The electroactive polymer market is estimated to be valued at USD 5.9 billion in 2025 and is projected to reach USD 9.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Breakpoint analysis reveals critical inflection points in the market's growth, where shifts in demand and technological adoption influence market dynamics. The market starts at USD 4.7 billion in 2025 and sees gradual increases, reaching USD 5.9 billion in 2029. This early phase is marked by stable demand as electroactive polymers find growing applications in industries such as sensors, actuators, and automotive, especially in response to increasing requirements for flexible, lightweight materials.

From 2029 to 2031, the market experiences a significant breakpoint, where the growth rate accelerates from USD 6.2 billion to USD 6.8 billion. This surge is driven by advancements in material science, the growing demand for smart materials, and increased investment in wearable technologies. Another critical breakpoint occurs between 2031 and 2033, when the market value jumps from USD 7.5 billion to USD 8.2 billion. This growth reflects wider industrial adoption, particularly in the fields of robotics and biomedical devices, where electroactive polymers are increasingly utilized for their unique properties. The final stage, from 2033 to 2035, sees the market reaching USD 9.4 billion, reflecting sustained demand as applications diversify and the benefits of electroactive polymers continue to be recognized across various sectors.

Materials engineers evaluate electroactive polymer specifications based on actuation strain capabilities, response time characteristics, and electrical conductivity requirements when developing applications for robotic systems, prosthetic devices, and adaptive aerospace structures. Material selection involves analyzing mechanical properties, environmental stability, and processing compatibility while considering voltage requirements, frequency response, and durability specifications necessary for specific application environments. Procurement decisions balance initial material costs against performance advantages including weight reduction, energy efficiency, and design flexibility that influence overall system effectiveness and operational economics.

Technology advancement prioritizes conducting polymer development, dielectric elastomer optimization, and hybrid material systems that improve actuation performance while reducing power consumption and manufacturing complexity. Materials scientists develop ionic electroactive polymers, carbon nanotube composites, and graphene-enhanced formulations that provide enhanced electrical conductivity while maintaining mechanical flexibility and processing compatibility. Control system integration encompasses feedback sensors, power management, and actuation algorithms that optimize electroactive polymer performance while addressing application-specific control requirements.

Innovation trends emphasize self-healing polymer development, wireless power transmission integration, and multi-functional material systems that combine actuation capabilities with sensing functions throughout advanced electroactive polymer applications supporting next-generation smart material implementation across robotics, healthcare, and adaptive structural systems requiring intelligent material responses to environmental stimuli.

| Metric | Value |

|---|---|

| Electroactive Polymer Market Estimated Value in (2025 E) | USD 5.9 billion |

| Electroactive Polymer Market Forecast Value in (2035 F) | USD 9.4 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The electroactive polymer market is experiencing accelerated growth driven by advancements in material science, expanding application areas, and increased focus on lightweight and flexible electronic components. These polymers are being increasingly utilized for their ability to respond to electrical stimuli, enabling innovation in sensors, actuators, energy harvesting devices, and wearable electronics.

Their light weight, cost efficiency, and ability to be molded into complex shapes without compromising performance make them a preferred choice in sectors demanding smart materials. Research initiatives focused on biocompatible electroactive polymers have also opened doors in biomedical fields.

The overall outlook remains strong, supported by the convergence of sustainability, miniaturization of electronic devices, and demand for smarter, multifunctional materials across industries.

The electroactive polymer market is segmented by type, application, end use, and geographic regions. By type, the electroactive polymer market is divided into Conductive Plastics, Inherently Conductive Polymers (ICP), Inherently Dissipative Polymers (IDP), and Others. In terms of application, the electroactive polymer market is classified into Electrostatic Discharge (ESD) Protection, Electromagnetic Interference (EMI) Shielding, Actuators, Capacitors, Batteries, Sensors, and Others.

Based on end use, the electroactive polymer market is segmented into Automotive, Aerospace, Healthcare, Electronics, and Others. Regionally, the electroactive polymer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conductive plastics segment is projected to account for 48.60% of total market revenue by 2025 within the type category, making it the leading sub-segment. Its dominance is attributed to high electrical conductivity, excellent thermal stability, and lightweight properties that are critical in advanced electronics, automotive, and aerospace applications.

These materials offer enhanced processability and compatibility with injection molding techniques, enabling scalable manufacturing. Additionally, conductive plastics support device miniaturization and energy efficiency, making them ideal for integration into next-generation electronics.

As demand for low-weight, high-strength alternatives to metals continues to grow, this segment maintains a leading edge by combining electrical performance with design flexibility.

The electrostatic discharge protection application is expected to hold 42.70% of total revenue within the application category by 2025, securing its position as the most significant segment. This prominence is due to the increasing use of electroactive polymers in protecting sensitive electronic components from static discharge damage during manufacturing and operation.

These materials serve as an effective barrier, safeguarding microelectronic assemblies and preventing costly malfunctions. The shift toward miniaturized devices and the rising complexity of integrated circuits has elevated the importance of ESD protection across electronic production lines.

Additionally, regulatory mandates on electronic safety have reinforced demand for ESD protective solutions, positioning this application as critical to ensuring product reliability and longevity.

The automotive end-use segment is anticipated to contribute 37.90% of the market revenue by 2025, making it the dominant sector within end-use applications. This growth is being fueled by rising demand for lightweight materials that support electric mobility, fuel efficiency, and electronic integration in vehicles.

Electroactive polymers are being increasingly used in sensors, actuators, and advanced driver assistance systems due to their flexibility, low energy consumption, and adaptability to automotive design needs. As electric and autonomous vehicle trends continue to gain traction, manufacturers are prioritizing materials that combine performance with energy optimization.

The automotive sector remains the frontrunner due to its strong alignment with innovation and efficiency goals in mobility systems.

The electroactive polymer (EAP) market is expanding due to the increasing demand for advanced materials in various industries, including automotive, healthcare, aerospace, and robotics. EAPs are materials that change shape or size when an electric field is applied, making them ideal for applications that require actuation, sensors, and energy harvesting. Their flexibility, lightweight nature, and ability to mimic biological muscle movement make them highly attractive for a range of innovative applications. As industries continue to explore new solutions for robotics, wearable devices, and smart sensors, the market for electroactive polymers is set for continued growth.

The electroactive polymer market is driven by the increasing demand for lightweight and flexible materials across various industries. In the automotive and aerospace sectors, EAPs are used to create actuators that offer high performance while reducing the weight of components. In healthcare, EAPs are being developed for soft robotics and wearable devices that can adapt to the human body’s movements. These polymers are also used in energy-harvesting applications, where they can convert mechanical energy into electrical energy. The growing demand for advanced, flexible materials that combine functionality and adaptability is driving the adoption of EAPs in various sectors.

The electroactive polymer market faces several challenges, primarily related to high production costs and material limitations. Manufacturing EAPs requires specialized processing techniques and materials, making them more expensive compared to traditional polymers and actuators. Additionally, while EAPs offer impressive actuation properties, their performance can be limited by factors such as durability, efficiency, and response time, which can hinder their adoption in certain applications. Overcoming these challenges requires continued research and development to improve the material properties, enhance manufacturing efficiency, and reduce the overall costs of electroactive polymer production, which will enable broader market adoption.

The electroactive polymer market presents significant opportunities, particularly in the fields of smart devices and robotics. As the demand for soft robotics and wearable technologies increases, EAPs offer a promising solution for creating flexible actuators and sensors that can mimic natural movements. EAPs are also being explored for their potential in prosthetics and rehabilitation devices, where their ability to mimic muscle movement can provide more lifelike and responsive functionality. Additionally, the growing interest in energy-efficient systems is driving the use of EAPs for energy harvesting in wearable electronics and sensors. The advancements in these technologies are expected to open new growth avenues for the electroactive polymer market.

A key trend in the electroactive polymer market is the increasing integration of these materials in wearable electronics and energy harvesting applications. As the demand for wearable devices grows, EAPs are being utilized to create flexible sensors and actuators that can be seamlessly integrated into clothing, jewelry, and accessories. In energy harvesting, EAPs are used to convert mechanical energy from movement or vibrations into electrical energy, providing a sustainable power source for low-power devices. These advancements are creating new applications for EAPs in smart textiles, portable electronics, and self-powered devices, driving innovation and further expanding the market. As these trends evolve, EAPs will play a crucial role in the development of next-generation smart devices.

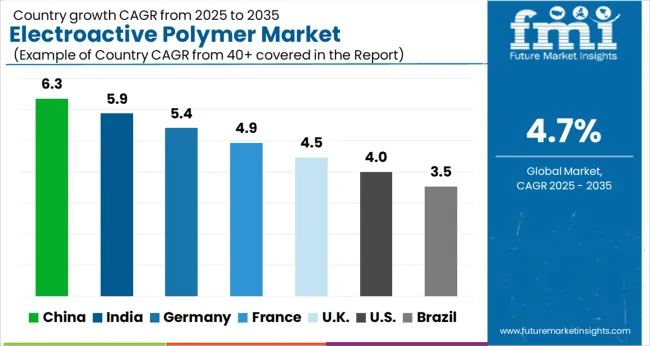

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

Global foam tape market demand is projected to rise at a 6.8% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 9.2%, followed by India at 8.5%, and Germany at 7.8%, while the United Kingdom records 6.5% and the United States posts 5.8%. These rates translate to a growth premium of +35% for China, +25% for India, and +15% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Increased demand for automotive and construction applications in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to established usage in packaging and insulation sectors. The analysis spans over 40+ countries, with the leading markets shown below.

The electroactive polymer market in China is projected to grow at a CAGR of 6.3% through 2035. As one of the world’s largest manufacturing hubs, China’s increasing demand for electroactive polymers in various sectors such as automotive, electronics, and healthcare is driving market growth. The country’s push toward technological advancements and innovations, particularly in smart materials and flexible electronics, further accelerates the demand for electroactive polymers. China’s rising investments in renewable energy technologies and the development of energy-efficient products further support the adoption of electroactive polymers, making the market highly dynamic and expansive.

The electroactive polymer market in India is expected to grow at a CAGR of 5.9% through 2035. As the country’s industrial and electronics sectors continue to grow, the demand for advanced materials such as electroactive polymers is increasing. India’s rising focus on renewable energy, coupled with a growing demand for smart materials in industries like automotive and healthcare, drives the adoption of electroactive polymers. The country’s expanding manufacturing base and rising investments in research and development contribute significantly to the growth of this market, fostering the use of electroactive polymers in diverse applications.

The electroactive polymer market in France is projected to grow at a CAGR of 4.9% through 2035. France’s well-established automotive, electronics, and healthcare industries continue to generate substantial demand for electroactive polymers. The market benefits from increasing demand for energy-efficient and smart products, such as flexible sensors and actuators, which use electroactive polymers for various applications. Additionally, France’s growing investments in research and development for next-generation electronics and renewable energy technologies contribute to the adoption of electroactive polymers, further driving market growth in the country.

The electroactive polymer market in the United Kingdom is projected to grow at a CAGR of 4.5% through 2035. The UK is seeing increased demand for electroactive polymers in industries like automotive, robotics, and electronics, driven by the need for lightweight and energy-efficient materials. Additionally, the UK’s growing focus on advanced manufacturing technologies, such as smart materials and flexible electronics, is further promoting the adoption of electroactive polymers. Government support for technological innovation and renewable energy development continues to enhance market opportunities for electroactive polymers in the UK

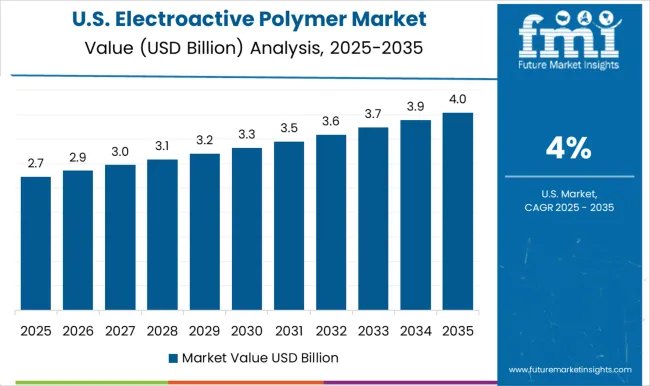

The USA electroactive polymer market is projected to grow at a CAGR of 4.0% through 2035. As a global leader in technology and innovation, the USA sees increasing demand for electroactive polymers in various industries such as automotive, aerospace, and healthcare. The growing need for flexible electronics, sensors, and actuators further drives the adoption of electroactive polymers. The USA market benefits from significant investments in R&D and the increasing focus on energy-efficient technologies, supporting the growth of the electroactive polymer market in applications ranging from consumer electronics to medical devices.

The electroactive polymer (EAP) market is growing due to the increasing applications of EAPs in industries such as automotive, healthcare, robotics, and consumer electronics, driven by their unique ability to change shape or size in response to an electric field. Key players in the market include 3M Company, Agfa-Gevaert NV, Heraeus Holding GmbH, The Lubrizol Corporation, Merck KGaA, Novasentis Inc., Parker Hannifin Corporation, Avient Corporation (formerly PolyOne), Premix Oy, and Solvay SA.

3M Company and Heraeus Holding GmbH are at the forefront, developing advanced electroactive polymer solutions for sensors, actuators, and displays. Agfa-Gevaert NV offers high-performance materials used in industrial and medical applications, while The Lubrizol Corporation focuses on polymer formulations with electroactive properties for a variety of markets.

Merck KGaA and Novasentis Inc. are innovating in electroactive films and coatings for flexible, lightweight applications, including wearables and artificial muscles. Parker Hannifin Corporation and Avient Corporation provide polymers and composite materials that enhance the functionality of EAP devices, such as actuators and sensors, in high-performance applications. Premix Oy and Solvay SA focus on developing customized electroactive polymers for specific industry needs, including energy-efficient devices and medical solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.9 Billion |

| Type | Conductive Plastics, Inherently Conductive Polymers (ICP), Inherently Dissipative Polymers (IDP), and Others |

| Application | Electrostatic Discharge (ESD) Protection, Electromagnetic Interference (EMI) Shielding, Actuators, Capacitors, Batteries, Sensors, and Others |

| End use | Automotive, Aerospace, Healthcare, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

3M Company, Agfa-Gevaert NV, Heraeus Holding GmbH, The Lubrizol Corporation, Merck KGaA, Novasentis Inc., Parker Hannifin Corporation, Avient Corporation (formerly PolyOne), Premix Oy, Solvay SA |

| Additional Attributes | Dollar sales by product type (conductive polymers, dielectric elastomers, piezoelectric polymers) and end-use segments (automotive, healthcare, robotics, consumer electronics). Demand dynamics are driven by the increasing use of electroactive polymers in flexible electronics, smart textiles, and biomedical applications. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with innovations in polymer technologies and the growing adoption of EAP solutions across diverse industries contributing to market expansion. |

The global electroactive polymer market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the electroactive polymer market is projected to reach USD 9.4 billion by 2035.

The electroactive polymer market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in electroactive polymer market are conductive plastics, inherently conductive polymers (icp), inherently dissipative polymers (idp) and others.

In terms of application, electrostatic discharge (esd) protection segment to command 42.7% share in the electroactive polymer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Polymer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Adsorbents Market Size and Share Forecast Outlook 2025 to 2035

Polymerization Initiator Market Size and Share Forecast Outlook 2025 to 2035

Polymer Processing Aid (PPA) Market Size and Share Forecast Outlook 2025 to 2035

Polymer Feed System Market Size and Share Forecast Outlook 2025 to 2035

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Polymer Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Polymer Nanomembrane Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Sand Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Polymer Binders Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

Polymer Gel Market Size and Share Forecast Outlook 2025 to 2035

Polymeric Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Fillers Market Analysis - Size, Share, and Forecast 2025 to 2035

Polymer Coated Fabrics Market Trends 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Polymeric Membrane Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA