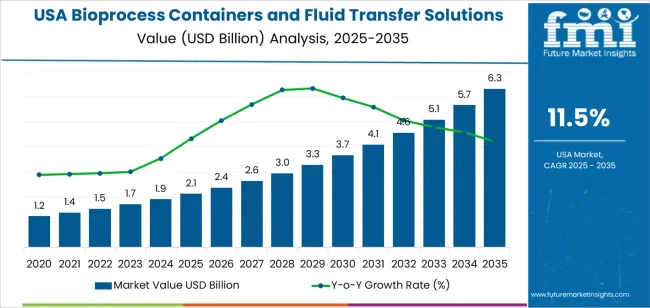

Bioprocess containers and fluid transfer solution demand in the USA is valued at USD 2.1 billion in 2025 and is projected to reach USD 6.3 billion by 2035 at a CAGR of 11.5%. Early growth is shaped by expanding biologics manufacturing, vaccine production, and cell and gene therapy programs that rely on single-use systems for contamination control and rapid changeover. Biopharmaceutical CDMOs represent a major source of demand as outsourcing of upstream and downstream processing continues to rise. Bags, tubing assemblies, connectors, and sterile storage containers see strong uptake across monoclonal antibody and recombinant protein production. Adoption is driven by reduced cleaning validation, lower capital intensity, and faster scaling compared with traditional stainless steel systems across USA manufacturing hubs in California, Massachusetts, and North Carolina.

After 2030, demand growth becomes more capacity and pipeline driven than technology driven. Market value rises from about USD 3.7 billion in 2030 toward USD 6.3 billion by 2035 as commercial-scale biologics, biosimilars, and advanced therapies move deeper into late-stage production. Fluid transfer solutions gain higher specification requirements for pressure stability, leachables control, and flow consistency in continuous processing setups. Large pharmaceutical firms expand internal single-use capacity for flexible multiproduct facilities, while CDMOs invest in modular bioprocess suites to support variable batch sizes. Supplier competition centers on material purity, weld integrity, customized assemblies, and long-term supply reliability under strict regulatory oversight across the USA biomanufacturing ecosystem.

Bioprocess containers and fluid transfer solutions follow the scale and intensity of biologics manufacturing rather than general medical device cycles, giving the category a capacity-driven growth profile. Demand in USA increases from USD 2.1 billion in 2025 to USD 3.7 billion by 2030, adding USD 1.6 billion in absolute value. This phase reflects steady expansion in single-use bioreactors, sterile bags, tubing assemblies, and aseptic connectors across vaccine production, monoclonal antibodies, cell therapies, and recombinant protein manufacturing. Growth is anchored in facility expansions, clinical pipeline progression, and outsourcing to contract development and manufacturing organizations. Value growth remains volume-led as manufacturers focus on throughput, contamination control, and flexible batch changeover rather than major pricing escalation.

From 2030 to 2035, the market expands from USD 3.7 billion to USD 6.3 billion, adding a larger USD 2.6 billion in the second half of the decade. This back weighted acceleration reflects deeper penetration of single-use systems into large-scale commercial biologics, continuous processing platforms, and personalized medicine production. Higher container volumes, multi-layer barrier films, and advanced sterile welding systems increase value per installation. As decentralized manufacturing, rapid scale-out facilities, and multi-product biologics campuses expand, bioprocess containers and fluid transfer solutions shift from supporting infrastructure to core production-enabling assets, strengthening long-term demand growth.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 2.1 billion |

| Forecast Value (2035) | USD 6.3 billion |

| Forecast CAGR (2025–2035) | 11.5% |

Demand for bioprocess containers and fluid transfer solutions in the USA expanded as biotechnology, pharmaceutical manufacturing, and biopharmaceutical R&D scaled up. In earlier decades, many producers relied on fixed stainless steel tanks and manual transfer systems. As biologics, cell-culture based therapies, and sterile-fill processes increased, firms adopted single-use containers, sterile bags, and specialized fluid transfer lines to reduce cross-contamination risk and cleaning costs. This shift was particularly driven by contract development and manufacturing organizations servicing multiple products where change-over speed and validation overhead mattered. The growth of biologics pipelines, vaccine manufacturing, and cell/gene therapy programs reinforced need for reliable, validated sterile transfer systems across development and commercial production.

Looking ahead, demand in the USA will grow faster as biologics mature, regulatory expectations tighten, and production scales increase. Increased reliance on single-use process trains, modular manufacturing facilities, and flexible contract manufacturing setups will drive fluid transfer system adoption. Downsizing of facility footprints and demand for rapid batch turnaround will favor disposable or modular containers and bag-based fluid paths over legacy hard-piped systems. Growth will also come from emerging cell therapies, personalized medicine, and small-batch fill/finish operations requiring high sterility and documentation. Constraints may include raw-material supply bottlenecks (bags, sterile film), pressure on waste disposal due to single-use waste, and demand for more sustainable or recyclable solutions. The market’s expansion will depend on balancing sterility, flexibility, cost efficiency, and environmental impact.

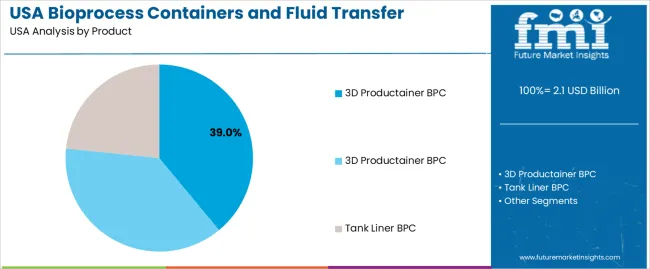

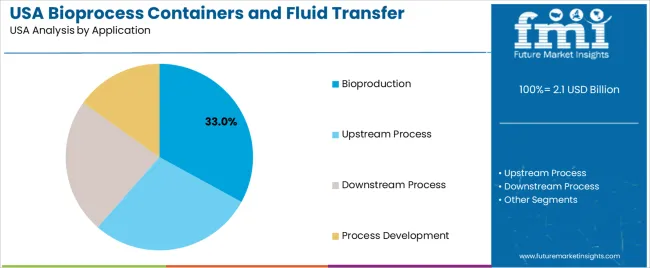

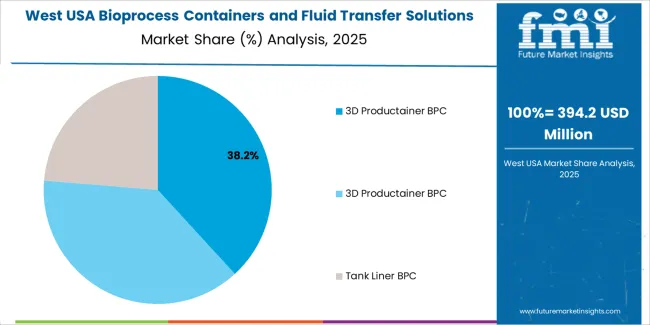

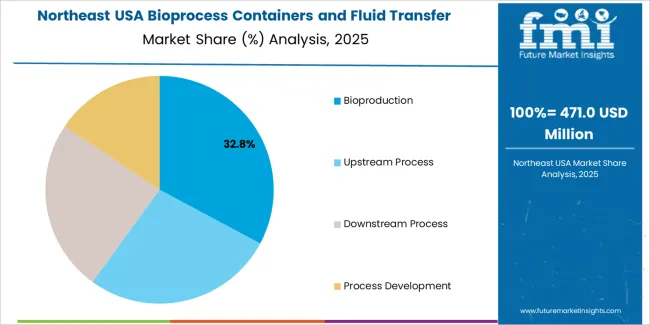

The demand for bioprocess containers and fluid transfer solutions in the USA is structured by product type and application. Three dimensional productainer BPC systems account for 39% of total demand, followed by tank liner BPC solutions used across large volume fluid handling environments. By application, bioproduction represents 33.0% of total consumption, followed by upstream processing, downstream processing, and process development activities. Demand behavior is shaped by contamination control requirements, process flexibility needs, sterilization standards, and scale variability across biologics manufacturing. These segments reflect how single use technologies and modular fluid handling systems are reshaping liquid management practices across pharmaceutical and biotechnology production facilities in the USA.

Three dimensional productainer BPC systems account for 39% of total demand in the USA due to their ability to support flexible, closed system fluid handling across multiple bioprocessing stages. These containers are widely used for buffer storage, media preparation, intermediate product transfer, and bulk drug substance holding. Their pre sterilized design reduces the need for cleaning validation and lowers turnaround time between production batches. These features support rapid scale up and changeover in multiproduct biologics facilities.

Three dimensional productainer systems also integrate easily with standard tubing, connectors, and pump assemblies, which supports automated and gravity driven transfer operations. Their collapsible structure improves space utilization during storage and disposal. Contract manufacturers favor these systems due to reduced capital equipment dependency and faster facility reconfiguration. These contamination control, operational flexibility, and deployment efficiency factors sustain three dimensional productainer BPC systems as the leading product category across the USA bioprocess container demand structure.

Bioproduction accounts for 33.0% of total demand for bioprocess containers and fluid transfer solutions in the USA due to high volume manufacturing of monoclonal antibodies, vaccines, cell therapies, and recombinant proteins. Large scale bioreactor operations require continuous movement of sterile media, buffers, and harvested product streams between processing stages. Single use containers and fluid transfer assemblies support rapid batch turnaround and reduce cross contamination risk across successive production cycles.

Bioproduction facilities also operate under strict regulatory oversight that prioritizes closed system processing and validated material transfer pathways. Disposable fluid handling systems minimize cleaning downtime and eliminate risks associated with residual contamination from stainless steel systems. The expansion of domestic biologics manufacturing capacity further reinforces demand across multiple regions. These production intensity, regulatory compliance, and contamination control requirements position bioproduction as the dominant application segment for bioprocess containers and fluid transfer solutions in the USA.

Bioprocess containers in the USA are now treated as fixed production infrastructure rather than temporary consumables. Biologics manufacturers rely on single-use bags, mixing systems, and storage containers to avoid cross-batch contamination in multi-product facilities. Rapid product turnover in contract manufacturing requires equipment flexibility that stainless steel systems cannot provide without long cleaning downtime. Pandemic-era capacity expansion normalized disposable processing across vaccines, cell therapies, and recombinant proteins. This structural dependence makes single-use containers a baseline requirement for USA biomanufacturing operations rather than a niche processing choice.

Fluid transfer solutions in the USA are heavily shaped by the growth of cell and gene therapy, mRNA platforms, and contract development manufacturing organizations. These processes depend on closed, sterile fluid handling across media preparation, filtering, filling, and final formulation. Small batch sizes with high material value require ultra-secure connections, aseptic connectors, and leak-free tubing assemblies. Rapid tech transfer between sponsor and CDMO sites also demands standardized fluid paths for process reproducibility. This therapeutic shift drives demand toward precision-engineered, disposable fluid transfer architectures rather than traditional rigid piping.

Despite operational advantages, USA users face pressure from high recurring consumable cost, long validation cycles, and supplier dependency. Every container and connector type requires extractables and leachables qualification tied to specific drug formulations. Switching suppliers mid-program triggers expensive revalidation. Supply chain concentration in some single-use components creates procurement risk during demand surges. Waste disposal cost from high plastic throughput also affects facility economics. These financial and regulatory burdens prevent unrestricted expansion despite strong technical dependence on disposable processing systems.

Bioprocess containers and fluid transfer systems in the USA are evolving toward fully modular, automation-ready platforms. Smart mixing bags now integrate sensor ports for pH, dissolved oxygen, and volume tracking. Pre-assembled, gamma-sterilized fluid paths reduce on-site assembly error. Robotic filling lines require standardized connector geometries for high-speed attachment. Closed-system sampling ports minimize operator exposure in high-potency biologics. These advances show demand shifting from generic disposable hardware toward digitally integrated, closed-loop bioprocess flow control ecosystems.

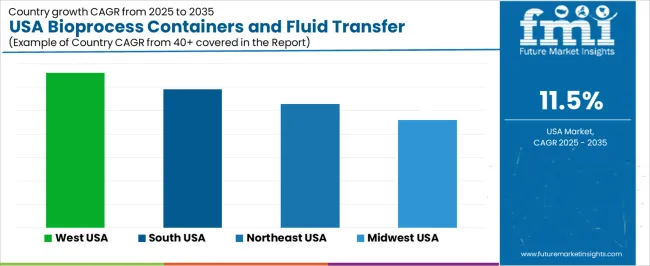

| Region | CAGR (%) |

|---|---|

| West | 13.2% |

| South | 11.8% |

| Northeast | 10.6% |

| Midwest | 9.2% |

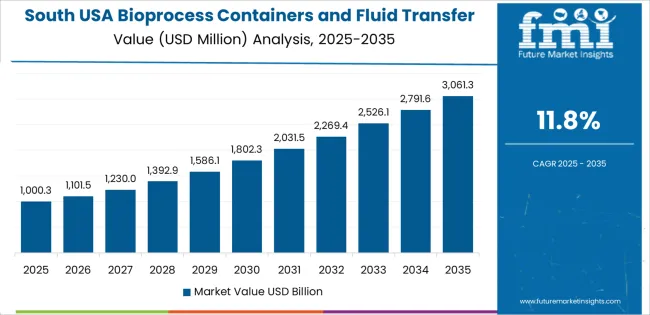

The demand for bioprocess containers and fluid transfer solutions in the USA shows strong regional momentum, with the West leading at a 13.2% CAGR. This growth is supported by a high concentration of biotechnology firms, contract development and manufacturing organizations, and expanding biologics production capacities. The South follows at 11.8%, driven by rapid growth in pharmaceutical manufacturing, vaccine production facilities, and life science industrial parks. The Northeast records 10.6% growth, supported by established pharmaceutical clusters, academic research institutions, and steady investment in bioprocess infrastructure. The Midwest shows comparatively moderate growth at 9.2%, reflecting slower expansion of biologics manufacturing and more limited concentration of large scale bioprocessing facilities.

Expansion in the West reflects a CAGR of 13.2% through 2035 for bioprocess container and fluid transfer solution demand, supported by strong concentration of biotechnology firms, cell therapy developers, and contract development and manufacturing organizations. Single use systems are widely adopted for upstream and downstream bioprocessing to reduce contamination risk and improve batch flexibility. Research driven production and pilot scale manufacturing dominate demand patterns. Venture backed biomanufacturing facilities add steady equipment turnover. Demand remains process scalability driven, with emphasis on sterile fluid handling, closed system transfer, and rapid changeover efficiency.

The South advances at a CAGR of 11.8% through 2035 for bioprocess container and fluid transfer solution demand, driven by vaccine manufacturing expansion, biologics production, and growing pharmaceutical packaging operations. Large scale sterile filling facilities require consistent supply of bags, tubing, and aseptic connectors. Medical research parks and life science clusters support continued scale up of production capacity. Workforce availability and lower facility costs attract new manufacturing investments. Demand remains volume oriented and production driven, guided by continuous output from regulated biologics, injectables, and diagnostic reagent manufacturing plants.

The Northeast records a CAGR of 10.6% through 2035 for bioprocess container and fluid transfer solution demand, shaped by pharmaceutical research hubs, academic medical centers, and advanced clinical manufacturing programs. Personalized medicine, monoclonal antibody development, and clinical trial production require precision fluid handling systems. High regulatory oversight increases reliance on validated single use technologies. Urban research hospitals integrate fluid transfer systems into translational manufacturing workflows. Demand remains compliance and data integrity driven, with sustained growth tied to continuous clinical development and regulated biologics production across research intensive facilities.

The Midwest expands at a CAGR of 9.2% through 2035 for bioprocess container and fluid transfer solution demand, supported by pharmaceutical production, enzyme manufacturing, and food ingredient biotechnology operations. Large scale fermentation facilities require durable fluid transfer systems for media handling and intermediate processing. Regional biologics manufacturers emphasize cost control and long run production stability. Academic research institutions add pilot scale demand. Growth remains steady and production led, aligned with predictable output from fermentation driven manufacturing, biosafety testing, and industrial biotechnology processing across central manufacturing corridors.

Demand for bioprocess containers and fluid transfer solutions in the USA is rising as the biopharmaceutical and biotech industries expand production of biologics, vaccines, cell therapies, and other advanced therapies. Manufacturers increasingly adopt single use container systems and disposable fluid path solutions because they reduce the risk of contamination, lower validation and cleaning burdens, and accelerate turnaround between production batches. The need for flexible manufacturing capacity, the surge in contract manufacturing, and the trend toward smaller batch and diversified production runs all support adoption of these systems. Growth in research scale and commercial scale biologics production, plus regulatory pressure for sterility and traceability, further boost demand for advanced fluid handling and aseptic containers.

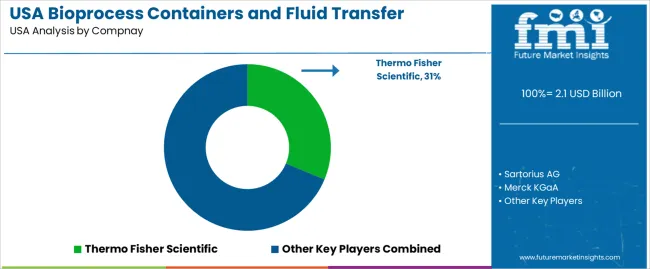

Key suppliers shaping the USA market for bioprocess containers and fluid transfer solutions include Thermo Fisher Scientific, Sartorius AG, Merck KGaA, Danaher Corporation (through its Cytiva and Pall units), and Saint Gobain Life Sciences. Thermo Fisher and Sartorius are major providers of single use bag systems, tubing, sterile connectors, and full fluid management assemblies suited for upstream and downstream bioprocessing. Merck offers a broad portfolio of sterile container systems and filtration integrated transfer solutions for biologics production. Danaher (Cytiva/Pall) supplies modular fluid transfer and single use systems optimized for large scale biomanufacturing. Saint Gobain Life Sciences focuses on high purity polymer based fluid handling components for sensitive biologic processing. Together, these firms ensure that USA biotechnology manufacturers have access to scalable, sterility compliant container and transfer solutions that support modern biologics and cell/gene therapy development at commercial scale.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product | 3D Productainer BPC, Tank Liner BPC |

| Application | Bioproduction, Upstream Process, Downstream Process, Process Development |

| End-User | Biopharmaceutical Companies, Life Sciences Companies, Research and Development Companies |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Thermo Fisher Scientific, Sartorius AG, Merck KGaA, Danaher Corporation (Cytiva, Pall), Saint-Gobain Life Sciences |

| Additional Attributes | Dollar by sales by product, Dollar by sales by application, Dollar by sales by region, Regional CAGR, Adoption across CDMOs and biomanufacturers, Single-use system penetration, Sterility compliance and contamination control, Fluid transfer efficiency, Modular and automation-ready system integration, Supply reliability under regulatory oversight |

The demand for bioprocess containers and fluid transfer solutions in USA is estimated to be valued at USD 2.1 billion in 2025.

The market size for the bioprocess containers and fluid transfer solutions in USA is projected to reach USD 6.3 billion by 2035.

The demand for bioprocess containers and fluid transfer solutions in USA is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in bioprocess containers and fluid transfer solutions in USA are 3d productainer bpc, 3d productainer bpc and tank liner bpc.

In terms of application, bioproduction segment is expected to command 33.0% share in the bioprocess containers and fluid transfer solutions in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioprocess Containers & Fluid Transfer Solutions Market – Trends & Forecast 2025 to 2035

Fluid Transfer Solutions Market – Demand & Forecast 2024-2034

IV Fluid Transfer Drugs Devices Market Trends – Growth & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

Demand for Upstream Bioprocessing Equipment in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Collapsible Rigid Containers in USA Size and Share Forecast Outlook 2025 to 2035

Fluidized Conveying Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fluidized Bed Dryer Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Fluid Aspiration System Market Size and Share Forecast Outlook 2025 to 2035

Fluid Dispensing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocess Fermentation Monitoring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA