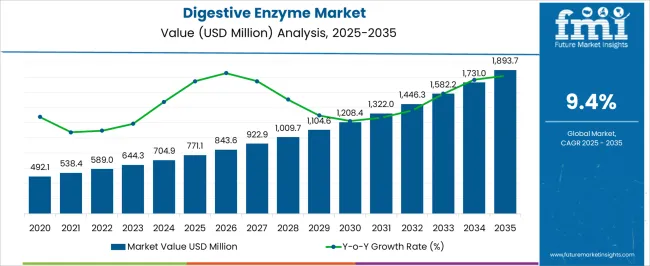

The digestive enzyme market is estimated to be valued at USD 771.1 million in 2025 and is projected to reach USD 1893.7 million by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period. A growth momentum analysis reveals strong and steady growth with early acceleration and subsequent sustained expansion. Between 2025 and 2030, the market grows from USD 771.1 million to USD 1,208.4 million, contributing USD 437.3 million in growth, with a CAGR of 9.3%. This phase is marked by increasing demand for digestive enzymes driven by rising awareness of gut health, the growing prevalence of digestive disorders, and the expanding adoption of enzyme supplements as a preventive health measure.

From 2030 to 2035, the market continues its upward trajectory, expanding from USD 1,208.4 million to USD 1,893.7 million, adding USD 685.3 million in growth, with a slightly higher CAGR of 9.5%. This acceleration reflects the continued rise in consumer demand, especially in emerging markets, as well as innovations in enzyme formulations and delivery mechanisms. The late-phase growth is further supported by the integration of digestive enzymes in functional foods and beverages. The analysis highlights a consistent and strong momentum, driven by ongoing health trends, increasing product availability, and expanding applications of digestive enzymes in diverse industries.

| Metric | Value |

|---|---|

| Digestive Enzyme Market Estimated Value in (2025 E) | USD 771.1 million |

| Digestive Enzyme Market Forecast Value in (2035 F) | USD 1893.7 million |

| Forecast CAGR (2025 to 2035) | 9.4% |

The current market scenario reflects growing demand for enzyme supplements among individuals with enzyme deficiencies, lactose intolerance, and irritable bowel conditions. Industry publications and pharmaceutical press releases have highlighted that the inclusion of digestive enzymes in functional foods and nutraceutical formulations is gaining momentum across global markets.

Additionally, growing consumer preference for preventive healthcare and self-directed wellness is influencing demand across both retail and clinical channels. The future outlook for the market is expected to remain favorable, supported by continued innovation in enzyme extraction technologies, an expanding geriatric population, and increasing penetration in emerging economies.

Statements from leading health supplement manufacturers have indicated that strategic investments in product development and natural sourcing are shaping the competitive landscape. These factors are contributing to a positive growth trajectory and a diversified product pipeline for the Digestive Enzyme market.

The digestive enzyme market is segmented by product, source, and geographic regions. By product, the digestive enzyme market is divided into Proteases, Lipases, Alpha-Galactosidase, Maltase, and Others (Beta-Glucanases, Beta-Glucosidases, etc.). In terms of the source of the digestive enzyme market, it is classified into Animal, Plant, and Microbial. Regionally, the digestive enzyme industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

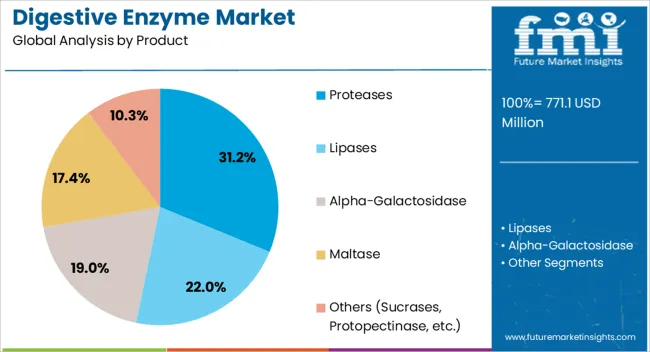

The proteases segment is projected to account for 31.2% of the Digestive Enzyme market revenue share in 2025, making it the leading product category. Its dominance is being driven by the essential role proteases play in the breakdown of proteins, which is a critical function in the human digestive system. It has been noted in clinical publications and healthcare product announcements that proteases are widely used in treating indigestion, protein malabsorption, and pancreatic insufficiency.

Their inclusion in over-the-counter supplements, sports nutrition, and therapeutic formulations has expanded rapidly due to proven efficacy and favorable consumer response. Pharmaceutical and nutraceutical companies have focused on developing stable and fast-acting protease-based products that can cater to individuals with high-protein diets or compromised digestion.

Additionally, their compatibility with multi-enzyme formulations makes them a preferred choice among healthcare practitioners. The segment's leadership is further supported by increasing awareness of digestive health and the availability of targeted products catering to different age groups and health conditions.

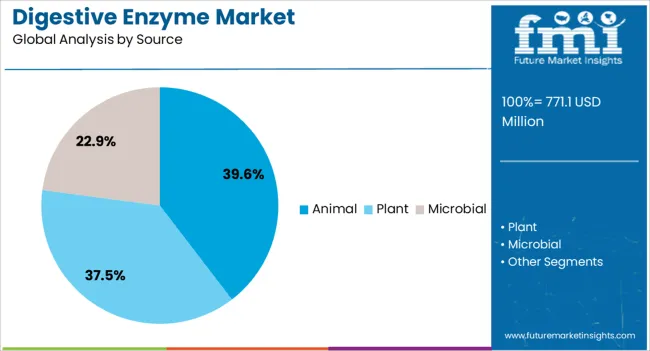

The animal source segment is anticipated to contribute 39.6% of the Digestive Enzyme market revenue share in 2025, positioning it as the dominant source category. This leadership is being attributed to the high enzymatic activity and effectiveness of enzymes derived from animal tissues such as the pancreas or stomach lining. Industry insights and product literature have consistently highlighted that animal-based enzymes offer superior bioavailability and faster action compared to some plant or microbial alternatives.

Healthcare providers continue to recommend animal-sourced enzymes for clinical applications, especially for individuals with pancreatic enzyme deficiencies or severe digestive disorders. The cost-effectiveness of sourcing enzymes from animal origins and the long-standing research backing their safety and efficacy have reinforced their continued use.

Moreover, consistent supply chains and regulatory clarity surrounding animal-derived ingredients have supported broader adoption in both prescription and non-prescription categories. These advantages have collectively enabled the animal source segment to maintain its leading market position.

Digestive enzymes, which help break down food and enhance nutrient absorption, are gaining popularity due to their ability to support gastrointestinal health. Rising awareness about digestive disorders, such as lactose intolerance and irritable bowel syndrome (IBS), is driving the demand for enzyme supplements. Additionally, the growing preference for natural and plant-based digestive solutions is pushing the market forward. As consumers continue to prioritize holistic health, digestive enzyme supplements are becoming an integral part of maintaining a balanced digestive system, boosting market growth and innovation.

One major issue is the lack of standardization in enzyme formulations, leading to variations in efficacy and consumer trust. As enzymes are derived from a range of natural sources, ensuring consistent quality and effectiveness across products can be difficult. Additionally, high prices for premium enzyme supplements may limit adoption among budget-conscious consumers. The complexity of digestive health itself adds another layer of challenge, as individual responses to enzymes can vary, making it harder for manufacturers to offer universally effective products. Regulatory hurdles surrounding enzyme claims also pose difficulties, as companies must navigate varying laws across regions to market their products effectively.

The digestive enzyme market is driven by increasing awareness of digestive health and a growing desire for preventive healthcare solutions. As people seek ways to address common digestive issues like bloating, gas, and indigestion, digestive enzymes are becoming a popular solution. Additionally, the rise in chronic conditions related to the digestive system, such as IBS and Crohn’s disease, is pushing consumers toward enzyme-based supplements for symptom relief. The growing interest in gut health and its connection to overall wellness, along with a shift toward natural, non-pharmaceutical alternatives, further drives market demand. Additionally, the increasing availability of digestive enzyme products in online and retail markets is contributing to broader consumer access and adoption.

The digestive enzyme market presents numerous opportunities, particularly with advancements in product innovation. Manufacturers can focus on developing enzyme blends tailored to specific digestive issues, such as lactose intolerance or enzyme deficiencies. There is a growing market for plant-based and vegan enzyme supplements, which presents an opportunity to cater to a more health-conscious and eco-aware consumer base. Furthermore, as more research uncovers the role of enzymes in promoting gut health, the development of specialized enzyme formulations for enhanced digestive function is becoming a key growth area. Expanding distribution networks through e-commerce platforms and partnerships with healthcare providers offers additional avenues for growth. As consumer demand for personalized health solutions increases, the potential for targeted enzyme-based products is vast.

Several key trends are shaping the digestive enzyme market. First, there is a noticeable shift toward personalized nutrition, where consumers seek supplements tailored to their unique digestive needs. This trend is fostering innovation in enzyme formulations designed to address specific issues such as bloating, indigestion, and food sensitivities. Another trend is the rising preference for plant-based and vegan digestive enzyme products, driven by growing consumer interest in clean-label and natural ingredients. Additionally, the increasing integration of digestive enzyme supplements into broader wellness routines is expanding their appeal beyond those with specific digestive issues. The rise of e-commerce and the growing availability of these products in online marketplaces are also contributing to market growth. These trends indicate a future where digestive enzyme products become a more mainstream solution for maintaining digestive health.

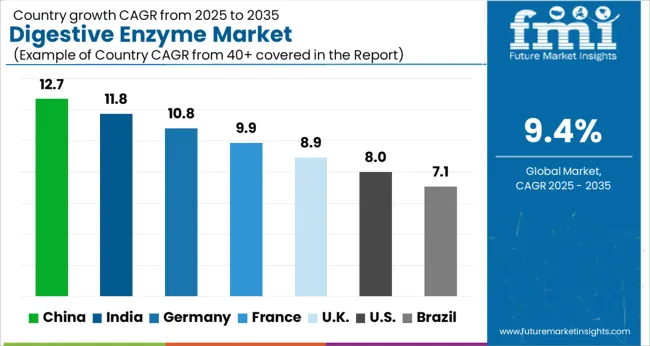

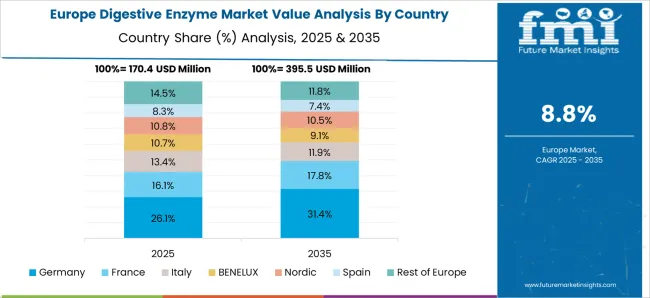

The global digestive enzyme market is projected to grow at a CAGR of 9.4% from 2025 to 2035. China leads the market with a growth rate of 12.7%, followed by India at 11.8%. Germany records a growth rate of 10.8%, while the UK shows 8.9% and the USA follows at 8.0%. The market is primarily driven by increasing awareness of digestive health, rising consumer demand for natural and plant-based supplements, and advancements in enzyme technology. China and India lead the growth, backed by expanding healthcare access and a rising middle-class population. Developed economies like Germany, the UK, and the USA are seeing steady growth, supported by higher health awareness and a focus on preventive healthcare. The analysis spans over 40+ countries, with the leading markets shown below.

The digestive enzyme market in China is growing at a robust CAGR of12.7% from 2025 to 2035, driven by an increasing awareness of digestive health and a rise in the demand for dietary supplements. As urbanization and disposable incomes rise, more Chinese consumers are seeking natural solutions to improve digestion and overall well-being. The country’s healthcare sector is expanding, and there is a growing focus on preventive health, further fueling the demand for digestive enzyme products. Additionally, with a rise in digestive issues such as bloating, constipation, and indigestion, more consumers are turning to supplements to alleviate symptoms. The Chinese government’s efforts to improve healthcare accessibility are also contributing to the broader adoption of digestive enzyme products.

The digestive enzyme market in India is expected to grow at a CAGR of .8% through 2035 ,fueled by rising awareness of digestive health and an expanding healthcare industry. India’s increasing focus on wellness and preventive healthcare is driving consumers toward natural dietary supplements, including digestive enzymes. As a large portion of India’s population deals with digestive issues due to diet and lifestyle, the demand for enzyme-based products is increasing. India’s growing middle class and higher disposable incomes are also contributing to market growth, with more consumers seeking easy-to-use and effective digestive solutions. Additionally, as the market for supplements continues to expand in urban areas, more consumers are becoming aware of the benefits of digestive enzymes.

The digestive enzyme market in Germany is projected to grow at a CAGR of 10.8% through 2035 ,supported by rising consumer demand for natural supplements and health-conscious products. Germany is known for its strong focus on preventative healthcare and wellness, and this trend is increasingly translating into a preference for digestive enzyme products. With a well-developed healthcare system and an aging population that is more prone to digestive issues, there is a growing need for effective and natural digestive support. The German market also benefits from increased product innovation, particularly in plant-based and vegetarian digestive enzyme solutions, in response to consumer demand for clean-label products. Additionally, Germany’s access to cutting-edge research and development in enzyme technology is helping drive market growth.

The UK digestive enzyme market is expected to expand at a CAGR of 8.9%, driven by increasing demand for dietary supplements to support digestive health. The growing trend of preventive healthcare and the rising prevalence of digestive issues such as IBS (Irritable Bowel Syndrome) and bloating are encouraging more consumers to seek digestive enzyme products. The UK market is seeing a rise in demand for plant-based and vegan supplements, as consumers become more health-conscious and choose alternatives to traditional supplements. Increased consumer awareness about the benefits of digestive health, alongside growing concerns about gut health, continues to contribute to the adoption of digestive enzymes. Innovations in enzyme formulations and easy-to-consume formats are appealing to busy urban consumers.

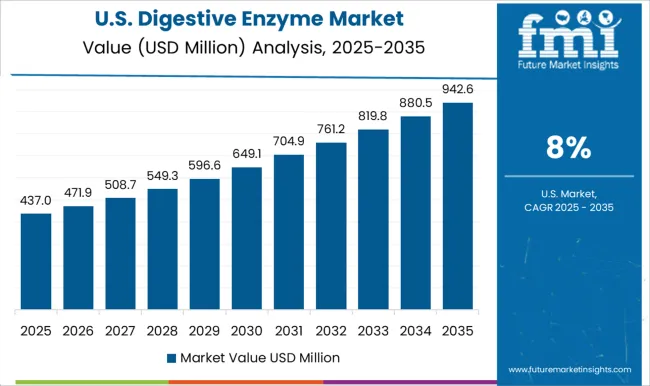

The USA digestive enzyme market is forecasted to expand at a CAGRof 8.0%, supported by rising awareness of digestive health and increasing consumer demand for natural supplements. As the USA continues to prioritize wellness and preventive care, the adoption of digestive enzyme products is becoming more widespread. The growing prevalence of digestive issues like heartburn, indigestion, and bloating is driving consumers toward effective solutions. Furthermore, the USA market is benefiting from an increasing trend of self-care, with consumers becoming more proactive in managing their health. Product innovations in digestive enzymes, such as customized enzyme formulations and delivery methods, are further fueling market growth. E-commerce and retail expansion are also increasing product availability.

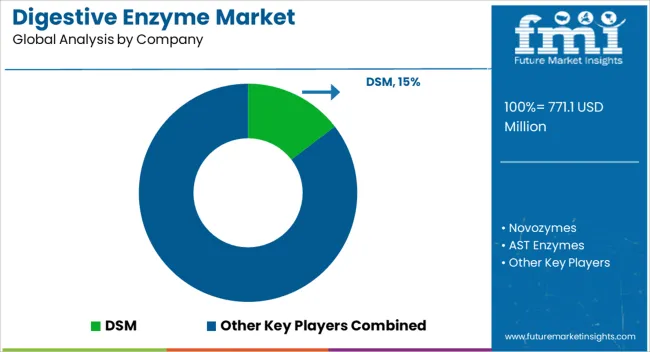

The digestive enzyme market is driven by key players that offer a wide range of enzyme-based products designed to aid in digestion, improve gut health, and support overall wellness. DSM is a market leader, providing high-quality digestive enzymes used in dietary supplements and functional foods. The company focuses on offering enzyme solutions that enhance digestion, absorption, and the breakdown of complex nutrients, catering to both individual consumers and large food manufacturers. Novozymes specializes in producing industrial enzymes for various applications, including digestive health, offering innovative enzyme formulations that support efficient digestion and gut microbiome health. AST Enzymes provides a range of digestive enzyme products, focusing on high potency and targeted formulations designed to help with food digestion and overall digestive system health. Biotech Research Corporation offers enzyme solutions for both healthcare and dietary supplements, emphasizing high-performance and bioavailability in its products.

Abbott Corporation is a significant player, offering digestive enzyme supplements designed to support digestion and overall gastrointestinal health, with a focus on developing advanced, science-backed formulations. Country Life, LLC offers a variety of digestive enzyme products, combining high-quality ingredients that promote digestive health, including enzyme blends that support nutrient absorption. Amway Corporation provides enzyme-based supplements that cater to gut health, focusing on convenience and efficacy in digestion-related products. Specialty Enzymes and Probiotics focus on high-quality enzyme and probiotic formulations, providing digestive solutions that promote balance in the gut microbiome. Lumis Biotech and Amano Enzyme offer specialized enzymes that target digestive health, known for their effectiveness in breaking down proteins, fats, and carbohydrates. Aumenzymes produces digestive enzyme formulations with a focus on providing natural, plant-based enzyme solutions, targeting the growing consumer interest in plant-based and clean-label products.

The digestive enzyme market sits at the intersection of nutraceutical growth, digestive health awareness, and bioprocess innovation. Rising incidence of digestive disorders, growing consumer interest in preventive gut health, and advances in enzyme discovery (microbial, plant- and fungal-derived) position digestive enzymes as a fast-growing ingredient class across supplements, functional foods, medical nutrition, and pharmaceuticals. Market expansion depends on coordinated action from governments, industry bodies, manufacturers/OEMs, suppliers, and investors. Together these stakeholders can move digestive enzymes from a specialty segment to a mainstream health & clinical nutrition staple.

| Item | Value |

|---|---|

| Quantitative Units | USD 771.1 Million |

| Product | Proteases, Lipases, Alpha-Galactosidase, Maltase, and Others (Sucrases, Protopectinase, etc.) |

| Source | Animal, Plant, and Microbial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM, Novozymes, AST Enzymes, Biotech Research Corporation, Abbott Corporation, Country Life, LLC, Amway Corporation, Specialty Enzymes and Probiotics, Lumis Biotech, Amano Enzyme, and Aumenzymes |

| Additional Attributes | Dollar sales by product type (capsules, tablets, powders, liquids) and end-use segments (dietary supplements, functional foods, medical nutrition). Demand dynamics are influenced by the rising consumer awareness of gut health, increasing digestive disorders, and the growing popularity of natural and plant-based enzyme products. Regional trends show strong growth in North America and Europe, driven by an aging population and a growing focus on digestive wellness, while Asia-Pacific is expanding due to increasing disposable income and the rising demand for dietary supplements. |

The global digestive enzyme market is estimated to be valued at USD 771.1 million in 2025.

The market size for the digestive enzyme market is projected to reach USD 1,893.7 million by 2035.

The digestive enzyme market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in digestive enzyme market are proteases, lipases, _amylases, _cellulase, _lactases, alpha-galactosidase, maltase and others (sucrases, protopectinase, etc.).

In terms of source, animal segment to command 39.6% share in the digestive enzyme market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digestive Enzyme Supplements Market Size, Growth, and Forecast for 2025 to 2035

Digestive Health Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Digestive Health Drinks Market Analysis by Ingredient Type, Sales Channel, Region Through 2025 to 2035

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Enzyme Protectants Market Size and Share Forecast Outlook 2025 to 2035

Enzyme-Enabled Cold-Brew Concentrates Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enzyme Replacement Therapy Market Insights - Size & Forecast 2025 to 2035

Enzyme Substrates Market – Growth & Forecast 2025 to 2035

Enzyme Inhibitors Market

Coenzyme Q10 Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bioenzyme Fertilizer Market Size, Growth, and Forecast 2025 to 2035

Sea Enzyme Products Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cake Enzyme Market Size and Share Forecast Outlook 2025 to 2035

Food Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multi-Enzyme Blends Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA