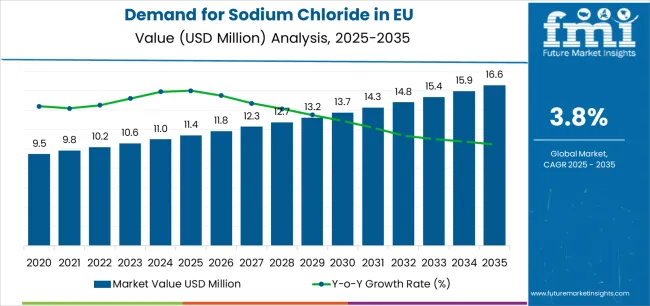

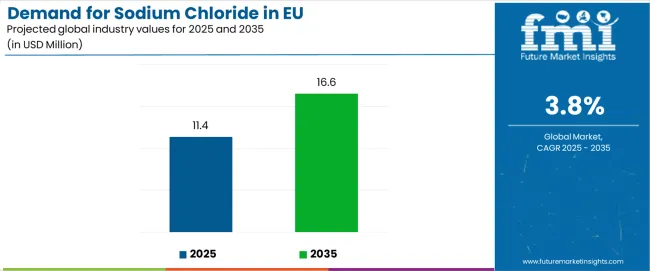

The demand for sodium chloride in the EU is projected to grow from USD 11.4 million in 2025 to USD 16.6 million by 2035, reflecting an absolute increase of USD 5.2 million at a CAGR of 3.8%. The demand growth shows moderate but steady expansion, shaped by industrial consumption, food processing requirements, and chemical feedstock applications. However, the growth pattern across EU regions is not uniform, creating a regional imbalance that will define supply chain adjustments and investment priorities over the forecast period.

Northern and Western Europe are expected to experience relatively slower growth. Mature industries in Germany, France, and the Benelux countries already have high per capita consumption of sodium chloride for both food-grade and industrial use. Growth here is expected to be incremental, driven primarily by chemical processing, chlor-alkali production, and stable demand in packaged foods. By contrast, Southern and Eastern Europe are forecast to post stronger gains, supported by expanding food manufacturing, rising meat processing volumes, and growth in water treatment infrastructure. Countries such as Poland, Hungary, and Romania are projected to outpace the EU average CAGR as industrial clusters expand and per capita consumption catches up with Western standards.

Coastal regions with access to large-scale evaporation and mining capacity, such as Spain and Portugal, contribute to the supply balance but are also heavily export-oriented. Central and landlocked countries remain dependent on cross-border supply, which creates localized price volatility when logistics or energy costs fluctuate. This imbalance is magnified by the uneven pace of industrial expansion across the EU. While high-value sectors in Germany and France sustain steady volume consumption, emerging economies in the east are reshaping trade flows as demand growth accelerates. The EU sodium chloride market will advance at a balanced pace, but regional disparities indicate that Southern and Eastern Europe will contribute disproportionately to incremental demand. Western regions will stabilize consumption at mature levels, while coastal producers retain their strategic role in balancing intra-EU supply.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 11.4 million |

| Forecast Value in (2035F) | USD 16.6 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

Industry expansion is being supported by the consistent requirements of large-scale chemical manufacturing operations across European countries and the corresponding demand for reliable, cost-effective chlor-alkali feedstock with proven quality standards for industrial applications. Modern industries rely on sodium chloride as an essential raw material for chlorine and caustic soda production, food preservation and processing, water softening and treatment systems, and winter road safety operations, driving demand for products that deliver consistent purity levels, appropriate physical specifications, and reliable supply availability. Even specialized applications, such as pharmaceutical manufacturing, food-grade processing, or high-purity electronics production, drive comprehensive sodium chloride requirements to maintain optimal production efficiency and support critical industrial operations.

The established infrastructure of European chemical parks and increasing recognition of water treatment infrastructure modernization are driving demand for sodium chloride supplies from certified producers with appropriate quality certifications and logistics capabilities. Regulatory authorities are increasingly establishing clear guidelines for sodium chloride purity specifications, food-grade certifications, and quality requirements to maintain production standards and ensure product consistency. Industrial supply agreements and long-term procurement contracts are providing stability supporting sodium chloride production investments, requiring specialized mining operations and standardized processing protocols for consistent quality delivery, optimal particle size distribution, and appropriate purity profiles, including sodium chloride content specifications and controlled impurity levels.

Sales are segmented by product type (form), application (end use), distribution channel, nature (source), and country. By product type, demand is divided into solid, liquid brine, and high-purity refined/vacuum. Based on the application, sales are categorized into chemicals, food and beverages, water treatment, deicing, industrial (non-chemical), oil and gas, pharmaceuticals, and agriculture. In terms of distribution channel, demand is segmented into industrial contracts, municipal procurement, food/pharma distributors, and direct brine pipelines. By nature, sales are classified into seawater and brine, and solid mining. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The solid segment is projected to account for 44% of EU sodium chloride sales in 2025, establishing itself as the dominant product form across European industries. This commanding position is fundamentally supported by solid sodium chloride's versatility across diverse applications, ease of transportation and storage compared to liquid alternatives, and established distribution infrastructure enabling cost-effective delivery to varied end users. The solid format delivers exceptional flexibility, providing customers with convenient handling characteristics that facilitate storage, dosing accuracy for industrial processes, and straightforward integration into existing production systems.

This segment benefits from mature mining operations, well-established processing facilities, and extensive distribution networks from multiple European producers who maintain rigorous quality standards and consistent production capacity. Additionally, solid sodium chloride offers versatility across various grain sizes and purity grades, including coarse industrial salt, fine food-grade varieties, and compressed tablet formats, supported by proven logistics systems that address regional distribution requirements and seasonal demand fluctuations.

The solid segment is expected to maintain a strong 41.0% share through 2035, demonstrating gradual decline as liquid brine and high-purity refined products gain modest share, reflecting specialized application growth while solid maintains its established position throughout the forecast period.

.webp)

Chemicals application is positioned to represent 30% of total sodium chloride demand across European industries in 2025, maintaining substantial share around 31.0% through 2035, reflecting the segment's dominance as the primary industrial consumption driver within the overall industry ecosystem. This considerable share directly demonstrates that chemical manufacturing represents the largest single application, with producers consuming sodium chloride for chlor-alkali electrolysis producing chlorine gas, caustic soda, and hydrogen, which serve as fundamental building blocks for plastics, solvents, pharmaceuticals, and countless chemical intermediates.

Modern chemical facilities increasingly view sodium chloride as an irreplaceable raw material for integrated production complexes, driving demand for consistent-purity brine deliveries optimized for electrolysis efficiency with minimal impurities, reliable supply continuity supporting continuous production operations, and proximity to manufacturing sites reducing transportation costs. The segment benefits from long-term supply contracts between sodium chloride producers and chemical manufacturers, infrastructure investments in direct brine pipelines connecting deposits to production facilities, and technical specifications ensuring optimal electrolysis performance.

The segment's stable share reflects proportional growth across all application categories, with chemicals maintaining its leading position as the primary industrial driver throughout the forecast period.

EU sodium chloride sales are advancing steadily due to consistent industrial demand from chemical manufacturing, ongoing food processing requirements, and reliable municipal deicing programs. However, the industry faces challenges, including environmental concerns regarding road salt runoff affecting freshwater ecosystems, price sensitivity in commodity-grade applications limiting premium positioning, and logistical complexities associated with seasonal demand fluctuations for deicing operations. Continued optimization of production efficiency and supply chain reliability remains central to industry development.

The rapidly accelerating development of seawater desalination facilities across Mediterranean coastal regions and water-stressed European areas is fundamentally transforming sodium chloride supply dynamics from traditional mining-dependent sourcing to integrated desalination by-product recovery, enabling cost-effective brine production without dedicated extraction investments. Advanced desalination plants featuring reverse osmosis and thermal distillation technologies generate concentrated brine streams containing dissolved sodium chloride that can be processed into commercial products, reducing waste disposal requirements while creating revenue opportunities from previously discarded by-products. These infrastructure developments prove particularly transformative for coastal chemical facilities and regional food processors, where proximity to desalination plants enables direct brine utilization without transportation costs associated with mined sodium chloride.

Modern sodium chloride producers systematically incorporate advanced purification technologies, including recrystallization systems, membrane filtration, and vacuum evaporation that deliver pharmaceutical-grade products meeting stringent regulatory specifications for injectable solutions, dialysis applications, and medical device manufacturing. Strategic integration of high-purity processing capabilities enables manufacturers to position specialized sodium chloride products commanding premium pricing where quality certifications directly determine industry access and customer qualification. These purity improvements prove essential for pharmaceutical adoption, as medical applications demand guaranteed impurity levels, comprehensive quality documentation, and validated manufacturing processes ensuring patient safety.

European consumers and industrial purchasers increasingly prioritize sustainable sodium chloride sourcing featuring responsible mining operations, renewable energy utilization in production facilities, and transparent environmental management practices that align with corporate sustainability commitments. This sustainability emphasis enables producers to differentiate operations through environmental certifications, carbon footprint disclosure, and responsible sourcing claims that resonate with environmentally conscious customers seeking sodium chloride suppliers demonstrating measurable environmental performance improvements. Sustainable production positioning proves particularly important for food and pharmaceutical applications where brand reputation and supply chain responsibility directly influence purchasing decisions.

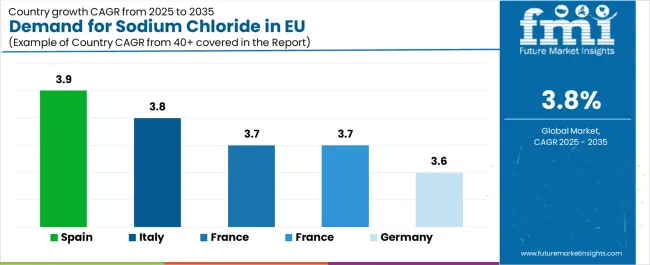

| Country | CAGR % |

|---|---|

| Spain | 3.9% |

| Italy | 3.8% |

| France | 3.7% |

| Netherlands | 3.7% |

| Germany | 3.6% |

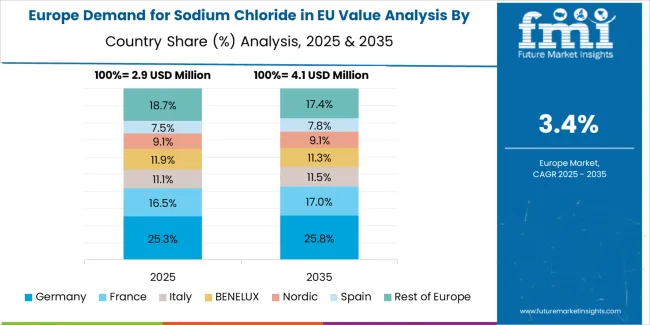

EU sodium chloride sales demonstrate stable growth across major European economies, with Spain leading expansion at 3.9% CAGR through 2035, driven by chemical sector growth and favorable production conditions. Germany maintains leadership through established industrial consumption and mature supply infrastructure. France benefits from diversified applications across chemicals, food processing, and winter maintenance. Italy leverages growing pharmaceutical manufacturing and expanding food industry requirements. Spain shows strongest growth supported by coastal production advantages and industrial expansion. The Netherlands emphasizes chemical manufacturing concentration and logistics excellence. Overall, sales show steady regional development reflecting consistent industrial demand and reliable consumption patterns.

Revenue from sodium chloride in Germany is projected to exhibit steady growth with a CAGR of 3.6% through 2035, driven by exceptionally well-developed chemical manufacturing infrastructure, comprehensive food processing industry, and substantial winter deicing requirements throughout the country. Germany's sophisticated industrial base and internationally recognized leadership in chemical production are creating substantial demand for diverse sodium chloride grades across all industrial segments.

Major chemical producers, including BASF, Covestro, and integrated chlor-alkali facilities, systematically consume massive sodium chloride volumes for chlorine and caustic soda production, often through dedicated brine pipelines connecting underground deposits to manufacturing complexes. German demand benefits from high industrial output, substantial manufacturing capacity supporting chemical exports, and well-established supply relationships between sodium chloride producers and major industrial consumers ensuring reliable procurement and quality consistency.

Revenue from sodium chloride in France is expanding at a CAGR of 3.7%, substantially supported by diversified industrial consumption across chemical manufacturing, food processing, and municipal applications despite stable overall growth patterns. France's balanced industrial structure and comprehensive infrastructure are systematically driving demand for consistent sodium chloride supplies across diverse application segments.

Major chemical facilities, including those operated by Arkema and other producers, along with extensive food processing operations for cheese production, meat curing, and bakery applications, are gradually establishing comprehensive sodium chloride procurement programs to serve continuously evolving requirements. French sales particularly benefit from Mediterranean salt production facilities providing cost-effective supply, Atlantic coast operations supporting western regions, and established distribution networks ensuring reliable availability across diverse geographic areas.

Revenue from sodium chloride in Italy is growing at a robust CAGR of 3.8%, fundamentally driven by expanding pharmaceutical manufacturing, growing food processing requirements, and steady chemical industry consumption. Italy's traditionally strong pharmaceutical sector and expanding food industry are gradually increasing sodium chloride requirements while maintaining quality standards for specialized applications.

Major pharmaceutical producers, including generic drug manufacturers and medical solution providers, strategically invest in high-purity sodium chloride procurement supporting injectable solutions, dialysis products, and medical device manufacturing. Italian sales particularly benefit from Mediterranean coastal salt production facilities providing competitive supply, established pharmaceutical manufacturing clusters requiring certified high-purity grades, and growing food processing exports necessitating reliable preservation materials.

Demand for sodium chloride in Spain is projected to grow at the highest CAGR of 3.9%, substantially supported by advantageous coastal production conditions, expanding chemical manufacturing capacity, and growing food processing sector requirements. Spanish coastal geography's emphasis on solar evaporation operations positions domestic sodium chloride production as cost-competitive while supporting export opportunities to broader European industries.

Major chemical facilities, expanding food processing operations serving both domestic and export industries, and municipal requirements systematically expand sodium chloride consumption, with coastal production facilities proving particularly successful in delivering competitive pricing through efficient solar evaporation operations. Spain's substantial tourism industry indirectly supports food processing demand, water treatment facility requirements increase with population growth and infrastructure development, and Mediterranean climate conditions optimize natural evaporation production methods.

Demand for sodium chloride in the Netherlands is expanding at a CAGR of 3.7%, fundamentally driven by concentrated chemical manufacturing infrastructure, strategic port facilities enabling efficient import/export operations, and established industrial supply relationships. Dutch chemical industry's emphasis on chlor-alkali production and derivative manufacturing positions sodium chloride as critical feedstock material supporting major industrial facilities.

Netherlands sales significantly benefit from well-developed port infrastructure at Rotterdam and Amsterdam facilitating international sodium chloride trade, integrated chemical manufacturing complexes receiving brine through pipeline infrastructure, and sophisticated logistics networks ensuring reliable distribution across Benelux industries. The country's chemical industry concentration creates substantial industrial demand, while strategic geographic position enables efficient supply chain operations serving both domestic consumption and regional distribution throughout northern European industries.

EU sodium chloride sales are projected to grow from USD 11.4 million in 2025 to USD 16.6million by 2035, registering a CAGR of 3.8% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory with a 3.9% CAGR, supported by expanding chemical manufacturing, the growing food processing sector, and advantageous coastal solar evaporation conditions. Italy and France follow with 3.8% and 3.7% CAGR respectively, attributed to diversified industrial consumption and established production infrastructure.

Germany, while maintaining the largest share at 22.1% in 2025, is expected to grow at a 3.6% CAGR, reflecting industrial maturity and stable consumption patterns. The Netherlands demonstrates 3.7% CAGR, supported by chemical manufacturing concentration and strategic port infrastructure.

EU sodium chloride sales are defined by competition among integrated mining companies, coastal solar evaporation producers, and specialized high-purity processors. Companies are investing in sustainable production practices, logistics optimization, quality certification programs, and customer relationship management to deliver reliable, cost-effective, and application-appropriate sodium chloride solutions. Strategic partnerships with major industrial consumers, long-term supply agreements, and infrastructure investments in pipeline delivery systems are central to strengthening competitive position.

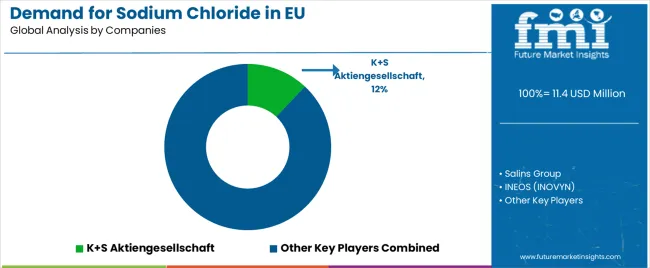

Major participants include K+S Aktiengesells chaft with an estimated 12.0% share, leveraging its extensive German rock salt mining operations, established logistics infrastructure, and comprehensive customer relationships supporting consistent supply to chemical manufacturers, food processors, and municipal customers. K+S benefits from integrated mining operations, diverse product portfolio spanning industrial to food-grade specifications, and the ability to provide reliable volumes supporting large-contract procurement requirements.

Salins Group holds approximately 9.0% share, emphasizing comprehensive solar evaporation production network across Mediterranean coastal locations, strong presence in food-grade industries, and established distribution serving multiple European countries. Salins' success in developing cost-effective solar salt production and maintaining quality certifications creates strong positioning across food and industrial applications, supported by strategic production locations optimizing natural evaporation conditions.

INEOS (INOVYN) accounts for roughly 7.5% share through its position as an integrated chlor-alkali producer consuming captive brine supplies while also serving external industries. The company benefits from vertical integration connecting sodium chloride production to downstream chemical manufacturing, technical expertise in electrolysis-grade specifications, and comprehensive infrastructure including solution mining operations and pipeline delivery systems supporting chemical facilities.

Other companies and regional producers collectively hold 71.5% share, reflecting the highly fragmented nature of European sodium chloride sales.

| Item | Value |

|---|---|

| Quantitative Units | USD 16,556.1 Million |

| Product Type (Form) | Solid, Liquid Brine, High-Purity Refined/Vacuum |

| Application (End Use) | Chemicals, Food & Beverages, Water Treatment, Deicing, Industrial (Non-Chemical), Oil & Gas, Pharmaceuticals, Agriculture |

| Distribution Channel | Industrial Contracts, Municipal Procurement, Food/Pharma Distributors, Direct Brine Pipelines |

| Nature (Source) | Seawater & Brine, Solid Mining |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | K+S Aktiengesellschaft, Salins Group, INEOS (INOVYN), Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (form), application (end use), distribution channel, and nature (source); regional demand trends across major European industries; competitive landscape analysis with established mining companies and coastal evaporation producers; customer preferences for various purity grades and physical specifications; integration with chemical manufacturing facilities and food processing operations; innovations in sustainable production practices and high-purity processing technologies; adoption across industrial, municipal, and food/pharmaceutical sectors. |

The global demand for sodium chloride in eu is estimated to be valued at USD 11.4 million in 2025.

The market size for the demand for sodium chloride in eu is projected to reach USD 16.6 million by 2035.

The demand for sodium chloride in eu is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in demand for sodium chloride in eu are solid, liquid brine and high-purity refined/vacuum.

In terms of application (end use), chemicals segment to command 30.0% share in the demand for sodium chloride in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA