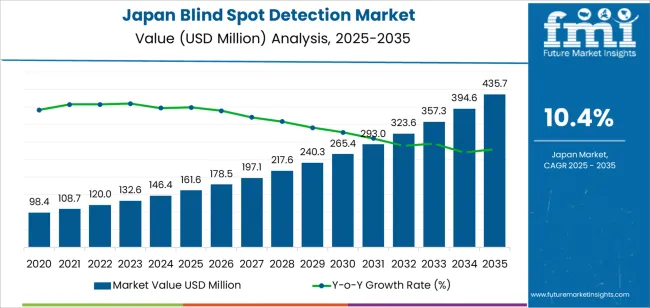

The demand for blind spot detection systems in Japan is projected to grow from USD 161.6 million in 2025 to USD 435.7 million by 2035, reflecting a CAGR of 10.4%. Blind spot detection systems are a critical component of advanced driver assistance systems (ADAS), providing added safety by alerting drivers to vehicles in their blind spots. The growing adoption of ADAS technologies across both consumer vehicles and commercial fleets is expected to drive significant market growth. As Japan’s automotive industry continues to integrate safety features into standard vehicle models, blind spot detection systems will become an essential element in the drive toward safer roads and automated driving.

The increasing focus on vehicle safety and regulations mandating ADAS technologies will support the growth of blind spot detection systems. Additionally, the rise of electric vehicles (EVs) and autonomous driving will further contribute to the integration of these systems. With technological advancements in sensor systems such as radar and camera-based solutions, the effectiveness and affordability of blind spot detection will improve, encouraging its wider adoption across a broader range of vehicles.

From 2025 to 2030, the demand for blind spot detection systems in Japan will grow from USD 161.6 million to USD 265.4 million, adding USD 103.8 million in value. This early phase will see strong growth momentum as the automotive industry continues to shift toward standardizing safety technologies. The demand will be particularly driven by the increased adoption of ADAS systems in consumer vehicles, as well as the expansion of EVs and autonomous driving technologies. During this phase, growth will be further supported by enhancements in sensor technology, which will improve the accuracy, affordability, and reliability of blind spot detection systems, making them accessible for a broader range of vehicles. The expansion of safety features in mainstream vehicles will continue to fuel the rapid growth of blind spot detection systems.

From 2030 to 2035, the market will grow from USD 265.4 million to USD 435.7 million, contributing USD 170.3 million in value. The market will continue to experience strong growth momentum, but at a more moderate rate as it matures. As more vehicles integrate blind spot detection as a standard feature, growth will be driven by market penetration rather than adoption. The transition from premium to mass-market vehicles adopting these systems will ensure steady growth, while ongoing technological innovations in radar and camera systems will keep the market competitive. Price reductions, along with increasing consumer awareness of vehicle safety, will ensure the continued expansion of this technology, solidifying its role in mainstream vehicle safety systems.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 57.1 million |

| Industry Forecast Value (2035) | USD 86.2 million |

| Industry Forecast CAGR (2025-2035) | 4.2% |

Demand for blind spot detection systems in Japan is increasing as automotive manufacturers and consumers seek enhanced safety features amid regulatory support and evolving vehicle technology. The market value is projected to grow from USD 161.6 million to USD 435.7 million, representing a compound annual growth rate (CAGR) of approximately 10.4%. The expansion is supported by rising integration of radar, camera, and ultrasonic sensors into passenger vehicles, especially given active support for advanced driver assistance systems (ADAS) in Japan.

Another factor contributing to demand is the continued shift toward electric and connected vehicles, which often incorporate blind spot detection as standard rather than optional equipment. In addition, Japan’s strong presence of automotive electronics suppliers and the need to comply with global vehicle safety standards underpin uptake in both domestic vehicles and exports. Remaining challenges include cost pressure for sensor systems, calibration complexities across vehicle models, and market competition from integrated safety suites. Despite these constraints, the combination of vehicular safety upgrade cycles and sensor technology advancements suggests sustained growth for blind spot detection systems in Japan.

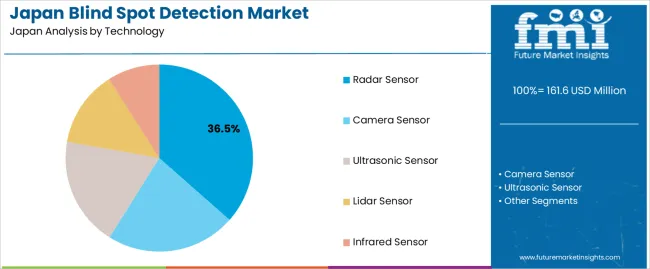

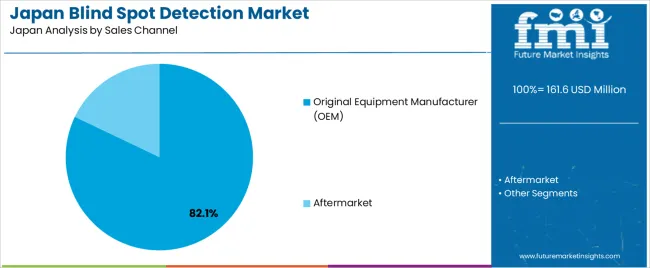

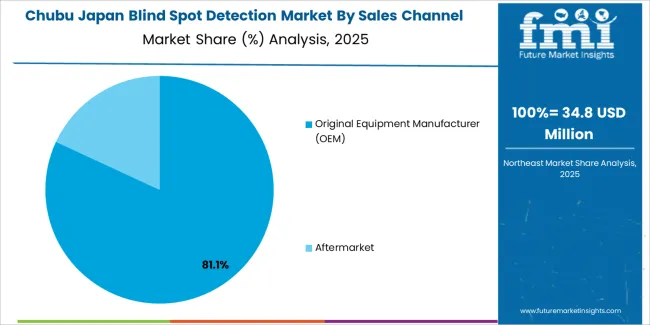

The demand for blind spot detection in Japan is primarily driven by technology and sales channel. The leading technology is radar sensors, accounting for 37% of the market share, while Original Equipment Manufacturer (OEM) sales dominate, capturing 82.1% of the demand. Blind spot detection systems are becoming a key safety feature in vehicles, enhancing driver awareness and preventing accidents. As the automotive industry increasingly focuses on improving vehicle safety, these systems are gaining traction, with advanced technologies like radar sensors and OEM installations leading the way in the Japanese market.

Radar sensors lead the demand for blind spot detection systems in Japan, holding 37% of the market share. Radar sensors are favored for their ability to reliably detect objects in a vehicle’s blind spots, even in adverse weather conditions such as rain, fog, or low visibility. They work by emitting radio waves to monitor areas around the vehicle, providing real-time alerts to drivers when other vehicles or obstacles are present in their blind spots.

The demand for radar sensors is driven by their precision, robustness, and reliability. Compared to other sensor technologies, radar sensors are less susceptible to environmental interference, making them ideal for use in blind spot detection systems. As the automotive industry continues to enhance safety features and meet regulatory requirements for driver assistance systems, radar sensors are expected to remain the dominant technology in the market. Their ability to provide consistent and accurate data in various driving conditions ensures their continued leadership in the blind spot detection sector in Japan.

Original Equipment Manufacturer (OEM) sales dominate the market for blind spot detection systems in Japan, accounting for 82.1% of the demand. OEMs play a pivotal role in integrating blind spot detection technology into new vehicles, either as standard or optional features. This trend is driven by consumer demand for advanced driver assistance systems (ADAS) and the increasing adoption of safety features across all vehicle segments.

OEM installations are particularly important due to the fact that many new vehicles come equipped with built-in blind spot detection systems, often as part of a broader suite of ADAS features. The preference for OEM installations is fueled by factors such as enhanced vehicle safety, manufacturer warranties, and integration with other vehicle technologies, such as lane-keeping assistance and automatic braking systems. As the automotive industry continues to prioritize safety and regulatory compliance, OEM sales are expected to remain the primary channel for blind spot detection system adoption in Japan, driving the market forward.

Demand for blind spot detection (BSD) systems in Japan is driven by increasing consumer safety expectations, government regulations aimed at reducing traffic accidents, and the growing trend toward vehicle automation. Japanese automakers are incorporating BSD systems into their advanced driver-assistance systems (ADAS) to enhance vehicle safety. However, high sensor costs, integration complexities in smaller vehicle platforms, and regional regulatory variations limit the pace of widespread adoption. These factors collectively influence the market development for BSD systems in Japan.

What Are the Primary Growth Drivers for Blind Spot Detection System Demand in Japan?

Several factors support growth. First, increased consumer demand for advanced safety features encourages automakers to include BSD in their vehicle offerings. Second, government regulations and safety targets, such as the "Traffic Safety Vision 2025," are pushing for broader adoption of ADAS features, including BSD. Third, the rise of electric vehicles (EVs) with sensor-rich platforms allows easier integration of BSD systems. Fourth, growing use of vehicle fleets and shared mobility services creates further demand for BSD systems due to their ability to improve driver safety and reduce liability.

What Are the Key Restraints Affecting Blind Spot Detection System Demand in Japan?

Despite strong growth drivers, several challenges remain. The high cost of sensors and associated technologies increases the overall vehicle cost, particularly for lower-cost models. Integration into smaller, compact vehicles commonly found in Japan presents technical difficulties due to space limitations. Additionally, the perceived value of BSD features, particularly in non-premium models, may be lower, limiting consumer adoption. Finally, the lack of clear regulatory mandates for BSD systems at the national level means adoption may be slower, especially in certain vehicle segments.

What Are the Key Trends Shaping Blind Spot Detection System Demand in Japan?

Key trends include the increasing integration of radar, camera, and AI-based sensors in BSD systems to enhance detection accuracy under challenging conditions, such as rain or fog. The aftermarket for BSD systems is expanding, with more consumers opting to retrofit their vehicles, which broadens the addressable market. Furthermore, automakers are packaging BSD with other safety features, such as lane change assist, as part of comprehensive ADAS suites. Lastly, advancements in sensor technology are helping to reduce the cost of BSD systems, making them more accessible for mid-range and compact vehicles.

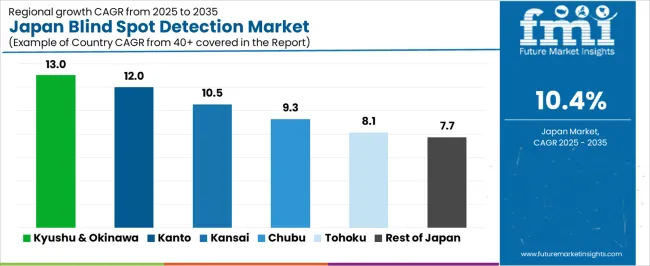

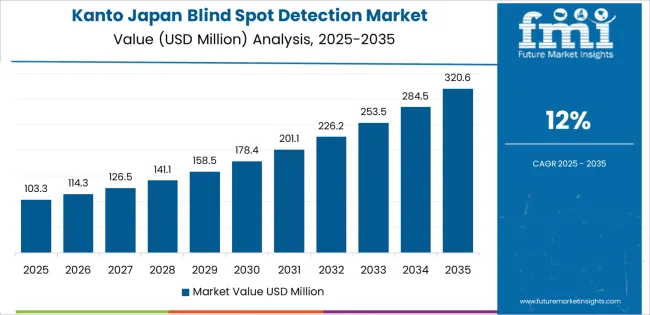

The demand for blind spot detection systems in Japan is experiencing strong growth across various regions, with Kyushu & Okinawa leading at a CAGR of 13.0%. Kanto follows closely with a 12.0% CAGR, driven by the region's large automotive market and consumer focus on vehicle safety. The Kinki region shows steady growth at 10.5%, while Chubu, Tohoku, and the Rest of Japan exhibit slower growth, with respective CAGRs of 9.3%, 8.1%, and 7.7%. These regional differences are influenced by factors such as population density, the strength of the automotive industry, and consumer awareness of vehicle safety technologies. The overall demand for blind spot detection systems is growing as consumers increasingly prioritize advanced safety features in vehicles.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 13% |

| Kanto | 12% |

| Kinki | 10.5% |

| Chubu | 9.3% |

| Tohoku | 8.1% |

| Rest of Japan | 7.7% |

The demand for blind spot detection in Kyushu & Okinawa is projected to grow at a CAGR of 13.0%, reflecting the region’s increasing focus on automotive safety and technological advancements. Kyushu & Okinawa have a strong automotive market, with manufacturers and dealerships offering a variety of vehicles equipped with advanced safety features, including blind spot detection. The growing awareness of road safety and the increasing prevalence of traffic accidents in densely populated urban areas are contributing to higher consumer demand for these safety systems. Additionally, the region’s investments in improving transportation infrastructure and vehicle technology further support the widespread adoption of blind spot detection. As consumers in Kyushu & Okinawa become more safety-conscious, the demand for vehicles with enhanced driver assistance systems is expected to continue to rise.

In the Kanto region, the demand for blind spot detection is expected to grow at a CAGR of 12.0%, driven by the region’s large automotive market, high population density, and emphasis on vehicle safety. Kanto, particularly Tokyo, is Japan’s largest automotive hub, with a significant number of consumers seeking vehicles equipped with advanced safety features. The growing awareness of traffic-related risks and the increasing number of accidents in urban areas are pushing consumers to prioritize safety when purchasing vehicles. The demand for blind spot detection systems is also supported by the region’s strong automotive industry, where both traditional and electric vehicle manufacturers are integrating these features into their models. As more consumers demand higher levels of safety in their vehicles, the adoption of blind spot detection technology is expected to continue to grow in Kanto.

The demand for blind spot detection in the Kinki region is projected to grow at a CAGR of 10.5%, supported by the region's strong automotive and consumer markets. Kinki, which includes Osaka and Kyoto, is a major economic and automotive hub in Japan, with a large number of vehicle dealerships and manufacturers offering cars equipped with advanced safety features. As urbanization continues to increase and traffic congestion remains a concern, the demand for driver assistance systems such as blind spot detection is rising. The region’s population, which includes a mix of younger, tech-savvy individuals and older drivers, is also contributing to the growing interest in these systems. Additionally, the widespread availability of vehicles with these safety features, particularly in mid-to-high-end models, is helping drive the adoption of blind spot detection in Kinki.

The demand for blind spot detection in Chubu is expected to grow at a CAGR of 9.3%, reflecting a steady rise in automotive safety awareness in the region. Chubu, home to key industrial cities such as Nagoya, is a major center for automotive manufacturing and innovation. As the automotive market in the region continues to expand, the adoption of advanced driver assistance systems (ADAS) like blind spot detection is becoming increasingly common. The growing focus on vehicle safety, combined with rising consumer demand for more sophisticated features, is driving the market for these technologies. While the growth rate is slightly slower than in Kyushu & Okinawa and Kanto, Chubu’s well-developed automotive infrastructure and rising safety standards ensure that the demand for blind spot detection systems will continue to grow steadily.

In Tohoku, the demand for blind spot detection is projected to grow at a CAGR of 8.1%, driven by the region’s aging population and increasing adoption of vehicle safety technologies. While Tohoku is less densely populated and has fewer large urban centers compared to regions like Kanto and Kinki, the demand for advanced safety features like blind spot detection is growing as the population ages and older drivers become more focused on vehicle safety. The region’s relatively slower pace of automotive technology adoption may result in more gradual growth, but as awareness of road safety increases and more vehicle models are equipped with these technologies, demand for blind spot detection systems is expected to rise. Furthermore, government and industry initiatives promoting safety in rural and suburban areas are likely to contribute to the adoption of these technologies.

In the Rest of Japan, the demand for blind spot detection is expected to grow at a CAGR of 7.7%, reflecting steady but slower adoption compared to other regions. The Rest of Japan includes rural areas and smaller cities where traditional vehicle models are still more common, and the adoption of advanced safety technologies like blind spot detection tends to be slower. However, as consumer awareness of road safety increases and more automakers offer these systems as standard or optional features in a wider range of vehicles, demand for blind spot detection systems is gradually growing. The region’s aging population and increasing need for accessible, safer transportation options are contributing to the rising interest in advanced driver assistance systems. While the growth rate is more moderate, the overall trend toward safety-conscious driving in the Rest of Japan ensures that the demand for these systems will continue to rise steadily.

Demand for blind-spot detection systems in Japan is rising as automakers respond to stricter safety regulations and growing consumer interest in advanced driver assistance systems (ADAS). The Japan blind-spot detection system market is projected to grow significantly in the coming years. Key companies in this sector include Continental AG (holding approximately 20% share), Bosch, Denso Corporation, Aptiv, and Valeo. These firms supply radar-, camera-, and sensor-based systems required for detecting vehicles in a car’s blind zones during lane changes and merges.

Competition in this industry centers on sensor accuracy, system integration, and localization. Providers focus on integrating radar and camera sensors that function reliably in various driving conditions found in Japan. Another key aspect is compatibility with Japanese vehicle platforms and OEM supply chains, requiring robust technical support, domestic calibration, and compliance with local automotive standards. Service providers also emphasize delivery speed and modular designs to support tier-1 and tier-2 integration. Marketing materials typically emphasize detection range, false-alarm rate, platform compatibility, and ease of integration. By aligning their product portfolios with Japanese automakers’ safety upgrade strategies, these companies aim to strengthen their position in Japan’s blind-spot detection market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Technology | Radar Sensor, Camera Sensor, Ultrasonic Sensor, Lidar Sensor, Infrared Sensor |

| Sales Channel | Original Equipment Manufacturer (OEM), Aftermarket |

| Vehicle Type | Passenger Vehicle, Light Commercial Vehicle, Heavy Commercial Vehicle |

| Key Companies Profiled | Continental AG, Bosch, Denso Corporation, Aptiv, Valeo |

| Additional Attributes | The market analysis includes dollar sales by technology, sales channel, vehicle type, and company categories. It also covers regional demand trends in Japan, particularly driven by the increasing adoption of blind spot detection systems in passenger, light commercial, and heavy commercial vehicles. The competitive landscape highlights key manufacturers focusing on innovations in sensor technologies, including radar, camera, ultrasonic, lidar, and infrared sensors. Trends in the growing demand for enhanced safety features in vehicles, along with advancements in sensor integration, system reliability, and real-time data processing, are explored. |

The demand for blind spot detection in japan is estimated to be valued at USD 161.6 million in 2025.

The market size for the blind spot detection in japan is projected to reach USD 435.7 million by 2035.

The demand for blind spot detection in japan is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in blind spot detection in japan are radar sensor, camera sensor, ultrasonic sensor, lidar sensor and infrared sensor.

In terms of sales channel, original equipment manufacturer (oem) segment is expected to command 82.1% share in the blind spot detection in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blind Spot Detection Market Growth - Trends & Forecast 2025 to 2035

Adaptive Cruise Control and Blind Spot Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Blind Spot Monitor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Blind Spot Monitors Market

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Blinds and Shades Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA