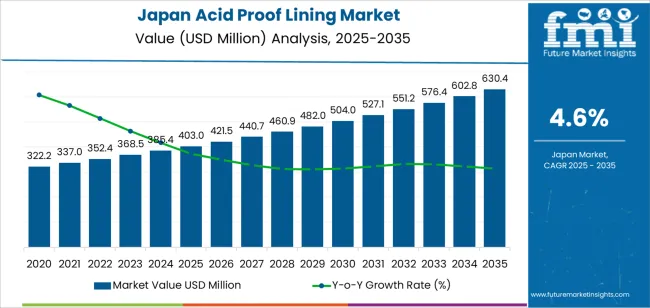

The demand for acid-proof lining in Japan is expected to grow from USD 403.0 million in 2025 to USD 630.4 million by 2035, with a compound annual growth rate (CAGR) of 4.6%. Acid-proof linings are essential in industries like chemical processing, wastewater treatment, and metal refining, where exposure to corrosive substances is common. These linings protect industrial structures from damage caused by highly acidic environments, increasing the longevity and efficiency of machinery, tanks, and pipelines. The growing emphasis on safety, durability, and operational efficiency across industries in Japan is expected to drive continued demand for acid-proof linings over the coming decade.

The main drivers for the growth in acid-proof lining demand include the increasing need for corrosion resistance in industrial applications, environmental protection measures, and the rise of eco-friendly practices across manufacturing sectors. As Japan's industrial sectors modernize, acid-resistant coatings will remain integral in maintaining the integrity of critical infrastructure while reducing maintenance costs and ensuring safe operations. Moreover, the focus on improving operational efficiency in industries that rely on chemical processes will continue to boost the demand for acid-proof linings, making them an essential part of Japan’s industrial landscape.

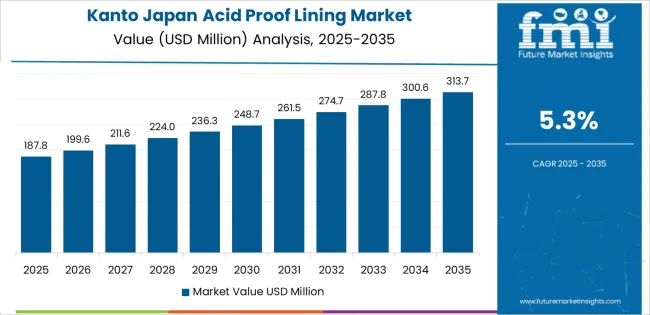

Between 2025 and 2030, the demand for acid-proof lining in Japan is expected to increase from USD 403.0 million to USD 421.5 million. This period will experience gradual growth, driven by the increasing need for protective coatings in industrial settings, particularly in sectors dealing with highly acidic chemicals and wastewater management. Industries like pharmaceuticals, food processing, and chemical production will continue to invest in robust acid-proof solutions to ensure the longevity of their assets and improve workplace safety. The demand during this phase will be supported by ongoing technological advancements in acid-resistant materials that offer enhanced performance and durability.

From 2030 to 2035, the demand for acid-proof lining will grow more sharply, rising from USD 421.5 million to USD 630.4 million. This acceleration will be driven by the expanding demand for eco-friendly industrial solutions and regulatory compliance in highly regulated industries such as chemical manufacturing and petrochemicals. As these industries continue to scale operations and meet stricter environmental standards, the adoption of advanced protective linings will increase. Rising investments in infrastructure and the renewable energy sector will further fuel the demand for reliable, corrosion-resistant materials to protect facilities exposed to harsh operational conditions.

| Metric | Value |

|---|---|

| Demand for Acid Proof Lining in Japan Value (2025) | USD 403.0 million |

| Demand for Acid Proof Lining in Japan Forecast Value (2035) | USD 630.4 million |

| Demand for Acid Proof Lining in Japan Forecast CAGR (2025-2035) | 4.6% |

The demand for acid proof lining in Japan is increasing due to its essential role in protecting industrial equipment and infrastructure from corrosive substances, particularly in industries such as chemical manufacturing, pharmaceuticals, and food processing. Acid proof linings are designed to provide durable protection for tanks, pipes, and floors exposed to aggressive chemicals, making them a critical component for ensuring the longevity and safety of industrial systems. As Japan continues to expand its industrial and manufacturing capabilities, the need for effective corrosion-resistant solutions is driving the growth of the acid proof lining market.

A major driver of this growth is the increasing focus on maintaining the integrity of infrastructure in industries that deal with aggressive chemicals and corrosive environments. Japan’s strong chemical and pharmaceutical sectors, which produce a wide variety of chemicals, require reliable acid-proof lining solutions to safeguard their equipment and prevent costly downtime or damage. As Japan continues to implement stringent environmental and safety regulations, the demand for high-quality and compliant acid proof linings is expected to rise, particularly for applications in hazardous environments.

The trend towards durability and the adoption of eco-friendlier manufacturing processes is also contributing to the growing demand for acid proof lining solutions. These linings help reduce the environmental impact of chemical processes by preventing leaks and spills, thus improving safety and ensuring compliance with environmental regulations. As Japan continues to prioritize industrial efficiency, safety, and environmental durability, the demand for acid proof linings is expected to grow steadily through 2035.

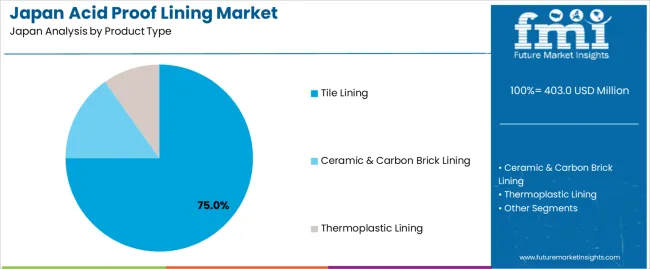

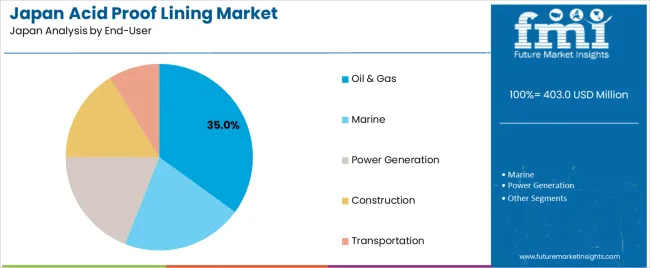

Demand for acid proof lining in Japan is segmented by product type, end-user industry, form type, and region. By product type, demand is divided into tile lining, ceramic & carbon brick lining, and thermoplastic lining, with tile lining leading the demand at 75%. The demand is also segmented by end-user industry, including oil & gas, marine, power generation, construction, and transportation, with oil & gas leading the demand at 35%. In terms of form type, demand is divided into solvent-borne, water-borne, and powder-based forms. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Tile lining accounts for 75% of the demand for acid proof lining in Japan. This product type is highly favored due to its excellent resistance to aggressive chemicals, making it ideal for industries such as oil & gas, power generation, and marine. Tile linings are particularly valued for their durability, easy installation, and the ability to cover large surface areas with minimal seams, which helps prevent leaks and ensures long-lasting protection against corrosive substances.

The durability of tile lining in extreme conditions, combined with its ability to withstand high temperatures and chemical exposure, makes it the go-to solution for acid proofing in various industries. Tile linings are highly versatile and can be customized to meet specific application needs. As industrial sectors in Japan continue to confront increasingly corrosive environments, the demand for tile lining remains dominant, ensuring its leadership in the market.

The oil & gas industry accounts for 35% of the demand for acid proof lining in Japan. This industry is heavily reliant on acid proof linings to protect essential infrastructure, such as pipelines, storage tanks, and refining equipment, from the damaging effects of corrosive chemicals and acids used throughout the exploration, refining, and transportation processes. Acid proof linings play a crucial role in ensuring that these components remain intact and operational under extreme conditions, reducing the risk of corrosion-related failures and costly maintenance.

With Japan’s ongoing emphasis on energy production and refining, the demand for high-performance acid proof linings in the oil & gas sector continues to rise. The ability of these linings to safeguard valuable assets from corrosion ensures that they remain indispensable for the oil & gas industry, cementing their position as the dominant choice for protection in the sector.

In Japan, demand for acid‑proof lining is rising as chemical, petrochemical, wastewater‑treatment, metal‑processing, and infrastructure industries expand or upgrade facilities. Acid‑proof lining is increasingly used to protect tanks, pipelines, reactors, flooring and structural components from corrosion and chemical damage, especially where strong acids, solvents, or corrosive effluents are handled. Stringent regulatory standards for environmental protection, worker safety, and corrosion prevention further drive adoption. High costs for specialized linings (ceramic, polymer, hybrid), skilled installation requirements, and maintenance complexity restrict uptake particularly for smaller plants or older facilities that must retrofit existing infrastructure.

Demand in Japan is growing because industries dealing with harsh chemicals, acidic waste, or corrosive materials such as chemical manufacturing, pharmaceuticals, wastewater treatment, metal processing and power generation require reliable protection to ensure safety and asset longevity. As domestic firms upgrade ageing infrastructure and comply with stricter environmental or safety regulations, acid‑proof linings offer an effective barrier against chemical degradation, leakage, and structural failure. In addition, growth in sectors like wastewater treatment, chemical manufacturing and industrial refurbishment fuels ongoing need for durable, long‑lasting corrosion‑resistant solutions, making acid‑proof lining an increasingly indispensable investment.

Technological advances are strengthening appeal of acid‑proof linings. Newer materials polymer‑based coatings, hybrid composite linings, ceramic or carbon‑brick systems, and advanced resin-/ceramic‑based blends offer improved chemical resistance, abrasion resistance, durability, and longer lifespans. Innovations in water‑based or low‑VOC lining formulations help meet environmental and safety regulations. Enhanced application techniques, improved adhesion, and better quality‑control processes reduce maintenance intervals and extend asset life. These developments make acid‑proof linings more cost‑effective over the full lifecycle and more suitable for use in diverse industrial settings, including newer facilities or retrofits, thus driving broader adoption in Japanese industries.

High upfront costs for premium materials and professional installation especially for ceramic or composite linings pose budgetary constraints. Many small or older plants may find retrofitting expensive and disruptive. Skilled labour is required to ensure correct application and long‑term performance; lack of such expertise increases risk of failure or poor performance. Volatility in raw‑material costs (resins, ceramics, specialized compounds) can affect pricing and project economics. Finally, for operations with less corrosive exposure or short equipment lifespans, simpler or cheaper protection methods may still seem more economically viable, reducing the incentive for high‑performance linings.

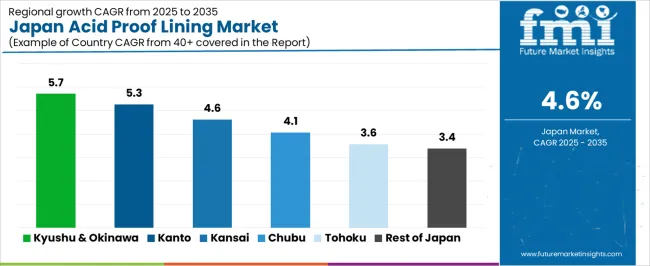

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.7% |

| Kanto | 5.3% |

| Kinki | 4.6% |

| Chubu | 4.1% |

| Tohoku | 3.6% |

| Rest of Japan | 3.4% |

Demand for acid proof lining in Japan is growing steadily, with Kyushu & Okinawa leading at a 5.7% CAGR, driven by the region’s expanding industrial sector, including chemicals, manufacturing, and energy production. The Kanto region follows with a 5.3% CAGR, supported by its strong industrial base, particularly in manufacturing and chemical processing industries. Kinki shows a 4.6% CAGR, driven by high demand from industrial facilities in automotive, electronics, and chemicals. Chubu experiences a 4.1% CAGR, with demand fueled by its key manufacturing sectors, including automotive and heavy industries. Tohoku and the Rest of Japan see slower growth at 3.6% and 3.4%, respectively, as industrial activities in these regions expand more gradually.

Kyushu & Okinawa is seeing the highest demand for acid proof lining in Japan, growing at a 5.7% CAGR. The region’s industrial sector, particularly in chemicals, manufacturing, and energy production, is a major driver of this demand. Kyushu has a significant number of chemical plants and industrial facilities that require acid-proof lining to protect equipment and infrastructure from corrosive substances. The region's ongoing investments in industrial modernization and infrastructure upgrades are contributing to this growth.

Okinawa’s growing energy sector, particularly in renewable energy projects, is also boosting the demand for acid-proof lining, as these projects require highly durable and resistant materials for their operations. As industries in Kyushu & Okinawa continue to expand, the need for corrosion-resistant materials like acid-proof lining is expected to increase, sustaining growth in the region.

Kanto is experiencing strong demand for acid proof lining, growing at a 5.3% CAGR. The region’s industrial base, particularly in manufacturing, chemical processing, and energy production, is the primary driver of this demand. Kanto, home to Tokyo and other industrial centers, has a high concentration of chemical plants, power plants, and factories that rely on acid-proof lining to safeguard their equipment from corrosive environments.

The region’s continuous push for industrial growth, particularly in chemical manufacturing and renewable energy, has led to a rise in the adoption of durable materials like acid-proof lining. Kanto’s large-scale infrastructure projects and a growing focus on enhancing the durability and efficiency of industrial facilities are also contributing to this growth. As Kanto continues to lead in industrial innovation and expansion, demand for acid-proof lining is expected to remain strong, supporting the region’s 5.3% CAGR.

In Kinki, demand for acid proof lining is growing at a 4.6% CAGR, driven by the region’s diverse industrial base, particularly in automotive, electronics, and chemical manufacturing. Major cities like Osaka and Kyoto are home to numerous factories and industrial plants that require acid-proof lining to protect their infrastructure from corrosive substances. Kinki’s automotive industry, which involves the production of automotive parts and components, heavily relies on acid-resistant materials for their manufacturing processes.

The region's chemical manufacturing sector, which includes large-scale production of chemicals and pharmaceuticals, uses acid-proof lining to safeguard equipment and maintain safety standards. As Kinki continues to prioritize industrial innovation and improve infrastructure, the demand for durable and corrosion-resistant materials like acid-proof lining is expected to increase. The region’s continued growth in industrial production and manufacturing ensures that demand for acid-proof lining will remain strong.

Chubu is experiencing steady growth in demand for acid proof lining, with a 4.1% CAGR. The region’s automotive and manufacturing industries are the primary drivers of this demand, particularly in cities like Nagoya, which is home to several large automotive manufacturers. These industries rely on acid-proof lining to protect manufacturing equipment and industrial facilities from the corrosive effects of chemicals and other harsh substances used in production.

Chubu’s heavy industries, including steel and machinery manufacturing, are increasingly adopting acid-resistant materials to extend the lifespan of equipment and ensure safety. The region’s focus on technological innovation in manufacturing processes is also contributing to the rise in demand for durable materials like acid-proof lining. As industrial sectors in Chubu continue to expand and modernize, the demand for acid-proof lining will remain steady, supporting the region’s 4.1% growth.

Tohoku is seeing moderate growth in demand for acid proof lining, growing at a 3.6% CAGR. The region’s industrial activities, particularly in manufacturing and energy, are the main contributors to this demand. Tohoku’s chemical plants and power stations require acid-resistant materials to safeguard equipment exposed to corrosive chemicals and gases. As the region’s industrial base continues to expand, particularly in the manufacturing of heavy machinery and chemical products, the demand for durable and reliable materials like acid-proof lining is increasing.

Tohoku’s focus on developing eco-friendly energy sources and improving industrial infrastructure is driving the need for acid-proof lining in new facilities. As industries in Tohoku modernize and new industrial projects emerge, the demand for acid-proof lining is expected to rise gradually, ensuring continued growth in the region, albeit at a slower pace compared to more industrialized areas.

The Rest of Japan is experiencing steady demand for acid proof lining, with a 3.4% CAGR. This growth is largely driven by the expanding industrial sectors in more rural and suburban areas. As smaller factories and plants adopt more advanced manufacturing technologies, the need for durable materials like acid-proof lining increases. The demand is particularly strong in regions involved in chemical processing, energy production, and manufacturing.

As industries across the Rest of Japan modernize and adopt more advanced production processes, the requirement for corrosion-resistant materials to protect equipment grows. Regional governments are increasingly investing in industrial infrastructure, further supporting the need for high-quality acid-proof lining. As the automotive and chemical sectors expand outside the major industrial hubs, the demand for acid-proof lining in the Rest of Japan will continue to grow, albeit at a more moderate rate compared to urbanized regions.

The demand for acid-proof lining in Japan is increasing as industries like chemical manufacturing, pharmaceuticals, food processing, and wastewater treatment seek durable solutions for protecting infrastructure from corrosive substances. Acid-proof linings are essential for safeguarding equipment and surfaces exposed to harsh chemicals and acids, providing long-term protection against damage and degradation. As Japan continues to strengthen its industrial capabilities and enhance its environmental durability initiatives, the need for high-quality acid-proof linings is expected to grow across various sectors requiring reliable corrosion protection.

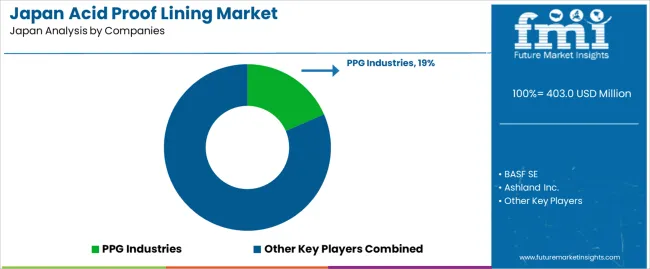

Key players in the acid-proof lining market in Japan include PPG Industries, BASF SE, Ashland Inc., Axalta Coating Systems Ltd, and Sherwin-Williams Company. PPG Industries leads with a market share of 18.5%, offering a range of acid-resistant coatings and linings known for their durability and performance in corrosive environments. BASF SE provides high-performance protective coatings for industrial applications, including acid-resistant linings. Ashland Inc. offers advanced resin-based acid-proof coatings, while Axalta Coating Systems Ltd specializes in protective coatings that are widely used in industrial sectors. Sherwin-Williams Company offers a range of corrosion-resistant coatings that are particularly effective in chemical and industrial applications.

Competition in the acid-proof lining market is driven by the increasing demand for high-performance, cost-effective, and durable solutions that can withstand exposure to corrosive substances in harsh industrial environments. Companies compete by offering coatings with superior resistance to chemical attacks, UV degradation, and wear, while also addressing durability concerns by providing eco-friendly formulations. As industries in Japan focus on enhancing operational efficiency, reducing downtime, and complying with stringent environmental regulations, the demand for reliable acid-proof linings continues to rise. Providers that can offer innovative, customizable, and high-quality products will maintain a competitive edge in the market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Tile Lining, Ceramic & Carbon Brick Lining, Thermoplastic Lining |

| Form Type | Solvent-Borne, Water-Borne, Powder-Based |

| End-User | Oil & Gas, Marine, Power Generation, Construction, Transportation |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | PPG Industries, BASF SE, Ashland Inc., Axalta Coating Systems Ltd, Sherwin-Williams Company |

| Additional Attributes | Dollar sales by product type, form type, and end-user; regional CAGR and adoption trends; demand trends in acid proof lining; growth in oil & gas, marine, and power generation sectors; technology adoption for protective lining solutions; vendor offerings including coatings, linings, and services; regulatory influences and industry standards |

The demand for acid proof lining in Japan is estimated to be valued at USD 403.0 million in 2025.

The market size for the acid proof lining in Japan is projected to reach USD 630.4 million by 2035.

The demand for acid proof lining in Japan is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in acid proof lining in Japan are tile lining, ceramic & carbon brick lining and thermoplastic lining.

In terms of form type, solvent-borne segment is expected to command 40.0% share in the acid proof lining in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Proof Lining Market Trends 2025 to 2035

Germany Acid Proof Lining Market Trends 2022 to 2032

Demand for Acid Proof Lining in USA Size and Share Forecast Outlook 2025 to 2035

Corrosion Protection Coatings & Acid Proof Lining Market Growth - Trends & Forecast 2025 to 2035

Japan Adipic Acid Market Insights – Trends, Demand & Growth 2025-2035

Japan Hyaluronic Acid Products Market Analysis – Growth, Applications & Outlook 2025-2035

Demand for Amino Acids in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Acidity Regulator in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bio-Based Levulinic Acid in Japan Size and Share Forecast Outlook 2025 to 2035

Lining Bellows Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA