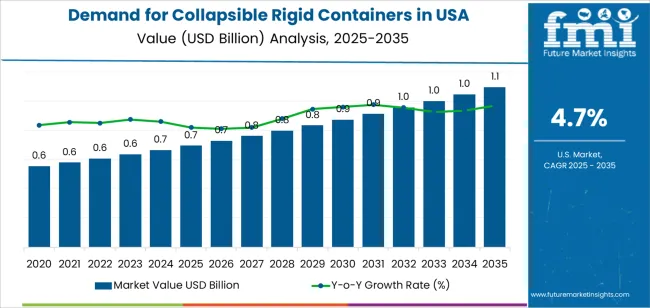

The USA collapsible rigid containers demand is valued at USD 0.7 billion in 2025 and is forecasted to reach USD 1.1 billion by 2035, rising at a CAGR of 4.7%. Growth is supported by expanding use of reusable packaging across food distribution, retail logistics, automotive supply chains, and agricultural transport. Collapsible rigid containers provide space-saving storage, reduced return-trip volume, and improved handling efficiency, which strengthens adoption across distribution centers and closed-loop shipping systems. Their durability and long service life further reinforce transitions away from single-use packaging.

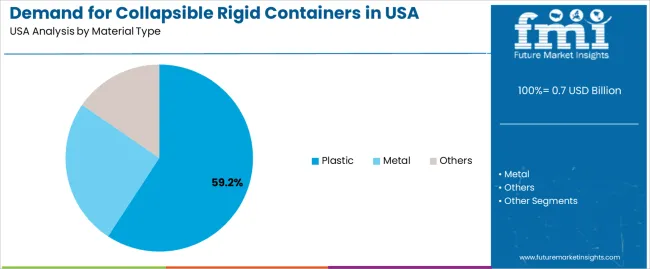

Plastic units represent the leading material category due to their strength-to-weight balance, resistance to impact and moisture, and compatibility with automated handling equipment. Plastic construction enables repeated folding and unfolding cycles while maintaining structural integrity. Advancements in high-density polymers, hinge reinforcement, and contamination-resistant designs are improving performance in temperature-controlled storage and high-load transport environments.

Demand is strongest in the West, South, and Northeast, where distribution hubs, e-commerce fulfillment centers, and agricultural producers rely on reusable containers to streamline operations and reduce handling costs. Major suppliers include Brambles Limited, Supreme Industries Limited, Schoeller Allibert Services B.V., DS Smith plc, and SSI Schäfer AG. These companies focus on structural reliability, efficient fold-flat ratios, and compatibility with automated storage systems.

Saturation point analysis shows a gradual shift from early expansion toward a moderated, maturity-oriented demand profile. Between 2025 and 2029, the segment will remain well below saturation, supported by broad adoption across e-commerce, retail distribution, food handling, and industrial logistics. Growth during this phase will be reinforced by space-saving requirements, reduced return-freight costs, and wider use of reusable packaging in warehouse and supply-chain operations.

Between 2030 and 2035, the segment will begin approaching an initial saturation point as major users standardize collapsible container systems and procurement shifts toward replacement cycles. Large logistics networks and manufacturing facilities will already have established container fleets, leading to more predictable purchasing patterns. Incremental gains will come from design improvements in load capacity, material durability, and fold-ratio efficiency rather than rapid volume expansion. The saturation trend reflects an industry moving from adoption-driven growth to stable operational integration, supported by durability needs, cost-efficiency objectives, and continued emphasis on reusable transport packaging within USA supply-chain environments.

| Metric | Value |

|---|---|

| USA Collapsible Rigid Containers Sales Value (2025) | USD 0.7 billion |

| USA Collapsible Rigid Containers Forecast Value (2035) | USD 1.1 billion |

| USA Collapsible Rigid Containers Forecast CAGR (2025-2035) | 4.7% |

Demand in the USA for collapsible rigid containers is rising as logistics, warehousing and supply-chain operations prioritise efficient use of space and reusable packaging. Collapsible containers reduce return-transport volume and improve storage density in warehouses and distribution centres. Growth in e-commerce and omnichannel fulfilment drives requirements for packaging systems that can be folded when empty and reliably deployed during inbound or outbound operations. Manufacturers across food & beverage, automotive parts, pharmaceuticals and retail sectors use these containers to lower total logistics cost and meet ecofriendly goals by reducing single-use packaging.

Innovation in materials and design, such as fold-flat crates, modular reusable bins and advanced polymer hinges, supports broader adoption. Challenges to growth include higher upfront investment compared to standard rigid packaging, the need for reverse-logistics systems to manage container returns and potential cleaning or maintenance requirements in reuse cycles. Some users may delay adoption until total cost-of-ownership savings are proven in their specific operations.

Demand for collapsible rigid containers in the United States is shaped by material selection, product design, and distribution channel structure. These containers support warehousing, logistics, industrial handling, and bulk movement of goods across sectors that prioritize space efficiency and reusability. The distribution of demand across segments reflects cost considerations, durability needs, and operational consolidation trends in storage and transport systems.

Plastic collapsible rigid containers hold 59.2% of USA demand, making them the leading material category. Plastic options remain dominant due to durability, corrosion resistance, lighter weight, and cost efficiency in repeated handling cycles. They are widely used in food processing, retail distribution, agriculture, and industrial supply chains requiring easy cleaning and long service life. Metal containers account for 25.4%, supporting applications that require enhanced structural strength and suitability for heavy loads or harsh environments. The 15.4% share held by other materials includes wood–polymer blends, composite formats, and niche engineered options suited for specialized handling and closed-loop operations. Material share patterns reflect performance consistency, ease of maintenance, and compatibility with automated storage systems.

Key drivers and attributes:

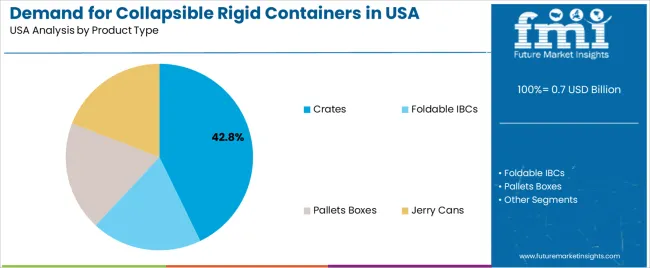

Crates hold 42.8% of USA demand for collapsible rigid containers and lead the product-type segment. Their dominance comes from broad use in agriculture, distribution centers, food and beverage supply chains, and automated warehouse systems that require efficient stacking and rapid loading. Foldable IBCs account for 19.1%, supporting liquid and semi-liquid bulk materials in chemicals, food ingredients, and industrial processing lines. Pallet boxes represent 19.0%, used for heavier bulk items and integrated pallet-handling systems in logistics hubs. Jerry cans hold 19.1% and serve applications involving liquid storage, transport, and field operations. These product categories reflect durability requirements, compatibility with material-handling equipment, and growing focus on collapsibility to reduce return-transport costs.

Key drivers and attributes:

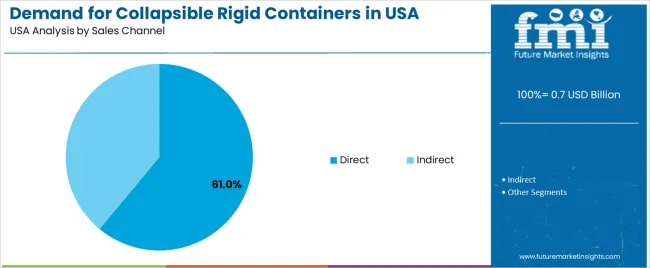

Direct sales channels account for an estimated 61.0% of USA demand for collapsible rigid containers. Large industrial users, logistics operators, and agricultural distributors frequently purchase directly from manufacturers to align specifications, negotiate volume-based pricing, and ensure predictable supply. Direct supply relationships also support customization and compatibility with automated systems. Indirect sales represent 39.0%, including distributors, wholesalers, and e-commerce suppliers serving small and mid-size buyers. Indirect channels remain essential for replacement cycles, low-volume purchases, and regional availability. Channel distribution reflects purchasing structure differences between large fleet-based users and smaller operations requiring flexible order quantities.

Key drivers and attributes:

Storage optimization, growth in e-commerce logistics, and circular packaging initiatives are driving demand.

In the United States, demand for collapsible rigid containers is increasing as industrial users and logistics operators seek solutions that reduce empty-container volume during return transport and storage. E-commerce expansion and multi-channel fulfilment require efficient container systems that support dense warehouse layouts and reusable logistics networks. Manufacturers are adopting returnable and collapsible containers to cut freight costs, lower carbon emissions, and improve supply-chain sustainability. Services such as bulk parts distribution, automotive component supply, and food-and-beverage plant in-plant logistics further reinforce USAge of fold-flat or stackable rigid crates and boxes.

Up-front investment cost, compatibility with existing systems, and material durability concerns are restraining uptake.

Collapsible rigid containers typically cost more than single-use or simple rigid alternatives owing to hinges, collapse mechanisms, and higher-quality materials. Some facilities must retrofit racks, conveyors, or return-loops to handle fold-flat container systems, which adds integration cost. Durability of repeated collapsing and re-expanding under heavy loads raises concerns in harsh industrial environments, which may slow acceptance until long-term reliability is proven. In sectors where one-way packaging remains dominant, the economic incentive to switch may remain marginal.

Broader adoption in closed-loop supply chains, rising use in aftermarket and automotive parts logistics, and material innovation for lighter weight containers define future trends.

Container suppliers are increasingly offering systems tailored to closed-loop supply chains, particularly in automotive, aerospace and appliances, where predictable return logistics provide a business case for collapsible systems. Demand is rising for hybrid material containers that combine rigid structural panels with foldable sections and lighter material options to reduce weight and cost while maintaining strength. Growth in USA manufacturing reshoring and warehouse automation is prompting interest in logistics equipment and container systems that harmonise with automated handling and conveyor systems. These developments are supporting a gradual rise in demand for collapsible rigid containers across American industrial logistics networks.

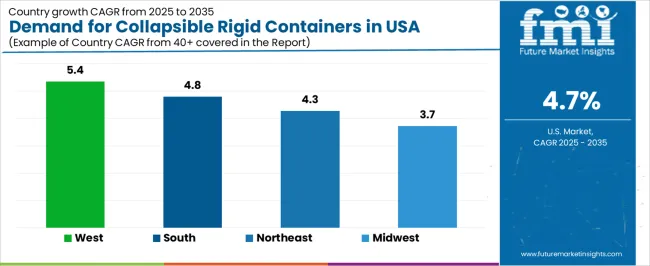

Demand for collapsible rigid containers in the United States is increasing through 2035 as supply-chain operators, distribution centers, retailers, and manufacturing facilities shift toward space-efficient and reusable packaging solutions. These containers support cost reduction in reverse logistics, improve warehouse utilization, and reduce material waste compared with single-use bulk packaging. The West leads with a 5.4% CAGR, followed by the South at 4.8%, the Northeast at 4.3%, and the Midwest at 3.7%. Growth is shaped by regional industrial activity, transportation density, retail-movement patterns, and automation initiatives in warehousing operations.

| Region | CAGR (2025-2035) |

|---|---|

| West | 5.4% |

| South | 4.8% |

| Northeast | 4.3% |

| Midwest | 3.7% |

The West grows at 5.4% CAGR, supported by strong distribution-center activity, extensive e-commerce fulfillment networks, and increased adoption of reusable packaging across retail and manufacturing hubs. States including California, Washington, Arizona, and Colorado rely on collapsible rigid containers for palletized transport, back-room storage, and interfacility movement due to their durability and reduced space footprint when collapsed. Logistics providers use these containers to lower freight costs on return loads and improve warehouse efficiency. Technology-driven warehousing environments in Western urban centers encourage the use of standardized, automation-compatible foldable containers across large operations.

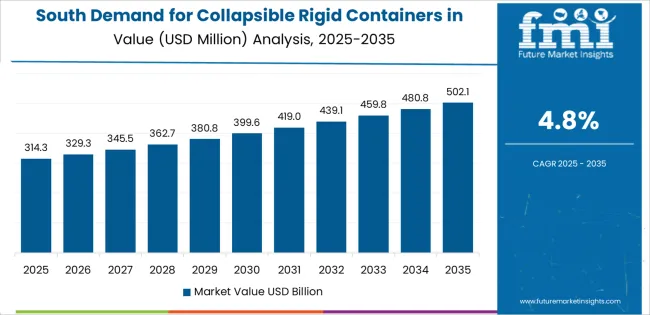

The South grows at 4.8% CAGR, driven by warehouse expansion, rapid population growth, and increased manufacturing activity across states such as Texas, Florida, Georgia, and Tennessee. Collapsible rigid containers support large-scale movement of goods across regional trucking corridors and industrial facilities. Food processing, automotive parts distribution, and home-improvement retail chains use these containers to optimize inbound and outbound shipments. The region’s distribution hubs adopt reusable containers to reduce storage space and improve handling efficiency in high-volume logistics environments. Growing adoption of returnable packaging programs contributes to consistent demand.

The Northeast grows at 4.3% CAGR, supported by dense retail networks, strong distribution activity, and increased reliance on space-efficient warehousing solutions. States including New York, New Jersey, Pennsylvania, and Massachusetts use collapsible containers to streamline storage in constrained industrial spaces. Retailers deploy foldable rigid containers for back-room operations, seasonal inventory transport, and regional distribution flows. Manufacturing operations adopt them for short-haul packaging cycles that require durability and reduced waste. Higher warehousing costs in urban centers encourage greater use of collapsible units to maximize available space.

The Midwest grows at 3.7% CAGR, supported by established manufacturing activity, agriculture-related distribution, and stable warehouse operations. States such as Illinois, Ohio, Michigan, and Wisconsin use collapsible rigid containers for movement of components, bulk products, and agricultural goods across regional supply chains. Industrial facilities adopt rigid collapsible packaging to enhance durability in repetitive shipment cycles. Warehouses rely on these containers for efficient stacking and reduced storage footprints when not in use. Growth remains moderate due to mature industrial patterns, though gradual expansion of automated logistics environments supports incremental container adoption.

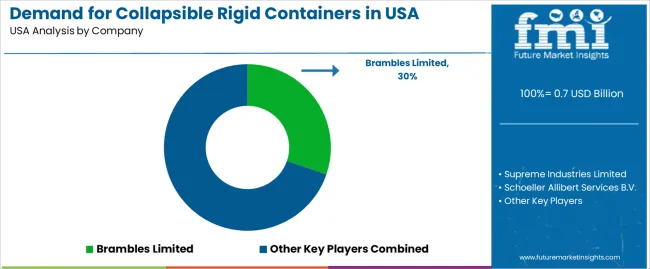

The collapsible rigid container industry in the United States is moderately concentrated, with global and regional suppliers serving automotive, food processing, retail distribution, and industrial logistics networks. Brambles Limited leads the industry with an estimated 30.3% share, supported by its extensive CHEP pooling system, standardized container designs, and reliable reverse-logistics infrastructure. Its position is reinforced by consistent fleet availability and controlled quality standards across high-volume supply chains.

Supreme Industries Limited and Schoeller Allibert Services B.V. follow as major competitors, offering collapsible rigid containers designed for multi-trip durability, space optimization, and compatibility with automated handling systems. Their competitive strength lies in material stability, fold-flat efficiency, and broad product lines that support diverse load requirements. DS Smith plc maintains a strong position through lightweight, durable plastic container systems tailored for reusable packaging programs in retail and fast-moving consumer goods distribution. SSI Schäfer AG contributes to industry depth with engineered containers integrated into warehouse storage, picking, and material-flow systems. Its products are used widely in logistics centers requiring consistent dimensional accuracy and high stacking strength.

Competition in the USA industry centers on container durability, payload capacity, folding efficiency, and lifecycle cost performance. Demand is driven by the expansion of reusable packaging programs, increased automation in logistics operations, and the need for space-saving container solutions that reduce storage and return-transport costs. Adoption continues to grow as companies prioritize standardized, reusable assets that support supply chain efficiency, reduced waste, and long-term cost control in closed-loop distribution environments.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Material Type | Plastic, Metal, Others |

| Product Type | Crates, Foldable IBCs, Pallets Boxes, Jerry Cans |

| Sales Channel | Direct, Indirect |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Brambles Limited, Supreme Industries Limited, Schoeller Allibert Services B.V., DS Smith plc, SSI Schäfer AG |

| Additional Attributes | Dollar sales by material type, product type, and sales channel categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of reusable packaging and rigid container manufacturers; advancements in collapsible logistics solutions and space-saving industrial packaging systems; integration with supply chain optimization, warehouse handling, and eco-friendly packaging strategies. |

The global demand for collapsible rigid containers in USA is estimated to be valued at USD 0.7 billion in 2025.

The market size for the demand for collapsible rigid containers in USA is projected to reach USD 1.1 billion by 2035.

The demand for collapsible rigid containers in USA is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in demand for collapsible rigid containers in USA are plastic, metal and others.

In terms of product type, crates segment to command 42.8% share in the demand for collapsible rigid containers in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA