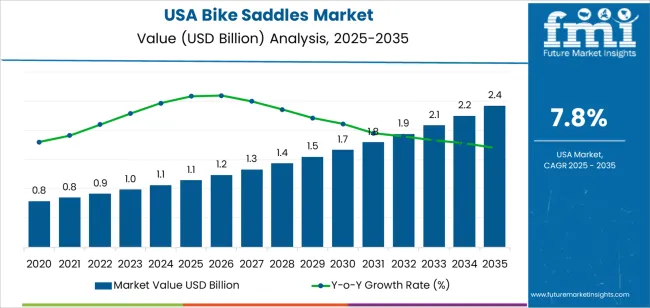

In 2025, demand for bike saddles in the USA is valued at USD 1.1 billion and is projected to reach USD 2.4 billion by 2035 at a CAGR of 7.8%. Growth in the early forecast years reflects sustained cycling participation across urban commuting, fitness riding, and trail use. Gravel bikes, electric bicycles, and endurance road bikes raise saddle replacement rates due to longer ride times and higher comfort expectations. Specialty retail and direct to consumer brands play a central role in driving premium saddle adoption through ergonomic design and fit customization. Medical awareness of saddle related pressure points and posture correction also supports higher value product uptake across recreational and performance segments.

After 2030, demand expansion in the USA becomes more usage intensity driven than new rider driven. Market value rises as rider’s upgrade saddles for long distance touring, indoor training platforms, and rapidly growing e bike usage among older age groups. Women specific and anatomically engineered saddles gain wider acceptance as female cycling participation expands. Materials shift toward lightweight composite bases, memory foam padding, and pressure mapping based design. Key demand centers remain California, the Pacific Northwest, Colorado, and the Northeast where cycling infrastructure density is highest. Competitive focus rests on comfort benchmarking, durability under high mileage use, and digital fitting tools linked to online purchasing behavior.

The overall demand for bike saddles in USA increases from USD 1.1 billion in 2025 to USD 1.2 billion by 2030, adding USD 0.1 billion in absolute value. This phase reflects steady expansion anchored in regular bicycle replacement cycles, consistent participation in recreational cycling, and stable commuter bike usage across urban areas. Demand is supported by incremental upgrades toward ergonomic designs, gel padding, pressure-mapping geometry, and lightweight rail materials rather than large shifts in rider base. Growth during this period remains structurally controlled, with value largely driven by mid-range and performance replacement demand across road, hybrid, and mountain bike categories.

From 2030 to 2035, the market expands more sharply from USD 1.2 billion to USD 2.4 billion, adding a substantially larger USD 1.2 billion in the second half of the decade. This back weighted acceleration reflects structural changes in mobility behavior, including higher sustained adoption of cycling for daily transport, growth in electric bicycle ownership, and rising demand for premium comfort saddles tailored to long-distance and urban commuting use. As saddle designs integrate advanced foams, vibration-damping rails, and rider-specific fit technologies, value per unit increases alongside volume. Demand shifts from routine replacement toward performance and comfort-driven spending expansion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.1 billion |

| Forecast Value (2035) | USD 2.4 billion |

| Forecast CAGR (2025–2035) | 7.8% |

Demand for bike saddles in the USA has grown over decades in response to rising interest in cycling for commuting, fitness, recreation, and sport. Urbanisation and growing road congestion pushed many to adopt bicycles and e-bikes for efficient transportation or last-mile mobility. Increasing health awareness and cycling as exercise encouraged a wave of recreational riding and long-distance cycling, driving demand for comfortable, ergonomic saddles. Women’s cycling and youth cycling trends added demographic depth to demand. Manufacturers responded with a variety of saddle shapes, padding densities, and materials to suit different use cases commuting, mountain biking, road cycling, leisure riding or e-bike commuting broadening the product base and widening appeal beyond traditional cycling communities.

Future demand for bike saddles in the USA will reflect evolving mobility, active-lifestyle preferences, and urban design. Growth in e-bike adoption and micromobility solutions will sustain aftermarket saddle demand as users seek comfort upgrades for longer rides or daily commutes. As cycling expands into suburban and urban commuting zones, demand will shift toward durable, weather-resistant, and low-maintenance saddle designs. Customisation and comfort trends may push innovation in saddle ergonomics, gels, adaptive padding, and gender-specific designs. At the same time, competition from ride-sharing, public transport, and changing city infrastructure may influence overall cycling uptake. Demand patterns will depend on infrastructure investments, fuel prices, lifestyle choices, and mobility policy direction.

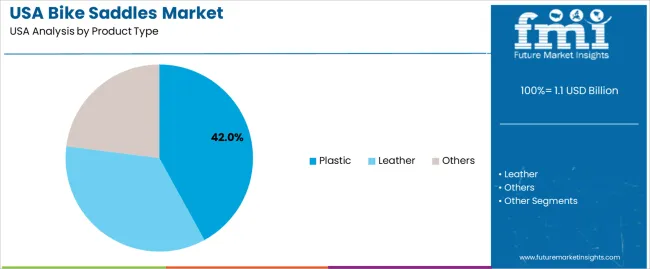

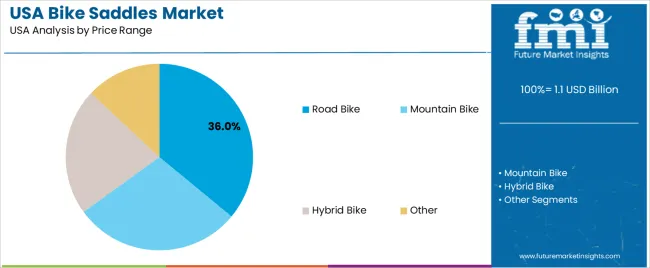

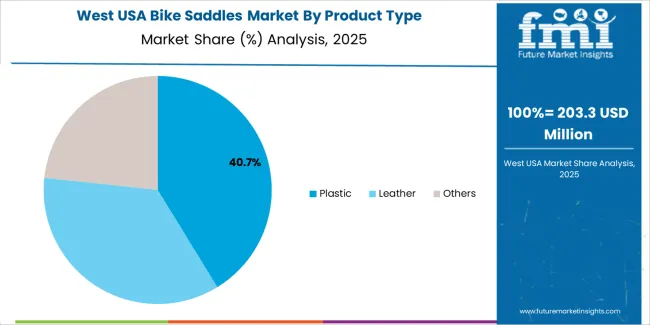

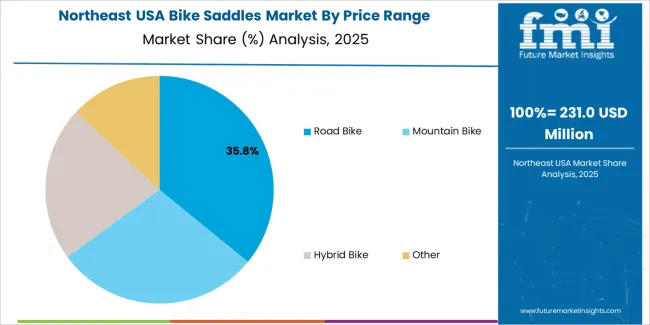

The demand for bike saddles in the USA is structured by product type and price related USAge category. Plastic saddles account for 42% of total demand, followed by leather and other material types used in niche comfort and specialty riding segments. By USAge based price range, road bikes represent 36.0% of total consumption, followed by mountain bikes, hybrid bikes, and other cycles. Demand behavior is shaped by rider comfort expectations, weight considerations, durability needs, and performance requirements. These segments reflect how riding style, terrain exposure, and cost sensitivity define saddle selection across recreational, commuting, and performance cycling in the USA.

Plastic saddles account for 42% of total bike saddle demand in the USA. Their dominance reflects low manufacturing cost, light weight, and high resistance to moisture and weather exposure. Plastic saddle shells perform reliably across commuting, fitness cycling, and entry level recreational use where durability and affordability are prioritized over premium finishing. Their compatibility with gel and foam padding also supports comfort enhancement at accessible price points.

Plastic saddles are widely adopted across mass market bicycles sold through sporting goods stores and online retail platforms. Injection molding scalability allows consistent output across multiple size and shape variants. Replacement demand remains high due to wear from daily use and exposure to UV radiation. These production efficiency, affordability, and durability advantages sustain plastic as the leading bike saddle material across the USA.

Road bikes account for 36.0% of total bike saddle demand in the USA. This leadership reflects the strong presence of road cycling for fitness, competitive racing, and long distance recreational riding. Road bike saddles are selected based on low weight, narrow profile, and pressure distribution to support high cadence riding and aerodynamic posture.

Growth in endurance cycling events, triathlons, and organized road racing continues to support saddle replacement and upgrade activity. Riders frequently adjust saddle types to improve performance positioning and reduce fatigue. Road bike owners also demonstrate higher accessory spending compared with casual riders. These performance intensity, sport participation, and upgrade driven factors position road bikes as the leading usage segment for saddle demand across the USA.

Demand for bike saddles in the USA is driven by rising participation in cycling for fitness, recreation, commuting, and competitive sports. Urban bike lanes, trail development, and community cycling programs support steady growth in ridership. Road cycling, gravel riding, mountain biking, and indoor training each require different saddle designs, which expands overall product variety and replacement frequency. Growth in electric bicycles also increases saddle demand due to new rider entry and higher daily usage rates. These participation and usage patterns make saddles a recurring-fit and comfort-driven replacement component.

Cycling in the USA spans endurance road riding, trail-based mountain biking, bikepacking, commuting, and indoor trainer workouts. Each category places different pressure points on rider posture, creating demand for saddles tailored to riding angle, vibration exposure, and distance duration. Performance riders seek narrow, stiff saddles that support aggressive positioning. Commuters prioritize cushioning and upright comfort. E-bike users generate higher saddle wear due to increased mileage and heavier rider load. Gender-specific and pressure-relief channel designs address long-ride comfort concerns. These usage differences diversify saddle demand across multiple performance tiers.

Bike saddle demand in the USA faces limits tied to fit complexity, price sensitivity, and trial uncertainty. Comfort is highly individual, leading to high return rates for online purchases. Premium saddles using carbon rails and advanced padding carry high prices that restrict access to performance-focused riders. Entry-level riders often remain on stock saddles despite discomfort due to low replacement awareness. Retail saddle fitting services remain uneven across regions. These behavioral, pricing, and fit challenges slow conversion from factory-installed saddles to aftermarket upgrades.

Bike saddles in the USA are shifting toward 3D-printed lattice padding, lightweight composite shells, and vibration-damping rail systems. Pressure-mapping and saddle-width measurement systems influence buying decisions at specialty retailers. Wider adoption of cut-out channels improves blood-flow comfort for long-distance riders. Sustainability-driven materials such as recycled foams and bio-based covers are entering premium lines. Gravel cycling and endurance events increase demand for hybrid saddles that balance stiffness and cushioning. These trends show saddles evolving from simple contact surfaces into precision-engineered rider interface components.

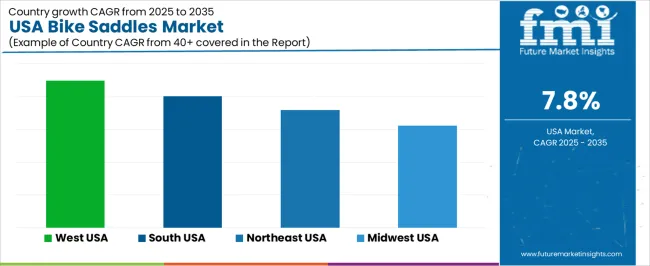

| Region | CAGR (%) |

|---|---|

| West | 9.0% |

| South | 8.0% |

| Northeast | 7.2% |

| Midwest | 6.2% |

The demand for bike saddles in the USA is growing across regions with the West leading at 9.0% CAGR. Growth in that region is driven by rising popularity of cycling for commuting and recreation, increased bicycle sales, and demand for comfort and performance upgrades. The South at 8.0% benefits from favorable climate conditions and growth in outdoor and cycling activities. The Northeast at 7.2% shows steady demand, supported by urban cycling infrastructure and recreational cycling interest. The Midwest at 6.2% exhibits moderate growth, reflecting gradual adoption of cycling and replacement of components in existing bicycles.

Growth in the West reflects a CAGR of 9.0% through 2035 for bike saddle demand, supported by strong cycling participation, outdoor recreation culture, and high adoption of performance bicycles across urban and trail networks. Mountain biking, road cycling, and commuter use sustain continuous replacement demand for saddles optimized for comfort and endurance. Electric bicycle adoption further increases saddle upgrade frequency due to higher ride duration. Specialty bike retailers and direct to consumer brands dominate distribution. Demand remains performance driven, with riders prioritizing ergonomic design, lightweight materials, and pressure relief features.

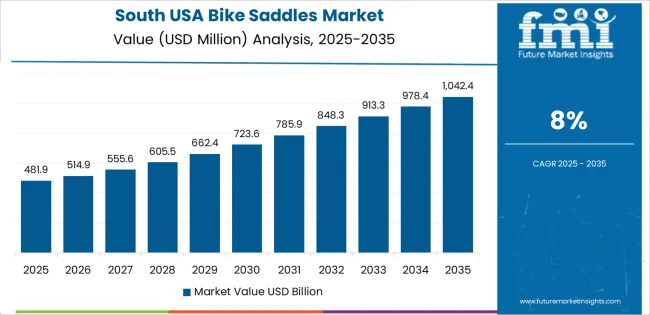

The South advances at a CAGR of 8.0% through 2035 for bike saddle demand, driven by expanding urban cycling infrastructure, recreational riding, and growing health focused mobility adoption. Warm climate conditions allow near year round cycling activity, supporting steady wear and replacement cycles. Entry level and mid range bicycles dominate volumes, with comfort focused saddles preferred for casual riders. Sporting goods chains and online platforms serve as key sales channels. Demand growth remains volume driven, supported by suburban trail development and fitness oriented riding participation.

The Northeast records a CAGR of 7.2% through 2035 for bike saddle demand, shaped by dense urban commuting, fitness cycling, and rising investment in protected bike lane infrastructure. City based riders prioritize saddles designed for daily commuting comfort and durability. Seasonal cycling patterns influence replacement timing, with peak demand concentrated in spring and summer. Premium hybrid and commuter bicycles contribute a growing share of installed saddle volume. Demand remains functionality driven, with urban mobility needs shaping consistent purchasing behavior across metropolitan cycling communities.

The Midwest expands at a CAGR of 6.2% through 2035 for bike saddle demand, supported by recreational cycling, family oriented trail use, and steady participation in fitness riding across suburban communities. Long distance trail systems and park pathways sustain replacement demand for durable, comfort oriented saddles. Cost sensitivity remains higher than in coastal regions, influencing preference for mid-priced products. Independent bike shops and sporting goods retailers anchor distribution. Demand remains stable and activity driven, supported by predictable seasonal cycling participation and community level fitness programs.

Demand for bike saddles in the USA is strengthening as cycling gains popularity for commuting, fitness, recreation, and e bike use. Riders value comfort, ergonomics, and performance. The rise of road cycling, mountain biking, gravel cycling, and urban commuting drives demand for specialized saddles. Advances in materials and seat design, including lighter frames, improved padding, anatomical shaping, pressure relief features, and durability, encourage upgrades from basic saddles. Growth of e bikes also adds momentum as users seek more comfortable, long-ride compatible seats. Trends in health awareness, outdoor activity, and sustainable mobility support steady growth in saddle demand across commuter, recreational, and performance riding segments.

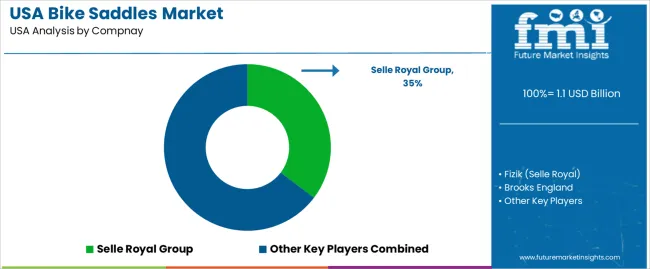

Leading suppliers active in the USA saddle market include Selle Royal Group (owner of Fizik), Brooks England, WTB (Wilderness Trail Bikes), Prologo, and other specialist brands. Selle Royal and Brooks England lead in comfort and commuter/touring segments. WTB and Prologo target mountain bike, road bike, and performance oriented riders seeking durability and ergonomic design. These firms shape demand by offering a diverse range of saddles from classic leather to modern performance models ensuring supply meets varied rider preferences across commuter, recreational, and performance segments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Plastic, Leather, Others |

| Price Range / Usage | Road Bike, Mountain Bike, Hybrid Bike, Other |

| Sales Channel | Online Stores, Departmental Store, Direct Sales, Other Sales Channel |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Selle Royal Group, Fizik (Selle Royal), Brooks England, WTB (Wilderness Trail Bikes), Prologo |

| Additional Attributes | Dollar value distribution by product type and price range; regional CAGR projections; plastic leads with 42% share due to light weight, affordability, and durability; road bikes lead 36% of consumption reflecting endurance and commuter cycling; growth from 2030–2035 is back-weighted driven by e-bike adoption, long distance riding, and premium ergonomic saddle upgrades; materials include lightweight composite rails, memory foam padding, and pressure-mapping designs; distribution includes specialty bike retailers, online stores, and direct to consumer; demand influenced by urban cycling infrastructure, commuter adoption, and recreational cycling culture. |

The demand for bike saddles in USA is estimated to be valued at USD 1.1 billion in 2025.

The market size for the bike saddles in USA is projected to reach USD 2.4 billion by 2035.

The demand for bike saddles in USA is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in bike saddles in USA are plastic, leather and others.

In terms of price range, road bike segment is expected to command 36.0% share in the bike saddles in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bike Saddles Market Trends – Growth & Demand Forecast 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Bike Sharing Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Bike And Scooter Rental Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA