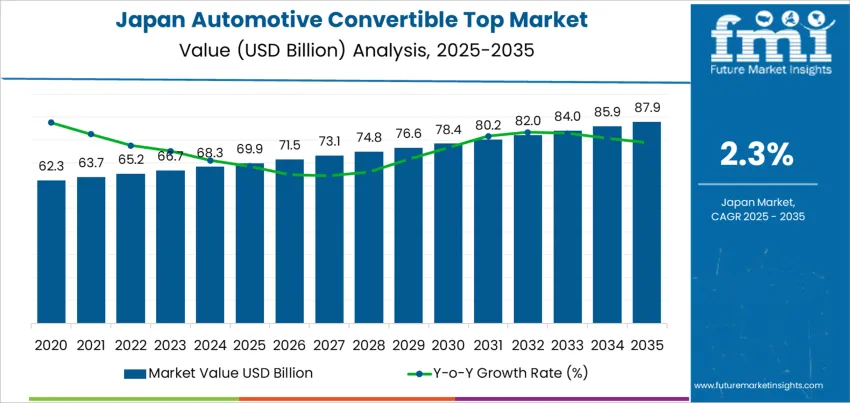

At USD 69.9 billion in 2025, the demand for automotive convertible tops in Japan is projected to advance to USD 87.9 billion by 2035 at a CAGR of 2.3%. Demand in the current decade reflects the limited but stable scale of the domestic convertible vehicle segment, which remains concentrated in premium passenger cars and niche recreational models. Japanese automakers maintain low but consistent production volumes, supported by steady domestic replacement cycles and select export programs. Fabric and multi-layer composite tops dominate installations, while hardtop systems retain a smaller share. Replacement demand plays a central role as aging vehicles undergo refurbishment through authorized service centers and specialty workshops tied to luxury vehicle ownership.

Beyond 2030, growth is shaped more by material upgrades and pricing than vehicle volume expansion. Manufacturers focus on lighter roof assemblies, improved acoustic insulation, and higher weather resistance to meet stricter quality expectations. Hybrid and electric models with convertible configurations remain limited, which restrains structural expansion of addressable demand. Key suppliers include domestic textile processors, polymer compounders, and global roof system integrators with operations in Japan. Supplier strategies emphasize long term OEM programs, localized material sourcing, and tight dimensional tolerances to meet fit and durability specifications. Aftermarket channels remain steady as convertible ownership clusters in urban and coastal prefectures where climate conditions favor seasonal open top use.

From 2020 to 2025, demand for automotive convertible tops in Japan increases from USD 62.3 billion to USD 69.9 billion, reflecting a controlled rise with annual additions staying within a tight USD 1.4 to 1.6 billion band. This phase forms the pre breakpoint structure where demand is shaped mainly by replacement cycles, limited new model launches, and a stable premium vehicle base. Convertible volumes remain structurally capped by climate conditions and urban usage patterns. Growth is steady but restrained, with no large year to year deviations. The data confirms a low volatility expansion phase with predictable ordering patterns for OEMs and tier one roof system suppliers.

The breakpoint emerges after 2028, becoming clearer between 2030 and 2035 as demand accelerates from USD 73.1 billion to USD 87.9 billion. Annual absolute additions rise progressively from about USD 1.8 billion to nearly USD 2.0 billion by the end of the period. This shift reflects structural change rather than cyclical lift, driven by broader adoption of lightweight roofing systems, higher penetration of electric convertibles, and modular roof architectures. The market transitions from replacement driven stability to feature driven value expansion. This breakpoint indicates a change in revenue density per vehicle rather than unit volume alone, raising strategic importance for material suppliers and roof system integrators.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 69.9 billion |

| Forecast Value (2035) | USD 87.9 billion |

| Forecast CAGR (2025–2035) | 2.3% |

Demand for automotive convertible tops in Japan has long been shaped by a small but stable base of lifestyle-focused vehicle buyers rather than mass passenger segments. Interest historically concentrated around compact roadsters, premium sports cars, and imported two-door convertibles that emphasize driving experience over utility. Urban ownership patterns supported this demand because short leisure trips, weekend use, and strong enthusiast communities sustained repeat purchases. A consistent share of demand also came from refurbishment rather than new vehicle sales. Japans strict inspection system, combined with humidity and UV exposure, accelerated wear of fabric roofs, seals, and folding mechanisms, keeping replacement demand active across aging convertible fleets.

Future demand in Japan will be shaped less by volume expansion and more by design relevance within evolving vehicle platforms. Electrification and hybridization will not remove the need for convertible tops but will force redesign of roof systems to match lighter vehicle structures and altered center-of-gravity requirements. Focus will increase on quieter operation, improved thermal insulation, and long-life surface coatings suited to humid climates. Convertible formats will remain concentrated in premium and enthusiast models, where emotional design still influences purchasing decisions. Replacement demand will remain steady as long as older roadsters stay in circulation and owners prioritize appearance, cabin sealing, and resale condition.

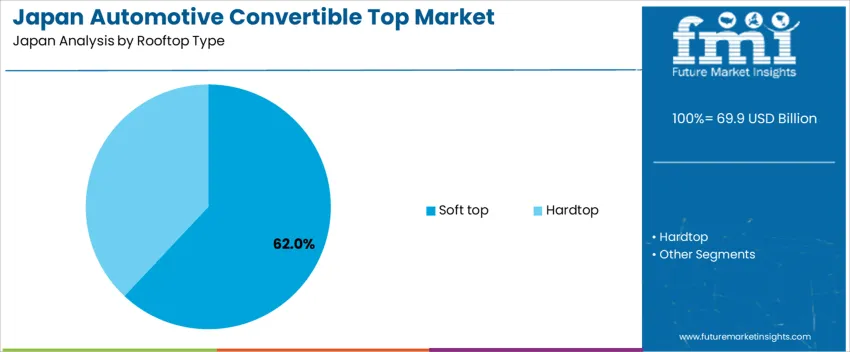

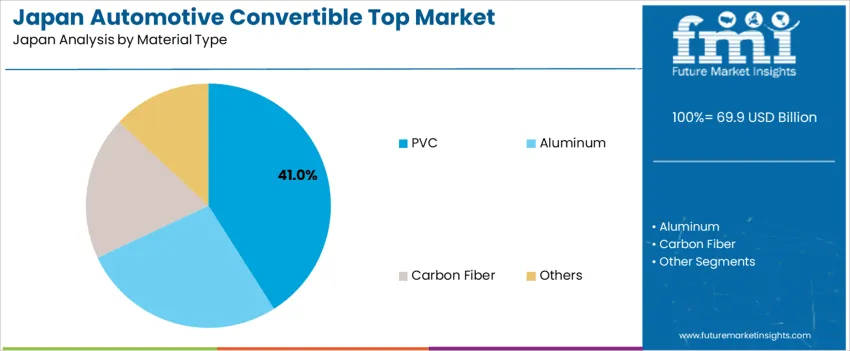

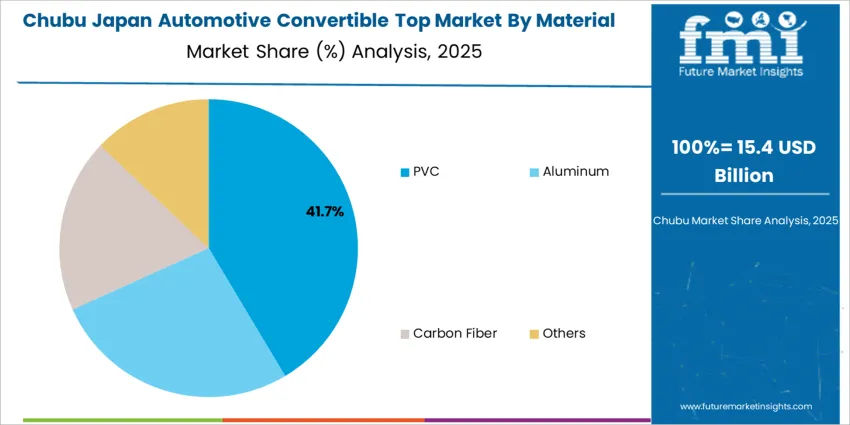

The demand for automotive convertible tops in Japan is shaped by rooftop type and material type. Soft tops account for 62% of total demand, while hardtops serve a smaller but stable niche. By material, PVC leads with a 41% share, followed by aluminum, carbon fiber, and other materials. Consumer preferences for vehicle weight, cost control, insulation performance, and styling influence rooftop selection. Material choice is guided by durability, weather resistance, acoustic performance, and production cost. These segments reflect how performance requirements and ownership patterns determine design adoption across passenger car models positioned within the domestic convertible vehicle segment.

Soft top convertible roofs account for 62% of total demand in Japan, making them the dominant rooftop type. This leadership reflects their lower weight, simpler mechanical structure, and lower production cost compared with hardtops. Soft tops allow manufacturers to reduce overall vehicle mass, supporting fuel efficiency targets and handling balance. Their compact folding mechanisms also preserve trunk space, which is valued in small and mid-size convertibles sold in Japan. Noise insulation and weather sealing standards have improved steadily, narrowing historical performance gaps between soft and hard rooftops in everyday driving conditions.

Replacement demand further supports soft top consumption as fabric materials face higher wear rates than hard panels. Exposure to sunlight, humidity, and repeated folding leads to predictable replacement cycles in ownership beyond five to seven years. Dealer service networks stock standardized fabric roof assemblies for common passenger models. Customization options tied to color and texture also contribute to aftermarket demand in urban ownership segments. These combined factors reinforce soft tops as the primary rooftop configuration across both original equipment and service markets.

PVC accounts for 41% of total material demand in automotive convertible tops in Japan. Its leading position reflects a balance between durability, flexibility, water resistance, and cost control. PVC offers consistent sealing performance under heavy rainfall and humidity, which aligns with typical operating conditions across coastal and urban regions. The material supports repeated folding without rapid surface cracking when properly treated. These functional advantages allow manufacturers to standardize PVC roofs across multiple vehicle platforms with predictable quality outcomes.

PVC also allows efficient mass production through established lamination and coating processes within domestic supply chains. Acoustic insulation properties remain sufficient for everyday passenger vehicle comfort expectations. Repair and refurbishment costs are lower for PVC compared with aluminum or carbon fiber, which supports aftermarket adoption. Dealers favor PVC for replacement work due to shorter installation times and stable material pricing. The combination of technical reliability, production scalability, and repair economics sustains PVC as the dominant material choice within the Japan convertible top supply structure.

Demand for convertible tops in Japan gains support from a niche but stable segment of buyers seeking compact luxury and lifestyle vehicles. Japanese automakers and niche importers offer convertibles to appeal to consumers desiring open-air driving in temperate climates. Affluent younger urban buyers view convertibles as status and lifestyle symbols. Low overall production volumes in Japan’s automotive industry encourage OEMs to offer limited-series or premium variants, which keeps demand for convertible roof systems alive. The presence of older sport-car models needing replacement tops also sustains aftermarket demand for convertible roofs among enthusiasts.

Japan’s dense cities and limited parking space favour smaller, sport-scar or compact convertible body styles rather than large luxury convertibles. Kei-cars and compact models seldom support convertible roofs, so demand concentrates on imported or niche domestic convertibles. Seasonal weather and occasional rainfall encourage demand for reliable, easy-to-operate convertible tops rather than permanent soft-tops. Buyers with leisure orientation appreciate open-air driving on weekends or coastal roads. These urban conditions and lifestyle preferences make convertible tops a specialized feature for select owners rather than a mass-market demand driver.

Convertible top demand in Japan remains constrained by narrow market appeal, high manufacturing cost of roof systems, and limited model availability from OEMs. Many buyers prefer traditional sedans, hatchbacks or SUVs due to practicality, fuel economy and space efficiency. Strict safety and crash-regulation standards add cost and complexity to convertible designs, which discourages automakers from expanding convertible line-ups. Aging population and declining car ownership among young households reduce long-term growth potential. These structural and demographic factors put a ceiling on widespread adoption of convertible roof systems in Japan.

In Japan there is gradual interest in higher-quality convertible roof systems using improved materials for sound insulation, weather resistance and reliability. Convertible roof suppliers offer retrofit soft-tops for older imported or domestic convertibles, often using advanced fabrics and corrosion-resistant mechanisms. Some aftermarket providers specialise in custom tops for classic European and Japanese convertibles, catering to enthusiasts. Lightweight design, ease of operation (manual or power-assisted), and improved sealing against rain and noise align with Japanese driving conditions. These technology and aftermarket trends preserve a steady albeit niche demand for convertible tops.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 2.9% |

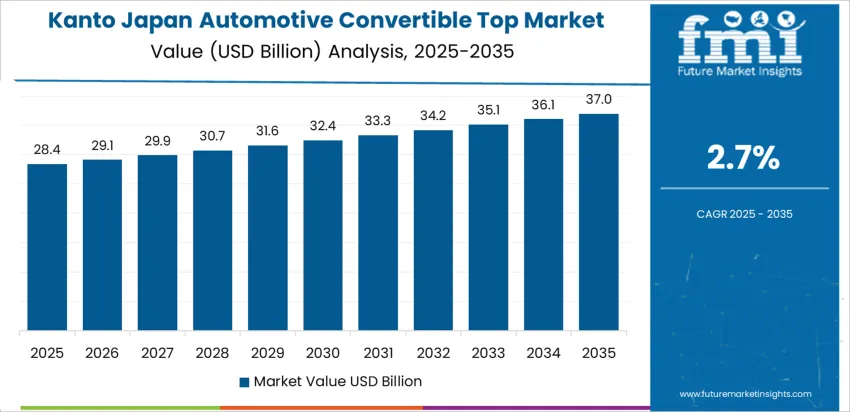

| Kanto | 2.7% |

| Kinki | 2.3% |

| Chubu | 2.1% |

| Tohoku | 1.8% |

| Rest of Japan | 1.7% |

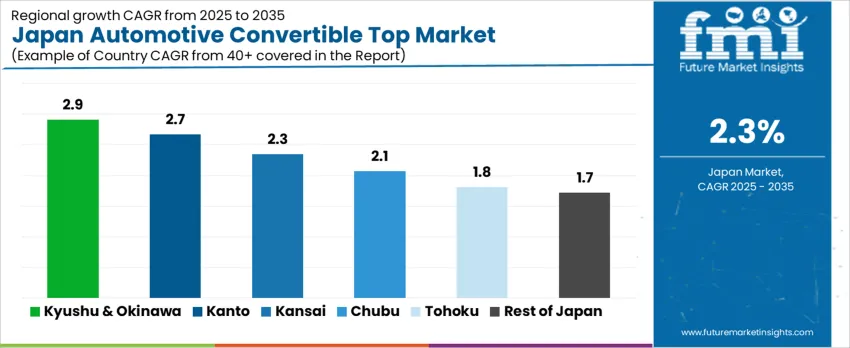

The demand for automotive convertible tops in Japan shows modest regional growth. Kyushu & Okinawa lead with a CAGR of 2.9 %, supported by niche demand among enthusiasts and limited production of convertible models. The Kanto region’s 2.7 % growth reflects steady but slow growth linked to a stable yet small convertible-car market. The Kinki region at 2.3 % and Chubu at 2.1 % show moderate demand tied to occasional orders of specialty cars. Tohoku and the Rest of Japan, at 1.8 % and 1.7 %, display lowest growth likely due to limited market size, lower consumer demand for convertibles, and higher cost of ownership. The overall pattern suggests convertibles remain a niche segment in Japan with only gradual incremental demand across regions.

Growth across Kyushu and Okinawa reflects a CAGR of 2.9% through 2035 for automotive convertible top demand, supported by niche passenger vehicle sales and replacement activity linked to tourism oriented mobility. Open roof vehicles remain limited in fleet share, yet periodic replacement cycles sustain steady aftermarket material demand. Coastal exposure increases wear on fabric and mechanical components, shortening service intervals. Import driven supply dominates due to the absence of localized convertible top manufacturing. Demand remains concentrated within premium vehicle owners, rental fleets, and specialty repair workshops serving resort and leisure focused transport corridors.

Kanto advances at a CAGR of 2.7% through 2035 for automotive convertible top demand, driven by higher luxury vehicle ownership and dense aftermarket service networks. Urban income concentration supports limited but consistent adoption of convertible models. Authorized service centers and specialty workshops manage most replacement and refurbishment activities. Demand correlates with seasonal usage rather than fleet scale. Imports dominate supply, with parts distributed through OEM aligned networks. Promotional vehicle leasing and lifestyle oriented models maintain visibility of convertibles despite low overall penetration in the broader passenger car market of the region.

Kinki records a CAGR of 2.3% through 2035 for automotive convertible top demand, shaped by limited ownership penetration and selective replacement activity. Urban vehicle usage patterns favor compact and sedans over open roof configurations. Replacement demand remains confined to private collectors and performance oriented vehicle owners. Retail distribution depends on multi brand aftermarket networks rather than dedicated OEM channels. Environmental exposure in urban traffic conditions drives gradual fabric degradation. Demand stability depends more on discretionary spending behavior than vehicle production or fleet expansion across regional transport systems.

Chubu expands at a CAGR of 2.1% through 2035 for automotive convertible top demand, influenced by balanced private vehicle ownership and controlled discretionary spending. Industrial commuting patterns favor practical body styles, constraining convertible adoption. Demand originates mainly from specialty car owners and seasonal leisure usage. Imported replacement kits dominate supply chains due to the absence of domestic convertible top fabrication at scale. Sales volumes remain low but predictable, supported by stable household income in automotive workforce communities and consistent maintenance practices across certified workshops and independent service operators.

Tohoku reflects a CAGR of 1.8% through 2035 for automotive convertible top demand, restrained by lower vehicle ownership of discretionary body styles and harsher climatic conditions. Seasonal weather shortens convertible usage periods and reduces replacement frequency. Demand is concentrated among private collectors rather than daily commuters. Service requires interregional part sourcing due to thin local inventory. Replacement intervals extend longer than in central regions. Growth remains modest as transport preferences remain utility driven, with limited lifestyle oriented vehicle penetration across rural and intercity mobility patterns.

The rest of Japan posts a CAGR of 1.7% through 2035 for automotive convertible top demand, supported by low volume replacement activity in secondary cities and rural prefectures. Ownership remains limited to enthusiasts and aging premium models. Parts supply relies on distributor networks linking metropolitan warehouses to regional workshops. Service frequency remains extended due to lower mileage accumulation. Demand stability comes from predictable refurbishment needs rather than new installations. Slow vehicle turnover and conservative purchase behavior moderate overall growth across non metropolitan passenger vehicle segments.

Demand for automotive convertible tops in Japan is supported by a niche interest in luxury and sports vehicles. Consumers value open air driving experiences and distinctive vehicle design, particularly in premium segments. Automakers incorporate convertible roof systems in selected models to cater to this demand. Advances in materials and mechanisms for both soft tops and retractable hard tops have improved durability, ease of use, and weather resistance, making convertible options more attractive. The focus on design aesthetics and performance features ensures that demand remains consistent among consumers seeking premium or lifestyle vehicles.

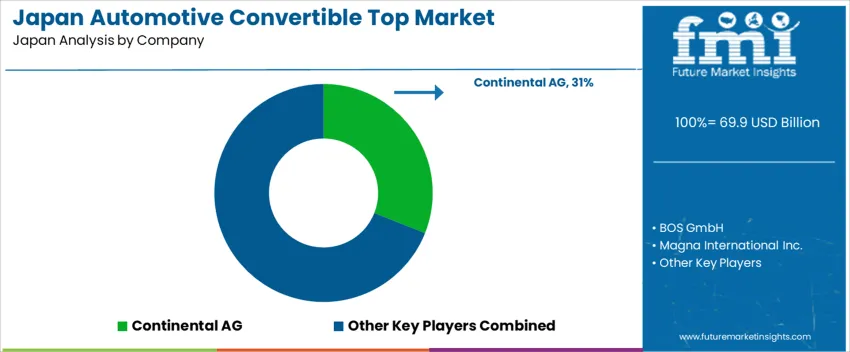

Key players shaping the convertible top market in Japan include Continental AG, BOS GmbH, Magna International Inc., Standex International Corporation, and Inalfa Roof Systems Group B.V. These companies provide roof modules, mechanisms, and assembly solutions tailored to automaker specifications. Continental and BOS GmbH focus on engineering and precision mechanisms. Magna International and Standex International supply integrated roof systems and components for high-end models. Inalfa Roof Systems offers both soft and hard convertible tops for luxury and sports vehicles. Their combined expertise and local support networks ensure the availability and quality of convertible tops in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Rooftop Type | Soft top, Hardtop |

| Material Type | PVC, Aluminum, Carbon Fiber, Others |

| Vehicle Type | Passenger Car, SUV, Sedan/Hatchback, Electric Vehicles |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Continental AG, BOS GmbH, Magna International Inc., Standex International Corporation, Inalfa Roof Systems Group B.V. |

| Additional Attributes | Dollar by sales by rooftop type, material type, and vehicle type; regional CAGR and volume projections; breakdown by soft top vs hardtop demand; PVC, aluminum, carbon fiber material share; replacement vs OEM demand; aftermarket and refurbishment trends; adoption in premium passenger and niche sports vehicles; influence of hybrid and electric vehicle adoption on roof design; climate and seasonal use effects on replacement cycles; performance requirements including weather resistance, acoustic insulation, and durability; supplier strategies for OEM programs and localized sourcing. |

The demand for automotive convertible top in Japan is estimated to be valued at USD 69.9 billion in 2025.

The market size for the automotive convertible top in Japan is projected to reach USD 87.9 billion by 2035.

The demand for automotive convertible top in Japan is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in automotive convertible top in Japan are soft top and hardtop.

In terms of material type, pvc segment is expected to command 41.0% share in the automotive convertible top in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Convertible Top Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Convertible Top in USA Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Automotive Start-Stop Battery Market Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Fabrics in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Headliner in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Racing Seats in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Spindle in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA