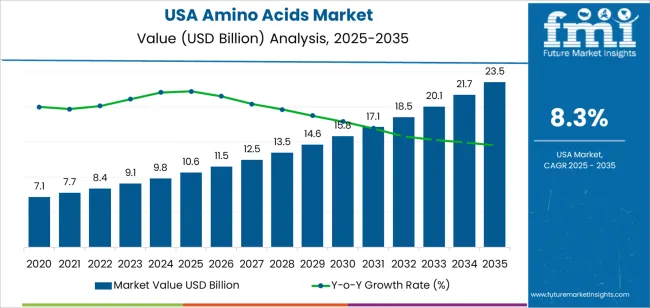

The demand for amino acids in the USA is expected to grow from USD 10.6 billion in 2025 to USD 23.5 billion by 2035, driven by a compound annual growth rate (CAGR) of 8.3%. Several factors are contributing to this growth, including increased use in various industries such as food and beverages, pharmaceuticals, animal feed, and personal care. Amino acids are crucial in protein synthesis, making them vital for dietary supplements, functional foods, and animal nutrition. The rising demand for protein-rich products, along with an emphasis on functional ingredients, is accelerating the growth of this market.

The expanding applications of amino acids are creating strong market demand across diverse sectors. By 2026, the market is forecasted to reach USD 11.5 billion, and this growth continues each year, reaching USD 12.5 billion by 2027. Over the following years, the market shows steady growth, driven by the increasing awareness of amino acids' health benefits and their growing role in various sectors. These factors collectively point toward a consistent demand for amino acids, which will continue to support the market's expansion through to 2035. The steady growth also reflects the increasing investment in nutritional products and animal feed.

The amino acids market in the USA is expected to see steady year-over-year growth from 2025 through 2035. In 2026, the market will grow from USD 10.6 billion to USD 11.5 billion, reflecting an 8.5% increase. The market will continue to expand in 2027, reaching USD 12.5 billion, an 8.7% increase, and to USD 13.5 billion by 2028, marking an 8.0% growth rate. This continued expansion can be attributed to rising demand for amino acids in sectors such as health supplements, functional foods, and animal nutrition.

The steady year-over-year growth rate reflects the ongoing importance of amino acids in meeting the nutritional and functional needs of various industries. By 2031, the market is projected to exceed USD 17 billion and continues to rise, reaching USD 23.5 billion by 2035. This growth will be supported by the expanding adoption of amino acid-based products in the health and wellness sector and the increasing demand for protein-rich ingredients across different food and beverage applications. The sustained rise in demand is indicative of the amino acids' crucial role in meeting evolving consumer preferences.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 2.4 billion |

| Industry Forecast Value (2035) | USD 3.8 billion |

| Industry Forecast CAGR (2025-2035) | 4.8% |

The demand for amino acids in the USA is growing significantly, primarily driven by increasing awareness of health, fitness, and nutrition. Amino acids are vital for muscle recovery, protein synthesis, and metabolic function, making them highly sought after in human nutrition and dietary supplements. Fitness enthusiasts, athletes, and those pursuing healthier lifestyles are consuming more amino acid-enriched products, such as protein bars, shakes, and nutritional drinks.

The rise of functional foods, coupled with consumer interest in preventive healthcare, has also expanded the market for amino acids in the food and beverage sector. Additionally, advances in biotechnology and fermentation processes have made the production of amino acids more efficient, affordable, and scalable, further fueling their adoption. As consumers prioritize better nutrition, the demand for amino acids in these products is expected to grow steadily in the coming years.

Amino acids are also experiencing increased demand in the animal feed industry, where they play a crucial role in improving feed efficiency and livestock productivity. Amino acids like lysine, methionine, and threonine are commonly added to feed for poultry, swine, and other livestock to support optimal growth and protein utilization. With the rising demand for animal-based protein products and a shift toward sustainable farming practices, amino acids are being used more extensively to enhance feed performance and reduce environmental impacts. Regulatory changes, such as the reduction of antibiotic growth promoters, are also driving the adoption of amino acid supplementation in animal feed. As livestock production continues to grow, the market for amino acids in animal feed is expected to expand through the next decade.

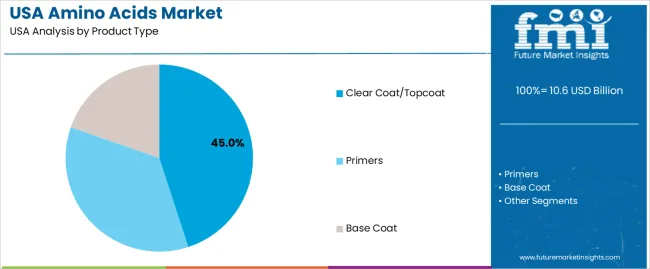

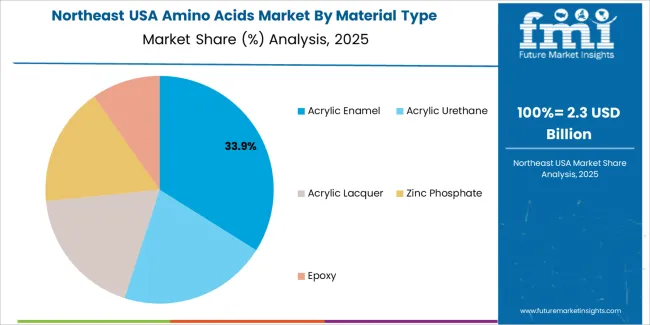

The demand for amino acids in the USA is primarily driven by product type and material type. The leading product type is clear coat/topcoat, which captures 45% of the market share, while acrylic enamel is the dominant material type, accounting for 35% of the demand. Amino acids play a critical role in various applications, particularly in the automotive and industrial sectors, where they are used in coatings and finishes. As the demand for durable and high-quality finishes continues to rise, amino acids are increasingly being incorporated into products to improve their performance and longevity.

Clear coat/topcoat is the leading product type for amino acids in the USA, holding 45% of the market share. Clear coat and topcoat formulations are widely used in automotive and industrial applications, providing a protective layer that enhances the appearance and durability of the underlying surfaces. Amino acids are used in these coatings to improve properties such as hardness, gloss retention, and chemical resistance, making them essential for achieving high-performance finishes.

The demand for amino acids in clear coats and topcoats is driven by their ability to enhance the quality of the finish, particularly in automotive paints, where durability and visual appeal are crucial. As consumer expectations for longer-lasting, high-quality products increase, the need for advanced coatings that incorporate amino acids continues to grow. This product type is particularly important in the automotive industry, where topcoat formulations need to withstand various environmental factors such as UV exposure, temperature fluctuations, and chemical wear, ensuring the continued dominance of clear coat/topcoat formulations in the market.

Acrylic enamel is the leading material type for amino acids in the USA, capturing 35% of the demand. Acrylic enamel is widely used in automotive and industrial coatings due to its excellent adhesion, color retention, and resistance to environmental factors. The incorporation of amino acids into acrylic enamel formulations enhances these properties, improving the durability and performance of the final coating.

The demand for acrylic enamel with amino acids is driven by the need for high-quality, long-lasting finishes in applications where appearance and protection are critical. In the automotive industry, acrylic enamel coatings are commonly used for vehicle exteriors and interiors due to their ability to provide a glossy, durable finish. As the automotive and industrial sectors continue to prioritize coatings that offer both aesthetic appeal and long-term protection, the demand for acrylic enamel with amino acids is expected to remain strong. This material type ensures that the coatings maintain their visual appeal while withstanding the rigors of daily use and environmental exposure.

Demand for amino acids in the USA is driven by growing interest in health and wellness, particularly within the nutrition, pharmaceutical, and animal-feed industries. Amino acids are integral to protein synthesis, and their use in dietary supplements, functional foods, and clinical nutrition continues to rise. Additionally, increased demand for animal feed supplements in the agriculture sector supports growth. However, the high cost of raw materials and competition from alternative protein sources can limit further expansion. These factors shape the overall demand for amino acids in the USA market.

Several factors support growth in amino acid demand. First, there is increasing consumer interest in health and fitness, leading to a higher demand for amino acids in dietary supplements for muscle recovery, metabolism support, and general wellness. Second, the growing use of amino acids in the animal-feed sector to enhance livestock growth, efficiency, and feed conversion drives market growth. Third, the adoption of biotechnology and fermentation processes has made amino acid production more efficient, lowering costs and ensuring steady supply. Fourth, the demand for amino acids in pharmaceutical and clinical nutrition for the treatment of metabolic disorders also contributes to their market growth.

Despite strong growth drivers, several challenges exist. The cost of raw materials, including the volatility in feedstock prices, can raise production costs and make amino acids less competitive for cost-sensitive applications. Regulatory barriers for food and pharmaceutical-grade amino acids can also delay product development and market entry. Additionally, the increasing popularity of plant-based and alternative proteins may reduce the demand for animal-derived amino acids, particularly in the food and beverage sectors. These factors create limitations to the full market potential of amino acids.

Key trends include the increasing use of amino acids in functional foods and sports nutrition, driven by growing health-consciousness among consumers. The demand for more sustainable and plant-derived amino acids is also rising, in line with the growing interest in plant-based diets and clean-label products. Another trend is the shift towards precision nutrition, where amino acids are tailored to meet specific dietary needs for improved performance and health. Finally, advances in bio-based manufacturing and fermentation technologies are improving the sustainability and scalability of amino acid production, which is likely to further support market expansion.

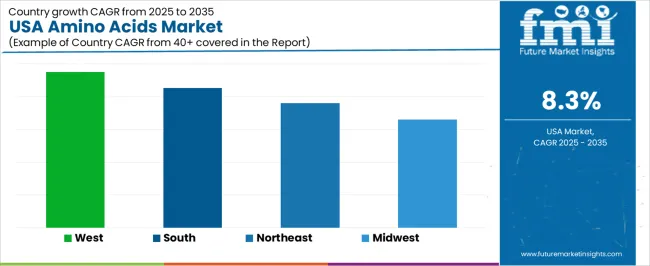

The demand for amino acids in the USA shows varying growth rates across regions, with the West leading at a CAGR of 9.5%. The South follows with a CAGR of 8.5%, driven by growth in industries such as agriculture, food processing, and pharmaceuticals. The Northeast shows steady growth at 7.6%, supported by its strong pharmaceutical and biotech sectors. The Midwest has the lowest growth rate at 6.6%, reflecting slower adoption in certain industrial applications. These regional differences reflect the varying levels of industrial activity, consumer demand, and advancements in sectors such as nutrition, healthcare, and agriculture.

| Region | CAGR (2025-2035) |

|---|---|

| West | 9.5% |

| South | 8.5% |

| Northeast | 7.6% |

| Midwest | 6.6% |

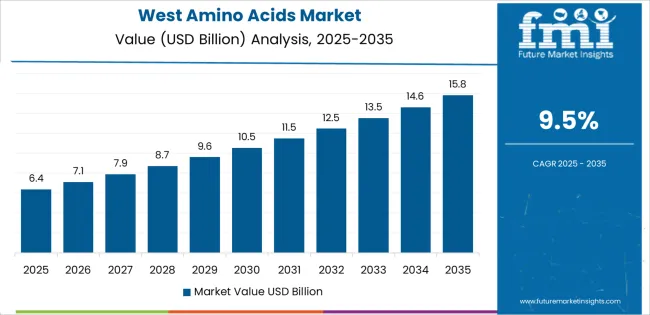

The demand for amino acids in the West is projected to grow at a CAGR of 9.5%, driven by several key factors. The West has a strong presence of industries that rely heavily on amino acids, including the agriculture, food, and pharmaceutical sectors. The region’s growing population and increasing awareness of health and wellness have led to greater demand for amino acid-based products in dietary supplements and functional foods.

Additionally, the West’s robust biotechnology and pharmaceutical industries, particularly in California, are driving the demand for amino acids used in drug development, medical treatments, and as additives in nutrition. The region’s focus on sustainable and plant-based proteins is also contributing to the growth of amino acids used in plant-based food alternatives. As a result, the West is expected to continue to lead in the demand for amino acids, particularly as consumer demand for health-focused and functional products increases.

In the South, the demand for amino acids is expected to grow at a CAGR of 8.5%, reflecting strong growth in industries such as agriculture, food processing, and pharmaceuticals. The South is home to a large agricultural sector, where amino acids are used in animal feed to improve growth, productivity, and overall animal health. The increasing focus on optimizing livestock nutrition and the rising demand for high-quality animal protein are key drivers of this market.

Additionally, the region’s expanding food processing industry is increasing its use of amino acids in flavor enhancers, preservatives, and fortification of food products. As consumer demand for protein-rich foods rises, particularly from animal and plant-based sources, the South’s demand for amino acids is expected to continue growing. The region's pharmaceutical sector, though smaller than the West, is also contributing to the demand for amino acids used in various medical applications.

In the Northeast, the demand for amino acids is projected to grow at a CAGR of 7.6%, supported by the region’s strong pharmaceutical, biotech, and food industries. The Northeast is a hub for biotechnology and pharmaceutical research, where amino acids are used in drug development, protein-based therapeutics, and as precursors in the synthesis of essential compounds for medical treatments.

Additionally, the region’s growing focus on health and wellness, particularly in major cities like New York and Boston, is driving demand for amino acids in dietary supplements, functional foods, and sports nutrition products. The Northeast’s established food manufacturing industry is also contributing to the demand for amino acids used in fortifying processed foods. As consumer preferences for health-oriented products rise, particularly those aimed at improving muscle health and overall wellness, the demand for amino acids is expected to continue increasing in the Northeast.

The demand for amino acids in the Midwest is expected to grow at a CAGR of 6.6%, reflecting slower but steady growth compared to other regions. The Midwest has a significant agricultural sector, which uses amino acids in animal feed to improve livestock nutrition and performance. However, the region’s demand for amino acids is somewhat more moderate than in the South, due to the more traditional nature of agricultural practices and slower adoption of newer feed additives.

The Midwest also has a strong food processing industry, where amino acids are used in the production of fortified foods, flavor enhancers, and meat products. While the demand for amino acids is growing, the Midwest’s relatively lower rate of industrial innovation compared to regions like the West and South results in a slower adoption of amino acid-based products. Nevertheless, as consumer demand for protein and functional foods increases, and as more agricultural producers embrace advanced feed additives, the demand for amino acids is expected to grow steadily in the Midwest.

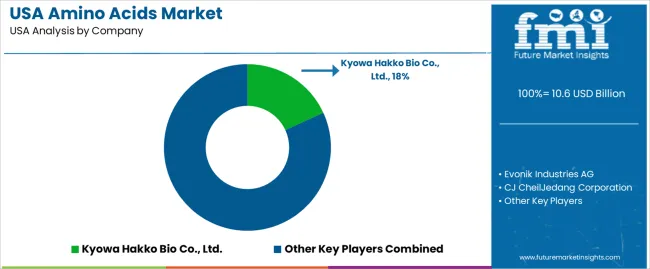

The amino acids market in the United States is growing due to increased demand from sectors such as food, dietary supplements, animal feed, and pharmaceuticals. Key players in the market include Kyowa Hakko Bio Co., Ltd. (holding about 18.2% market share), Evonik Industries AG, CJ CheilJedang Corporation, and ADM (Archer Daniels Midland). These companies supply amino acids used in various applications, including nutritional supplements, fortified foods, and animal feed additives.

Competition in this industry is driven by factors such as product purity, supply chain reliability, and versatility of applications. Leading firms focus on offering high-purity amino acids for dietary supplements and clinical nutrition, while also providing feed-grade products like lysine and methionine for livestock. Another area of competition is sustainability, with companies investing in more efficient, eco-friendly production methods, including fermentation and biotechnological processes.

As the market for sports nutrition, plant-based diets, and clean-label products continues to rise, companies are focusing on providing bio-based and non-animal-derived amino acids. To differentiate themselves, these companies emphasize features such as regulatory compliance, nutritional completeness, and consistent supply. By aligning their products with emerging consumer trends and industry demands, these firms aim to solidify their position in the USA amino acids market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Clear Coat/Topcoat, Primers, Base Coat |

| Material Type | Acrylic Enamel, Acrylic Urethane, Acrylic Lacquer, Zinc Phosphate, Epoxy |

| Key Companies Profiled | Ajinomoto Co., Inc., Kyowa Hakko Bio Co., Ltd., Evonik Industries AG, CJ CheilJedang Corporation, ADM (Archer Daniels Midland) |

| Additional Attributes | The market analysis includes dollar sales by product type, material type, and company categories. It also covers regional demand trends in the USA, driven by the increasing use of amino acids in coatings and paints for both industrial and consumer applications. The competitive landscape highlights key manufacturers focusing on amino acid-based solutions in the formulation of topcoats, primers, and base coats. Trends in the growing demand for sustainable and bio-based amino acids, as well as innovations in the development of advanced coatings for automotive, industrial, and architectural applications, are explored. |

The demand for amino acids in USA is estimated to be valued at USD 10.6 billion in 2025.

The market size for the amino acids in USA is projected to reach USD 23.5 billion by 2035.

The demand for amino acids in USA is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in amino acids in USA are clear coat/topcoat, primers and base coat.

In terms of material type, acrylic enamel segment is expected to command 35.0% share in the amino acids in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Amino Acids Market Growth - Trends & Forecast 2025 to 2035

Amino Acids Premixes Market

Food Amino Acids Market Size, Growth, and Forecast for 2025 to 2035

Feed Amino Acids Market Analysis by Product, Application, and Region through 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Branched Chain Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Demand for Acetaminophen API in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Dihydroxybenzoic Acids (DHBA) in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA