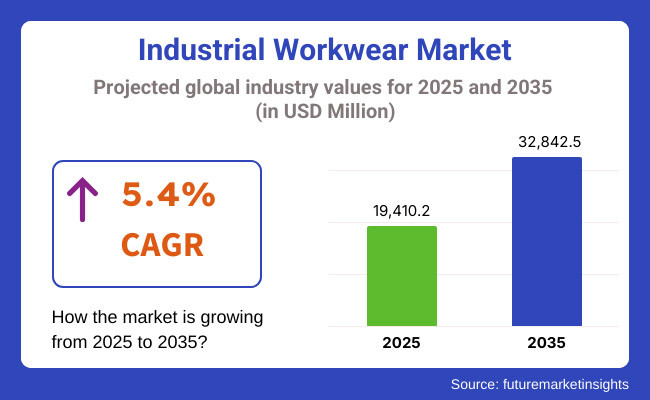

The market is projected to reach USD 19,410.2 Million in 2025 and is expected to grow to USD 32,842.5 Million by 2035, registering a CAGR of 5.4% over the forecast period. The expansion of industrial safety standards, increasing investment in durable and sustainable workwear, and technological advancements in smart fabrics and wearable safety solutions are shaping the industry’s future.

Additionally, rising awareness of occupational hazards and corporate initiatives promoting workplace safety are fueling market expansion.

The market for industrial workwear is set to grow from 2025 to 2035. Tough safety rules at work and strong protective clothes drive this growth. Governments and safety groups like OSHA and EU-OSHA are putting in place strict safety standards.

This forces industries to buy durable and safe workwear. The need for protective clothing, fire-resistant wear, high-visibility gear, and chemical-proof suits is rising in key areas like building, oil & gas, factories, and healthcare where workers face dangers. More accidents and increasing focus on workplace safety help the market grow, with companies putting employee safety first and improving productivity.

New inventions and new stuff are changing work gear. This means lighter, comfy, and useful clothes. Makers use tiny tech, fabrics that wick sweat, and germ-free coats for comfort and staying power. Smart gear with sensors and wearable tech helps check health and sends danger alerts in risky places.

Also, many people want green gear made from reused things, as firms care about Earth. Even though costs are high and supply chains have troubles, the market will grow. This growth will come from busy industries, new tech, and the need for safer work gear soon.

North America will lead the industrial workwear market. Strong rules for worker safety boost growth. Smart protective clothes are more common. Major makers are based here. The USA and Canada are top in the area. OSHA rules help drive this growth. More money is put into safe clothes for oil and gas. Bright workwear sees more use in transportation and building.

Smart wearables with IoT are growing. Workwear with real-time tracking is in demand. Fabrics that stop germs and pull away moisture are getting popular. Light and comfy clothes are also in demand. Government help for safe workplaces adds to growth. Steps for better company sustainability also help the market grow.

Europe has a big part in the industrial workwear market. Countries like Germany, the UK, France, and Italy are leaders. They focus on high-quality work clothes, eco-friendly designs, and strict safety rules. The EU’s rules on PPE and green goals push for recyclable and eco-safe materials.

Flame-proof and chemical-proof clothes are growing in use. More are using anti-static and electric-proof workwear. New fabrics that control temperature are hot trends. More money is going into industrial robots and automation. This rise needs special safety gear for risky tasks, increasing market demand.

The Asia-Pacific area will see the most growth in the industrial workwear market. This is due to fast-growing industries, more building projects, and better awareness of safety at work. Countries like China, India, Japan, and South Korea are leading the use of work clothes in factories, car-making, and energy.

China's large number of workers, safety rules from the government, and need for fire-resistant and chemical-proof clothes in big industries are helping the market grow. India’s booming building sector and more use of standard work clothes in small businesses, along with the need for bright and visible wear, are also driving adoption. Besides, Japan and South Korea are focusing on advanced work clothes with wearable safety and smart fabrics, which boosts the market further in the region.

Challenges

High Costs of Specialized Workwear and Market Fragmentation

The industrial workwear market faces big troubles. Flame-resistant and high-performance gear is costly, making it hard for small and medium businesses to buy. Differences in safety rules add more problems for makers and sellers.

Fake and low-quality safety clothing, especially in markets where price matters most, is another issue for well-known brands.

Opportunities

Smart Workwear, Sustainable Fabrics, and Customizable Industrial Apparel

Though hard times exist, the industrial workwear market offers big chances for growth. Smart workwear with IoT sensors, biometric monitoring, and hazard alerts is making work safer and better.

The rise of eco-friendly work clothes, like recycled polyester, biodegradable materials, and no-chemical, fire-resistant stuff is boosting the need for green work gear. More people want work clothes fit for specific jobs, with safety features and company logos, opening more ways for makers to earn.

The growth of rent and subscription-based work clothes for short-term jobs and contract workers is making these clothes cheaper and easier to get.

From 2020 to 2024, the work clothing industry has seen sustained growth, with improved attention paid to workplace safety regulation, fabric advancement in textiles, and a growing appreciation for protecting workers between 2020 and 2024.

The expansion of construction, manufacturing, oil & gas, and chemical industries obviously led to strong demand for durable protective clothing, flame-resistant (FR) garments and high-visibility work clothes. The use of lighter, wicking and anti-microbial fabrics further enhanced worker safety or welfare.

Between 2025 and 2035, the work clothing market will witness a period of transformational growth. AI-integrated smart clothing, self-healing fabrics for long life, and IoT-linked safety monitoring equipment are expected to appear. The development of wearable exoskeletons to prevent injury at a production line, AI-powered hazard prediction, and environmentally sustainable textiles will redefine worker safety, productivity.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with OSHA, ANSI, and EU-OSHA safety standards for PPE and workwear. |

| Technological Advancements | Growth in FR clothing, antimicrobial textiles, moisture-wicking workwear, and lightweight PPE. |

| Industry Applications | Used in construction, manufacturing, oil & gas, chemicals, and healthcare. |

| Adoption of Smart Equipment | Integration of durable synthetic fabrics, weather-resistant materials, and high-visibility gear. |

| Sustainability & Cost Efficiency | Shift toward eco-friendly fabric blends, low-energy textile production, and waste reduction. |

| Data Analytics & Predictive Modeling | Use of basic hazard risk assessments, manual safety compliance tracking, and limited real-time monitoring. |

| Production & Supply Chain Dynamics | Challenges in supply chain disruptions, fluctuating raw material costs, and high-performance fabric production limitations. |

| Market Growth Drivers | Growth fueled by rising workplace safety awareness, stringent PPE regulations, and innovations in workwear fabrics. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-powered compliance tracking, AI-driven workplace hazard monitoring, and global zero-carbon workwear standards. |

| Technological Advancements | AI-powered smart textiles, self-healing fabrics, wearable exoskeletons, and IoT-enabled safety workwear. |

| Industry Applications | Expanded into AI-integrated workplace safety, predictive health monitoring wearables, and nanotechnology-enhanced industrial PPE. |

| Adoption of Smart Equipment | Smart PPE with biometric sensors, AI-powered predictive safety alerts, and 3D-printed custom-fit workwear. |

| Sustainability & Cost Efficiency | Carbon-neutral textile manufacturing, AI-optimized resource utilization, and circular economy-driven workwear recycling. |

| Data Analytics & Predictive Modeling | AI-enhanced predictive workplace safety, blockchain-backed product authenticity tracking, and smart data-driven PPE optimization. |

| Production & Supply Chain Dynamics | Decentralized manufacturing, AI-driven supply chain automation, and blockchain-verified ethical workwear sourcing. |

| Market Growth Drivers | Future expansion driven by AI-powered worker safety wearables, smart PPE ecosystems, and sustainable textile material advancements. |

The industrial workwear market in the USA is growing steadily. This growth is because of strict safety rules at work, more need for fire-safe and bright clothes, and new smart fabrics. OSHA and ANSI make sure there are strong rules for safety gear in dangerous jobs.

People now use smart wearables with IoT tech for worker safety. There's also more demand for eco-friendly and recycled work clothes. Lighter, airier fabrics are getting popular too. The oil, gas, construction, and manufacturing sectors are growing. This boosts the need for work clothes even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

The industrial workwear market in the UK is growing. There is a bigger focus on keeping workers safe, higher need for clothing that lasts and works well, and more use of designs made for comfort. Groups like the Health and Safety Executive (HSE) and the British Safety Industry Federation (BSIF) set rules for safety clothing and PPE.

Eco-friendly clothing is on the rise. Clothes that fight germs and keep sweat away are wanted more. Renting work clothes is also getting popular. New designs for light and multi-use gear help keep workers safe and comfy.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.1% |

The Industrial Workwear Market in the European Union is growing well. This is due to strict safety rules, new and better protective clothing, and more need for workwear that guards against many risks. The European Agency for Safety and Health at Work (EU-OSHA) and standards like EN 20471, EN 343, and EN 11612 ensure high performance workwear.

Germany, France, and Italy are ahead in using strong, flame-resistant, and chemical-resistant workwear. Also, money is being put into smart workwear with sensors for health checks and tracking. This is changing the industry a lot.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.4% |

The industrial workwear market in Japan is growing. There is more need for safety gear. High-tech, safe clothes are wanted more. New smart fabrics help this market grow too. The JISHA and MHLW set strong rules for work gear.

Companies in Japan spend money on clothes that clean themselves and adjust temperature. They add smart cloth for tracking body signs. Also, very light but strong clothes are made. Automation and robots in factories need special gear, like anti-static and tough clothes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

The industrial workwear market in South Korea is growing fast. More factories, more safety needs in dangerous places, and government steps to make work safe are the reasons. The Ministry of Employment and Labor and Korean Safety and Health Agency (KOSHA) set the rules for work clothes.

People now want flame-resistant and heat-resistant fabrics. There is also more need for clothes that fight bacteria and bad smells. Interest in green and earth-friendly materials is on the rise too. Smart and AI-driven safety gear investments are pushing the market upwards too.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

The market for industrial workwear is growing because of new rules about work safety. Strong clothes that keep workers safe are in high demand. People know more now about how worker comfort and being productive go hand in hand. Shirts and overalls are key products in this market since they help meet safety rules and protect workers from danger.

Top wear for work includes shirts with buttons, tees, sweatshirts, and jackets. These clothes give comfort, air flow, and last long for workers in many fields. The stitches on these clothes are strong, they use fabrics that keep you dry, and some are fire-resistant for safety.

More workers are using these clothes because of the need for the same uniforms for all, the push for company branding, and new better fabrics. New trends in fabrics that resist germs and keep dry, making fabrics that last longer, and light fireproof materials are making workers safer and more comfy.

Though these benefits exist, problems like high prices for good protective clothes, not wanting to change to new uniforms, and needing to get new ones often in risky jobs still occur. Yet, new ideas like special protective coatings, fabrics that clean themselves, and custom uniforms are set to make them stand up better and save money in the long run.

Overalls are very important for industrial work. They give full-body guard from chemicals, heat, sparks, and other dangers. Folks in hard jobs like oil drilling, factories, and chemical plants need them for safety.

More people are using overalls at work because of strict safety rules, money being spent on protective clothes, and more use of bright and fire-proof overalls. New fabrics that are light and breathe well, many layers of protection, and smart cloth with sensors help workers stay comfy, move better, and stay safe with real-time checks.

But there are problems too. Overalls can be uncomfortable in very hot or cold places. The best ones cost a lot at first and can be hard to clean and look after. New ideas like cloth that cools or warms itself, single-use strong overalls, and smart safety gear with AI will help make overalls more common and grow the market.

The need for work clothes in factories is mainly due to specific job needs. Job areas like service and building sites show the most use. This is because they have a lot of workers, strict safety rules, and a focus on keeping workers safe and healthy.

The service world needs special work clothes. Jobs like home services, security, catering, and installation call for tough yet comfy uniforms. It's key for these clothes to be safe and make workers look professional. Clothes with company logos made from strong fabrics help in this.

More service jobs need such uniforms. This demand grows as more service businesses pop up. Uniforms help keep a brand's look the same. Rules may also require safe clothes for risky jobs. New treatments make these clothes last longer and fight stains. Custom designs are a plus too.

Still there are some issues. Small firms can't always afford these clothes. Workers might not like wearing them. High-tech clothes are not used much yet. Yet, cheaper rental plans and smart fitting tools are on the rise. New fabrics that adjust to weather could help a lot. These changes may push more service fields to adopt such uniforms.

The building trade needs safety clothes like flame-resistant jackets, tough pants, and bright vests. These keep workers safe on risky job sites. The clothes protect from scrapes, hits, and weather changes, useful for inside and outside jobs.

More building work means more need for these clothes. Rules demand it, and better designs are being made. Smart gear like PPE (Personal Protective Equipment) with real-time health checks and tough, light materials are helping.

But, there are problems. The price, differing safety rules in different areas, and keeping bright gear clean in bad weather are hard. New fixes like fabrics that fix themselves, sun-powered cool clothes, and smart safety gear should help more workers stay safe.

The need for protective work clothes is growing in many fields such as building, oil and gas, making, and healthcare. As a result, the workwear market is expanding. Rules for safety at work help push this growth. Better fabrics that don't catch fire and those that are easy to see are also helping. People care more about staying safe at work now.

Companies make tough, comfortable clothes for varied weather to boost safety and comfort. These firms include top makers of work clothes and goods for protection at work. Textile development firms also help with new fabrics like those that move sweat, fight germs, and smart clothes for work.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| VF Corporation (Dickies, Red Kap, Timberland PRO) | 18-22% |

| Honeywell International Inc. | 12-16% |

| 3M Company | 10-14% |

| Lakeland Industries, Inc. | 8-12% |

| Ansell Ltd. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| VF Corporation (Dickies, Red Kap, Timberland PRO) | Manufactures flame-resistant, high-visibility, and weatherproof industrial workwear. |

| Honeywell International Inc. | Develops protective clothing, chemical-resistant suits, and high-visibility jackets. |

| 3M Company | Specializes in high-performance protective clothing, reflective safety apparel, and disposable workwear. |

| Lakeland Industries, Inc. | Provides industrial-grade coveralls, fire-resistant gear, and hazardous material protective clothing. |

| Ansell Ltd. | Focuses on chemical-resistant suits, cut-resistant gloves, and medical-grade protective workwear. |

Key Company Insights

VF Corporation (18-22%)

VF Corporation leads the industrial workwear market, offering premium protective apparel under brands like Dickies and Red Kap for manufacturing, construction, and oil & gas industries.

Honeywell International Inc. (12-16%)

Honeywell specializes in multi-layer protective clothing, ensuring compliance with OSHA and NFPA safety standards.

3M Company (10-14%)

3M provides disposable and reusable protective workwear, integrating advanced reflective and lightweight materials for improved worker safety.

Lakeland Industries, Inc. (8-12%)

Lakeland focuses on high-durability industrial coveralls and chemical-resistant suits, catering to hazardous work environments.

Ansell Ltd. (6-10%)

Ansell is known for specialized protective workwear, including chemical-resistant and fire-retardant clothing for industrial applications.

Other Key Players (30-40% Combined)

Several industrial workwear manufacturers, textile technology firms, and PPE suppliers contribute to advancements in durable, ergonomic, and safety-compliant workwear. These include:

The overall market size for the industrial workwear market was USD 19,410.2 Million in 2025.

The industrial workwear market is expected to reach USD 32,842.5 Million in 2035.

Rising workplace safety regulations, increasing adoption of high-performance protective gear, and growing demand from industries such as construction, oil & gas, and manufacturing will drive market growth.

The USA, Germany, China, India, and the UK are key contributors.

Flame-resistant workwear is expected to dominate due to its critical role in protecting workers from fire hazards and electrical risks.

Table 1: Global Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast, By End-Use Industry, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast, By End-Use Industry, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast, By Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast, By Distribution Channel, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast, By Region, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast, By Region, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast, By End-Use Industry, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast, By End-Use Industry, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast, By Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast, By Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast, By End-Use Industry, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast, By End-Use Industry, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast, By Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast, By Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast, By End-Use Industry, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast, By End-Use Industry, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast, By Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast, By Distribution Channel, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 44: East Asia Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast, By End-Use Industry, 2018 to 2033

Table 46: East Asia Market Volume (Units) Forecast, By End-Use Industry, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 48: East Asia Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast, By Distribution Channel, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast, By Distribution Channel, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 52: South Asia Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 54: South Asia Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast, By End-Use Industry, 2018 to 2033

Table 56: South Asia Market Volume (Units) Forecast, By End-Use Industry, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 58: South Asia Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast, By Distribution Channel, 2018 to 2033

Table 60: South Asia Market Volume (Units) Forecast, By Distribution Channel, 2018 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 62: Oceania Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 64: Oceania Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast, By End-Use Industry, 2018 to 2033

Table 66: Oceania Market Volume (Units) Forecast, By End-Use Industry, 2018 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 68: Oceania Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast, By Distribution Channel, 2018 to 2033

Table 70: Oceania Market Volume (Units) Forecast, By Distribution Channel, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 72: MEA Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 73: MEA Market Value (US$ Million) Forecast, By Product Type, 2018 to 2033

Table 74: MEA Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 75: MEA Market Value (US$ Million) Forecast, By End-Use Industry, 2018 to 2033

Table 76: MEA Market Volume (Units) Forecast, By End-Use Industry, 2018 to 2033

Table 77: MEA Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 78: MEA Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 79: MEA Market Value (US$ Million) Forecast, By Distribution Channel, 2018 to 2033

Table 80: MEA Market Volume (Units) Forecast, By Distribution Channel, 2018 to 2033

Figure 01: Global Market Value (US$ Million) and Volume (Units) Analysis, 2018 to 2022

Figure 02: Global Market Value (US$ Million) and Volume (Units) Forecast, 2023 to 2033

Figure 03: Global Market Value (US$ Million) Analysis, 2018 to 2022

Figure 04: Global Market Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Global Market Absolute $ Opportunity Value (US$ Million), 2023 to 2033

Figure 06: Global Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 07: Global Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 08: Global Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: Global Market Attractiveness By Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis By End-Use Industry, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis By End-Use Industry, 2018 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections, By End-Use Industry, 2023 to 2033

Figure 13: Global Market Attractiveness By End-Use Industry, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 17: Global Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis By Region, 2018 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 25: Global Market Attractiveness By Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 28: North America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 29: North America Market Attractiveness By Country, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 33: North America Market Attractiveness By Product Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis By End-Use Industry, 2018 to 2033

Figure 35: North America Market Volume (Units) Analysis By End-Use Industry, 2018 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections, By End-Use Industry, 2023 to 2033

Figure 37: North America Market Attractiveness By End-Use Industry, 2023 to 2033

Figure 38: North America Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 39: North America Market Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 41: North America Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 42: North America Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 43: North America Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 46: Latin America Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 47: Latin America Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 48: Latin America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 49: Latin America Market Attractiveness By Country, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 51: Latin America Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 52: Latin America Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness By Product Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis By End-Use Industry, 2018 to 2033

Figure 55: Latin America Market Volume (Units) Analysis By End-Use Industry, 2018 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections, By End-Use Industry, 2023 to 2033

Figure 57: Latin America Market Attractiveness By End-Use Industry, 2023 to 2033

Figure 58: Latin America Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 59: Latin America Market Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 61: Latin America Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 63: Latin America Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 68: Europe Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 69: Europe Market Attractiveness By Country, 2023 to 2033

Figure 70: Europe Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 71: Europe Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 72: Europe Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 73: Europe Market Attractiveness By Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis By End-Use Industry, 2018 to 2033

Figure 75: Europe Market Volume (Units) Analysis By End-Use Industry, 2018 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections, By End-Use Industry, 2023 to 2033

Figure 77: Europe Market Attractiveness By End-Use Industry, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 79: Europe Market Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 81: Europe Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 82: Europe Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 83: Europe Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 85: Europe Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 86: East Asia Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 87: East Asia Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 88: East Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 89: East Asia Market Attractiveness By Country, 2023 to 2033

Figure 90: East Asia Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 91: East Asia Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 92: East Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 93: East Asia Market Attractiveness By Product Type, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis By End-Use Industry, 2018 to 2033

Figure 95: East Asia Market Volume (Units) Analysis By End-Use Industry, 2018 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections, By End-Use Industry, 2023 to 2033

Figure 97: East Asia Market Attractiveness By End-Use Industry, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 99: East Asia Market Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 100: East Asia Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 101: East Asia Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 103: East Asia Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 105: East Asia Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 107: South Asia Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 109: South Asia Market Attractiveness By Country, 2023 to 2033

Figure 110: South Asia Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 111: South Asia Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 112: South Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 113: South Asia Market Attractiveness By Product Type, 2023 to 2033

Figure 114: South Asia Market Value (US$ Million) Analysis By End-Use Industry, 2018 to 2033

Figure 115: South Asia Market Volume (Units) Analysis By End-Use Industry, 2018 to 2033

Figure 116: South Asia Market Y-o-Y Growth (%) Projections, By End-Use Industry, 2023 to 2033

Figure 117: South Asia Market Attractiveness By End-Use Industry, 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 119: South Asia Market Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 121: South Asia Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 123: South Asia Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 124: South Asia Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 125: South Asia Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 126: Oceania Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 127: Oceania Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 128: Oceania Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 129: Oceania Market Attractiveness By Country, 2023 to 2033

Figure 130: Oceania Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 131: Oceania Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 132: Oceania Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 133: Oceania Market Attractiveness By Product Type, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis By End-Use Industry, 2018 to 2033

Figure 135: Oceania Market Volume (Units) Analysis By End-Use Industry, 2018 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections, By End-Use Industry, 2023 to 2033

Figure 137: Oceania Market Attractiveness By End-Use Industry, 2023 to 2033

Figure 138: Oceania Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 139: Oceania Market Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 140: Oceania Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 141: Oceania Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 142: Oceania Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 143: Oceania Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 144: Oceania Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 145: Oceania Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 146: MEA Market Value (US$ Million) Analysis By Country, 2018 to 2033

Figure 147: MEA Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 148: MEA Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 149: MEA Market Attractiveness By Country, 2023 to 2033

Figure 150: MEA Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Figure 151: MEA Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 152: MEA Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 153: MEA Market Attractiveness By Product Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis By End-Use Industry, 2018 to 2033

Figure 155: MEA Market Volume (Units) Analysis By End-Use Industry, 2018 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections, By End-Use Industry, 2023 to 2033

Figure 157: MEA Market Attractiveness By End-Use Industry, 2023 to 2033

Figure 158: MEA Market Value (US$ Million) Analysis By Consumer Orientation, 2018 to 2033

Figure 159: MEA Market Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 160: MEA Market Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 161: MEA Market Attractiveness By Consumer Orientation, 2023 to 2033

Figure 162: MEA Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Figure 163: MEA Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 164: MEA Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 165: MEA Market Attractiveness By Distribution Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA