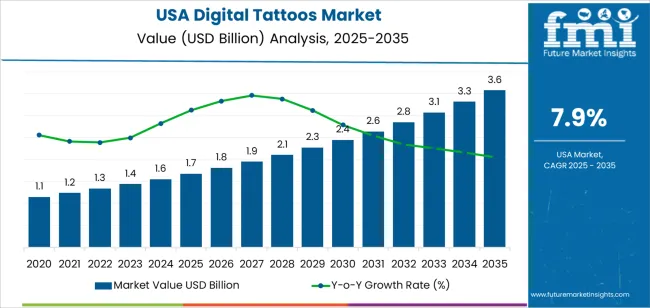

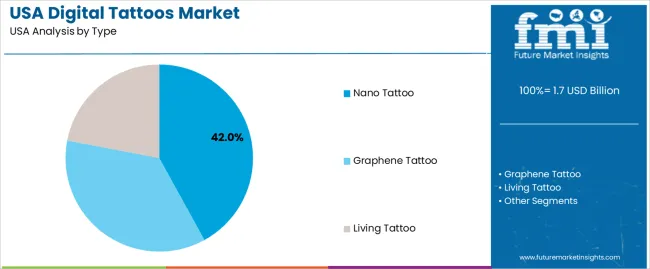

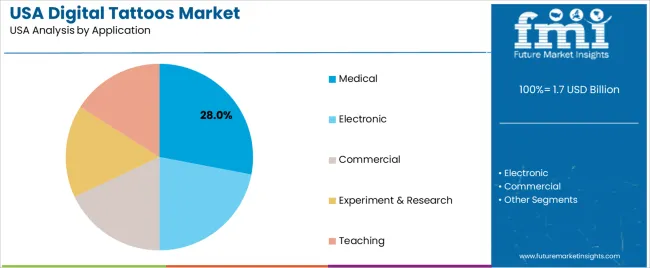

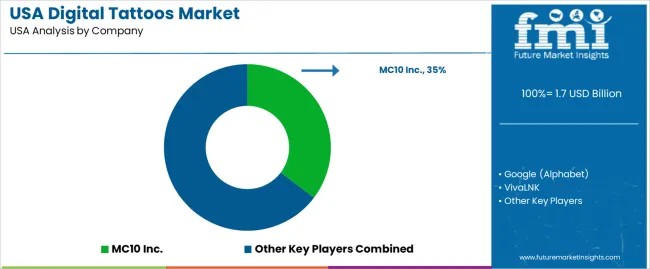

In 2025, demand for digital tattoos in the USA stands at USD 1.7 billion and is projected to reach USD 3.6 billion by 2035 at a CAGR of 7.9%. Early adoption is led by medical and electronic monitoring uses rather than consumer novelty. Nano tattoos account for 42% share due to their suitability for continuous vital sign tracking and drug delivery research. Medical applications hold the largest application share at 28%, supported by hospital pilots, remote patient monitoring programs, and chronic disease management trials. Graphene tattoos at 36% play a central role in electronic sensing for motion detection and biometric authentication. Demand remains concentrated in research hospitals, defense-linked medical labs, and university-backed clinical programs during the early growth phase.

After 2030, demand expands into commercial and applied research workflows as reliability and fabrication repeatability improve. Electronic applications rise beyond laboratory use into workforce health monitoring, wearable human-machine interfaces, and industrial safety systems. Commercial use reaches 18% as logistics firms, sports organizations, and field service operators test fatigue and hydration sensing. Living tattoos at 22% remain largely research-led, supporting experimental biology and biosensor development. Teaching and academic applications together account for 32% through medical education and materials science programs. Growth in this phase reflects broader institutional procurement rather than consumer retail uptake. Value expansion is shaped by sensor integration yield, wireless signal stability, and scalable manufacturing under medical-grade quality controls in the USA ecosystem.

The overall demand for digital tattoos in USA increases from USD 1.7 billion in 2025 to USD 2.4 billion by 2030, adding USD 0.7 billion in absolute value. This phase reflects early mainstreaming of digital tattoo technologies across healthcare monitoring, fitness tracking, and identity authentication applications. Growth is driven by rising adoption of skin-mounted biosensors for vital sign tracking, glucose monitoring, hydration assessment, and motion analytics in consumer wellness and clinical trials. Demand is further supported by military research programs, human performance labs, and sports science integration. During this period, value growth remains application-led rather than volume-led, as unit prices remain elevated due to specialized materials, sensor integration complexity, and regulatory-grade manufacturing requirements.

From 2030 to 2035, the market expands from USD 2.4 billion to USD 3.6 billion, adding a larger USD 1.2 billion in the second half of the decade. This back weighted acceleration reflects digital tattoos transitioning from specialized medical and performance tools into broader lifestyle, security, and human-machine interface applications. Wider penetration into remote patient monitoring, continuous diagnostics, authentication wearables, and immersive gaming ecosystems drives higher deployment density. As manufacturing scales, printable electronics mature, and regulatory pathways stabilize, digital tattoos shift from experimental platforms to commercial-grade continuous monitoring infrastructure, increasing both unit volume and system value per user across consumer and enterprise environments.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.7 billion |

| Forecast Value (2035) | USD 3.6 billion |

| Forecast CAGR (2025–2035) | 7.9% |

The market for digital tattoos in the USA began gaining traction as advances in flexible electronics and skin-integrated sensors matured. Early use focused on medical and research applications, where ultrathin, temporary electronic patches on skin provided better signal acquisition for vital signs than traditional electrodes. Researchers developed prototypes that adhere to skin comfortably and transmit data wirelessly, enabling continuous monitoring of heart rate, brain activity, sweat composition or muscle signals without bulky devices. This opened interest among medical device makers, wearables firms and biomedical researchers. Rising demand for discreet, body-worn health sensors and declining cost of manufacturing stretchable electronics supported early adoption beyond lab settings.

Growth going forward will depend on how digital tattoos bridge health, identity and consumer electronics. As wearable fatigue grows and consumers seek lighter, more integrated alternatives to smartwatches and chest straps, electronic tattoos may appeal for long-term health tracking, biometric authentication, and seamless interface with smart devices. Advances in biocompatible inks, wireless power transfer, flexible sensors and miniaturized communication modules will expand use cases beyond medical to fitness, security, human-machine interaction, and lifestyle. At the same time widespread adoption will face barriers: regulatory and privacy concerns around biometric data, biocompatibility and long-term skin effects, consumer hesitancy about body-worn electronics, and cost relative to traditional wearables. Market growth will likely be steady but measured, with uptake concentrated in early adopter, health-conscious, tech-savvy segments rather than broad mainstream penetration.

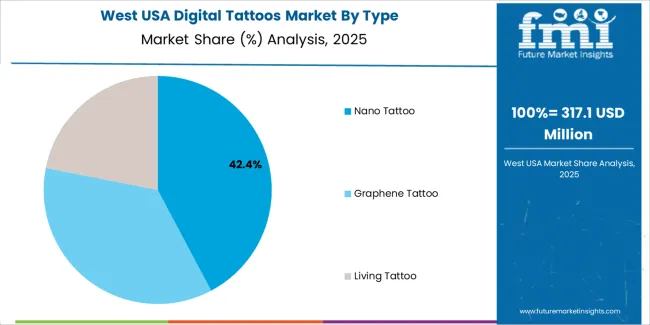

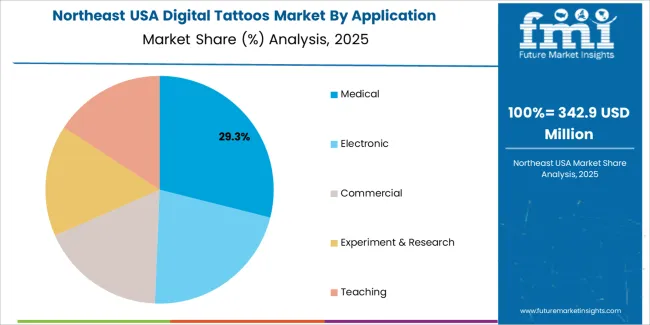

The demand for digital tattoos in the USA is structured by type and application. Nano tattoos account for 42% of total demand, followed by graphene tattoos and living tattoos used in advanced sensing and biointerface use cases. By application, medical use represents 28.0% of total adoption, followed by electronics, commercial use, experiment and research, and teaching applications. Demand behavior is shaped by sensor sensitivity requirements, skin compatibility, data transmission needs, and regulatory oversight. These segments reflect how material engineering choices and end use priorities define digital tattoo deployment across healthcare, research, and wearable electronics development in the USA.

Nano tattoos account for 42% of total digital tattoo demand in the USA due to their ultra-thin structure, high signal sensitivity, and strong compatibility with skin mounted bio sensing applications. These tattoos enable continuous monitoring of temperature, hydration, electrophysiological signals, and biochemical markers with minimal user discomfort. Their flexibility allows stable adhesion to irregular skin surfaces during movement, which supports accurate real time data capture in both clinical and consumer environments.

Nano tattoos are widely used in medical diagnostics, fitness monitoring, and experimental bioelectronics due to their low power requirements and miniaturized circuit integration. Manufacturing scalability through printed electronics and nanoscale deposition techniques supports consistent output. Research institutions and medical device developers favor nano formats for their balance between performance and patient comfort. These sensitivity, comfort, and fabrication advantages uphold nano tattoos as the leading type in the USA digital tattoo landscape.

Medical applications account for 28.0% of total digital tattoo demand in the USA due to the growing need for continuous, non-invasive patient monitoring. Digital tattoos are used for tracking vital signs, muscle activity, neurological signals, wound healing indicators, and hydration status. These capabilities support early diagnosis, remote monitoring, and post treatment recovery assessment across hospitals, rehabilitation centers, and outpatient care settings.

Medical research programs and clinical trials rely on digital tattoos for high resolution biological data collection without traditional wired sensors. Regulatory clearance pathways for wearable medical electronics have also improved adoption confidence. Integration with telehealth platforms allows physicians to access real time patient data outside clinical environments. These monitoring precision, patient compliance, and clinical data continuity factors position medical applications as the leading demand driver for digital tattoos in the USA.

Demand for digital tattoos in the USA is driven by the convergence of wearable electronics, health monitoring, and human–device interaction research. Healthcare providers explore digital tattoos for continuous vital sign tracking, hydration monitoring, and neurological signal measurement without bulky devices. Defense, sports performance, and occupational safety programs also test these systems for fatigue and stress sensing. Consumer electronics firms investigate skin-based interfaces as alternatives to smartwatches. Growth in chronic disease monitoring, aging population needs, and remote patient care models reinforces interest in ultra-thin, skin-mounted sensor platforms.

In the USA, early adoption of digital tattoos is concentrated in clinical research, military performance monitoring, and elite athletic training. Hospitals use pilot programs to evaluate real-time biosignal capture for cardiac rhythm, muscle activation, and metabolic indicators. Defense agencies test digital tattoos for soldier endurance, heat stress, and injury detection. Universities and biotech startups use these platforms for neuroscience, rehabilitation, and prosthetics interface research. These controlled institutional environments allow validation of accuracy, durability, and skin tolerance before any large-scale commercial deployment.

Digital tattoo growth in the USA is restrained by durability limits, skin compatibility challenges, and power supply constraints. Long-term adhesion under sweat, motion, and washing remains difficult. Regulatory oversight for medical-grade biosensors requires lengthy validation and approval. Data privacy concerns around continuous biological data collection slow consumer acceptance. Wireless power and ultra-thin battery integration add engineering complexity. Manufacturing at scale with consistent sensor accuracy also remains unresolved. These technical, regulatory, and ethical barriers keep digital tattoos largely in experimental and controlled-use phases.

Digital tattoos in the USA are shifting toward stretchable electronics, graphene-based conductors, and breathable polymer substrates to improve comfort and signal stability. Wireless power transfer and energy harvesting from body motion reduce dependence on micro-batteries. Integration with smartphones and cloud diagnostics platforms improves real-time analytics capability. Interface design focuses on transparent or skin-toned aesthetics to reduce visual intrusion. Multisensor tattoo arrays capable of monitoring multiple biomarkers on one patch are under development. These advances signal gradual movement from laboratory prototypes toward limited commercial health and performance applications.

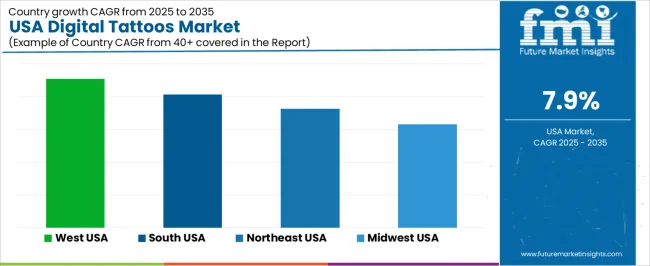

| Region | CAGR (%) |

|---|---|

| West | 9.1% |

| South | 8.1% |

| Northeast | 7.3% |

| Midwest | 6.3% |

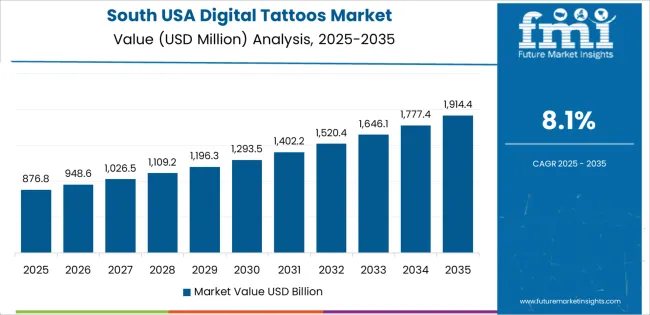

The demand for digital tattoos in the USA shows strong growth momentum across all regions, led by the West at a 9.1% CAGR. Growth in this region is driven by higher adoption of wearable electronics, wellness monitoring technologies, and integration of digital skin sensors in fitness and sports applications. The South follows at 8.1%, supported by expanding healthcare monitoring programs, consumer electronics uptake, and growing interest in remote health tracking. The Northeast records 7.3% growth, reflecting demand from medical research institutions, hospitals, and technology developers focused on biosensing applications. The Midwest shows comparatively moderate growth at 6.3%, influenced by steady adoption in healthcare monitoring and gradual penetration of wearable tech across industrial and personal health use segments.

Acceleration in the West reflects a CAGR of 9.1% through 2035 for digital tattoo demand, supported by strong presence of wearable technology users, sports performance communities, and entertainment driven personal electronics adoption. Fitness tracking, biometric monitoring, and interactive consumer applications sustain early adoption across urban technology hubs. Influencer culture and product trials in media production also support visibility. Research institutions test digital tattoos for health monitoring pilots. Demand remains innovation led rather than medically driven, with early stage consumer use shaping steady expansion across technology forward population clusters.

The South advances at a CAGR of 8.1% through 2035 for digital tattoo demand, driven by growth in sports training academies, fitness chains, and remote health monitoring trials. College athletics programs and physical therapy centers test skin mounted sensors for performance logging. Warm climate supports year round outdoor fitness tracking USAge. Healthcare systems explore temporary biometric patches for patient monitoring. Adoption remains application specific rather than mass consumer driven. Demand grows steadily through institutional trials, sports performance programs, and regional wellness technology partnerships.

The Northeast records a CAGR of 7.3% through 2035 for digital tattoo demand, shaped by research hospital activity, medical device trials, and urban fitness technology adoption. University medical centers test electronic skin sensors for cardiac and neurological monitoring. Dense urban populations support boutique fitness and biofeedback applications. Regulatory review cycles slow broad commercialization. Consumer interest follows wellness tracking rather than entertainment positioning. Demand remains research and pilot driven, with structured trials guiding gradual expansion across healthcare, rehabilitation, and high intensity urban fitness communities.

The Midwest expands at a CAGR of 6.3% through 2035 for digital tattoo demand, supported by university research, occupational safety monitoring, and limited sports science adoption. Industrial ergonomics testing uses skin sensors for worker fatigue and motion tracking. Rehabilitation centers apply temporary biometric patches for therapy assessment. Consumer driven adoption remains limited due to lower wearable experimentation. Demand stays institution led rather than lifestyle led. Growth follows research funding cycles and gradual integration into safety, rehabilitation, and applied physiology monitoring programs.

Demand for digital tattoos in the USA is growing because wearable technology and health monitoring needs are pushing users toward skin conformal, non invasive sensor solutions. These ultrathin, flexible tattoos provide real time data on vital signs, hydration levels, and biometric parameters without the bulk of traditional wearables. The rise in remote patient monitoring, fitness and wellness tracking, and interest in seamless human machine interfaces supports adoption. Improvements in flexible electronics, skin friendly adhesives, and sensor reliability make digital tattoos more practical. Use cases span healthcare monitoring, fitness, wearable medical devices, and smart authentication, creating a broad base of potential users.

Companies leading supply and innovation in this space in the USA include MC10 Inc., Google (Alphabet), VivaLNK, Wearable X, and Chaotic Moon. MC10 has pioneered epidermal sensor tattoos used in clinical and wellness monitoring. VivaLNK and Google invest in scalable production and integration with digital health ecosystems. Wearable X and Chaotic Moon focus on consumer oriented applications and human machine interface use cases. These firms shape industry norms by advancing sensor technology, regulatory compliance, and user adoption. Their presence supports a competitive yet evolving market for skin integrated digital wearable devices.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Nano Tattoo, Graphene Tattoo, Living Tattoo |

| Application | Medical, Electronic, Commercial, Experiment & Research, Teaching |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | MC10 Inc., Google (Alphabet), VivaLNK, Wearable X, Chaotic Moon |

| Additional Attributes | Dollar by sales by type, Dollar by sales by application, Regional CAGR, Institutional adoption trends, Sensor integration and wireless performance, Human-machine interface deployment, Regulatory compliance and clinical testing, Commercial scaling of printed electronics |

The demand for digital tattoos in USA is estimated to be valued at USD 1.7 billion in 2025.

The market size for the digital tattoos in USA is projected to reach USD 3.6 billion by 2035.

The demand for digital tattoos in USA is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in digital tattoos in USA are nano tattoo, graphene tattoo and living tattoo.

In terms of application, medical segment is expected to command 28.0% share in the digital tattoos in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Digital Illustration App Market Insights – Growth & Demand 2025-2035

USA Digital Commerce Market Growth – Innovations, Trends & Forecast 2025-2035

USA Digital Textile Printing Market Trends – Growth, Demand & Forecast 2025-2035

Digital Tattoos Market Analysis by Type, Application, and Region through 2035

Demand for Digital Tattoos in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Scale in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Power Conversion in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Oilfield Solutions in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Instrument Clusters in USA Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA