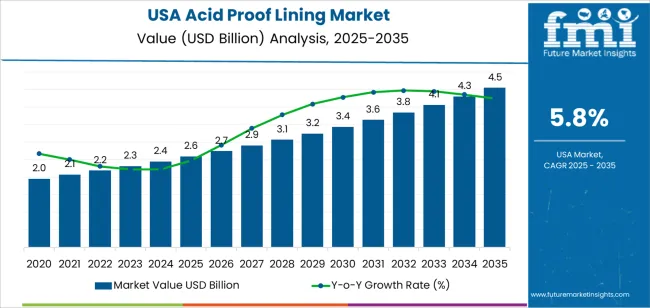

The demand for acid proof lining in the USA is expected to grow from USD 2.6 billion in 2025 to USD 4.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.8%. This growth is driven by the increasing need for corrosion-resistant materials in industries such as chemicals, pharmaceuticals, food and beverages, and wastewater treatment. Acid proof linings are essential for protecting equipment and structures from aggressive chemicals and extreme environments. As industrial production continues to increase, the demand for reliable protective linings that ensure the longevity and safety of assets is expected to rise steadily.

Year-over-year (Y-o-Y) growth shows a gradual increase, starting at USD 2.6 billion in 2025 and rising to USD 2.7 billion in 2026. Over the following years, the market will grow steadily, reaching USD 2.9 billion in 2027, USD 3.1 billion in 2028, and USD 3.2 billion in 2029. By 2035, the demand for acid proof lining is forecasted to reach USD 4.5 billion, indicating continued strong market demand supported by the increasing adoption of acid-resistant materials across various sectors.

The acid proof lining market in the USA is expected to continue expanding at a steady pace over the next decade. From USD 2.6 billion in 2025, the market will grow to USD 2.7 billion in 2026 and USD 2.9 billion in 2027, reflecting moderate year-over-year growth. Over the following years, the market will continue its gradual rise, reaching USD 3.1 billion in 2028, USD 3.2 billion in 2029, and increasing steadily through the early 2030s. By 2035, the market will reach USD 4.5 billion, reflecting an overall increase driven by the growing need for corrosion-resistant materials in key industries.

The 5-year growth blocks indicate a steady upward trajectory for the acid proof lining market, with a consistent increase of approximately USD 0.4 billion every five years. This growth is supported by the continued expansion of industrial applications and the increasing focus on safety and durability in manufacturing environments. The market will benefit from the rising demand for materials that can withstand extreme conditions, offering significant opportunities for manufacturers and suppliers in the acid-proof lining segment.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 2.6 billion |

| Industry Forecast Value (2035) | USD 4.5 billion |

| Industry Forecast CAGR (2025-2035) | 5.8% |

The demand for acid proof lining in the United States is increasing as industrial sectors expand and regulatory pressure on safety and environmental compliance intensifies. Acid proof linings are used to protect equipment, tanks, pipes and structures from corrosion and chemical attack in industries such as chemical processing, oil and gas, power generation, wastewater treatment, mining, metallurgy, and other heavy industries. As these sectors maintain or grow operations dealing with acidic or corrosive materials, the need for reliable, high performance linings rises.

In addition, stricter regulations from environmental and workplace safety agencies drive companies to adopt acid resistant solutions to ensure compliance and avoid costly corrosive damage. Concurrently, advances in lining technologies such as polymer based linings, ceramic or carbon brick linings, and hybrid/coating systems are improving durability, chemical resistance, and ease of application. These improvements make acid proof linings a more viable long-term protection measure for industrial assets. As a result, industrial operators increasingly favour acid proof lining over older, less-resistant methods.

Growth in infrastructure projects, upgrades in water treatment and wastewater facilities, and rising investments in power generation and petrochemical capacity also support demand for acid proof linings. As industrial plants modernize or expand, they often replace older, corroded components or build new facilities both of which require corrosion resistant linings. The broadening range of application from storage tanks and reactors to pipelines and waste handling equipment expands the addressable market. Moreover, the push toward sustainable industrial operations and lifecycle cost optimization encourages industries to choose acid proof linings to reduce maintenance, downtime, and long term replacement costs. Taken together, these factors contribute to a steady upward trend in demand for acid proof lining in the USA through the next several years.

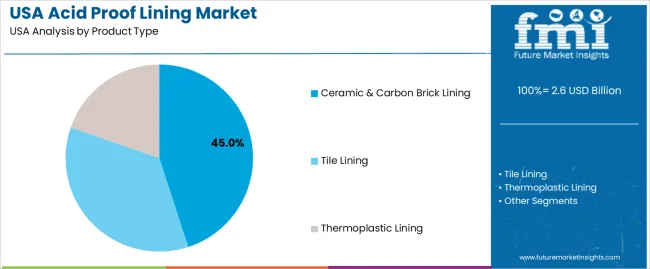

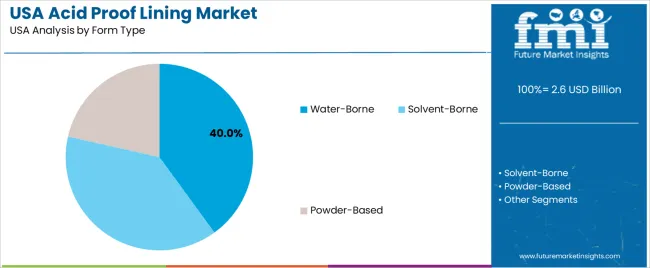

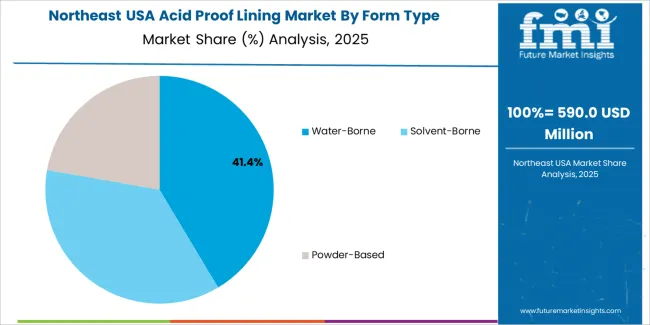

The demand for acid proof lining in the USA is primarily driven by product type and form type. The leading product type is ceramic & carbon brick lining, capturing 45% of the market share, while water-borne is the dominant form type, accounting for 40% of the demand. Acid proof linings are essential in protecting surfaces from corrosion and damage caused by acidic substances, particularly in industries such as chemical processing, manufacturing, and wastewater treatment. As the need for durable, long-lasting protective coatings grows across these sectors, acid proof linings continue to be in high demand.

Ceramic & carbon brick lining leads the demand for acid proof lining in the USA, holding 45% of the market share. This product type is highly valued for its exceptional resistance to acidic environments, making it ideal for applications in industries such as chemical manufacturing, mining, and wastewater treatment, where equipment and surfaces are regularly exposed to corrosive substances. Ceramic & carbon brick linings are known for their durability, high temperature tolerance, and ease of maintenance, offering a long-lasting solution for industrial facilities.

The demand for ceramic & carbon brick linings is driven by their proven effectiveness in protecting surfaces from severe chemical corrosion. These linings are often used to line tanks, reactors, and pipelines, ensuring that the integrity of the equipment is maintained over time. The continued growth in industries that handle harsh chemicals, combined with the need for reliable, high-performance coatings, ensures that ceramic & carbon brick lining will remain the leading product type in the acid proof lining market in the USA.

Water-borne is the leading form type for acid proof lining in the USA, accounting for 40% of the demand. Water-borne coatings are widely preferred due to their ease of application, low environmental impact, and ability to provide a durable, corrosion-resistant finish. Water-borne acid proof linings are particularly valuable in industries where stringent environmental regulations are in place, as these coatings contain fewer volatile organic compounds (VOCs) compared to solvent-borne alternatives.

The demand for water-borne acid proof linings is driven by their ability to provide a strong protective layer while being more environmentally friendly. These coatings are ideal for use in sensitive environments, such as food processing facilities, wastewater treatment plants, and pharmaceutical manufacturing, where both corrosion protection and environmental compliance are important. As industries continue to prioritize sustainable practices and compliance with environmental regulations, the demand for water-borne acid proof linings is expected to grow, making it a dominant choice in the market.

Demand for acid proof lining in the USA is driven by ongoing needs across multiple industrial sectors for corrosion-resistant protection of equipment, pipes, storage tanks, and infrastructure exposed to aggressive chemicals. Industries such as chemical processing, oil and gas, wastewater treatment, power generation, and manufacturing rely on acid-resistant linings to preserve structural integrity and ensure safety when handling acids, alkalis, or corrosive media. At the same time, tightening environmental and worker-safety regulations encourage adoption of durable, certified lining systems. These factors shape the overall demand trajectory for acid proof lining solutions in the USA industrial landscape.

Several developments support the expansion of acid proof lining demand. First, increased industrial and infrastructure activity, including expansion or renovation of chemical plants, refineries, water treatment facilities, and power-generation units, drives the need for corrosion-resistant protection. Second, enforcement of stricter environmental, safety, and emission standards pushes operators to use linings that resist acid and chemical corrosion, reducing the risk of leaks and contamination.

Third, advances in lining materials, such as fiber-reinforced polymers, ceramic, or thermoplastic systems, enable more reliable, long-lasting protection and easier installation compared with earlier solutions. Fourth, rising demand for maintenance, overhaul, and rehabilitation of aging industrial assets in the USA motivates retrofitting with acid-proof linings to extend lifespan and avoid costly downtime.

Despite favorable drivers, several constraints limit growth. The cost of high-performance lining materials and specialized installation remains considerable, which can deter adoption, especially among smaller operators or plants with tight capital budgets. Some existing facilities in the USA still rely on simpler protective systems, and retrofitting or replacing those may require downtime and specialized installation, adding complexity and cost. Additionally, supply-chain challenges for lining components and stricter environmental compliance can slow adoption or increase the cost of coatings.

Important trends include increased use of cellulose-based or starch-derived microbeads in exfoliating scrubs, facial washes, and personal-care products as part of clean-label and eco-friendly positioning. Suppliers are also offering microbeads engineered for controlled dissolution in water, minimal residue, and improved biodegradability in marine conditions, aligning with Japanese environmental priorities. There is growing interest in integrating microbeads within multifunctional formulations, combining exfoliation with skincare benefits and biodegradability. Finally, collaboration between material scientists, cosmetic formulators, and Japanese regulatory bodies is accelerating innovation and standard-setting for next-generation biodegradable microbeads.

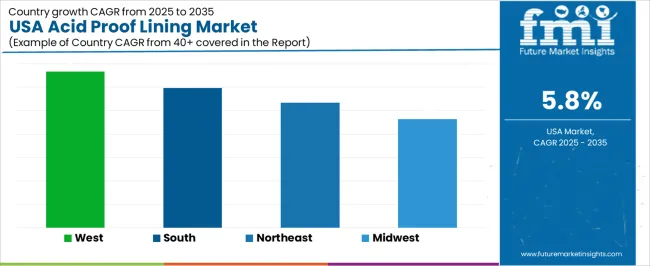

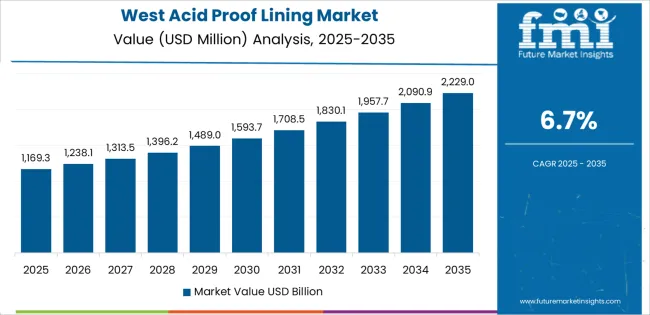

The demand for acid proof lining in the USA shows steady growth across different regions, with the West leading at a CAGR of 6.7%. The South follows with a CAGR of 6.0%, supported by the increasing industrial activity in sectors such as chemical manufacturing and waste management. The Northeast shows moderate growth at 5.3%, driven by its strong industrial and manufacturing base. The Midwest has the lowest growth rate at 4.6%, reflecting a more traditional industrial landscape. These regional differences are influenced by factors such as industrial concentration, regulatory requirements, and sector-specific needs for corrosion-resistant solutions.

| Region | CAGR (%) |

|---|---|

| West | 6.7 |

| South | 6.0 |

| Northeast | 5.3 |

| Midwest | 4.6 |

The demand for acid proof lining in the West is projected to grow at a CAGR of 6.7%, driven by the region’s strong industrial sector, which includes chemical manufacturing, mining, and environmental industries. The West has a high concentration of industries that require corrosion-resistant solutions for protecting infrastructure exposed to harsh chemicals, such as acid-proof linings for tanks, pipes, and floors. Additionally, the region’s focus on environmental sustainability and regulatory requirements for handling hazardous materials is contributing to increased demand for acid-resistant materials. As the region continues to expand its industrial base, especially in states like California, the need for high-quality acid proof linings to ensure safety and regulatory compliance will continue to drive market growth.

In the South, the demand for acid proof lining is expected to grow at a CAGR of 6.0%, driven by the region’s expanding industrial and manufacturing base. The South is home to a variety of industries, including chemical production, petroleum refining, and power generation, all of which rely heavily on acid-resistant materials for their operations. As industrial activity continues to grow, particularly in Texas and other Southern states, the need for durable, corrosion-resistant materials like acid proof linings is rising. Additionally, environmental regulations and the growing focus on safety in industrial operations are pushing companies to invest in high-quality protective linings for tanks, pipes, and processing equipment. The region’s increasing industrial output and stringent compliance requirements ensure continued demand for acid proof lining.

In the Northeast, the demand for acid proof lining is projected to grow at a CAGR of 5.3%, supported by the region’s established industrial and manufacturing infrastructure. The Northeast is home to many industries, including chemicals, pharmaceuticals, and food processing, which require acid proof linings to protect equipment from corrosive materials used in production processes. The region's emphasis on maintaining stringent safety standards and environmental regulations further drives demand for durable, acid-resistant materials. While the growth rate is moderate compared to the West and South, the Northeast's robust industrial sector ensures a steady market for acid proof lining, particularly as aging infrastructure and increased environmental concerns make protective solutions more critical.

The demand for acid proof lining in the Midwest is expected to grow at a CAGR of 4.6%, reflecting slower growth compared to other regions. The Midwest has a strong presence in manufacturing, particularly in automotive, machinery, and food processing industries, which are key users of acid-resistant materials. However, the growth rate is more moderate as compared to the West and South, likely due to the region’s relatively lower concentration of industries requiring specialized corrosion protection. Despite this, the demand for acid proof lining remains steady as industrial operations, including chemical processing and agriculture, continue to rely on these materials for safe and efficient operations. As industries in the Midwest modernize and face stricter environmental regulations, the demand for acid proof lining is expected to rise, although at a slower pace.

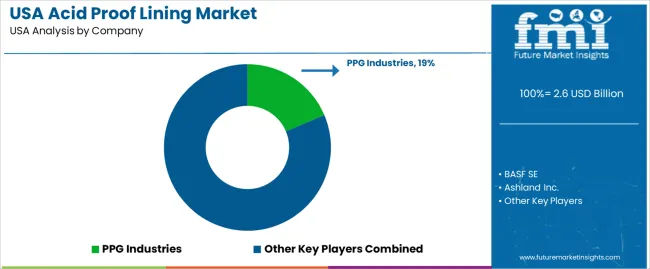

Demand for acid proof lining in the United States remains strong as industries such as chemical processing, wastewater treatment, mining, and energy require corrosion resistant coatings to protect equipment, tanks, and piping from aggressive chemicals and acidic environments. Key suppliers include PPG Industries (holding approximately 18.7% share among major providers), along with BASF SE, Ashland Inc., and Axalta Coating Systems Ltd. These companies offer specialized lining solutions, including epoxy, vinyl ester, and high performance polymer coatings, designed for longevity and reliable performance under harsh chemical exposure.

Competition in this sector centers on lining performance, regulatory compliance, and technical support. Suppliers emphasize chemical resistance, adhesion strength, and durability under thermal cycling and abrasion. Another dimension of competition is certification and compliance with industry standards used in chemical or waste management facilities. Firms offering comprehensive services, from surface preparation to on site application and maintenance support, tend to be preferred by industrial clients.

Product documentation often highlights factors such as chemical compatibility, expected service life, application methods, and safety credentials. By aligning their product portfolios with the operational requirements and regulatory standards of USA industrial users, these companies aim to maintain or expand their presence in the acid proof lining market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Ceramic & Carbon Brick Lining, Tile Lining, Thermoplastic Lining |

| Form Type | Solvent-Borne, Water-Borne, Powder-Based |

| End-User | Marine, Oil & Gas, Power Generation, Construction, Transportation |

| Key Companies Profiled | PPG Industries, BASF SE, Ashland Inc., Axalta Coating Systems Ltd |

| Additional Attributes | The market analysis includes dollar sales by product type, form type, end-user, and company categories. It also covers regional demand trends in the USA, particularly driven by the increasing adoption of acid-proof linings in industries like oil & gas, marine, power generation, and construction. The competitive landscape highlights key manufacturers focusing on innovations in acid-resistant materials for various applications. Trends in the growing demand for durable and high-performance linings that can withstand harsh environments, particularly in corrosive conditions, are explored, along with advancements in coating technologies and eco-friendly formulations. |

The demand for acid proof lining in USA is estimated to be valued at USD 2.6 billion in 2025.

The market size for the acid proof lining in USA is projected to reach USD 4.5 billion by 2035.

The demand for acid proof lining in USA is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in acid proof lining in USA are ceramic & carbon brick lining, tile lining and thermoplastic lining.

In terms of form type, water-borne segment is expected to command 40.0% share in the acid proof lining in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Proof Lining Market Trends 2025 to 2035

Germany Acid Proof Lining Market Trends 2022 to 2032

Corrosion Protection Coatings & Acid Proof Lining Market Growth - Trends & Forecast 2025 to 2035

USA Lactic Acid Market Analysis – Trends, Growth & Industry Insights 2025-2035

USA Adipic Acid Market Analysis – Size & Industry Trends 2025-2035

USA Hyaluronic Acid Products Market Insights – Growth, Demand & Forecast 2025-2035

Demand for Amino Acids in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Acidity Regulator in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bio-Based Levulinic Acid in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Dihydroxybenzoic Acids (DHBA) in USA Size and Share Forecast Outlook 2025 to 2035

Lining Bellows Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA