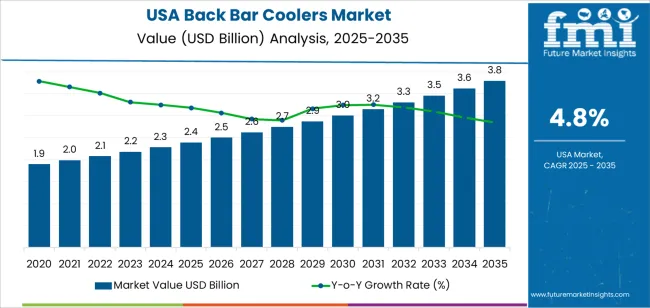

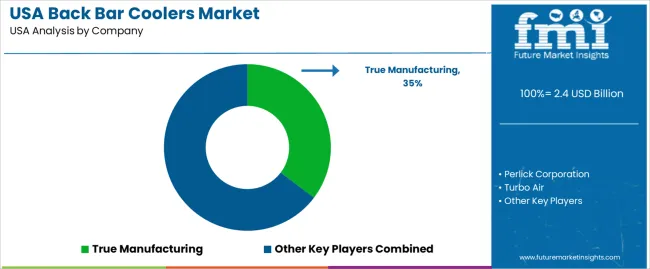

Back bar cooler demand in the USA is estimated at USD 2.4 billion in 2025 and is projected to reach USD 3.8 billion by 2035 at a CAGR of 4.8%. Early growth is tied to steady expansion of licensed on-premise locations such as bars, hotels, casual dining chains, and entertainment venues rather than rapid outlet proliferation. Replacement demand forms a large share of sales as operators rotate aging refrigeration units to meet energy performance and reliability expectations. Glass-door coolers dominate installations for visibility of bottled beer, spirits, and mixers, while undercounter formats support space-constrained urban outlets. Demand is strongest in metropolitan hospitality hubs across the Sun Belt, Midwest, and coastal tourism markets where beverage throughput remains high across the year.

After 2030, value growth is shaped more by equipment specification and pricing than by outlet count expansion. Demand rises from about USD 3.0 billion in 2030 toward USD 3.8 billion by 2035 as operators favor multi-zone temperature control, higher compressor efficiency, and quieter operation in premium venues. Craft beer rotations, ready-to-drink cocktails, and non-alcoholic beverage programs increase cooler stocking complexity and raise average unit value. Chain standardization programs drive bulk procurement of uniform models across franchise networks. Distribution remains centered on foodservice equipment dealers and national supply groups, while aftermarket service contracts contribute a growing share of recurring revenue as operators prioritize uptime and predictive maintenance across multi-unit portfolios.

Back bar coolers reflect the operational heartbeat of bars, restaurants, hotels, and entertainment venues, making their demand closely tied to on-premise beverage traffic and outlet density rather than retail appliance cycles. Demand in USA increases from USD 2.4 billion in 2025 to USD 3.0 billion by 2030, adding USD 0.6 billion in absolute value. This phase reflects steady reopening and refurbishment of hospitality venues, menu expansion in craft beverages, and replacement of aging refrigeration assets with energy-efficient display units. Growth is also supported by rising installations in fast-casual dining and experiential food venues where visual merchandising of beverages directly influences sales throughput and inventory rotation.

From 2030 to 2035, the market expands from USD 3.0 billion to USD 3.8 billion, adding a larger USD 0.8 billion within five years. This back-weighted acceleration reflects higher equipment density per outlet, premiumization of stainless steel and glass-door display coolers, and deeper penetration into compact urban venues with space-efficient refrigeration layouts. Smart temperature control, remote monitoring, and energy compliance upgrades raise value per unit. As beverage menus diversify across alcohol, functional drinks, and cold brew formats, back bar coolers evolve from storage equipment into active revenue-generating display infrastructure, pushing demand growth beyond simple outlet count expansion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 2.4 billion |

| Forecast Value (2035) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

Demand for back bar coolers in the USA has grown alongside expansion of bars, convenience stores, quick-service restaurants, and small retail outlets. Historically, as beverage variety increased and cold-serve demand rose, establishments replaced basic refrigerated storage with dedicated back bar coolers to store bottled drinks, mixers, and perishable ingredients in easy-access display units. The shift from storing products in general-purpose walk-in coolers or kitchen refrigerators to dedicated back-bar storage helped improve beverage service speeds, maintain temperature consistency, and support inventory organisation. Adoption was strongest among independent bars, small chains, convenience stores, and take-out restaurants operating with limited space and needing compact, self-contained cooler units.

Looking ahead, future demand will be shaped by evolving beverage trends, retail convenience, and foodservice operational needs rather than simple outlet count growth. Growth in craft beverages, ready-to-drink cocktails, specialty soft drinks, and cold-serve coffee will raise demand for display-oriented coolers with adjustable shelving, LED lighting, and energy-efficient compressors. Store-in-store concepts, micro-markets in workplaces, and grab-and-go retail formats will use back bar coolers as convenient cold-storage solutions. Barriers include rising energy cost, tightening efficiency regulations, and competition from multi-purpose refrigeration units that combine storage and display. Market evolution will depend on how well cooler designs balance size, energy efficiency, visibility, and ease of maintenance to meet shifting foodservice and retail dynamics.

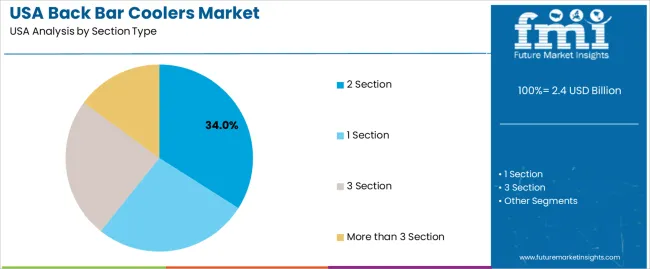

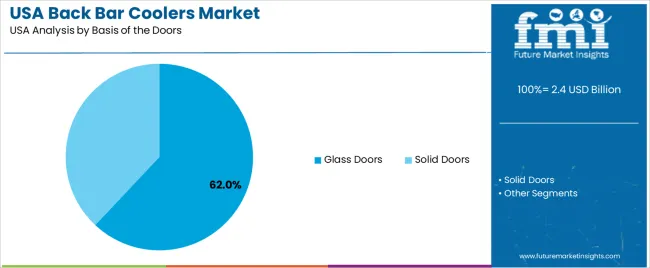

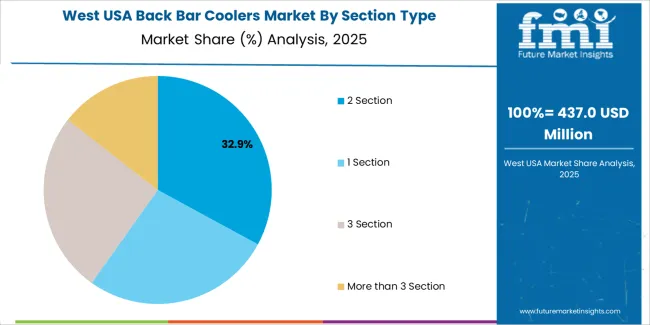

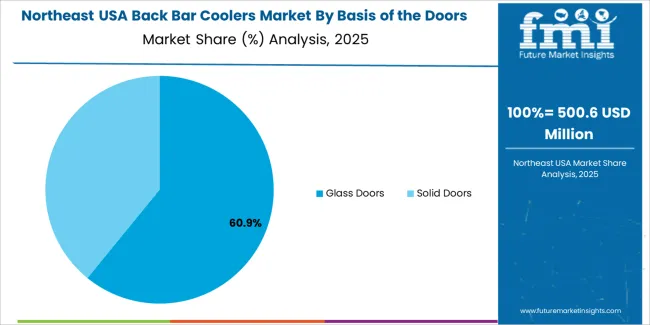

The demand for back bar coolers in the USA is structured by section type and door configuration. Two section units account for 34% of total demand, followed by one section, three section, and more than three section models used across bars, restaurants, hotels, and convenience outlets. By door basis, glass door units represent 62.0% of total consumption, while solid door variants serve restricted storage and back of house needs. Demand behavior is shaped by beverage display requirements, space availability, product visibility needs, cooling efficiency, and service workflow design. These segments reflect how outlet size, beverage turnover, and merchandising strategies guide equipment selection across on premise food and beverage establishments in the USA.

Two section back bar coolers account for 34% of total demand in the USA due to their balance between storage capacity and space efficiency. These models provide sufficient volume to store multiple beverage categories while maintaining a compact footprint suited for standard bar counters and undercounter installations. Two section units support organized separation of bottled beer, canned beverages, mixers, and chilled ingredients without overextending refrigeration load requirements. This balance makes them suitable for mid sized bars, casual dining outlets, and hotel lounges that require steady beverage rotation without excessive inventory buildup.

Two section coolers also align well with standardized installation layouts in franchised restaurant chains and hospitality outlets. Power consumption stays within manageable operating thresholds while providing adequate cooling recovery during peak service hours. Maintenance access and component replacement remain simpler than larger multi section units. These spatial efficiency, capacity balance, and operational control factors sustain two section back bar coolers as the leading section type across the USA hospitality equipment demand structure.

Glass doors account for 62.0% of total back bar cooler demand in the USA due to their strong role in product visibility and impulse driven beverage sales. Glass doors allow customers and staff to view inventory without opening the unit, which reduces cold air loss and supports faster service during peak hours. Beverage brands benefit from direct visual exposure through illuminated glass displays, which encourages upselling and premium product selection in bars and restaurants. These visual merchandising advantages directly influence purchasing behavior at the point of service.

Glass door units also support faster restocking verification and improved inventory control without disrupting cooling performance. Advanced insulated glass designs now provide improved thermal retention while maintaining display clarity. LED lighting integration further enhances brand presentation while minimizing energy load. Hospitality operators favor glass models for front of house installations where appearance influences customer perception. These merchandising, efficiency, and service speed benefits position glass doors as the dominant door type in the USA back bar cooler demand landscape.

Back bar coolers in the USA are no longer treated as basic cold storage units but as revenue-facing display infrastructure. Bars, taverns, breweries, casinos, and hotel lounges rely on visual merchandising of bottled beer, spirits, and ready-to-drink beverages to stimulate impulse ordering. Transparent doors, interior lighting, and brand-facing layouts directly influence drink selection behavior at the point of sale. Rising competition among on-premise venues pushes operators to maximize sales per linear foot of bar space. This commercial pressure shifts back bar coolers from utility equipment into sales-optimization assets.

How Do Beverage Portfolio Expansion and Service Speed Shape Cooler Specifications?

USA beverage menus now carry far more stock-keeping units than in prior years, including craft beers, flavored seltzers, canned cocktails, and premium mixers. This diversification increases the need for multi-zone temperature control, adjustable shelving, and rapid restocking access. High-volume service during sporting events and nightlife hours demands fast door recovery and reliable compressor performance under repeated openings. Draft beer support equipment often sits adjacent to back bar coolers, concentrating thermal load. These service-speed and portfolio-expansion dynamics directly shape capacity sizing, airflow design, and temperature stability requirements.

What Capital, Energy, and Installation Constraints Limit Broader Market Expansion?

Back bar cooler adoption in the USA is constrained by upfront equipment cost, electrical load limitations, and retrofit complexity in older hospitality venues. Many legacy bars operate with outdated wiring that cannot easily support modern energy-efficient compressors. Space restrictions behind tightly built bars limit depth and ventilation clearance options. Energy consumption scrutiny also influences purchasing decisions as operators face rising utility rates. Independent bars and seasonal venues defer upgrades due to uncertain cash flow. These physical, financial, and infrastructure constraints slow conversion from aging refrigeration stock despite clear performance advantages.

How Are Energy Management, Aesthetic Design, and Multi-Functionality Redefining the Market?

Back bar coolers in the USA are shifting toward low-noise, variable-speed compressor systems that adapt to traffic intensity across service hours. Black stainless finishes, frameless glass, and custom lighting align cooler aesthetics with venue branding rather than generic appliance appearance. Dual-temperature zones now allow beer and wine storage in a single chassis. Smart controllers with remote diagnostics support preventive maintenance. Some models integrate under-counter refrigeration and display functions in one platform. These shifts signal that back bar coolers are evolving into design-integrated, digitally managed beverage presentation systems.

| Region | CAGR (%) |

|---|---|

| West | 5.5% |

| South | 4.9% |

| Northeast | 4.4% |

| Midwest | 3.8% |

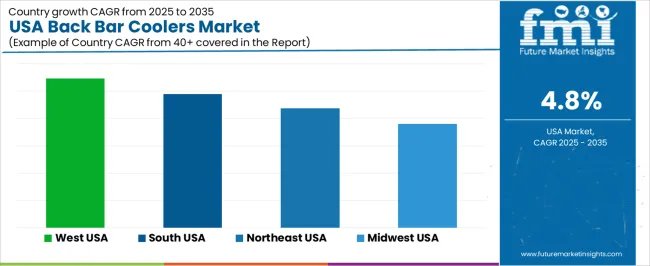

The demand for back bar coolers in the USA is growing steadily across regions, with the West leading at a 5.5% CAGR. Growth in this region is supported by a high concentration of restaurants, bars, breweries, and hospitality venues, along with ongoing refurbishment of foodservice outlets. The South follows at 4.9%, driven by expansion of casual dining chains, rising tourism activity, and steady growth in beverage service formats. The Northeast records 4.4% growth, supported by dense urban hospitality infrastructure and consistent replacement demand from legacy establishments. The Midwest shows comparatively moderate growth at 3.8%, reflecting slower growth in new hospitality outlets and stable demand from existing foodservice operations with longer replacement cycles.

Growth in the West reflects a CAGR of 5.5% through 2035 for back bar cooler demand, supported by dense hospitality activity, premium beverage service, and high tourism traffic across coastal metros. Craft cocktail bars, brewpubs, and hotel lounges maintain steady equipment replacement cycles. Outdoor dining culture increases demand for compact, visually integrated cooling systems. Energy efficiency standards also influence upgrade decisions among operators. Demand remains driven by renovation activity and new outlet openings rather than unit expansion at existing locations. Purchasing decisions emphasize display visibility, temperature stability, and space efficient cabinet formats.

The South advances at a CAGR of 4.9% through 2035 for back bar cooler demand, driven by casual dining growth, sports bar expansion, and suburban restaurant development. Warm climate supports year round cold beverage consumption across indoor and patio service areas. Franchise restaurants and chain bars dominate volume purchases through standardized equipment programs. New outlet development contributes more to demand than replacement activity. Demand remains volume oriented, with operators favoring durable units that support continuous service during peak hours across high traffic foodservice corridors.

The Northeast records a CAGR of 4.4% through 2035 for back bar cooler demand, shaped by dense urban bar networks, premium restaurant concepts, and strong seasonal beverage sales. Limited floor space favors undercounter and narrow footprint cooler designs. Cold season indoor dining concentrates sales into smaller spaces with high equipment utilization. Replacement demand remains steady due to heavy daily USAge. Demand remains renovation driven rather than new venue driven, with operators prioritizing reliable cooling, noise control, and compact glass door display formats.

The Midwest expands at a CAGR of 3.8% through 2035 for back bar cooler demand, supported by stable bar and grille establishments, community dining venues, and regional brewery taprooms. Demand centers on replacement rather than expansion due to slower new outlet formation. Independent operators dominate purchases and show strong price sensitivity. Equipment selection prioritizes rugged build quality and simple maintenance. Demand remains predictable and predictable service driven, aligned with steady local dining traffic rather than high tourism or rapid hospitality infrastructure growth.

Demand for back bar coolers in the USA is rising as bars, restaurants, cafes, and hospitality venues expand in number and invest in beverage service infrastructure. Growing interest in craft beers, cocktails, and specialty beverages pushes establishments to adopt dedicated refrigeration solutions that maintain optimal serving temperatures, preserve beverage quality, and support quick drink service during peak hours. Space constraints in urban and suburban venues encourage use of slim, under counter or compact back bar refrigeration units. Rising energy costs and regulatory pressure also encourage operators to favor energy efficient coolers with improved insulation, efficient compressors, and low maintenance needs.

Major suppliers in the USA back bar cooler segment include True Manufacturing, Perlick Corporation, Turbo Air, Hoshizaki Corporation, and Avantco Refrigeration. True Manufacturing leads the premium segment, offering customizable coolers with glass door visibility and robust temperature control. Perlick specializes in commercial grade under bar refrigeration systems preferred by cocktail bars and restaurants. Turbo Air provides energy efficient and space optimized units suited to mid sized establishments. Hoshizaki focuses on durable stainless steel coolers with reliable cooling for high traffic venues. Avantco serves budget conscious customers with compact, cost effective coolers. These firms compete on reliability, energy performance, design flexibility, and after sales service to meet the varied needs of USA food service and hospitality operators.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Section Type | 2 Section, 1 Section, 3 Section, More than 3 Section |

| Basis of the Doors | Glass Doors, Solid Doors |

| Basis of the Depth | 26–29”, Under 20”, 20–25” |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | True Manufacturing, Perlick Corporation, Turbo Air, Hoshizaki Corporation, Avantco Refrigeration |

| Additional Attributes | Dollar by sales by section type, Dollar by sales by door basis, Dollar by sales by depth, Dollar by sales by region, Regional CAGR, Premiumization and multi-zone adoption, Energy efficiency and insulation upgrades, Uptime and maintenance contracts, Space-constrained venue adaptation, Visual merchandising and beverage display impact |

The demand for back bar coolers in USA is estimated to be valued at USD 2.4 billion in 2025.

The market size for the back bar coolers in USA is projected to reach USD 3.8 billion by 2035.

The demand for back bar coolers in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in back bar coolers in USA are 2 section, 1 section, 3 section and more than 3 section.

In terms of basis of the doors, glass doors segment is expected to command 62.0% share in the back bar coolers in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Back Bar Coolers Market Analysis - Demand & Growth Forecast 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Barcode Printer Market Trends – Size, Share & Industry Growth 2025-2035

USA Barrier Packaging Market Analysis – Trends & Forecast 2024-2034

Demand for Barrel Liner in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Snack Bars in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Barcode Printers and Consumables in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Massoia Bark Essential Oil in USA Size and Share Forecast Outlook 2025 to 2035

Backside Power Supply Network (BSPDN) Technology Market Size and Share Forecast Outlook 2025 to 2035

Barrier System Market Forecast Outlook 2025 to 2035

Bariatric Surgery Device Market Forecast and Outlook 2025 to 2035

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Barometer Market Size and Share Forecast Outlook 2025 to 2035

Backflow Preventers Market Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Barite Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA