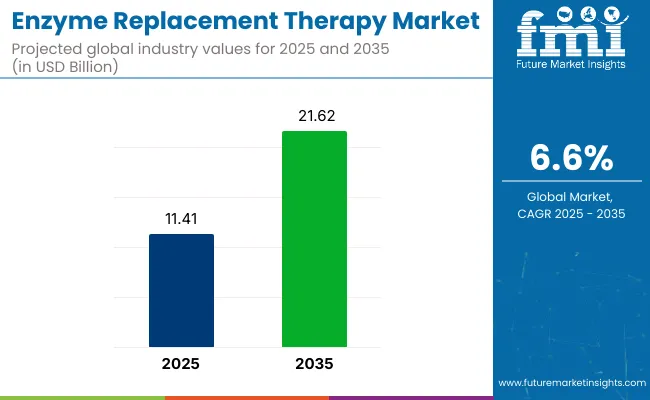

The global enzyme replacement therapy (ERT) market is valued at USD 11.41 billion in 2025 and is projected to reach USD 21.62 billion by 2035, which shows a CAGR of 6.6% over the forecast period. This growth is being driven by rising awareness, early diagnosis, and treatment advancements for rare genetic and metabolic disorders such as Gaucher disease, Fabry disease, Pompe disease, and mucopolysaccharidosis.

ERT plays a vital role in treating enzyme deficiency conditions by replacing missing or malfunctioning enzymes, improving patient outcomes and quality of life. Increasing research funding, improved access to genetic testing, and patient advocacy initiatives are contributing to early intervention and broader adoption of ERT across global healthcare systems.

Biopharmaceutical innovation and personalized medicine approaches are reshaping the development landscape for ERT. Companies are focusing on improving the efficacy, safety, and dosing regimens of enzyme therapies through next-generation biologics, PEGylation techniques, and targeted delivery platforms.

Advancements in recombinant DNA technology are enabling the production of highly purified enzymes with improved pharmacokinetics. Additionally, clinical trials are exploring expanded indications, pediatric applications, and home-based infusion options to enhance patient convenience. Partnerships between pharmaceutical firms and research institutes are driving pipeline expansion, while orphan drug designations and fast-track regulatory approvals are accelerating market entry of novel treatments.

Supportive policy frameworks and reimbursement structures are strengthening the ERT market outlook. Regulatory agencies like the USA FDA, EMA, and Japan’s PMDA are actively promoting orphan drug development through tax incentives, grant support, and exclusivity periods. Market access is further supported by rare disease policies in North America and Europe, while emerging economies are increasing investments in specialized care infrastructure.

As healthcare systems integrate precision medicine and real-world evidence into treatment protocols, the enzyme replacement therapy market is expected to expand steadily, offering life-changing solutions for patients with previously untreatable lysosomal storage and metabolic disorders.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 11.41 billion |

| Industry Value (2035F) | USD 21.62 billion |

| CAGR (2025 to 2035) | 6.6% |

The market is segmented based on therapeutic condition, route of administration, pharmacy type, and region. By therapeutic condition, the market is divided into Fabry disease, Gaucher disease, mucopolysaccharidosis (including MPS I, MPS II, MPS IVA, MPS VI, and MPS VII), Pompe disease, lysosomal acid lipase deficiency, and others (Krabbe disease, Niemann-Pick disease type B, Wolman disease, and Batten disease).

In terms of route of administration, it is segmented into oral enzyme replacement therapy and injectable enzyme replacement therapy. Based on pharmacy type, the market is categorized into hospital pharmacies, specialty treatment pharmacies, and retail pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

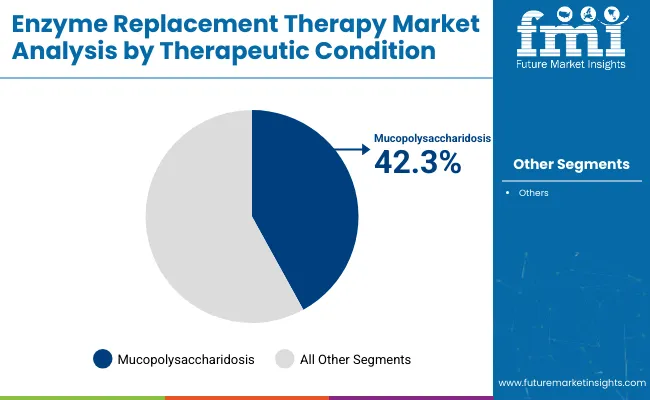

The mucopolysaccharidosis (MPS) segment is expected to account for 42.3% of the enzyme replacement therapy market by therapeutic condition in 2025. MPS encompasses a group of inherited lysosomal storage disorders caused by enzyme deficiencies that impair glycosaminoglycan (GAG) degradation.

These conditions include MPS I (Hurler), MPS II (Hunter), MPS IVA (Morquio A), MPS VI (Maroteaux-Lamy), and MPS VII (Sly syndrome). Enzyme replacement therapy (ERT) has become the cornerstone of treatment for these conditions, with companies like BioMarin, Sanofi, and JCR Pharmaceuticals offering type-specific therapies. ERT helps alleviate symptoms such as skeletal deformities, joint stiffness, hepatosplenomegaly, and respiratory issues, significantly improving patient quality of life.

The Gaucher disease segment is projected to hold 27.9% of the market in 2025. As one of the most common lysosomal storage diseases, Gaucher benefits from well-established ERT protocols and long-standing market presence. Approved treatments like imiglucerase and velaglucerase are widely adopted in both developed and emerging markets.

Despite advances in oral substrate reduction therapy (SRT) for Gaucher, ERT remains the preferred choice due to its superior clinical efficacy. With the expansion of newborn screening, earlier diagnosis, and improved healthcare access globally, MPS and Gaucher will continue to dominate therapeutic demand in the ERT space from 2025 to 2035.

| By Therapeutic Condition | Market Share (2025) |

|---|---|

| Mucopolysaccharidosis | 42.3% |

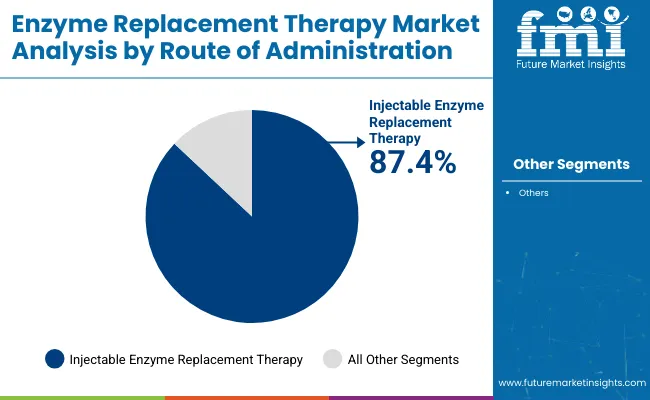

Injectable enzyme replacement therapy (ERT) is forecasted to maintain its dominant position in the ERT market, capturing 87.4% of the total share in 2025. Intravenous infusion is the standard delivery route for lysosomal storage disorders, offering reliable enzyme delivery, rapid systemic absorption, and minimized degradation risks.

Injectable ERT is widely used in treating Gaucher disease, Fabry disease, Pompe disease, and multiple subtypes of mucopolysaccharidosis. Companies such as Takeda, Sanofi, and Alexion are continuously enhancing stability, reducing immunogenicity, and extending half-life to minimize infusion frequency, thereby improving patient compliance and outcomes. Hospitals and specialty clinics remain the primary settings for administration due to the need for monitoring and structured dosing.

The oral ERT segment is constrained by the challenge of enzyme degradation in the gastrointestinal tract, making systemic delivery inefficient. However, innovation is underway, particularly for conditions where enzyme activity is required locally in the gut or where oral bioavailability can be enhanced via encapsulation or enzyme modification.

While oral therapies are still experimental or newly approved for select indications, the convenience and home-use potential may unlock growth. Nonetheless, injectable ERT remains the physician-preferred and clinically validated route of administration across most lysosomal disorders.

| By Route of Administration | Market Share (2025) |

|---|---|

| Injectable Enzyme Replacement Therapy | 87.4% |

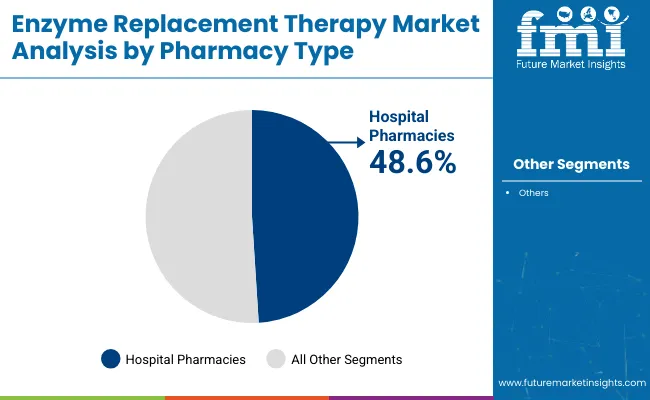

Hospital pharmacies are projected to command a 48.6% share of the enzyme replacement therapy market by pharmacy type in 2025, emerging as the primary distribution channel for complex infusion-based therapies. Their role is crucial in the administration of intravenous ERT treatments for conditions such as Gaucher, Fabry, and mucopolysaccharidosis.

Hospitals provide the necessary infrastructure, trained infusion specialists, and regulatory oversight needed to manage adverse reactions and ensure dosing accuracy. Inpatient and outpatient departments work in tandem to deliver these therapies in controlled settings, often aligned with national reimbursement programs and treatment guidelines for rare diseases.

The specialty pharmacies segment is estimated to hold 32.1% of the market in 2025. These pharmacies are increasingly serving patients with chronic or rare conditions by offering personalized coordination, home delivery, and infusion support. Their ability to manage cold-chain logistics, patient adherence, and insurance authorization makes them essential for expanding access to ERT beyond traditional hospital settings.

As the trend toward home-based care gains momentum, specialty pharmacies are expected to bridge the gap between clinical efficiency and patient convenience. While retail pharmacies play a minor role in ERT due to administration limitations, hospital and specialty channels will remain the backbone of therapy delivery across global markets.

| By Pharmacy Type | Market Share (2025) |

|---|---|

| Hospital Pharmacies | 48.6% |

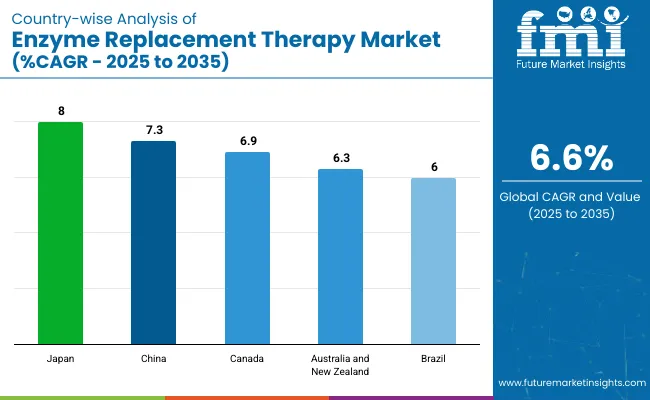

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 8% |

| China | 7.3% |

| Canada | 6.9% |

| Australia and New Zealand | 6.3% |

| Brazil | 6% |

The enzyme replacement therapy market in Japan is lucrative. It is slated to grow at a CAGR of 8% from 2025 to 2035. Japan is currently dealing with a growing aging population. As of 2024, one in every four people living in Japan is above the age of sixty.

This has created a conducive environment for ERTs, as this demographic is more susceptible to rare diseases. Responding to these demands, Japanese healthcare companies are also investing billions of dollars in curating novel technologies and therapies to tackle these fatal diseases.

China is a lucrative country in this market. The Chinese enzyme replacement therapy market is poised to grow at a CAGR of 7.3% from 2025 to 2035. The Chinese government, in the last few years, has been announcing a multitude of schemes and policies to strengthen its medical infrastructure.

The recent pandemic has also put a lot of pressure on the Chinese healthcare sector. All these factors have led to the adoption of best-in-class medical facilities in the country. This improved medical infrastructure has led to the expansion of the ERT market as more people become aware of rare diseases for which this treatment is used.

The future of the Canada ERT market also looks lucrative. The Canadian enzyme replacement therapy market is slated to grow at a CAGR of 6.9% from 2025 to 2035 in Canada. The presence of numerous medical institutes and government support in the form of grants and subsidies have proved to be a boon for Canada’s healthcare sector. This has also benefitted ERTs as medical research institutes have come up with top-tier methodologies for treating deadly diseases in the country.

The Australia and New Zealand ERT market is slated to grow at a CAGR of 6.3% from 2025 to 2035. Although the incidence of LSDs in Australia and New Zealand is very low, both countries are conducting continuous research and development in these fields. The purpose is to entirely terminate these diseases from their population.

Players involved in the ERT market are pouring billions of dollars into making therapies affordable for the common public. For instance, in April 2024, Inozyme Pharma initiated the Phase Ib ENERGY-1 trial, dosing the first infant with INZ-701 enzyme therapy for ENPP1 deficiency, aiming to assess safety and efficacy.

The market in Brazil is very likely to flourish in the coming years. The Brazilian enzyme replacement therapy market is slated to grow at a CAGR of 6% from 2025 to 2035. Lysosomal storage disorders are gradually picking up pace in Brazil. To mitigate these diseases altogether, Brazilian companies are collaborating with international partners. They are also investing in research and developing innovative therapies to address lysosomal storage disorders in the country.

The enzyme replacement therapy market is a very limited one as the disease mortality rate is minuscule. This is why very few companies exist in the market, most of which have already established themselves as key players.

The competition is also not that intense as top players hold the majority share of the market. Besides this, these companies are found collaborating with research institutions for more effective and affordable therapies.

Recent Developments in the Enzyme Replacement Therapy Market:

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 11.41 billion |

| Projected Market Size (2035) | USD 21.62 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value |

| By Therapeutic Condition | Fabry Disease, Gaucher Disease, Mucopolysaccharidosis (MPS I, MPS II, MPS IVA, MPS VI, MPS VII), Pompe Disease, Lysosomal Acid Lipase Deficiency, Others (e.g., Krabbe, Niemann-Pick Type B, Wolman, Batten) |

| By Route of Administration | Oral Enzyme Replacement Therapy, Injectable Enzyme Replacement Therapy |

| By Pharmacy Type | Hospital Pharmacies, Specialty Treatment Pharmacies, Retail Pharmacies |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | Japan, China, Canada, Australia and New Zealand, Brazil |

| Key Players | Sanofi S.A., Shire plc, Pfizer Inc., Alexion Pharmaceuticals Inc., BioMarin Pharmaceutical Inc., Ultragenyx Pharmaceutical Inc., Johnson & Johnson Services Inc., Allergan plc, Leadiant Biosciences Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global enzyme replacement therapy market is expected to reach USD 21.62 billion by 2035, growing from USD 11.41 billion in 2025, at a CAGR of 6.6% during the forecast period.

The mucopolysaccharidosis (MPS) segment is forecasted to grow at the fastest rate, registering a CAGR of 7.1% from 2025 to 2035, due to increasing awareness, improved diagnosis, and expansion of newborn screening programs.

Injectable ERT remains the dominant delivery route, expected to account for 87.4% of the market share in 2025, owing to its proven efficacy, widespread physician acceptance, and better systemic absorption.

Hospital pharmacies are projected to lead the market, capturing a 48.6% share in 2025, as they offer the infrastructure and clinical support required for supervised enzyme infusions in high-risk patients.

Key companies include Sanofi S.A., Shire plc, Pfizer Inc., BioMarin Pharmaceutical Inc., Ultragenyx Pharmaceutical Inc., and Alexion Pharmaceuticals, all of whom are advancing rare disease treatment from ERT innovation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Therapeutic Condition, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Pharmacy Type, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Therapeutic Condition, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Pharmacy Type, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Therapeutic Condition, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Pharmacy Type, 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Therapeutic Condition, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Pharmacy Type, 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Therapeutic Condition, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Pharmacy Type, 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Therapeutic Condition, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Pharmacy Type, 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Therapeutic Condition, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by Pharmacy Type, 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Therapeutic Condition, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Pharmacy Type, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Therapeutic Condition, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Pharmacy Type, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Therapeutic Condition, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Therapeutic Condition, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Therapeutic Condition, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Pharmacy Type, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Pharmacy Type, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Pharmacy Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Therapeutic Condition, 2024 to 2034

Figure 18: Global Market Attractiveness by Route of Administration, 2024 to 2034

Figure 19: Global Market Attractiveness by Pharmacy Type, 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Therapeutic Condition, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by Pharmacy Type, 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Therapeutic Condition, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Therapeutic Condition, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Therapeutic Condition, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Pharmacy Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Pharmacy Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Pharmacy Type, 2024 to 2034

Figure 37: North America Market Attractiveness by Therapeutic Condition, 2024 to 2034

Figure 38: North America Market Attractiveness by Route of Administration, 2024 to 2034

Figure 39: North America Market Attractiveness by Pharmacy Type, 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Therapeutic Condition, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by Pharmacy Type, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Therapeutic Condition, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Therapeutic Condition, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Therapeutic Condition, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by Pharmacy Type, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Pharmacy Type, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Pharmacy Type, 2024 to 2034

Figure 57: Latin America Market Attractiveness by Therapeutic Condition, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Route of Administration, 2024 to 2034

Figure 59: Latin America Market Attractiveness by Pharmacy Type, 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Therapeutic Condition, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by Pharmacy Type, 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Therapeutic Condition, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Therapeutic Condition, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Therapeutic Condition, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by Pharmacy Type, 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Pharmacy Type, 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Pharmacy Type, 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Therapeutic Condition, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Route of Administration, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by Pharmacy Type, 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Therapeutic Condition, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by Pharmacy Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Therapeutic Condition, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Therapeutic Condition, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Therapeutic Condition, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Pharmacy Type, 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Pharmacy Type, 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Pharmacy Type, 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Therapeutic Condition, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Route of Administration, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by Pharmacy Type, 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Therapeutic Condition, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by Pharmacy Type, 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Therapeutic Condition, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Therapeutic Condition, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Therapeutic Condition, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Pharmacy Type, 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Pharmacy Type, 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Pharmacy Type, 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Therapeutic Condition, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Route of Administration, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by Pharmacy Type, 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Therapeutic Condition, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by Pharmacy Type, 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Therapeutic Condition, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Therapeutic Condition, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Therapeutic Condition, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by Pharmacy Type, 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Pharmacy Type, 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Pharmacy Type, 2024 to 2034

Figure 137: East Asia Market Attractiveness by Therapeutic Condition, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Route of Administration, 2024 to 2034

Figure 139: East Asia Market Attractiveness by Pharmacy Type, 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Therapeutic Condition, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by Pharmacy Type, 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Therapeutic Condition, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Therapeutic Condition, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Therapeutic Condition, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Pharmacy Type, 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Pharmacy Type, 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Pharmacy Type, 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Therapeutic Condition, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Route of Administration, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by Pharmacy Type, 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gaucher and Pompe Diseases Enzyme Replacement Therapy (ERT) Market - Growth & Forecast 2025 to 2035

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Enzyme Protectants Market Size and Share Forecast Outlook 2025 to 2035

Enzyme-Enabled Cold-Brew Concentrates Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enzyme Substrates Market – Growth & Forecast 2025 to 2035

Enzyme Inhibitors Market

Coenzyme Q10 Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bioenzyme Fertilizer Market Size, Growth, and Forecast 2025 to 2035

Sea Enzyme Products Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cake Enzyme Market Size and Share Forecast Outlook 2025 to 2035

Food Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multi-Enzyme Blends Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Enzymes Market Analysis by Product Type, End User and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA