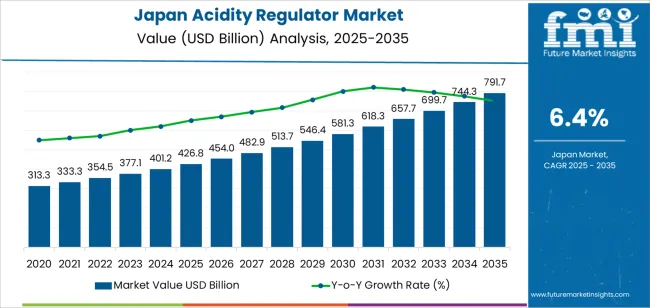

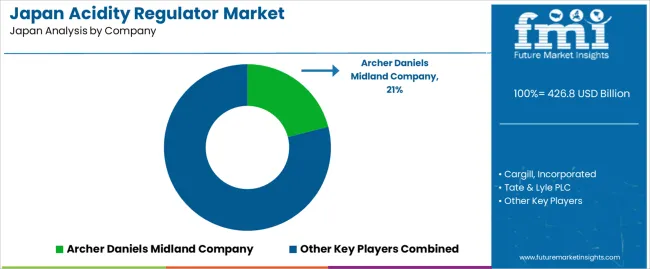

The demand for acidity regulators in Japan is valued at USD 426.8 billion in 2025 and is projected to reach USD 791.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.4%. This growth is driven by the increasing use of acidity regulators in food and beverages, pharmaceuticals, and industrial applications. As consumers increasingly demand processed foods with controlled acidity levels, the demand for these regulators continues to rise. Additionally, the growth in the pharmaceutical industry, where acidity regulators are used for pH control in medications, contributes significantly to the market's expansion. Innovations in product formulations and their application across various sectors also support the growth of this market.

The market for acidity regulators in Japan is expected to grow steadily over the forecast period, with demand rising from USD 313.3 billion in earlier years to USD 426.8 billion in 2025. The growth momentum continues, with incremental increases in demand each year, reaching USD 791.7 billion by 2035. The demand progresses from USD 454.0 billion in 2026 to USD 482.9 billion in 2027, with steady expansion throughout the period. This consistent upward trajectory reflects the increasing adoption of acidity regulators in diverse industries, driven by both consumer preferences for safe, high-quality products and technological advancements in food and pharmaceutical production processes.

Demand for acidity regulators in Japan is projected to rise from USD 426.8 billion in 2025 to USD 791.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.4%. Starting at USD 313.3 billion in 2020, the market value increases each year, reaching USD 426.8 billion in 2025 and continuing upward through USD 513.7 billion by 2029. Growth is primarily driven by the increasing demand for processed food production, as acidity regulators are essential for maintaining the stability and safety of food products. Additionally, their growing use in beverages, sauces, and other industrial applications will support continued expansion in the coming years, as manufacturers increasingly rely on these additives for pH control and preservation.

The total dollar opportunity for acidity regulators over the 2025 to 2035 period amounts to USD 364.9 billion. In the first half of the decade, from 2025 to 2030, demand is expected to increase by USD 154.5 billion, moving from USD 426.8 billion to USD 581.3 billion. The remaining growth of USD 210.4 billion will occur from 2030 to 2035, with the latter period accounting for a larger portion of the overall growth. This highlights that the most significant value creation will occur in the second half of the forecast period, driven by advancements in acidity regulation technologies and the expansion of industrial applications across various sectors, including food, beverage, and chemicals.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 426.8 billion |

| Forecast Value (2035) | USD 791.7 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The demand for acidity regulator in Japan is growing alongside the expansion of processed and convenience food segments. Many food and beverage manufacturers rely on acidity regulators to control pH levels, enhance flavor, and extend shelf life of products such as soft drinks, sauces, bakery goods and dairy items. Consumer interest in flavored beverages and ready to eat meals supports this trend. The increasing number of imported food products and domestic reformulations also contribute to demand, as regulators help manufacturers meet both quality standards and storage requirements in Japan’s varied climate.

In addition, shifting dietary preferences and food safety regulations in Japan are influencing demand for acidity regulators. Manufacturers are under pressure to optimise formulations that appeal to health aware consumers while maintaining product stability. Acidity regulators enable reduction of sodium content and may offer an alternative means of preservation, aligning with reformulation goals. At the same time, price fluctuations of raw materials and regulatory compliance costs pose constraints. Despite these challenges, the overall requirement for acidity regulators in Japan is expected to remain on an upward path as the food industry evolves.

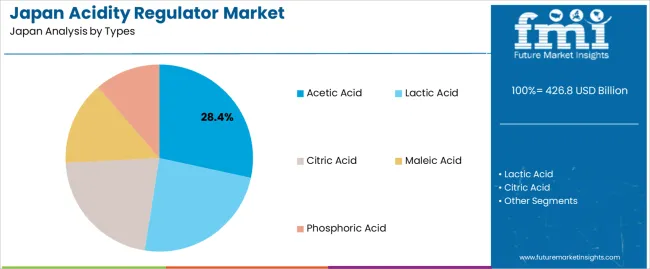

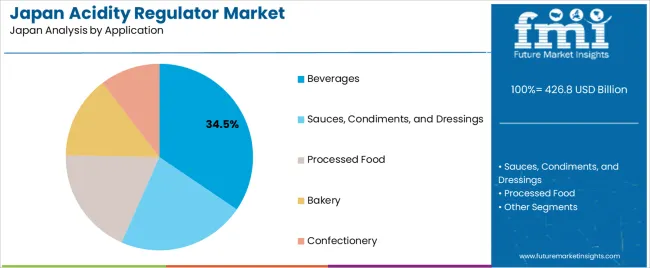

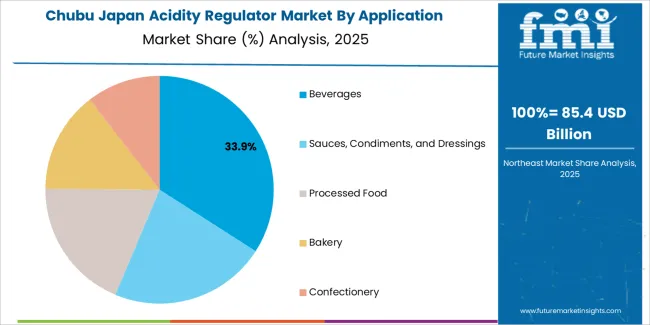

The demand for acidity regulators in Japan is influenced by the types of acids used and their applications in various food products. The main types of acidity regulators include acetic acid, lactic acid, citric acid, maleic acid, and phosphoric acid. These acids serve different functions in maintaining the desired pH levels in food and beverages, helping to preserve taste, texture, and shelf life. Applications of acidity regulators include beverages, sauces, condiments, dressings, processed food, bakery products, and confectionery, each requiring specific acidity regulation to meet consumer preferences and safety standards.

Acetic acid accounts for 28% of the total demand for acidity regulators in Japan. This high demand is driven by its widespread use in food preservation, flavor enhancement, and acidification processes. Acetic acid is commonly used in vinegar production and various pickled food products, making it an essential ingredient in the Japanese food industry. Its role in controlling the pH and preserving the freshness of food products helps extend shelf life and improve taste, driving its adoption across various applications, particularly in sauces, dressings, and beverages.

The demand for acetic acid is also supported by its versatility and cost-effectiveness. It is widely used not only in the food and beverage sectors but also in other industries such as cleaning and pharmaceuticals, contributing to its continued demand. As consumer preferences shift toward more natural and organic food products, acetic acid remains a vital component of the food industry due to its long-established role in food preservation and safety.

Beverages account for 34.5% of the total demand for acidity regulators in Japan. This segment is driven by the need for acidity regulation in the production of various beverages, including carbonated drinks, fruit juices, energy drinks, and alcoholic beverages. Acidity regulators, such as citric acid and phosphoric acid, are essential for maintaining the desired taste profile, balancing sweetness and tartness, and ensuring the stability of flavors in beverages. They also help preserve the beverages by preventing microbial growth and extending shelf life.

The demand for acidity regulators in beverages is also influenced by the growing trend toward healthier and functional drinks. As the Japanese market increasingly favors beverages with added health benefits, such as low-sugar options and fortified drinks, acidity regulators play a key role in optimizing the taste, texture, and preservation of these products. The continued growth in the non-alcoholic beverage market, along with the innovation in functional drinks, ensures the sustained demand for acidity regulators in the beverage sector.

The demand for acidity regulators in Japan is strengthening as the processed food, beverage and functional food industries expand. Japan’s advanced food processing sector, rising consumption of convenience foods and increasing interest in clean label and natural additives support growth. Meanwhile, strict regulatory oversight and high product quality expectations raise entry thresholds. Cost pressures from raw materials and the need for natural/organic alternatives present further challenges. Together these factors shape how acidity regulators are adopted across applications in Japan.

Japanese consumers are increasingly seeking products labelled as natural, minimally processed and transparent in ingredient sourcing. This shift is prompting manufacturers to replace synthetic acidity regulators with natural options such as citric acid or lactic acid. In Japan, the food additives regulatory framework requires strict compliance, which favours high purity and approved acidulants. These dynamics are driving demand for newer acidity regulator formulations that align with health conscious and premium product segments in the Japanese food and beverage industry.

An emerging opportunity lies in use of acidity regulators in Japan’s growing functional beverage and health food sectors. Products such as probiotic drinks, plant based dairy alternatives and fermented foods require pH control and flavour stability, so acidity regulators play an important role. Manufacturers able to offer specialty acidulants suited to these applications, or that carry “natural” or “clean label” credentials, may capture additional demand. Japan’s consumer trend toward wellness oriented foods supports expansion into these niche segments for acidity regulators.

Several constraints hinder broader uptake of acidity regulators in Japan. One issue is the high cost of raw materials and production for natural or specialty acidulants, which can squeeze margins. Another challenge is regulatory complexity: Japan’s positive list system for food additives and updated analysis methods impose strict compliance burdens for manufacturers and importers. Also, substitution by alternatives or consumer resistance to additives may slow adoption in certain product types. These factors together moderate growth in the acidity regulator segment.

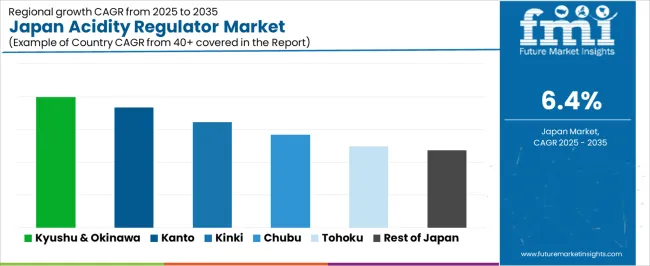

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 8.0% |

| Kanto | 7.3% |

| Kinki | 6.4% |

| Chubu | 5.7% |

| Tohoku | 5.0% |

| Rest of Japan | 4.7% |

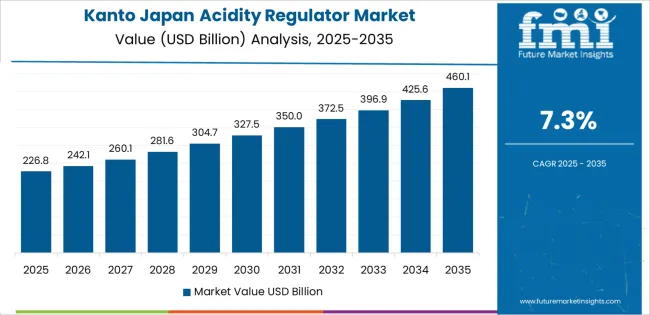

The demand for acidity regulators in Japan is growing across all regions, with Kyushu and Okinawa leading at an 8.0% CAGR. This growth is driven by increasing demand for food and beverage products that require acidity regulation for flavor and preservation, as well as expanding food processing industries. Kanto follows at 7.3%, supported by a high concentration of food manufacturers and consumers' growing interest in processed food products. Kinki records 6.4%, influenced by regional food production and industrial applications. Chubu grows at 5.7%, with demand in food production and various industries. Tohoku experiences a 5.0% increase, and the rest of Japan shows a 4.7% growth, reflecting broader use of acidity regulators across food and beverage sectors.

Kyushu & Okinawa is projected to grow at a CAGR of 8.0% through 2035 in demand for acidity regulators. The region’s food processing and beverage industries are significant drivers of growth, using acidity regulators to control pH levels in various products. The increasing demand for processed foods, beverages, and dairy products fuels the need for these regulators. Kyushu & Okinawa’s focus on enhancing food safety and product consistency, along with a growing consumer preference for naturally sourced ingredients, accelerates the adoption of acidity regulators in food manufacturing.

Kanto is projected to grow at a CAGR of 7.3% through 2035 in demand for acidity regulators. As Japan’s economic and industrial hub, Kanto, particularly Tokyo, leads in the food and beverage industry’s use of acidity regulators for food preservation and flavor control. With a diverse range of food products being produced, the region’s food manufacturing sector increasingly relies on these regulators to maintain product quality. The adoption of clean-label ingredients and natural additives further drives the demand for acidity regulators as companies seek to meet consumer expectations.

Kinki is projected to grow at a CAGR of 6.4% through 2035 in demand for acidity regulators. The region’s strong food and beverage manufacturing base, particularly in Osaka and Kyoto, drives the adoption of acidity regulators in product formulations. With rising consumer demand for processed foods, snacks, and beverages, the use of acidity regulators to enhance taste, preserve freshness, and maintain consistency has grown. Kinki’s focus on improving food safety standards and meeting consumer preferences for healthier, more natural products further supports the growth of acidity regulators in the market.

Chubu is projected to grow at a CAGR of 5.7% through 2035 in demand for acidity regulators. As the region continues to expand its food processing industry, especially in Nagoya, the use of acidity regulators in food and beverage production increases. The need for pH control in various products such as dairy, sauces, and dressings drives the market. Additionally, Chubu’s focus on improving food manufacturing processes to meet quality and safety standards further boosts the adoption of acidity regulators. The increasing trend towards natural and organic products also supports market growth.

Tohoku is projected to grow at a CAGR of 5.0% through 2035 in demand for acidity regulators. The region’s food manufacturing sector is adopting acidity regulators to enhance food preservation and quality. With an increasing focus on improving the safety and shelf life of food products, the demand for acidity regulators rises, particularly in processed foods and beverages. Tohoku’s growing consumer base, along with its shift toward healthier food options, further accelerates the need for these products. The region’s emphasis on regional food production and sustainability contributes to market growth.

The Rest of Japan is projected to grow at a CAGR of 4.7% through 2035 in demand for acidity regulators. As smaller cities and rural areas continue to adopt modern food production techniques, the need for acidity regulators in food and beverage processing increases. With rising consumer demand for processed, packaged, and ready-to-eat foods, the adoption of acidity regulators in food formulations is growing. Additionally, regional food manufacturing companies are increasingly integrating these products to improve flavor, texture, and shelf life while meeting safety and quality standards.

The demand for acidity regulators in Japan is driven by an expanding packaged food sector and growing consumer interest in clean label and functional items. Processed beverages, bakery goods and confectioneries increasingly rely on acids like citric, lactic and phosphoric to control taste, texture and shelf life. The shift in Japanese consumption patterns toward convenience and premium food products has heightened demand for additives that maintain product stability under storage and transport conditions. Regulatory oversight in Japan for food additives ensures high quality and safety standards, thereby raising industry expectations for acidity regulators that meet these criteria.

Key companies influencing the Japanese acidity regulator segment include Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle PLC, Jungbunzlauer Suisse AG and Corbion N.V. These global firms supply acidity regulator solutions both synthetic and bio derived to food and beverage manufacturers operating in Japan. Their service models emphasise compliance with Japanese food additive regulations, product traceability, and ingredient innovation to address shifting consumer tastes. By partnering with formulators in Japan, these companies help shape how acidity regulators are incorporated into new product development and supply chain strategies.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| End Use | Food and Beverages, Pharmaceuticals, Industrial |

| Types | Acetic Acid, Lactic Acid, Citric Acid, Maleic Acid, Phosphoric Acid |

| Applications | Beverages, Sauces, Condiments, and Dressings, Processed Food, Bakery, Confectionery |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle PLC, Jungbunzlauer Suisse AG, Corbion N.V. |

| Additional Attributes | Dollar by sales across product types, applications, and regional distribution; consumer trends in clean label, organic additives, and food safety; regulatory compliance requirements; impact of the growing processed food market |

The demand for acidity regulator in Japan is estimated to be valued at USD 426.8 billion in 2025.

The market size for the acidity regulator in Japan is projected to reach USD 791.7 billion by 2035.

The demand for acidity regulator in Japan is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in acidity regulator in Japan are acetic acid, lactic acid, citric acid, maleic acid and phosphoric acid.

In terms of application, beverages segment is expected to command 34.5% share in the acidity regulator in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA