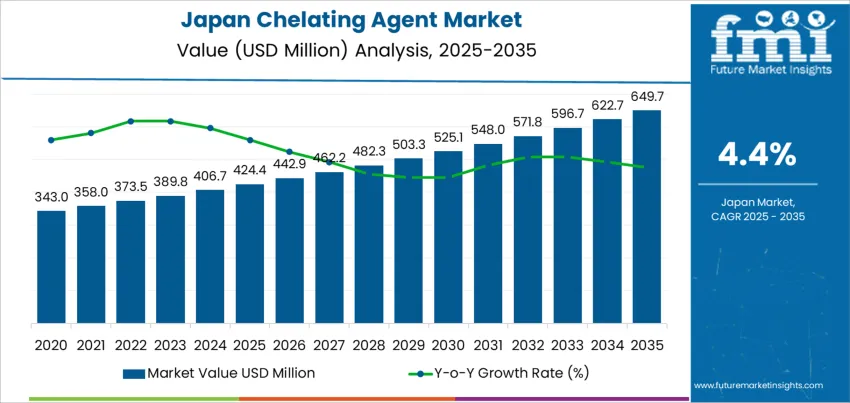

The demand for chelating agents in Japan is expected to grow from USD 424.4 million in 2025 to USD 649.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.4%. Chelating agents are essential for a wide range of applications, including agriculture, water treatment, pharmaceuticals, and food processing. Their role in binding metal ions and enhancing product efficacy makes them crucial across industries. As Japan continues to focus on improving water quality, enhancing agricultural productivity, and maintaining high manufacturing standards, demand for chelating agents is expected to rise steadily throughout the forecast period.

The market will show gradual, consistent growth, starting at USD 424.4 million in 2025 and growing to USD 442.9 million in 2026. By 2027, the market will expand to USD 462.2 million, continuing to rise each year, with demand reaching USD 503.3 million by 2029. By 2035, the market is forecasted to reach USD 649.7 million, reflecting steady, long-term growth driven by the increasing adoption of chelating agents across Japan’s key industrial sectors.

The chelating agent market in Japan is expected to experience steady growth through 2035. From USD 424.4 million in 2025, the market will gradually increase, reaching USD 442.9 million in 2026 and USD 462.2 million in 2027. By 2029, demand is projected to reach USD 503.3 million, with further growth expected in the subsequent years. By 2035, the demand for chelating agents is forecasted to reach USD 649.7 million, driven by the increasing applications of these agents in sectors like water treatment, agriculture, and industrial cleaning.

The peak-to-trough analysis indicates a steady growth pattern with minimal fluctuations in the market demand. From 2025 to 2029, the market experiences a gradual rise in demand, with a modest increase each year. The demand continues to grow in the latter half of the forecast period, but the rate of growth will remain stable, without any significant peaks or troughs. This suggests that the chelating agent market in Japan will continue its steady expansion, with consistent demand driven by evolving industrial and environmental needs.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 424.4 million |

| Industry Forecast Value (2035) | USD 649.7 million |

| Industry Forecast CAGR (2025-2035) | 4.4% |

The demand for chelating agents in Japan is rising as industrial sectors expand their use of these compounds for water treatment, electronics manufacturing, agriculture, personal care, pharmaceuticals, and cleaning applications. Japan’s growing water and wastewater treatment infrastructure drives demand because chelating agents are used to bind and remove metal ions, control scale and corrosion, and manage water quality in industrial effluent and municipal systems. As water treatment regulations tighten and industries require high purity water and strict effluent standards, the need for effective chelants increases. The electronics and semiconductor industries in Japan further fuel demand because manufacture of electronic components often requires chelating agents for cleaning parts and controlling metal ion contamination. In agriculture and agrochemical applications, chelating agents improve micronutrient bioavailability in soils and fertilizers, supporting crop yields in soils with metal ion imbalance or deficiency. Industries producing household cleaning products, cosmetics, and personal care goods also contribute to demand as they shift toward using chelants to improve performance in hard water and extend shelf life. Rising awareness of environmental impact and consumer preference for safer, biodegradable chemical products encourage adoption of more environmentally friendly chelating agents in these segments.

The chelating agent market in Japan is showing growth projections over the next decade. Market estimates indicate the nation’s chelating agent market value was about USD 0.3 billion in 2024 and may rise to around USD 0.6 billion by 2033, implying a compound annual growth rate of roughly 9.2 percent. This growth is supported by broadening applications across water treatment, agrochemical, pharmaceuticals, cosmetics, electronics and industrial processing. The push for high purity formulations, regulatory pressure toward sustainability and increased use of biodegradable chelants also support expansion. Manufacturers in Japan appear to be expanding production capacity of high purity and eco friendly chelating agents to meet diversified demand. As industrial diversification, environmental regulation, and demand across multiple sectors converge, the market for chelating agents in Japan is likely to grow steadily in the coming years.

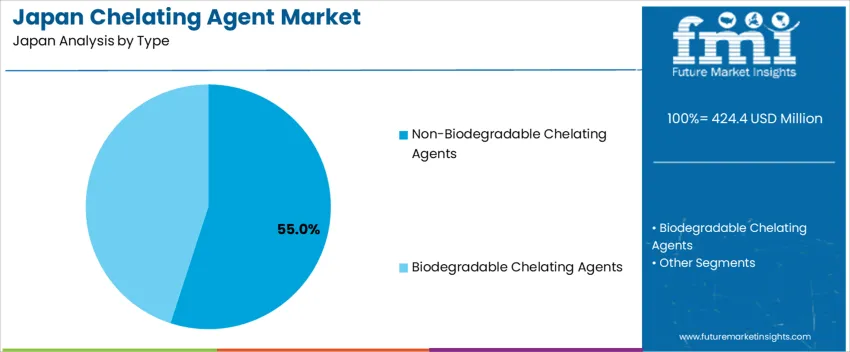

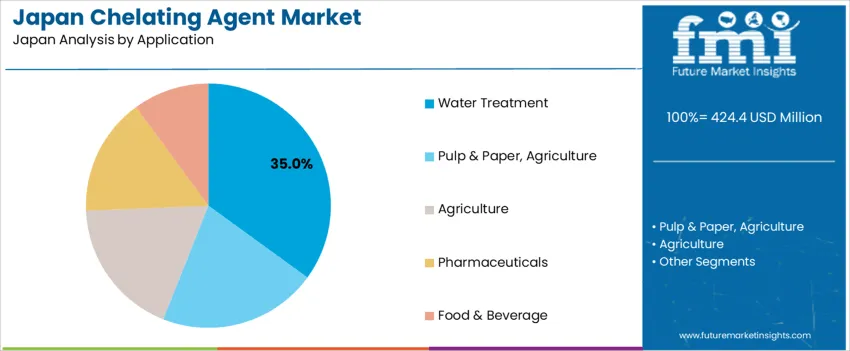

The demand for chelating agents in Japan is driven by type and application. The leading type is non-biodegradable chelating agents, capturing 55% of the market share, while water treatment is the dominant application, accounting for 35% of the demand. Chelating agents are essential in various industries to bind and remove metal ions, preventing scale formation, corrosion, and enhancing process efficiency. As industries in Japan continue to prioritize environmental sustainability and operational efficiency, the demand for chelating agents is expected to remain strong.

Non-biodegradable chelating agents lead the demand for chelating agents in Japan, holding 55% of the market share. These chelating agents are commonly used in industrial applications where long-lasting, stable performance is required. They are particularly effective at binding metal ions in processes such as water treatment, cleaning, and pulp processing. Non-biodegradable chelating agents are often preferred for their high efficiency in complex industrial environments where reliability and extended operational life are critical.

The demand for non-biodegradable chelating agents is driven by their superior performance in harsh environments, including the ability to maintain stability in high-pressure, high-temperature applications. Industries like water treatment, paper production, and agriculture rely on non-biodegradable chelating agents to remove unwanted metals and ensure smooth processing. While biodegradable alternatives are gaining attention due to environmental concerns, non-biodegradable chelating agents continue to dominate due to their effectiveness, especially in demanding industrial settings.

Water treatment is the leading application for chelating agents in Japan, capturing 35% of the demand. Chelating agents are widely used in water treatment to bind metal ions, prevent scale buildup, and reduce corrosion, ensuring that water systems remain efficient and operational. In Japan, where industrial water use is high, chelating agents are crucial for maintaining the quality of water used in manufacturing, power plants, and municipal systems.

The demand for chelating agents in water treatment is driven by the need to maintain clean, safe water supplies and to reduce system inefficiencies caused by metal contamination. As industries and municipalities focus on improving water quality and compliance with environmental standards, the use of chelating agents becomes increasingly vital. Chelating agents help to optimize water treatment processes by ensuring that metals like calcium, magnesium, and iron do not interfere with equipment or affect water quality. As the need for efficient water management grows, especially in industrial sectors, the demand for chelating agents in water treatment is expected to continue to rise in Japan.

Demand for chelating agents in Japan has been rising in recent years. The national market was valued at about USD 0.3 billion in 2024. Growth is expected to drive market value to roughly USD 0.6 billion by 2033, nearly doubling over the next several years. This increase reflects expanding use across water treatment, cleaning, agrochemicals, pharmaceuticals, electronics manufacturing and other industrial and consumer sectors. The shift toward higher purity and specialized chelating agents supports this demand. Application diversification and regulatory driven substitution of older compounds with newer chelates underlie the upward trajectory.

What are the Drivers of Demand for Chelating Agents in Japan?

Several factors drive demand for chelating agents in Japan. Growing demand in water treatment and industrial wastewater management supports chelant use to control metal ions and ensure water quality. Use in agrochemical formulations and fertilizers pushes demand for chelants to improve nutrient bioavailability and soil treatment. Expanding electronics manufacturing and pharmaceutical sectors require high purity chelating agents for metal ion control, cleaning, and process stability. Household and industrial cleaning product demand also supports use of chelants to manage water hardness and improve detergent performance. Additionally, regulatory pressure and shifting industry preference toward more environmentally acceptable or lower impact chelating agents encourage replacement of older compounds with newer alternatives, enhancing chelant consumption.

What are the Restraints on Demand for Chelating Agents in Japan?

Some factors may restrain growth of chelating agent demand in Japan. Concerns about environmental impact and toxicity of certain traditional chelating agents could lead to regulatory limits or reduced usage in sensitive applications. Cost pressures or raw material volatility may make high purity or specialized chelants more expensive, reducing their adoption, especially in cost sensitive segments such as commodity cleaning or fertilizers. In sectors where alternative methods for metal ion control, water treatment, or nutrient delivery are available, substitution away from chelants may occur. Also slow growth or contraction in key end use industries such as heavy manufacturing or paper processing may reduce demand for chelants. Finally, the need for certification or compliance for specialty chelants in pharmaceuticals or electronics may delay adoption and restrict near term uptake.

What are the Key Trends Influencing Demand for Chelating Agents in Japan?

A key trend is increasing use of high purity and specialized chelating agents, tailored for sectors such as electronics manufacturing, pharmaceuticals, and precision industrial processes. This reflects demand for stricter performance and quality standards. Another trend is growing use of chelating agents in agrochemical and fertilizer formulations to improve nutrient delivery and soil treatment, particularly where metal availability in soil needs management. Expanded use in water treatment and wastewater management remains a major trend given regulatory and environmental pressures to control metal contamination. Demand from household and industrial cleaning segments continues to sustain chelant use because of water hardness and detergent performance needs. Finally, there is gradual substitution of older chelants with newer or more acceptable agents as industries and regulators seek safer, more efficient solutions for metal ion binding across applications.

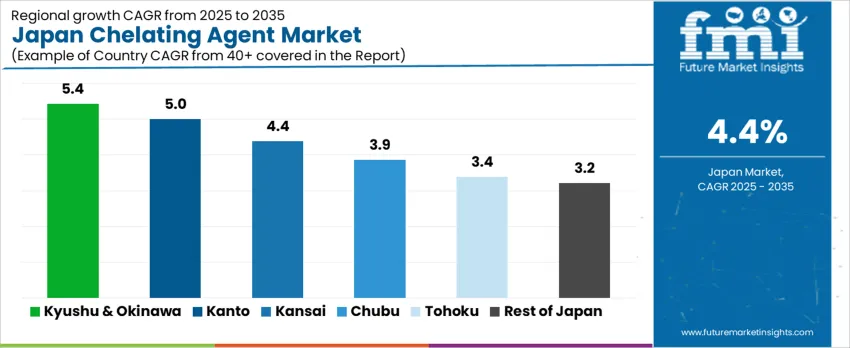

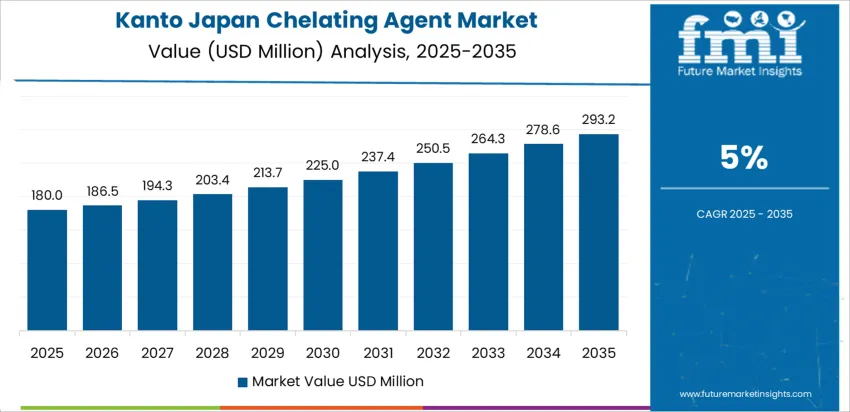

The demand for chelating agents in Japan shows steady growth across regions, with Kyushu & Okinawa leading at a CAGR of 5.4%. Kanto follows closely with a 5.0% CAGR, supported by strong industrial activity. The Kinki region exhibits moderate growth at 4.4%, while Chubu, Tohoku, and the Rest of Japan show more modest growth, with respective CAGRs of 3.9%, 3.4%, and 3.2%. These regional differences are driven by varying industrial needs, agricultural applications, and water treatment demands.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.4 |

| Kanto | 5.0 |

| Kinki | 4.4 |

| Chubu | 3.9 |

| Tohoku | 3.4 |

| Rest of Japan | 3.2 |

The demand for chelating agents in Kyushu & Okinawa is projected to grow at a CAGR of 5.4%, driven by the region’s agricultural industry and the need for effective water treatment solutions. Kyushu & Okinawa have a strong agricultural base, where chelating agents are used to improve nutrient uptake in crops, especially in soil with high levels of metal ions. Additionally, the increasing focus on sustainable farming practices and efficient irrigation systems is driving the demand for chelating agents in agriculture. The region’s efforts to address water quality issues, including the removal of heavy metals, further contribute to the demand for chelating agents. As environmental concerns grow and industries seek greener solutions, the use of chelating agents in both agriculture and water treatment applications is expected to continue to rise.

In Kanto, the demand for chelating agents is expected to grow at a CAGR of 5.0%, supported by the region’s significant industrial, agricultural, and water treatment sectors. Kanto, home to Tokyo and surrounding areas, is Japan’s industrial and economic hub, with many manufacturers and water treatment facilities requiring chelating agents to improve efficiency and reduce the environmental impact of their operations. The region’s focus on advancing technology, particularly in the fields of electronics and pharmaceuticals, also drives the need for chelating agents, which are used in various industrial applications such as metal ion sequestration and process optimization. Furthermore, Kanto’s large-scale agricultural operations and growing awareness of sustainable farming practices further contribute to the rising demand for chelating agents to optimize soil health and enhance crop productivity.

The demand for chelating agents in Kinki is projected to grow at a CAGR of 4.4%, driven by the region’s industrial and agricultural activities. Kinki, which includes major cities like Osaka and Kyoto, has a well-established industrial base, including chemical production, food processing, and water treatment. The demand for chelating agents in Kinki is primarily driven by their use in water treatment to manage heavy metal contamination and improve water quality in industrial processes. Additionally, chelating agents are increasingly being used in agriculture to improve the bioavailability of nutrients in soils with high metal content. While growth is moderate compared to Kyushu & Okinawa and Kanto, Kinki’s strong industrial and agricultural sectors ensure steady demand for chelating agents in various applications.

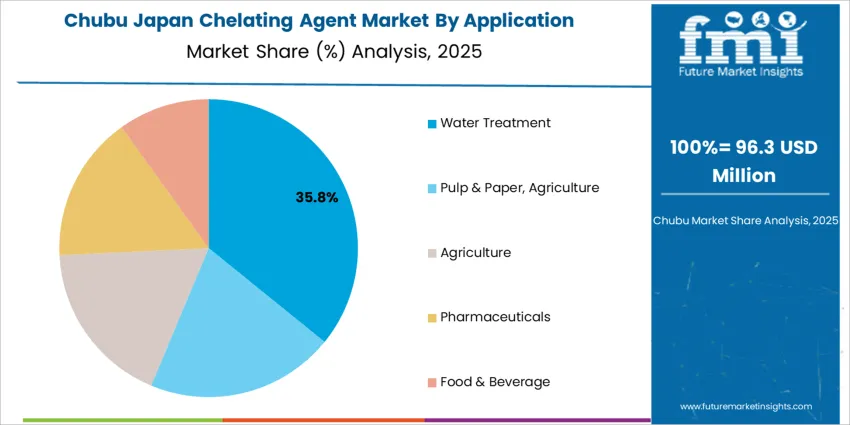

The demand for chelating agents in Chubu is expected to grow at a CAGR of 3.9%, reflecting steady demand in the region’s industrial and agricultural sectors. Chubu, home to industrial centers like Nagoya, has a diverse range of manufacturing operations, including automotive, chemicals, and electronics. These industries often require chelating agents in their production processes, particularly for metal ion removal and process optimization. The region’s agricultural sector, while smaller compared to Kyushu & Okinawa and Kanto, still contributes to demand for chelating agents used in fertilizers and soil treatments. As industrial and agricultural activities continue to grow and evolve, the demand for chelating agents in Chubu is expected to rise gradually, although at a slower pace compared to other regions.

In Tohoku, the demand for chelating agents is projected to grow at a CAGR of 3.4%, reflecting slower adoption compared to other regions. Tohoku, with its more rural and less industrialized landscape, has a smaller agricultural sector and fewer large-scale industrial operations compared to other parts of Japan. However, as awareness of sustainable farming practices and the need for efficient water treatment solutions grows, the demand for chelating agents is gradually increasing. Tohoku’s efforts to improve water quality and optimize agricultural practices in its farming communities are key factors contributing to the rising demand. While growth is slower, the increasing focus on environmental concerns and sustainable agriculture ensures that demand for chelating agents will continue to rise in the region.

In the Rest of Japan, the demand for chelating agents is expected to grow at a CAGR of 3.2%, reflecting modest but steady growth across less industrialized and rural areas. This region, which includes smaller prefectures and rural areas, has a less concentrated industrial base, but demand for chelating agents is rising as agriculture and water treatment applications continue to grow. The use of chelating agents in agriculture to improve soil health and enhance nutrient uptake is becoming more common, particularly in regions that rely heavily on crop production. Additionally, the need for better water quality and more efficient industrial processes is gradually driving the demand for chelating agents. While the growth rate is slower than in urbanized regions, the increasing adoption of environmentally sustainable practices is expected to support steady growth in the Rest of Japan.

Demand for chelating agents in Japan is rising as sectors such as water treatment, industrial cleaning, textile processing, agriculture, and personal care seek effective chemical solutions. Dow Inc. (holding roughly 21.6 percent share), Kemira, Mitsubishi Chemical Corporation, and Nippon Shokubai are principal suppliers. They provide chelating agents used for metal ion sequestration, scale prevention, water softening, wastewater treatment, and process water management. These products meet needs across both municipal utilities and industrial facilities.

Competition in this market centers on performance, environmental impact, and regulatory compliance. Suppliers focus on offering chelators with strong ion binding capacity over a wide pH range and good stability in hard water or aggressive chemical environments. Some firms emphasize biodegradable or low impact formulations to appeal to environmentally conscious users and to comply with Japanese environmental regulations. Another important factor is versatility: chelating agents that serve multiple industries-from water treatment to cleaning and agriculture-offer more value to buyers. Firms that deliver consistent supply, transparent technical data, and compliance with local standards tend to win larger contracts. By aligning their products with Japan’s needs for effective, safe, and versatile chemical solutions, these companies work to expand their share in the Japanese chelating agent market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Type | Non-Biodegradable Chelating Agents, Biodegradable Chelating Agents |

| Application | Water Treatment, Pulp & Paper, Agriculture, Pharmaceuticals, Food & Beverage |

| Key Companies Profiled | BASF SE, Dow Inc., Kemira, Mitsubishi Chemical Corporation, Nippon Shokubai |

| Additional Attributes | The market analysis includes dollar sales by type, application, and company categories. It also covers regional demand trends in Japan, driven by the increasing use of chelating agents in water treatment, agriculture, and food & beverage industries. The competitive landscape highlights key manufacturers focusing on both biodegradable and non-biodegradable chelating agents. Trends in the growing demand for sustainable and eco-friendly chelating agents in agriculture and water treatment, along with innovations in formulations for enhanced performance and regulatory compliance, are explored. |

The demand for chelating agent in Japan is estimated to be valued at USD 424.4 million in 2025.

The market size for the chelating agent in Japan is projected to reach USD 649.7 million by 2035.

The demand for chelating agent in Japan is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in chelating agent in Japan are non-biodegradable chelating agents and biodegradable chelating agents.

In terms of application, water treatment segment is expected to command 35.0% share in the chelating agent in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chelating Agent Market Growth & Forecast 2025 to 2035

Chelating / Sequestering Agents Market Size and Share Forecast Outlook 2025 to 2035

Demand for Chelating Agent in USA Size and Share Forecast Outlook 2025 to 2035

Industrial Plant Derived Chelating Agent Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Chelating Facial Masks Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA