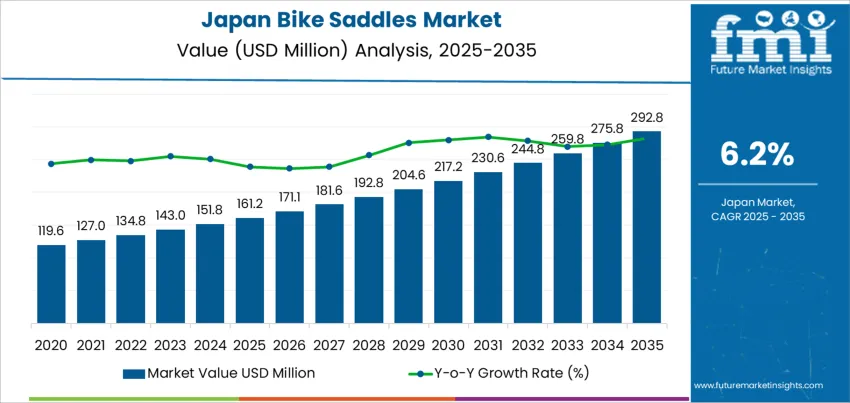

The Japan bike saddles demand is valued at USD 161.2 million in 2025 and is forecasted to reach USD 292.8 million by 2035, recording a CAGR of 6.2%. Growth reflects steady bicycle usage for commuting, recreation, and fitness across urban and suburban regions. Trends including e-bike adoption, cycling-tourism activities, and demand for upgraded comfort components drive replacement purchases. Product selection continues to emphasize ergonomic pressure distribution, durability, and compatibility with varied bicycle categories such as road bikes, commuter cycles, and e-mobility platforms.

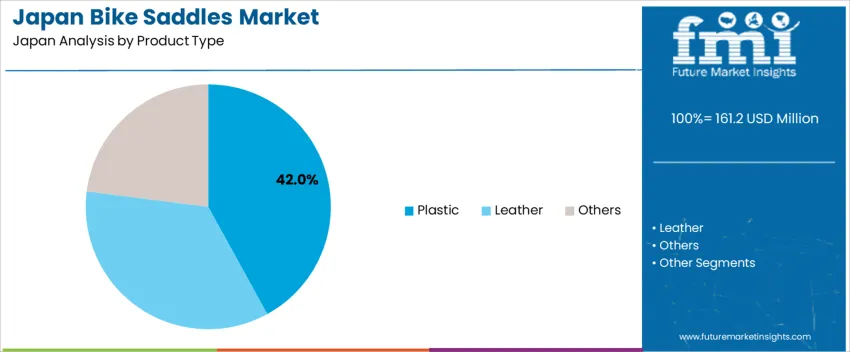

Plastic saddles lead the product landscape due to their lightweight structure, lower cost, and suitability for mass-production bike models. These saddles provide consistent performance in wet conditions and support integration of foam padding, gel inserts, and ventilation channels. Ongoing design advances address shock absorption, pelvic stability, and reduced perineal pressure across long-duration rides.

Kyushu & Okinawa, Kanto, and Kansai represent the strongest demand clusters. These areas maintain high commuting bicycle density, strong cycling club participation, and concentrated distribution networks for aftermarket components. Leading suppliers include Velo Enterprise Co., Ltd., Miyata Saddle Co., Ltd., GIZA Products, Bridgestone Cycle Components, and Prologo Japan. Their portfolios include platform-based saddle geometries optimized for endurance cycling, daily commuting, and leisure-riding comfort requirements.

Demand for bike saddles in Japan shows a moderate peak-to-trough range shaped by seasonal mobility patterns and consumer lifestyle trends. Peak demand aligns with increased cycling participation during spring and early autumn, when leisure commuting and outdoor fitness activities rise. Saddle upgrades linked to comfort, ergonomic support, and lightweight materials also add momentum during these periods, particularly in urban regions with strong cycling infrastructure.

Trough phases occur in winter months and during periods of reduced recreational spending. Since saddles have relatively long replacement intervals, upgrades are often postponed when economic caution increases. Fleet operators such as bike-sharing services provide counterbalance, though their procurement cycles are planned and infrequent. Regulatory encouragement of micromobility can lift the floor of trough phases by sustaining minimum purchasing from city programs and commuter usage. The peak-to-trough profile illustrates a category driven by seasonal and discretionary elements rather than continuous replacement demand. Peaks are supported by lifestyle and comfort innovations, while troughs remain manageable due to consistent utility cycling in metropolitan areas.

| Metric | Value |

|---|---|

| Japan Bike Saddles Sales Value (2025) | USD 161.2 million |

| Japan Bike Saddles Forecast Value (2035) | USD 292.8 million |

| Japan Bike Saddles Forecast CAGR (2025-2035) | 6.2% |

Demand for bike saddles in Japan is increasing because cycling is widely used for commuting, recreation and short-distance urban travel. Cities with strong infrastructure such as bike lanes and secure parking support daily bicycle use, which drives replacement and upgrade purchases for saddles. Comfort and ergonomic design influence buying decisions among commuters and older adults who seek better pressure distribution on long rides. Growth in road cycling and recreational touring encourages adoption of performance saddles with lighter materials and tailored shapes.

Bike-sharing services and rental operators also contribute to demand, as saddles require periodic replacement due to wear in high-use environments. E-bikes are gaining popularity in Japan for hillier regions and for senior users, and these models often require saddles with enhanced cushioning and stability. Retail presence in sporting goods stores and online marketplaces offers wide choice for both casual users and enthusiasts. Constraints include cost sensitivity in budget segments where riders may delay replacement until saddles become visibly worn. Some consumers rely on basic factory-installed saddles, limiting upgrades in value bicycles. Seasonal variations in cycling activity can also influence purchasing cycles.

Demand for bike saddles in Japan is driven by commuter cycling culture, recreational sports participation, and interest in lightweight ergonomics that support longer rides. Manufacturers focus on pressure relief technology, fit customization, and durability to align with Japanese consumers who prioritize comfortable urban transport and weekend performance use. E-bikes, fitness riding trends, and organized cycling events further contribute to replacement and upgrade purchases within both mass retail and online marketplaces.

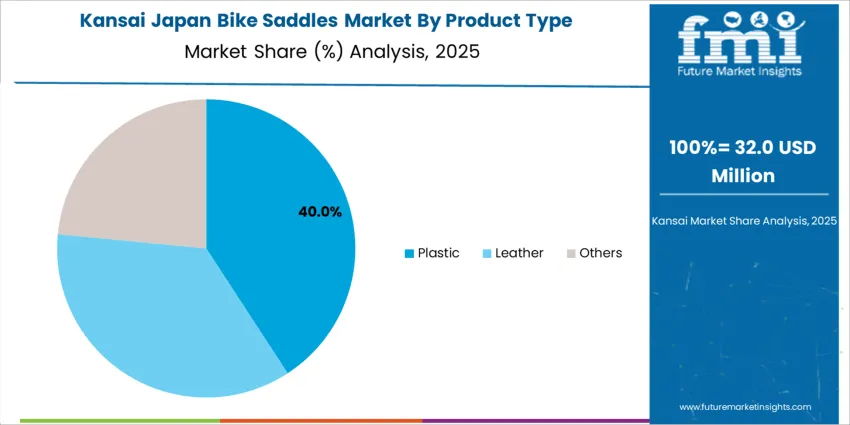

Plastic saddles account for 42.0%, supported by widespread use among city bikes, shared bicycles, and entry-level sports cycles. They provide balanced durability and water resistance suited for Japan’s varied climate. Leather saddles represent 35.0%, driven by enthusiasts seeking long-lasting form-fitting comfort and premium craftsmanship, especially on commuter and touring bikes. 23.0% corresponds to other materials, including gel-infused, foam-composite, and advanced performance saddles that reduce contact pressure and weight. Product type selection aligns with ride duration, frame style, and consumer willingness to invest in personalization upgrades. Japanese cyclists often replace stock saddles to improve comfort on constrained urban routes and extended weekend rides.

Key Points:

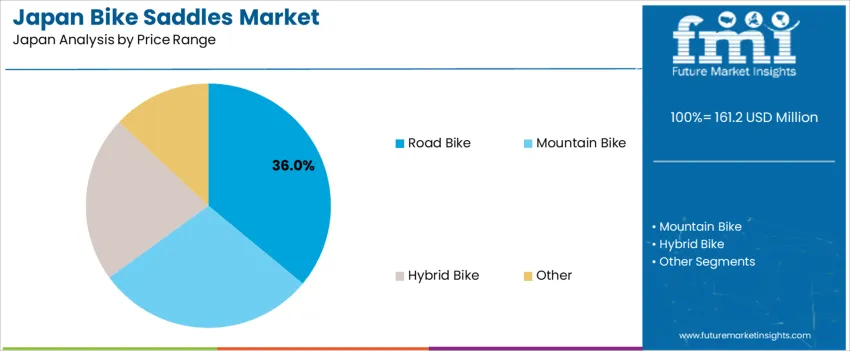

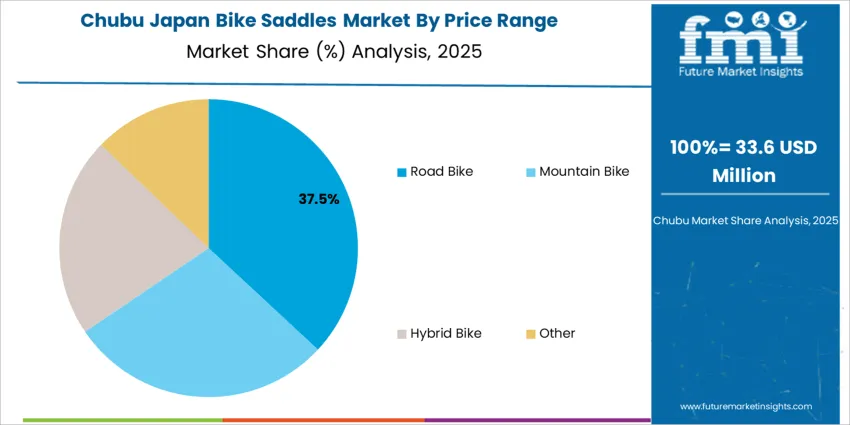

Road bike saddles represent 36.0%, reflecting Japan’s active road cycling community, competitive racing clubs, and focus on lightweight seat profiles supporting aerodynamic posture. Mountain bike use accounts for 29.0%, driven by trail riding and growing bike tourism in regional areas. Hybrid bike use holds 22.0%, aligning with urban riders seeking multi-surface comfort. Other categories contribute 13.0%, covering folding bikes and commuter e-bikes. Category trends align with saddle geometry differences, including reduced width and minimal padding in road formats versus stability-based cushioning in mountain and hybrid designs. Purchase decisions rely on fit precision, rail strength, and compatibility with adjustable seat posts.

Key Points:

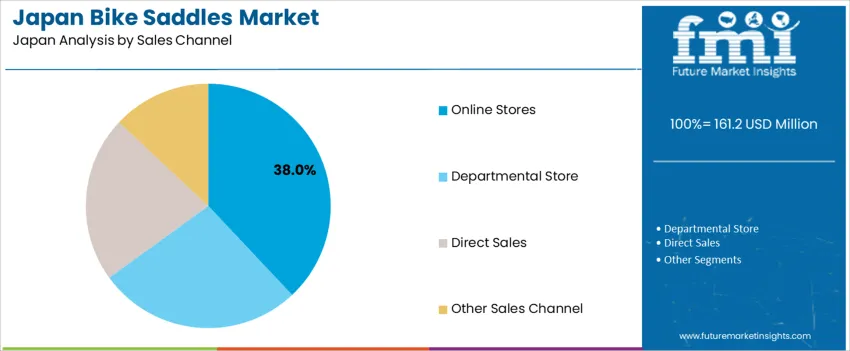

Online sales account for 38.0%, supported by broad size availability, quick comparison of ergonomic features, and home delivery convenience. Department stores represent 27.0%, offering in-person evaluation for comfort and proper fit. Direct sales hold 22.0%, including specialty bike shops that provide installation support and expert fitting guidance for sports users. Other channels contribute 13.0%, covering local retail and cycling event vendors. Distribution reflects strong digital purchasing patterns in densely populated Japan, while specialty channels remain important for custom adjustments and premium product consultation.

Key Points:

Growth of daily bicycle commuting, expansion of cycling tourism and increased interest in health-oriented mobility are driving demand.

In Japan, bike saddle demand increases as commuters in cities such as Tokyo, Osaka and Kyoto rely on bicycles for short-distance travel to train stations and workplaces. Municipal cycling infrastructure improvements, including dedicated lanes and expanded bicycle parking near rail hubs, encourage more frequent riding and replacement of worn saddles. Cycling tourism in Hokkaido, Shimanami Kaido and Okinawa promotes longer-distance riding, increasing demand for comfort-oriented and endurance saddles. Health-conscious adults use bicycles for regular exercise to manage lifestyle-related conditions, supporting sales of ergonomic designs through sports shops and online retailers. Rental operators and bike-sharing programs also refresh saddles regularly to maintain hygiene, adding stable commercial demand.

High price sensitivity in commuter segments, limited adoption of premium components on entry-level bikes and ageing population comfort concerns restrain demand.

Many commuters choose budget saddles when replacing OEM components, slowing adoption of higher-priced performance models. Entry-level bicycles sold through mass retailers often remain in service for years without upgrades, reducing aftermarket opportunities. Older riders may avoid narrower sport saddles due to pressure discomfort, leading to preference for wide, cushioned seats that have lower replacement frequency. Seasonal weather patterns and limited household storage space also reduce year-round cycling in some regions, tempering rapid growth in premium saddle categories.

Shift toward ergonomic pressure-relief designs, increased use of lightweight materials for sport cycling and rising demand in e-bike upgrades define key trends.

Manufacturers are expanding saddles with pressure-relief channels and gel padding to serve riders seeking comfort for daily commuting and leisure tours. Sport cyclists in Kansai and the Kanto region show growing interest in carbon rails and performance shells that reduce weight for competitive and training use. E-bikes adopted by delivery services and older adults create a segment that values durable, vibration-absorbing saddles for extended riding comfort. Custom-fit and adjustable models offered through specialty bike shops support personalized comfort solutions. These trends indicate steady, comfort-driven and performance-oriented demand for bike saddles across Japan’s commuting, tourism and recreational cycling industries.

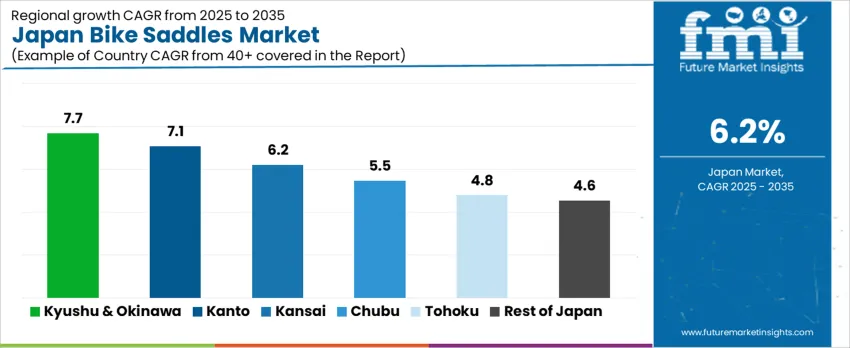

Demand for bike saddles in Japan is shaped by recreational cycling, commuter behavior, e-bike adoption, and focus on posture-supportive components. Replacement purchases maintain volume due to wear from frequent use. Growth varies by region based on cycling infrastructure, sports participation, and access to specialty retailers. Kyushu & Okinawa leads at 7.7%, followed by Kanto (7.1%), Kansai (6.2%), Chubu (5.5%), Tohoku (4.8%), and the Rest of Japan (4.6%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 7.7% |

| Kanto | 7.1% |

| Kansai | 6.2% |

| Chubu | 5.5% |

| Tohoku | 4.8% |

| Rest of Japan | 4.6% |

Kyushu & Okinawa show a 7.7% CAGR, supported by stable use of bicycles for daily travel and recreational routes that span coastal and suburban areas. Regional purchasing focuses on comfortable saddles designed for varied surface conditions and extended riding durations. Retailers track demand for ergonomic profiles with flexible base construction that preserves comfort during climbs. Tourism adds seasonal requirements, with rental fleets cycling through saddle replacements after frequent short-trip usage. Casual riders choose saddles with weather-resistant coverings suitable for humid climates. Logistics through local ports support supply availability from domestic and international manufacturers. Customer evaluation emphasizes fair pricing and durability for long-distance use rather than premium customization. The region maintains a balanced adoption of commuter saddles, fitness-oriented styles, and lightweight variants used in hobby cycling groups.

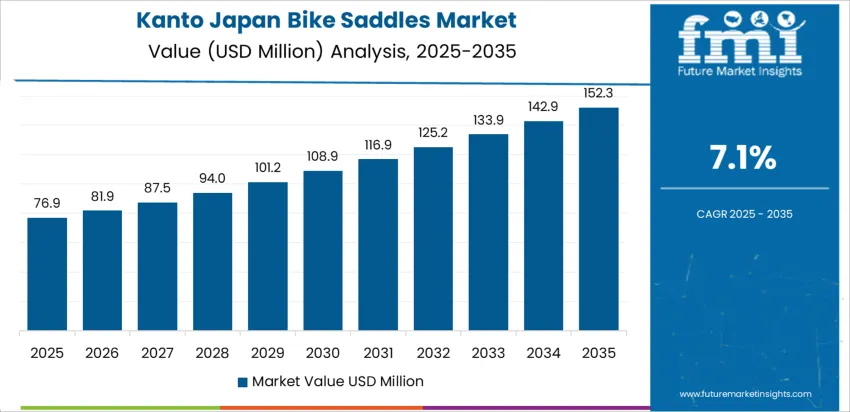

Kanto records 7.1% CAGR driven by dense cycling participation in Tokyo, Kanagawa, and surrounding prefectures. Commuter riders select saddles that meet comfort standards during crowded multi-modal travel while remaining lightweight enough for portable bicycles. Road cyclists emphasize reduced pressure designs that maintain posture control over longer distances on major cycling routes. Retailers operate extensive collections, offering standardized fit options for varied riding positions. Saddle exchange programs encourage frequent replacement when padding deformation affects comfort. Urban logistics support delivery efficiency for e-commerce-driven purchases. Fleet operators for bike-share systems contribute demand through scheduled component renewals. Customers evaluate saddle geometry that supports upright urban riding and occasional fitness outings.

Kansai posts a 6.2% CAGR, supported by strong cycling culture across Osaka and Kyoto. Riders pursue ergonomic seating upgrades that preserve stability during urban commuting and weekend leisure activities. Saddles with balanced firmness attract buyers interested in comfort without performance compromise. Retailers highlight compatibility with adjustable seat posts used in city bikes and entry-level road bikes. Clubs and recreational groups encourage periodic component upgrades associated with increased ride frequency. Product decisions consider wear-resistant coverings that tolerate temperature shifts across the region. Delivery centers provide stable fulfillment for retailers and repair shops. Consumer preferences lean toward practicality, with performance benefits evaluated on comfort retention during daily routines.

Chubu achieves 5.5% CAGR linked to commuter traffic connecting automotive and industrial prefectures. Bicycle riding integrates into daily routines, reinforcing requirements for saddles with adequate cushioning for extended trips. Long-distance leisure cycling across varied terrain encourages procurement of shock-mitigating saddle bases. Buyers evaluate saddle width and foam density for compatibility with personal posture during uphill and downhill movement. Retail networks provide stable inventory turnover for mid-range designs. Replacement demand occurs when wear affects riding comfort. Shops assist customers in identifying models suited to multipurpose bicycles supporting both commuting and light fitness use.

Tohoku reaches 4.8% CAGR with a consumer base focused on reliability and comfort across longer travel routes. Riders adopt saddles that maintain cushioning performance in seasonal climate variations. Procurement follows practical decision-making where durability and weather tolerance outweigh aesthetic detail. Rural commuting requires saddles that handle daily distance across road surfaces with varying smoothness. Retail offerings balance affordability and ergonomic benefit. Workshops provide fitting assistance where customers test saddle geometry for tailored alignment. Saddle upgrades occur during bicycle refresh cycles, often linked with tire and drivetrain servicing.

The Rest of Japan posts 4.6% CAGR with demand concentrated in smaller cities and towns where bicycles remain cost-efficient transportation. Saddles with moderate padding meet every day travel needs. Distribution relies on e-commerce and hardware-style retail outlets. Purchasers prioritize functional improvements and longevity, replacing saddles when surface wear reduces comfort. Leisure-focused riding supports interest in slightly contoured profiles offering stability. Logistics networks enable steady fulfillment of standard saddle models from domestic warehouses.

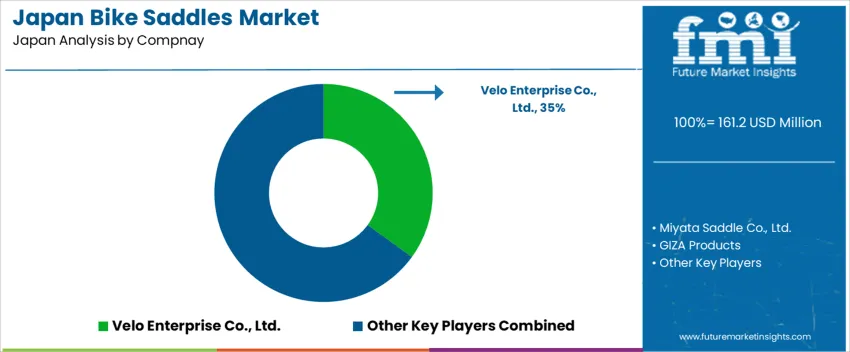

Demand for bike saddles in Japan is shaped by suppliers supporting commuter, city, electric-assist, and sport-cycling usage across urban and regional transport networks. Velo Enterprise Co., Ltd. holds an estimated 35.0% share, supported by controlled ergonomics, standardized rail geometry, and broad installation on commuter and e-bike models distributed by Japanese bicycle assemblers. Its saddles provide stable comfort characteristics that suit short-distance mobility routines.

Miyata Saddle Co., Ltd. maintains strong participation in domestic bicycle supply, delivering saddles with consistent padding resilience and weather-resistant coverings required for everyday transport in Japan’s variable outdoor conditions. GIZA Products contributes share in mid-grade replacement and aftermarket saddles valued for dependable durability and compatibility across widely used Japanese seat-post specifications.

Bridgestone Cycle Components supports demand through fitted saddles on its national bicycle lineup, where vibration control and stable weight support are necessary for daily commuting. Prologo Japan remains active in performance and competitive cycling where lightweight shells and precise pressure distribution are priorities. Competition in Japan focuses on long-ride comfort, padding-recovery performance, waterproofing reliability, rail-mount stability, and compatibility with domestic bicycle geometries. Demand continues as riders rely on comfortable, durable saddles for utility mobility and recreational cycling across Japan’s urban transport environment.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Plastic, Leather, Others |

| Bike Type | Road Bike, Mountain Bike, Hybrid Bike, Other |

| Sales Channel | Online Stores, Departmental Store, Direct Sales, Other Sales Channel |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Velo Enterprise Co., Ltd., Miyata Saddle Co., Ltd., GIZA Products, Bridgestone Cycle Components, Prologo Japan |

| Additional Attributes | Coverage includes OEM and aftermarket distribution; weight-optimized performance saddles for competitive cycling and ergonomically-designed commuter saddles; demand variations based on urban cycling growth in Kanto and Kansai; product adoption influenced by comfort materials, durability, rail composition, and cushioning technology; segmentation by specialty bike shops vs. online cycling accessory marketplaces. |

The demand for bike saddles in Japan is estimated to be valued at USD 161.2 million in 2025.

The market size for the bike saddles in Japan is projected to reach USD 292.8 million by 2035.

The demand for bike saddles in Japan is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in bike saddles in Japan are plastic, leather and others.

In terms of price range, road bike segment is expected to command 36.0% share in the bike saddles in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bike Saddles Market Trends – Growth & Demand Forecast 2025 to 2035

Demand for Bike Saddles in USA Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Bike Sharing Market Size and Share Forecast Outlook 2025 to 2035

Bike And Scooter Rental Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA