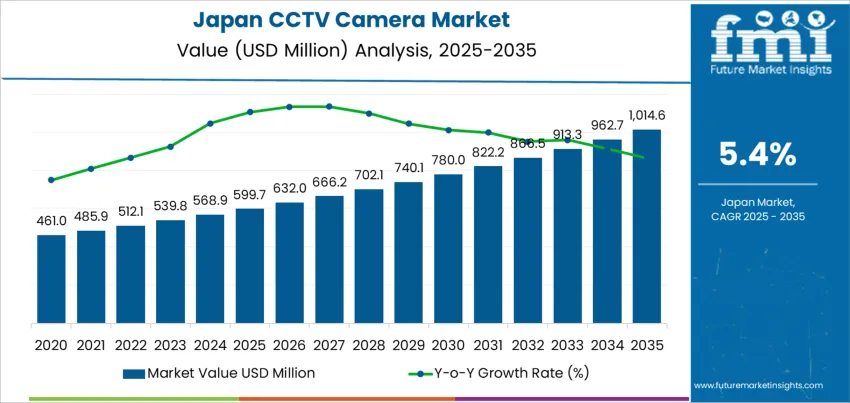

The demand for CCTV cameras in Japan is expected to grow from USD 599.7 million in 2025 to USD 1,014.6 million by 2035, at a compound annual growth rate (CAGR) of 5.4%. This growth is primarily driven by an increasing focus on security, surveillance, and safety across both public and private sectors. With the growing importance of crime prevention, public safety, and asset protection, both government agencies and businesses are investing more in CCTV technology to enhance security.

Technological advancements, such as AI-powered cameras, facial recognition, and cloud-based storage, are also contributing to this growth. These features enable smarter, more efficient surveillance, making CCTV systems more appealing. The integration of these systems into broader security ecosystems is driving demand in industries like retail, transportation, and real estate.

Japan’s push towards "smart cities" will further boost the adoption of CCTV cameras. These smart surveillance systems, integrated with other urban infrastructure, are becoming increasingly important for managing public safety and monitoring traffic. As the need for advanced, data-driven security systems continues to grow, CCTV cameras are expected to play an integral role in urban development, driving steady demand for the foreseeable future.

From 2025 to 2030, the demand for CCTV cameras in Japan is projected to grow from USD 599.7 million to USD 822.2 million, adding USD 222.5 million in value. This period will see robust growth driven by several key factors. The primary drivers include the increased expansion of surveillance systems in public spaces, commercial properties, and industrial sectors. As safety and security concerns remain a top priority for both public and private sectors, the adoption of CCTV cameras will grow significantly. The demand for high-definition, real-time surveillance solutions in urban areas, transport systems, and commercial establishments is set to rise.

From 2030 to 2035, demand for CCTV cameras will continue to rise from USD 822.2 million to USD 1,014.6 million, contributing USD 192.4 million in value. Although the growth rate may moderate as the industry matures, several factors will sustain steady demand. Advancements in smart surveillance technologies, including cloud integration and AI-driven analytics, will continue to enhance the performance of CCTV systems. The integration of CCTV systems with broader security frameworks, such as access control, alarm systems, and building management systems, will also be a significant driver.

| Metric | Value |

|---|---|

| Demand for CCTV Camera in Japan Value (2025) | USD 599.7 million |

| Demand for CCTV Camera in Japan Forecast Value (2035) | USD 1,014.6 million |

| Demand for CCTV Camera in Japan Forecast CAGR (2025-2035) | 5.4% |

The demand for CCTV cameras in Japan is growing due to increasing concerns about security and safety in both public and private sectors. As the need for surveillance and monitoring in urban areas, commercial properties, and industrial sites rises, CCTV cameras have become an essential tool for preventing crime, monitoring traffic, and ensuring safety. The growing adoption of smart city technologies and the increased focus on public security are significant contributors to the demand for CCTV cameras in Japan.

A key driver behind this growth is the increasing emphasis on safety and security, particularly in densely populated areas. Japan’s major urban centers, including Tokyo and Osaka, face challenges related to public safety, and CCTV systems are vital for monitoring public spaces, transportation networks, and key infrastructure. Furthermore, the growing threat of cybersecurity risks and the need for surveillance in high-traffic areas are pushing the adoption of advanced CCTV systems equipped with features such as high-definition video capture, facial recognition, and real-time monitoring capabilities.

The rise of smart cities and technological advancements in IoT (Internet of Things) integration are contributing to the demand for more advanced CCTV systems. These systems are increasingly connected, enabling remote monitoring and analysis, making them more efficient and cost-effective for users. As Japan continues to invest in smart infrastructure, the demand for CCTV cameras is expected to grow steadily through 2035, driven by technological advancements and the increasing need for enhanced security and surveillance.

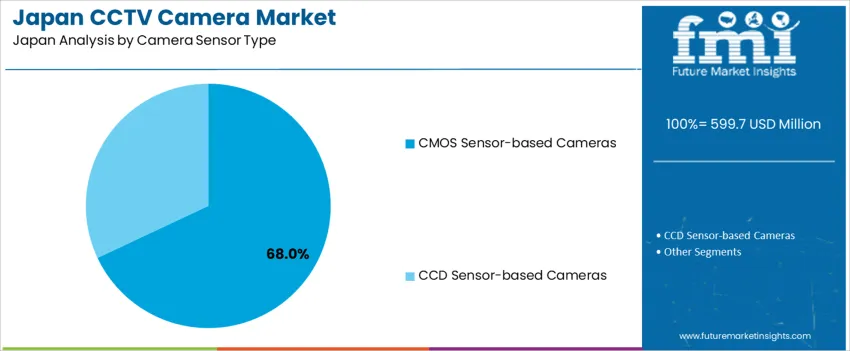

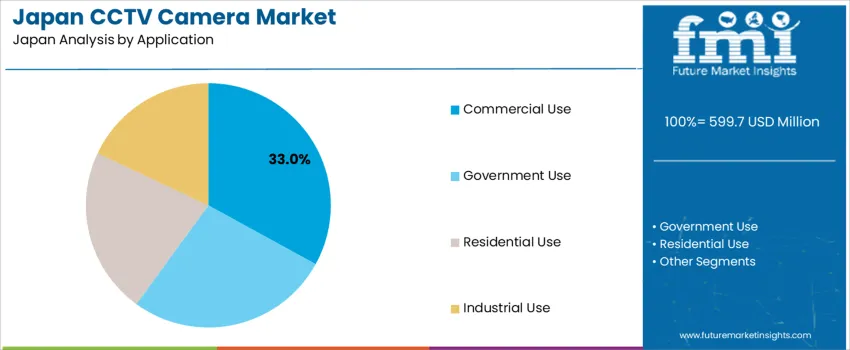

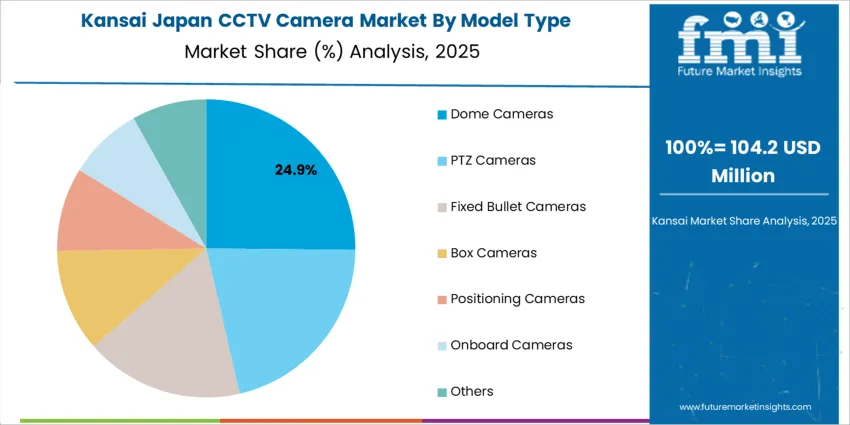

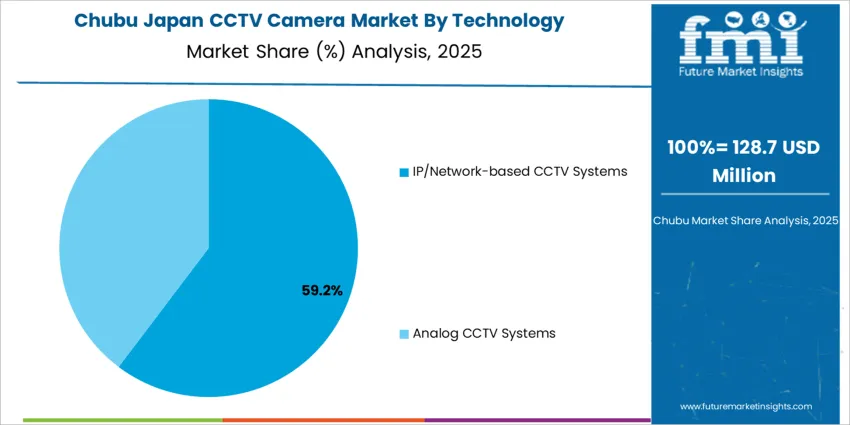

Demand for CCTV cameras in Japan is segmented by camera sensor type, application, model type, technology, and region. By camera sensor type, demand is divided into CMOS sensor-based cameras and CCD sensor-based cameras. The demand is also segmented by application, including commercial use, government use, residential use, and industrial use. Model type segmentation includes dome cameras, PTZ (pan-tilt-zoom) cameras, fixed bullet cameras, box cameras, positioning cameras, onboard cameras, and others. In terms of technology, demand is divided into IP/network-based CCTV systems and analog CCTV systems. Regionally, demand is spread across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the Rest of Japan.

CMOS sensor-based cameras account for 68% of the demand for CCTV cameras in Japan, primarily due to their superior image quality, lower power consumption, and cost-effectiveness. CMOS sensors provide high-resolution imaging, faster processing speeds, and greater sensitivity to light, making them ideal for security applications requiring real-time monitoring. The growing need for advanced surveillance solutions, particularly in commercial and residential sectors, has increased the popularity of CMOS sensor-based cameras. The rise of integrated security systems, such as IP-based CCTV, has further fueled their adoption. CMOS cameras are compatible with digital technologies, offering network-based capabilities that are more cost-efficient than CCD cameras, which consume more power and are pricier. As demand for reliable and high-quality surveillance grows, CMOS sensor-based cameras continue to dominate the industry.

Commercial use accounts for 33% of the demand for CCTV cameras in Japan, driven by an increasing need for security in business environments, retail stores, and public spaces. As concerns over public safety rise, commercial establishments are adopting CCTV systems to enhance security, monitor customer behavior, and protect assets. The demand for smart surveillance systems that enable remote monitoring and integration with other security technologies has further boosted CCTV camera usage in commercial applications. Sectors such as retail, banking, hospitality, and transportation are increasingly relying on CCTV for efficient and real-time surveillance. With the commercial sector expanding and security concerns escalating, the demand for CCTV cameras in these industries is expected to grow. CCTV systems have become essential tools in maintaining the safety of large spaces and high-value assets, ensuring their importance in commercial environments in Japan.

Demand for CCTV cameras in Japan is rising as security, public‑safety, and smart‑infrastructure needs increase across both urban and rural areas. Use of surveillance cameras extends beyond crime prevention to elder‑care monitoring, traffic control, facility management, and smart‑city implementations. The growth of IP‑based and AI‑enabled systems, along with rising demand for real‑time video analytics and cloud‑based storage, further supports adoption. Urbanization and population density in major cities generate demand for robust surveillance networks. Yet, concerns regarding data privacy, regulatory compliance, and high installation or maintenance costs in older or small structures remain as key restraints on faster penetration.

Demand for CCTV cameras is growing in Japan because institutions, businesses, and households increasingly value safety, security, and monitoring capability. Aging population and rising elder‑care needs push residential and care‑facility users to adopt cameras for remote monitoring and safety assurance. Commercial establishments, public transport networks, and municipal authorities invest in cameras to manage traffic, ensure public security, and deter crime. The rise of smart‑city initiatives and digitalisation of public services encourage deployment of connected surveillance infrastructure. Broader use of online and cloud‑based video storage and viewing makes CCTV systems convenient and accessible, boosting demand among both private and public sectors.

Technological innovations are significantly enhancing the appeal of CCTV cameras in Japan. The shift toward IP‑based cameras with high‑definition, CMOS sensors, and 4K/UHD resolution offers better image clarity and improved low-light performance. Integration of AI-based video analytics enables features like motion detection, facial recognition, behavior analysis, and real‑time alerts, adding value beyond simple recording. Wireless connectivity and edge‑AI architectures reduce installation complexity and enable flexible deployments in homes, offices, or urban infrastructure. Cloud storage, remote access via smartphones, and smart‑home integration further expand use cases. These advances make CCTV adoption more practical, scalable, and attractive for diverse users, from households to municipalities.

Despite strong growth drivers, several challenges could limit CCTV camera adoption in Japan. Raising concerns about privacy, data protection, and surveillance ethics create regulatory and social pushback, especially in residential or public‑space deployment. High upfront costs for advanced systems with AI, high‑resolution sensors, and cloud infrastructure may deter small businesses or households. In older buildings or compact urban dwellings, installation and wiring may be difficult or costly. The need for ongoing maintenance, updates, secure data storage, and skilled operation reduces appeal for some purchasers. Competition from alternative safety solutions (e.g. security services, smart door systems) may also limit the expansion of conventional CCTV systems.

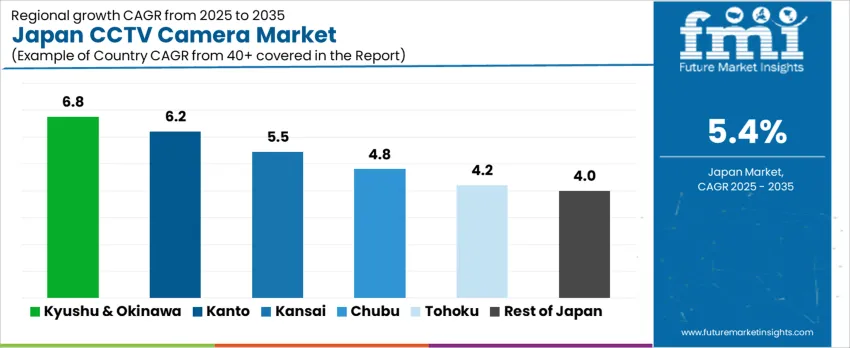

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.8% |

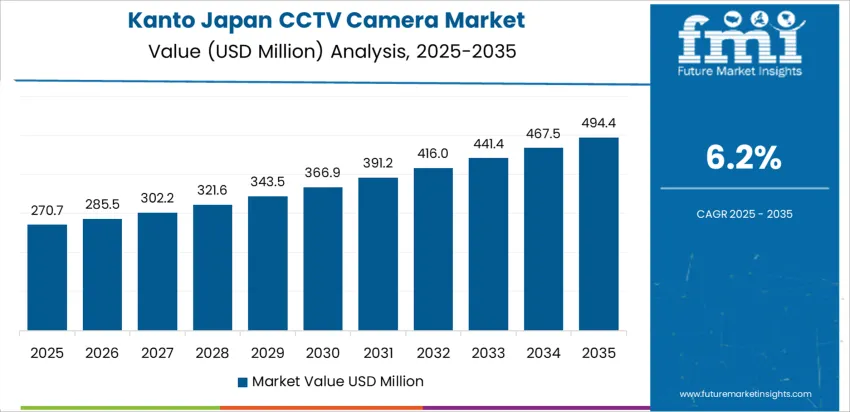

| Kanto | 6.2% |

| Kansai | 5.5% |

| Chubu | 4.8% |

| Tohoku | 4.2% |

| Rest of Japan | 4.0% |

Demand for CCTV cameras in Japan is steadily increasing, with Kyushu & Okinawa leading at a 6.8% CAGR, driven by the region's growing focus on security, tourism, and infrastructure development. Kanto follows with a 6.2% CAGR, supported by its high population density, strong industrial base, and technological advancements in smart city projects. Kansai shows a 5.5% CAGR, fueled by its emphasis on public safety, retail growth, and tourism. Chubu experiences a 4.8% CAGR, with steady demand driven by industrial sectors like automotive and manufacturing. Tohoku sees a 4.2% CAGR, with moderate growth fueled by regional safety initiatives and expanding urbanization. The Rest of Japan shows a 4.0% CAGR, supported by increased adoption of surveillance in rural and suburban areas.

Kyushu & Okinawa leads the demand for CCTV cameras, growing at a 6.8% CAGR. The region’s industrial growth, particularly in sectors like automotive, electronics, and energy, is driving the rising need for surveillance solutions. With increasing concerns about safety and security, businesses and public spaces in Kyushu & Okinawa are increasingly adopting CCTV systems for surveillance. The tourism sector, which plays a significant role in the region, also contributes to the growing demand as local businesses and hotels seek to ensure the safety of guests and protect their property. Government initiatives focusing on improving public safety and infrastructure in urban and rural areas are further driving the adoption of CCTV cameras. As the region continues to embrace clean technologies and modernize its infrastructure, the demand for advanced surveillance solutions like CCTV cameras will remain strong, particularly in areas related to public safety, tourism, and industrial operations.

Kanto is experiencing steady demand for CCTV cameras, growing at a 6.2% CAGR. The region’s large urban population, particularly in Tokyo, drives a significant portion of this demand. With an emphasis on public safety, Kanto has seen widespread adoption of CCTV cameras in commercial spaces, public transport networks, and government buildings. The demand is further boosted by the region’s robust e-commerce, retail, and hospitality industries, all of which rely on surveillance systems for security purposes. In addition, Kanto’s focus on developing smart city technologies and improving infrastructure is contributing to the growing need for advanced surveillance systems, including AI-driven CCTV cameras. The increasing awareness of crime prevention and the rise in urban security concerns are encouraging both businesses and local governments in Kanto to invest in comprehensive surveillance solutions. As security needs continue to grow, Kanto’s demand for CCTV cameras is expected to remain strong and steady.

Kansai is seeing steady demand for CCTV cameras, growing at a 5.5% CAGR. The region’s industrial and retail sectors, particularly in cities like Osaka, drive the demand for surveillance solutions. Kansai has a strong focus on safety and security, especially in public spaces such as shopping malls, transportation hubs, and tourist destinations, which all require CCTV systems for monitoring and safety. The region’s growing hospitality sector, particularly hotels and event venues, also contributes to the rise in CCTV camera adoption. As the region focuses on modernizing its infrastructure, especially with smart city initiatives, the need for intelligent and efficient security systems is increasing. Kansai is also home to a significant number of commercial properties, which rely on CCTV cameras for monitoring and protecting their assets. With an expanding focus on safety, crime prevention, and public security, demand for CCTV cameras in Kansai is expected to continue growing steadily.

Chubu is experiencing steady demand for CCTV cameras, with a 4.8% CAGR. The region’s industrial base, particularly in Nagoya, contributes significantly to the rise in demand for surveillance systems. The automotive sector, which plays a large role in Chubu’s economy, has seen increasing demand for CCTV cameras to monitor factories, assembly lines, and warehouses. The growing number of commercial establishments, including retail stores, offices, and public spaces in the region, also drives the adoption of CCTV systems. Chubu’s focus on improving public safety through modern infrastructure development, especially in urban areas, further accelerates demand for surveillance solutions. The region’s expanding e-commerce presence and local retail outlets are increasing the need for security measures, as well as enhancing safety in residential areas. As Chubu continues to develop its manufacturing and commercial sectors, the demand for CCTV cameras is expected to rise steadily, ensuring continued growth in the region.

Tohoku is seeing moderate demand for CCTV cameras, with a 4.2% CAGR. While the region’s industry is smaller than more industrialized areas, Tohoku’s growing focus on public safety and security has contributed to an increase in CCTV installations. As the region’s infrastructure continues to expand and urbanize, the need for surveillance solutions in commercial, industrial, and public spaces is growing. Government initiatives to improve safety and security in local communities and public transport systems are driving demand for CCTV cameras. The tourism industry in Tohoku, including cultural festivals and regional events, has also led to an increased need for surveillance solutions. The rise in eco-friendly technologies and smart city initiatives in Tohoku further boosts demand for advanced surveillance systems. As Tohoku continues to adopt new technologies and enhance its urban infrastructure, the demand for CCTV cameras will continue to grow at a steady pace.

The Rest of Japan is experiencing steady demand for CCTV cameras, with a 4.0% CAGR. Although the industry is smaller compared to major urban regions, the demand for CCTV systems is increasing due to a growing focus on security in rural and suburban areas. As local governments and businesses invest in improving public safety and infrastructure, CCTV cameras are becoming more prevalent. The adoption of smart technologies and the push for energy-efficient solutions in these areas are also contributing to the growing demand for surveillance systems. Rural areas are increasingly using CCTV cameras for protecting property, monitoring agricultural sites, and ensuring safety in public spaces. As the region’s industries, including agriculture and small-scale manufacturing, embrace digital technologies, the need for CCTV systems will continue to grow. Demand remains steady as surveillance systems become a common security tool in rural and suburban environments across Japan.

The demand for CCTV cameras in Japan continues to grow, driven by rising concerns about security in both public and private sectors. Increasing adoption of surveillance systems for security purposes in urban areas, residential buildings, commercial spaces, and government installations is a key factor fueling this industry growth. With the rise in digital surveillance technologies, including high-definition video, motion detection, and AI-enabled systems, the CCTV industry is expanding. Japan’s advanced technological infrastructure also supports the demand for cutting-edge surveillance solutions, especially as smart city initiatives and IoT integration become more prevalent.

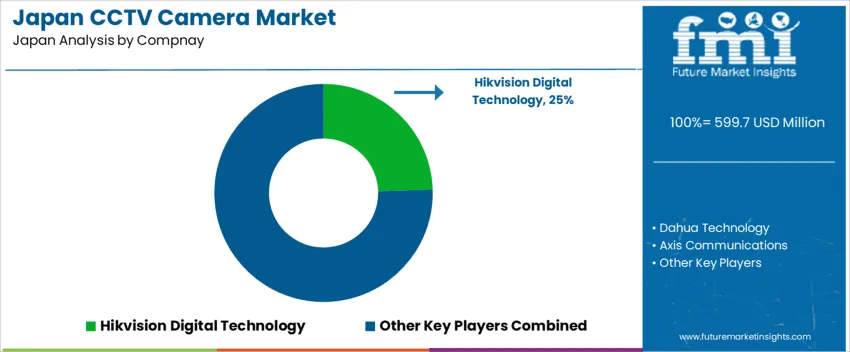

Leading companies in the CCTV camera industry in Japan include Hikvision Digital Technology, Dahua Technology, Axis Communications, Bosch Security Systems, Honeywell Security, and Samsung Techwin (Hanwha). Hikvision Digital Technology holds the largest industry share of 24.5%, offering a wide range of CCTV cameras known for their high performance, video clarity, and advanced features such as AI-driven analytics. Dahua Technology is another major player, providing innovative and cost-effective surveillance solutions with robust video analytics. Axis Communications specializes in IP-based surveillance systems that offer scalability and high-definition video quality. Bosch Security Systems provides reliable and flexible surveillance solutions, focusing on smart features and integration. Honeywell Security offers cutting-edge cameras for both residential and commercial applications. Samsung Techwin (Hanwha) focuses on high-quality video surveillance systems, including AI-driven cameras for advanced security needs.

Competition in the CCTV camera industry is driven by technological innovation, image quality, and the ability to provide smart, scalable surveillance solutions. Companies compete by offering cameras with superior resolution, enhanced video analytics, and real-time monitoring features. The increasing demand for AI-powered solutions, including facial recognition, motion tracking, and predictive analytics, is also shaping the industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Synthetic, Natural |

| Model Type | Dome Cameras, PTZ Cameras, Fixed Bullet Cameras, Box Cameras, Positioning Cameras, Onboard Cameras, Others |

| Technology | IP/Network-based CCTV Systems, Analog CCTV Systems |

| Camera Sensor Type | CMOS Sensor-based Cameras, CCD Sensor-based Cameras |

| Application | Commercial Use, Government Use, Residential Use, Industrial Use |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Hikvision Digital Technology, Dahua Technology, Axis Communications, Bosch Security Systems, Honeywell Security, Samsung Techwin (Hanwha) |

| Additional Attributes | Dollar sales by product type, model type, technology, and application; regional CAGR and adoption trends; demand trends in CCTV cameras; growth in commercial, residential, and industrial sectors; technology adoption for IP and analog CCTV systems; vendor offerings including camera sensors and positioning solutions; regulatory influences and industry standards |

The demand for CCTV camera in Japan is estimated to be valued at USD 599.7 million in 2025.

The market size for the CCTV camera in Japan is projected to reach USD 1,014.6 million by 2035.

The demand for CCTV camera in Japan is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in CCTV camera in Japan are dome cameras, ptz cameras, fixed bullet cameras, box cameras, positioning cameras, onboard cameras and others.

In terms of technology, ip/network-based CCTV systems segment is expected to command 61.0% share in the CCTV camera in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CCTV Camera Market Demand & Sustainability Trends 2025-2035

Demand for Camera Technology in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Smart Home Security Camera in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

CCTV Tester Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Camera Lens Market Size and Share Forecast Outlook 2025 to 2035

Camera Module Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA