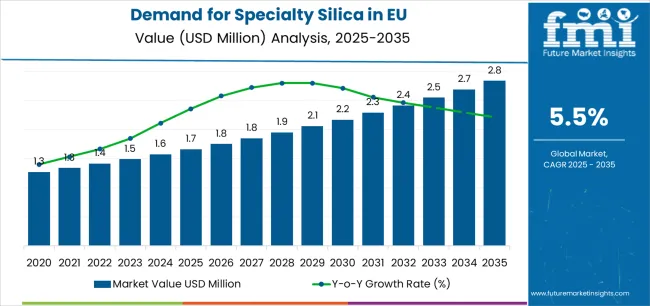

Demand for specialty silica in EU is projected to increase from USD 1.7 million in 2025 to USD 2.8 million by 2035, at a CAGR of 5.5%. Production is concentrated in precipitated, fumed, gel, and colloidal forms, each requiring distinct processing methods. Precipitated grades rely on neutralization of sodium silicate, while fumed grades are tied to vapor-phase hydrolysis of chlorosilanes. The choice of process influences particle size, surface area, and pore structure, which ultimately determine end-use performance. Cost structures remain closely linked to electricity and water requirements, along with efficiencies in filtration, drying, and surface treatment. Producers in EU often rely on incremental capacity additions through debottlenecking rather than building new plants, due to the high cost and lengthy approval cycles associated with greenfield investments. Maintaining REACH compliance and stable quality standards has been a key factor for suppliers targeting automotive and consumer product applications.

On the demand side, the tire industry continues to be the largest consumer, as specialty silica improves rolling resistance, wet grip, and wear resistance. Adhesives, sealants, and industrial coatings also create steady pull for fumed silica, valued for its rheology control and thixotropic properties. Silica gel finds outlets in food and beverage clarification, as well as chromatography and personal care. Oral care applications are particularly sensitive, requiring defined particle hardness and size for controlled abrasivity. Growth in applications such as lithium-ion batteries, silicone elastomers, and 3D printing is smaller in volume but signals diversification of demand drivers. In coatings, the use of silica as a matting agent remains important, especially in high-end wood and coil coating formulations where gloss control is critical.

Supply flows across EU are supported by large plants located near raw material clusters, with distributors handling smaller accounts and specialty blends. Precipitated grades are influenced by sodium silicate availability and energy pricing, while fumed grades are tied to chlorosilane supply from chemical intermediates. Contract structures often include quarterly price adjustments to account for changes in energy and freight costs. Lead times generally range between six and ten weeks, though disruptions in gas or power supply have stretched timelines further in recent years. Imports from Asia compete in standard grades, but local producers retain an edge in high-performance formulations where technical service and shorter qualification cycles matter. Key challenges for the supply base include exposure to volatile energy markets, regulatory scrutiny over wastewater handling, and logistics congestion. Demand from fuel-efficient tires, advanced coatings, and high-performance oral care offers opportunities for growth.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.7 million |

| Forecast Value in (2035F) | USD 2.8 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

Industry expansion is being supported by the stringent fuel efficiency regulations across European automotive industries and the corresponding demand for advanced tire compounds incorporating highly dispersible silica that reduces rolling resistance while maintaining safety performance. Modern tire manufacturers rely on specialty silica as an essential reinforcing filler enabling green tire technology, improving wet grip characteristics, and reducing fuel consumption, driving demand for products that deliver optimal dispersion in rubber matrices, consistent particle size distributions, and proven performance characteristics supporting regulatory compliance. Even moderate efficiency improvements, such as reducing rolling resistance by several percentage points, require comprehensive specialty silica utilization to maintain optimal tire performance and support automotive manufacturers' fuel economy targets.

The established infrastructure of European chemical manufacturing parks and increasing recognition of functional additive requirements are driving demand for specialty silica from certified producers with appropriate quality certifications and technical capabilities. Regulatory authorities are increasingly establishing clear guidelines for tire labeling including fuel efficiency ratings, coating VOC emissions requiring functional additives supporting solvent reduction, and pharmaceutical purity specifications to maintain product quality and ensure performance consistency. Industrial application requirements and performance validation protocols are providing specifications supporting specialty silica characteristics, requiring specialized precipitation processes and standardized surface treatment protocols for consistent particle morphology, optimal surface chemistry, and appropriate moisture content, including rigorous quality control ensuring batch-to-batch consistency.

Sales are segmented by product type (form), application (end use), distribution channel, nature (grade), and country. By product type, demand is divided into highly dispersible/precipitated, water-dispersible/colloidal, pyrogenic/fumed, silica gel, and fused silica. Based on the application, sales are categorized into rubber and tire manufacturing, paints and coatings, adhesives and sealants, personal care, electronics and optics, pharmaceuticals, catalysts, food and feed, packaging, and others. In terms of distribution channel, demand is segmented into direct to OEM (tires/majors), industrial distributors, contract/blend partners, and e-commerce/spot. By nature, sales are classified into conventional grades, ultra-high-purity (electronics/pharma), and circular/bio-based. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The highly dispersible/precipitated segment is projected to account for 41.0% of EU specialty silica sales in 2025, establishing itself as the dominant product type across European industries. This commanding position is fundamentally supported by precipitated silica's critical role in green tire technology, superior reinforcement properties in rubber compounds, and proven performance enabling fuel efficiency improvements mandated by European regulations. The highly dispersible format delivers exceptional functionality, providing tire manufacturers with reinforcing fillers that facilitate uniform dispersion in rubber matrices, enable low rolling resistance formulations, and maintain wet grip safety characteristics essential for automotive performance.

This segment benefits from established precipitation manufacturing infrastructure, well-developed quality control systems ensuring consistent particle characteristics, and extensive technical relationships with major European tire manufacturers who maintain rigorous performance specifications. Additionally, highly dispersible silica offers versatility across tire applications, including passenger car tires prioritizing fuel efficiency, truck tires requiring durability, and performance tires demanding wet traction, supported by proven surface treatment technologies that optimize silica-rubber coupling through silane chemistry.

The segment is expected to maintain a strong 40.0% share through 2035, demonstrating stable positioning as the primary tire reinforcement technology while other specialty silica types serve complementary niche applications throughout the forecast period.

.webp)

Rubber and tire manufacturing application is positioned to represent 36.0% of total specialty silica demand across European industries in 2025, maintaining substantial share around 35.0% through 2035, reflecting the segment's dominance as the primary consumption driver within the overall industry ecosystem. This considerable share directly demonstrates that tire production represents the largest single application, with manufacturers consuming specialty silica for passenger car tire compounds, commercial truck tire formulations, and performance tire applications requiring enhanced wet grip and reduced rolling resistance.

Modern tire manufacturing increasingly relies on silica-based compounds replacing traditional carbon black reinforcement, driving demand for highly dispersible precipitated silica optimized for fuel efficiency with minimal rolling resistance penalties, consistent quality supporting automated tire production processes, and technical support from suppliers helping optimize compound formulations. The segment benefits from European Union tire labeling regulations mandating fuel efficiency disclosure, automotive manufacturers' fuel economy targets requiring low rolling resistance tires, and consumer awareness driving demand for environmentally friendly tire technology.

The segment's stable share reflects proportional growth across all application categories, with rubber and tire manufacturing maintaining its leading position as the primary industrial driver throughout the forecast period.

EU specialty silica sales are advancing steadily due to sustained tire manufacturing driven by automotive production, expanding coatings applications benefiting from functional performance attributes, and growing electronics sector requirements. However, the industry faces challenges, including energy-intensive production processes affecting cost competitiveness, raw material availability concerns for high-purity sodium silicate feedstocks, and competition from Asian producers offering lower pricing. Continued innovation in sustainable production technologies and application development remains central to industry development.

The rapidly accelerating transition to electric vehicles across European automotive industries is fundamentally transforming tire specifications from traditional internal combustion engine requirements to specialized EV tire compounds, creating new opportunities for advanced specialty silica grades optimized for electric vehicle performance characteristics. Advanced EV tire formulations featuring specialized precipitated silica grades address unique requirements including supporting increased vehicle weight from battery systems, minimizing rolling resistance maximizing EV driving range, and reducing tire noise critical for quiet EV cabins lacking engine sound masking. These EV-specific applications prove particularly transformative for premium tire segments, where performance requirements demand optimized silica grades, advanced surface treatments, and precisely controlled particle characteristics supporting demanding specifications.

Modern specialty silica producers systematically incorporate sustainable production approaches, including agricultural waste valorization producing silica from rice husk ash, circular economy models recovering silica from industrial waste streams, and bio-based processes reducing fossil fuel dependency and carbon footprint. Strategic integration of sustainable production capabilities enables manufacturers to differentiate products through environmental credentials, renewable content claims, and carbon footprint reduction supporting customer sustainability targets across tire, coatings, and consumer applications. These sustainability innovations prove essential for brand positioning, as major tire manufacturers and coatings companies increasingly prioritize suppliers demonstrating measurable environmental performance improvements.

European electronics and pharmaceutical industries increasingly prioritize ultra-high-purity specialty silica grades featuring stringent contamination controls, precisely controlled particle characteristics, and comprehensive quality documentation supporting critical applications. This purity emphasis enables specialty silica producers to differentiate premium offerings through advanced purification technologies, cleanroom production facilities, and rigorous analytical testing resonating with customers requiring guaranteed specifications for semiconductor manufacturing, pharmaceutical excipients, and optical applications. Ultra-high-purity positioning proves particularly important for electronics applications where trace metal contamination directly impacts semiconductor device performance and pharmaceutical uses where regulatory compliance requires comprehensive quality documentation.

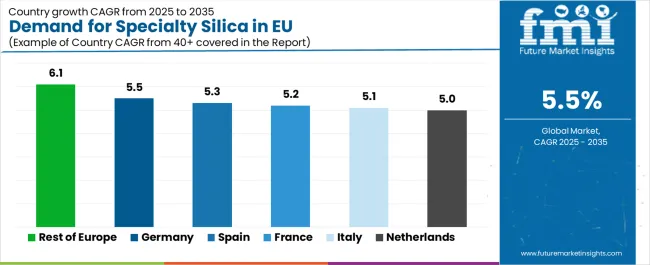

| Country | CAGR % |

|---|---|

| Rest of Europe | 6.1% |

| Germany | 5.5% |

| Spain | 5.3% |

| France | 5.2% |

| Italy | 5.1% |

| Netherlands | 5.0% |

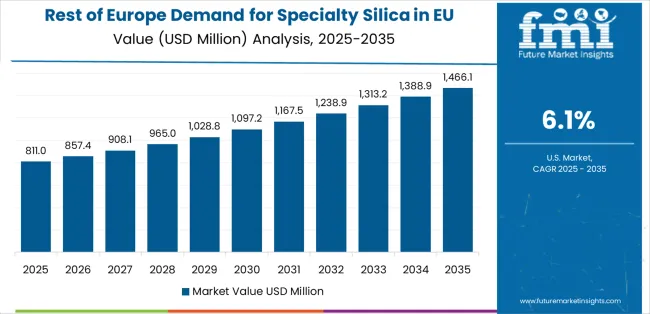

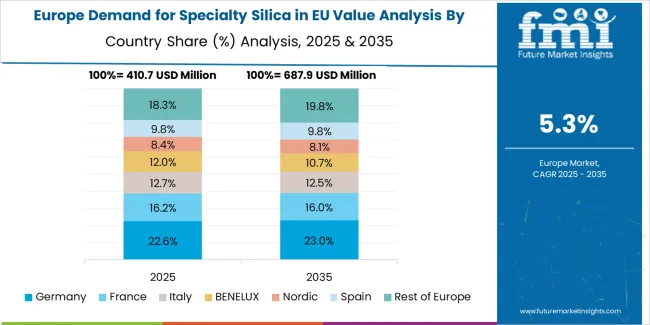

EU specialty silica sales demonstrate solid growth across major European economies, with the Rest of Europe leading expansion at 6.1% CAGR through 2035, driven by emerging automotive manufacturing and chemical industry development. Germany maintains leadership through established tire manufacturing concentration and comprehensive chemical industry infrastructure. France benefits from diversified automotive and coatings industries. Italy leverages steady tire production and growing pharmaceutical applications. Spain shows strong growth supported by expanding automotive manufacturing and coatings sector development. The Netherlands emphasizes chemical manufacturing concentration and logistics excellence. Overall, sales show robust regional development reflecting sustained automotive production and expanding specialty chemical applications.

Revenue from specialty silica in Germany is projected to exhibit steady growth with a CAGR of 5.5% through 2035, driven by exceptionally well-developed automotive industry including major tire manufacturing facilities, comprehensive chemical production infrastructure, and strong technical expertise supporting advanced materials development throughout the country. Germany's position as Europe's automotive manufacturing center and internationally recognized chemical industry leadership are creating substantial demand for diverse specialty silica grades across tire and industrial applications.

Major tire manufacturers, including Continental's extensive European production network, along with automotive suppliers and specialty chemical companies, systematically consume specialty silica for green tire compounds, coating formulations, and industrial applications, with direct procurement relationships ensuring technical support and quality consistency. German demand benefits from stringent fuel efficiency regulations driving green tire adoption, substantial chemical industry requiring functional additives across multiple applications, and technical sophistication supporting advanced product development naturally driving specialty silica consumption.

Revenue from specialty silica in France is expanding at a CAGR of 5.2%, substantially supported by diversified automotive manufacturing including Michelin's global headquarters and major production facilities, growing coatings industry, and steady pharmaceutical sector requirements. France's balanced industrial structure and established tire manufacturing presence are systematically driving demand for specialty silica products across diverse application segments.

Major industrial operations, including Michelin's tire production facilities, automotive component manufacturers, and specialty coatings producers, are gradually expanding specialty silica utilization serving continuously evolving performance requirements. French sales particularly benefit from Michelin's innovation leadership in green tire technology, established coatings industry requiring rheology control additives, and pharmaceutical manufacturing supporting high-purity silica applications.

Revenue from specialty silica in Italy is growing at a CAGR of 5.1%, fundamentally driven by established tire manufacturing operations, growing pharmaceutical industry, and steady automotive component production. Italy's traditional strength in tire manufacturing through Pirelli and expanding pharmaceutical sector are gradually increasing specialty silica requirements while maintaining quality standards for specialized applications.

Major tire producers, pharmaceutical manufacturers, and coatings companies strategically utilize specialty silica for performance tire compounds, pharmaceutical excipients, and functional coatings applications. Italian sales particularly benefit from Pirelli's premium and performance tire focus requiring advanced silica grades, pharmaceutical industry concentration in specific regions supporting high-purity consumption, and automotive component production serving European industries.

Demand for specialty silica in Spain is projected to grow at a CAGR of 5.3%, substantially supported by expanding automotive manufacturing sector, growing tire production facilities, and increasing industrial chemical consumption. Spanish automotive industry's growth trajectory and developing chemical sector position specialty silica as important functional material supporting industrial expansion.

Major automotive manufacturing facilities, expanding tire production operations, and coatings manufacturers systematically increase specialty silica consumption, with automotive sector growth proving particularly successful in driving tire compound demand. Spain's automotive production expansion creates increasing tire manufacturing requirements, industrial development supports coatings and adhesives consumption, and strategic location enables efficient logistics supporting European industry distribution.

Demand for specialty silica in the Netherlands is expanding at a CAGR of 5.0%, fundamentally driven by concentrated chemical manufacturing infrastructure, strategic port facilities enabling efficient import/export operations, and established industrial supply networks. Dutch chemical industry's emphasis on specialty chemicals and functional materials positions specialty silica as important input material supporting diverse applications.

Netherlands sales significantly benefit from Rotterdam port infrastructure facilitating international specialty silica trade, chemical manufacturing concentration creating substantial industrial consumption, and sophisticated distribution networks ensuring efficient supply throughout Benelux industries. The country's chemical industry specialization creates consistent demand, while strategic geographic position enables efficient logistics supporting both domestic consumption and regional distribution serving northern European industries.

EU specialty silica sales are projected to grow from USD 1.7 million in 2025 to USD 2.8 million by 2035, registering a CAGR of 5.5% over the forecast period. The Rest of Europe region is expected to demonstrate the strongest growth trajectory with a 6.1% CAGR, supported by emerging automotive production, expanding industrial base, and growing chemical manufacturing capabilities. Germany and Spain follow with 5.5% and 5.3% CAGR respectively, attributed to established tire manufacturing infrastructure and growing automotive sector activity.

Germany, while maintaining the largest share at 27.7% in 2025, is expected to grow at a 5.5% CAGR, reflecting its position as Europe's automotive and chemical manufacturing hub. France, Italy, and the Netherlands demonstrate 5.2%, 5.1%, and 5.0% CAGR, respectively, supported by diversified industrial consumption and steady automotive production.

EU specialty silica sales are defined by competition among integrated chemical manufacturers, specialized silica producers, and multinational materials companies. Companies are investing in sustainable production technologies, application development programs, technical service capabilities, and strategic partnerships with major tire manufacturers to deliver high-performance, environmentally responsible, and application-optimized specialty silica solutions. Strategic relationships with tire OEMs, long-term supply agreements, and innovations in circular production methods are central to strengthening competitive position.

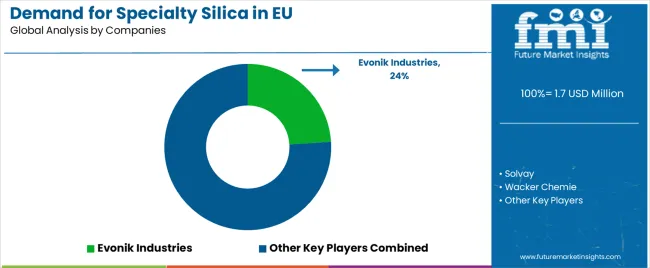

Major participants include Evonik Industries with an estimated 24.0% share, leveraging its extensive European highly dispersible silica production infrastructure, strong technical relationships with major tire manufacturers, and comprehensive application development capabilities supporting green tire formulations. Evonik benefits from integrated silica production operations, specialized surface treatment technologies optimizing silica-rubber coupling, and the ability to provide technical support services helping tire manufacturers optimize compound formulations for fuel efficiency and performance.

Solvay holds approximately 21.0% share, emphasizing its Zeosil highly dispersible silica brand recognized throughout the tire industry, comprehensive European production footprint, and leadership in circular economy initiatives including bio-based silica development. Solvay's success in developing high-performance tire silicas and advancing sustainable production technologies creates strong positioning across automotive and industrial applications, supported by technical service teams providing formulation support and application development assistance.

Wacker Chemie accounts for roughly 15.0% share through its position as a leading fumed silica producer, emphasizing pyrogenic production technology, strong presence in coatings and adhesives applications, and comprehensive product portfolio spanning multiple specialty silica types. The company benefits from integrated silica production capabilities, technical expertise in surface chemistry modification, and diversified application presence reducing dependence on tire industry cyclicality. Other companies and regional producers collectively hold 40.0% share, reflecting moderate fragmentation in European specialty silica sales.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Million |

| Product Type (Form) | Highly Dispersible/Precipitated, Water-Dispersible/Colloidal, Pyrogenic/Fumed, Silica Gel, Fused Silica |

| Application (End Use) | Rubber & Tire Manufacturing, Paints & Coatings, Adhesives & Sealants, Personal Care, Electronics & Optics, Pharmaceuticals, Catalysts, Food & Feed, Packaging, Others |

| Distribution Channel | Direct to OEM (Tires/Majors), Industrial Distributors, Contract/Blend Partners, E-commerce/Spot |

| Nature (Grade) | Conventional Grades, Ultra-High-Purity (Electronics/Pharma), Circular/Bio-Based |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Evonik Industries, Solvay, Wacker Chemie, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (form), application (end use), distribution channel, and nature (grade); regional demand trends across major European industries; competitive landscape analysis with established chemical manufacturers and specialized silica producers; customer preferences for various silica grades and particle characteristics; integration with tire manufacturing operations and specialty chemical applications; innovations in sustainable production technologies including bio-based and circular economy approaches; adoption across automotive, coatings, electronics, and pharmaceutical sectors. |

The global demand for specialty silica in eu is estimated to be valued at USD 1.7 million in 2025.

The market size for the demand for specialty silica in eu is projected to reach USD 2.8 million by 2035.

The demand for specialty silica in eu is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in demand for specialty silica in eu are highly dispersible/precipitated, water-dispersible/colloidal, pyrogenic/fumed, silica gel and fused silica.

In terms of application (end use), rubber & tire manufacturing segment to command 36.0% share in the demand for specialty silica in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA