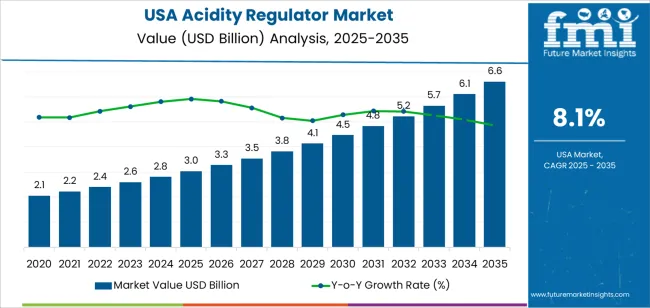

The demand for acidity regulators in the USA is projected to reach USD 6.6 billion by 2035, reflecting an absolute increase of USD 3.6 billion over the forecast period. Starting at USD 3.0 billion in 2025, the industry is expected to grow at a steady CAGR of 8.1%. Acidity regulators are crucial for controlling the pH levels in food and beverages, ensuring product stability, taste, and shelf life. These solutions are widely used in industries such as food and beverage processing, pharmaceuticals, and cosmetics, where maintaining consistent pH levels is essential to product quality and safety.

Key drivers of growth for acidity regulators include the increasing demand for processed food products and the growing consumer preference for convenience foods. There is a rise in demand for clean-label and natural food products, as consumers become more health-conscious and seek products with fewer artificial ingredients. As food safety and product quality continue to be a priority, the need for effective pH control solutions will grow, particularly as regulatory requirements become more stringent.

The increasing popularity of functional foods and beverages that offer health benefits, such as probiotics and fortified drinks, will drive the demand for acidity regulators. The ongoing trend toward healthier, safer, and more ecological food options will further contribute to the growth of this industry, making acidity regulators an essential component of modern food and beverage production.

The peak-to-trough analysis for the demand for acidity regulators in the USA highlights a steady upward trend with significant growth in the latter half of the forecast period. The trough year occurs in 2025, when demand is projected to start at USD 3.0 billion. This phase will see steady growth driven by well-established industries, such as food and beverage production, where pH control is already a standard practice. However, the industry will still be in the early stages of tapping into emerging consumer trends like clean-label products and functional foods. Demand during this period will be stable as industries gradually adopt more advanced and specialized acidity regulator solutions, influenced by product innovation and growing consumer awareness.

The peak year is anticipated to be 2035, when the demand for acidity regulators will reach USD 6.6 billion. This sharp increase will be driven by significant growth in food and beverage innovations, particularly as consumers increasingly demand healthier, functional, and natural products. Technological advancements in acidity regulator formulations, including natural and clean-label alternatives, will further propel industry growth. The growth phase from 2025 to 2030 will see moderate growth, from USD 3.0 billion to USD 3.8 billion, as the industry adapts to evolving consumer demands. From 2030 to 2035, the industry will accelerate, growing from USD 3.8 billion to USD 6.6 billion, fueled by innovations, stricter regulations, and increasing demand for healthier, high-quality food and beverage products.

| Metric | Value |

|---|---|

| Demand for Acidity Regulator in USA Value (2025) | USD 3.0 billion |

| Demand for Acidity Regulator in USA Forecast Value (2035) | USD 6.6 billion |

| Demand for Acidity Regulator in USA Forecast CAGR (2025-2035) | 8.10% |

The demand for acidity regulators in the USA is rising as food and beverage manufacturers increasingly turn to these additives to maintain product quality, enhance flavour, and extend shelf life. Acidity regulators such as citric acid, lactic acid, and phosphoric acid play a critical role in processed foods, beverages, and condiments by stabilising pH levels and preventing microbial spoilage. As consumption of convenience and packaged foods continues to grow, the reliance on acidity regulators becomes more pronounced.

Consumer trends are also shaping this growth. With heightened interest in taste, freshness, and natural‑label ingredients, manufacturers are shifting to acidity regulators derived from clean‑label sources. This shift is supported by the increasing use of functional beverages, sports drinks, and plant‑based foods, all of which often require pH‑control agents to preserve texture and safety without compromising flavour. At the same time, stringent food‑safety regulations in the USA are encouraging adoption of high‑quality acidity regulators that meet compliance standards.

Technological advances are making acidity regulators more efficient and cost‑effective. Innovations in fermentation‑based production and improved extraction processes are reducing costs and environmental impact, making them attractive for large‑scale food processing. As processors aim to reduce waste, enhance shelf stability, and respond to evolving regulations and consumer demands, the need for reliable acidity regulation continues to strengthen driving demand through 2035.

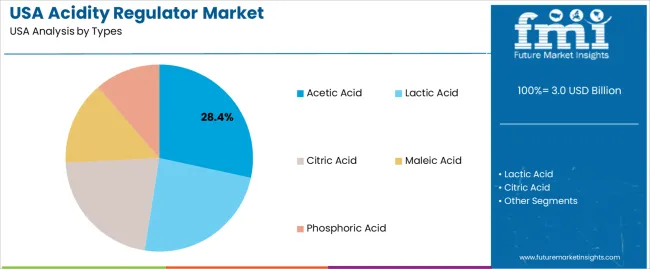

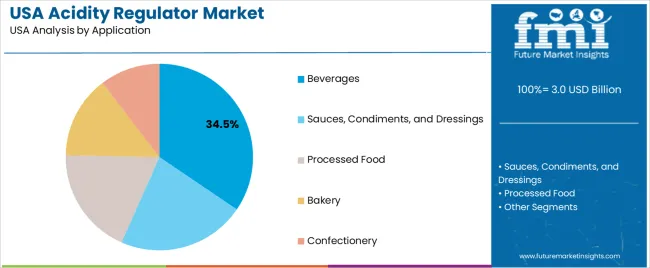

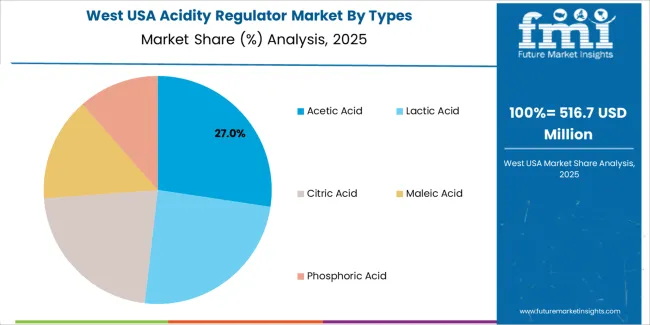

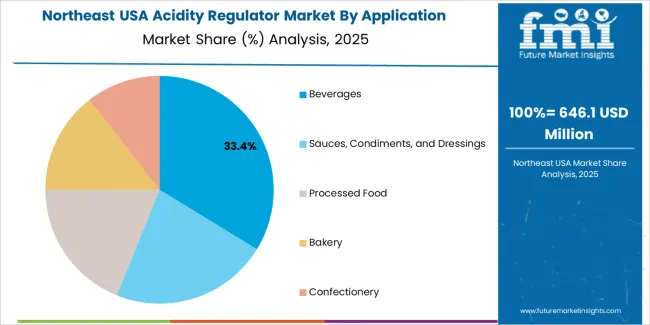

Demand for acidity regulators is segmented by type and application. By type, demand is divided into acetic acid, lactic acid, citric acid, maleic acid, and phosphoric acid, with acetic acid holding the largest share. The demand is also segmented by application, including beverages, sauces, condiments, and dressings, processed food, bakery, and confectionery, with beverages leading the demand. Regionally, demand is divided into West, South, Northeast, and Midwest.

Acetic acid accounts for 28% of the demand for acidity regulators in the USA. It is widely used for its ability to control pH levels in food and beverages, providing a tangy flavor and acting as a preservative. Acetic acid is crucial in applications like pickling, salad dressings, sauces, and beverages, where it enhances taste while maintaining product stability. It is also a key ingredient in vinegar, a staple in various food products.

The demand for acetic acid is driven by its versatility, cost-effectiveness, and extensive use in the food and beverage industry. Its role in flavor enhancement, preservation, and ensuring food safety makes it an indispensable acidity regulator. As consumer preferences shift toward more processed and packaged foods, the use of acetic acid will remain strong. It continues to dominate due to its established functionality, cost efficiency, and relevance across numerous food sectors.

Beverages account for 34.5% of the demand for acidity regulators in the USA. The use of acidity regulators in beverages is essential for maintaining the desired pH levels, enhancing flavor profiles, and prolonging shelf life. Acidity regulators like citric acid and phosphoric acid are commonly added to soft drinks, fruit juices, energy drinks, and other beverages to balance tartness and preserve product quality. The demand for acidity regulators in beverages is driven by the growing beverage industry, especially in soft drinks and juice segments, where flavor and stability are crucial.

As consumers increasingly seek refreshing, flavor-enhanced drinks, the importance of acidity regulators in maintaining these characteristics rises. The growth of functional beverages and emerging flavor trends further boosts the need for precise pH control. As the beverage industry evolves, the role of acidity regulators will remain vital, ensuring the desired taste, consistency, and shelf life of beverages.

Demand for acidity regulators in the USA is increasing as food and beverage manufacturers seek to extend shelf life, improve flavour stability, and support processed‑and ready‑to‑eat foods. These additives are used in applications such as sodas, fruit juices, sauces, condiments and baked goods. Important drivers include rising consumption of convenience foods, increased regulatory focus on food safety and microbial control, and consumer interest in "clean‑label" natural acids. Restraints include growing scrutiny of additives by health‑conscious consumers, fluctuations in raw material costs and regulatory limits on certain synthetic acidulants.

In the USA, demand for acidity regulators is increasing due to the rising production of processed and packaged foods that require pH control, preservation, and flavor stability. As busy lifestyles drive consumer preference for convenience, pre-packaged and ready-to-eat meals are becoming more popular. This leads food producers to incorporate acidity regulators to prevent spoilage, preserve texture, and extend shelf life. The beverage industry, including soft drinks, fruit juices, and functional beverages, also uses acidity regulators to balance acidity levels and maintain consistent taste profiles. As manufacturers aim to differentiate products with clean-label claims and enhanced formulations, acidity regulators are vital in delivering stable, appealing, and safe food and beverage options.

Technological innovations are fueling the growth of acidity regulators in the USA through advancements in natural and multifunctional acidulants, extraction processes, and formulation technologies that allow for lower usage while maintaining effectiveness. In response to consumer demand for clean-label products, manufacturers are producing natural acids such as citric, malic, and lactic acid from plant-based sources. Innovations in processing also enable finer control over pH levels, improve flavor profiles, and enhance shelf stability. New formulations support a broader range of applications, including bakery, confectionery, and frozen foods, driving the increased adoption of acidity regulators across various food manufacturing sectors.

Despite the growing demand for acidity regulators in the USA, several challenges hinder their widespread adoption. A major challenge is the growing consumer awareness and skepticism about food additives, which forces manufacturers to reconsider or reformulate products with fewer or more natural acidulants. Another issue is the volatility in raw material costs, especially for citrus-derived acids like citric acid, which impacts pricing and profitability. Regulatory scrutiny on permissible additive levels and their long-term safety can also slow industry growth. Reformulating products to reduce synthetic acidulants or to incorporate natural alternatives can result in higher costs and extended development timelines, slowing industry uptake.

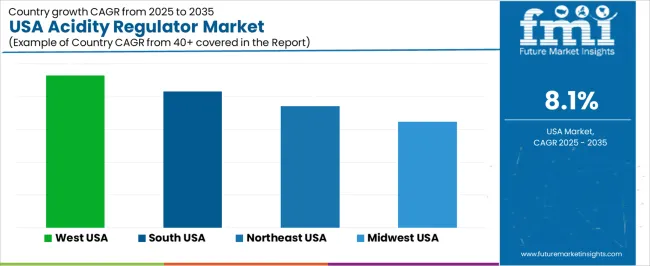

| Region | CAGR (%) |

|---|---|

| West | 9.3% |

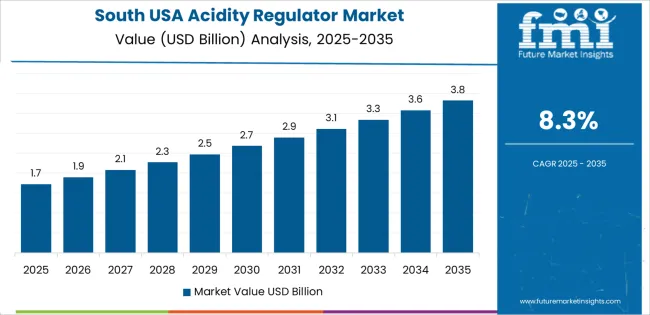

| South | 8.3% |

| Northeast | 7.4% |

| Midwest | 6.5% |

The demand for acidity regulators in the USA is growing across all regions, with the West leading at a 9.3% CAGR. This growth is driven by the increasing use of acidity regulators in the food and beverage, pharmaceuticals, and agriculture industries. The South follows with an 8.3% CAGR, supported by a large food processing and manufacturing sector. The Northeast shows a 7.4% CAGR, influenced by a strong demand for processed food and health-related products. The Midwest experiences moderate growth at 6.5%, driven by steady adoption in food production and agriculture sectors.

The West is seeing the highest demand for acidity regulators in the USA, with a 9.3% CAGR. This is primarily due to the region’s strong food and beverage manufacturing industry, particularly in states like California and Washington, where a large volume of processed food and beverage products are produced. Acidity regulators are essential for controlling pH levels in food, beverages, and processed products, ensuring quality and safety.

The West’s growing health-conscious population is driving the demand for functional food products, many of which rely on acidity regulators to maintain stability and preserve nutrients. The region’s focus on innovation in food processing and natural preservatives is further accelerating the adoption of acidity regulators. As the demand for convenient, healthy, and stable food products rises, the West is expected to continue leading the industry for acidity regulators.

The South is experiencing strong growth in demand for acidity regulators, with an 8.3% CAGR. The region’s significant food processing and agricultural industries are key drivers of this growth. States like Texas, Georgia, and Florida are major hubs for food production, where acidity regulators play an important role in ensuring the quality and shelf life of products like sauces, canned goods, and beverages.

The South’s growing manufacturing sector, including pharmaceuticals and personal care, contributes to the rising demand for acidity regulators in non-food applications. As the region continues to expand its food production capacity and adopt new preservation techniques, the need for effective acidity regulation will remain strong. With a diverse and expanding food industry, the South is expected to continue its steady growth in acidity regulator adoption, driven by both domestic demand and increasing industrial production.

The Northeast is seeing steady demand growth for acidity regulators, with a 7.4% CAGR. The region’s strong food processing industry, combined with its high concentration of health-conscious consumers, is a key factor driving this growth. Cities like New York, Boston, and Philadelphia are major centers for the food industry, where acidity regulators are used in the production of a wide range of products, from beverages to ready-to-eat meals.

The Northeast’s emphasis on functional foods and health-related products is also contributing to the increased use of acidity regulators. With growing demand for natural and stable ingredients, food manufacturers are turning to acidity regulators to help maintain product quality and enhance flavor profiles. As the region continues to innovate in food production and processing, the demand for acidity regulators will continue to grow steadily.

The Midwest is experiencing moderate growth in demand for acidity regulators, with a 6.5% CAGR. The region’s steady growth is driven by its large agricultural and food production sectors, particularly in states like Illinois, Michigan, and Ohio, where acidity regulators are essential in the production of processed foods, dairy products, and beverages.

As the Midwest continues to modernize its agricultural and food processing systems, the adoption of acidity regulators in both food and non-food applications is expected to grow. The region’s strong presence in the agricultural sector, where acidity regulation is critical for preserving the quality and safety of produce and dairy products, ensures continued demand. While growth is more moderate compared to other regions, the ongoing focus on improving food quality and shelf life will continue to support steady growth in the Midwest for acidity regulators.

The demand for acidity regulators in the United States is on a steady upward trend, driven by the robust food and beverage processing sector, growth in convenience and ready‑to‑eat product formats, and rising consumer preference for clean‑label ingredients. Acidity regulators such as citric, lactic, malic, and phosphoric acids play a pivotal role in maintaining product stability, enhancing flavor profiles, and extending shelf life. As manufacturers respond to evolving taste expectations and regulatory demands around food safety and labeling, the utilization of these ingredients continues to expand.

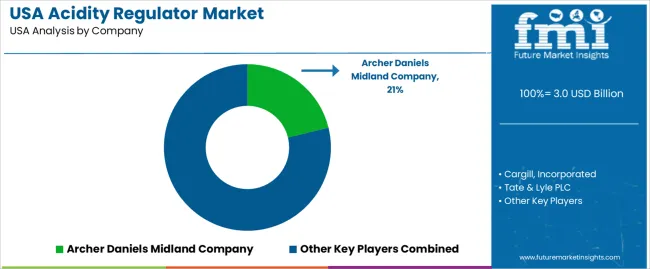

In the USA demand landscape, Archer Daniels Midland Company (ADM) holds an estimated 21.2% share, reflecting its strong supply chain and broad portfolio of acidity regulation solutions. Other key contributors include Cargill, Incorporated, Tate & Lyle PLC, Jungbunzlauer Suisse AG, and Corbion N.V., each supplying specialized acidulants and buffer systems tailored for USA formulators and processors. These companies support demand through scalable production, innovation in natural‑origin acids, and solutions that align with USA industry demands for performance and regulatory compliance.

Key factors fueling this demand include increasing production of processed foods and beverages, expansion of functional and fortified food categories, and emphasis on natural/plant‑based ingredients that meet consumer expectations. Regulatory attention on additive sourcing, food safety, and shelf‑life performance underscores the importance of high‑quality acidity regulators. Challenges such as raw material cost fluctuations, connectivity to specialized production infrastructure, and competitive pressure from alternate ingredients exist.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Types | Acetic Acid, Lactic Acid, Citric Acid, Maleic Acid, Phosphoric Acid |

| Application | Beverages, Sauces, Condiments, and Dressings, Processed Food, Bakery, Confectionery |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Archer Daniels Midland Company, Cargill, Incorporated, Tate & Lyle PLC, Jungbunzlauer Suisse AG, Corbion N.V. |

| Additional Attributes | Dollar sales are driven by key types like acetic acid, lactic acid, citric acid, and phosphoric acid, with applications spanning beverages, sauces, processed foods, bakery, and confectionery. Regional distribution covers the West, South, Northeast, and Midwest, with a strong focus on sectors like beverages, processed foods, and confectionery, where acidity regulators play a crucial role in flavor and preservation. |

The global demand for acidity regulator in USA is estimated to be valued at USD 3.0 billion in 2025.

The market size for the demand for acidity regulator in USA is projected to reach USD 6.6 billion by 2035.

The demand for acidity regulator in USA is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in demand for acidity regulator in USA are acetic acid, lactic acid, citric acid, maleic acid and phosphoric acid.

In terms of application, beverages segment to command 34.5% share in the demand for acidity regulator in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Demand for Acidity Regulator in Japan Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Regulatory Information Management Market Size and Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA