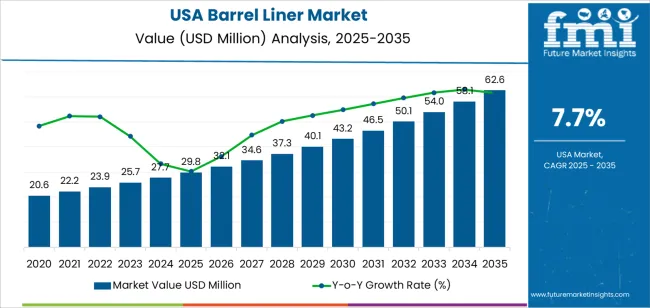

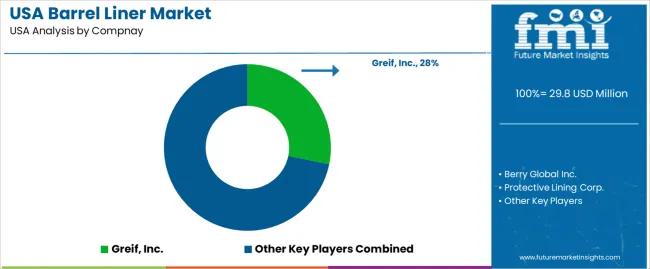

In 2025, barrel liner demand in the USA is valued at USD 29.8 million and is projected to reach USD 62.6 million by 2035 at a CAGR of 7.7%. Early growth reflects rising use across chemical processing, food ingredients, pharmaceutical intermediates, and hazardous material transport. Liners play a central role in contamination control, moisture protection, and safe handling of powders, semi liquids, and corrosive materials. The strongest uptake is seen in specialty chemicals and nutraceutical ingredients where purity and shelf stability are tightly regulated. Polyethylene based liners dominate due to their balance of chemical resistance and cost efficiency. Contract packaging firms and industrial distributors form the core demand channel during this phase.

After 2030, demand expansion in the USA becomes more logistics driven than production driven. Market value rises from about USD 43.2 million in 2030 toward USD 62.6 million by 2035 as bulk handling volumes increase in agrochemicals, resins, and specialty additives. Export oriented manufacturers raise liner USAge to reduce cross batch contamination risk in international shipments. Pharmaceutical and biotechnology sectors also contribute through higher compliance standards for sterile and low extractables packaging. Key suppliers focus on multilayer film construction, anti-static properties, and tighter dimensional consistency for automated drum and barrel filling lines. Growth remains supported by regulatory scrutiny, higher material traceability requirements, and rising outsourcing of bulk packaging operations across the USA.

The long-term value accumulation curve for barrel liner demand in USA shows a steady and compounding build-up from USD 29.8 million in 2025 to USD 32.1 million by 2026 and USD 34.6 million by 2027, indicating early-stage accumulation driven by food ingredients, chemicals, and specialty liquid logistics. The market adds USD 2.3 million to USD 2.7 million annually during the first half of the forecast window, reflecting growing adoption of hygienic and contamination-resistant packaging in bulk transport. Value accumulation in this phase is shaped by compliance-driven demand, especially in edible oils, flavor concentrates, and agrochemical intermediates, where barrel liners shift from optional protection to routine safety infrastructure.

From 2030 onward, the accumulation curve steepens in absolute terms as the market expands from USD 40.1 million in 2030 to USD 62.6 million by 2035, generating USD 22.5 million in cumulative value in the second half of the decade alone. Annual additions widen from about USD 3.1 million to more than USD 4.5 million by the final years, reflecting volume scale-up and rising liner specification standards. This back-weighted value build-up is driven by higher use in pharmaceutical liquids, resin transport, and bio-based chemicals, where contamination control and material compatibility elevate both unit demand and pricing.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 29.8 million |

| Forecast Value (2035) | USD 62.6 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

Demand for barrel liners in the USA has grown as industries increasingly rely on bulk transport and storage of liquids, powders, and chemicals that require contamination-free containment. Agricultural producers, food and beverage firms, chemical and pharmaceutical manufacturers often use barrels for transport and storage. Liners help prevent direct contact between the barrel wall and the contents, which reduces risk of contamination, chemical reactions, odors, and flavour transfer. Growth in food-processing, chemicals, and contract manufacturing sectors contributed to rising USAge of plastic-film barrel liners. Tightening hygiene standards and regulatory compliance requirements in regulated sectors enhanced demand for liner solutions over traditional barrel reuse.

Future demand for barrel liners in the USA will depend on expansion of industries dealing with bulk materials, increased regulatory scrutiny over cross-contamination, and growth in contract manufacturing and outsourcing. As companies outsource more production and storage, they will demand single-use or disposable liners to guarantee product integrity throughout the supply-chain. Demand may rise in markets such as food ingredients, fine chemicals, pet foods, and specialty chemicals where traceability and contamination control are critical. However cost pressures, environmental concerns around single-use plastics, and preference for reusable barrels may pose constraints. The market’s growth will depend on balancing contamination risk mitigation against sustainability and cost efficiency.

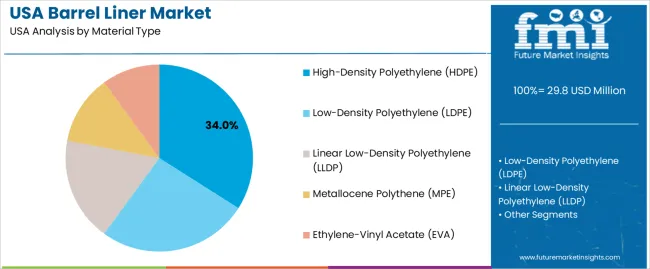

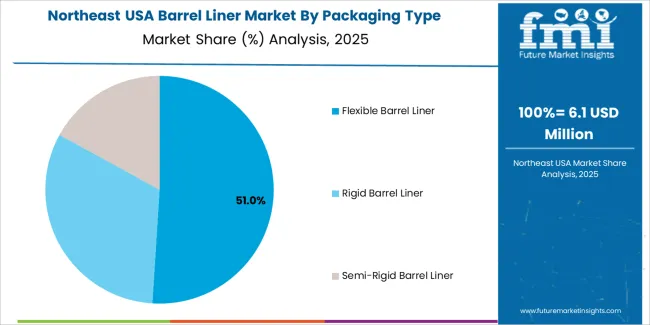

The demand for barrel liners in the USA is structured by material type and packaging type. High density polyethylene accounts for 34% of total demand, followed by low density polyethylene, linear low density polyethylene, metallocene polythene, and ethylene vinyl acetate. By packaging type, flexible barrel liners represent 51.0% of total USAge, followed by rigid and semi rigid barrel liners. Demand behavior is shaped by chemical compatibility, puncture resistance, temperature tolerance, and disposal requirements. These segments reflect how material performance and liner flexibility determine suitability across chemical processing, food ingredients, pharmaceuticals, and hazardous material handling in the USA.

High density polyethylene accounts for 34% of total barrel liner demand in the USA. This leadership reflects its high tensile strength, strong chemical resistance, and low moisture permeability. HDPE performs reliably when used with solvents, acids, powders, and viscous liquids commonly handled in industrial and food grade applications. Its resistance to tearing during drum loading and unloading supports safe material transfer under high weight conditions.

HDPE barrel liners also show strong performance in temperature variable storage environments. Compatibility with both hot fill and cold storage operations expands its application range. Domestic processing capacity for HDPE film extrusion supports stable supply across regional packaging hubs. Replacement demand remains consistent across chemical distributors and contract manufacturers. These performance stability and supply chain advantages sustain HDPE as the leading barrel liner material in the USA.

Flexible barrel liners account for 51.0% of total demand in the USA. Their dominance reflects ease of installation, broad drum compatibility, and reduced storage space requirements when shipped in flat packed form. Flexible liners conform to standard steel, fiber, and plastic drums, which improves sealing efficiency and minimizes product residue during discharge.

Flexible liners also support cost efficient disposal and contamination control between batch changes. Industries handling food ingredients, powders, resins, and agrochemicals rely on flexible liners to simplify sanitation procedures and shorten turnaround times. Their lightweight structure reduces freight costs compared with rigid formats. Inventory management also benefits from compact stacking and rapid deployment. These handling, hygiene, and logistics advantages position flexible barrel liners as the leading packaging type in the USA.

Demand for barrel liners in the USA is driven by strict contamination control requirements across chemicals, food ingredients, pharmaceuticals, and specialty resins. Drum and barrel packaging remains central to bulk handling in domestic manufacturing and export logistics. Liners are used to protect high-value contents from moisture, oxygen exposure, and cross-contamination while extending container reuse cycles. Growth in contract manufacturing and toll processing increases reliance on clean, insert-based packaging rather than dedicated drums. These industrial handling and cross-sector regulatory conditions support steady baseline demand for barrel liners across U.S. supply chains.

In the USA, chemical producers use barrel liners to isolate corrosive, hygroscopic, and reactive materials from steel or plastic drum walls. Food ingredient processors rely on liners to meet sanitation standards for sugars, starches, powders, oils, and enzymes. Pharmaceutical logistics require ultra-clean liners for APIs, intermediates, and excipients where cross-batch contamination risk cannot be tolerated. Shared drum pools and third-party logistics operators increasingly require liners to prevent trace residue transfer. These application-specific hygiene and material-compatibility needs anchor consistent multi-industry barrel liner consumption.

Barrel liner demand in the USA faces constraints tied to resin pricing volatility, disposal cost, and sustainability scrutiny. Single-use plastic liners attract waste management attention in regulated states with strict packaging waste targets. Heavy-duty multilayer liners raise unit costs for low-margin bulk commodities. Improper liner fitting can cause tearing or product loss, leading some operators to revert to rigid liners or dedicated drums. Heat exposure during filling also limits use in certain applications. These economic, environmental, and handling limitations slow aggressive expansion beyond controlled industrial segments.

Barrel liner demand in the USA is shifting toward thinner-gauge, high-strength films engineered to deliver puncture resistance with reduced plastic mass. Recyclable mono-material liners are gaining preference in food and specialty chemical markets. Some logistics operators pair liners with drum refurbishing programs to extend container life and reduce transport emissions. Antistatic and conductive liners see increased use for fine powders and flammable materials. Precision-fit liners with tie-off, form-fit, and gusseted bottoms improve filling efficiency. These trends show barrel liners moving from disposable accessories toward engineered components of sustainable bulk packaging systems.

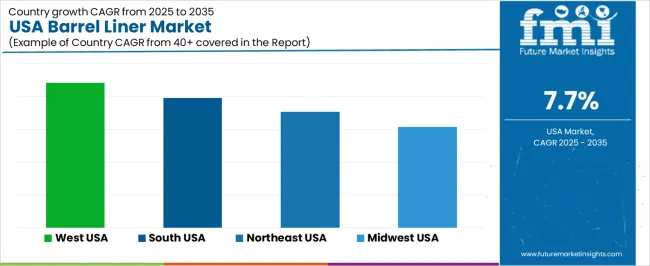

| Region | CAGR (%) |

|---|---|

| West | 8.8% |

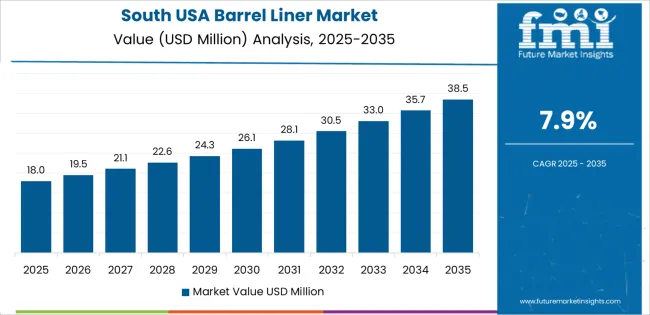

| South | 7.9% |

| Northeast | 7.1% |

| Midwest | 6.2% |

The demand for barrel liners in the USA shows a clear regional gradient with the West leading at 8.8 % CAGR. This region likely benefits from growth in industrial storage, waste-management, chemical processing, and food & beverage packaging requiring durable barrel liners. The South, at 7.9 %, sees strong demand due to its industrial base, agricultural commodities processing, and logistics operations that use liners for safe transport and storage. The Northeast at 7.1 % reflects demand from manufacturing, chemicals, and specialty packaging sectors concentrated in urban and industrial zones. The Midwest’s 6.2 % growth suggests moderate uptake, aligned with stable industrial activity and growing awareness of containment and protection standards for bulk materials.

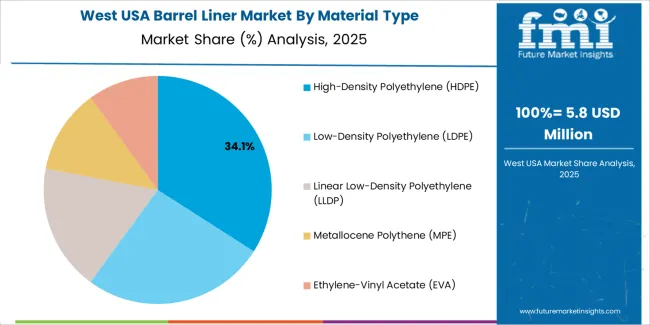

Growth in the West reflects a CAGR of 8.8% through 2035 for barrel liner demand, supported by strong chemical processing, food ingredient handling, and pharmaceutical manufacturing activity. Coastal ports and export oriented industries rely on liners for contamination control and moisture protection during bulk transport. Wine, specialty chemicals, and nutraceuticals generate consistent liner USAge. Hazardous material regulations strengthen adoption for safe material handling. Demand remains strongly compliance driven rather than discretionary, with purchasing tied to bulk storage and shipment volumes across industrial corridors serving domestic processing and international export supply chains.

The South advances at a CAGR of 7.9% through 2035 for barrel liner demand, driven by large scale food processing, agricultural chemicals, and resin manufacturing. Poultry, edible oils, and liquid additives require liners to prevent cross contamination during storage. Warm climate conditions increase the need for barrier protection against humidity and microbial growth. Regional chemical distributors supply liners across food, polymer, and agrochemical plants. Demand remains volume oriented, linked closely to continuous production cycles in food manufacturing and industrial material processing zones across southern states.

The Northeast records a CAGR of 7.1% through 2035 for barrel liner demand, shaped by pharmaceutical production, specialty chemicals, and institutional food ingredient manufacturing. Urban industrial zones require strict contamination control for sensitive materials. Pharmaceutical excipients and active ingredients depend on high integrity liner systems. Dense regulatory oversight reinforces routine liner replacement. Port proximity supports chemical import and re export activity using lined barrels. Demand remains quality driven rather than scale driven, with high specification liner purchases supporting consistent value growth across regulated manufacturing and distribution environments.

The Midwest expands at a CAGR of 6.2% through 2035 for barrel liner demand, supported by agricultural chemicals, food ingredients, and industrial resins production. Grain processing byproducts, flavor extracts, and polymer additives rely on lined barrels for storage stability. Manufacturing led demand outweighs logistics hub driven consumption. Seasonal agricultural output influences liner purchase cycles. Regional packaging distributors supply bulk liner volumes to processing plants. Demand remains operational and predictable, guided by production batch schedules rather than export logistics intensity seen in coastal regions.

Demand for barrel liners in the USA is rising across several sectors, especially chemicals, food & beverage, pharmaceuticals, and bulk raw material storage. Users rely on barrel liners to prevent contamination between the drum interior and stored contents. Liners help maintain product integrity, reduce cleaning and maintenance costs, and enable reuse of drums. For chemical or hazardous materials storage, liners provide protection against corrosion and leakage. In food, beverage, and pharmaceutical contexts, liners support hygiene standards and regulatory compliance, especially when handling sensitive or reactive substances. Growing regulatory scrutiny and rising volumes of industrial packaging reinforce continued uptake of high performance and barrier type liners.

Key suppliers active in the US barrel liner market include the firms you listed: Greif, Inc., Berry Global Inc., Protective Lining Corp., CDF Corporation, and International Plastics, Inc. Greif and Berry Global leverage large-scale plastic film manufacturing and distribution networks to supply standard and high barrier liners for drums and barrels. Protective Lining Corp. and CDF specialize in linings tailored for chemical, lubricant, and hazardous materials drums, offering heavy duty and corrosion resistant solutions for industrial customers. International Plastics serves more general purpose and food grade liner needs, supplying a range of film types suited for packaging coatings, powders, and liquids. This mix of large-scale producers and specialized liner manufacturers supports a competitive and flexible supply base.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Material Type | High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDP), Metallocene Polythene (MPE), Ethylene-Vinyl Acetate (EVA) |

| Packaging Type | Flexible Barrel Liner, Rigid Barrel Liner, Semi-Rigid Barrel Liner |

| Capacity | Above 50 Liters, 20–50 Liters, Below 20 Liters |

| Application | Chemicals & Lubricants, Food & Beverages, Flammable Liquids, Grease and Oils, Adhesives |

| Sales Channel | Offline, Online |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Greif, Inc., Berry Global Inc., Protective Lining Corp., CDF Corporation, International Plastics, Inc. |

| Additional Attributes | Dollar-value distribution by material and packaging type; regional CAGR projections; HDPE leads material demand for chemical resistance and strength; flexible liners dominate packaging type for ease of installation and drum compatibility; early growth 2025–2030 adds USD 13.4 million reflecting food, chemical, and pharmaceutical uptake; 2030–2035 growth adds USD 22.5 million driven by export, compliance, and higher specification liners; adoption in pharmaceutical liquids, resins, and nutraceutical ingredients; demand shaped by regulatory scrutiny, contamination control, moisture protection, and bulk logistics; supply chain anchored in contract packaging and industrial distributors; back-weighted growth with higher unit value and increased technical specifications; multi-industry use drives sustained baseline demand in chemicals, food, beverage, and pharma logistics. |

The demand for barrel liner in USA is estimated to be valued at USD 29.8 million in 2025.

The market size for the barrel liner in USA is projected to reach USD 62.6 million by 2035.

The demand for barrel liner in USA is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in barrel liner in USA are high-density polyethylene (hdpe), low-density polyethylene (ldpe), linear low-density polyethylene (lldp), metallocene polythene (mpe) and ethylene-vinyl acetate (eva).

In terms of packaging type, flexible barrel liner segment is expected to command 51.0% share in the barrel liner in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barrel Liner Market Insights - Growth, Trends & Demand 2025 to 2035

Demand for Box Liners in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Hydrocyclone Liners in USA Size and Share Forecast Outlook 2025 to 2035

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Linerless Closures Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA