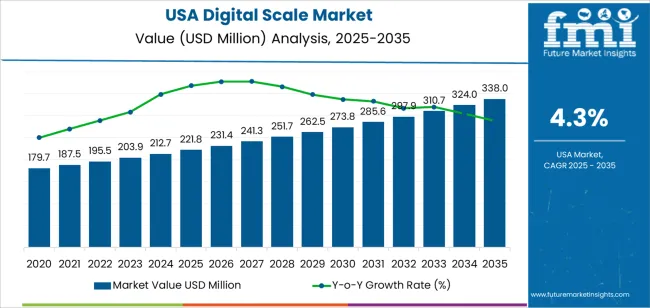

The demand for digital scales in the USA is expected to grow from USD 221.8 million in 2025 to USD 337.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.3%. Digital scales are widely used in sectors such as retail, healthcare, logistics, and manufacturing, where they play a key role in inventory management, shipping, and product testing. These scales provide accurate and reliable weight measurements, which are essential for businesses that rely on precise data to optimize operations and ensure product quality.

In retail, digital scales are increasingly adopted for self-service kiosks and automated checkouts, where accuracy is crucial for seamless customer transactions. In healthcare, digital scales are used for patient monitoring and medication dosing, especially in hospitals and clinics, driving demand in the medical field. The logistics sector also contributes significantly to the growth of digital scales, as e-commerce and warehouse automation continue to expand, requiring accurate weight readings for packaging and shipping. Technological advancements are another major driver for the digital scale industry. The integration of smart technologies such as IoT and real-time data tracking in digital scales offers improved functionality and efficiency.

Between 2025 and 2030, the demand for digital scales in the USA is expected to increase from USD 221.8 million to USD 231.3 million. This phase will experience moderate growth driven by the ongoing adoption of automation and the need for precision in retail and logistics sectors. As businesses strive to enhance efficiency and accuracy in weighing products, digital scales will see consistent demand. The increasing emphasis on e-commerce and logistics operations will further boost the need for digital scales, particularly in warehouses and distribution centers, where weight measurements are essential for inventory control and shipping.

From 2030 to 2035, the demand for digital scales is projected to rise significantly, increasing from USD 231.3 million to USD 337.2 million. The sharp increase during this period will be driven by innovations in weighing technology, the growing reliance on automated solutions, and expanding industries such as healthcare, e-commerce, and manufacturing. In healthcare, digital scales are increasingly used for patient monitoring and medication dosage in hospitals and clinics, which will fuel demand. The retail sector’s transition to self-service kiosks and automated checkouts will require precise weighing capabilities, contributing to the growth in digital scale demand.

| Metric | Value |

|---|---|

| Demand for Digital Scale in USA Value (2025) | USD 221.8 million |

| Demand for Digital Scale in USA Forecast Value (2035) | USD 337.2 million |

| Demand for Digital Scale in USA Forecast CAGR (2025-2035) | 4.3% |

The demand for digital scales in the USA is increasing due to their growing applications across industries such as retail, healthcare, food processing, and logistics. Digital scales offer high precision, ease of use, and the ability to measure weight accurately, making them ideal for both commercial and consumer use. The rise in e-commerce, food delivery services, and healthcare applications is driving the need for advanced weighing solutions that provide quick, reliable, and accurate measurements.

A major driver of this growth is the increasing demand for digital scales in retail and e-commerce for packaging and shipping. With the rise of online shopping, businesses need efficient systems to measure products for shipping and logistics. Digital scales play a crucial role in ensuring accurate product weight measurements, which is essential for pricing, inventory management, and order fulfillment in the e-commerce supply chain. As e-commerce continues to expand, the demand for digital scales is expected to rise.

The healthcare and wellness sectors are contributing to the growth in digital scale adoption. Digital scales are commonly used for monitoring weight in medical facilities, fitness centers, and personal health management. As more people focus on health and wellness, digital scales that track weight, body composition, and other health metrics are increasingly popular in both clinical and home settings. With advancements in technology and growing applications across various industries, the demand for digital scales in the USA is expected to continue to grow steadily through 2035.

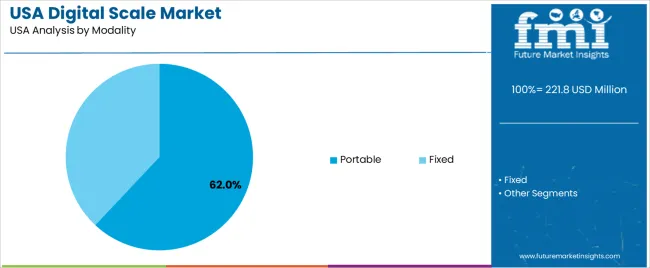

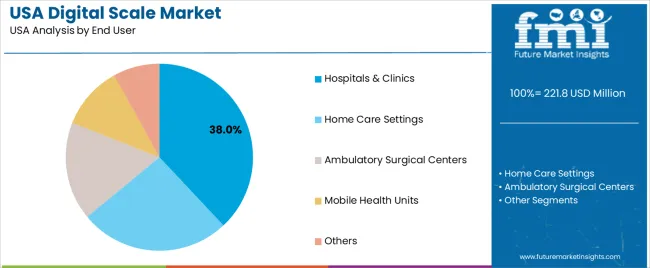

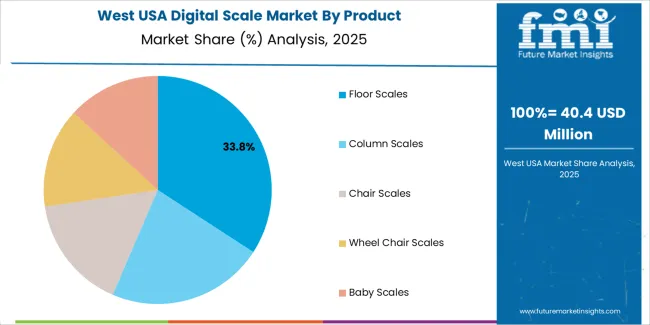

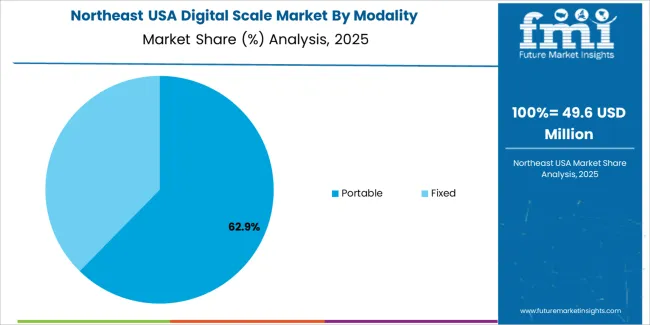

Demand for digital scales in the USA is segmented by modality, end user, product type, age group, and region. By modality, demand is divided into portable and fixed scales, with portable scales holding the largest share at 62%. The demand is also segmented by end user, including hospitals & clinics, home care settings, ambulatory surgical centers, mobile health units, and others, with hospitals & clinics leading the demand at 38%. In terms of product type, demand is divided into floor scales, column scales, chair scales, wheel chair scales, baby scales, and others, with floor scales being the most commonly used. Age group segmentation includes adults, bariatric, geriatric, and pediatric populations, with adults leading the demand. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Portable digital scales account for 62% of the demand for digital scales in the USA. These scales are preferred for their versatility, compact design, and ease of use, making them suitable for a wide variety of settings, including home care, ambulatory surgical centers, and mobile health units. Their portability allows them to be easily moved and used in different environments, such as patient homes or while transporting patients, making them ideal for on-the-go health monitoring. The lightweight nature of portable scales also contributes to their convenience, making them easy to store and transport. These scales offer flexibility in measuring patients in a variety of positions and locations, which is especially valuable in healthcare scenarios where mobility and space efficiency are important. As the demand for remote patient monitoring and personalized healthcare solutions increases, portable digital scales will continue to dominate the industry, providing healthcare professionals with the tools needed for effective patient care in non-traditional settings.

Hospitals & clinics account for 38% of the demand for digital scales in the USA. In these healthcare settings, digital scales are critical for accurately measuring patients’ weight, which plays a crucial role in diagnosis, monitoring health conditions, and determining appropriate medication dosages. Digital scales are used in a variety of applications, from tracking weight changes in patients with chronic diseases to assessing pediatric and bariatric patients. The precision of digital scales ensures that healthcare professionals can rely on accurate data for treatment planning. Their user-friendly design and ability to provide quick, reliable results make them indispensable tools in medical settings. With an increasing focus on patient care and efficient healthcare services, the demand for digital scales in hospitals and clinics will continue to rise, reinforcing their position as a key tool for effective healthcare delivery.

Demand for digital scales in USA is rising as industries and consumers increasingly seek accurate, efficient and reliable weighing solutions in sectors such as healthcare, retail, logistics, food processing, and manufacturing. Growth in e‑commerce, parcel delivery, and supply‑chain logistics drives need for precise weighing for shipping and inventory. At the same time, rising health awareness and home‑fitness trends increase demand for personal digital body‑weight scales (and connected “smart” scales) for weight management and wellness monitoring. Technological advancement better sensors, digital displays, portability and connectivity is boosting adoption. Cost of high‑precision or industrial‑grade digital scales, calibration / regulatory compliance requirements for trade or medical use, and competition from low-cost or analog alternatives restrict uptake in cost-sensitive segments.

In USA, demand for digital scales grows because businesses require consistent accuracy for trade, retail sales, shipping, packaging, inventory management and quality control. For logistics and e‑commerce operations, digital scales provide quicker and more reliable weight measurements for parcel handling and invoicing. In healthcare, clinics, hospitals and home‑care settings increasingly use digital scales for patient monitoring, weight tracking, and body‑composition analytics. On the consumer side, rising health consciousness, fitness regimes, and convenience of “smart” health‑monitoring devices encourage households to buy personal digital scales. This convergence of commercial, industrial, and personal‑health needs drives widespread scale adoption.

Technological innovations significantly accelerate demand: modern digital scales feature precise load‑cell sensors, fast calibration, clear digital readouts, portability and compact forms. Many include connectivity (Bluetooth/WiFi), data logging, body‑composition analysis, smartphone integration and cloud‑linked health/fitness apps blending weighing with analytics and health tracking. Industrial and platform scales now offer high load capacities, rugged construction, and automated interfaces for integration into logistics, warehouse, manufacturing or lab automation systems. These innovations make digital scales more versatile and attractive for both everyday users and complex industrial applications, expanding their utility across sectors.

Despite growing interest, certain challenges limit adoption. High‑precision industrial or medical‑grade digital scales often carry hefty upfront costs, deterring smaller businesses or price‑sensitive buyers. For trade or regulated use (e.g. commerce, medical), devices must meet calibration and certification standards, which can add compliance burden and deter casual users. In some sectors, analog or simpler mechanical scales remain adequate and cheaper reducing incentive to upgrade. Also, for personal use, industry saturation and consumer concerns about digital‑device privacy (in case of connected “smart” scales) may slow breakthrough in certain segments.

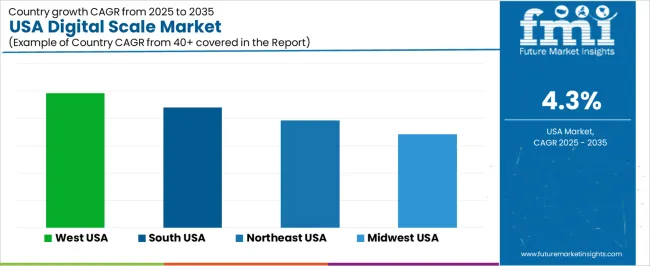

| Region | CAGR (%) |

|---|---|

| West USA | 4.9% |

| South USA | 4.4% |

| Northeast USA | 3.9% |

| Midwest USA | 3.4% |

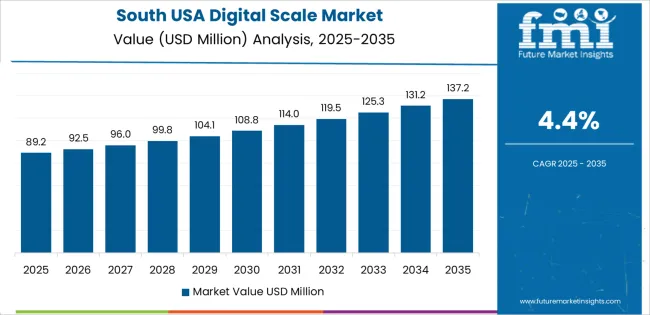

Demand for digital scales in the USA is growing steadily, with West USA leading at a 4.9% CAGR, driven by its strong commercial, industrial, and retail sectors, particularly in e-commerce, logistics, and food processing. South USA follows with a 4.4% CAGR, supported by its expanding manufacturing, agriculture, and retail industries, which require precision in weight measurements. Northeast USA shows a 3.9% CAGR, fueled by demand in retail, healthcare, and food industries, particularly in metropolitan areas like New York and Boston. Midwest USA experiences a 3.4% CAGR, with moderate growth driven by the region’s industrial base, especially in agriculture, automotive, and logistics.

West USA is experiencing the highest demand for digital scales, growing at a 4.9% CAGR. The region’s robust commercial, industrial, and retail sectors, including e-commerce, logistics, and food industries, drive the demand for digital weighing solutions. Digital scales are essential in applications such as shipping, inventory management, and food processing, where precision and efficiency are critical. West USA's focus on technological innovation, including the integration of digital solutions in smart logistics and automated systems, further boosts the demand for digital scales. The rapid growth of sectors like healthcare and fitness is also contributing to increased demand for digital scales in personal health monitoring and fitness tracking.

The vast consumer industry in West USA, particularly in states like California, which leads in consumer goods and technological adoption, drives the need for advanced, reliable digital scales in retail and commercial settings. With the rise of e-commerce and demand for accurate weight measurements, West USA’s digital scale industry is expected to continue expanding steadily.

South USA is seeing steady demand for digital scales, with a 4.4% CAGR, fueled by the region’s strong manufacturing, agriculture, and retail sectors. The growing demand for digital scales in the food and beverage industries, as well as in agriculture for weighing crops, livestock, and agricultural products, is a key driver. The increasing adoption of digital scales in industrial applications, including packaging, logistics, and warehousing, is also contributing to growth in this sector. With South USA being home to a diverse range of industries, the need for accurate, high-performance digital scales is on the rise.

South USA’s expanding healthcare and wellness industrys are pushing demand for digital scales in fitness and medical applications. As consumers become more health-conscious and the need for precision measurements increases, digital scales are being used more frequently in personal health devices and commercial health applications. With regional industrial growth and increasing adoption in personal sectors, the demand for digital scales in South USA is expected to grow steadily.

Northeast USA is seeing moderate growth in demand for digital scales, with a 3.9% CAGR. This demand is largely driven by the region’s strong commercial and industrial sectors, particularly in retail, healthcare, and food industries. The Northeast, home to major metropolitan areas like New York and Boston, sees a significant amount of digital scale USAge in retail stores, food processing, and logistics. In the healthcare sector, digital scales are used for precise weight measurements in medical settings, contributing to demand from hospitals and clinics. The growing trend of fitness and wellness in Northeast USA is boosting the use of digital scales for personal health monitoring.

As the region continues to embrace technological advancements in digital measurement, the demand for digital scales in industrial and commercial applications is expected to rise. As e-commerce continues to grow in the region, digital scales play a crucial role in logistics, inventory management, and packaging. Northeast USA’s diverse economy ensures steady demand for these solutions.

Midwest USA is experiencing moderate growth in the demand for digital scales, with a 3.4% CAGR. The region’s industrial base, particularly in automotive manufacturing, agriculture, and logistics, is contributing to the steady adoption of digital weighing solutions. In agriculture, digital scales are increasingly used for precise measurements of livestock, crops, and bulk products. In the manufacturing and logistics sectors, digital scales are essential for ensuring accurate weight measurements for packaging, shipping, and quality control.

The growth rate in Midwest USA is slower compared to other regions, as the demand for digital scales in personal and consumer sectors is less pronounced. Despite this, the region’s focus on improving industrial processes and optimizing supply chains through digital solutions is helping maintain steady growth in digital scale demand. As industries in the region continue to modernize and adopt more efficient technologies, the industry for digital scales in Midwest USA is expected to expand, albeit at a more moderate pace.

The demand for digital scales in the USA has been increasing across various sectors such as healthcare, retail, industrial, and food processing. Digital scales are essential for providing accurate and reliable weight measurements in applications ranging from medical diagnostics and logistics to quality control in manufacturing and food packaging. With advancements in technology, digital scales are becoming more sophisticated, offering features such as Bluetooth connectivity, data storage, and integration with other systems. As industries and consumers continue to prioritize precision and efficiency, the demand for high-quality digital scales is expected to remain strong.

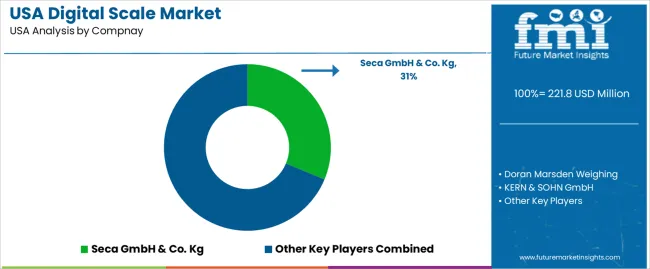

Key players in the digital scale industry in the USA include Seca GmbH & Co. Kg, Doran Marsden Weighing, KERN & SOHN GmbH, Scale-Tronix, and Wedderburn. Seca GmbH & Co. Kg holds the largest share of 31.3%, providing high-precision digital scales used in medical, fitness, and clinical environments. Doran Marsden Weighing offers a range of scales for industrial and retail applications, focusing on durability and accuracy. KERN & SOHN GmbH specializes in laboratory scales and precision weighing instruments for scientific and industrial applications. Scale-Tronix is known for its healthcare scales, particularly in clinical and hospital settings, while Wedderburn provides digital weighing solutions tailored for food processing and retail.

The demand for digital scales is also influenced by trends in healthcare, where accurate weight measurement is crucial for patient monitoring and diagnostics, as well as in retail, logistics, and manufacturing where weight data integration into broader systems is essential. As industries evolve and technology advances, companies that can offer smart, user-friendly, and precise digital weighing solutions will continue to lead the industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product | Floor Scales, Column Scales, Chair Scales, Wheel Chair Scales, Baby Scales |

| Modality | Portable, Fixed |

| Age Group | Adults, Bariatric, Geriatric, Paediatric |

| End User | Hospitals & Clinics, Home Care Settings, Ambulatory Surgical Centers, Mobile Health Units, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Seca GmbH & Co. Kg, Doran Marsden Weighing, KERN & SOHN GmbH, Scale-Tronix, Wedderburn |

| Additional Attributes | Dollar sales by product type, modality, and age group; regional CAGR and adoption trends; demand trends in digital scales; growth in healthcare settings and mobile health units; technology adoption for weighing solutions; vendor offerings including digital scales and related products; regulatory influences and industry standards |

The demand for digital scale in USA is estimated to be valued at USD 221.8 million in 2025.

The market size for the digital scale in USA is projected to reach USD 338.0 million by 2035.

The demand for digital scale in USA is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in digital scale in USA are floor scales, column scales, chair scales, wheel chair scales and baby scales.

In terms of modality, portable segment is expected to command 62.0% share in the digital scale in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Digital Illustration App Market Insights – Growth & Demand 2025-2035

USA Digital Commerce Market Growth – Innovations, Trends & Forecast 2025-2035

USA Digital Textile Printing Market Trends – Growth, Demand & Forecast 2025-2035

Digital Scale Market Analysis by Product, Age Group, Modality, End User, and Region 2025 to 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Tattoos in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Power Conversion in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Oilfield Solutions in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Digital Instrument Clusters in USA Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA