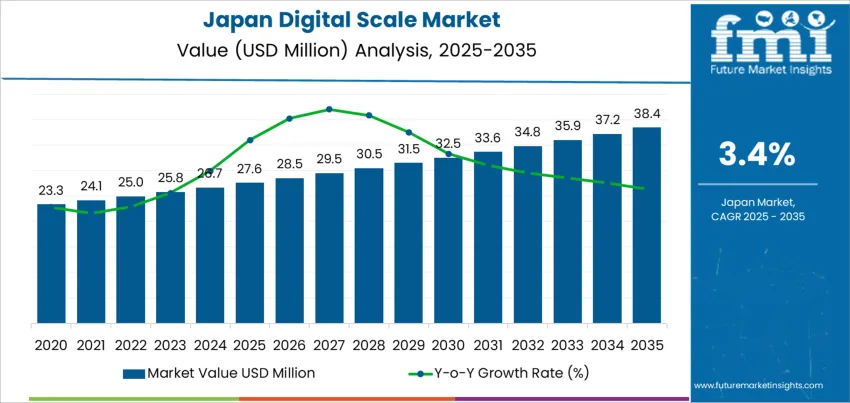

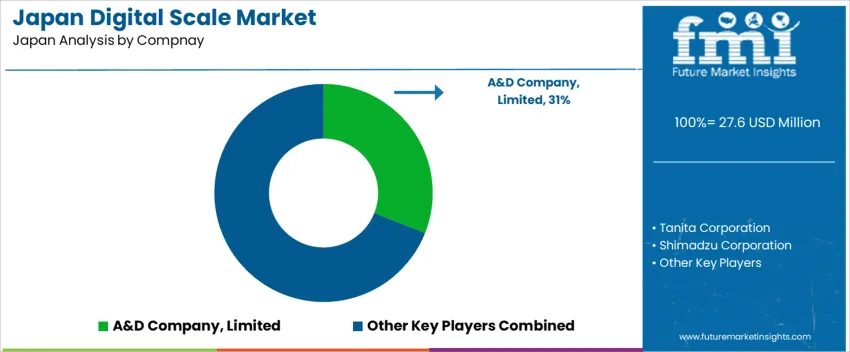

The Japan digital scale demand is valued at USD 27.6 million in 2025 and is forecasted to reach USD 38.4 million by 2035, reflecting a CAGR of 3.4%. Demand is driven by continued use of weighing equipment in healthcare facilities, fitness centers, and home monitoring settings. Requirements for accurate weight tracking and digital readout reliability support steady procurement. Integration of user-friendly interfaces and compact device designs influences purchasing decisions in household and clinical environments. Floor scales lead product utilization. These devices are selected for stability, higher weight-bearing capability, and suitability for medical assessment and home-based health management. Demand is also supported by increasing adoption of scales featuring body composition indicators in fitness and preventive healthcare programmes. Advancements in load-cell precision and connectivity options continue to influence replacement cycles within facilities.

Kyushu & Okinawa, Kanto, and Kinki represent primary utilization zones due to concentration of hospitals, clinics, and retail distribution networks. Residential adoption also remains high in these regions due to demographic ageing and proactive health tracking behaviours. Key suppliers include A&D Company, Limited, Tanita Corporation, Shimadzu Corporation, Yamato Scale Co., Ltd., and METTLER TOLEDO (Japan). Their product portfolios span consumer digital scales, medical-grade weighing systems, and connected devices used in diagnostics and daily health monitoring applications.

Demand for digital scales in Japan is approaching a gradual saturation stage due to high penetration in households, retail checkout systems, clinical settings, and industrial measurement environments. Most large-volume users already operate digital weighing systems, establishing a replacement-led demand dynamic. Household adoption is near maximum, as compact digital kitchen and personal scales are widely distributed across demographics. Retail and healthcare sectors continue to replace aging devices, but infrequent upgrade cycles slow volume expansion.

Industrial requirements sustain additional demand through logistics, pharmaceutical manufacturing, and precision electronics production. However, automation integration and multi-sensor systems may reduce the frequency of standalone scale purchases. Sustainability and compliance initiatives generate periodic refresh cycles but do not create large new-user segments. The approach toward saturation is therefore defined by incremental improvements in accuracy, connectivity, and calibration, rather than broad adoption gains. Growth continues, but it is anchored in technology renewal rather than industry expansion, signaling a mature trajectory with controlled long-term progression.

| Metric | Value |

|---|---|

| Japan Digital Scale Sales Value (2025) | USD 27.6 million |

| Japan Digital Scale Forecast Value (2035) | USD 38.4 million |

| Japan Digital Scale Forecast CAGR (2025-2035) | 3.4% |

Demand for digital scales in Japan is increasing because households, healthcare facilities and industrial operations require accurate and user-friendly measurement tools. Ageing demographics strengthen demand for personal health scales that track weight, body composition and daily health indicators. Pharmacies and clinics also use digital scales to support preventive care and monitoring of chronic conditions. Growth in home cooking and interest in portion control contribute to regular use of compact kitchen scales among younger consumers and single-person households.

Industrial sectors such as logistics, manufacturing and food processing rely on digital scales for quality control, packaging accuracy and regulatory compliance. Automated weighing systems connect with data platforms to improve traceability and reduce human error, which aligns with Japan’s focus on operational efficiency. Retail environments adopt checkout scales and self-service weighing to maintain consistent pricing and improve customer flow. Constraints include price competition in low-range consumer models and saturation in some mature categories where replacement cycles are long. Smaller businesses may postpone upgrades when manual or analog systems remain workable. Connectivity concerns for smart scales can also affect adoption when data integration requires additional infrastructure investment.

Demand for digital scales in Japan is linked to regulated diagnostic practices, home health monitoring, and routine weight-tracking in clinical environments. Hospitals and clinics require precision instruments with calibrated measurement responses, while households adopt compact units integrated with wellness routines. Procurement priorities include measurement reliability, stability under frequent use, and ergonomic designs suited to older adults. Digital connectivity features are increasingly introduced to align with electronic health record integration and remote-monitoring initiatives.

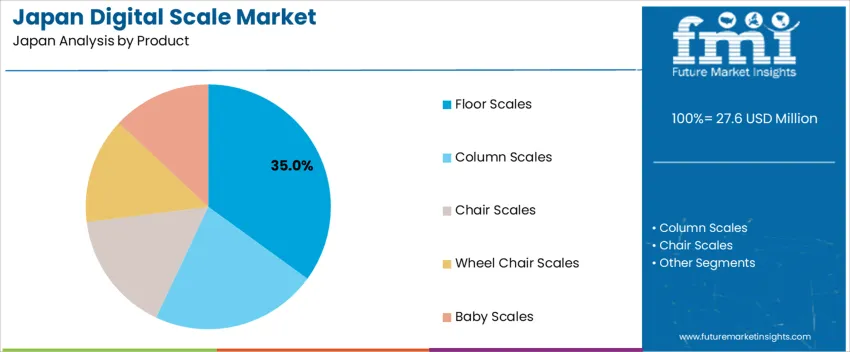

Floor scales represent 35.0%, supporting routine patient assessments in clinical facilities and frequent home-based monitoring. Their broad platform and load capacity suit adult measurement, contributing to consistent usage across healthcare delivery points. Column scales hold 22.0%, selected for standing support in hospital wards and reflecting medical-grade measurement standards. Chair scales represent 16.0%, assisting individuals with limited mobility. Wheelchair scales account for 14.0%, driven by accessibility in rehabilitation and long-term care settings. Baby scales hold 13.0%, supporting pediatric growth monitoring. Product choice centers on patient mobility needs, balance assistance, and Japan’s emphasis on accurate anthropometric data collection within clinical evaluation procedures.

Key points:

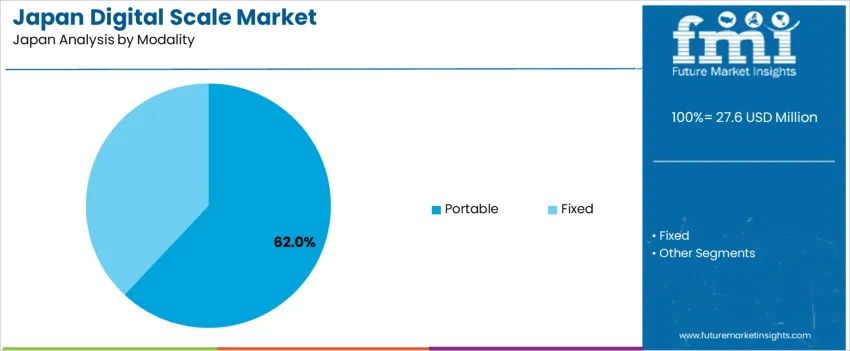

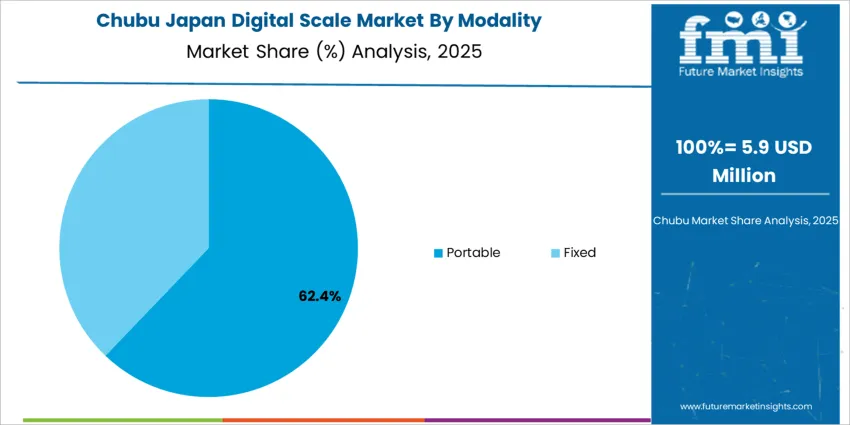

Portable scales account for 62.0%, driven by home-care integration, community health programs, and ease of deployment across varied clinical areas. Lightweight construction and small footprints support health worker mobility and space constraints in Japanese residences. Fixed scales represent 38.0%, preferred in hospitals for durable calibration and stable support during repeated measurements. Modality selection is influenced by patient throughput, reliability during frequent handling, and surface stability on limited floor areas. Domestic healthcare policies promoting early detection and self-monitoring contribute to portable equipment distribution. Procurement reflects alignment with device hygiene management and consistent measurement control in structured clinical settings.

Key points:

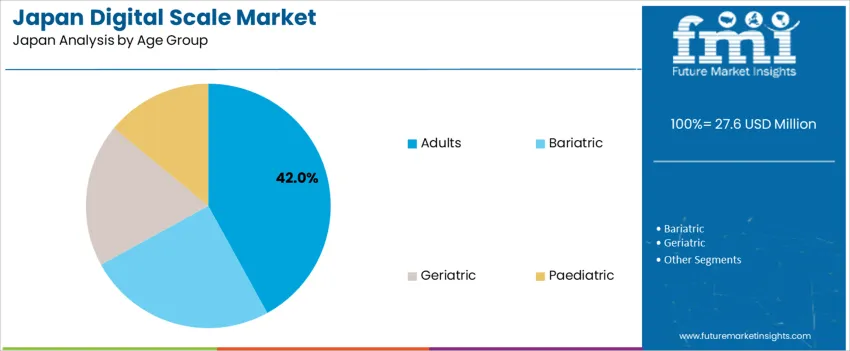

Adult-focused scales represent 42.0%, reflecting routine weight tracking in preventive healthcare and chronic-disease management across Japan’s general population. Bariatric applications hold 25.0%, driven by specialized equipment requirements for higher load capacity and reinforced stability. Geriatric use represents 19.0%, aligned with fall-risk reduction, balance support, and monitoring in long-term care facilities. Paediatric applications account for 14.0%, emphasizing growth-stage measurement accuracy. Age-segment distribution reflects demographic structure, as Japan maintains a large older-adult population requiring frequent clinical evaluation. Product design across age groups considers safety rails, seated weighing options, and readable displays tailored to patient-specific usability demands in professional care environments.

Key points:

Growth of health monitoring among aging adults, increased use in logistics automation and widespread integration in retail weighing systems are driving demand.

In Japan, digital scales see strong usage as adults monitor weight and body composition to manage lifestyle-related diseases, which remain a major health concern in prefectures with older populations such as Hokkaido and Akita. Home-use body composition scales remain popular due to the availability of compact designs that connect to smartphones through local health-tracking apps. Logistics operators in Kanto and Kansai use digital parcel scales to support automated shipping workflows as e-commerce volumes increase. Retailers and fresh-food industries rely on digital check weighing to maintain consistent portion accuracy and comply with point-of-sale labeling requirements in supermarkets and department-store food halls. These daily operational needs create continuous procurement across households and commercial users.

Pricing pressure in consumer retail, long replacement cycles in industrial sites and limited adoption of connected devices among older users restrain demand.

Household purchasers often choose basic models when economic conditions are uncertain, slowing premium-scale upgrades with advanced features. Industrial facilities maintain scales for long periods through recalibration programs, reducing frequent replacement despite rising automation. Older adults may prefer manual recordkeeping instead of app-linked devices, limiting uptake of connected smart-scale features designed to expand subscription-based wellness platforms. These behaviour and cost dynamics create gradual growth rather than rapid category shifts.

Shift toward body-composition analytics, increased adoption of waterproof and compact food scales and rising demand in pharmaceutical dispensing environments define key trends.

Manufacturers expand digital scales that measure skeletal muscle, visceral fat and metabolic indicators, reflecting strong domestic interest in precision health tracking. Home cooking and convenience-store food preparation drive demand for compact waterproof scales that improve portion accuracy for calorie-controlled diets. Pharmacies and medical sites adopt precision dispensing scales to support dosage control in an environment where prescription accuracy is emphasized by national insurance standards. Smart-home integration is emerging among tech-savvy consumers who prefer seamless data transfer into health-record platforms. These trends support ongoing digital-scale demand within Japan’s consumer wellness, retail and logistics sectors.

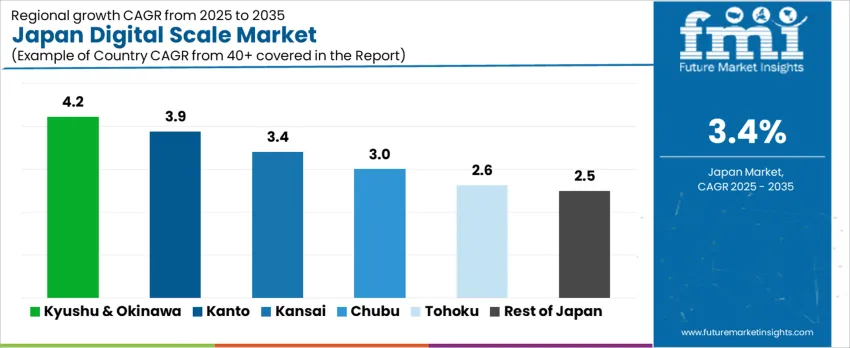

Demand for digital scales in Japan is shaped by household use, personal health monitoring, food retail weighing, logistics operations, and industrial measurement processes that require precise weight control. Product evaluation emphasizes sensor reliability, calibration consistency, and integration with automated workflows in commercial environments. Retail distribution spans electronics chains, e-commerce, and pharmacy outlets where replacement cycles follow equipment aging and hygiene standards. Kyushu & Okinawa leads at 4.2% CAGR, followed by Kanto (3.9%), Kinki (3.4%), Chubu (3.0%), Tohoku (2.6%), and Rest of Japan (2.5%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.2% |

| Kanto | 3.9% |

| Kinki | 3.4% |

| Chubu | 3.0% |

| Tohoku | 2.6% |

| Rest of Japan | 2.5% |

Kyushu & Okinawa posts 4.2% CAGR, supported by food retail, household usage, and healthcare-linked procurement. Supermarkets depend on digital weighing systems for produce, baked goods, and bulk items, requiring consistent measurement accuracy across high-use cycles. Tourism activity drives packaged-food production where manufacturing sites utilize scales for batch control. Home users adopt digital bathroom scales for routine health tracking in regional cities where aging demographics influence steady demand for weight monitoring. Small restaurants and cafés use compact scales for portion management aligned with standardized menu output. Ports facilitate inbound shipment of devices from regional manufacturing hubs. Procurement decisions focus on display clarity, calibration retention, and spill-resistant housings for daily retail cleaning procedures.

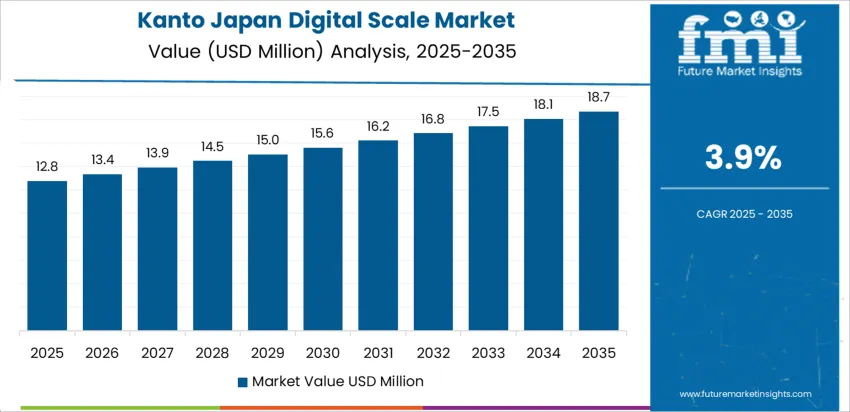

Kanto records 3.9% CAGR, driven by commercial installations in dense retail zones and household purchasing in urban apartments. Convenience stores rely on digital scales for fresh items in limited-space counters. Hospitals and clinics require medical-grade scales to support patient assessment routines across Tokyo’s healthcare network. Electronics retailers promote Bluetooth-enabled weighing devices that support personal data tracking where consumers actively monitor health metrics. Food manufacturers located near major distribution corridors integrate industrial floor scales for consistency in packaged product weight. Demand emphasizes compact designs compatible with tight retail layouts and automated functions that reduce manual adjustments.

Kinki expands at 3.4% CAGR, linked to active food service operations and household use near Osaka and neighboring prefectures. Supermarkets and specialty food outlets rely on scales that maintain accuracy through continuous handling. Personal weighing devices support everyday health monitoring for households across competitive retail pricing channels. Small-format manufacturing uses tabletop scales for process control in confectionery and packaged food production. Commercial buyers review material characteristics that support cleaning frequency and abrasion resistance. Growth reflects stability in distribution rather than rapid capacity additions, with product assortments matched to established store layouts.

Chubu posts 3.0% CAGR, shaped by industrial installation in automotive and machinery component production. Assembly lines adopt floor and bench scales for inventory check and process standardization. Retailers in regional hubs rely on reliable weighing solutions during long-distance logistics. Households follow incremental adoption where purchase cycles follow device wear and functional obsolescence. Procurement emphasizes stability during vibration exposure found in factory environments.

Tohoku reaches 2.6% CAGR, supported by agriculture-linked weighing, household adoption, and healthcare usage. Cold-weather handling conditions require performance that sustains accuracy at lower temperatures. Regional supermarkets adopt standardized weighing systems to support consistent labeling across dispersed store networks. Procurement focuses on practical features like large display visibility and straightforward calibration.

Rest of Japan advances at 2.5% CAGR, driven by steady household buying and practical retail installation. Industrial adoption moves cautiously with replacement focused on existing equipment nearing end of life. Buyers evaluate energy efficiency and straightforward maintenance. Distribution networks support predictable supply for smaller retailers operating in lower-density industries.

Demand for digital scales in Japan is supported by domestic manufacturers providing precision measurement systems for clinical facilities, laboratories, production lines, and retail environments. A&D Company, Limited holds about 31.0% share, supported by controlled measurement accuracy, robust signals under varied loads, and established relationships with Japanese medical institutions and industrial users. Tanita Corporation maintains strong participation in consumer and healthcare weighing, supplying stable body-composition and patient-monitoring scales widely adopted in clinics and households. Shimadzu Corporation contributes significant share in laboratory and research facilities, where precise resolution, calibrated load cells, and verified measurement traceability are required.

Yamato Scale Co., Ltd. supports demand in industrial weighing and packaging lines with scales offering dependable durability and smooth integration with production-control systems. METTLER TOLEDO Japan adds presence in regulated laboratory and pharmaceutical weighing, ensuring stable calibration integrity and repeatability. Competition in Japan centers on accuracy, calibration stability, maintenance reliability, sensor durability, and seamless connectivity with hospital and factory systems. Demand remains steady as Japanese users rely on consistent digital measurement performance to support clinical assessment, laboratory workflows, and automated process-control across national operations.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product | Floor Scales, Column Scales, Chair Scales, Wheel Chair Scales, Baby Scales |

| Modality | Portable, Fixed |

| Age Group | Adults, Bariatric, Geriatric, Paediatric |

| End User | Hospitals & Clinics, Home Care Settings, Ambulatory Surgical Centers, Mobile Health Units, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | A&D Company, Limited, Tanita Corporation, Shimadzu Corporation, Yamato Scale Co., Ltd., METTLER TOLEDO (Japan) |

| Additional Attributes | Dollar demand by modality, product category, and age-specific use; expansion driven by remote patient monitoring and rising elderly care requirements; increasing adoption of connected and smart scales within home care settings; compliance with precision standards in clinical settings; distribution concentrated around medical device suppliers and hospital networks across major Japanese regions. |

The demand for digital scale in Japan is estimated to be valued at USD 27.6 million in 2025.

The market size for the digital scale in Japan is projected to reach USD 38.4 million by 2035.

The demand for digital scale in Japan is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in digital scale in Japan are floor scales, column scales, chair scales, wheel chair scales and baby scales.

In terms of modality, portable segment is expected to command 62.0% share in the digital scale in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Digital Illustration App Market Insights – Growth, Demand & Trends 2025-2035

Japan Digital Textile Printing Market Report – Trends & Innovations 2025-2035

Digital Scale Market Analysis by Product, Age Group, Modality, End User, and Region 2025 to 2035

Demand for Digital Scale in USA Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Tattoos in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Commerce in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Power Conversion in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Oilfield Solutions in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Instrument Clusters in Japan Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA