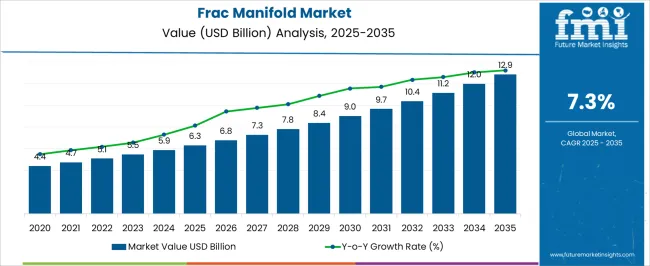

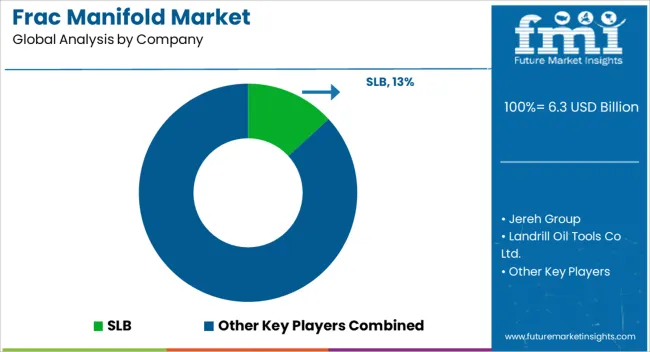

The Frac Manifold Market is estimated to be valued at USD 6.3 billion in 2025 and is projected to reach USD 12.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

| Metric | Value |

|---|---|

| Frac Manifold Market Estimated Value in (2025 E) | USD 6.3 billion |

| Frac Manifold Market Forecast Value in (2035 F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The frac manifold market is expanding steadily, driven by rising demand for efficient hydraulic fracturing operations in unconventional oil and gas fields. Industry reports, company press releases, and energy sector updates have emphasized the growing importance of reliable pressure control equipment to improve well completion efficiency and reduce downtime. The market has gained traction as shale exploration and production activities have increased globally, particularly in North America and parts of Asia.

Investments by upstream oilfield service providers in advanced manifold systems that enable faster rig-up and rig-down times have enhanced operational safety and cost-effectiveness. Furthermore, technological innovations in valve design, high-pressure containment, and automation are strengthening manifold reliability in complex fracturing environments.

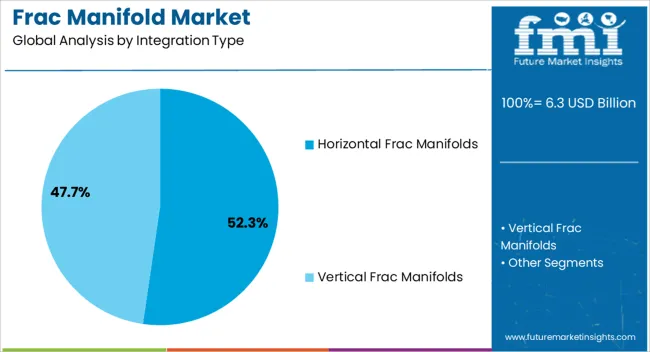

Future growth is expected to be shaped by demand for scalable systems that can handle high-pressure, multi-stage fracking operations, alongside the industry’s gradual transition toward digital monitoring and predictive maintenance. Segmental expansion is being led by Horizontal Frac Manifolds, Carbon Steel material adoption, and Multiple Outlet configurations, reflecting efficiency, durability, and operational flexibility.

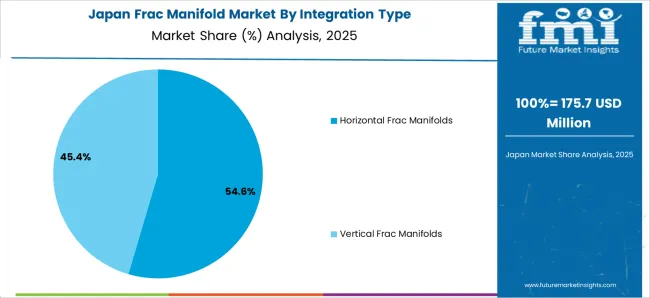

The Horizontal Frac Manifolds segment is projected to account for 52.3% of the market revenue in 2025, establishing itself as the leading integration type. Growth has been supported by the operational advantages of horizontal designs, which simplify equipment alignment and streamline fluid flow during multi-well fracturing operations.

Field operators have preferred horizontal manifolds due to their ability to reduce rig-up time, minimize equipment footprint, and enhance worker safety during high-pressure pumping. Additionally, their modularity has allowed easier integration with advanced pumping units and digital monitoring systems.

Reports from oilfield equipment manufacturers have highlighted that horizontal manifolds provide consistent flow control while reducing wear and tear, thereby extending service life and lowering maintenance costs. These benefits, combined with the growing prevalence of large-scale shale operations, have reinforced the adoption of horizontal frac manifolds as the preferred integration type.

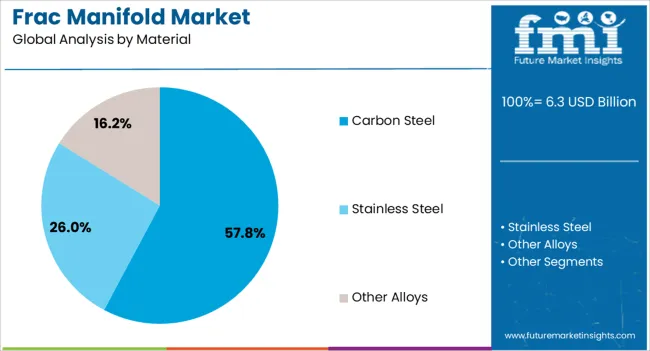

The Carbon Steel segment is projected to hold 57.8% of the frac manifold market revenue in 2025, maintaining its dominance as the preferred material. Its widespread use has been driven by high mechanical strength, durability, and cost-effectiveness under demanding pressure conditions.

Carbon steel manifolds have been valued for their ability to withstand abrasive fluids and high-pressure pumping cycles typical of hydraulic fracturing operations. Industry updates have noted that while alternative alloys and composites are being explored, carbon steel remains the most practical option due to its availability, machinability, and proven track record in oilfield environments.

The material’s favorable balance between performance and affordability has allowed operators to deploy carbon steel manifolds at scale without compromising safety or reliability. As hydraulic fracturing continues to intensify in key oil and gas regions, the Carbon Steel segment is expected to retain its leadership.

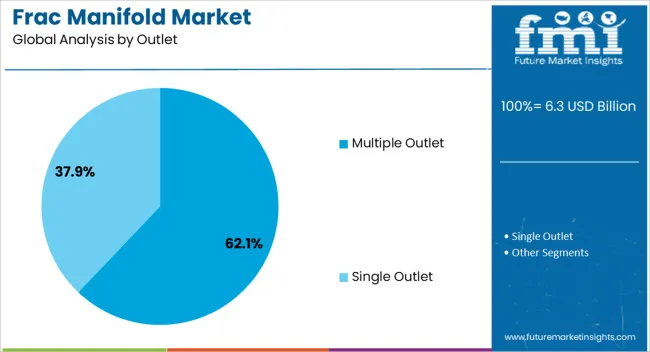

The Multiple Outlet segment is projected to contribute 62.1% of the frac manifold market revenue in 2025, securing its position as the leading outlet configuration. This growth has been driven by the need for efficient management of complex, multi-stage fracturing operations that require simultaneous fluid distribution across several wellheads.

Multiple outlet manifolds have been preferred due to their ability to optimize flow paths, reduce pumping interruptions, and enable greater operational flexibility in pad drilling environments. Energy sector briefings have emphasized that the use of multiple outlet systems improves pumping efficiency, reduces equipment changeovers, and maximizes fracturing productivity.

Additionally, the configuration supports scalability, allowing operators to manage larger fracturing jobs with fewer interruptions. With increasing adoption of multi-well pad operations and the industry’s emphasis on maximizing well output, the Multiple Outlet segment is expected to continue driving market growth as the most operationally efficient outlet design.

With the rising shale gas exploration initiatives in different countries, the need for fracturing fluid controlling systems was increased during the historical era.

To achieve better hydraulic fracturing efficiency, hydrofracking manifolds were demanded more, driving the growth of the frac manifold market during the period.

| Attributes | Values |

|---|---|

| Historical CAGR | 7.1% |

| Valuation in 2020 | USD 4.17 billion |

| Valuation in 2025 | USD 5.47 billion |

The forecasted period is concerned with the growing energy demands due to the rising population and urbanization rate. These factors result in the increasing energy source exploration demands on a wider landscape, inflating the demand of the frac manifold market.

Key players in the frac manifold industry can get better opportunities in developing countries. The Asia-Pacific region provides a wide landscape to them, raising the demand for the frac manifold market in the area.

Innovation and technological advancements in the frac manifold in North America can integrate cutting-edge solutions to traditional fluid flow-controlling systems. As a result, it is another key contributor to the industry.

The rising governmental efforts for sustainable production create prospects for the growth of the frac manifold market.

China focuses on exploring different local energy resources to cater to the rising energy demands of the population. This can be achieved with the help of shale gas.

The government has been encouraging key players in the frac manifold industry by investing heavily to achieve the goal. With the growing government’s attention to the sector, the investment opportunities in the industries will likely spur.

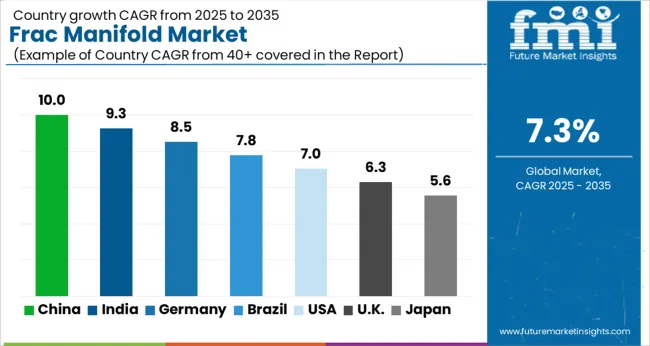

Thus, demand for the frac manifold market in China will likely be pushed at a moderate CAGR of 5.9% from 2025 to 2035.

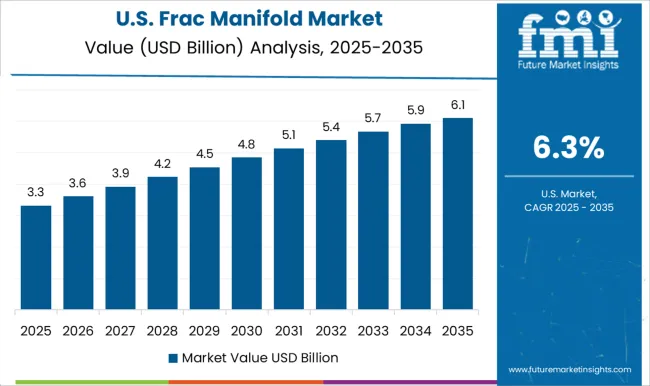

The United States of America projects the growth of the frac manifold market to occur at a moderate advancement rate of 6.3% during the forecasted period.

The growing technological infrastructure leverages local players to explore many fracking techniques, including horizontal drilling, multi-stage fracking, etc. This will likely spur the demand for cutting-edge systems, uplifting the popularity of these segments.

Innovations will also spike the efficiency of these systems. This will enhance the popularity of the industry, driving the sector.

Demand for the frac manifold market in Japan will likely inflate at a moderate CAGR of 6.5%.

Japan invests heavily in utilizing local alternative energy resources. Due to this, the diversification in the competitive landscape increases, creating demand for fracking solutions.

The country will likely invest to promote overseas energy procurement projects. This will generate more demand in the local market, elevating the industry's size.

The United Kingdom’s new policy reforms emphasize reducing oil imports and fueling local businesses. This government initiative will likely spur the demand for fracking solutions in the local landscape.

Various government offerings, including subsidies, incentives, and tax relaxation on oil extraction, will help key players in the frac manifold industry. This will benefit the ecosystem.

Therefore, the United Kingdom’s growth of the frac manifold market will occur at 6.7% through the forecasted period.

India will likely heavily invest in infrastructural projects. Such projects will spur the demand for frac manifolds due to their ability to inject fracturing solutions.

The government and key players have been investing largely in the development of the oil and gas industry. This spurs the demand for fracking equipment and solutions, creating several industrial opportunities for key players.

These factors will inflate the demand of the frac manifold market at a CAGR of 7.7% through 2035.

With the elevated safety standards and better operational efficiency, horizontal frac manifold systems gain traction in different sectors. However, the growing demand for oil and gas in day-to-day life governs the popularity of the segment in the industry.

| Category | By Integration- Horizontal |

|---|---|

| Industry Share in 2025 | 52.3% |

| Segment Drivers | With the elevated efficiency and cost-effectiveness of the process, the segment gains popularity in the industry., Horizontal integration provides better alignment with environmental safety standards, driving the segment., Better operator safety enhances operational security, driving its demand and inflating the demand of the frac manifold market. |

| Category | By Industry- Oil & Gas |

|---|---|

| Industry Share in 2025 | 31.4% |

| Segment Drivers | With the extreme volatility of fracturing fluids in the sector, a safe operation is required. This can be provided by fracking equipment., The uniform distribution and less downtime of fracking manifold enhance their popularity., These factors fuel the demand in the oil and gas industry, elevating the demand of the frac manifold market. |

With the growing opportunities in developing countries, key players in the frac manifold industry can expand internationally, which can enhance their presence in foreign landscapes.

They also use different key strategies, including collaborations, acquisitions, partnerships, and mergers, to gain better strategic positions in the industry.

New entrants need more negotiating power against large-scale organizations, affecting their market share. However, innovation can uplift their functioning. It will provide them with a decent competitive edge.

Key Recent Developments

| Attributes | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 5.87 billion |

| Projected Industry Valuation in 2035 | USD 11.99 billion |

| Value-based CAGR 2025 to 2035 | 7.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Analysis in | Value in USD billion |

| Key Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Segments Covered |

Integration Type, Material, Outlet, Industry, Region |

| Key Countries Profiled |

The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled |

SLB; Jereh Group; Landrill Oil Tools Co. Ltd.; NOV (National Oilwell Varco); Weatherford International; FMC Technologies; Yancheng Qihang Petroleum Machinery Co. Ltd.; Neeco Industries; Worldwide Oilfield Machine (WOM); Halliburton; GOES GmbH; Dixon |

Based on integration type, the industry is classified as Horizontal Frac Manifolds and Vertical Frac Manifolds.

Carbon Steel, Stainless Steel, and Other Alloys are key materials used in the sector.

The ecosystem is segmented into single-outlet and multiple-outlet systems.

Oil & Gas Industry, Shale Gas Industry, Coal Seam Gas Industry, and Other Energy Industries are key industrial segments of the landscape.

The frac mani:fold industry analysis has been carried in key countries across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and the Middle East and Africa

The global frac manifold market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the frac manifold market is projected to reach USD 12.9 billion by 2035.

The frac manifold market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in frac manifold market are horizontal frac manifolds and vertical frac manifolds.

In terms of material, carbon steel segment to command 57.8% share in the frac manifold market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fracking Fluids And Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Fractionated Fatty Acid Market Size, Growth, and Forecast for 2025 to 2035

Fractionated Lecithin Market Growth - Source & Industry Trends

Refractor Type Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Refractor Type Optical Telephoto Lens Market Size and Share Forecast Outlook 2025 to 2035

Refractories Market Size and Share Forecast Outlook 2025 to 2035

Refractory Cement Market Growth – Trends & Forecast 2024-2034

Refractive Surgery Device Market Insights – Growth & Forecast 2024-2034

Refractometers Market Growth – Trends & Forecast 2018-2027

Rib Fracture Repair Systems Market Size and Share Forecast Outlook 2025 to 2035

Abbe Refractometers Market Size and Share Forecast Outlook 2025 to 2035

Palm Mid-Fraction Market Size, Growth, and Forecast for 2025 to 2035

Milk Fat Fractions Market

Hydraulic Fracturing Market Size and Share Forecast Outlook 2025 to 2035

Chronic Refractory Cough Treatment Market – Growth & Innovations 2025 to 2035

Clinical Refractometer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fractional Horsepower Motors Market Analysis by End-user and Region: Forecast for 2025 to 2035

Butylene-divinyl Fraction Market Growth – Trends & Forecast 2024-2034

Anti-Osteoporosis Fracture Healing Market Trends – Size & Forecast 2025-2035

Examining Market Share Trends in Anti-Osteoporosis Fracture Healing

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA