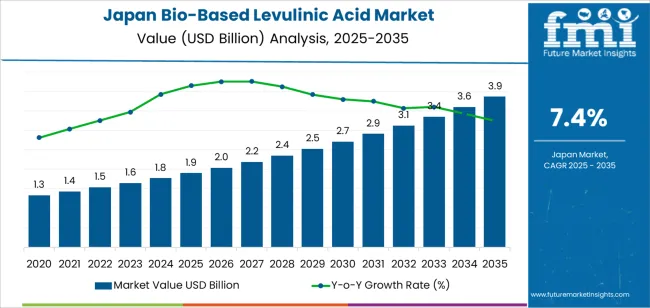

The Japan bio-based levulinic acid demand is valued at USD 1.9 billion in 2025 and is forecasted to reach USD 3.8 billion by 2035, reflecting a CAGR of 7.4%. Demand is supported by the wider shift toward renewable chemical intermediates used in polymers, plasticizers, personal-care formulations, solvents, and fuel additives. Increased interest in biomass-derived platform chemicals, supported by research activity and adoption in regulated consumer segments, contributes to steady utilization. Industrial buyers adopt levulinic-acid derivatives for applications requiring lower toxicity profiles and improved biodegradability, while supply-chain expansion among domestic distributors strengthens product availability.

Liquid levulinic acid leads the product landscape. Its selection is influenced by consistent handling properties, compatibility with downstream esterification and reduction processes, and suitability for large-scale blending. Liquid formulations are applied across fine-chemical production, agricultural formulations, resin modification, and biobased solvent systems. Kyushu & Okinawa, Kanto, and Kinki record the highest utilization levels. These regions host chemical-processing clusters, polymer-manufacturing units, and distribution hubs serving intermediate and specialty-chemical applications.

They also maintain access to research institutions and pilot-scale facilities that support the integration of biobased intermediates into industrial formulations. Key suppliers include GF Biochemicals, Thermochemical Biofuels Group, Biofine Technology LLC, Segetis Inc., and Avantium N.V. These companies provide levulinic-acid solutions used in solvents, plasticizers, resins, fuels, and value-added biobased chemicals deployed across Japan’s industrial and consumer-product sectors.

The growth-rate volatility index indicates a stable mid-range pattern with limited fluctuation across the forecast period. From 2025 to 2029, annual growth remains consistent as chemical manufacturers, polymer formulators, and solvent producers expand adoption of levulinic-acid derivatives in plasticizers, biodegradable solvents, and resin-modification applications. Demand is reinforced by corporate sustainability commitments and steady feedstock availability, resulting in controlled year-to-year variation.

Between 2030 and 2035, volatility stays restrained as utilization becomes anchored in mature downstream formulations. Growth aligns with predictable procurement cycles across personal-care ingredients, agrochemical blends, and specialty-chemical intermediates. Incremental improvements in bio-refinery yields, process-optimization technologies, and supply-chain efficiency support steady expansion without producing abrupt accelerations. Recycling integration and broader use of high-purity levulinates further stabilize adoption trends. The resulting volatility profile reflects a predictable, technology-supported trajectory in which both early and late growth phases maintain consistent annual increments, shaped by stable industrial utilization and well-established application pathways within Japan’s chemical-manufacturing ecosystem.

| Metric | Value |

|---|---|

| Japan Bio-Based Levulinic Acid Sales Value (2025) | USD 1.9 billion |

| Japan Bio-Based Levulinic Acid Forecast Value (2035) | USD 3.8 billion |

| Japan Bio-Based Levulinic Acid Forecast CAGR (2025-2035) | 7.4% |

Demand in Japan for bio-based levulinic acid is rising because industries seek renewable alternatives to conventional petrochemicals and are under pressure to meet ecofriendly goals. Levulinic acid produced from biomass serves as a platform chemical in applications including biodegradable plastics, green solvents, agrochemicals and specialty additives. Japanese makers of coatings, packaging, personal care and bioplastics see value in sourcing renewable feedstocks that help differentiate products in an industry with heightened environmental awareness.

Research institutions and corporate innovation labs in Japan are also exploring levulinic-acid derivatives, which supports early adoption. Uptake is constrained by higher cost of bio-based levulinic acid relative to petrochemical equivalents, limited production capacity and scale-up of biomass conversion technologies and the need for formulation-validation by manufacturers before large-scale use. Some companies may postpone switching until pricing, performance and supply reliability align with conventional chemicals.

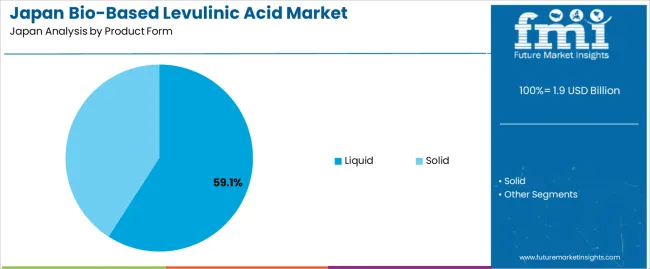

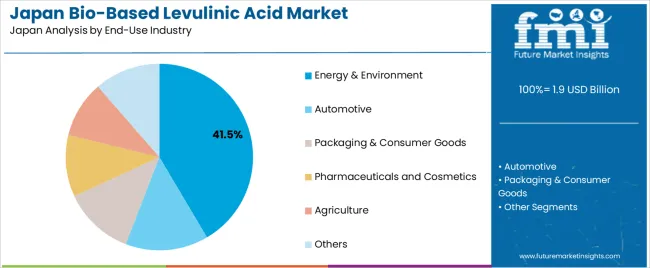

Demand for bio-based levulinic acid in Japan reflects its use as a renewable intermediate in chemical processing, polymer development, coatings, personal-care formulations, and fuel-related applications. Product-form preferences correspond to processing requirements, solubility characteristics, and compatibility with downstream reactions. End-use patterns demonstrate how Japanese industries integrate levulinic acid into value chains emphasizing sustainability, reduced petrochemical dependency, and controlled reaction performance.

Liquid levulinic acid holds 59.1% of national demand and represents the leading product form. Its solubility, processability, and ease of incorporation into chemical formulations support widespread use across energy additives, personal-care blends, and polymer-intermediate synthesis. Liquid form enables consistent mixing, controlled dosing, and efficient transport in manufacturing environments. Solid levulinic acid accounts for 40.9%, supporting applications requiring extended storage stability or controlled-release properties in specialty chemical processes. Product-form distribution reflects differences in handling needs, production methods, and end-use compatibility across Japanese processors selecting renewable intermediates based on formulation conditions and operational workflows.

Key drivers and attributes:

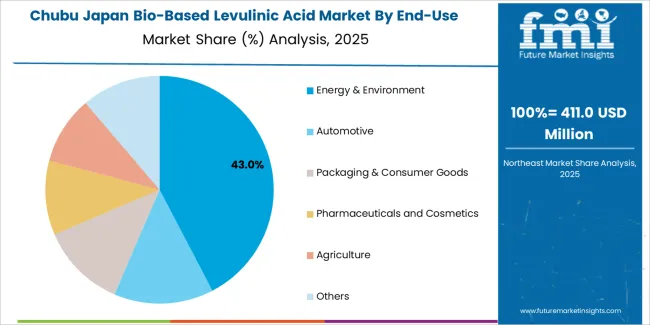

Energy and environment applications hold 41.5% of national demand and represent the dominant end-use category. Levulinic acid supports fuel-additive development, bio-derived solvent production, and environmental formulations targeting reduced emissions. Automotive applications account for 14.3%, using levulinic derivatives in lubricants and fuel-improvement systems. Packaging and consumer goods represent 12.3%, followed by pharmaceuticals and cosmetics at 10.7%, where levulinic acid supports stabilizers, antimicrobial agents, and formulation enhancers. Agriculture holds 9.8%, including crop-protection blends and controlled-release products. Other industries account for 11.4%, covering specialty chemicals and emerging applications. End-use distribution reflects material-performance needs, renewable-source preferences, and integration of bio-derived intermediates into Japanese production processes.

Key drivers and attributes:

Growth in clean-label chemicals, increasing regulation of fossil-derived feedstocks and expansion of biomass-based manufacturing are driving demand.

In Japan, demand for bio-based levulinic acid is rising as manufacturers of personal-care, speciality chemicals and coatings seek renewable alternatives to petrochemicals. As consumers demand greener products and brands adopt ecofriendly targets, levulinic acid derived from biomass offers an attractive platform chemical for plasticizers, solvents and intermediates. Japan’s advanced chemical-manufacturing ecosystem and interest in circular-economy feedstocks further strengthen uptake of bio-based levulinic acid across high-value specialty segments.

High production cost, limited domestic scale and competition from established petro-based alternatives restrain faster adoption.

Bio-based levulinic acid production is only at early commercial scale in Japan, which results in higher cost relative to established petro-derived intermediates. Domestic feed-stock availability (such as lignocellulosic residues) and conversion process investment remain constrained, which limits supply and flexibility. Some chemical users remain reluctant to switch until performance and cost parity are established, and established supply chains for petro-chemicals make substitution less urgent in certain applications. These factors moderate near-term growth in Japan’s industry.

Shift toward certified renewable-content grades, increasing integration with beauty and pharmaceutical applications and strategic partnerships between biomass suppliers and chemical firms define key trends.

In Japan, suppliers are introducing levulinic acid grades with renewable-content certification to meet demand in cosmetics, food-contact chemicals and high-purity intermediates. Growth is strong for applications that require premium or clean-label positioning in personal-care and functional materials. Strategic collaborations are forming between biomass-processors, specialty-chemical manufacturers and downstream formulators to secure feed-stocks, optimize conversion pathways and localise production. These developments support steady growth and broadened application of bio-based levulinic acid in Japan’s chemical landscape.

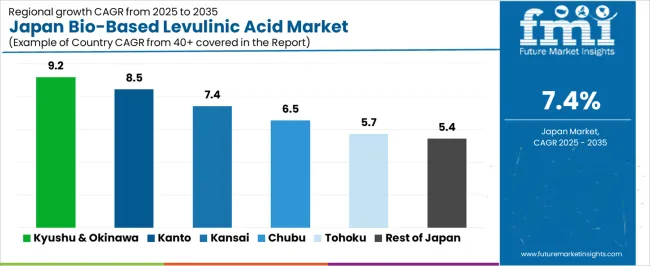

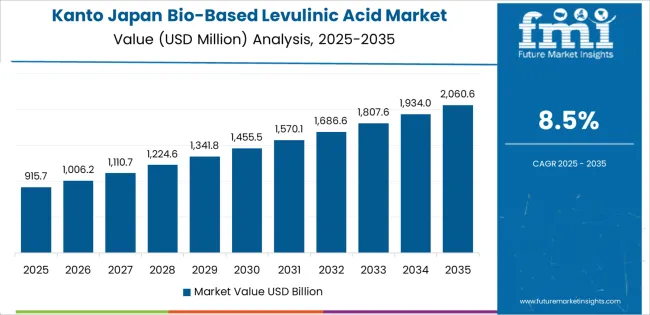

Demand for bio-based levulinic acid in Japan is increasing through 2035 as manufacturers expand the use of renewable platform chemicals across solvents, plasticizers, resins, personal-care ingredients, and biodegradable formulations. Levulinic acid’s compatibility with bio-based synthesis pathways strengthens its role in green product development for cosmetics, agrochemicals, lubricants, and specialty polymers. Rising corporate decarbonization targets, interest in biomass-derived intermediates, and broader demand for low-toxicity chemical inputs encourage long-term adoption. Regional variation reflects industrial density, chemical-processing capabilities, and readiness to transition toward renewable feedstocks. Kyushu & Okinawa leads with 9.2%, followed by Kanto (8.5%), Kinki (7.4%), Chubu (6.5%), Tohoku (5.7%), and the Rest of Japan (5.4%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 9.2% |

| Kanto | 8.5% |

| Kinki | 7.4% |

| Chubu | 6.5% |

| Tohoku | 5.7% |

| Rest of Japan | 5.4% |

Kyushu & Okinawa grows at 9.2% CAGR, supported by active chemical manufacturing, emerging biorefinery projects, and expanding cosmetics and agrochemical production across Fukuoka, Kumamoto, Oita, and Okinawa. Chemical producers incorporate bio-based levulinic acid into polymer intermediates, biodegradable plasticizers, and specialty solvents. Cosmetics manufacturers adopt levulinic-acid derivatives for skin-care emulsifiers, stabilizers, and antimicrobial systems aligned with natural-ingredient development. Agrochemical facilities integrate levulinic-acid-based inputs into controlled-release formulations and crop-protection blends. Regional interest in biomass utilization and value-added chemical production strengthens long-term adoption.

Kanto grows at 8.5% CAGR, influenced by high consumer-goods production, advanced chemical synthesis operations, and steady demand for plant-derived ingredients across Tokyo, Kanagawa, Chiba, and Saitama. Personal-care manufacturers use levulinic-acid derivatives as stabilizers and preservative alternatives in clean-label formulations. Chemical producers rely on bio-based levulinic acid for plasticizer development, solvent production, and resin-modification reactions. Food-contact material developers examine levulinic-acid-derived additives for biodegradable packaging. Research institutions explore catalytic upgrading pathways for new renewable intermediates.

Kinki grows at 7.4% CAGR, supported by diversified chemical manufacturing, cosmetics production, and polymer-materials development across Osaka, Kyoto, Hyogo, and Nara. Cosmetics companies adopt levulinic-acid derivatives in lotions, gels, and hair-care systems requiring mild, plant-derived ingredients. Polymer producers use levulinic acid in resin-modification and flexible-material applications. Industrial manufacturers integrate levulinic-acid-derived solvents into cleaning and surface-treatment processes. Local R&D groups strengthen interest in bio-based additives for specialty materials.

Chubu grows at 6.5% CAGR, shaped by industrial clusters, automotive materials development, and chemical-processing activity across Aichi, Shizuoka, and Gifu. Automotive suppliers examine levulinic-acid-derived plasticizers and resins for flexible interior components and lightweight polymer blends. Chemical manufacturers incorporate bio-based levulinic acid into solvents, intermediates, and additive packages used in coatings and adhesives. Food-packaging producers explore levulinic-acid-based biodegradable additives for moisture-resistant applications.

Tohoku grows at 5.7% CAGR, supported by regional chemical upgrading, agricultural-linked industries, and gradual adoption of renewable intermediates across Miyagi, Aomori, Iwate, and Akita. Agrochemical producers integrate levulinic-acid-derived components into formulations designed for controlled release and reduced toxicity. Food-processing and packaging firms evaluate levulinic-acid additives for biodegradable and compostable material development. Smaller chemical processors adopt levulinic-acid-based solvents and intermediates for specialty products.

The Rest of Japan grows at 5.4% CAGR, shaped by small-scale cosmetics production, emerging packaging manufacturers, and rising interest in renewable chemical inputs. Personal-care firms adopt levulinic-acid-based stabilizers and mild functional ingredients. Packaging companies integrate levulinic-acid derivatives into biodegradable material systems. Local chemical manufacturers explore renewable intermediates for specialty cleaning agents, plasticizers, and additive blends.

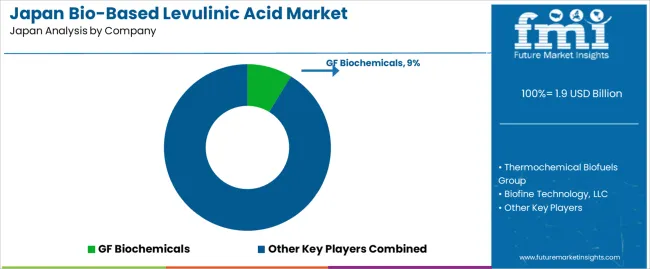

Demand for bio-based levulinic acid in Japan is shaped by a small group of renewable-chemistry developers supporting applications in solvents, plasticizers, fuel additives, personal care, and specialized industrial intermediates. GF Biochemicals holds the leading position with an estimated 8.7% share, supported by controlled catalytic-conversion processes, consistent purity levels, and long-standing investment in biomass-to-chemicals technologies. Its position is reinforced by predictable carbon-yield efficiency and reliable material stability suited to Japanese formulators seeking renewable alternatives.

Thermochemical Biofuels Group and Biofine Technology, LLC follow as significant participants. Both groups are active in hydrothermal and acid-catalysed conversion routes that deliver steady output from lignocellulosic feedstocks, supporting early-stage commercial adoption in Japan’s renewable-intermediate segment. Segetis, Inc. maintains a presence through levulinic-based derivatives used in plasticizer and polymer-additive applications, offering controlled impurity levels and consistent performance characteristics.

Avantium N.V. contributes capability through biomass-conversion expertise that provides levulinic acid suitable for downstream solvents and speciality-chemical formulations requiring stable reactivity and verifiable renewable content.

Competition across this segment centers on conversion efficiency, feedstock flexibility, catalyst durability, purification stability, and supply reliability. Demand continues to grow as Japanese manufacturers incorporate renewable-carbon intermediates into formulations requiring controlled purity, consistent reactivity, and alignment with national ecofriendly objectives.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Form | Liquid, Solid |

| End-Use Industry | Energy & Environment, Automotive, Packaging & Consumer Goods, Pharmaceuticals and Cosmetics, Agriculture, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | GF Biochemicals, Thermochemical Biofuels Group, Biofine Technology, LLC, Segetis, Inc., Avantium N.V. |

| Additional Attributes | Dollar sales by product form and end-use industries; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of bio-based levulinic acid producers; developments in biomass-to-chemical pathways, sustainable solvents and plasticizer production, and low-carbon chemical synthesis; integration with automotive materials, green packaging, pharmaceutical intermediates, cosmetics ingredients, agricultural formulations, and environmental applications across Japan. |

The demand for bio-based levulinic acid in japan is estimated to be valued at USD 1.9 billion in 2025.

The market size for the bio-based levulinic acid in japan is projected to reach USD 3.9 billion by 2035.

The demand for bio-based levulinic acid in japan is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in bio-based levulinic acid in japan are liquid and solid.

In terms of end-use industry, energy & environment segment is expected to command 41.5% share in the bio-based levulinic acid in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Adipic Acid Market Insights – Trends, Demand & Growth 2025-2035

Japan Hyaluronic Acid Products Market Analysis – Growth, Applications & Outlook 2025-2035

Bio-Based Levulinic Acid Market Growth - Trends & Forecast 2025 to 2035

Demand for Acidity Regulator in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Propylene Glycol in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in Japan Size and Share Forecast Outlook 2025 to 2035

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA