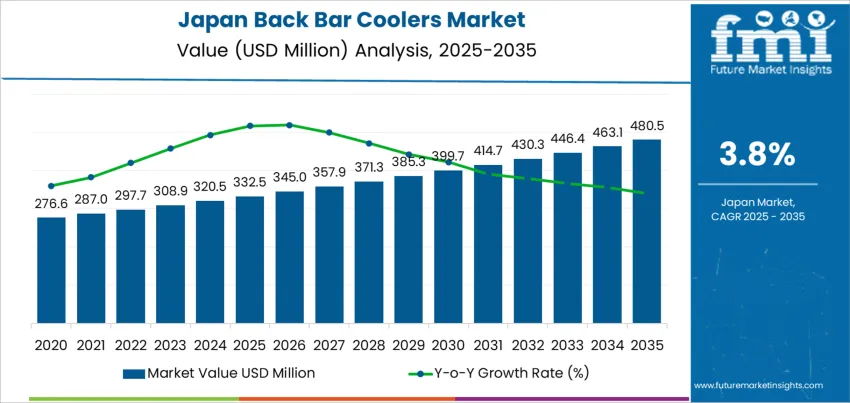

The demand for back bar coolers in Japan is expected to grow from USD 332.5 million in 2025 to USD 480.5 million by 2035, with a compound annual growth rate (CAGR) of 3.8%. Back bar coolers, which are essential for storing and displaying beverages in bars, restaurants, and cafes, are integral to the foodservice industry. As Japan’s hospitality sector continues to recover and expand, the demand for efficient, reliable, and energy-efficient back bar coolers is expected to rise steadily. The growing consumer preference for chilled beverages, particularly craft beer, wine, and soft drinks, is a key driver of this demand.

The expansion of the foodservice and hospitality sectors in Japan, especially post-pandemic, is a major driver of rising demand for back bar coolers. As bars, restaurants, and cafes seek to upgrade or expand their beverage storage systems to accommodate a growing range of drinks and customer preferences, back bar coolers are becoming essential equipment. The versatility of back bar coolers, offering both functionality and aesthetic appeal, makes them popular in establishments where presentation and customer experience are crucial.

The trend toward energy-efficient and environmentally friendly refrigeration systems is also influencing the industry. Back bar cooler manufacturers are increasingly integrating advanced technologies that minimize energy consumption, improve cooling efficiency, and reduce environmental impact. These innovations are appealing to businesses looking to cut operational costs while adhering to durability regulations and consumer demand for eco-conscious products.

From 2025 to 2030, the demand for back bar coolers in Japan is expected to grow from USD 332.5 million to USD 414.7 million, representing an increase of USD 82.2 million in value. During this period, the demand will be driven by the continued expansion of the foodservice sector, especially with the growing trend of premium, craft beverages requiring high-quality storage solutions. The increasing popularity of specialty drinks such as craft beer and chilled wines, particularly among younger consumers, will drive the need for efficient and visually appealing cooling systems. The growing focus on energy-efficient appliances in commercial establishments will continue to drive demand for back bar coolers featuring advanced energy-saving technologies.

From 2030 to 2035, demand will continue to grow from USD 414.7 million to USD 480.5 million, contributing USD 65.8 million in value. Growth during this phase will be steady, driven by the sustained expansion of Japan’s hospitality industry and the continued preference for chilled beverages. The sector will also see a focus on innovation, with businesses seeking back bar coolers that offer improved features, such as smart connectivity, enhanced temperature control, and more compact designs. While the industry growth rate may slow slightly as it matures, the demand for energy-efficient, high-performance coolers will remain strong, particularly as bars and restaurants continue to prioritize energy conservation and durability in their operations.

| Metric | Value |

|---|---|

| Demand for Back Bar Coolers in Japan Value (2025) | USD 332.5 million |

| Demand for Back Bar Coolers in Japan Forecast Value (2035) | USD 480.5 million |

| Demand for Back Bar Coolers in Japan Forecast CAGR (2025-2035) | 3.8% |

The demand for back bar coolers in Japan is growing as the hospitality and retail industries continue to expand, driven by the increasing popularity of bars, restaurants, and convenience stores that offer chilled beverages. Back bar coolers are essential for maintaining optimal temperatures for beer, wine, and soft drinks, making them a key component in establishments that serve cold beverages. The rise in consumer demand for ready-to-drink and chilled beverages is contributing to the growth of this industry in Japan.

A major driver behind this growth is the thriving foodservice industry, particularly in urban areas where the number of bars, cafes, and restaurants is increasing. These establishments require efficient and compact cooling solutions to store drinks close to serving areas for convenience and quick access. Back bar coolers provide an ideal solution for these businesses, allowing them to enhance service speed and ensure the quality of beverages.

The growing trend of convenience and premiumization in the beverage sector is driving the demand for high-quality refrigeration units. Consumers are increasingly seeking premium, chilled beverages, including craft beers, specialty wines, and high-end cocktails, which require specialized storage and refrigeration. As the demand for better beverage experiences continues to rise, back bar coolers are expected to see steady growth in Japan, with both commercial and convenience-driven factors fueling their adoption through 2035.

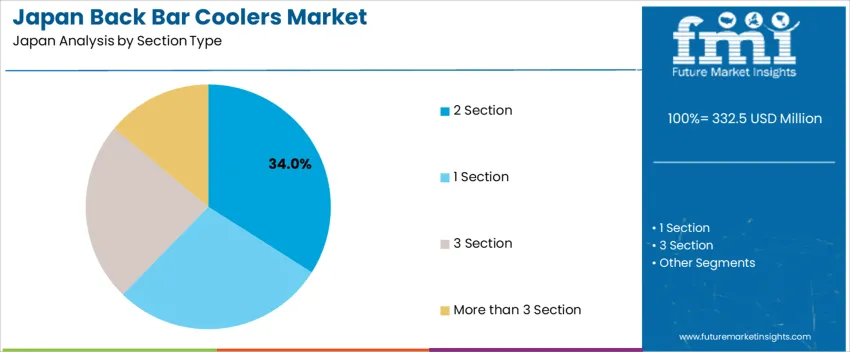

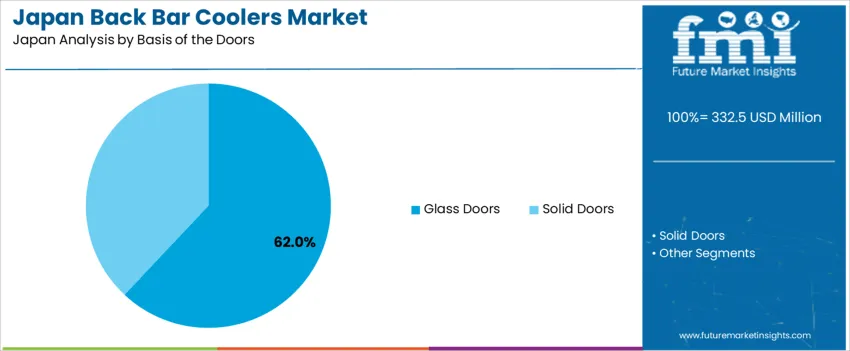

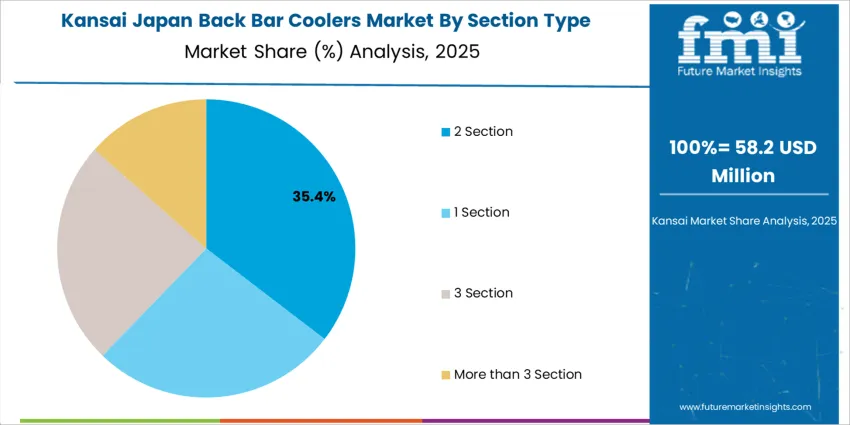

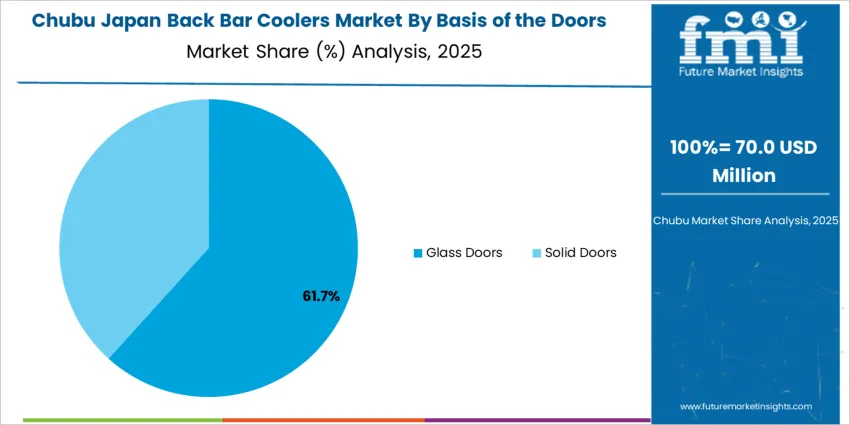

Demand for back bar coolers in Japan is segmented by section type, basis of the doors, basis of the depth, and region. By section type, demand is divided into 2-section, 1-section, 3-section, and more than 3-section coolers, with 2-section coolers leading at 34%. The demand is also segmented by the basis of the doors, including glass doors and solid doors, with glass doors holding the largest share at 62%. In terms of depth, demand is split into 26 - 29 inches, under 20 inches, 20 - 25 inches, and more than 30 inches. Regionally, demand is distributed across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the Rest of Japan.

2-section back bar coolers account for 34% of the demand in Japan, primarily due to their balanced size, capacity, and versatility. These coolers offer the ideal storage space for bars, restaurants, and cafes, where a moderate volume of chilled beverages is required for efficient service. The 2-section design allows for an organized and accessible layout, enabling bartenders to quickly access a variety of drinks while maintaining an attractive and functional display.

The moderate size also makes 2-section coolers suitable for a range of establishments, from smaller bars to medium-sized restaurants, as they can fit comfortably in different back bar configurations. As demand for convenient, high-quality refrigeration solutions grows in Japan’s vibrant foodservice sector, the 2-section cooler remains the top choice for businesses seeking a reliable and space-efficient option to store and display chilled beverages.

Glass doors account for 62% of the demand for back bar coolers in Japan, driven by their ability to showcase products while maintaining optimal temperature control. Glass doors allow customers to see the available beverages, creating an attractive and inviting display that can boost sales and promote product visibility. For businesses such as bars, cafes, and restaurants, glass-door coolers offer both functional storage and a promoting opportunity, enabling establishments to highlight their drink offerings.

Glass doors provide better visibility for staff, making it easier for bartenders and servers to quickly access and organize beverages. As Japan’s foodservice sector continues to focus on customer experience and presentation, glass-door coolers are expected to remain the dominant choice for back bar refrigeration, combining both aesthetics and efficiency in a single solution.

Demand for back bar coolers in Japan is rising as the hospitality, restaurant and bar sectors expand. Bars, pubs, izakayas, cafes, hotels and other venues serving beverages increasingly rely on back bar coolers to store and chill drinks, ensuring optimal serving temperature and freshness. Growth in demand for chilled beverages, including alcohol and non-alcoholic drinks, supports the need for efficient refrigeration solutions. The trend toward compact, space-efficient equipment and stylish, display-friendly glass-door coolers helps venues with limited space maintain optimal display and storage. On the downside, high initial cost, energy consumption, and space constraints in small or traditional establishments may restrain broader adoption.

Demand is growing because beverage-serving establishments in Japan need reliable, efficient ways to store and chill beverages immediately before serving. Back bar coolers allow bartenders and staff quick access to chilled drinks while freeing up storage space compared with traditional refrigerators. As the variety of beverage offerings expands, including craft beers, premium spirits, cocktails, soft drinks and bottled beverages, demand increases for specialized refrigeration that preserves quality and flavor. Also, growing interest in customer experience and presentation means venues prefer glass-door or display-type back bar coolers to showcase their drink selection. Small-space bars, convenience-oriented venues, and expanding nightlife culture are contributing to rising demand.

Advances in refrigeration technology are boosting demand. Modern units offer improved energy efficiency, better insulation, quieter compressors, and temperature-controlled cooling, making them more cost-effective to run and suitable for urban venues with tight space and noise constraints. Compact and modular designs enable easier installation in small bars and restaurants where space is limited.

Glass-door models with LED lighting and adjustable shelving support display and merchandising needs, making them appealing for premium beverage presentation. Some newer models also emphasize eco-friendly refrigerants and low energy consumption, aligning with tighter environmental and regulatory standards. These innovations make back bar coolers more practical, efficient, and attractive for various hospitality settings.

Several factors could limit wider adoption. High initial investment cost, particularly for premium, display-type or energy-efficient models, may deter small or budget-conscious bars and restaurants. Space constraints in older or compact establishments, common in many Japanese urban areas, may make installation difficult or impractical. Ongoing operating costs, such as electricity and maintenance, can add financial burden, especially for low-volume venues. Regulatory requirements around energy efficiency and refrigerants may limit use of some older or less-efficient models, increasing replacement cost. Finally, if beverage consumption patterns shift, such as reduced bar visits or increased home consumption, demand for commercial back bar coolers could weaken.

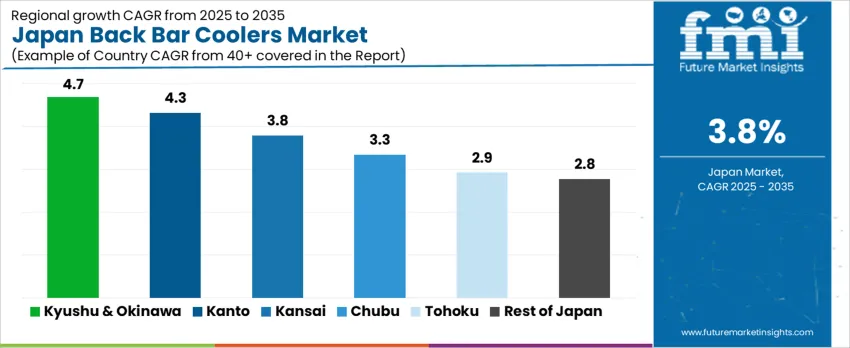

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.7% |

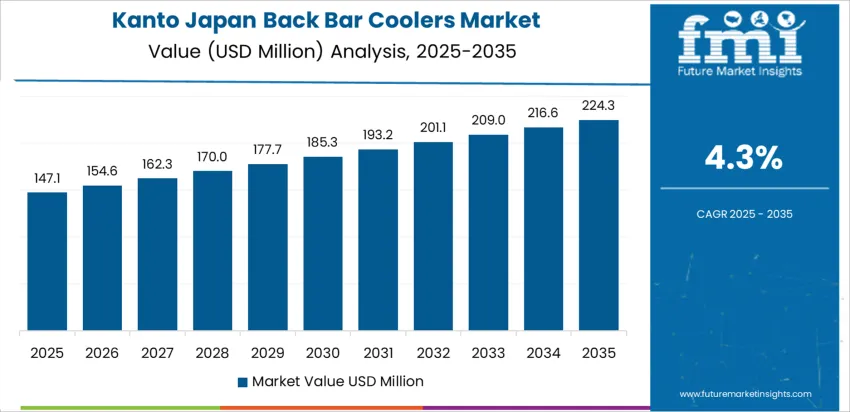

| Kanto | 4.3% |

| Kansai | 3.8% |

| Chubu | 3.3% |

| Tohoku | 2.9% |

| Rest of Japan | 2.8% |

Demand for back bar coolers in Japan is growing steadily, with Kyushu & Okinawa leading at a 4.7% CAGR, driven by the region’s growing hospitality and tourism sectors. Kanto follows with a 4.3% CAGR, supported by its large consumer base and strong hospitality industry. Kansai shows a 3.8% CAGR, fueled by its focus on tourism and high-quality beverages. Chubu experiences a 3.3% CAGR, with demand driven by its expanding hospitality industry. Tohoku and the Rest of Japan see moderate growth at 2.9% and 2.8% CAGR, respectively, with an increasing focus on local dining experiences and ecological solutions. As the hospitality sector continues to expand, demand for back bar coolers will rise steadily across Japan.

Kyushu & Okinawa leads the demand for back bar coolers, growing at a 4.7% CAGR. The region's growing hospitality and tourism sectors are driving this demand, particularly in restaurants, bars, and hotels that require efficient refrigeration solutions to store beverages and ensure product quality. Kyushu & Okinawa's expanding tourism industry, coupled with a rise in the number of dining and nightlife establishments, contributes to the increasing need for back bar coolers.

As consumer preferences shift toward high-quality, cold beverages, businesses in the hospitality industry are turning to modern refrigeration solutions. The region’s increasing focus on durability and energy-efficient cooling solutions further supports the demand for energy-efficient back bar coolers. With the continued growth of tourism and hospitality in Kyushu & Okinawa, the demand for back bar coolers is expected to remain strong.

Kanto is experiencing steady demand for back bar coolers, with a 4.3% CAGR. The region’s large concentration of bars, restaurants, and hotels, particularly in Tokyo, drives a significant portion of this demand. With the growing focus on providing high-quality beverages and enhancing the customer experience, businesses in Kanto are increasingly adopting back bar coolers to store and display drinks at optimal temperatures. The rise in consumer demand for craft cocktails, premium spirits, and cold beverages further boosts this trend.

As Kanto continues to develop its hospitality industry, the need for reliable, energy-efficient refrigeration systems grows. The increasing focus on durability and eco-friendly practices in Tokyo and its surrounding areas contributes to the rising demand for energy-efficient back bar coolers. As the hospitality sector continues to expand, demand for back bar coolers in Kanto is expected to remain strong and grow steadily.

Kansai is seeing steady demand for back bar coolers, growing at a 3.8% CAGR. The region’s thriving hospitality and tourism sectors, particularly in cities like Osaka and Kyoto, drive the adoption of refrigeration solutions for bars, restaurants, and hotels. As dining and nightlife establishments continue to increase in number, so does the need for high-quality, energy-efficient refrigeration systems like back bar coolers. Kansai’s growing consumer base and the increasing popularity of premium beverages further contribute to the demand for these coolers.

The region’s emphasis on providing top-tier service in the hospitality industry supports the need for reliable and modern refrigeration equipment. Kansai’s focus on durability and reducing energy consumption is driving the demand for energy-efficient refrigeration systems. As Kansai’s hospitality sector expands, the demand for back bar coolers is expected to rise steadily.

Chubu is experiencing steady demand for back bar coolers, with a 3.3% CAGR. The region’s growing hospitality industry, particularly in cities like Nagoya, is contributing to the rising adoption of back bar coolers in bars, restaurants, and hotels. With an increase in the number of dining and entertainment venues, the need for reliable and efficient refrigeration solutions for beverages is also growing. The rise of craft breweries, cocktail bars, and premium spirits consumption in Chubu further fuels this demand.

Chubu’s focus on energy-efficient and ecological solutions is leading businesses in the hospitality industry to adopt environmentally friendly back bar coolers. As the region’s hospitality and foodservice sectors continue to expand, the demand for back bar coolers is expected to grow steadily, ensuring consistent demand for high-quality refrigeration equipment in this sector.

Tohoku is seeing moderate demand for back bar coolers, with a 2.9% CAGR. While the region’s hospitality sector is smaller compared to other areas, the demand for refrigeration solutions is rising due to the growing number of dining establishments and bars. The region’s increasing focus on tourism and local dining experiences is contributing to the steady growth in demand for back bar coolers.

As Tohoku’s tourism industry expands and more businesses adopt modern refrigeration systems to meet consumer demand for high-quality beverages, the need for efficient and reliable cooling solutions is rising. As businesses in the region continue to embrace energy-efficient solutions, the demand for eco-friendly back bar coolers is expected to grow. With Tohoku’s ongoing emphasis on local food culture and tourism, demand for back bar coolers will continue to expand at a moderate pace.

The Rest of Japan is experiencing steady demand for back bar coolers, with a 2.8% CAGR. While demand is smaller compared to major urban regions, the growing adoption of modern refrigeration systems in rural areas and smaller cities is contributing to the increase. The rise of local dining establishments, cafes, and bars in suburban areas is driving the need for efficient refrigeration solutions to store and display beverages. The ongoing focus on durability and reducing energy consumption also contributes to the steady growth of demand for energy-efficient back bar coolers. As businesses in rural and suburban regions continue to modernize and prioritize customer service, the demand for reliable, high-performance back bar coolers will continue to rise at a steady pace.

The demand for back bar coolers in Japan is rising as bars, restaurants, cafés, and convenience-store beverage counters increasingly seek efficient refrigeration solutions. Tight urban spaces and high real-estate costs create a need for compact, space-saving refrigeration units that can store and chill drinks without occupying large floor areas. As consumer interest in craft beers, cocktails, pre-mixed drinks, and cold-served beverages grows, businesses require reliable storage that ensures optimal serving temperatures and preserves product quality.

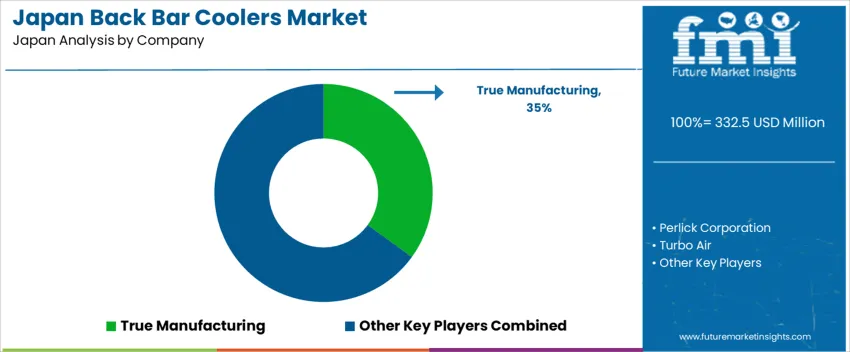

Leading companies supplying back bar coolers in Japan include True Manufacturing, Perlick Corporation, Turbo Air, Hoshizaki Corporation, and Avantco Refrigeration. True Manufacturing holds an estimated share of 35.0%, offering premium back bar coolers with strong cooling performance, modern design, and energy-efficient systems. Perlick Corporation and Turbo Air also provide robust solutions Perlick focusing on customizable, high-capacity coolers ideal for busy bars, while Turbo Air emphasizes efficiency and reliability for restaurants and cafés. Hoshizaki Corporation supplies durable under-counter and back bar refrigeration units suited to the requirements of Japanese hospitality venues. Avantco Refrigeration offers value-oriented options targeted at smaller or budget-conscious establishments.

Growth in this sector is driven by increasing beverage consumption outside the home, expansion of small-to-medium bars and eateries, and rising demand for compact, efficient refrigeration to match limited floor space in Japanese urban settings. Energy efficiency and compliance with environmental regulations push operators toward newer models with better insulation, eco-friendly refrigerants, and lower power consumption. Innovation in design such as glass-door display units, adjustable shelving, and compact footprints enhances appeal for establishments aiming for both functionality and customer attraction. As the hospitality and food-service sectors continue to expand, providers that combine space-efficient design, reliable performance, and energy-efficient technology are likely to lead the Japanese back bar cooler industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Section Type | 2 Section, 1 Section, 3 Section, More than 3 Section |

| Basis of the Doors | Glass Doors, Solid Doors |

| Basis of the Depth | 26 - 29”, Under 20”, 20 - 25”, >30” |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | True Manufacturing, Perlick Corporation, Turbo Air, Hoshizaki Corporation, Avantco Refrigeration |

| Additional Attributes | Dollar sales by section type, door basis, and depth; regional CAGR and adoption trends; demand trends in back bar coolers; growth in commercial use of refrigeration; vendor offerings in cooler solutions; space optimization features and energy efficiency trends; regulatory influences and industry standards |

The demand for back bar coolers in Japan is estimated to be valued at USD 332.5 million in 2025.

The market size for the back bar coolers in Japan is projected to reach USD 480.5 million by 2035.

The demand for back bar coolers in Japan is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in back bar coolers in Japan are 2 section, 1 section, 3 section and more than 3 section.

In terms of basis of the doors, glass doors segment is expected to command 62.0% share in the back bar coolers in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Back Bar Coolers Market Analysis - Demand & Growth Forecast 2025 to 2035

Demand for Back Bar Coolers in USA Size and Share Forecast Outlook 2025 to 2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barcode Printer Market Growth – Innovations, Trends & Forecast 2025-2035

Demand for Snack Bars in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Demand for Minibar Refrigerator in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Barcode Printers and Consumables in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Light Bars in Japan Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Backside Power Supply Network (BSPDN) Technology Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Barrier System Market Forecast Outlook 2025 to 2035

Bariatric Surgery Device Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA