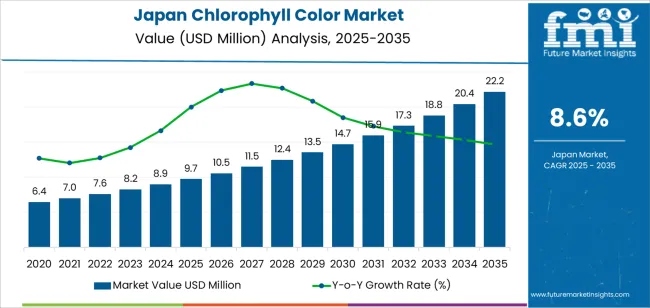

The demand for chlorophyll color in Japan stands at USD 9.7 billion in 2025 and is expected to climb to USD 22.2 billion by 2035, registering a compound annual growth rate of 8.6%. This expansion is underpinned by Japan's stringent clean-label movement, where food and beverage manufacturers increasingly replace synthetic dyes with plant-derived colorants. Regulatory frameworks under the Ministry of Health, Labour and Welfare have tightened approval pathways for artificial additives, prompting formulators to prioritize natural alternatives that align with consumer expectations for transparency.

Chlorophyll extracts, derived from sources such as alfalfa, nettle, and bamboo, meet these requirements while delivering stable green hues across diverse pH environments and processing conditions. As manufacturers reformulate products to comply with voluntary industry standards and consumer-driven purity criteria, chlorophyll adoption extends across categories ranging from confectionery to ready-to-drink teas.

The trajectory begins at USD 7.1 billion in 2020, advancing to USD 8.1 billion in 2022 and USD 9.1 billion in 2024 before reaching the 2025 baseline of USD 9.7 billion. Subsequent years show incremental gains: USD 10.3 billion in 2026, USD 11.0 billion in 2027, USD 11.7 billion in 2028, and USD 12.5 billion in 2029. By 2030, the value reaches USD 13.3 billion, continuing upward through USD 14.1 billion in 2031, USD 15.0 billion in 2032, and USD 16.0 billion in 2033.

The penultimate year of 2034 records USD 17.0 billion before the final 2035 valuation of USD 22.2 billion. This consistent upward progression reflects the deepening penetration of chlorophyll across Japan's food production landscape, where clean-label reformulation is no longer optional but a baseline requirement for shelf presence in retail channels. The growth pattern also captures the shift from initial adoption in premium segments to broader deployment in mainstream categories, supported by improved extraction techniques that lower cost barriers while maintaining color stability and regulatory compliance.

Demand in Japan for chlorophyll color is projected to increase from USD 9.7 billion in 2025 to USD 22.2 billion by 2035, reflecting a compound annual growth rate of approximately 8.6%. Starting at USD 7.1 billion in 2020, the valuation rises steadily: USD 7.6 billion in 2021, USD 8.1 billion in 2022, USD 8.6 billion in 2023, and USD 9.1 billion in 2024. From 2025 to 2030, demand climbs to around USD 13.3 billion, and by 2035 it reaches USD 22.2 billion. Growth is driven by Japan's rigorous food additive regulations, consumer preference for plant-derived ingredients, and manufacturers' strategic shift away from synthetic colorants in response to both regulatory guidance and retailer procurement standards that favor natural formulations.

Over the forecast period, the value uplift from USD 9.7 billion to USD 22.2 billion translates into an incremental opportunity of USD 8.4 billion. Early growth (2025 2030) is primarily volume driven as more food and beverage producers adopt chlorophyll across product lines previously reliant on synthetic green dyes. In the latter years (2030 2035), value growth becomes increasingly significant: premium chlorophyll variants with enhanced stability in acidic beverages, heat-resistant formulations for baked goods, and microencapsulated powders for confectionery applications command higher prices. Suppliers who innovate in extraction purity, color consistency, and technical support for formulators are best positioned to capture the full breadth of this demand growth in Japan.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 9.7 billion |

| Forecast Value (2035) | USD 22.2 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

Demand for chlorophyll color in Japan has been shaped by the country's historically cautious approach to synthetic food additives, rooted in multiple food safety incidents that heightened public scrutiny of ingredient labels. Japanese consumers exhibit unusually high literacy regarding additive names, with surveys showing that over 60% actively avoid products containing synthetic colorants such as Brilliant Blue FCF or Tartrazine.

This cultural wariness created an early foundation for natural colorant adoption, particularly in children's food categories where parental oversight is strictest. The introduction of voluntary clean-label certifications by the Japan Food Additives Association further accelerated reformulation efforts, as manufacturers sought differentiation in crowded retail environments. Historical growth was also supported by Japan's well-developed extraction industry for plant-based ingredients, allowing domestic suppliers to scale chlorophyll production efficiently while maintaining traceability standards demanded by major food conglomerates.

Future growth will be influenced by tightening regulatory interpretations of "natural flavoring" and "natural coloring" designations, as the Ministry of Health, Labour and Welfare aligns with international standards while preserving stricter domestic requirements. Japan's aging population, paradoxically, supports chlorophyll demand: older consumers prioritize perceived health benefits associated with plant-derived additives, while younger demographics drive demand for visually appealing, Instagram-friendly food products that rely on vibrant natural colors.

The expansion of ready-to-drink tea categories, particularly matcha-infused beverages and health-oriented green juices, creates sustained pull for chlorophyll as both a colorant and a label-friendly ingredient that reinforces product positioning. Long-term challenges include competition from spirulina and other microalgae-based green colorants, which offer functional benefits beyond coloration and may capture premium segments if price parity is achieved.

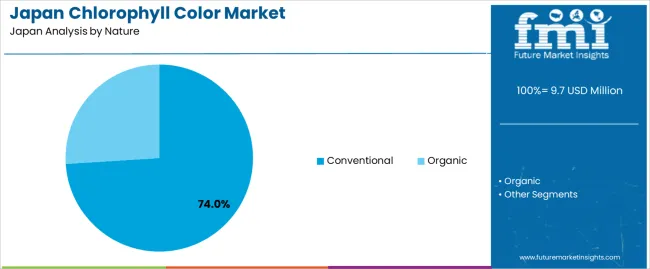

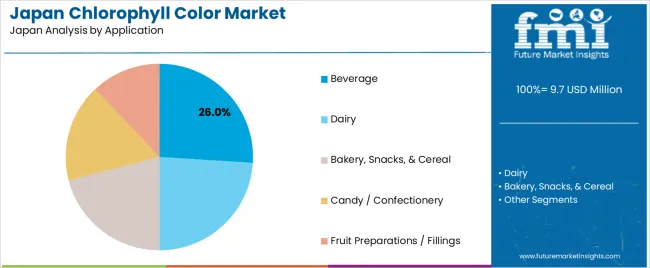

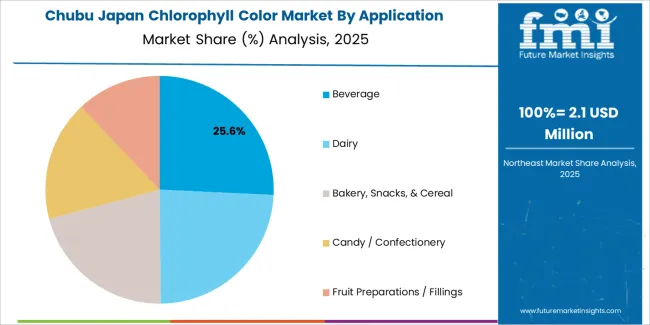

Demand for chlorophyll color in Japan is shaped by the nature of production methods and the applications where these colorants are deployed. Nature categories include conventional and organic chlorophyll extracts, each meeting different regulatory requirements and consumer expectations. Application segments such as beverage, dairy, bakery and snacks, candy and confectionery, and fruit preparation support varied formulation needs and stability profiles. As food manufacturers balance cost considerations with clean-label positioning and technical performance requirements, the combination of production nature and end-use application influences procurement decisions across Japan's food and beverage landscape.

Conventional chlorophyll accounts for 74% of total demand across nature categories in Japan. This dominant share reflects the established infrastructure for conventional agricultural sourcing, predictable supply chains, and cost advantages that matter significantly in price-sensitive categories. Many food processors rely on conventional chlorophyll for applications where organic certification does not materially influence consumer purchasing decisions, particularly in mass-produced confectionery, budget-tier beverages, and institutional food service. Conventional chlorophyll also benefits from decades of formulation optimization, where technical teams have developed robust protocols for color stability, pH tolerance, and heat resistance using these standardized extracts.

Demand for conventional chlorophyll grows as manufacturers seek to meet clean-label requirements without incurring the premium pricing associated with organic certification. Large-scale producers appreciate the consistent availability and quality control enabled by conventional agricultural practices, which support high-volume production schedules without supply interruptions. The nature type also aligns with Japan's practical approach to sustainability, where natural sourcing is prioritized but organic certification is pursued selectively based on category positioning. As regulatory definitions continue to favor "natural" over "synthetic" without mandating organic status, conventional chlorophyll maintains a strong presence across Japan's food production infrastructure.

Beverage applications account for 26.0% of total demand across application categories in Japan. This leading position reflects the explosive growth of ready-to-drink tea products, functional beverages, and health-oriented juice formulations that rely on natural green coloration. Japan's beverage sector is characterized by rapid product innovation cycles, often introducing limited-edition seasonal variants that require flexible colorant sourcing. Chlorophyll's stability in aqueous environments and compatibility with common beverage pH ranges make it particularly suitable for green tea blends, matcha lattes, and vegetable-fruit juice combinations. Vending machine distribution, which remains uniquely important in Japan, demands colorants that maintain appearance under varied storage temperatures and light exposure conditions.

Demand for chlorophyll in beverage applications grows as functional drink categories expand beyond traditional offerings. Sports nutrition beverages, meal replacement shakes, and fortified water products increasingly incorporate chlorophyll to signal naturalness and plant-based content. The rise of transparent PET bottle packaging, which allows consumers to evaluate color before purchase, places additional emphasis on consistent, appealing green hues that chlorophyll delivers. Beverage manufacturers also value chlorophyll's dual functionality as both a colorant and a potential functional ingredient, allowing formulators to simplify ingredient declarations. As Japan's beverage sector continues to innovate within the natural and functional segments, chlorophyll remains central to product development strategies.

Demand for chlorophyll color in Japan is influenced by accelerating clean-label reformulation mandates from major retailers, heightened consumer awareness of synthetic additive risks, and the Ministry of Health, Labour and Welfare's evolving guidance on natural colorant classifications. Japanese retailers such as Aeon and Seven & i Holdings have implemented supplier standards that effectively require natural alternatives to synthetic dyes across private-label product lines.

This top-down pressure, combined with grassroots consumer activism organized through social media platforms like LINE and Twitter, creates a pincer effect on manufacturers. At the same time, Japan's food safety culture, where even one adverse incident can destroy brand value, encourages conservative ingredient choices that favor established natural colorants with long safety records.

Chlorophyll color gains traction because Japan's regulatory framework, while not explicitly banning most synthetic dyes, creates a de facto preference for natural alternatives through labeling requirements that highlight artificial additives. The Japanese Agricultural Standards (JAS) system for organic products, combined with voluntary certification schemes like the Natural Food Color Association's approval marks, provides clear industry signals that favor chlorophyll.

Japanese consumers demonstrate willingness to pay premiums for products featuring recognizable plant-based ingredients, and chlorophyll's association with green vegetables reinforces positive health perceptions. Food service operators, particularly in school lunch programs and hospital catering, increasingly specify natural colorants in procurement contracts, creating institutional demand that extends beyond retail channels.

Opportunities exist in reformulating legacy product lines that still employ synthetic green dyes, particularly in the candy and confectionery segment where color stability challenges have historically limited natural alternatives. Japan's thriving convenience store sector, which introduces approximately 100 new food products weekly across major chains, creates continuous demand for differentiated colorant solutions that support novel product concepts.

The expansion of plant-based and flexitarian food categories, such as soy-based desserts and vegetable-enriched noodles, opens new applications where chlorophyll serves both coloration and positioning functions. Export-oriented manufacturers targeting health-conscious industries in Asia and North America increasingly adopt chlorophyll to meet importing countries' natural ingredient preferences, indirectly boosting domestic demand through standardized global formulations.

Constraints stem from chlorophyll's inherent sensitivity to pH extremes and high heat processing, which limits adoption in certain acidic beverage categories and retort-processed foods without expensive stabilization technologies. Some traditional Japanese food products, particularly those with centuries-old preparation methods, face technical challenges when substituting synthetic dyes with chlorophyll due to altered visual characteristics that deviate from consumer expectations.

Price considerations remain significant in value-tier product categories, where cost-conscious manufacturers resist switching from lower-priced synthetic alternatives unless regulatory or retailer pressure becomes absolute. Supply chain vulnerabilities also emerge periodically, as chlorophyll production depends on agricultural raw materials subject to seasonal variations and climate impacts, creating occasional availability constraints that synthetic dyes do not face.

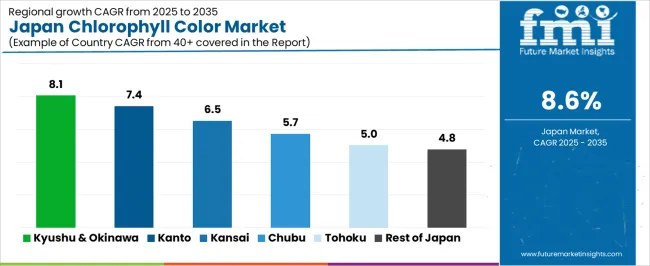

| Region | CAGR (%) |

|---|---|

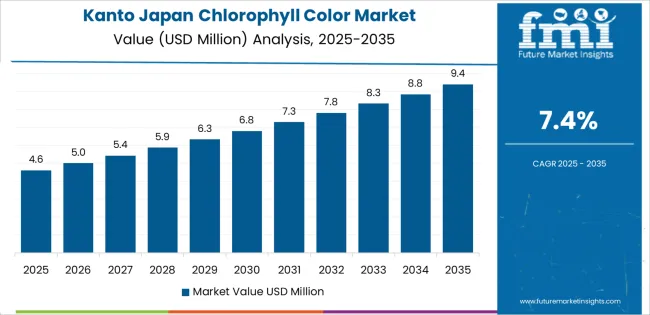

| Kanto | 7.4% |

| Kansai | 6.5% |

| Kyushu & Okinawa | 8.1% |

| Chubu | 5.7% |

| Tohoku | 5.0% |

| Rest of Japan | 4.8% |

Demand for chlorophyll color in Japan is rising across regions, with Kyushu and Okinawa leading at 8.1%. Growth in this region reflects concentrated food manufacturing facilities, expanding beverage production, and strong agricultural ties that facilitate chlorophyll sourcing. Kanto follows at 7.4%, supported by Tokyo's density of food innovation centers and the region's role as headquarters for major food and beverage corporations.

Kansai records 6.5%, shaped by Osaka's confectionery manufacturing clusters and Kyoto's traditional food production heritage, adapting natural colorants. Chubu grows at 5.7%, driven by Nagoya's industrial food-processing infrastructure and by tea cultivation regions experimenting with chlorophyll applications. Tohoku reaches 5.0%, showing steady but measured adoption. The rest of Japan posts 4.8%, reflecting the gradual integration of natural colorants across smaller regional food producers and cooperative processors.

Kanto is projected to grow at a CAGR of 7.4% through 2035 in demand for chlorophyll color. Tokyo and surrounding prefectures concentrate Japan's largest food and beverage companies, including headquarters of major manufacturers that set national reformulation strategies. The region's dominance in product development, where new formulations are tested before national rollout, accelerates chlorophyll adoption as clean-label initiatives move from concept to production. Kanto also benefits from proximity to major ports facilitating imported raw materials and access to research institutions like the National Food Research Institute that advance natural colorant applications. Retailers based in the region, particularly convenience store chains, drive demand through private-label specifications requiring natural alternatives.

Kansai is projected to grow at a CAGR of 6.5% through 2035 in demand for chlorophyll color. Osaka's concentration of confectionery manufacturers, including traditional wagashi producers modernizing formulations, drives steady adoption. Kyoto's food culture, which emphasizes aesthetic presentation and natural ingredients, creates local demand that influences national trends. The region's role as a historical center for tea ceremony culture supports chlorophyll use in matcha-adjacent products and premium beverage categories. Kobe's port facilities enable efficient import of international chlorophyll extracts while supporting domestic suppliers serving regional food processors.

Kyushu & Okinawa is projected to grow at a CAGR of 8.1% through 2035 in demand for chlorophyll color. Fukuoka's position as a regional food production hub, combined with local agricultural abundance that supports chlorophyll raw material sourcing, creates favorable conditions. The region's subtropical climate in Okinawa enables year-round cultivation of chlorophyll-rich crops, potentially reducing supply chain dependencies. Kyushu's strong beverage manufacturing sector, particularly in shochu and health drink categories, experiments aggressively with natural colorants. Regional food companies, often family-owned enterprises with strong local identities, prioritize natural ingredients as core brand values, accelerating chlorophyll integration across product portfolios.

Chubu is projected to grow at a CAGR of 5.7% through 2035 in demand for chlorophyll color. Nagoya's industrial food processing infrastructure, serving both domestic and export channels, drives measured adoption as manufacturers balance cost and performance requirements. Shizuoka's dominance in tea production creates natural synergies with chlorophyll applications, where processors leverage regional expertise in green plant pigments. The region's automotive supply chain culture, emphasizing quality control and process optimization, translates into food manufacturing practices that carefully validate natural colorant performance before widespread implementation. Chubu's mix of large-scale processors and mid-sized regional brands creates diverse demand patterns.

Tohoku is projected to grow at a CAGR of 5.0% through 2035 in demand for chlorophyll color. Sendai's food processing sector, serving northern Japan's population, adopts natural colorants in line with national trends but at a measured pace reflecting regional industry dynamics. The area's strong agricultural base provides potential for local chlorophyll raw material sourcing, though processing infrastructure remains less developed than southern regions. Traditional food producers in Tohoku, particularly sake breweries and regional specialty manufacturers, selectively integrate chlorophyll where it aligns with product heritage and consumer expectations. The region's recovery and rebuilding efforts following the 2011 disaster have emphasized quality and safety, indirectly supporting natural ingredient adoption.

The Rest of Japan is projected to grow at a CAGR of 4.8% through 2035 in demand for chlorophyll color. Smaller prefectures and rural food producers adopt natural colorants more gradually, often following larger manufacturers' reformulation precedents. Regional cooperative processors, serving local agricultural communities, integrate chlorophyll as member farmers supply suitable raw materials. Traditional food categories produced in these areas, including pickles, fermented products, and regional confections, face technical and cultural considerations when transitioning from long-used synthetic dyes. Price sensitivity remains higher in these segments, requiring clear consumer demand signals before manufacturers commit to potentially costlier natural alternatives.

Demand for chlorophyll color in Japan is driven by the intersection of regulatory evolution, retail procurement standards, and consumer literacy regarding food additives. The Ministry of Health, Labour and Welfare's ongoing review of food additive classifications creates anticipation of stricter natural-versus-synthetic distinctions, prompting proactive reformulation. Major retailers leverage their consolidated buying power to impose supplier standards that effectively mandate natural colorants across expanding product categories.

Consumer advocacy groups, amplified through social media, maintain pressure on manufacturers regarding synthetic additive use, with organized boycotts targeting brands perceived as slow to adopt natural alternatives. Technological improvements in chlorophyll extraction and stabilization reduce historical barriers related to heat sensitivity and pH instability, making natural alternatives increasingly practical across difficult applications.

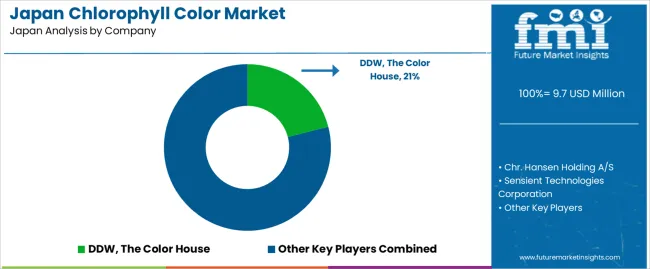

Key companies active in Japan's chlorophyll color space include Danish firm Chr. Hansen Holding A/S, American supplier Sensient Technologies Corporation, Swiss multinational Givaudan (through its Naturex division), German company Dohler Group, and American firm DDW The Color House. Chr. Hansen maintains technical centers in Japan providing application support for food manufacturers, while Sensient operates through its Japanese subsidiary Sensient Technologies Japan Ltd. Givaudan's Naturex acquisition strengthened its natural colorant portfolio with direct access to Japanese customers.

Dohler Group supplies both chlorophyll extracts and complete formulation systems through its Asian operations. DDW The Color House, despite being smaller globally, maintains strong relationships with Japanese beverage producers requiring customized natural color solutions. This competitive mix ensures that Japanese food manufacturers access both global innovation and localized technical support for chlorophyll integration.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Nature | Conventional, Organic |

| Application | Beverage, Dairy, Bakery and Snacks, Candy and Confectionery, Fruit Preparation |

| Region | Kanto, Kansai, Kyushu & Okinawa, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Chr. Hansen Holding A/S, Sensient Technologies Corporation, Givaudan (Naturex), Dohler Group, DDW The Color House |

| Additional Attributes | Dollar sales by nature and application, regional CAGR trends, and value-volume contributions are analyzed alongside conventional vs. organic penetration, beverage vs. food technical requirements, clean-label reformulation, sourcing and extraction advances, Japanese additive compliance, competitive green colorants, retailer influence, consumer willingness-to-pay, and supplier technical support. |

The demand for chlorophyll color in Japan is estimated to be valued at USD 9.7 million in 2025.

The market size for the chlorophyll color in Japan is projected to reach USD 22.2 million by 2035.

The demand for chlorophyll color in Japan is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in chlorophyll color in Japan are conventional and organic.

In terms of application, beverage segment is expected to command 26.0% share in the chlorophyll color in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chlorophyll Color Market Trends – Natural Pigments & Applications 2025 to 2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Demand for Caramel Food Colors in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Color Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chlorophyll Extract Market Size and Share Forecast Outlook 2025 to 2035

Colorectal Cancer Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Coloring Foodstuffs Market Insights – Natural Pigments & Growth 2025 to 2035

Colorimeter Market Growth - Trends & Forecast 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA