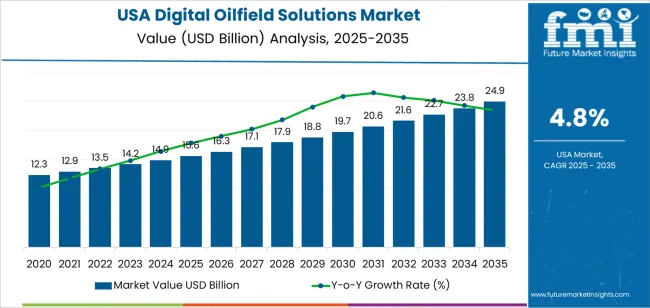

The demand for digital oilfield solutions in the USA is expected to grow from USD 15.6 billion in 2025 to USD 25.0 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.8%. Digital oilfield solutions integrate advanced technologies, data analytics, and automation to optimize exploration, production, and overall oilfield operations. As oil and gas companies increasingly adopt these technologies, they can enhance operational efficiency, reduce downtime, and improve resource management. The shift toward these solutions is being driven by the need to stay competitive, improve productivity, and meet regulatory requirements for more sustainable practices in the sector.

The growth of digital oilfield solutions is linked to advancements in IoT, artificial intelligence (AI), machine learning, and big data analytics. These technologies enable companies to leverage real-time data for better decision-making, predictive maintenance, and more precise monitoring of oilfield assets. As companies focus on improving asset management, workflow automation, and environmental safety, the demand for digital oilfield solutions is set to expand significantly. The increasing focus on energy efficiency and environmental sustainability in oil extraction and production processes will further support the adoption of digital solutions.

Between 2025 and 2030, the demand for digital oilfield solutions in the USA is expected to increase from USD 15.6 billion to USD 16.3 billion, representing moderate growth. During this phase, the industry will see steady, incremental demand driven by the increasing reliance on automated processes and data-driven decision-making in oil and gas operations. Companies will continue to focus on improving efficiency and safety through real-time monitoring and predictive maintenance. While the demand will rise gradually, it will remain stable as businesses integrate digital solutions into their operations at a measured pace, driven by the expanding adoption of IoT and advanced sensor technologies.

From 2030 to 2035, the demand for digital oilfield solutions will experience a sharp increase, rising from USD 16.3 billion to USD 25.0 billion. This significant rise will be fueled by the accelerated adoption of 5G technology, smart data analytics, and edge computing. The demand will also be influenced by the growing need for autonomous oil rigs, digital twins, and advanced drilling systems, all of which will drive major improvements in oilfield productivity, safety, and sustainability. The rise of intelligent oilfield systems capable of self-diagnosis, decision-making, and real-time adaptability will further contribute to this demand spike, marking a clear peak in the industry. The industry acceleration in this phase will be driven by the increasing complexity of oilfield operations, which will require more sophisticated digital solutions to manage the scale and diversity of tasks.

| Metric | Value |

|---|---|

| Demand for Digital Oilfield Solutions in USA Value (2025) | USD 15.6 billion |

| Demand for Digital Oilfield Solutions in USA Forecast Value (2035) | USD 25.0 billion |

| Demand for Digital Oilfield Solutions in USA Forecast CAGR (2025-2035) | 4.8% |

The demand for digital oilfield solutions in the USA is growing as the oil and gas industry increasingly embraces digitalization to optimize operations, improve efficiency, and reduce costs. Digital oilfield solutions leverage advanced technologies such as IoT, big data analytics, AI, and automation to streamline exploration, drilling, production, and reservoir management processes. These solutions enable real-time data monitoring, predictive maintenance, and enhanced decision-making, which are critical for improving productivity and managing the complexity of modern oilfield operations.

A key driver behind this growth is the industry's push for operational efficiency and cost reduction, especially in response to fluctuating oil prices and the need to maintain profitability. Digital oilfield solutions allow operators to monitor equipment performance, track well conditions, and optimize production in real-time, helping companies maximize output while minimizing downtime and operational risks. As oil and gas companies continue to focus on improving the sustainability and efficiency of their operations, the demand for these digital solutions is expected to grow significantly.

The increasing use of advanced data analytics and artificial intelligence in reservoir management and predictive maintenance is fueling the adoption of digital oilfield solutions. These technologies provide valuable insights that help companies optimize resource allocation, reduce energy consumption, and enhance safety. As the oil and gas sector in the USA moves towards smarter, data-driven operations, the demand for digital oilfield solutions is expected to continue to rise, driven by the ongoing need for innovation, efficiency, and sustainability in oilfield operations.

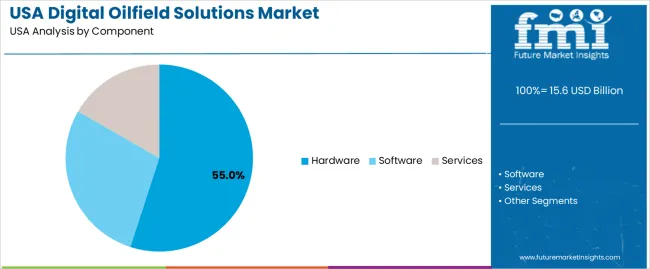

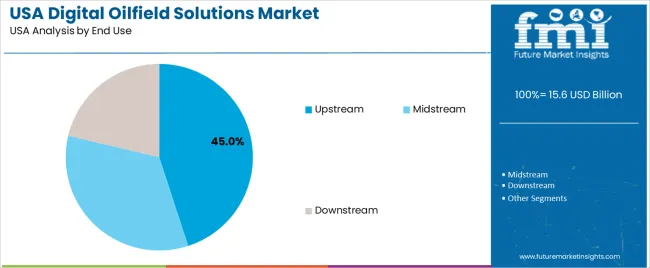

Demand for digital oilfield solutions in the USA is segmented by component, end-use, and domain. By component, demand is divided into hardware, software, and services, with hardware holding the largest share at 55%. The demand is also segmented by end-use, including upstream, midstream, and downstream, with upstream leading the demand at 45%. In terms of domain, demand is divided into automation solutions and instrumentation. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Hardware accounts for 55% of the demand for digital oilfield solutions in the USA. It is essential for real-time data collection, transmission, and analysis in the oilfield. Key hardware solutions include sensors, monitoring devices, and control systems that automate processes such as drilling, production, and reservoir management. These hardware components ensure operations are more efficient, safe, and cost-effective by providing accurate data to optimize performance. As the oil and gas industry increasingly adopts digital technologies like predictive maintenance and performance monitoring, the need for robust hardware will continue to grow. The capability of hardware to enhance operational efficiency and reduce downtime in complex oilfield environments drives its leading position in the industry.

Upstream accounts for 45% of the demand for digital oilfield solutions in the USA. The upstream sector, which focuses on exploration, drilling, and production, benefits greatly from digital technologies that enhance efficiency and reduce operational costs. Solutions like automation systems and instrumentation help optimize drilling processes, improve reservoir management, and enable real-time monitoring of production. As oil and gas companies seek increased precision and cost-efficiency, digital technologies are becoming indispensable in the upstream sector. The growing focus on automation and smart technology to enhance safety, performance, and decision-making ensures that upstream will remain the largest driver of demand for digital oilfield solutions.

Demand for digital oilfield solutions in the USA is rising as oil & gas operators increasingly seek to modernize operations for higher efficiency, safety, and cost control. The drive comes from maturing oilfields many domestic fields are aging, so companies need smarter reservoir management, enhanced oil recovery (EOR) techniques, and optimization of production with minimal extra capital. Digital oilfield tools (IoT sensors, real‑time monitoring, automation, analytics) enable better use of existing assets, reduce rig downtime, and lower operational expenses. Also, environmental regulation and pressure to reduce emissions and waste spur adoption of monitoring/analytics platforms that enhance compliance and resource efficiency. Adoption is restrained by high initial implementation costs, complexity of integrating legacy infrastructure, and concerns around data security in digitally connected operations.

In the USA, demand for digital oilfield solutions is growing because oil & gas companies face mounting pressure to maximize output while controlling costs especially in fields with declining natural productivity. Digital technologies provide tools for predictive maintenance, real‑time monitoring of wells/pipelines, and data‑driven decision making that improve operational reliability and uptime. The shift toward automation helps reduce risks, improve safety, and streamline workflows in remote or offshore operations. As global energy demand remains high and competition intensifies, companies are embracing smart‑field solutions to remain competitive. The growing emphasis on compliance, emissions control, and resource optimization also makes digital systems essential for modern operations.

Technological advances play a major role. Integration of IoT devices, advanced sensors, cloud‑based data analytics, AI/machine‑learning models, and digital‑twin simulations enable continuous monitoring and optimization of oilfield processes from drilling and reservoir management to production and maintenance. These tools deliver real‑time insights, predictive maintenance, and remote control capabilities, reducing human intervention and operational risk. Modular, software‑defined architectures and scalable solutions make adoption easier even for older fields or distributed assets. As these technologies mature and become more cost‑effective, they drive broader deployment across upstream, midstream, and in‑field operations.

Despite strong demand and technological promise, several challenges hinder universal adoption. First, the high upfront cost to retrofit existing infrastructure with digital‑ready sensors, communication networks, and analytics platforms can be prohibitive especially for smaller operators or older oilfields. Integration complexity with legacy equipment and data architectures adds technical risk. Second, the volume and sensitivity of field data raise cybersecurity and data‑privacy concerns; securing digital networks across remote or offshore sites demands robust safeguards. Third, workforce readiness many operators may lack staff with expertise in data analytics, digital infrastructure or automation which can slow deployment. Uneven economic cycles, oil‑price volatility, and regulatory uncertainties may reduce CAPEX appetite, delaying investments in digital upgrades.

| Region | CAGR (%) |

|---|---|

| West USA | 5.6% |

| South USA | 5.0% |

| Northeast USA | 4.5% |

| Midwest USA | 3.9% |

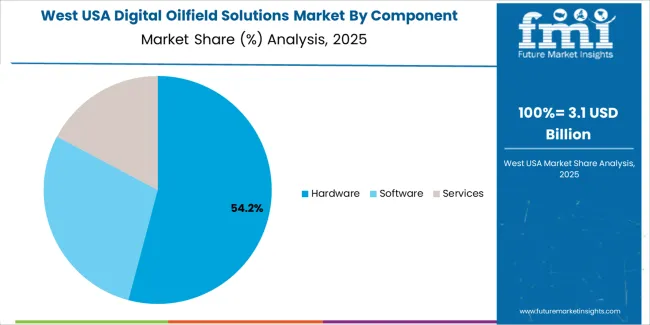

Demand for digital oilfield solutions in the USA is steadily growing, with the West leading at a 5.6% CAGR, driven by its key oil and gas production areas and a strong focus on operational efficiency. The South follows with a 5.0% CAGR, fueled by the region’s significant oil production and shale oil extraction. The Northeast shows a 4.5% CAGR, supported by the adoption of digital technologies in shale oil fields. The Midwest experiences a 3.9% CAGR, with steady growth driven by the need for automation and optimization in oil production. As the oil and gas industry continues to modernize with a focus on efficiency and sustainability, the demand for digital oilfield solutions is expected to increase across all regions in the USA.

The West USA leads the demand for digital oilfield solutions, with a 5.6% CAGR. The region’s demand is primarily driven by its key oil and gas production areas, including California, Alaska, and Colorado, where digital solutions are essential for maximizing operational efficiency. Oilfield operators in the West are increasingly adopting automation, remote monitoring, and predictive maintenance technologies to enhance exploration, drilling, and production processes. The growing emphasis on improving oil recovery, reducing costs, and optimizing field performance is contributing to the increasing demand for digital oilfield solutions in the region. The West’s focus on utilizing data analytics, IoT, and AI to drive performance improvements in oil and gas production also fuels the adoption of digital solutions. As the region continues to evolve toward more efficient and sustainable oilfield operations, the demand for digital oilfield solutions is expected to remain strong.

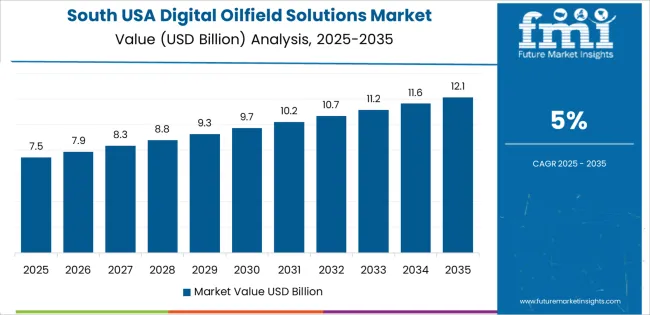

The South USA is experiencing strong demand for digital oilfield solutions, with a 5.0% CAGR. This growth is driven by the region’s central role in the oil and gas industry, particularly in Texas, which is one of the largest oil-producing states in the USA. The adoption of digital technologies in the South is being spurred by the need for real-time data analytics, remote monitoring, and predictive maintenance solutions to improve production efficiency and reduce operational costs. The rise of shale oil production and the increasing complexity of oilfield operations have led to a higher reliance on digital oilfield solutions to optimize drilling, production, and field management processes. The South’s ongoing efforts to modernize its oil and gas infrastructure to incorporate digital technologies further contribute to the growing demand for these solutions. As the industry continues to expand, demand for digital oilfield solutions in the South is expected to stay strong.

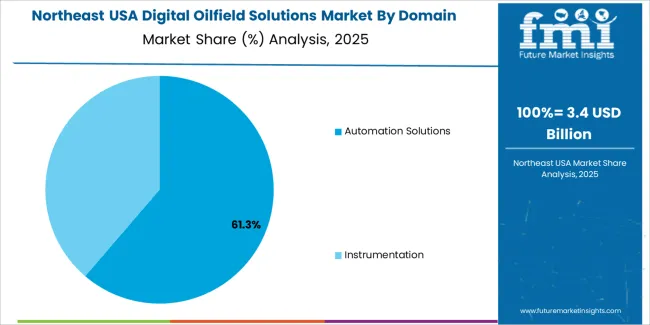

The Northeast USA is seeing steady demand for digital oilfield solutions, with a 4.5% CAGR. This demand is largely driven by the region’s focus on optimizing oil and gas production processes and improving energy efficiency. States like Pennsylvania and Ohio are seeing increased adoption of digital technologies in oil and gas fields, particularly in shale oil extraction. As operators in the Northeast seek to improve production rates and reduce costs, the need for digital oilfield solutions such as remote sensing, data analytics, and automated drilling systems is growing. The region’s continued shift toward more sustainable and efficient operations also contribute to the demand for advanced oilfield technologies. As companies look to improve their energy efficiency and ensure regulatory compliance, digital oilfield solutions are becoming increasingly integral to their operations. As the Northeast’s oil and gas industry continues to modernize, demand for these solutions is expected to rise steadily.

The Midwest USA is seeing moderate demand for digital oilfield solutions, with a 3.9% CAGR. The demand in this region is primarily driven by the growing need for automation, optimization, and cost efficiency in oil production processes, particularly in states like North Dakota and Illinois. As the region’s oil and gas industry continues to embrace digital technologies, the demand for remote monitoring, predictive maintenance, and data-driven analytics is increasing. Digital oilfield solutions are helping operators in the Midwest improve their decision-making, reduce downtime, and enhance production efficiency. The rise of unconventional oil production, particularly in shale fields, is driving the need for more advanced technologies to optimize operations. While the growth rate in the Midwest is slower compared to other regions, the steady adoption of digital oilfield solutions is expected to continue as operators seek to improve operational efficiency and maximize output.

The demand for digital oilfield solutions in the USA has been steadily increasing as the oil and gas industry adopts advanced technologies to enhance operational efficiency, reduce costs, and improve safety. Digital oilfield solutions involve the use of sensors, data analytics, automation, and cloud computing to optimize exploration, drilling, and production activities. These solutions are crucial for increasing the productivity of oilfields, improving decision-making processes, and enabling predictive maintenance. As the industry focuses on maximizing production and minimizing downtime, digital solutions are becoming a key driver of innovation and competitive advantage in the sector.

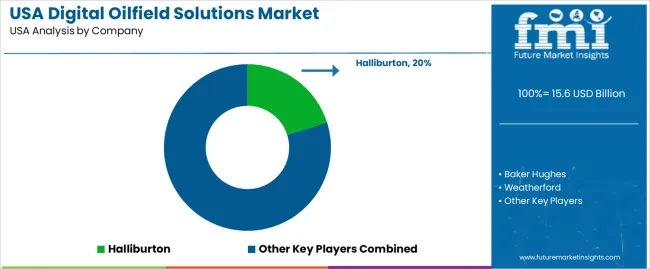

The leading companies in the digital oilfield solutions industry in the USA include Halliburton, Baker Hughes, Weatherford, Siemens Energy, and Schlumberger. Halliburton leads the industry with a share of 20.2%, providing a range of digital solutions aimed at optimizing well performance, enhancing reservoir management, and improving operational efficiency through advanced data analytics and cloud-based technologies.

Baker Hughes offers digital solutions that focus on automation, data integration, and remote monitoring to enhance oilfield productivity. Weatherford specializes in digital oilfield services, including integrated data solutions and automation systems that support real-time decision-making. Siemens Energy provides energy-efficient solutions, including digital technologies that optimize production and maintenance in oilfields. Schlumberger offers a wide array of digital oilfield technologies, leveraging its expertise in data analytics, cloud computing, and automation to improve operational performance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Component | Hardware, Software, Services |

| Domain | Automation Solutions, Instrumentation |

| End Use | Upstream, Midstream, Downstream |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Halliburton, Baker Hughes, Weatherford, Siemens Energy, Schlumberger |

| Additional Attributes | Dollar sales by component and domain; regional CAGR and adoption trends; demand trends in digital oilfield solutions; growth in upstream, midstream, and downstream sectors; technology adoption for automation and instrumentation in the oil and gas industry; vendor offerings including software, hardware, and services; regulatory influences and industry standards |

The demand for digital oilfield solutions in USA is estimated to be valued at USD 15.6 billion in 2025.

The market size for the digital oilfield solutions in USA is projected to reach USD 24.9 billion by 2035.

The demand for digital oilfield solutions in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in digital oilfield solutions in USA are hardware, software and services.

In terms of domain, automation solutions segment is expected to command 60.0% share in the digital oilfield solutions in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Oilfield Solutions Market Growth - Trends & Forecast 2025 to 2035

USA Digital Illustration App Market Insights – Growth & Demand 2025-2035

USA Digital Commerce Market Growth – Innovations, Trends & Forecast 2025-2035

USA Digital Textile Printing Market Trends – Growth, Demand & Forecast 2025-2035

Digital Oilfield Market Growth – Trends & Forecast 2024-2034

Women Digital Health Solutions Market Size and Share Forecast Outlook 2025 to 2035

Operational Digital Oilfield Solution Market Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Scale in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Tattoos in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Power Conversion in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Instrument Clusters in USA Size and Share Forecast Outlook 2025 to 2035

Spending In Digital Customer Experience and Engagement Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand for Bioprocess Containers and Fluid Transfer Solutions in USA Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA