenges in solubility and functional performance.

The food-grade segment is expected to increase its share to 62.0% by 2035, demonstrating strengthening positioning as clean-label trends and premium food applications drive higher-grade sodium caseinate adoption throughout the forecast period.

Food additives format is positioned to represent 38% of total sodium caseinates demand across European markets in 2025, declining slightly to 36.0% by 2035, reflecting the segment's importance as a primary usage format within the industry ecosystem. This substantial share directly demonstrates that food additives represent the largest single application, with manufacturers utilizing sodium caseinates for nutritional enhancement, protein fortification, texture modification, and functional property improvement mirroring traditional protein additive usage in processed foods.

Modern food manufacturers increasingly view sodium caseinates as versatile, functionally superior protein additives for bakery products, processed meats, nutritional beverages, and confectionery applications, driving demand for ingredients optimized for specific functional requirements with appropriate nutritional profiles, consistent quality that ensures manufacturing reliability, and regulatory compliance that maintains commercial viability. The segment benefits from continuous product innovation focused on improved solubility across temperature ranges, protein content standardization preventing batch variability, and processing optimization eliminating cost premiums associated with specialty protein ingredients.

The segment's slight share decline reflects proportional growth acceleration in emulsifier and stabilizer applications, with food additives format maintaining its leading position as the primary commercial application throughout the forecast period.

Direct (B2B) channels are strategically estimated to control 62% of total European sodium caseinates sales in 2025, declining slightly to 60.0% by 2035, reflecting the critical importance of direct relationships between sodium caseinate suppliers and food manufacturing customers for driving technical collaboration and formulation optimization. European food manufacturers consistently demonstrate growing demand for sodium caseinates that perform reliably in industrial processing, deliver consistent quality across production batches, and meet specific functional requirements for emulsification, stabilization, and protein fortification.

The segment provides essential development support through technical collaboration, formulation optimization services, and customized product specifications that address specific manufacturing requirements and application challenges. Major European food manufacturers, ingredient formulators, and industrial processors systematically establish direct supply relationships with sodium caseinate producers, often conducting extensive application testing, pilot production trials, and quality validation that drive volume commitments and long-term supply agreements.

The segment's stable share reflects balanced growth across both direct and distributor channels, with B2B maintaining its dominant position as technical collaboration and customized formulation support continue driving commercial adoption throughout the forecast period.

EU sodium caseinates sales are advancing steadily due to expanding processed food manufacturing, growing protein fortification trends, and increasing demand for functional protein ingredients with proven emulsification and stabilization capabilities. The industry faces challenges, including competition from alternative protein ingredients that offer comparable functionality, price volatility in dairy raw materials affecting production costs, and clean-label consumer preferences requiring processing modifications. Continued innovation in processing technologies and functional performance optimization remains central to industry development.

The rapidly accelerating development of clean-label processing technologies is fundamentally transforming sodium caseinates production from conventional chemical neutralization to more natural processing methods, enabling products that meet consumer expectations for minimal processing and ingredient transparency. Advanced processing approaches featuring enzymatic modification, membrane filtration, and controlled pH adjustment would allow manufacturers to produce sodium caseinates with clean-label positioning, minimal additive use, and natural processing claims that resonate with health-conscious consumers. These processing innovations prove particularly transformative for premium food applications, including organic products, natural foods, and specialty nutrition products, where clean-label credentials prove essential for consumer acceptance and premium positioning.

Major sodium caseinate producers invest heavily in clean-label technology development, processing facility upgrades, and quality validation programs, recognizing that natural processing methods represent breakthrough solutions for consumer perception challenges limiting premium market penetration. Manufacturers collaborate with processing equipment suppliers, dairy technology experts, and food scientists to develop alternative production methods that maintain functional performance while achieving clean-label positioning and natural ingredient status.

Modern sodium caseinate producers systematically incorporate advanced processing modifications, including controlled hydrolysis, specialized drying techniques, and particle size optimization that deliver superior solubility, enhanced emulsification capacity, and improved heat stability, supporting diverse food manufacturing applications. Strategic integration of processing innovations optimized for functional performance enables manufacturers to position sodium caseinates as premium functional ingredients where performance characteristics directly determine commercial success and customer satisfaction. These functional improvements prove essential for demanding applications, as food manufacturers require consistent functional behavior, reliable processing performance, and predictable results across diverse formulation conditions.

Companies implement extensive functional testing programs, application development partnerships with food manufacturers, and processing optimization targeting specific use cases, including high-temperature processing requiring heat stability, acid conditions demanding pH tolerance, and high-shear applications requiring emulsion stability. Manufacturers leverage functional performance improvements in technical communications, product specifications, and application guides, positioning functionally enhanced sodium caseinates as superior alternatives delivering reliable manufacturing performance.

European food manufacturers increasingly prioritize responsible ingredient sourcing, featuring local dairy suppliers, reduced transportation emissions, and transparent supply chains that align with corporate commitments. This trend enables sodium caseinate suppliers to differentiate premium offerings through local production, reduced carbon footprint, and supply chain transparency that resonate with eco-conscious food brands seeking responsible ingredient portfolios. This positioning proves particularly important for premium food applications, where environmental credentials support brand positioning and consumer loyalty.

The development of regional dairy processing infrastructure, cooperative supplier networks, and certification programs enhances manufacturers' abilities to create responsibly positioned sodium caseinates that meet food brand commitments and consumer expectations. Suppliers collaborate with dairy cooperatives, certification bodies, and food manufacturers to develop supply chains balancing ethical sourcing requirements with cost competitiveness, supporting environmental claims and premium positioning while maintaining price accessibility across customer segments.

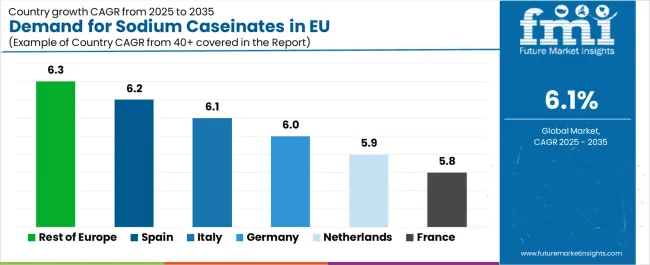

| Country | CAGR % |

|---|---|

| Rest of Europe | 6.3% |

| Spain | 6.2% |

| Italy | 6.1% |

| Germany | 6.0% |

| Netherlands | 5.9% |

| France | 5.8% |

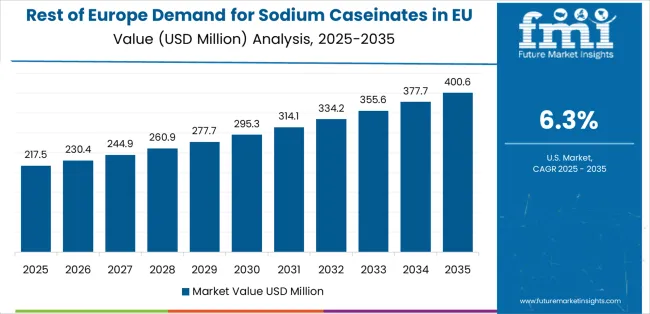

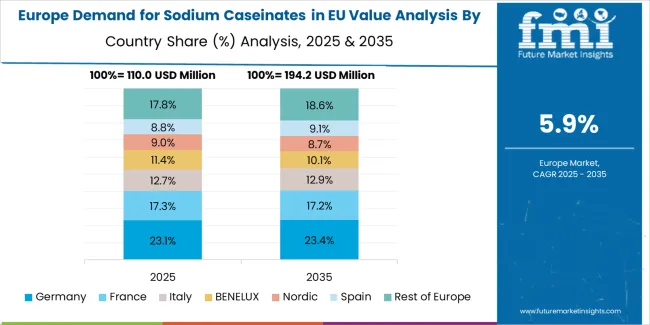

EU sodium caseinates sales demonstrate consistent growth across major European economies, with the Rest of Europe leading expansion at 6.3% CAGR through 2035, driven by emerging development and increasing processed food manufacturing expansion. Germany maintains leadership through established dairy processing infrastructure and mature food manufacturing sectors. France benefits from sophisticated food culture and premium ingredient positioning. Italy leverages expanding processed food manufacturing and growing protein fortification trends. Spain shows strong growth supported by food industry modernization and expanding bakery applications. The Netherlands emphasizes dairy processing expertise and advanced food technology capabilities. Sales show robust regional development reflecting EU-wide expansion of processed food manufacturing and functional ingredient adoption.

Revenue from sodium caseinates in Germany is projected to exhibit steady growth with a CAGR of 6.0% through 2035, driven by exceptionally well-developed dairy processing infrastructure, comprehensive food manufacturing capabilities, and strong technical expertise in functional ingredient applications throughout the country. Germany's sophisticated food technology sector and internationally recognized leadership in dairy processing innovation are creating substantial demand for diverse sodium caseinate grades across all food manufacturing segments.

Major food manufacturers, including dairy processors, bakery operations, and processed meat producers, systematically incorporate sodium caseinates into formulations, often dedicating technical resources to functional ingredient optimization and application development. German demand benefits from advanced food technology capabilities, substantial food manufacturing output supporting ingredient volumes, and technical sophistication that naturally supports sodium caseinate adoption across diverse applications beyond traditional uses.

Revenue from sodium caseinates in France is expanding at a CAGR of 5.8%, substantially supported by sophisticated food culture emphasizing quality ingredients, established dairy processing heritage, and growing protein fortification trends across French food manufacturing. France's traditional strength in dairy processing and culinary innovation are systematically driving demand for high-quality sodium caseinates across diverse food applications.

Major food manufacturers, including cheese processors, bakery chains, and specialty food producers, strategically utilize sodium caseinates for functional applications requiring emulsification, protein fortification, and texture modification. French sales particularly benefit from quality-focused food culture that demands superior functional performance and consistent ingredient quality, driving premium product positioning within the sodium caseinates category. Technical collaboration between dairy processors and food manufacturers significantly enhances adoption rates across traditional and innovative applications.

Revenue from sodium caseinates in Italy is growing at a robust CAGR of 6.1%, fundamentally driven by expanding food manufacturing sector, growing protein fortification adoption, and increasing functional ingredient utilization across traditional Italian food products. Italy's substantial food processing industry is gradually incorporating sodium caseinates as manufacturers recognize functional benefits and nutritional enhancement opportunities while maintaining culinary authenticity.

Major food manufacturers, including pasta producers, processed cheese manufacturers, and bakery operations, strategically invest in functional ingredient adoption and formulation optimization to enhance product quality and nutritional profiles. Italian sales particularly benefit from strong dairy processing tradition, creating natural supply chain integration for sodium caseinate production, combined with expanding processed food exports driving demand for ingredients supporting extended shelf life and consistent quality.

Demand for sodium caseinates in Spain is projected to grow at a CAGR of 6.2%, substantially supported by food industry modernization initiatives, expanding bakery and confectionery sectors, and increasing processed food manufacturing capabilities. Spanish food industry's ongoing investment in production technology and formulation optimization positions sodium caseinates as valuable functional ingredients supporting quality improvement and product innovation.

Major food manufacturers, including bakery chains, processed meat producers, and dairy processors, systematically expand sodium caseinate utilization, with growing recognition of functional benefits in texture improvement, protein fortification, and emulsion stabilization. Spain's substantial bakery sector particularly drives sodium caseinate demand through applications in bread improvers, cake formulations, and cream fillings requiring emulsification and texture modification.

Demand for sodium caseinates in Netherlands is expanding at a CAGR of 5.9%, fundamentally driven by exceptional dairy processing expertise, leadership in food technology innovation, and comprehensive technical capabilities supporting functional ingredient development and application optimization. Dutch dairy processors demonstrate particularly strong technical sophistication in sodium caseinate production and functional optimization supporting diverse food manufacturing applications.

Netherlands sales significantly benefit from world-class dairy processing infrastructure, including advanced production facilities, technical research capabilities, and quality assurance systems that ensure consistent sodium caseinate quality. The country's dairy processing heritage paradoxically coexists with food technology innovation, as processors leverage traditional expertise while adopting advanced technologies. The Netherlands also serves as innovation center for European food ingredients, with successful Dutch processing innovations often expanding to broader European markets.

EU sodium caseinates sales are projected to grow from USD 456.0 million in 2025 to USD 824.4 million by 2035, registering a CAGR of 6.1% over the forecast period. The Rest of Europe region is expected to demonstrate the strongest growth trajectory with a 6.3% CAGR, supported by emerging development, increasing food processing expansion, and growing protein ingredient demand. Spain and Italy follow with 6.2% and 6.1% CAGR each, attributed to expanding food manufacturing sectors and growing functional ingredient adoption, respectively.

Germany, while maintaining the largest share at 22.0% in 2025, is expected to grow at a 6.0% CAGR, reflecting maturity and established dairy processing infrastructure. France and the Netherlands also demonstrate 5.8% and 5.9% CAGR, respectively, supported by evolving food formulation trends and expanding processed food manufacturing.

EU sodium caseinates sales are defined by competition among major dairy processors, specialized protein ingredient suppliers, and regional dairy cooperatives. Companies are investing in processing technology optimization, functional property enhancement, clean-label production methods, and technical support services to deliver high-quality, functionally superior, and competitively priced sodium caseinate solutions. Strategic partnerships with food manufacturers, application development initiatives, and technical marketing emphasizing functional performance are central to strengthening competitive position.

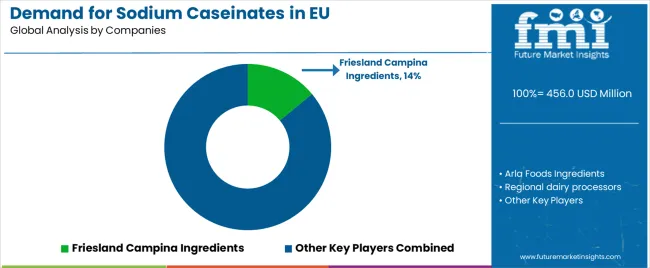

Major participants include FrieslandCampina Ingredients with an estimated 14.0% share, leveraging its extensive European dairy network, established casein production capacity, and comprehensive ingredient portfolio, supporting consistent supply to food manufacturers across Europe. FrieslandCampina benefits from integrated dairy processing, technical support capabilities, and the ability to provide customized sodium caseinate specifications, including functional modifications, particle size optimization, and application-specific formulations, supporting customer formulation development.

Arla Foods Ingredients holds approximately 12.5% share, emphasizing strong European dairy protein production footprint, technical expertise in functional dairy ingredients, and established customer relationships across food manufacturing sectors. Arla's success in developing functionally optimized sodium caseinates with enhanced solubility and emulsification properties creates strong competitive positioning and customer loyalty, supported by cooperative dairy supply structure and commitment to eco-friendly dairy processing.

Other companies and regional dairy processors collectively hold 73.5% share, reflecting the fragmented nature of European sodium caseinates sales, where numerous national dairy processors, regional cooperatives, specialized ingredient suppliers, and contract manufacturers serve local markets, specific customer requirements, and niche applications. This fragmentation provides opportunities for differentiation through specialized processing methods (clean-label production, functional modifications), customized specifications (particle size, solubility profiles), regional supply reliability, and technical support services resonating with food manufacturers seeking reliable ingredient partners with application expertise.

| Item | Value |

|---|---|

| Quantitative Units | USD 824.4 million |

| Product Type (Grade) | Food-grade, Industrial-grade |

| Application (Format) | Food additives, Emulsifiers, Free-fat stabilizers, Others (thickening/foaming/encapsulation) |

| Distribution Channel | Direct (B2B), Distributors, Online |

| Nature | Conventional, Clean-label |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | FrieslandCampina Ingredients, Arla Foods Ingredients, Regional dairy processors |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (grade), application (format), distribution channel, and nature; regional demand trends across major European markets; competitive landscape analysis with established dairy processors and specialized protein ingredient suppliers; customer preferences for various functional specifications and applications; integration with clean-label processing technologies and functional optimization development; innovations in solubility enhancement and emulsification performance; adoption across food manufacturing and ingredient formulation applications; regulatory framework analysis for food-grade protein ingredients and dairy derivative specifications; supply chain strategies; and penetration analysis for mainstream food manufacturers and specialized application developers across European markets. |

The global demand for sodium caseinates in eu is estimated to be valued at USD 456.0 million in 2025.

The market size for the demand for sodium caseinates in eu is projected to reach USD 824.4 million by 2035.

The demand for sodium caseinates in eu is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in demand for sodium caseinates in eu are food-grade and industrial-grade.

In terms of application, food additives segment to command 38.0% share in the demand for sodium caseinates in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA