Desert Air Cooler Market will show significant expansion between 2025 and 2035 because dry and semi-dry areas need efficient and inexpensive cooling technologies. The evaporative cooling method within desert air coolers functions as an environment-friendly solution which competes against conventional air conditioning equipment to lower home temperatures.

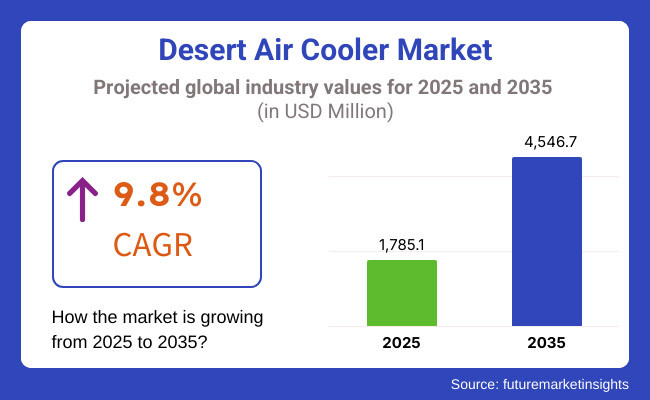

The market prediction indicates it will achieve USD 1,785.1 million in 2025 while surpassing USD 4,546.7 million by 2035 with a predicted 9.8% compound annual growth rate for the projected period. The rise of global temperatures and increasing heatwave occurrence leads people to select desert air coolers as their cooling option.

Consumers want cost-effective cooling systems that help save water while confronting emerging problems about water supply limitations in their regions. The adoption of evaporative cooling technology and automatic humidity control systems and improved airflow distribution has boosted the market's susceptibility to desert air cooler acceptance.

The market growth for desert air coolers faces restrictions because of excessive water consumption coupled with diminished performance under humid conditions. Industry manufacturers work to enhance their products' energy conservation characteristics while creating combination cooling methods along with smart operation systems for better performance.

The Desert Air Cooler Market exists in separate segments following product type and application categories and experiences substantial demand from residential, commercial and industrial applications. The main product group consists of direct evaporative coolers and indirect evaporative coolers together with hybrid air coolers.

The indirect evaporative cooling system uses heat exchangers to increase cooling output without moisture build-up thus making it appropriate for commercial buildings. The integration of direct cooling technology with indirect cooling technology within hybrid air coolers leads to better performance alongside energy cost reductions.

Desert air coolers also have a growing demand in North America as the region is witnessing an increase in temperature alongside the need for energy-efficient cooling solutions. High demand in the United States and Mexico, especially in dry areas such as Arizona, Texas, and California, where evaporative cooling is still a viable substitute for traditional air conditioning.

Cost savings and sustainability are top of mind for consumers, leading to increased adoption in residential and commercial applications. Additionally, government incentives supporting energy-efficient cooling systems contribute to market growth.

Improvement upon product efficiency and potentially hybrid cooling technologies are being advanced and invested in North American manufacturers using smart controls, advanced materials, and managing climate variations. Ongoing technological advancements promote market growth, notwithstanding performance challenges in humid conditions.

Air cooler market business distribution by region: Europe, especially southern countries with a hot and dry summer, is to see more and more desert air cooler. Demand is increasing in countries like Spain, Italy and Greece as extreme heat events become more common. Commercial businesses and home users are looking to cut down on electrical and carbon footprints with more effective cooling solutions.

The European regulations support sustainable cooling technologies, thus being a boost for the uptake of evaporative cooling systems. Manufacturers in the region build water-efficient designs and generate better-cooling-pad materials. Though high humidity in various parts of Europe creates limited market potential, desert air coolers still have a sound solution among dry climate areas.

Desert air cooler market has been dominated by Asia-Pacific region, owing to increase in urbanization, increase in the temperature, and rise in awareness regarding energy efficient cooling solutions among people. The market is driven by countries including India, China, and Australia with India being the leading consumer as it extensively utilizes desert air coolers in residential and commercial spaces.

The hot weather in India together with the need for affordable cooling has made the desert air coolers a leading option for many. Some local manufacturers are developing cheaper models with improved airflow and durability to serve mass-market demand.

China and Australia are also seeing growing adoption, especially in areas facing water scarcity and extreme heat conditions. A portion of the driving factors for the approval of smart-enabled and hybrid cooling systems also advocate for continued blooming of the market throughout Asia-Pacific.

Challenge: High Water Consumption and Seasonal Demand

Desert air coolers are based on evaporative cooling technology, and they need a constant supply of water for efficient operation. Ensuring their functionality in water-scarce areas is a considerable challenge, particularly in arid zones where they are critically needed.

Also, due to the nature of desert air coolers, as their demand is highly seasonal, peaking in summers and dropping steeply in other seasons. These seasonal shifts challenge manufacturers and retailers with inventory management, production planning, and maintaining stable revenue. Humid conditions also hinder the cooling capacity, significantly limiting their commercial use outside of dry and semi-arid regions.

Opportunity: Rising Demand for Energy-Efficient Cooling Solutions

Increasing emphasis on energy-efficient and sustainable cooling solutions creates abundant opportunities for the desert air cooler market. Consumers are looking for economical cooling at a cost which is lesser than energy of conventional air conditioners. The new technologies developed in high-efficiency cooling pads, smart control systems, and solar-powered air coolers provide more efficient cooling that is also less damaging to the environment.

In hot and dry areas, governments also encourage adoption of energy-efficient cooling technologies through subsidies, and other incentives. The rising planet-wide crisps in temperature prompted by climate change will continue to rise up market growth, as the need for sustainable economy and cooling solutions increases.

During the period 2020 to 2024, the desert air cooler market witnessed positive growth due to expanding urban areas in hot climate areas and increasing electricity prices. Air cooler outshined air conditioner among consumers over their low energy consumption cost and economy option.

Questions over their water use and efficiency in highly humid areas made their adoption limited, however. Innovative Features: Manufacturers introduced features like honeycomb cooling pads that improve performance and reduce power consumption.

From 2025 to 2035, the market will gradually move towards solar-powered and hybrid air coolers incorporating renewable energy sources to augment efficiency. IoT-enabled smart air coolers will become common, providing users with the ability to monitor and adjust cooling performance remotely.

Furthermore, development of advanced water recycling mechanisms will address the concern of water consumption, rendering desert air coolers more sustainable in water-scarce regions of the world. In this way, these solutions will make it possible to gradually approach semi-humid regions, thanks to increasing use of adaptive cooling technologies that optimize their performance according to ambient humidity.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Energy efficiency regulations encouraged air cooler adoption, but water consumption remained a concern. |

| Technological Advancements | Honeycomb cooling pads and inverter technology improved efficiency and airflow. |

| Consumer Preferences | Consumers prioritized affordability and energy savings, limiting the market for premium air coolers. |

| Industrial and Commercial Adoption | Air coolers were widely used in small commercial spaces but faced competition from air conditioners in large-scale applications. |

| Environmental Sustainability | Water usage concerns limited adoption in drought-prone areas. |

| Market Accessibility | Availability was primarily concentrated in high-temperature regions with dry climates. |

| Market Growth Drivers | Rising temperatures, electricity cost concerns, and affordability fuelled demand. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter sustainability regulations will drive innovations in water-efficient and low-power cooling technologies. |

| Technological Advancements | Solar-powered, AI-integrated air coolers with water recycling features will dominate the market. |

| Consumer Preferences | Demand for smart, remote-controlled air coolers with automation and advanced filtration will increase. |

| Industrial and Commercial Adoption | Large industrial facilities and warehouses will adopt high-capacity desert air coolers for cost-effective cooling. |

| Environmental Sustainability | Water-efficient and hybrid cooling solutions will mitigate environmental concerns and expand market reach. |

| Market Accessibility | Expansion into semi-humid regions will grow with adaptive cooling technology that adjusts to varying humidity levels. |

| Market Growth Drivers | Growth will accelerate with climate change adaptation strategies, renewable energy integration, and smart home adoption. |

Growing need for energy-efficient cooling systems in desert areas is one of the major factors driving the growth of this market. Increasing worries about climate change and record-high temperatures are pushing consumers toward sustainable, evaporative cooling systems as a replacement for traditional air conditioning. Residential and commercial infrastructure expansion in south western states such as Arizona, Texas, and Nevada also boosted demand for high-capacity desert coolers.

Technological development, like the installation of the smart IoT-enabled cooling systems, increases energy efficiency and allows to operate from anywhere. Government initiatives incentivizing low-energy cooling alternatives also help drive market adoption.

With electricity prices on the rise, along with a growing awareness of sustainability, desert air coolers are a compelling solution for consumers looking to save on costs and who are sensitive to environmental impact, further enhancing growth trends within the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.1% |

The UK desert air cooler market is projected to grow significantly, propelled by the increasing need for energy-efficient cooling solutions across industrial and commercial sectors. The UK has a temperate climate, but changing global temperatures and increasingly frequent heatwaves have made evaporative cooling systems more and more sought after.

Portable and fixed desert coolers are increasingly being adopted in warehouses, factories, and event spaces, where traditional air conditioning is expensive and expensive. Furthermore, the UK carbon neutrality initiative has redirected the efforts of several businesses searching out low-energy cooling solutions in keeping with national sustainability goals. The increasing emergence of smart-controlled and water-efficient air coolers is also contributing to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.6% |

The market for European Union desert air coolers is steadily growing as consumers become more conscious of energy-efficient and eco-friendly cooling systems. For example, Southern European countries, such as Italy, Spain, and Greece, are experiencing a jump in demand for desert coolers as temperatures rise and sustainability regulations drive green cooling options.

Regulatory measures as part of the European Green Deal are pushing businesses and residential users to adopt low-power cooling solutions that use less energy while still having cooling efficiency.

Factors such as the growing commercial and industrial infrastructure in hotter regions and technological advancements in smart cooling are driving the growth of the market. So are higher electricity costs and a drive toward low-carbon building designs, shifting more across Europe toward evaporative cooling systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 9.9% |

As the demand for energy-efficient climate control solutions increases in both residential and industrial sectors, the desert air cooler market in Japan is expanding. As summer heat rises, cities remain hot, and a focus on sustainable living becomes apparent in everyday life, desert air coolers are gaining significance as a powerful alternative to traditional air conditioning systems.

Performance and sustainability are being improved with the integration of high-efficiency cooling pads, IoT-enabled controls, and water-saving technologies. The government's focus on reducing carbon footprints in buildings is also driving consumers to switch to evaporative cooling solutions.

The growth of Japan's construction sector, along with increasing energy prices, is also driving market demand especially in commercial and industrial applications, in which air coolers are a cost-effective alternative to cooling methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.7% |

Factors like increasing summer temperatures, energy efficiency, and the adoption of smart homes are spurring the South Korean desert air cooler market. In coastal regions where humidity is high, hybrid evaporative cooling technologies are gaining ground as an alternative to conventional cooling systems.

A strong push from the government for green energy solutions and low-power cooling technologies is boosting the market growth. In addition to this, the development of smart sensors, auto climate adjustment, and mobile app control is making modern desert air coolers more attractive for customers. Market expansion is being further fuelled by the rising demand for industrial air coolers in factories, warehouses, and event venues.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.8% |

As the demand for cost-effective and energy-efficient cooling solutions in households, offices, and commercial spaces rises, the indoor application remains the largest contributor to the world desert air cooler market. Desert air coolers work on evaporative cooling technology, as opposed to regular air conditioners, which make them a perfect fit for indoor environments where ventilation gives way to a constant air input.

Available in massive offerings, these eco-friendly cooling systems consume a minimum amount of electricity to provide sufficient humidity to maintain a comfy feel in hot and arid regions.

Desert air cooler market growth is being driven by the rising adoption of such products in residential buildings and offices. Air curtains can be a great option for any household and business looking to lower energy consumption, due to their ability to effectively cool large areas indoors, while being cost-effective.

Moreover, technical improvements, including remote control operation, variable speed settings, and enhanced air filtration systems, have additionally bolstered their attractiveness for indoor use. With the increasing focus on sustainable cooling methods and the expansion of urban centres, the demand for indoor desert air coolers only grows stronger, solidifying their hold on the market.

Growing adoption of cleaning robots for outdoor applications across hospitality, retail, event management spheres among others, have also translated into its rising field in the outdoor application segment. Outdoor desert air coolers are an energy-efficient way to cool open spaces like patios, outdoor events, restaurants, and sports arenas. The high air circulation rates they provide make them a mainstay in commercial environments, where cooling large outdoor spaces can prove difficult.

Only 16 percent plan to invest in such a solution or have already adopted one. In outdoor seating areas, hotels and restaurants use desert air-coolers to offer diners some comfort, even in extreme temperatures. Also, event organizers used high capacity desert air coolers for stadiums, exhibitions, concerts etc., and providing comfort to the crowds.

The increasing popularity of outdoor social mixing and entertainment pursuits has considerably boosted the demand in this segment paving way for outdoor desert air coolers as a viable element of the modern cooling solution.

Because homeowners look for economical and energy-efficient cooling options, the residential sector holds a major share of the desert air cooler market. Some air coolers, such as desert air coolers, are commonly seen as great alternatives to traditional air conditioning systems, and are among the best products that you can buy, especially in dry climate areas.

As they can efficiently operate in ventilated roofs without needing extensive usage of electrification, they have become an inverse household equipment throughout semi-arid and arid places.

Desert air coolers are preferred by consumers due to its portability, convenient operation, and low maintenance costs. Air coolers with smart features such as touch control panels, remote operation, and humidity regulation, cater to user convenience.

Furthermore, growing awareness about green cooling solutions has led to a growing number of households adopting evaporative cooling technology. In terms of sustainable and economical climatic control devices, desert air coolers are very literal.

The commercial sector has witnessed significant growth as companies adopt desert air coolers to create a pleasant atmosphere indoors, while decreasing operational expenses. These systems are used by offices, retail stores and small businesses to keep temperatures low but avoid the heavy energy use typical of air conditioning units. With proper ventilation, their capacity for high-coverage efficient cooling has made them a commercial favourite when it comes to optimising comfort vs cost.

Supermarkets, shopping malls, and retail stores use desert air cooling machines not only to keep customers happy, but also to create a get environment when people shop. Likewise, enterprises and office buildings utilize central or portable air coolers to provide a pleasant working environment for employees encouraging productivity.

Desert air coolers have become an attractive proposition for companies looking for energy-efficient and eco-friendly alternatives to conventional cooling systems. Growing demand for green building practices and sustainable business processes is another factor contributing to the increasing growth of the market in this segment.

A competition exists between technological producers who offer global services alongside local companies that sell energy-saving cooling solutions within the desert air cooler market. Air coolers target hot areas with low moisture so they function well across household apartments as well as business and manufacturing spaces.

Key manufacturers invest in enhanced cooling pad development with inverter-capability and eco-friendly capabilities to improve performance. This market combines established appliance producers with new brands that specialize in inexpensive products which match different climate zones.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Symphony Limited | 20-25% |

| Bajaj Electricals Ltd. | 14-18% |

| Havells India Ltd. | 10-14% |

| Honeywell International Inc. | 8-12% |

| Kenstar (Videocon Group) | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Symphony Limited | Manufactures energy-efficient desert air coolers with advanced cooling pad technology and smart IoT-enabled models. |

| Bajaj Electricals Ltd. | Offers a range of high-airflow desert coolers with inverter compatibility and durable design for extreme climates. |

| Havells India Ltd. | Develops stylish and high-performance desert air coolers featuring honeycomb cooling pads and dust filters. |

| Honeywell International Inc. | Provides heavy-duty evaporative air coolers with industrial-grade cooling efficiency for large spaces. |

| Kenstar (Videocon Group) | Specializes in cost-effective desert coolers with turbo air delivery and multi-speed control features. |

Key Company Insights

Symphony Limited (20-25%)

Symphony is the market leader in desert air coolers, known for its energy-efficient, smart IoT-enabled models. The company’s advanced cooling pad technology enhances cooling efficiency and durability.

Bajaj Electricals Ltd. (14-18%)

Bajaj Electricals focuses on high-performance desert air coolers with powerful air delivery and inverter compatibility. Its products are widely used in residential and commercial spaces.

Havells India Ltd. (10-14%)

Havells manufactures stylish and high-airflow desert air coolers with advanced cooling pads and dust filtration systems, catering to premium market segments.

Honeywell International Inc. (8-12%)

Honeywell provides industrial-grade evaporative air coolers for large spaces. Its heavy-duty cooling solutions offer efficient air circulation for extreme climates.

Kenstar (Videocon Group) (5-9%)

Kenstar specializes in cost-effective desert coolers with turbo air delivery and multi-speed control. The brand is popular in residential and mid-range commercial applications.

Other Key Players (30-40% Combined)

Several other companies contribute to the desert air cooler market with innovative and affordable cooling solutions. These brands focus on improving efficiency and affordability:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Water Capacity, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Water Capacity, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Water Capacity, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Water Capacity, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Water Capacity, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Water Capacity, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Water Capacity, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Water Capacity, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Water Capacity, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Water Capacity, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Water Capacity, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Water Capacity, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Water Capacity, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Water Capacity, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Water Capacity, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Water Capacity, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Water Capacity, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Water Capacity, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by End Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Water Capacity, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Water Capacity, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Water Capacity, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Water Capacity, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Water Capacity, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Water Capacity, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by End Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Water Capacity, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Water Capacity, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Water Capacity, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Water Capacity, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Water Capacity, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Water Capacity, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Water Capacity, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Water Capacity, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Water Capacity, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Water Capacity, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Water Capacity, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Water Capacity, 2023 to 2033

Figure 117: Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Water Capacity, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Water Capacity, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Water Capacity, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Water Capacity, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Water Capacity, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Water Capacity, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Water Capacity, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Water Capacity, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Water Capacity, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Water Capacity, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Water Capacity, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Water Capacity, 2023 to 2033

Figure 177: MEA Market Attractiveness by Application, 2023 to 2033

Figure 178: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

The overall market size for Desert Air Cooler Market was USD 1,785.1 Million in 2025.

The Desert Air Cooler Market is expected to reach USD 4,546.7 Million in 2035.

The rising demand for energy-efficient cooling solutions, growing temperature extremes, and increasing adoption in residential and commercial sectors fuel the Desert Air Cooler Market during the forecast period.

The top 5 countries which drives the development of Desert Air Cooler Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Indoor Application Dominates to command significant share over the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.