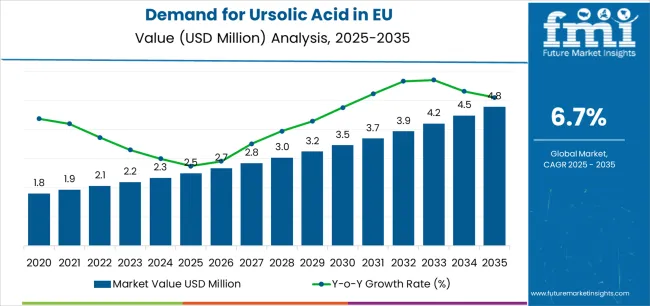

The EU ursolic acid market is projected to grow from USD 2.5 million in 2025 to USD 4.8 million by 2035, advancing at a 6.7% CAGR (modeled from EU anchors). Growth is led by pharmaceuticals (fastest-growing application) and sustained demand in cosmetics and nutraceuticals. Clean-label preferences, plant-based actives, and EFSA-aligned formulations support the adoption of products across skincare, supplements, and therapeutic R&D.

FMI’s chemical sector intelligence, encompassing circular chemistry, sustainability, and material transformation, projects that EU sales are expected to expand from USD 2.5 million (2025) to USD 4.8 million (2035), representing an absolute growth of USD 2.3 million over the decade. This reflects 92% overall growth, underpinned by: (1) rising use in oncology/cardiometabolic pipelines and adjunct therapies, (2) premium/anti-aging skincare leveraging anti-inflammatory and antioxidant properties, (3) preventive-health trends in nutraceuticals, and (4) greener extraction and clean-label sourcing aligned with REACH/EFSA expectations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.5 million |

| Forecast Value in (2035F) | USD 4.8 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

The ursolic acid market in the EU is projected to rise from USD 2.5 million in 2025 to approximately USD 3.5 million by 2030, adding nearly USD 1 million in value and contributing about 42% of total decade-long growth. Expansion during this phase is shaped by increasing use in oncology and cardiovascular trials, as well as adjunct pharmaceutical formulations. In cosmetics, cost-effective anti-aging actives and antioxidant benefits enhance demand for dermocosmetic products. Nutraceutical adoption broadens due to wellness and preventive health trends. At the same time, investment in improved bioavailability and cleaner extraction methods strengthens product competitiveness across applications.

Between 2030 and 2035, the Ursolic Acid Market in the EU is forecast to expand from about USD 3.5 million to USD 4.8 million, adding USD 1.3 million and accounting for 58% of decade growth. This later phase reflects stronger consumer preferences for clean-label, vegan, and halal-certified actives, alongside expanding premium skincare and anti-aging products. Functional nutraceuticals targeting metabolic health, recovery, and sarcopenia drive demand. Supply chains are increasingly shaped by sustainability mandates, with traceability of plant-based sourcing gaining importance. Innovation in multi-functional formulations and higher-grade pharmaceutical standardization ensures broader adoption across both therapeutic pipelines and consumer-facing wellness solutions.

From 2020 to 2025, the Ursolic Acid Market in the EU grew steadily from USD 1.8 million to USD 2.5 million, recording a modeled CAGR of 6.8%. Growth was supported by stable nutraceutical uptake, confectionery-inspired skincare premiumization, and regulatory alignment with EFSA and REACH standards. Manufacturers focused on advancing extraction efficiency, optimizing solvent and clean-label processes, and introducing standardized purity tiers of 95% and above. This period also marked the foundation for pharmaceutical exploration, with initial integration into cosmetic-grade and pharma-grade portfolios. These developments provided the structural and regulatory groundwork for stronger adoption and accelerated growth in the 2025–2035 decade.

Industry expansion is supported by the growing use of ursolic acid in pharmaceuticals, cosmetics, and nutraceuticals across Europe, driven by its anti-inflammatory, antioxidant, and anti-cancer properties. In the pharmaceutical sector, ursolic acid is being explored for oncology and cardiovascular applications, reflecting strong demand for natural actives in therapeutic formulations. Cosmetic manufacturers are integrating ursolic acid into anti-aging, skin-whitening, and dermocosmetic products to meet European consumer preferences for premium, natural skincare. Nutraceuticals also play a vital role, with supplements featuring ursolic acid promoted for weight management, immune support, and chronic disease prevention, reinforcing its importance in preventive healthcare.

The shift toward clean-label, plant-based, vegan, and organic wellness products is also propelling new demand for ursolic acid in the EU. Consumers increasingly seek safe, natural actives derived from botanicals, while manufacturers focus on eco-friendly sourcing and traceable supply chains. Compliance with EFSA guidelines and EU labeling regulations is shaping product development, ensuring that ursolic acid meets consumer expectations for transparency, purity, and sustainability. As environmental standards tighten, European suppliers are advancing extraction processes that reduce chemical use and highlight sustainability, aligning with the region’s broader push for ethical, green bioactives.

Scientific and industrial research is further validating ursolic acid’s role in anti-inflammatory therapies, cardiovascular protection, and oncology R&D, supporting its acceptance as a functional bioactive in both healthcare and personal care. Enhanced extraction technologies, including supercritical fluid and solvent-free methods, are improving yields and bioavailability, strengthening its adoption in pharmaceutical pipelines. At the same time, advances in multi-functional cosmetic and nutraceutical formulations are expanding market reach. Together, these trends are ensuring that ursolic acid secures a long-term role as a high-value, natural active across European pharmaceutical, cosmetic, and functional food industries.

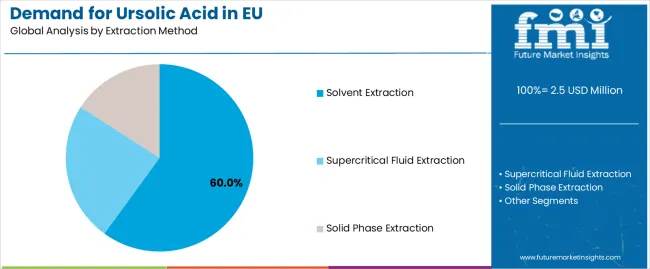

Sales are segmented by application (end use), extraction method, purity, and region. By application, demand is categorized into pharmaceutical, cosmetics, and functional foods. Based on extraction, sales are divided into solvent extraction, supercritical fluid extraction, and solid phase extraction. In terms of purity, demand is segmented into below 95%, 95%–99%, and 99% and above. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The pharmaceutical segment of the Ursolic Acid Market in the EU is projected to account for 36% of sales in 2025 (USD 0.9 million), increasing to 38% by 2035 (USD 1.8 million), making it the fastest-growing application area. This segment’s strength is underpinned by accelerating research into ursolic acid’s therapeutic potential across oncology, cardiovascular health, diabetes, and metabolic disorders. Its well-documented anti-inflammatory, antioxidant, and anti-cancer properties align closely with the EU’s growing emphasis on natural, plant-based actives for chronic disease management and preventive healthcare. Pharmaceutical manufacturers are increasingly incorporating ursolic acid into adjunct therapies, aiming to complement conventional treatments while offering safer, cleaner alternatives.

Regulatory support is another key driver. The European Food Safety Authority (EFSA) provides a clear framework for safety evaluations and labeling, giving manufacturers confidence in compliance and facilitating integration into therapeutic product pipelines. Investments are being directed toward improving bioavailability technologies, ensuring ursolic acid can achieve higher clinical efficacy, which is critical for drug development. With consumer demand for natural health solutions growing and clinical research validating its role, the pharmaceutical segment is set to emerge as the most strategically important driver of ursolic acid adoption in the EU.

Key advantages:

Solvent extraction continues to dominate the Ursolic Acid Market in the EU, accounting for 60% of total sales in 2025 (USD 1.5 million). Despite expectations that its share will decline to 50% by 2035 (USD 2.4 million), this method remains the most widely used approach due to its cost-effectiveness and ability to achieve consistent, large-scale output. Solvent extraction is especially valued in pharmaceutical and cosmetic-grade supply chains, where reliable yields and process familiarity are essential. Many EU manufacturers continue to adopt this method for its technical efficiency and scalability, particularly when producing intermediate grades of ursolic acid used in supplements and skincare formulations. Regulatory developments and consumer trends are reshaping the segment’s outlook. The EU’s sustainability mandates, coupled with EFSA’s increasing scrutiny of solvent residues, are creating pressure on producers to improve their environmental footprint. Consumers, meanwhile, are pushing for greener-label, eco-certified processes that minimize chemical use. While solvent extraction is expected to remain structurally important, especially in price-sensitive applications, its dominance will be increasingly challenged by supercritical fluid and other clean-extraction technologies. Producers investing in process innovation, hybrid methods, and improved waste management will be best positioned to maintain competitiveness while adapting to evolving EU sustainability requirements.

Key advantages:

The demand for ursolic acid in the EU is advancing due to increasing consumer preference for natural skincare products, growing interest in the health benefits of plant-based ingredients, and the expanding use of ursolic acid in pharmaceutical and nutraceutical applications. The market faces challenges, including the limited availability of raw materials for production, high extraction costs, and regulatory barriers surrounding its use in food and pharmaceutical products. Ongoing innovation in green extraction technologies and the rise of multifunctional formulations continue to shape the industry development throughout the forecast period.

The growing consumer shift towards natural and clean beauty is significantly driving the demand for ursolic acid in the EU. With its anti-aging, antioxidant, and anti-inflammatory properties, ursolic acid is gaining popularity in high-end skincare products. As more consumers prioritize natural ingredients in their daily skincare routines, demand for ursolic acid-based products is set to rise, particularly in the anti-aging and skin rejuvenation segments. This trend also extends to cosmetics focused on reducing environmental impact, aligning with broader consumer preferences for sustainable and organic formulations. Manufacturers are increasingly incorporating ursolic acid in premium skincare lines, making it a sought-after ingredient in Europe’s beauty industry.

The rising consumer interest in health and wellness continues to drive the ursolic acid market, particularly in the nutraceutical sector. Known for its potential anti-cancer, anti-inflammatory, and anti-obesity effects, ursolic acid is being researched for its therapeutic properties. The growing demand for plant-based ingredients in dietary supplements and functional foods further boosts its application. As consumers become more health-conscious, the need for effective, natural alternatives in both prevention and treatment options for various chronic diseases is fostering ursolic acid’s adoption in new product lines, including functional beverages and supplements.

The supply of ursolic acid is limited by the availability of raw materials such as apple peel, rosemary, and other plants. With demand increasing, there may be concerns over the sustainability and cost of sourcing these materials. The extraction process, which is often labor-intensive and costly, further contributes to high production costs. These factors may pose barriers to widespread use, particularly in mass-market products. Companies seeking to scale production of ursolic acid may encounter financial and logistical challenges related to maintaining a steady supply of raw materials at a reasonable cost.

To address the growing demand for ursolic acid while minimizing environmental impact, significant advancements are being made in sustainable extraction technologies. Bio-based and green chemistry methods for extracting ursolic acid are transforming the production process, helping to reduce carbon footprints and reliance on petrochemical-based processes. As more companies focus on eco-friendly and efficient production techniques, the EU market is expected to see an increased supply of sustainable ursolic acid, meeting both environmental and consumer demand for natural products. These innovations are critical for positioning ursolic acid as a viable, long-term ingredient in the growing market for sustainable cosmetics and health products.

Collaborations between manufacturers and research institutions are expanding the scope of ursolic acid applications. In the pharmaceutical industry, research into its potential as an anti-cancer agent and other therapeutic applications is intensifying. Academic institutions and industry partners are increasingly working together to unlock the full potential of ursolic acid, exploring new extraction methods, enhancing its bioavailability, and creating innovative products. These research-driven collaborations are essential for further diversifying the uses of ursolic acid in both existing and new markets, such as advanced materials science and drug development.

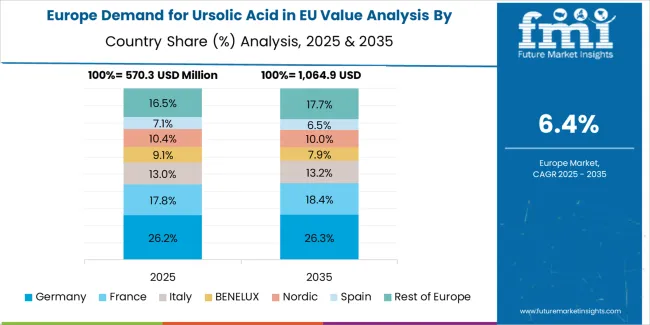

EU ursolic acid sales are projected to grow from USD 2.5 million in 2025 to USD 4.8 million by 2035, registering an overall CAGR of 6.7%. Germany maintains the largest share at 34% in 2025, reflecting its strong pharmaceutical and nutraceutical industries, followed by France (20%), Italy (15%), and Spain (12%). The Netherlands and Rest of Europe account for smaller but steadily rising shares, supported by growing cosmetics adoption, herbal product development, and research-driven pharmaceutical pipelines.

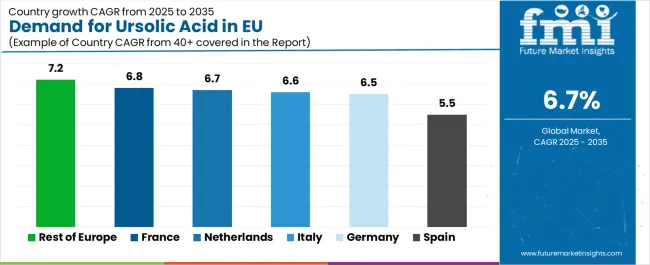

| Country | CAGR % (2025–2035) |

|---|---|

| Germany | 6.5 |

| France | 6.8 |

| Italy | 6.6 |

| Spain | 5.5 |

| Netherlands | 6.7 |

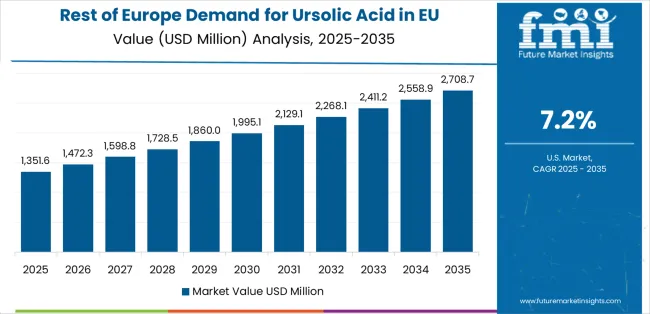

| Rest of Europe | 7.2 |

Germany will remain the largest market for ursolic acid in the EU, expanding from USD 0.9 million in 2025 to USD 1.7 million by 2035, at a 6.5% CAGR. Its dominance stems from a strong pharmaceutical base, where ursolic acid is researched for oncology, cardiovascular, and metabolic disorders. The country also shows strong nutraceutical demand, with supplements highlighting antioxidant and anti-inflammatory benefits. Cosmetics adoption is steady, driven by premium anti-aging products and EFSA-aligned formulations. Germany’s position is reinforced by technical precision, clinical research infrastructure, and consumer preference for natural actives. Despite slower growth compared to smaller EU markets, Germany’s scale and pharmaceutical leadership ensure it remains the anchor for EU sales throughout the forecast period.

Key Highlights:

France is forecast to expand from USD 0.5 million in 2025 to USD 1 million by 2035, advancing at a 6.8% CAGR, one of the highest among EU markets. Growth is driven by the country’s world-leading cosmetics sector, where ursolic acid is valued in premium skincare for anti-aging, whitening, and anti-inflammatory properties. Nutraceuticals add further momentum, supported by strong consumer interest in natural supplements targeting immunity and metabolic health. France’s emphasis on organic, vegan, and clean-label actives aligns with broader EU consumer shifts. Specialty cosmetic companies and dermocosmetic brands are integrating ursolic acid to differentiate portfolios, particularly in premium exports. This dual demand from beauty and wellness positions France as a fast-growing hub within Europe’s ursolic acid landscape.

Key Highlights:

Italy’s ursolic acid market is expected to grow from USD 0.4 million in 2025 to USD 0.8 million by 2035, reflecting a 6.6% CAGR. Its strength lies in nutraceuticals and traditional herbal remedies, with strong adoption in supplements supporting cardiovascular and immune health. Cosmetics represent another key driver, with demand in premium skincare and anti-aging products tailored to Italy’s high-end beauty culture. Urban centers such as Milan and Rome are hotbeds of demand for natural cosmetics and wellness supplements. Italy’s artisanal food and beauty traditions are blending with innovation, creating opportunities for ursolic acid in functional foods and dermocosmetics. The combination of cultural heritage and modern wellness trends makes Italy a stable yet steadily expanding EU market.

Key Highlights:

Spain’s ursolic acid market will expand from USD 0.3 million in 2025 to USD 0.6 million by 2035, advancing at a 5.5% CAGR. Demand is shaped by Spain’s growing nutraceutical sector, which is increasingly focused on metabolic health, weight management, and antioxidant supplementation. Pharmaceutical research pipelines exploring natural bioactives further reinforce demand. While Spain’s chocolate and confectionery history is weaker than France or Germany, its agricultural resources and expanding functional food industry support opportunities for ursolic acid integration. Rising consumer awareness of preventive healthcare is increasing uptake of natural supplements. Although smaller in absolute size, Spain’s steady growth and adoption of EU labeling frameworks ensure its long-term role in the EU landscape.

Key Highlights:

The Netherlands is projected to grow from USD 0.2 million in 2025 to USD 0.4 million by 2035, advancing at a 6.7% CAGR. Despite its small domestic base, its importance lies in logistics and re-export of nutraceutical and cosmetic ingredients. Dutch processors emphasize innovation and sustainability, with supercritical extraction gaining traction due to its green credentials. The Netherlands acts as a gateway for EU-wide distribution, leveraging its advanced trade infrastructure. Rising demand for vegan, organic, and certified ingredients enhances the role of Dutch suppliers. Though modest in volume, the Netherlands’ efficiency, innovation, and re-export strength ensure it has an outsized role in the European market.

Key Highlights:

The Rest of Europe segment is forecast to expand from USD 0.6 million in 2025 to USD 1.1 million by 2035, achieving the fastest CAGR at 7.2%. This includes dynamic markets such as Poland, Austria, and the Nordic countries, where nutraceutical and cosmetic demand is rising. These economies benefit from modernization of manufacturing facilities and growing integration into EU supply chains. Cost-sensitive supplement makers in Eastern Europe are adopting ursolic acid for affordability and functional benefits. Exports of affordable herbal supplements and cosmetic actives from these regions are increasing. While smaller in absolute terms, Rest of Europe represents the most dynamic growth opportunity in the EU.

Key Highlights:

EU ursolic acid sales are characterized by competition among global botanical extract leaders, regional nutraceutical suppliers, and specialty ingredient companies. Manufacturers are focusing on improving extraction efficiency, securing sustainable plant-based raw material supply chains, and developing high-purity standardized grades for pharmaceuticals, cosmetics, and nutraceuticals. Investments are directed toward bioavailability-enhancing technologies, clean-label and solvent-free extraction, and certifications such as organic, vegan, and halal to align with EU consumer preferences. Strategic collaborations with pharmaceutical R&D labs, cosmetics brands, and supplement formulators are central to strengthening positioning in a fragmented market.

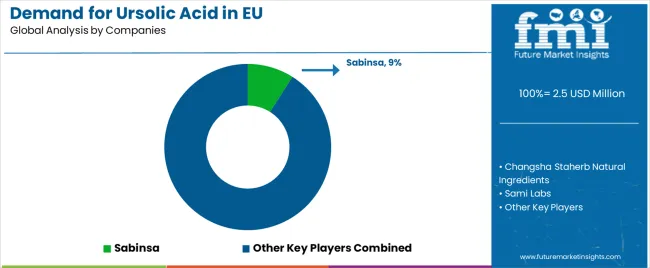

Key participants in the EU ursolic acid market include Sabinsa, holding an estimated 9% share, leveraging its global distribution network, standardized botanical portfolio, and strong European nutraceutical partnerships. Shaanxi Huike Botanical Development follows with approximately 6.5% share, supported by its extensive EU ingredient supply channels and investment in high-purity extracts for cosmetic and pharma clients. Changsha Staherb Natural Ingredients commands around 5% share, with strength in cosmetics-grade supply and growing links to EU personal care companies. The remaining ~79.5% of the market is highly fragmented, occupied by smaller regional botanical suppliers, niche phytochemical companies, and distributors catering to localized supplement, dermocosmetic, and R&D demand across Europe.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 million (2035) |

| Product Type (Grade) | Cosmetic-grade, Pharmaceutical-grade, Nutraceutical-grade |

| Application (End Use) | Pharmaceuticals, Cosmetics, Functional Foods |

| Extraction Method | Solvent Extraction, Supercritical Fluid Extraction, Solid Phase Extraction |

| Purity Level | Below 95%, 95%–99%, 99% and above |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | Sabinsa, Shaanxi Huike Botanical Development, Changsha Staherb Natural Ingredients, Sami Labs, Changsha Luyuan Bio-Tech, Acetar Bio-Tech |

| Additional Attributes | Dollar sales by grade, application, extraction, and purity; EU demand trends across major economies; competitive landscape analysis with botanical extract suppliers and nutraceutical distributors; buyer preferences for clean-label, vegan, and organic bioactives; integration with sustainable plant sourcing and green extraction methods; innovations in multi-functional formulations; adoption across pharmaceuticals, premium cosmetics, and functional foods; regulatory framework analysis under EFSA and REACH guidelines; risk factors linked to raw material sourcing, solvent usage regulations, and fragmented supplier base. |

The global demand for ursolic acid in EU is estimated to be valued at USD 2.5 million in 2025.

The market size for the demand for ursolic acid in EU is projected to reach USD 4.8 million by 2035.

The demand for ursolic acid in EU is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in demand for ursolic acid in EU are pharmaceuticals, cosmetics and functional foods.

In terms of extraction method, solvent extraction segment to command 60.0% share in the demand for ursolic acid in EU in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA