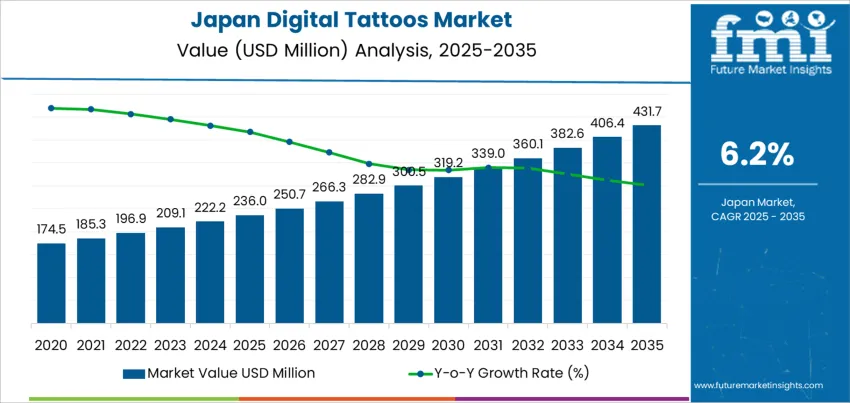

The demand for digital tattoos in Japan is projected to grow from USD 236.0 million in 2025 to USD 431.7 million by 2035, with a compound annual growth rate (CAGR) of 6.2%. Digital tattoos, which involve embedding digital and interactive technologies into the skin, are gaining popularity as wearable technology evolves. These tattoos can store data, enable biometric monitoring, and interact with external devices, making them a unique blend of fashion, health monitoring, and technology. As Japan remains at the forefront of innovation in technology and consumer products, digital tattoos are expected to see increased adoption, particularly in the fields of healthcare, sports, and personal tech.

The rise in consumer interest for personalized, multifunctional wearable technology is a key driver of this demand. Digital tattoos offer an alternative to traditional wearable devices like smartwatches and fitness trackers, providing users with a more discrete and potentially more integrated solution for health and fitness monitoring. The growing interest in body augmentation technologies and personalized technology is contributing to the appeal of digital tattoos. As wearable tech becomes more embedded in everyday life, digital tattoos are positioned to offer unique features such as biometric authentication, temperature and heart rate monitoring, and even digital communication capabilities.

From 2025 to 2030, the demand for digital tattoos is expected to grow from USD 236.0 million to USD 339.0 million, adding USD 103.0 million in value. This period will experience significant growth, driven by increasing adoption in both the consumer and healthcare sectors. Digital tattoos, positioned as a fashionable and functional alternative to traditional wearable devices, will gain popularity as consumers seek more discreet and personalized ways to monitor their health. The growing trend toward integrating technology into daily life will further contribute to this expansion, as digital tattoos offer features such as biometric tracking and data storage in an innovative, wearable form.

From 2030 to 2035, the demand will continue to rise from USD 339.0 million to USD 431.7 million, contributing USD 92.7 million in value. While the industry will mature during this phase, demand will remain strong due to technological advancements and the increasing acceptance of body-modifying wearable technology. As digital tattoos evolve, offering more advanced features such as enhanced integration with other smart devices and better functionality for personal and medical applications, their adoption will spread. The continued evolution of digital tattoos will ensure their place in the expanding wearable tech industry, supporting steady demand throughout the forecast period.

| Metric | Value |

|---|---|

| Demand for Digital Tattoos in Japan Value (2025) | USD 236.0 million |

| Demand for Digital Tattoos in Japan Forecast Value (2035) | USD 431.7 million |

| Demand for Digital Tattoos in Japan Forecast CAGR (2025-2035) | 6.2% |

The demand for digital tattoos in Japan is growing due to the increasing interest in wearable technology and innovations in personal identification, healthcare, and digital expression. Digital tattoos are a form of electronic skin technology, designed to provide users with personalized information and functionality through temporary or semi-permanent tattoos. These tattoos are embedded with sensors and microchips that can interact with smartphones, computers, and other devices, enabling a range of applications from health monitoring to payment systems.

A key driver behind the growth of digital tattoos in Japan is the rising interest in wearable devices that integrate seamlessly into daily life. Digital tattoos, being lightweight, flexible, and less intrusive than traditional wearables, appeal to consumers who are looking for discreet ways to access data and improve personal convenience. Japan’s strong technology culture and consumer interest in futuristic gadgets make digital tattoos an attractive option in the realm of wearable tech.

Japan’s focus on innovation in the healthcare sector is fueling the adoption of digital tattoos for medical and wellness purposes. These tattoos can be used for monitoring vital signs, tracking health metrics, and even administering medication through embedded sensors. As digital tattoos become more integrated into the fields of healthcare, fashion, and technology, their versatility and functionality are driving their demand. With continued advancements in materials science and the expanding applications of wearable tech, the demand for digital tattoos in Japan is expected to grow steadily through 2035.

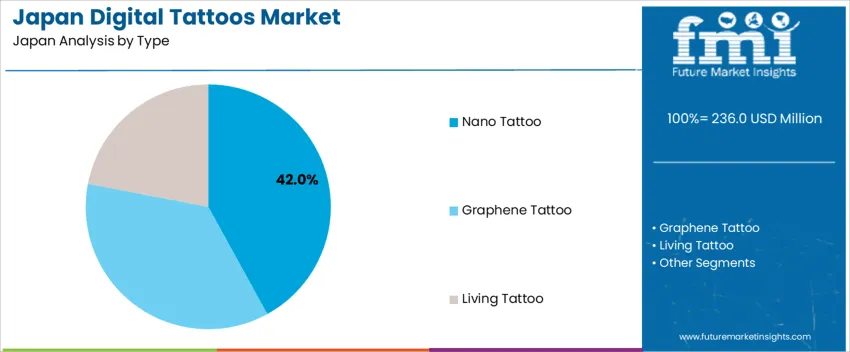

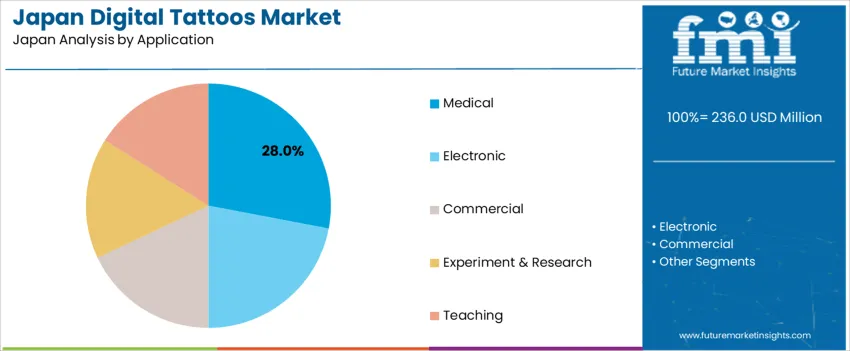

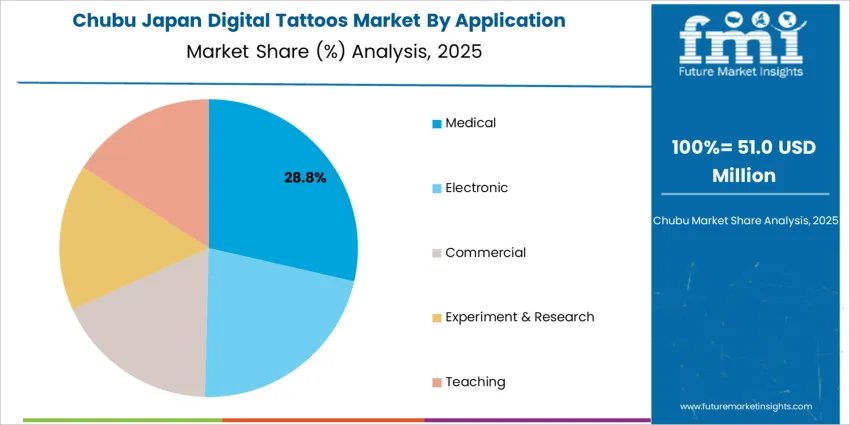

Demand for digital tattoos in Japan is segmented by type, application, and region. By type, demand is divided into nano tattoos, graphene tattoos, and living tattoos, with nano tattoos holding the largest share at 42%. The demand is also segmented by application, including medical, electronic, commercial, experiment & research, and teaching, with medical leading at 28%. Regionally, demand is spread across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the Rest of Japan.

Nano tattoos account for 42% of the demand for digital tattoos in Japan, largely due to their small size, high precision, and advanced technological features. These tattoos are primarily used in medical applications, where their ability to monitor health parameters or deliver micro-doses of medication makes them highly valuable. Nano tattoos are especially appealing in healthcare because they can be easily applied to the skin and integrate seamlessly with electronic devices or serve as biomarkers for various medical conditions. Their miniature size allows for minimal discomfort while providing high functionality. With the rising interest in wearable technology and advancements in nanotechnology, nano tattoos are becoming essential in health management and monitoring.

Medical applications lead the demand for digital tattoos in Japan, making up 28% of the industry. Digital tattoos in the medical field are being used to monitor vital signs, deliver medication, and assist with diagnostics. Nano tattoos, in particular, have gained traction due to their integration into wearable health technology, offering a non-invasive, real-time way to monitor a patient’s health. With Japan’s aging population and a growing demand for healthcare innovations, digital tattoos are becoming crucial in managing chronic diseases, tracking health metrics, and improving patient care. These tattoos provide continuous health data, removing the need for traditional and bulky medical equipment. The ability to deliver personalized healthcare based on continuous monitoring further enhances the appeal of digital tattoos in the medical industry.

Demand for digital tattoos in Japan is increasing as advances in wearable technology and health tech converge with cultural acceptance of minimally invasive health monitoring. Digital tattoos, ultra-thin, skin-conformal electronic patches or tattoos incorporating sensors or flexible electronics, are seen as the next evolution of wearable devices. They offer real-time biometric tracking, health monitoring, and seamless integration with digital platforms. Japan’s strengths in miniaturization, materials science, and wearables design help drive development and uptake. Use cases expanding beyond health into fitness, remote diagnostics, elder care, and lifestyle monitoring contribute to rising interest. Challenges such as regulatory oversight, data privacy concerns, long-term biocompatibility, and user trust remain obstacles that may restrain rapid adoption.

Why is Demand for Digital Tattoos Growing in Japan?

Demand for digital tattoos in Japan is rising as people seek non-invasive, convenient, and continuous health and wellbeing monitoring solutions. With an aging population and growing focus on preventive healthcare and personal wellness, many users value the ability to track vital signs, such as heart rate, stress, hydration, and more, without bulky external devices. Digital tattoos provide a discreet, comfortable alternative to traditional wearables. They adhere to the skin like a patch or sticker and capture biometric data continuously. As Japanese consumers become more aware of health management, chronic disease prevention, and lifestyle tracking, digital tattoos align with their needs for convenience, personalization, and real-time feedback.

How are Technological & Industry Innovations Driving Digital Tattoo Demand in Japan?

Technological improvements in flexible electronics, conductive bio-inks, skin-conformal sensors, and wireless data transmission are pushing digital tattoos closer to mainstream use in Japan. Modern digital tattoos can monitor a range of signals from heart rate and skin conductivity to sweat composition, muscle activity, and even neural data, all while remaining lightweight and unobtrusive. Advances in materials, such as ultrathin polymers or graphene, allow better skin contact, lower impedance, and more accurate signal capture. Integration with smartphones, cloud analytics, artificial intelligence, and remote health platforms enhances their utility in healthcare, fitness, elder care, and lifestyle management. As the ecosystem matures, digital tattoos are evolving from experimental prototypes to viable consumer and medical products.

What are the Key Challenges and Risks That Could Limit Digital Tattoo Demand in Japan?

Despite the promise of digital tattoos, several challenges could slow their adoption in Japan. Data privacy and security are major concerns because biometric information is sensitive, and users need assurance that their health and identity data are protected. Regulatory and medical-device approval processes may delay or limit availability, especially for tattoos used in diagnostic or medical settings. Technical issues, such as skin irritation, adhesive durability, long-term reliability, and battery or power management, remain significant obstacles. Cost of production and limited consumer awareness also affect uptake. Finally, social acceptance, especially given historical stigma around traditional tattoos in Japan, may slow consumer comfort with skin-applied electronic tattoos.

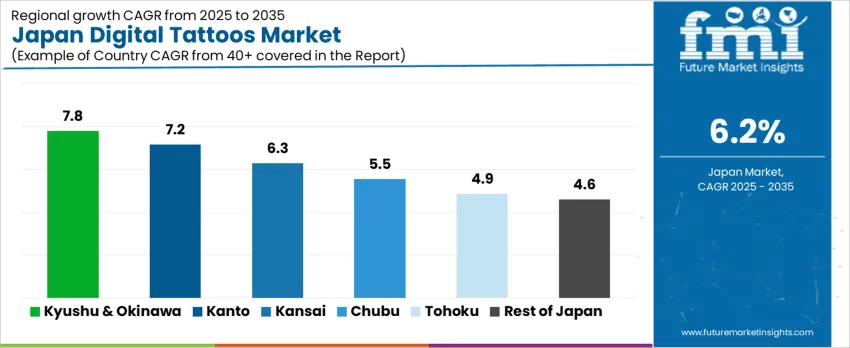

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 7.8% |

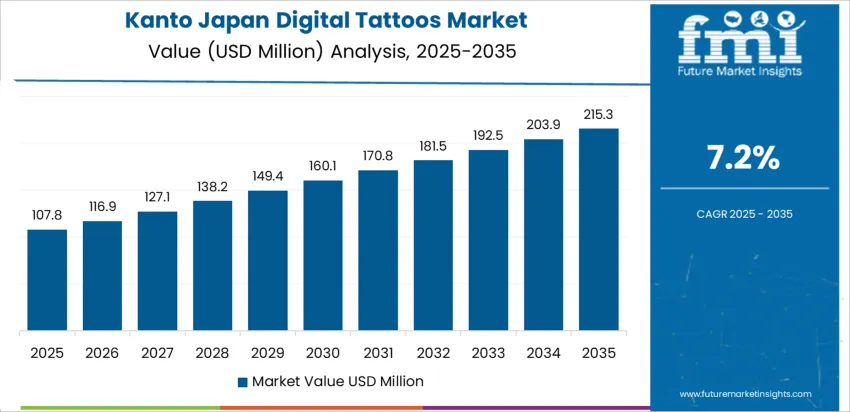

| Kanto | 7.2% |

| Kansai | 6.3% |

| Chubu | 5.5% |

| Tohoku | 4.9% |

| Rest of Japan | 4.6% |

Demand for digital tattoos in Japan is growing steadily, with Kyushu & Okinawa leading at a 7.8% CAGR, driven by industrial growth and the tourism sector. Kanto follows with a 7.2% CAGR, supported by its large consumer base and technological infrastructure. Kansai shows a 6.3% CAGR, fueled by its focus on fashion and consumer electronics. Chubu experiences a 5.5% CAGR, with demand driven by automotive and electronics industries. Tohoku and the Rest of Japan see moderate growth at 4.9% and 4.6% CAGR, respectively, with increasing interest in personalized fashion and wearable technology. As digital tattoos become more integrated into everyday life, their demand across Japan is expected to rise steadily.

Kyushu & Okinawa leads the demand for digital tattoos, growing at a 7.8% CAGR. The region’s increasing focus on digital technologies and its thriving tourism sector contribute significantly to this growth. Digital tattoos, which provide customizable designs for wearable electronics and other digital applications, have become increasingly popular in fashion, personal accessories, and tech gadgets. The tourism industry in Kyushu & Okinawa also boosts demand, as visitors seek unique and innovative products like digital tattoos as souvenirs. The region’s young, tech-savvy population is more inclined to experiment with new technologies, further supporting the demand for digital tattoos. As both the tourism and technology sectors continue to expand, the adoption of digital tattoos in Kyushu & Okinawa is expected to grow steadily, especially in industries focused on personalization and wearable tech.

Kanto is experiencing steady demand for digital tattoos, with a 7.2% CAGR, driven by the region’s strong technological infrastructure and large consumer base. Tokyo, being a global hub for innovation, plays a significant role in the rising popularity of digital tattoos. The growing interest in wearable technology and personalized fashion among Kanto’s younger population contributes to the demand for digital tattoos. These tattoos, often integrated with smart devices, offer a unique fusion of fashion and technology, making them a popular choice in the tech-driven culture of Kanto. As digital tattoos become more customizable and interactive, their adoption in the region continues to rise, especially in industries like electronics, fashion, and entertainment. With Kanto’s continued focus on digital innovation, demand for digital tattoos will likely remain strong and expand steadily in the coming years.

Kansai is seeing moderate demand for digital tattoos, with a 6.3% CAGR. The region’s focus on high-tech industries, fashion, and consumer electronics is driving the demand for wearable tech, including digital tattoos. Kansai’s urban areas, particularly Osaka, are embracing digital tattoos as part of their larger trend toward personalized and interactive consumer products. Digital tattoos, which are often integrated with fashion or smart devices, appeal to the region’s growing population of young, tech-conscious consumers. The rise of digital personalization in products, especially among millennials and Generation Z, is also a contributing factor. Kansai’s growing interest in advanced technologies, along with its strong electronics sector, will continue to fuel the steady growth of digital tattoos. As Kansai’s tech culture evolves, demand for innovative, customizable wearable technologies like digital tattoos will remain robust and expand further.

Chubu is experiencing steady demand for digital tattoos, with a 5.5% CAGR, driven by the region’s growing adoption of digital technologies. The automotive and electronics industries in Chubu are becoming increasingly interested in incorporating wearable tech and interactive products, such as digital tattoos, into their offerings. As digital tattoos provide a new way to personalize products like smart clothing and accessories, their appeal is growing in Chubu’s innovative industrial sectors. The region’s young population, especially in urban areas like Nagoya, is increasingly adopting digital tattoos as part of their fashion and tech preferences. Chubu’s increasing focus on integrating digital solutions into everyday life, along with the rise of smart gadgets and IoT devices, further contributes to the region’s demand for digital tattoos. As wearable tech continues to grow in popularity, Chubu’s demand for digital tattoos will continue to expand steadily.

Tohoku is seeing moderate demand for digital tattoos, with a 4.9% CAGR. While the region’s industry for wearable tech and digital tattoos is smaller compared to more urbanized areas, the growing interest in personalized fashion and technology among Tohoku’s younger population is driving steady growth. As digital tattoos offer a unique way to combine fashion with technology, they are increasingly being embraced by tech enthusiasts and early adopters in the region. The rising availability of wearable devices, such as smart clothing and interactive accessories, also contributes to the demand for digital tattoos. As Tohoku continues to develop its tech infrastructure and more consumers turn to innovative solutions for personal expression, the demand for digital tattoos is expected to rise gradually, supported by regional interest in wearable tech.

The Rest of Japan is experiencing steady demand for digital tattoos, with a 4.6% CAGR. While the industry in rural areas is smaller compared to more urban regions, the growing interest in personalized fashion and wearable technology is contributing to moderate growth in demand. As digital tattoos become more accessible and affordable, their appeal is growing among consumers looking for unique, tech-integrated fashion options. The rising adoption of wearable devices and smart gadgets in suburban and rural areas is helping to expand the industry for digital tattoos. The Rest of Japan’s ongoing shift towards more interactive, technology-driven consumer products ensures steady growth in the demand for digital tattoos, particularly as personalization becomes a key trend in the fashion and tech industries.

The demand for digital tattoos in Japan is emerging as a part of the growing wearable technology industry, driven by advancements in health monitoring, smart devices, and human-machine interaction. Digital tattoos, which are thin, flexible electronic devices that can be applied to the skin, have potential applications in healthcare, fitness, and entertainment. These innovative devices can monitor vital signs, track physical activity, and even enable communication between the wearer and digital systems. As consumers in Japan embrace more advanced, tech-driven solutions for health and convenience, the industry for digital tattoos is expected to expand, particularly in the context of health and wellness monitoring.

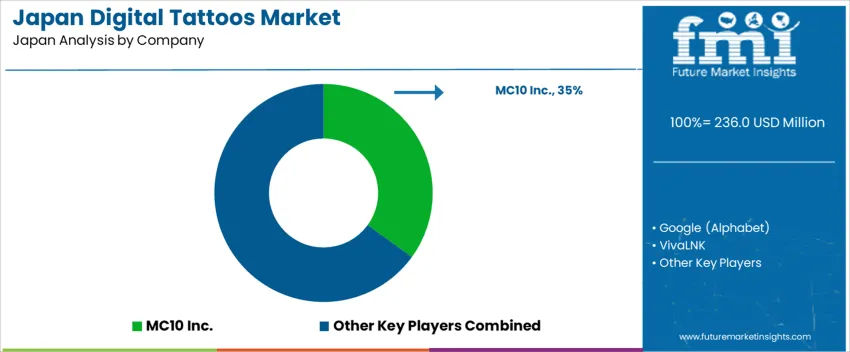

Leading companies in the digital tattoo industry in Japan include MC10 Inc., Google (Alphabet), VivaLNK, Wearable X, and Chaotic Moon. MC10 Inc. holds a dominant industry share of 35.0%, known for its innovation in flexible, stretchable electronics, and its applications in wearable health monitoring devices. Google (Alphabet) has made strides in wearable technology, exploring various uses for digital tattoos in conjunction with its broader interest in health tech through projects like Verily. VivaLNK specializes in creating wearable sensors, including digital tattoos for medical applications, while Wearable X focuses on integrating smart clothing and wearable devices with health applications. Chaotic Moon is known for its work in creative and experimental wearable technologies, including digital tattoos.

Competition in the digital tattoo industry is driven by factors such as technological innovation, user convenience, and the growing demand for personalized health solutions. Companies compete by offering products that are both functional and unobtrusive, integrating seamlessly into daily life. As wearable technology becomes more integrated into personal health monitoring and fitness applications, digital tattoos that provide real-time data collection and interaction with digital systems are becoming more attractive.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Nano Tattoo, Graphene Tattoo, Living Tattoo |

| Application | Medical, Electronic, Commercial, Experiment & Research, Teaching |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | MC10 Inc., Google (Alphabet), VivaLNK, Wearable X, Chaotic Moon |

| Additional Attributes | Dollar sales by type, application, and region; regional CAGR and adoption trends; demand trends in digital tattoos; growth in medical, electronic, and commercial applications; technology adoption for nano, graphene, and living tattoos; vendor offerings in digital tattoo technologies; regulatory influences and industry standards |

The demand for digital tattoos in Japan is estimated to be valued at USD 236.0 million in 2025.

The market size for the digital tattoos in Japan is projected to reach USD 431.7 million by 2035.

The demand for digital tattoos in Japan is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in digital tattoos in Japan are nano tattoo, graphene tattoo and living tattoo.

In terms of application, medical segment is expected to command 28.0% share in the digital tattoos in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Digital Illustration App Market Insights – Growth, Demand & Trends 2025-2035

Japan Digital Textile Printing Market Report – Trends & Innovations 2025-2035

Digital Tattoos Market Analysis by Type, Application, and Region through 2035

Demand for Digital Tattoos in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Commerce in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Power Conversion in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Instrument Clusters in Japan Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA