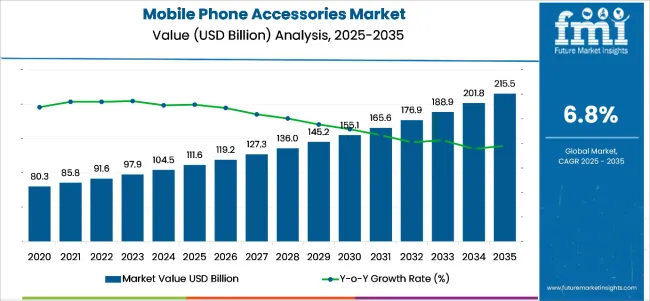

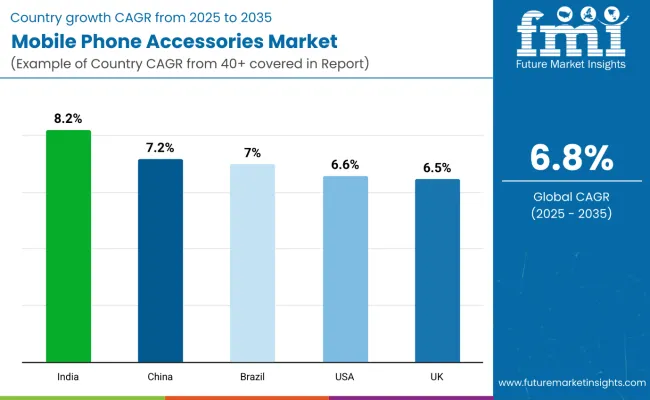

The mobile phone accessories market is poised to grow significantly over the forecast period, projected to rise from USD 111.6 billion in 2025 to USD 215.5 billion by 2035, reflecting a CAGR of 6.8%. Among the countries, the United States will remain the most valuable market in 2025, driven by strong consumer spending and ecosystem integration. However, India is expected to be the fastest-growing market, expanding at a CAGR of 8.2% as smartphone adoption deepens across Tier-2 and Tier-3 cities. China and Brazil are also emerging as high-potential markets, fueled by localized manufacturing and digital commerce expansion. Rising disposable incomes and tech-savvy younger populations in emerging economies are expected to further accelerate accessory adoption.

The growth trajectory is shaped by several converging trends. Rising smartphone penetration is creating consistent demand for supporting accessories such as chargers, earphones, and cases. The surge in wireless charging adoption and digital content consumption is driving product innovation. At the same time, increasing awareness about environmental sustainability is prompting consumers to shift toward recyclable, traceable, and RoHS-compliant accessories. Manufacturers are responding with eco-friendly product lines and packaging aligned with global circular economy goals. However, regulatory developments, such as USB-C standardization mandates and price competition from Asian imports, may challenge profitability in certain segments, especially in wireless audio.

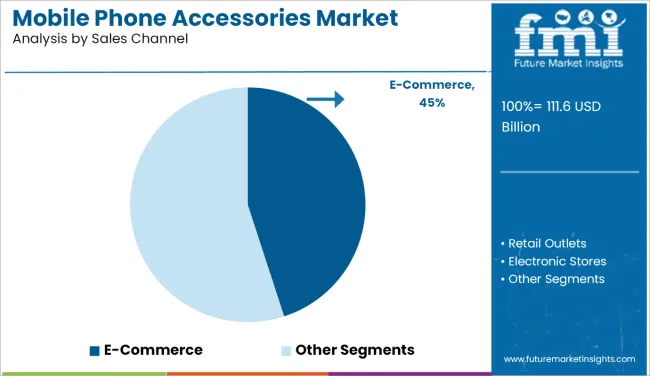

Looking ahead to 2035, the market is expected to undergo a tech-enabled transformation. High-growth sub-segments will include wireless chargers, GaN-powered fast adapters, and MagSafe-compatible accessories, supported by miniaturization and efficiency gains. E-commerce will account for nearly 45% of distribution, benefiting from last-mile logistics and growing consumer trust in digital platforms. Meanwhile, emerging economies such as India, Brazil, and China will become key battlegrounds for market share, driven by volume and scale. Future innovation will focus on ergonomics, traceability, and AI-integration, catering to an increasingly diverse and tech-savvy user base seeking utility, personalization, and sustainability in every purchase.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 111.6 billion |

| Projected Value (2035F) | USD 215.5 billion |

| Value-based CAGR (2025 to 2035) | 6.8% |

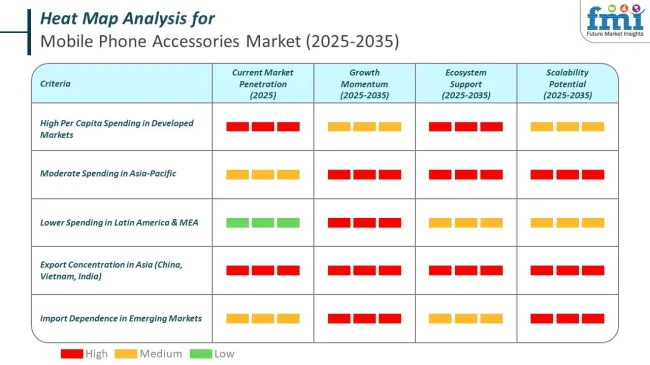

Per capita spending on mobile phone accessories varies significantly across regions due to income levels, purchasing habits, and market maturity. Developed economies record higher individual expenditure, driven by the demand for premium accessories and early adoption of innovative products. In contrast, emerging markets exhibit strong overall sales volumes but lower per-person spending because of affordability considerations.

The mobile phone accessories market is shaped by strong international trade flows, with manufacturing hubs in Asia dominating global exports and diverse markets driving import demand. Export activity is concentrated in countries with established electronics production ecosystems, while imports are driven by rising smartphone penetration and consumer preference for branded and premium accessories. This dynamic global trade network underscores the importance of strategic sourcing and market-specific supply chain planning for industry players.

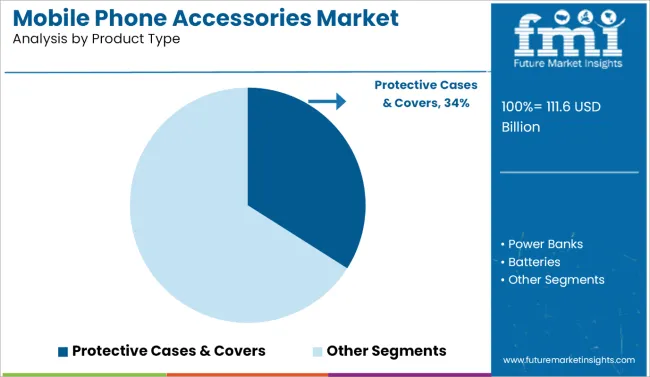

The mobile phone accessories market encompasses a broad range of categories, reflecting the evolving needs of global smartphone users. By product type, the market includes power banks, batteries, wireless chargers, protective cases & covers, headsets, portable speakers, and others a segment that consists of screen protectors, stylus pens, car mounts, selfie sticks, cooling fans, phone stands, and other miscellaneous mobile peripherals.

By sales channel, distribution occurs through retail outlets, electronic stores, franchise outlets, exclusive stores, e-commerce, and other sales channels, which include vending machines, kiosks, and pop-up stalls. Geographically, the market spans North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA) regions, each demonstrating unique consumer dynamics and regulatory frameworks.

The protective cases & covers segment accounts for 34% share. There is high demand for protective mobile cases and covers because consumers want to safeguard their smartphones from damage such as drops, scratches, and everyday wear and tear. As smartphones become more expensive and feature-rich, users are more motivated to protect their investment.

Cases and covers offer a simple, affordable way to extend the life of devices while also allowing for personalization through various colors, materials, and designs. Additionally, the wide variety of styles, from rugged shockproof cases to sleek and stylish covers, appeals to different preferences and lifestyles, driving consistent demand across all age groups and user segments.

| Product Type Segment | Share (2025) |

|---|---|

| Protective Cases & Covers | 34% |

The mobile phone accessories market is undergoing a digital commerce transformation, with e-commerce platforms emerging as the fastest-growing channel between 2025 and 2035. E-commerce is projected to contribute approximately 45% of total distribution share by 2035, growing at a CAGR of 8.5%. This acceleration is attributed to heightened consumer preference for online convenience, broader product assortment, and increased digital payments adoption. While exclusive stores maintain strong brand control and appeal to premium consumers, their growth is moderate due to high operational costs.

Electronic stores continue to perform steadily in urban centers, yet lack the reach of digital channels. Retail outlets and franchise stores face declining footfall, particularly in post-pandemic retail climates. Other sales channels, including kiosks and vending models, show marginal growth due to limited scalability. E-commerce, in contrast, leverages omni-channel logistics, real-time pricing, and last-mile delivery, enabling brands to scale faster with minimal overhead.

| Sales Channel Segment | Market Share |

|---|---|

| E-Commerce | 45% |

The US mobile phone accessories market is the world’s most valuable national hub for mobile phone accessories, valued at USD 22.5 billion in 2025 and projected to expand to USD 42.58 billion by 2035 at a 6.6% CAGR. Three key factors are likely to shape this trajectory. First, device penetration remains among the highest globally, with over 90% of adults owning smartphones. Refresh cycles are shortening due to the rollouts of 5G and AI chips, which are boosting recurring accessory demand.

Second, the rise of Gen Z digital consumption has created sustained demand across audio (TWS headsets), protective (shock-absorbing cases), and power (GaN chargers and power banks) categories. Regulatory clarity is also creating opportunities; right-to-repair laws in California and New York have accelerated aftermarket battery and screen kit sales via authorized accessory brands, insulating the segment from gray-market volatility.

Third, the USA distribution advantage is unmatched Amazon, Best Buy, and Target maintain integrated omni-channel frameworks with warehousing that supports 24-hour fulfillment, allowing premium accessory brands to push high-margin SKUs with minimal friction. Profit pools remain intact, with operating margins averaging 18-20% due to strong retail pricing power and efficient domestic logistics. Downside risks include potential FCC action on USB-C standardization enforcement and price compression in wireless audio due to Asian imports, but these risks are unlikely to weaken the trajectory materially.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.6% |

China represents the fastest-growing value engine in the mobile phone accessories ecosystem, expanding from USD 21.20 billion in 2025 to USD 42.28 billion by 2035 at a 7.2% compound annual growth rate (CAGR). Three macrostructural factors anchor growth. First, China’s vast domestic smartphone installed base, projected to exceed 1.2 billion active devices by 2026, continues to catalyze surging demand for protective gear, charging kits, and audio peripherals.

Second, China's accessory manufacturing footprint spans Shenzhen to Chongqing, with national champions like Anker and Baseus integrating vertically across design, assembly, and export. This enables cost advantages of 10-15% over global peers. Third, the 2024 rollout of China’s Green Supply Chain Initiative has pressured domestic brands to convert packaging and device components into recyclable or biodegradable formats, bolstering demand for sustainable accessories.

Local e-commerce platforms Taobao, JD.com, and Pinduoduo anchor omnichannel distribution, enabling wide access to both luxury and mass-market SKUs. While IP violations and counterfeit volumes remain a reputational drag, aggressive patent enforcement and QR-based authentication apps are mitigating downstream friction. As AI-integrated accessories and modular charging systems gain traction, China’s value pool will likely outperform global average margins.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.2% |

Germany holds Europe’s most sophisticated mobile accessory consumer base, with 2025 value estimated at USD 8.10 billion, forecasted to reach USD 14.74 billion by 2035 at a 6.2% CAGR. Three drivers define the German growth arc. First, accessory usage is shaped by sustainability-led consumption habits, consumer preference skews heavily toward biodegradable phone cases, RoHS-certified chargers, and Bluetooth peripherals with low energy profiles. Second, the country’s strong network of CE retailers, including MediaMarkt, Saturn, and Cyberport, offers deep product penetration and bundled device-accessory deals, stimulating category volume.

Third, EU regulatory harmonization on USB-C (from 2024) and energy labeling (by 2026) has cleared uncertainty from the channel, accelerating compliance-aligned sales. Germany’s domestic brands, such as Gigaset, are actively co-branding with accessory firms to promote Made-in-EU alternatives to Chinese imports. Digital authentication systems for warranty claims have also improved post-purchase stickiness. Barriers remain: retail price inflation and VAT hikes may suppress impulse accessory buying in 2027-2028, but underlying value levers remain strong.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.2% |

Japan’s mobile phone accessories segment is projected to expand from USD 8.60 billion in 2025 to USD 15.40 billion in 2035 at a 6.0% CAGR. Consumer behavior in Japan favors high-performance, compact accessories, particularly ultra-slim power banks, wireless earbuds with active noise cancellation (ANC), and fingerprint-secured phone cases. Japan’s elderly population has fueled niche accessory segments, such as tactile-friendly cases, large-button headsets, and ergonomic chargers. Retail chains like Yodobashi and BIC Camera dominate offline distribution, while Rakuten and Amazon JP drive online premium segment access.

Regulatory preference for high safety and recycling standards (JEITA guidelines) has forced global brands to localize packaging and limit lithium-based waste. Innovation remains central: Japanese firms like Elecom and Anker Japan have accelerated domestic production of MagSafe-compatible devices and waterproof audio solutions. However, high product expectations coupled with stagnant population growth may temper absolute volume growth. Nevertheless, margins remain resilient due to high unit ASPs and tech-first buyer behavior.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

India is poised to become the second-largest growth contributor globally, with market value rising from USD 11.00 billion in 2025 to USD 24.17 billion by 2035 at an 8.2% CAGR. This trajectory is driven by the expansion of mobile internet access, rapid smartphone penetration in Tier-2 and Tier-3 cities, and the rise of aspirational buying. Accessories such as fast chargers, rugged cases, and low-cost Bluetooth earphones remain primary drivers, often bundled with new handsets.

Government production-linked incentive (PLI) schemes for electronics are boosting domestic accessory manufacturing, reducing dependence on imports. Leading local platforms Flipkart, Amazon India, and Reliance Digital are expanding exclusive tie-ups with OEM-certified accessory brands. Regulatory pressure from BIS (Bureau of Indian Standards) and EPR obligations is forcing brands to upgrade safety and recyclability standards. While grey market activity persists in urban hubs, national e-invoicing policies are shrinking the informal sector. Margin compression is a challenge in the low-ASP range, but scale economics from BharatNet expansion and OEM bundling offset risks.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.2% |

The UK mobile phone accessories market is estimated to be worth USD 7.10 billion in 2025 and is projected to reach USD 13.32 billion by 2035, growing at a 6.5% CAGR. Three critical dynamics power this growth. First, a rising preference for minimalist, high-quality accessories, such as MagSafe cases, multi-port travel adapters, and foldable wireless chargers, has reshaped product portfolios across retail channels. Second, omnichannel integration has been optimized post-Brexit, with brands relying on D2C portals to avoid customs delays, enabling stable margins.

Third, the 2024 enactment of the UK Right-to-Repair regulation has led to increased sales of DIY kits and extended-life batteries. Consumer protection laws now mandate warranty-backed accessories, which raises the average unit value. Although post-Brexit cost pressures persist on imported accessories, domestic innovation, especially in sustainable materials and modular charging, is compensating. Tesco Mobile and Carphone Warehouse have maintained leading market shares through in-store bundles and EMI schemes, supporting volume growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

France is expected to scale from USD 6.10 billion in 2025 to USD 10.79 billion by 2035 at a 5.9%, fueled by strong regulatory frameworks and consumer sustainability consciousness. Three key dynamics support growth. First, France’s 2023 Circular Economy Law mandates recyclability in electronics and packaging, prompting top accessory manufacturers to replace PVC and lithium-heavy components with compostable and RoHS-compliant alternatives.

Second, consumer behaviorfavors compact, multifunctional accessories, including foldable Bluetooth speakers, hybrid charging pads, and biometric-secured cases, which command high ASPs across Carrefour, Fnac-Darty, and Boulanger channels. Third, rising mobile gaming and content creation among younger demographics has elevated demand for precision audio peripherals and heat-resistant protective gear.

Paris-based design startups are partnering with EU-certified original equipment manufacturers (OEMs) to bring localized, aesthetically forward-looking accessories to market. Risks include high VAT and declining margins in mid-tier SKUs, but value growth is underwritten by regulatory compliance premiums and stable replacement cycles averaging 18-20 months.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 5.9% |

Italy’s mobile phone accessories market is projected to grow from USD 5.11 billion in 2025 to USD 8.74 billion by 2035 at a 5.5% CAGR, driven by demand from both urban and regional tiers. Key growth factors include high smartphone penetration (over 85%) and robust brick-and-mortar retail ecosystems that support bundled handset-accessory deals.

Accessory demand remains strong in charging (USB-C, multi-socket plugs) and protective segments (anti-shock covers), driven by widespread use of premium handsets in Tier 1 cities like Milan, Rome, and Turin. The convergence of Italian fashion and technology has given rise to niche, high-margin categories, such as leather-wrapped wireless earbuds and customizable case skins.

Regulatory alignment with EU norms supports sustainability-focused innovation, with tax credits incentivizing the production of accessories made from recycled materials. E-commerce remains under-leveraged (only 18-20% penetration), offering a long-term opportunity. However, regional disparities in disposable income and tech infrastructure may slow uniform adoption across the south-central belt.

| Country | CAGR (2025 to 2035) |

|---|---|

| Italy | 5.5% |

South Korea's market is expected to grow from USD 6.30 billion in 2025 to USD 11.43 billion by 2035, at a 6.1% compound annual growth rate (CAGR), driven by rapid technology convergence and strong device upgrade cycles. South Korea ranks among the global top three for smartphone replacement rates (18-22 months), which directly fuels recurring demand for wireless earbuds, cases, and charging units.

Innovation is embedded: Samsung and LG ecosystem accessories dominate the premium tier, supported by robust 5G, IoT, and AI integration. Korean consumers prioritize form factor, low latency, and battery efficiency, making GaN chargers, clip-on fans, and bone-conduction headsets popular. Online-first behavior (71% accessory purchases via mobile apps) is sustained by fast delivery networks and high trust in domestic brands.

Regulatory mandates introduced in 2024 requiring full recyclability and labeling have nudged manufacturers to design eco-certified accessory lines. While market saturation poses limits on volumetric growth, ASP increases and margin strength keep the segment highly attractive.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

Brazil’s mobile phone accessories market is forecast to expand from USD 5.50 billion in 2025 to USD 10.83 billion by 2035 at a 7.0% CAGR, shaped by mass digitalization, urban retail growth, and mid-market handset adoption. As over 80% of Brazilians now access mobile internet, demand has surged for durable power banks, budget wireless headsets, and basic protective cases.

Regulatory enforcement on product safety (ANATEL certification) has improved over the past two years, helping remove counterfeit and substandard imports from marketplaces. National brands and resellers are leveraging the government's digital inclusion programs to bundle accessories with subsidized phones in rural zones.

E-commerce’s acceleration led by Mercado Livre and Americanas has enabled wider penetration of premium products. High import duties on tech goods have sparked growth in domestic accessory assembly, enhancing margins. Risk areas include FX volatility and VAT inconsistencies across federal states, but structural demand remains firm due to Brazil’s mobile-first population and content-driven app usage.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 7.0% |

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 111.6 billion |

| Projected Market Size (2035) | USD 215.5 billion |

| CAGR (2025 to 2035) | 6.80% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion |

| By Product Type | Power Banks, Batteries, Wireless Chargers, Protective Cases & Covers, Headsets and Portable Speakers |

| By Sales Channel | Retail Outlets, Electronic Stores, Franchise Outlets, Exclusive Stores, E-Commerce, Other Sales Channels |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA) |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Samsung Electronics, Logitech, Harman International, Plantronics, Sony, Apple, Skullcandy , GN Group, Incipio Group, Western Digital, and O ther R egional and N iche M anufacturers. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis. |

The industry is poised to reach USD 111.6 billion in 2025.

The industry is slated to register USD 215.5 billion by 2035.

Wireless chargers hold the largest share, driven by rapid adoption of wireless charging-enabled devices.

Asia-Pacific, with strong demand from China and India, is expected to grow fastest at a CAGR of 8.2%.

Key companies include Samsung Electronics Co., Ltd., Apple Inc., Sony Corporation, Logitech International S.A., Harman International Industries, GN Group, Skullcandy Inc., Plantronics, Inc., Incipio Group, and Western Digital Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Packaging Type, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Packaging Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Sales Category, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Sales Category, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 10: Global Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 12: Global Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by Packaging Type, 2019 to 2034

Table 18: North America Market Volume (Units) Forecast by Packaging Type, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Sales Category, 2019 to 2034

Table 20: North America Market Volume (Units) Forecast by Sales Category, 2019 to 2034

Table 21: North America Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 22: North America Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 24: North America Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Packaging Type, 2019 to 2034

Table 30: Latin America Market Volume (Units) Forecast by Packaging Type, 2019 to 2034

Table 31: Latin America Market Value (US$ Million) Forecast by Sales Category, 2019 to 2034

Table 32: Latin America Market Volume (Units) Forecast by Sales Category, 2019 to 2034

Table 33: Latin America Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 34: Latin America Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 36: Latin America Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: Western Europe Market Value (US$ Million) Forecast by Packaging Type, 2019 to 2034

Table 42: Western Europe Market Volume (Units) Forecast by Packaging Type, 2019 to 2034

Table 43: Western Europe Market Value (US$ Million) Forecast by Sales Category, 2019 to 2034

Table 44: Western Europe Market Volume (Units) Forecast by Sales Category, 2019 to 2034

Table 45: Western Europe Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 46: Western Europe Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 47: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 48: Western Europe Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 52: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Packaging Type, 2019 to 2034

Table 54: Eastern Europe Market Volume (Units) Forecast by Packaging Type, 2019 to 2034

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Sales Category, 2019 to 2034

Table 56: Eastern Europe Market Volume (Units) Forecast by Sales Category, 2019 to 2034

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 58: Eastern Europe Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 60: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 64: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Packaging Type, 2019 to 2034

Table 66: South Asia and Pacific Market Volume (Units) Forecast by Packaging Type, 2019 to 2034

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Category, 2019 to 2034

Table 68: South Asia and Pacific Market Volume (Units) Forecast by Sales Category, 2019 to 2034

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 70: South Asia and Pacific Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 72: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 74: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 75: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 76: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 77: East Asia Market Value (US$ Million) Forecast by Packaging Type, 2019 to 2034

Table 78: East Asia Market Volume (Units) Forecast by Packaging Type, 2019 to 2034

Table 79: East Asia Market Value (US$ Million) Forecast by Sales Category, 2019 to 2034

Table 80: East Asia Market Volume (Units) Forecast by Sales Category, 2019 to 2034

Table 81: East Asia Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 82: East Asia Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 83: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 84: East Asia Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 86: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 88: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Packaging Type, 2019 to 2034

Table 90: Middle East and Africa Market Volume (Units) Forecast by Packaging Type, 2019 to 2034

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Sales Category, 2019 to 2034

Table 92: Middle East and Africa Market Volume (Units) Forecast by Sales Category, 2019 to 2034

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2019 to 2034

Table 94: Middle East and Africa Market Volume (Units) Forecast by Price Range, 2019 to 2034

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 96: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Packaging Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Sales Category, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 6: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 8: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 12: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Packaging Type, 2019 to 2034

Figure 16: Global Market Volume (Units) Analysis by Packaging Type, 2019 to 2034

Figure 17: Global Market Value Share (%) and BPS Analysis by Packaging Type, 2024 to 2034

Figure 18: Global Market Y-o-Y Growth (%) Projections by Packaging Type, 2024 to 2034

Figure 19: Global Market Value (US$ Million) Analysis by Sales Category, 2019 to 2034

Figure 20: Global Market Volume (Units) Analysis by Sales Category, 2019 to 2034

Figure 21: Global Market Value Share (%) and BPS Analysis by Sales Category, 2024 to 2034

Figure 22: Global Market Y-o-Y Growth (%) Projections by Sales Category, 2024 to 2034

Figure 23: Global Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 24: Global Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 25: Global Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 26: Global Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 28: Global Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 31: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 32: Global Market Attractiveness by Packaging Type, 2024 to 2034

Figure 33: Global Market Attractiveness by Sales Category, 2024 to 2034

Figure 34: Global Market Attractiveness by Price Range, 2024 to 2034

Figure 35: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 36: Global Market Attractiveness by Region, 2024 to 2034

Figure 37: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: North America Market Value (US$ Million) by Packaging Type, 2024 to 2034

Figure 39: North America Market Value (US$ Million) by Sales Category, 2024 to 2034

Figure 40: North America Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 42: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 44: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 48: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 51: North America Market Value (US$ Million) Analysis by Packaging Type, 2019 to 2034

Figure 52: North America Market Volume (Units) Analysis by Packaging Type, 2019 to 2034

Figure 53: North America Market Value Share (%) and BPS Analysis by Packaging Type, 2024 to 2034

Figure 54: North America Market Y-o-Y Growth (%) Projections by Packaging Type, 2024 to 2034

Figure 55: North America Market Value (US$ Million) Analysis by Sales Category, 2019 to 2034

Figure 56: North America Market Volume (Units) Analysis by Sales Category, 2019 to 2034

Figure 57: North America Market Value Share (%) and BPS Analysis by Sales Category, 2024 to 2034

Figure 58: North America Market Y-o-Y Growth (%) Projections by Sales Category, 2024 to 2034

Figure 59: North America Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 60: North America Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 61: North America Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 62: North America Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 64: North America Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 67: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 68: North America Market Attractiveness by Packaging Type, 2024 to 2034

Figure 69: North America Market Attractiveness by Sales Category, 2024 to 2034

Figure 70: North America Market Attractiveness by Price Range, 2024 to 2034

Figure 71: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 72: North America Market Attractiveness by Country, 2024 to 2034

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) by Packaging Type, 2024 to 2034

Figure 75: Latin America Market Value (US$ Million) by Sales Category, 2024 to 2034

Figure 76: Latin America Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 84: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 87: Latin America Market Value (US$ Million) Analysis by Packaging Type, 2019 to 2034

Figure 88: Latin America Market Volume (Units) Analysis by Packaging Type, 2019 to 2034

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Packaging Type, 2024 to 2034

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Packaging Type, 2024 to 2034

Figure 91: Latin America Market Value (US$ Million) Analysis by Sales Category, 2019 to 2034

Figure 92: Latin America Market Volume (Units) Analysis by Sales Category, 2019 to 2034

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Sales Category, 2024 to 2034

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Sales Category, 2024 to 2034

Figure 95: Latin America Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 96: Latin America Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 100: Latin America Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 103: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 104: Latin America Market Attractiveness by Packaging Type, 2024 to 2034

Figure 105: Latin America Market Attractiveness by Sales Category, 2024 to 2034

Figure 106: Latin America Market Attractiveness by Price Range, 2024 to 2034

Figure 107: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 108: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 109: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: Western Europe Market Value (US$ Million) by Packaging Type, 2024 to 2034

Figure 111: Western Europe Market Value (US$ Million) by Sales Category, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 113: Western Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 114: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 119: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 120: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 123: Western Europe Market Value (US$ Million) Analysis by Packaging Type, 2019 to 2034

Figure 124: Western Europe Market Volume (Units) Analysis by Packaging Type, 2019 to 2034

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2024 to 2034

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2024 to 2034

Figure 127: Western Europe Market Value (US$ Million) Analysis by Sales Category, 2019 to 2034

Figure 128: Western Europe Market Volume (Units) Analysis by Sales Category, 2019 to 2034

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Sales Category, 2024 to 2034

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Sales Category, 2024 to 2034

Figure 131: Western Europe Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 132: Western Europe Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 135: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 136: Western Europe Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 139: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 140: Western Europe Market Attractiveness by Packaging Type, 2024 to 2034

Figure 141: Western Europe Market Attractiveness by Sales Category, 2024 to 2034

Figure 142: Western Europe Market Attractiveness by Price Range, 2024 to 2034

Figure 143: Western Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 144: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 145: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 146: Eastern Europe Market Value (US$ Million) by Packaging Type, 2024 to 2034

Figure 147: Eastern Europe Market Value (US$ Million) by Sales Category, 2024 to 2034

Figure 148: Eastern Europe Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 149: Eastern Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 156: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Packaging Type, 2019 to 2034

Figure 160: Eastern Europe Market Volume (Units) Analysis by Packaging Type, 2019 to 2034

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2024 to 2034

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2024 to 2034

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Sales Category, 2019 to 2034

Figure 164: Eastern Europe Market Volume (Units) Analysis by Sales Category, 2019 to 2034

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Category, 2024 to 2034

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Category, 2024 to 2034

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 168: Eastern Europe Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 172: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 175: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 176: Eastern Europe Market Attractiveness by Packaging Type, 2024 to 2034

Figure 177: Eastern Europe Market Attractiveness by Sales Category, 2024 to 2034

Figure 178: Eastern Europe Market Attractiveness by Price Range, 2024 to 2034

Figure 179: Eastern Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 180: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 181: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 182: South Asia and Pacific Market Value (US$ Million) by Packaging Type, 2024 to 2034

Figure 183: South Asia and Pacific Market Value (US$ Million) by Sales Category, 2024 to 2034

Figure 184: South Asia and Pacific Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 185: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 188: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 192: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Packaging Type, 2019 to 2034

Figure 196: South Asia and Pacific Market Volume (Units) Analysis by Packaging Type, 2019 to 2034

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Packaging Type, 2024 to 2034

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Packaging Type, 2024 to 2034

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Category, 2019 to 2034

Figure 200: South Asia and Pacific Market Volume (Units) Analysis by Sales Category, 2019 to 2034

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Category, 2024 to 2034

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Category, 2024 to 2034

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 204: South Asia and Pacific Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 208: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 211: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 212: South Asia and Pacific Market Attractiveness by Packaging Type, 2024 to 2034

Figure 213: South Asia and Pacific Market Attractiveness by Sales Category, 2024 to 2034

Figure 214: South Asia and Pacific Market Attractiveness by Price Range, 2024 to 2034

Figure 215: South Asia and Pacific Market Attractiveness by Sales Channel, 2024 to 2034

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 217: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 218: East Asia Market Value (US$ Million) by Packaging Type, 2024 to 2034

Figure 219: East Asia Market Value (US$ Million) by Sales Category, 2024 to 2034

Figure 220: East Asia Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 221: East Asia Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 222: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 224: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 227: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 228: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 231: East Asia Market Value (US$ Million) Analysis by Packaging Type, 2019 to 2034

Figure 232: East Asia Market Volume (Units) Analysis by Packaging Type, 2019 to 2034

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Packaging Type, 2024 to 2034

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Packaging Type, 2024 to 2034

Figure 235: East Asia Market Value (US$ Million) Analysis by Sales Category, 2019 to 2034

Figure 236: East Asia Market Volume (Units) Analysis by Sales Category, 2019 to 2034

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Sales Category, 2024 to 2034

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Sales Category, 2024 to 2034

Figure 239: East Asia Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 240: East Asia Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 243: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 244: East Asia Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 247: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 248: East Asia Market Attractiveness by Packaging Type, 2024 to 2034

Figure 249: East Asia Market Attractiveness by Sales Category, 2024 to 2034

Figure 250: East Asia Market Attractiveness by Price Range, 2024 to 2034

Figure 251: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 252: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 253: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 254: Middle East and Africa Market Value (US$ Million) by Packaging Type, 2024 to 2034

Figure 255: Middle East and Africa Market Value (US$ Million) by Sales Category, 2024 to 2034

Figure 256: Middle East and Africa Market Value (US$ Million) by Price Range, 2024 to 2034

Figure 257: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 260: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 264: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Packaging Type, 2019 to 2034

Figure 268: Middle East and Africa Market Volume (Units) Analysis by Packaging Type, 2019 to 2034

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging Type, 2024 to 2034

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging Type, 2024 to 2034

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Sales Category, 2019 to 2034

Figure 272: Middle East and Africa Market Volume (Units) Analysis by Sales Category, 2019 to 2034

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Category, 2024 to 2034

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Category, 2024 to 2034

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2019 to 2034

Figure 276: Middle East and Africa Market Volume (Units) Analysis by Price Range, 2019 to 2034

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2024 to 2034

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2024 to 2034

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 280: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 283: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 284: Middle East and Africa Market Attractiveness by Packaging Type, 2024 to 2034

Figure 285: Middle East and Africa Market Attractiveness by Sales Category, 2024 to 2034

Figure 286: Middle East and Africa Market Attractiveness by Price Range, 2024 to 2034

Figure 287: Middle East and Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 288: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Phone Accessories Packaging Market from 2024 to 2034

UK Mobile Phone Accessories Market Report – Growth, Innovations & Industry Trends 2025-2035

USA Mobile Phone Accessories Market Report – Growth, Innovations & Industry Trends 2025-2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Cases and Covers Market

Automobile Accessories Market

Japan Mobile Phone Accessory Market Analysis - Size, Share & Trends 2025 to 2035

Korea Mobile Phone Accessory Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Mobile Phone Accessory Market Analysis – Size, Share & Trends 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA