Grown increasingly for the demand of protective, sustainable, and cost-effective packaging solutions, the interior packaging market is rapidly growing. Companies working on new designs, developing eco-friendly materials, and enhancing protections are focusing on catering to the emerging needs in areas such as e-commerce, electronics, pharmaceuticals, and food & beverage industries. Automation along with smart packaging technologies further helps in improving efficiency and waste reduction in the sector.

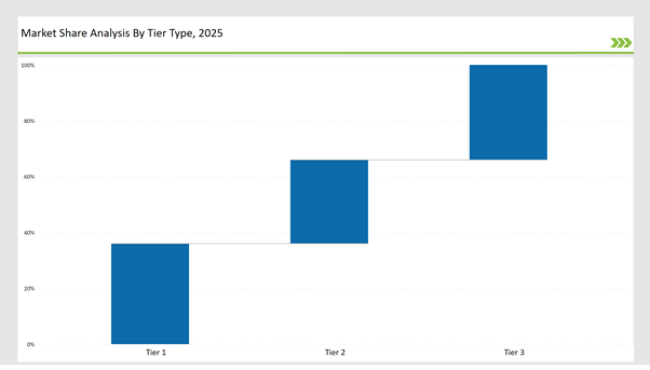

Tier 1 market leaders include Sealed Air Corporation, Smurfit Kappa, and Pregis, capturing 39% of the market share by leveraging advanced protective packaging technologies, extensive global networks, and continuous R&D investments.

Tier 2 includes companies like Storopack, Ranpak, and Polyair, which control 30% of the market. These firms cater to mid-sized customers with customized and cost-effective interior packaging solutions, benefiting from strong supply chain efficiencies and compliance with environmental regulations.

Tier 3 players, including regional and niche manufacturers specializing in protective, biodegradable, and temperature-sensitive packaging, constitute the remaining 31% of the market. These companies focus on tailored designs, localized production, and flexible manufacturing processes to meet diverse consumer demands.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Sealed Air Corporation, Smurfit Kappa, Pregis) | 18% |

| Rest of Top 5 (Storopack, Ranpak) | 12% |

| Next 5 of Top 10 (Polyair, Pro-Pac Packaging, Veritiv, FP International, Intertape Polymer Group) | 9% |

The interior packaging market is for a wide range of industries that require sturdy, secure, and eco-friendly protective solutions. Current emerging trends involve recyclability, automation, and cost-effective packaging solutions.

Companies innovate to meet the demands of industries by enhancing efficiency, sustainability, and protection.

Advances in biodegradable materials, automation, and AI-driven quality control were witnessed in this industry. Companies are ready to invest in R&D to improve packaging efficiency, reduce waste, and integrate smart packaging features.

Year-on-Year Leaders

Technology suppliers should adopt eco-friendly packaging solutions, automation, and customization to be aligned with the shifting trends of the industry.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Sealed Air Corporation, Smurfit Kappa, Pregis |

| Tier 2 | Storopack, Ranpak, Polyair |

| Tier 3 | Pro-Pac Packaging, Veritiv, FP International, Intertape Polymer Group |

The internal packaging sector players are evolving novel strategies for sustainability and efficient operations. The trend for the last few years has been towards introducing biodegradable materials, automation, and AI-based packaging solutions.

| Manufacturer | Latest Developments |

|---|---|

| Sealed Air Corporation | Launched an AI-enabled high-speed air cushioning system in March 2024. |

| Smurfit Kappa | Introduced new biodegradable molded pulp packaging in August 2023. |

| Pregis | Developed compact and high-performance sustainable cushioning solutions in May 2024. |

| Storopack | Expanded its recyclable foam insert line in November 2023. |

| Ranpak | Launched a low-energy, fully recyclable protective packaging solution in February 2024. |

The market of interior packaging is highly competitive; companies are shifting focus towards designing sustainable, automated, and protective designs. Increasingly, firms are adopting AI-driven quality control measures and novel eco-friendly materials to enhance efficiency in their packages and minimize adverse environmental impacts.

Market growth will be driven by advancements in automation, material innovations, and sustainability. Companies will integrate AI-driven monitoring systems, develop energy-efficient protective solutions, and enhance material recyclability. The demand for lightweight, cost-effective, and eco-friendly interior packaging is expected to rise, expanding market opportunities globally. Additionally, manufacturers are expected to focus on biodegradable alternatives and circular economy principles.

Leading players include Sealed Air Corporation, Smurfit Kappa, Pregis, Storopack, and Ranpak.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 39%.

Key drivers include sustainability, automation, material innovation, and regulatory compliance.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Interior Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Luxury Interior Fabric Industry Analysis in North America and Europe Growth, Trends and Forecast from 2025 to 2035

Vehicle Interior Air Quality Monitoring Technology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway Interior Lighting Market - Trends & Forecast 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Interior Plastic Components Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Leather Market Analysis Size Share and Forecast Outlook 2025 to 2035

Automotive Interior Trim Parts Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Ambient Lighting Market Growth - Trends & Forecast 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aircraft Cabin Interiors Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic For Interior Market Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Plastic Interior Trims Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA