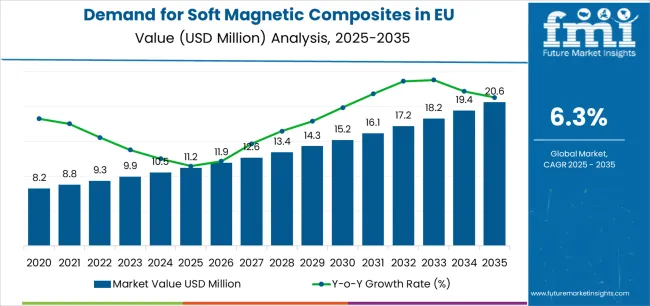

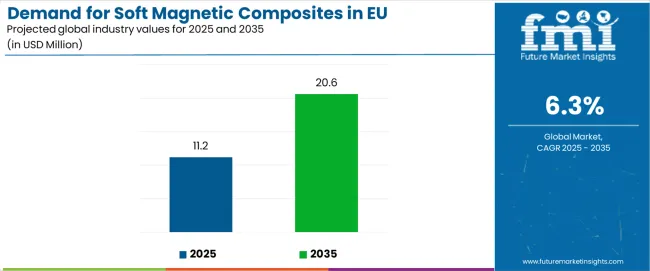

The demand for soft magnetic composites in the EU is expected to grow from USD 11.2 million in 2025 to USD 20.6 million by 2035, reflecting an absolute increase of USD 9.4 million at a CAGR of 6.3%. The primary share of demand is concentrated in the electrical and electronics industry, where soft magnetic composites are increasingly deployed in inductors, transformers, and electromagnetic shielding. Their ability to reduce eddy current losses and enable compact component designs makes them particularly suitable for high-frequency applications in consumer electronics and communication equipment, ensuring steady growth in this segment.

Automotive is set to be the fastest-growing end-use category. The transition toward electric vehicles and hybrid platforms is driving interest in soft magnetic composites for traction motors, onboard chargers, and auxiliary power units. The material’s advantages in weight reduction, low-loss magnetic properties, and ease of shaping complex geometries are aligning with EU directives for energy efficiency and emission reduction. Demand in this segment is expected to accelerate significantly between 2025 and 2030 as EV penetration deepens across Western and Northern Europe, while suppliers in Eastern Europe expand production capacity to support regional assembly lines.

Industrial machinery and energy systems also represent notable end-use demand. Soft magnetic composites are being adopted in power electronics, renewable energy equipment, and compact drives used in automation and robotics. As European manufacturers increase reliance on energy-efficient motors and high-frequency converters, demand for these materials is projected to gain momentum. In renewable energy, particularly wind and solar inverters, the adoption of high-frequency magnetic components will continue to underpin steady consumption. A smaller yet emerging layer of demand comes from healthcare technology and aerospace, where miniaturized magnetic devices are gaining ground in imaging systems, sensors, and specialized avionics. Though modest in size, these sectors add high-value demand that favors premium-grade composites. Overall, the EU demand structure suggests that while electrical and electronics will continue to anchor volumes, automotive electrification and industrial automation will drive the highest incremental growth.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 11.2 million |

| Forecast Value in (2035F) | USD 20.6 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

Industry expansion is being supported by the rapid increase in electric vehicle production across European automotive manufacturers and the corresponding demand for energy-efficient, high-performance, and compact electric motor solutions with proven magnetic properties in demanding automotive and industrial applications. Modern electric motor manufacturers rely on soft magnetic composites as essential core materials for stator and rotor assemblies, magnetic flux management, and electromagnetic component production, driving demand for materials that match or exceed traditional electrical steel's magnetic properties, including high saturation flux density, low core losses, and superior permeability characteristics. Even minor performance requirements, such as high-frequency operation, complex three-dimensional geometries, or miniaturization demands, can drive comprehensive adoption of soft magnetic composites to maintain optimal motor efficiency and support advanced electromagnetic designs.

The growing awareness of energy efficiency regulations and increasing recognition of magnetic materials' critical role in electric motor performance are driving demand for soft magnetic composites from certified suppliers with appropriate quality credentials and technical expertise. Regulatory authorities are increasingly establishing clear guidelines for energy efficiency standards, electromagnetic compatibility requirements, and material specifications to maintain product performance and ensure environmental compliance. Scientific research studies and engineering analyses are providing evidence supporting soft magnetic composites' performance advantages in specific applications, requiring specialized powder metallurgy methods and standardized processing protocols for optimal particle insulation, appropriate density control, and magnetic property optimization, including permeability enhancement and core loss minimization.

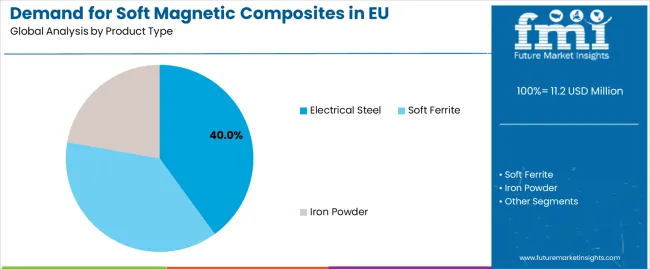

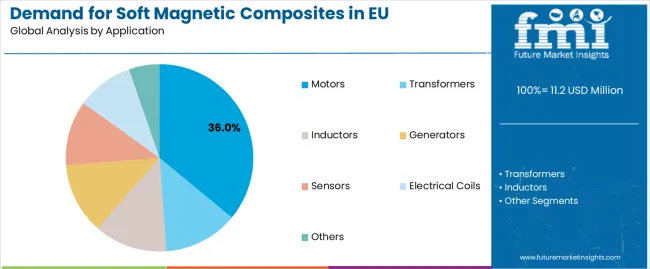

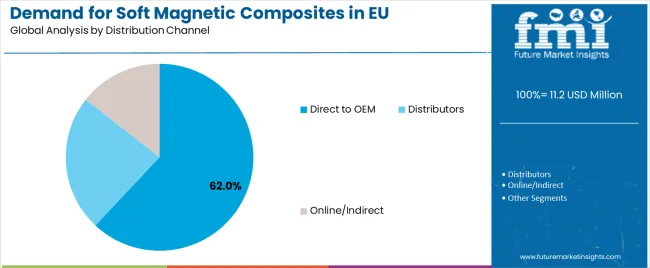

Sales are segmented by product type (material), application (format), distribution channel, nature (coating/insulation), and country. By product type, demand is divided into electrical steel, soft ferrite, and iron powder. Based on the application, sales are categorized into motors, transformers, inductors, generators, sensors, electrical coils, and others. In terms of distribution channel, demand is segmented into direct to OEM, distributors, and online/indirect. By nature, sales are classified into insulated/phosphate-coated, advanced nano-coating, and uncoated. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The electrical steel segment is projected to account for 40% of EU soft magnetic composites sales in 2025, establishing itself as the dominant material category across European markets. This commanding position is fundamentally supported by electrical steel's long-established presence in electromagnetic applications, comprehensive magnetic property profile featuring high saturation flux density, and superior performance in traditional motor and transformer designs. The electrical steel format delivers exceptional reliability, providing manufacturers with proven magnetic materials that facilitate core lamination stacking, transformer winding assemblies, and traditional motor construction properties essential for established electromagnetic device manufacturing.

This segment benefits from mature production infrastructure, well-established supply chains, and extensive availability from multiple certified European steel mills who maintain rigorous quality standards and grade specifications. Electrical steel offers versatility across various formats, including grain-oriented grades for transformer cores, non-oriented grades for motor applications, and thin-gauge materials for high-frequency applications, supported by proven manufacturing technologies that address traditional challenges in core loss reduction and magnetic property optimization.

The electrical steel segment is expected to decline slightly to 39.0% share by 2035, demonstrating gradual positioning adjustment as iron powder composites gain incremental market share in emerging electric vehicle motor applications, though electrical steel maintains dominant positioning throughout the forecast period.

Motors format is positioned to represent 36% of total soft magnetic composites demand across European markets in 2025, increasing to 38.0% by 2035, reflecting the segment's dominance as the primary usage format within the industry ecosystem. This substantial share directly demonstrates that motors represent the largest single application, with electric motor manufacturers utilizing soft magnetic composites for stator cores, rotor assemblies, magnetic flux management, and electromagnetic component production across industrial motors, automotive electric motors, and consumer appliance motors.

Modern motor manufacturers increasingly adopt soft magnetic composites for next-generation electric vehicle traction motors requiring high efficiency, driving demand for materials optimized for high-frequency switching with appropriate saturation flux density, low core losses that maximize motor efficiency, and manufacturing flexibility that enables complex rotor and stator geometries. The segment benefits from continuous material innovation focused on improved magnetic flux density supporting higher torque density, core loss reduction enhancing energy efficiency, and mechanical property optimization enabling high-speed motor operation without structural failure.

The segment's expanding share reflects accelerating electric vehicle motor production and increasing industrial motor efficiency requirements, with motors maintaining dominant positioning as electrification trends intensify throughout the forecast period.

Direct to OEM channels are strategically estimated to control 62% of total European soft magnetic composites sales in 2025, increasing to 65.0% by 2035, reflecting the critical importance of direct relationships between magnetic material suppliers and motor manufacturers for driving technical collaboration, material qualification, and supply reliability. European electric motor manufacturers, automotive OEMs, and power electronics companies consistently demonstrate strong preference for direct supplier relationships, delivering consistent material specifications, technical support, and supply security supporting manufacturing operations and quality requirements.

The segment provides essential supply chain support through application engineering, material customization, and quality assurance programs that address specific electromagnetic design requirements and performance specifications. Major European motor manufacturers systematically establish direct supply agreements with soft magnetic composite producers, often conducting extensive material qualification testing, electromagnetic performance validation, and long-term contracts that ensure supply security and enable collaborative product development for emerging motor designs.

The segment's expanding share reflects increasing importance of technical collaboration and customized magnetic materials as motor designs become more sophisticated, with direct OEM channels strengthening dominant positioning as performance requirements drive closer supplier-manufacturer relationships throughout the forecast period.

EU soft magnetic composites sales are advancing steadily due to accelerating electric vehicle motor production, growing industrial motor efficiency requirements, and increasing power electronics applications requiring advanced magnetic materials. Th industry faces challenges, including cyclical automotive demand creating volume uncertainty, raw material price volatility affecting production costs, and alternative material technologies threatening market share in specific applications. Continued innovation in particle coating technologies, magnetic property optimization, and manufacturing process efficiency remains central to industry development.

The rapidly accelerating growth of electric vehicle production is fundamentally transforming soft magnetic composites demand from traditional industrial motors toward high-performance traction motors requiring exceptional efficiency, compact designs, and high power density. Advanced soft magnetic composite formulations featuring optimized particle size distributions, superior coating technologies, and enhanced magnetic properties enable efficient traction motor designs supporting electric vehicle range, performance, and cost competitiveness. These automotive innovations prove particularly transformative for axial flux motor designs, including in-wheel motors requiring compact high-torque designs, integrated motor-gearbox assemblies demanding complex three-dimensional magnetic flux paths, and high-speed motors requiring reduced eddy current losses at elevated switching frequencies.

Modern soft magnetic composite producers systematically incorporate advanced nano-coating technologies, including atomic layer deposition, sol-gel processes, and chemical vapor deposition methods that deliver ultra-thin insulation coatings, maximized packing density, and superior magnetic properties supporting high-performance motor applications. Strategic integration of coating innovations optimized for minimal thickness enables manufacturers to position nano-coated soft magnetic composites as premium materials where efficiency directly determines motor competitiveness, vehicle range, and commercial success. These coating improvements prove essential for high-frequency motor operation, as switching frequencies above 10 kHz demand superior particle insulation, and for high-power-density designs where maximized magnetic flux density determines motor size and weight.

European automotive and motor manufacturers increasingly prioritize circular economy principles featuring recyclable soft magnetic composites, efficient powder metallurgy processes, and end-of-life material recovery that align with European waste management regulations and corporate environmental commitments. This trend enables soft magnetic composite suppliers to differentiate products through recycled content, closed-loop manufacturing processes, and material recovery programs that resonate with eco-conscious automotive brands seeking responsible material portfolios. This positioning proves particularly important for electric vehicle applications where environmental credentials support green transportation narratives, and for industrial motor applications where lifecycle environmental impact influences procurement decisions.

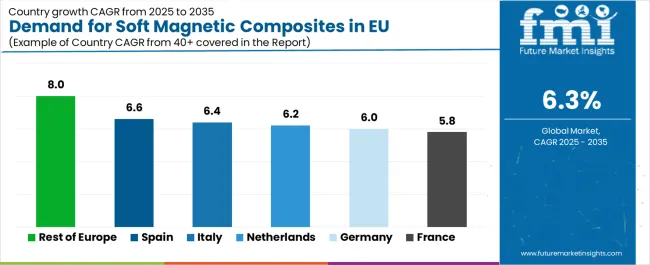

| Country | CAGR % |

|---|---|

| Rest of Europe | 8.0% |

| Spain | 6.6% |

| Italy | 6.4% |

| Netherlands | 6.2% |

| Germany | 6.0% |

| France | 5.8% |

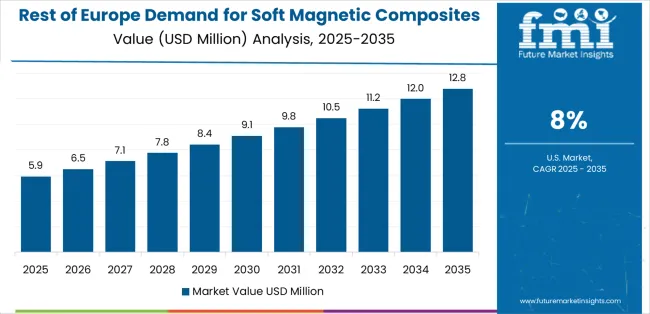

EU soft magnetic composites sales demonstrate robust growth across major European economies, with the Rest of Europe leading expansion at 8.0% CAGR through 2035, driven by emerging automotive electrification and increasing industrial motor production. Germany maintains leadership through established automotive and motor manufacturing excellence. France benefits from growing electric vehicle component production and aerospace applications. Italy leverages expanding automotive supply chain and industrial motor manufacturing. Spain shows strong growth supported by automotive component manufacturing expansion and increasing electrification. Netherlands emphasizes power electronics and high-tech manufacturing. Sales show strong regional development reflecting EU-wide automotive electrification and industrial motor efficiency trends.

Revenue from soft magnetic composites in Germany is projected to exhibit steady growth with a CAGR of 6.0% through 2035, driven by exceptionally well-developed automotive manufacturing ecosystem, comprehensive industrial motor production capabilities, and strong technical expertise in electromagnetic design throughout the country. Germany's sophisticated automotive industry and internationally recognized leadership in motor technology are creating substantial demand for diverse soft magnetic composite grades across all electromagnetic applications.

Major automotive suppliers, including Bosch, Continental, ZF, and specialized motor manufacturers, systematically incorporate soft magnetic composites into electric vehicle traction motors, hybrid powertrains, and industrial drive systems, often dedicating engineering resources to electromagnetic design optimization and material qualification. German demand benefits from extensive electric vehicle production including BMW, Mercedes-Benz, Volkswagen Group, and Porsche electrification programs naturally supporting soft magnetic composite adoption across traction motors, power electronics, and electromagnetic components.

Revenue from soft magnetic composites in France is expanding at a CAGR of 5.8%, substantially supported by growing electric vehicle production emphasizing Renault and Stellantis electrification strategies, established industrial motor manufacturing, and increasing power electronics applications across French manufacturing. France's strong automotive and industrial equipment industries and engineering capabilities are systematically driving demand for soft magnetic composites across diverse electromagnetic applications.

Major automotive manufacturers and suppliers strategically incorporate soft magnetic composites into electric vehicle component production and industrial motor manufacturing requiring advanced magnetic materials. French sales particularly benefit from aerospace and defense electronics applications demanding high-reliability magnetic materials, driving premium product positioning within the soft magnetic composites category. Technical collaboration between motor manufacturers and material suppliers significantly enhances adoption rates across traditional and emerging applications.

Revenue from soft magnetic composites in Italy is growing at a robust CAGR of 6.4%, fundamentally driven by expanding automotive component manufacturing, growing electric vehicle supply chain participation, and increasing industrial motor production across Italian manufacturing. Italy's substantial automotive supply chain is systematically incorporating soft magnetic composites as manufacturers recognize performance advantages and efficiency opportunities while supporting electrification initiatives.

Major automotive component suppliers, including Marelli and specialized motor manufacturers, strategically invest in soft magnetic composite adoption and electromagnetic design optimization to enhance motor efficiency and manufacturing competitiveness. Italian sales particularly benefit from strong automotive tier-one supplier presence, creating natural demand for motor cores and electromagnetic components supporting increasing electric vehicle content, combined with expanding industrial automation driving motor and power electronics requirements.

Demand for soft magnetic composites in Spain is projected to grow at a CAGR of 6.6%, substantially supported by automotive component manufacturing expansion, increasing electric vehicle production participation, and growing industrial motor applications. Spanish automotive industry's strong component production volumes and increasing electrification positioning soft magnetic composites as valuable materials supporting manufacturing growth and technology advancement.

Major automotive component manufacturers and motor suppliers systematically expand soft magnetic composite utilization, with growing recognition of material benefits in electric motor efficiency, manufacturing flexibility, and cost competitiveness. Spain's substantial automotive component production particularly drives soft magnetic composite demand through applications in electric vehicle motor components, power electronics assemblies, and industrial drive systems requiring efficient magnetic materials.

Demand for soft magnetic composites in Netherlands is expanding at a CAGR of 6.2%, fundamentally driven by power electronics manufacturing activities, leadership in high-tech equipment production, and comprehensive technical capabilities supporting advanced electromagnetic applications. Dutch manufacturers demonstrate particularly strong technical sophistication in power electronics and specialized electromagnetic components requiring premium soft magnetic materials.

Netherlands sales significantly benefit from the power electronics industry presence, including renewable energy power conversion equipment and industrial power supplies, creating demand for soft ferrite cores and inductor materials supporting efficient energy conversion. The country's high-tech manufacturing leadership goes hand-in-hand with a strong focus on environmental performance, as manufacturers leverage technical expertise while prioritizing eco-friendly outcomes. The Netherlands also serves as an innovation hub for European power electronics, with successful Dutch technology innovations often expanding to broader European markets.

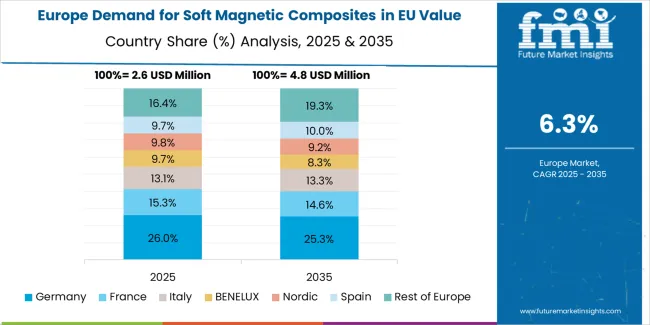

EU soft magnetic composites sales are projected to grow from USD 11.2 million in 2025 to USD 20.6 million by 2035, registering a CAGR of 6.3% over the forecast period. The Rest of Europe region is expected to demonstrate the strongest growth trajectory with an 8.0% CAGR, supported by emerging automotive production, increasing industrial automation, and growing power electronics manufacturing. Spain and Italy follow with 6.6% and 6.4% CAGR each, attributed to expanding electric vehicle component production and growing motor manufacturing sectors, respectively.

Germany, while maintaining the largest share at 38.3% in 2025, is expected to grow at a 6.0% CAGR, reflecting market maturity and established automotive and industrial motor manufacturing infrastructure. The Netherlands and France also demonstrate 6.2% and 5.8% CAGR, respectively, supported by evolving power electronics activities and expanding electric vehicle component manufacturing.

EU soft magnetic composites sales are defined by competition among major powder metallurgy companies, specialized magnetic materials suppliers, and steel producers with electrical steel capabilities. Companies are investing in particle coating technology optimization, magnetic property enhancement, application engineering support, and eco-friendly manufacturing to deliver high-performance, cost-competitive, and environmentally responsible soft magnetic composite solutions. Strategic partnerships with motor manufacturers, automotive qualification programs, and technical marketing emphasizing efficiency and performance are central to strengthening competitive position.

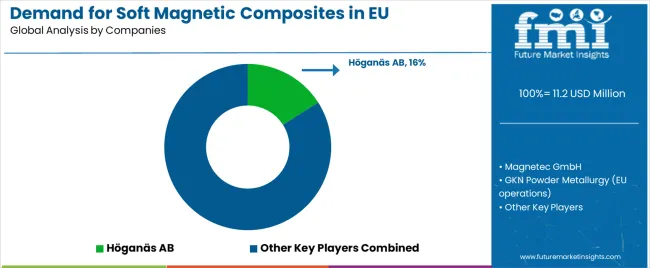

Major participants include Höganäs AB with an estimated 14.0% share, leveraging its extensive European powder metallurgy footprint, established automotive supply relationships, and comprehensive soft magnetic composite portfolio, supporting consistent supply to motor manufacturers across Europe. Höganäs benefits from integrated powder production, coating technology expertise, and the ability to provide complete soft magnetic solutions, including iron powder grades, particle coating technologies, and application engineering support, supporting customer electromagnetic design optimization.

Magnetec GmbH holds approximately 6.5% share, emphasizing strong European core manufacturing presence, automotive electronics focus, and specialized soft magnetic composite applications. Magnetec's success in developing high-performance motor cores with optimized magnetic properties creates strong competitive positioning in demanding automotive applications, supported by German manufacturing quality and technical expertise. GKN Powder Metallurgy (EU operations) accounts for roughly 5.8% share through its position as automotive component supplier, providing comprehensive powder metallurgy capabilities featuring soft magnetic composite production, motor core manufacturing, and electromagnetic component assembly. The company benefits from automotive industry relationships, powder metallurgy expertise, and integrated manufacturing supporting component supply.

Sumitomo Electric (EU sales) represents approximately 4.2% share, leveraging Japanese electromagnetic materials technology, electric vehicle industry relationships, and premium soft magnetic composite positioning. Sumitomo Electric benefits from material science leadership, advanced coating technologies, and automotive OEM partnerships supporting electric vehicle motor applications. Rio Tinto Metal Powders (EU) accounts for roughly 3.9% share through its position as iron powder supplier, providing raw material feedstock for soft magnetic composite production supporting European powder metallurgy industry. The company benefits from integrated iron ore mining, atomized powder production, and quality consistency supporting downstream magnetic material manufacturing.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.6 million |

| Product Type (Material) | Electrical Steel, Soft Ferrite, Iron Powder |

| Application (Format) | Motors, Transformers, Inductors, Generators, Sensors, Electrical Coils, Others |

| Distribution Channel | Direct to OEM, Distributors, Online/Indirect |

| Nature (Coating/Insulation) | Insulated/Phosphate-Coated, Advanced Nano-Coating, Uncoated |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Höganäs AB, Magnetec GmbH, GKN Powder Metallurgy, Sumitomo Electric, Rio Tinto Metal Powders |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (material), application (format), distribution channel, and nature (coating/insulation); regional demand trends across major European markets; competitive landscape analysis with established powder metallurgy companies and specialized magnetic materials suppliers; customer preferences for various magnetic material grades and coating technologies; integration with electric vehicle motor manufacturing and industrial automation technologies; innovations in particle coating and magnetic property optimization; adoption across automotive, industrial, and power electronics applications; regulatory framework analysis for energy efficiency standards and material specifications; supply chain strategies; and penetration analysis for motor manufacturers and automotive suppliers across European markets. |

The global demand for soft magnetic composites in eu is estimated to be valued at USD 11.2 million in 2025.

The market size for the demand for soft magnetic composites in eu is projected to reach USD 20.6 million by 2035.

The demand for soft magnetic composites in eu is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in demand for soft magnetic composites in eu are electrical steel , soft ferrite and iron powder.

In terms of application, motors segment to command 36.0% share in the demand for soft magnetic composites in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA