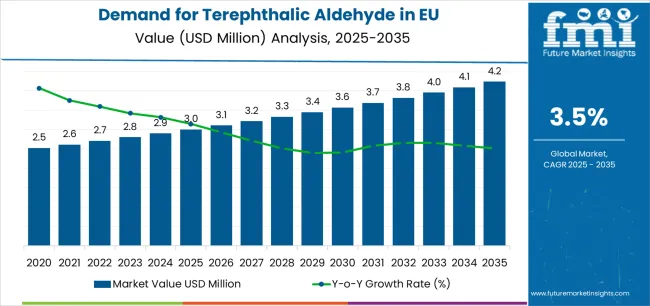

European Union terephthalic aldehyde sales are projected to grow from USD 3 million in 2025 to approximately USD 4.2 million by 2035, recording an absolute increase of USD 1.2 million over the forecast period. According to validated data from FMI’s Chemical Industry Analytics, tracking raw material price and sustainability drivers suggests this translates into total growth of 40%, with demand forecast to expand at a compound annual growth rate (CAGR) of 3.5% between 2025 and 2035. The overall industry size is expected to grow by nearly 1.4X during the same period, supported by the increasing demand for pharmaceutical intermediates, growing applications in optical brightener production, and developing uses across polymer synthesis and specialty chemical manufacturing throughout European fine chemical operations and research applications. The market is benefiting from expanding pharmaceutical synthesis requirements, escalating research activity in covalent organic frameworks and molecular cage development, and growing adoption of terephthalic aldehyde as a non-toxic cross-linker for advanced material applications across major European chemical clusters.

Between 2025 and 2030, EU terephthalic aldehyde demand is projected to expand from USD 3 million to USD 3.6 million, resulting in a value increase of USD 0.6 million, which represents 50% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for specialty pharmaceutical intermediates requiring aromatic aldehyde building blocks, increasing optical brightener production for textile and detergent applications, and growing research adoption of terephthalic aldehyde in advanced material synthesis including metal-organic frameworks and polyimine polymers. Manufacturers are expanding their product offerings to address the evolving preferences for high-purity grades, pharmaceutical-compliant specifications, and research-grade terephthalic aldehyde comparable to specialty fine chemical standards while meeting stringent European quality requirements.

From 2030 to 2035, sales are forecast to grow from USD 3.6 million to USD 4.2 million, adding another USD 0.6 million, which constitutes 50% of the overall ten-year expansion. This period is expected to be characterized by further acceleration of pharmaceutical intermediate applications, integration of terephthalic aldehyde in emerging polymer technologies, and development of innovative applications targeting biomaterial cross-linking and advanced chemical synthesis. The growing emphasis on sustainable chemistry and increasing pharmaceutical industry willingness to invest in specialty building blocks will drive demand for high-purity terephthalic aldehyde that delivers exceptional synthetic versatility with reliable quality standards and enhanced purity profiles supporting pharmaceutical manufacturing excellence.

Between 2020 and 2025, EU terephthalic aldehyde sales experienced moderate expansion at a CAGR of 2.5%, growing from USD 2.6 million to USD 3 million. This period was driven by steady pharmaceutical synthesis requirements across European countries, consistent optical brightener production demand, and growing recognition of terephthalic aldehyde's unique reactivity for specialized applications. The industry developed as fine chemical producers and specialty chemical manufacturers recognized the commercial potential of terephthalic aldehyde for pharmaceutical intermediates, optical brightener synthesis, and advanced polymer applications. Product quality improvements, enhanced purification technologies, and application diversification began establishing customer confidence and research acceptance of terephthalic aldehyde across pharmaceutical synthesis and specialty chemical processing segments.

EU terephthalic aldehyde sales are advancing steadily due to increasing pharmaceutical synthesis requirements and specialty chemical applications across European countries and the corresponding demand for high-purity, functionally versatile, and synthetically compatible aromatic aldehyde intermediates with proven effectiveness in pharmaceutical building block chemistry, optical brightener production, and advanced polymer synthesis applications. Modern pharmaceutical companies and specialty chemical processors rely on terephthalic aldehyde as an essential intermediate for consistent synthetic performance, product quality, and functional reliability, driving demand for grades that deliver superior reactivity, chemical purity exceeding 98%, and process compatibility compared to alternative aromatic aldehydes offering limited synthetic versatility.

The growing awareness of sustainable cross-linking technologies and increasing recognition of terephthalic aldehyde's non-toxic profile are driving demand for terephthalic aldehyde products from certified fine chemical suppliers with appropriate quality credentials and purity documentation. Regulatory authorities are increasingly establishing clear guidelines for pharmaceutical intermediate specifications, chemical purity standards, and quality control requirements to maintain product safety and ensure application consistency throughout European pharmaceutical manufacturing operations. Scientific research studies and synthetic methodology development are providing evidence supporting terephthalic aldehyde's versatility and application advantages, requiring standardized analytical methods, quality validation protocols, and purity specifications for optimal synthetic performance, appropriate chemical reactivity, and consistent quality across diverse pharmaceutical synthesis and specialty chemical applications.

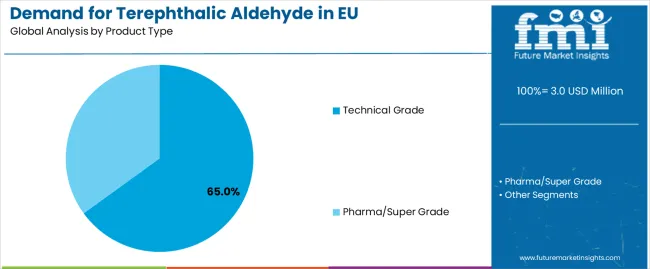

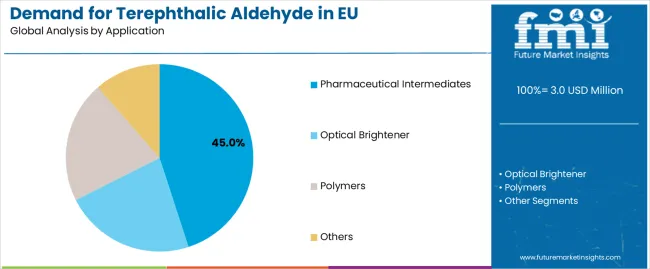

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into technical grade and pharma/super grade. Based on application, sales are categorized into pharmaceutical intermediates, optical brightener, polymers, and others. In terms of distribution channel, demand is segmented into direct B2B sales, distributors, and online marketplace platforms. By nature, sales are classified into eco-friendly/bio-based and conventional formulations. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The technical grade segment is projected to account for 65% of EU terephthalic aldehyde sales in 2025, declining slightly to 60% by 2035, establishing itself as the dominant product category across European specialty chemical and industrial applications. This commanding position is fundamentally supported by technical grade's cost-effective positioning, sufficient purity for optical brightener synthesis and polymer applications, and comprehensive functionality enabling effective performance across non-pharmaceutical applications. The technical grade format delivers exceptional economic appeal, providing optical brightener manufacturers and polymer producers with a product category that facilitates consistent synthetic performance, acceptable quality standards, and competitive pricing essential for cost-conscious industrial operations. This segment benefits from established production processes, well-developed supply networks, and extensive adoption by optical brightener manufacturers and specialty chemical companies who maintain confidence in product consistency for industrial applications. The technical grade segment's slight declining share reflects growing adoption of pharma/super grade, which expands from 35% in 2025 to 40% in 2035, capturing market share through pharmaceutical synthesis requirements and research applications demanding superior purity specifications throughout the forecast period.

Key advantages:

Pharmaceutical intermediates applications are strategically positioned to represent 45% of total European terephthalic aldehyde sales in 2025, expanding to 48% by 2035, reflecting the segment's dominance as the primary consumption category within the overall market. This substantial share directly demonstrates that pharmaceutical synthesis represents the dominant application, with terephthalic aldehyde utilized extensively as a building block for active pharmaceutical ingredient synthesis, intermediate preparation, and specialty pharmaceutical compound development requiring aromatic aldehyde functionality. Modern pharmaceutical companies increasingly view terephthalic aldehyde as an essential synthetic intermediate, driving demand for products optimized for chemical reactivity, purity specifications exceeding pharmaceutical standards, and regulatory compliance that supports drug manufacturing requirements. The segment benefits from continuous pharmaceutical innovation, expanding generic drug production requiring versatile intermediates, and research activity exploring terephthalic aldehyde applications in pharmaceutical synthesis. The segment's expanding share reflects faster pharmaceutical manufacturing growth compared to traditional optical brightener applications throughout the forecast period.

Success factors:

Optical brightener applications are strategically estimated to control 30% of total European terephthalic aldehyde sales in 2025, declining slightly to 28% by 2035, reflecting the established importance of terephthalic aldehyde for optical brightener production and fluorescent whitening agent synthesis. European optical brightener operations consistently demonstrate steady terephthalic aldehyde consumption delivering essential intermediate functionality for brightener compound synthesis and whitening agent production serving textile, detergent, and paper industries. The segment provides critical synthetic capabilities through aromatic aldehyde reactivity, fluorescent compound formation, and chemical functionality supporting optical brightener manufacturing operations. Major optical brightener manufacturers systematically utilize terephthalic aldehyde for specialized fluorescent compound synthesis, often requiring specific reactivity characteristics, consistent quality, and reliable supply that facilitate brightener production and synthetic efficiency. The segment's declining share reflects slower optical brightener industry growth compared to pharmaceutical applications expanding from drug synthesis and specialty chemical development throughout the forecast period.

Development factors:

Direct B2B sales channels are strategically estimated to control 55% of total European terephthalic aldehyde sales in 2025, declining to 50% by 2035, reflecting the critical importance of supplier-to-manufacturer direct relationships for pharmaceutical companies and specialty chemical processors. European direct sales operations consistently demonstrate strong customer retention delivering technical specifications, certificate of analysis documentation, and quality assurance to industrial customers requiring consistent terephthalic aldehyde supply. The segment provides essential customer service through dedicated technical support, regulatory documentation assistance, and quality consultation supporting pharmaceutical manufacturing operations and specialty chemical synthesis. Major fine chemical producers systematically supply terephthalic aldehyde directly to pharmaceutical companies, optical brightener manufacturers, and research institutions, often providing batch-specific documentation, quality guarantees, and technical consultation that facilitate adoption and application optimization. The segment's declining share reflects faster growth in online marketplace channels, which expand from 5% to 10%, capturing market share through convenience and research-grade chemical procurement platforms serving academic and small-scale industrial buyers throughout the forecast period.

Growth enablers:

Conventional terephthalic aldehyde products are strategically positioned to contribute 80% of total European sales in 2025, declining to 65% by 2035, representing products synthesized with traditional chemical processes without bio-based feedstocks or green chemistry certifications. These conventional products successfully deliver proven synthetic performance and established quality while ensuring broad commercial availability across all distribution channels that prioritize functional reliability and pricing accessibility over sustainability credentials. Conventional formulations serve cost-conscious optical brightener manufacturers, traditional chemical processors, and industrial operators that require effective terephthalic aldehyde at competitive price points without premium sustainability positioning. The segment derives significant competitive advantages from established production platforms, economies of scale in aromatic oxidation chemistry, and the ability to meet substantial volume requirements from major industrial customers without green chemistry constraints limiting production flexibility. The segment's declining share through 2035 reflects the category's evolution toward eco-friendly products, which grow from 20% in 2025 to 35% in 2035, as sustainability-focused pharmaceutical companies and environmentally conscious chemical processors increasingly prioritize bio-based derivatives and green synthesis pathways aligned with sustainable chemistry principles.

Competitive advantages:

EU terephthalic aldehyde sales are advancing steadily due to increasing pharmaceutical synthesis activity in European facilities, growing specialty chemical research requiring aromatic aldehyde intermediates, and consistent optical brightener production demand across European chemical processors. The industry faces challenges, including production concentration in Chinese facilities creating supply vulnerability, environmental regulations affecting manufacturing emissions and process sustainability, and limited commercial-scale green synthesis alternatives restricting sustainable production pathways. Continued innovation in bio-based synthesis routes and application diversification remains central to industry development throughout the forecast period.

The gradually accelerating development of bio-based and sustainable synthesis pathways is transforming terephthalic aldehyde production from traditional petrochemical-based oxidation processes to environmentally responsible synthesis routes enabling effective production with reduced environmental impact, delivering sustainability credentials previously unattainable through conventional chemical manufacturing. Advanced synthesis platforms featuring bio-based aromatic feedstocks, green oxidation chemistries, and renewable precursor materials allow producers to create eco-friendly terephthalic aldehyde with equivalent chemical purity, synthetic reactivity, and functional performance comparable to conventional products while meeting increasingly stringent environmental regulations and sustainability requirements. These sustainability innovations prove particularly transformative for environmentally conscious pharmaceutical companies, green chemistry researchers, and sustainability-committed institutions where environmental responsibility proves essential for corporate sustainability goals and research funding requirements. Major fine chemical producers invest in green chemistry research, bio-based process development, and environmental assessment programs, recognizing that sustainable synthesis represents breakthrough solutions for environmental demands driving pharmaceutical industry transformation and specialty chemical sector evolution.

Modern terephthalic aldehyde manufacturers systematically incorporate advanced purification techniques, quality enhancement methodologies, and analytical validation systems that deliver superior chemical purity, reduced impurity profiles, and enhanced quality consistency comparable to pharmaceutical-grade specialty chemicals. Strategic integration of crystallization optimization, chromatographic purification, and advanced analytical characterization optimized for pharmaceutical applications enables producers to position high-purity terephthalic aldehyde as legitimate pharmaceutical intermediates where chemical purity directly determines product acceptance among pharmaceutical manufacturers and research institutions requiring analytical documentation. These quality improvements prove essential for premium pharmaceutical positioning, as drug synthesis and research applications demand purity validation, impurity profiling documentation, and quality superiority supporting pharmaceutical manufacturing standards and research publication requirements. Companies implement extensive analytical testing programs including HPLC analysis, spectroscopic characterization, and certificate of analysis documentation targeting superior purity specifications, including total impurity levels below 2%, specific impurity identification, and batch consistency throughout production operations and quality control systems.

European research institutions and specialty material developers increasingly prioritize terephthalic aldehyde as an essential building block featuring unique bifunctional aldehyde reactivity, symmetric molecular structure, and condensation chemistry enabling advanced material synthesis including covalent organic frameworks, metal-organic coordination complexes, and polyimine polymers. This advanced material trend enables producers to drive application diversification through materials science research, nanotechnology development, and specialty polymer synthesis resonating with innovation-focused research groups seeking functional building blocks without compromising synthetic efficiency. Terephthalic aldehyde applications prove particularly important for materials research where symmetric bifunctional reactivity drives material design and framework construction, with terephthalic aldehyde serving as a critical organic linker for metal-organic framework synthesis and a versatile monomer for polyimine formation. Producers collaborate with academic institutions, materials research centers, and advanced polymer developers to develop terephthalic aldehyde grades optimized for research applications while maintaining chemical purity exceeding 99%, supporting materials science publications and patent applications while ensuring synthetic reproducibility across diverse research applications.

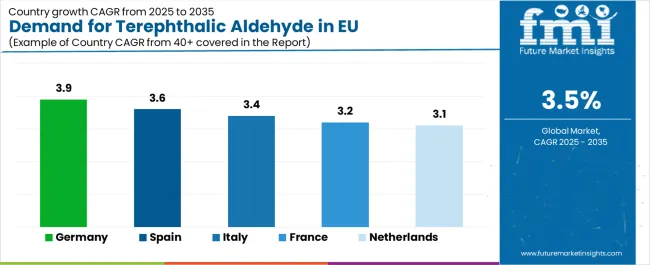

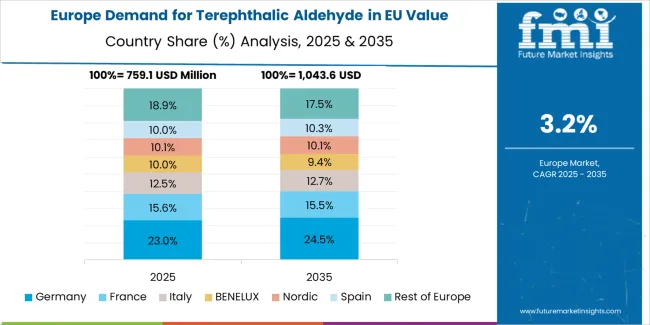

| Country | CAGR 2025-2035 |

|---|---|

| Germany | 3.9 |

| Spain | 3.6 |

| Italy | 3.4 |

| France | 3.2 |

| Netherlands | 3.1 |

EU terephthalic aldehyde sales demonstrate steady growth across major European economies, with Rest of Europe leading expansion at 4% CAGR through 2035, driven by emerging pharmaceutical sectors and specialty chemical operations. Germany shows strong growth at 3.9% CAGR through pharmaceutical manufacturing strength and research excellence. Spain demonstrates 3.6% CAGR with expanding chemical processing capacity. Italy records 3.4% CAGR reflecting pharmaceutical intermediate demand growth. France demonstrates 3.2% CAGR with mature pharmaceutical industry characteristics. Netherlands shows 3.1% CAGR with consistent fine chemical distribution excellence. Overall, sales show moderate regional development reflecting EU-wide trends toward specialty pharmaceutical manufacturing and research chemical utilization.

Revenue from terephthalic aldehyde in Germany is projected to exhibit robust growth with a CAGR of 3.9% through 2035, driven by well-developed pharmaceutical industry, comprehensive research infrastructure, and strong commitment to specialty chemical utilization throughout the country. Germany's sophisticated pharmaceutical manufacturing capabilities and internationally recognized research standards are creating substantial demand for high-purity terephthalic aldehyde across pharmaceutical synthesis and research applications. Major pharmaceutical companies and fine chemical producers, combined with extensive research institutions throughout German pharmaceutical clusters, systematically utilize terephthalic aldehyde for intermediate synthesis, often prioritizing pharma-grade formulations to maintain quality positioning. German demand benefits from stringent pharmaceutical quality standards, substantial research funding supporting chemical synthesis innovation, and technical sophistication that naturally supports specialty chemical intermediate adoption across pharmaceutical operations.

Growth drivers:

Demand for terephthalic aldehyde in Spain is projected to grow at a CAGR of 3.6%, substantially supported by expanding chemical processing operations, growing pharmaceutical sector, and increasing specialty chemical manufacturing throughout Spanish industrial regions. Spanish chemical industry modernization and pharmaceutical development positions terephthalic aldehyde as essential for synthesis strategies supporting pharmaceutical competitiveness. Major chemical companies and pharmaceutical manufacturers systematically expand terephthalic aldehyde utilization, with pharmaceutical intermediate applications proving particularly successful in driving mainstream adoption supporting Spanish pharmaceutical industry development. Spain's developing pharmaceutical capabilities support terephthalic aldehyde demand among intermediate manufacturers providing pharmaceutical building blocks to domestic and European pharmaceutical customers.

Success factors:

Revenue from terephthalic aldehyde in Italy is growing at a CAGR of 3.4%, fundamentally driven by established pharmaceutical manufacturing presence, specialty chemical operations, and quality-focused industrial practices. Italy's traditionally quality-conscious pharmaceutical culture naturally accommodates specialty intermediates as manufacturers recognize synthetic advantages and quality benefits. Major pharmaceutical producers and specialty chemical manufacturers strategically invest in terephthalic aldehyde utilization for synthetic performance and quality consistency supporting Italian pharmaceutical excellence standards. Italian sales particularly benefit from pharmaceutical intermediate requirements creating adoption among drug manufacturers, combined with specialty chemical capacity in Milan and other industrial centers contributing to expansion through pharmaceutical synthesis consumption.

Development factors:

Revenue from terephthalic aldehyde in France is expanding at a CAGR of 3.2%, supported by France's substantial pharmaceutical industry heritage, research excellence, and established fine chemical production practices throughout major French pharmaceutical regions. France's strong pharmaceutical economy and sophisticated research standards are driving steady demand for quality terephthalic aldehyde across pharmaceutical synthesis and research applications. Major pharmaceutical companies and research institutions maintain comprehensive terephthalic aldehyde utilization to serve pharmaceutical intermediate demand across drug synthesis and research development applications. French sales particularly benefit from pharmaceutical synthesis requirements demanding high-purity specifications and quality documentation supporting pharmaceutical manufacturing, driving product specialization within the terephthalic aldehyde category.

Development factors:

Demand for terephthalic aldehyde in the Netherlands is expanding at a CAGR of 3.1%, fundamentally driven by sophisticated fine chemical distribution infrastructure, research institution presence, and quality-focused procurement standards supporting specialty chemical excellence. Dutch research operations and pharmaceutical companies demonstrate receptivity to high-purity terephthalic aldehyde and research-grade products meeting stringent quality standards. Netherlands sales benefit from well-developed chemical distribution infrastructure, specialty chemical trading companies facilitating European distribution, and technical procurement standards driving quality adoption across Dutch research and pharmaceutical operations. The country's fine chemical expertise and research infrastructure support consistent terephthalic aldehyde demand across academic and pharmaceutical applications.

Innovation drivers:

EU terephthalic aldehyde sales are projected to grow from USD 3 million in 2025 to USD 4.2 million by 2035, registering a CAGR of 3.5% over the forecast period. Rest of Europe is expected to demonstrate the strongest growth trajectory with a 4% CAGR, supported by emerging pharmaceutical manufacturing and specialty chemical development. Germany follows with 3.9% CAGR attributed to established pharmaceutical industry and research infrastructure. Spain shows 3.6% CAGR, reflecting growing chemical processing operations. Germany maintains the largest share at 30% in 2025, driven by pharmaceutical manufacturing leadership and specialty chemical excellence.

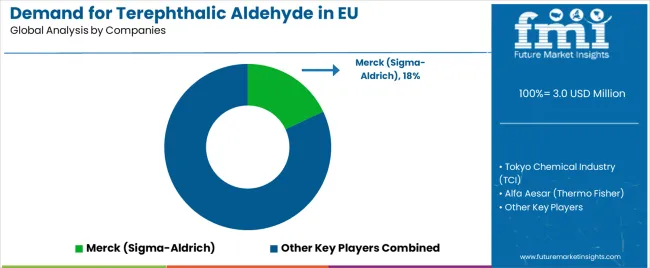

EU terephthalic aldehyde sales are defined by competition among global fine chemical producers, specialty chemical manufacturers, and research chemical suppliers. Companies are investing in purification technologies, quality assurance systems, pharmaceutical-grade production capabilities, and technical application support to deliver high-quality, performance-validated, and pharmaceutically compliant terephthalic aldehyde solutions. Strategic partnerships with pharmaceutical manufacturers and research institutions, distribution network expansion initiatives, and technical support programs emphasizing synthetic expertise and quality documentation are central to strengthening competitive position.

Major participants include Merck (Sigma-Aldrich) with an estimated 18% share, leveraging its European research chemical distribution network, comprehensive product catalog, and established presence through laboratory supply channels across multiple countries. Merck benefits from integrated distribution infrastructure, deep application expertise supporting research institutions, and ability to serve diverse sectors from pharmaceutical synthesis to materials research, supporting customer requirements through technical documentation excellence and comprehensive research chemical programs. Tokyo Chemical Industry and Alfa Aesar each hold approximately 10% share, emphasizing specialty organics portfolio strength, research-grade quality positioning, and European research supply capabilities supporting academic and pharmaceutical research applications. Solvay accounts for roughly 8% share through its position as fine chemicals producer with European manufacturing capabilities, providing technical-grade and pharma-grade terephthalic aldehyde through chemical expertise and production scale.

Other companies collectively hold 54% share, reflecting competitive dynamics within European terephthalic aldehyde sales, where numerous regional distributors, specialized fine chemical manufacturers, Chinese producers serving European markets, and emerging specialty chemical suppliers serve specific customer requirements, research applications, and niche segments. This competitive environment provides opportunities for differentiation through pharmaceutical-grade products, research-grade specifications, bio-based derivatives, and application-specific formulations resonating with pharmaceutical manufacturers and research institutions seeking high-quality terephthalic aldehyde aligned with synthetic requirements and quality standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 million |

| Product Type | Technical Grade, Pharma/Super Grade |

| Application | Pharmaceutical Intermediates, Optical Brightener, Polymers, Others |

| Distribution Channel | Direct (B2B), Distributors, Online/Marketplace |

| Nature | Eco-friendly/Bio-based, Conventional |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Merck, TCI, Alfa Aesar, Solvay, Specialized fine chemical manufacturers |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with established fine chemical producers and research chemical suppliers; customer preferences for various purity grades and quality specifications; integration with pharmaceutical synthesis methodologies and materials science research; innovations in bio-based synthesis pathways and green chemistry processes; adoption across pharmaceutical manufacturing, optical brightener production, polymer synthesis, and research applications; regulatory framework analysis for pharmaceutical intermediate standards, chemical purity requirements. |

The global demand for terephthalic aldehyde in EU is estimated to be valued at USD 3.0 million in 2025.

The market size for the demand for terephthalic aldehyde in EU is projected to reach USD 4.2 million by 2035.

The demand for terephthalic aldehyde in EU is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in demand for terephthalic aldehyde in EU are technical grade and pharma/super grade.

In terms of application, pharmaceutical intermediates segment to command 45.0% share in the demand for terephthalic aldehyde in EU in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA