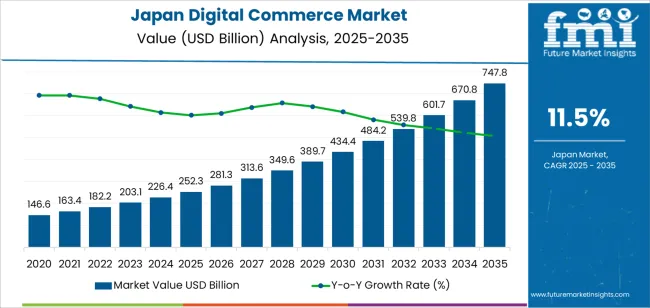

The demand for digital commerce in Japan is projected to grow from USD 252.3 billion in 2025 to approximately USD 747.8 billion by 2035, reflecting a CAGR of 11.5%. This rapid growth will be driven by the increasing shift towards online shopping, accelerated by digital transformation and changes in consumer behavior. As more Japanese consumers turn to digital platforms for purchasing goods and services, the demand for digital commerce solutions will continue to rise. Key drivers include the expansion of e-commerce, the growing use of mobile commerce, and the rise of omnichannel retail experiences. Japan's highly connected population and advanced technology infrastructure will also contribute to the continued growth of digital commerce in the region.

The digital commerce industry in Japan will benefit from advancements in digital payment systems, AI-driven personalization, and improvements in supply chain logistics. With the growing preference for seamless online shopping experiences, digital retailers will increasingly focus on enhancing customer engagement through tailored recommendations, smart delivery options, and mobile-optimized platforms. As more businesses adopt e-commerce to expand their reach and improve customer satisfaction, the need for secure and scalable digital commerce solutions will continue to grow. Japan’s leading position in the tech industry will further support the development and adoption of innovative digital commerce technologies.

From 2025 to 2030, the industry will grow from USD 252.3 billion to USD 389.7 billion, adding USD 137.4 billion in value. This phase will account for a substantial portion of the total industry growth, driven by the continued expansion of e-commerce and mobile commerce. The rising demand for fast and convenient online shopping, combined with the growing popularity of digital payment methods and personalized shopping experiences, will significantly accelerate industry growth. Retailers in Japan will invest heavily in digital infrastructure, further fueling the growth of digital commerce.

From 2030 to 2035, the industry will grow from USD 389.7 billion to USD 747.8 billion, contributing an additional USD 358.1 billion in value. This period will be marked by the maturation of digital commerce, with increased adoption of advanced technologies such as AI, AR, and VR in the shopping experience. As e-commerce continues to evolve, the demand for more sophisticated, integrated digital commerce platforms will surge. The rise of international digital industryplaces and the expansion of cross-border e-commerce will also contribute to growth during this period. Despite industry maturation, demand for digital commerce will remain robust, driven by consumer preference for convenience, personalization, and technological innovation in shopping experiences.

| Metric | Value |

|---|---|

| Demand for Digital Commerce in Japan Value (2025) | USD 252.3 billion |

| Demand for Digital Commerce in Japan Forecast Value (2035) | USD 747.8 billion |

| Demand for Digital Commerce in Japan Forecast CAGR (2025 to 2035) | 11.5% |

The demand for digital commerce in Japan is rising as consumers increasingly shift from traditional retail to online transactions across goods and services. With high internet penetration and growing mobile device use, Japanese buyers are embracing applications that enable ordering, payment and delivery through digital channels. As digital platforms improve user experience and extend coverage into smaller cities, access has widened and transaction volumes have surged.

Business‑to‑consumer and business‑to‑business digital commerce models are expanding rapidly. Companies are adopting platforms and tools to sell directly to consumers, manage inventory online, and integrate digital payments. The nature of commerce is changing: brands are engaging customers through socials, apps and industryplaces rather than just physical stores. This shift drives demand for associated infrastructure, logistics, and service‑ecosystem support.

Technology advancement and consumer expectation are also key drivers. Features such as one‑click checkout, integrated digital wallets, instant fulfilment, live‑stream shopping and personalised recommendations make digital commerce both convenient and compelling. As retail evolves and digital offerings multiply, the growth trajectory for digital commerce in Japan is set to continue through 2035.

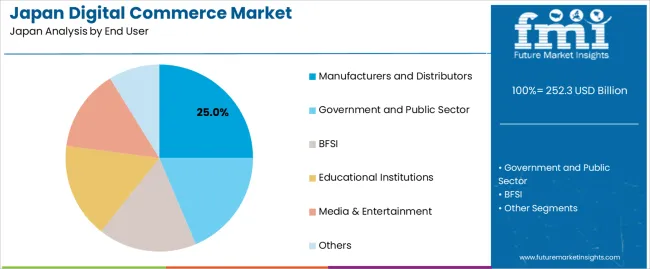

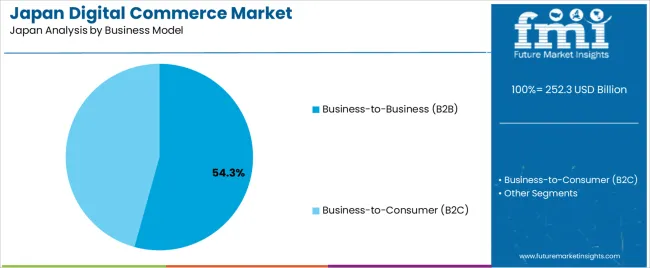

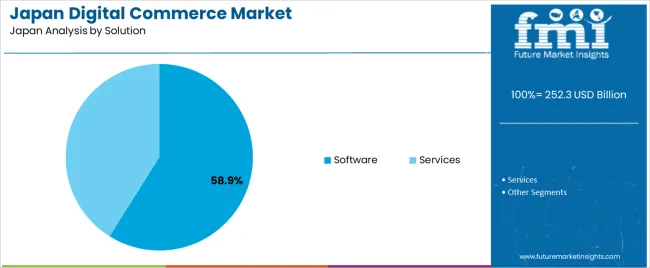

Demand for digital commerce in Japan is segmented by end user, business model, and solution. By end user, demand is divided into manufacturers and distributors, government and public sector, BFSI (banking, financial services, and insurance), educational institutions, media and entertainment, and others, with manufacturers and distributors holding the largest share. In terms of business model, the industry is categorized into business-to-business (B2B) and business-to-consumer (B2C). The industry is also segmented by solution type, which includes software and services.Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan..

Manufacturers and distributors account for 25% of the demand for digital commerce in Japan. These businesses are increasingly turning to digital commerce platforms to streamline their operations, manage inventory, and reach a broader range of customers. Manufacturers and distributors need digital solutions to optimize the supply chain, improve business efficiency, and facilitate seamless interactions with suppliers, partners, and customers across multiple regions.

The demand from manufacturers and distributors is driven by the need to enhance operational agility, reduce costs, and improve customer engagement. Digital commerce platforms enable these businesses to manage orders, track shipments, and offer a more personalized experience for customers. The shift towards e-commerce for industrial goods, parts, and services has expanded the industry for digital commerce solutions in this sector. As manufacturers and distributors continue to adopt digital tools for everything from inventory management to customer relationship management (CRM), their demand for digital commerce solutions is expected to grow.

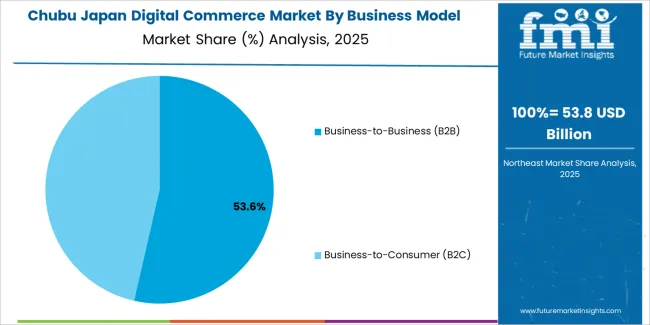

Business-to-business (B2B) models account for 54.3% of the demand for digital commerce in Japan. The B2B sector relies heavily on digital platforms to streamline transactions, manage large-scale orders, and optimize procurement processes. B2B digital commerce solutions provide businesses with the ability to conduct transactions online, automate procurement, and maintain real-time inventory management systems, which is essential for industries like manufacturing, distribution, and wholesale.

The demand for B2B digital commerce is driven by the increasing need for businesses to improve efficiency and reduce costs by eliminating manual processes and enabling faster transactions. B2B e-commerce platforms also provide companies with better control over their supply chain, enabling them to track products, manage orders, and collaborate with suppliers more effectively. As businesses seek to improve their digital presence and enhance customer experiences, the B2B sector continues to be the largest segment in the digital commerce industry in Japan.

Software accounts for 58.9% of the demand for digital commerce solutions in Japan. Software plays a pivotal role in powering digital commerce platforms by providing businesses with the tools they need to manage online stores, process transactions, track inventory, and offer customer support. The adoption of e-commerce software solutions has become essential for businesses looking to create seamless, efficient, and secure online shopping experiences.

The demand for software is driven by its ability to provide comprehensive solutions for businesses, from payment processing to customer relationship management (CRM) and supply chain optimization. As more businesses shift to digital platforms, the need for robust and scalable e-commerce software solutions continues to grow. With the rise of advanced technologies such as artificial intelligence (AI), machine learning, and automation, businesses are increasingly relying on software solutions to personalize the customer experience, improve operational efficiency, and drive sales growth. The continued digital transformation of businesses in Japan further ensures that software will remain the dominant solution in the digital commerce sector.

Demand for digital commerce in Japan is expanding as consumers and businesses increasingly shift transactions online across retail, services and B2B segments. These digital‑commerce systems enable purchases, payments, subscriptions and digital goods via mobile, web and ecosystem platforms. Key drivers include high internet and smartphone penetration, strong digital payment infrastructure, the growth of mobile and social commerce, and ongoing digital transformation in retail and services. Restraints include Japan’s mature consumer industry (which limits head‑count growth), enduring preference for physical retail in some categories, high consumer expectations for service and delivery.

Why is Demand for Digital Commerce Growing in Japan?

In Japan, demand is growing because consumers favour convenience, wide choice and digital‑first experiences. As more users shop via mobile apps and online platforms, and adopt digital payments, the threshold for online purchase continues to lower. The expansion of grocery, food delivery, digital subscriptions and online services adds to momentum. In addition, businesses are investing in omni‑channel strategies to meet rising online demand and to integrate web, app and offline touchpoints making digital commerce vital for competitiveness. The accumulating consumer comfort with online shopping and digital payments supports further growth.

How are Technological Innovations Driving Growth of Digital Commerce in Japan?

Technological innovations are accelerating digital commerce in Japan by improving UX, payments, logistics and personalisation. Key innovations include mobile wallet integrations, one‑click checkout, AI‑driven recommendations and supply‑chain/fulfilment technologies (e.g., same‑day delivery, robotics). Growth in 5G, cloud platforms and digital identity solutions supports richer commerce experiences on mobile devices. Also, platforms that integrate social, live‑stream and influencer‑driven commerce are gaining ground. These advances make digital commerce faster, more engaging and more scalable driving greater adoption across sectors.

What are the Key Challenges Limiting Adoption of Digital Commerce in Japan?

Despite strong growth trends, several challenges limit broader expansion of digital commerce in Japan. One challenge is intensifying competition and thinning margins platforms and retailers must invest heavily in logistics, UX and customer service. Another issue is that many consumers still value in‑store experience, which means digital commerce may cannibalise but not fully replace physical retail in some categories. Regulatory and data‑privacy frameworks add complexity, particularly for platforms operating cross‑border. Also, e‑commerce delivery costs and last‑mile logistics in Japan’s dense urban but complex geography raise operational cost and can erode profitability.

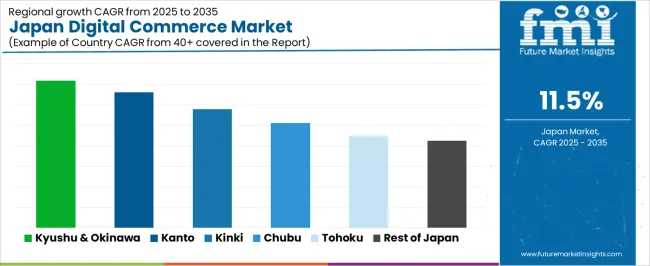

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 14.3% |

| Kanto | 13.2% |

| Kinki | 11.6% |

| Chubu | 10.2% |

| Tohoku | 9.0% |

| Rest of Japan | 8.5% |

The demand for digital commerce in Japan is growing across all regions, with Kyushu & Okinawa leading at a 14.3% CAGR. The region's expanding e-commerce and tech sectors are contributing to this growth. Kanto follows with a 13.2% CAGR, driven by its dense population, advanced infrastructure, and tech innovations. Kinki shows an 11.6% CAGR, supported by its business and manufacturing sectors increasingly adopting digital commerce. Chubu experiences a 10.2% CAGR, with growing e-commerce adoption in industrial and commercial sectors. Tohoku and the Rest of Japan show moderate growth at 9.0% and 8.5%, respectively, as digital commerce solutions continue to be embraced across the country.

Kyushu & Okinawa is experiencing the highest growth in digital commerce in Japan, with a 14.3% CAGR. The region is benefiting from the rise in e-commerce and digital adoption, particularly in cities like Fukuoka. Kyushu’s increasing focus on digital infrastructure and Okinawa’s growing role in the tourism and retail sectors are contributing to the surge in digital commerce demand. The growth is fueled by local businesses adopting e-commerce solutions to reach broader industrys and enhance customer engagement.

The region's emphasis on developing tech startups and fostering innovation in digital services is also playing a crucial role. As more businesses and consumers embrace online shopping and digital payments, Kyushu & Okinawa is seeing an increasing shift towards digital commerce. The ongoing investments in digital infrastructure and connectivity are expected to support continued growth in the region.

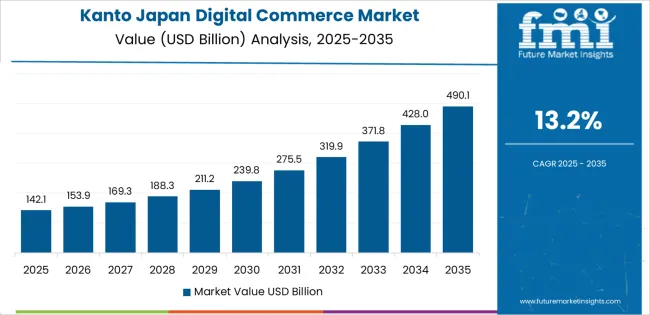

Kanto is witnessing strong demand for digital commerce, with a 13.2% CAGR. The region, which includes Tokyo, the center of Japan's digital economy, is a key player in the adoption of e-commerce and online retail solutions. The region’s advanced infrastructure, high consumer spending, and tech-savvy population contribute significantly to the rapid growth of digital commerce. Tokyo’s position as a global financial and technological hub further drives the demand for online shopping platforms and digital transactions.

The growth of mobile commerce, along with the increasing use of social media and digital platforms, has accelerated the shift toward e-commerce in Kanto. The region’s highly developed logistics network supports fast and efficient delivery services, which further boosts digital commerce adoption. As the demand for convenience and personalized shopping experiences rises, Kanto will continue to lead the country in digital commerce growth.

Kinki is experiencing steady demand for digital commerce, with an 11.6% CAGR. The region, including cities like Osaka and Kyoto, has a strong industrial and manufacturing base, and businesses in these sectors are increasingly turning to e-commerce to reach consumers more effectively. The region’s focus on innovation and technology, combined with a growing trend toward digital shopping, is contributing to the rise of digital commerce.

Kinki’s strong retail sector is also embracing digital platforms to enhance customer experience, improve sales, and streamline business operations. As consumers in Kinki increasingly turn to online shopping for convenience, the demand for digital commerce solutions is rising. The region’s adoption of digital promoting strategies and integration of e-commerce with traditional retail is driving continued growth. As businesses invest in digital tools to enhance their e-commerce offerings, Kinki is expected to see ongoing demand for digital commerce solutions.

Chubu is seeing moderate growth in demand for digital commerce, with a 10.2% CAGR. The region, known for its manufacturing and industrial sectors, is increasingly adopting e-commerce platforms to sell products directly to consumers and expand their reach. Chubu’s cities, such as Nagoya, are home to several major manufacturers that are now integrating digital commerce solutions to enhance their promoting and sales strategies.

The adoption of digital payment systems, online customer service, and mobile commerce is supporting the region’s shift towards digital retail. As more industries in Chubu look to modernize their sales processes and adopt new technologies, digital commerce is becoming an essential part of business growth. With expanding internet access and increasing consumer demand for online shopping, Chubu is expected to continue seeing steady growth in digital commerce adoption in both B2C and B2B sectors.

Tohoku is seeing moderate growth in digital commerce, with a 9.0% CAGR. While the region has fewer major urban centers compared to others, the increasing availability of high-speed internet and the adoption of e-commerce solutions in smaller cities and towns are driving this growth. As businesses in Tohoku recognize the benefits of digital platforms, there is a growing shift toward online sales and digital promoting strategies.

The region’s agricultural sector is also leveraging digital commerce to sell products directly to consumers, expanding the reach of local businesses. As more consumers in Tohoku embrace online shopping and digital payments, the region is gradually adopting more advanced e-commerce solutions. With the support of national and local government initiatives to improve digital infrastructure, Tohoku’s digital commerce industry is expected to continue its steady growth.

The Rest of Japan is experiencing steady growth in digital commerce, with an 8.5% CAGR. This includes rural areas and smaller urban centers where the adoption of e-commerce is growing steadily. As businesses in these regions embrace digital promoting and online retail, there is an increasing demand for digital commerce solutions to enhance product sales and customer engagement.

The Rest of Japan’s focus on expanding digital infrastructure and improving internet access is facilitating the rise in online shopping and digital payments. As more consumers in rural areas gain access to e-commerce platforms, demand for digital commerce tools will continue to grow. With local businesses increasingly adopting online sales channels and digital payment systems, the Rest of Japan is expected to see continued expansion in the digital commerce sector.

Demand for digital commerce in Japan is growing as it is increasingly used by both businesses and consumers for retail, services, and cross‑border transactions. These platforms combine storefront technology, payment integrations, customer analytics, and fulfilment logistics, enabling smoother shopping experiences and broader reach. As mobile penetration, online payment adoption, and hybrid retail models rise in Japan, digital commerce solutions provide faster, more convenient access and drive adoption. Challenges such as aging consumer demographics, complex distribution networks, and regional regulatory variations remain.

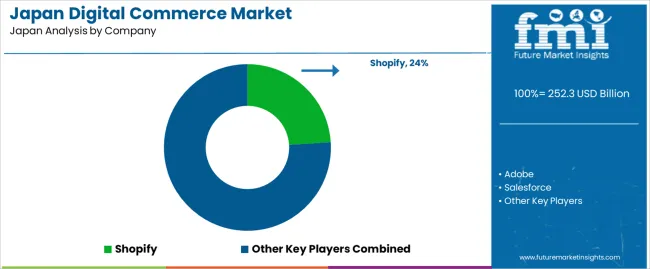

In the Japanese landscape, Shopify is estimated to command a share of approximately 24.0 %, reflecting its strength in enabling merchants to launch online stores, manage omnichannel sales, and integrate local payment gateways tailored for Japan. Other key providers include Adobe, Salesforce, Microsoft, Oracle, and SAP. Each offers enterprise‑grade systems that span digital commerce, CRM, order management, and analytics adapted to Japan’s digital and retail ecosystem.

Key drivers in Japan include strong smartphone and internet penetration, widespread consumer expectation for seamless online shopping, growth of cross‑border and mobile commerce, and increasing business investment in digital‑commerce infrastructure and omnichannel strategies. Challenges persist in the form of fragmented e‑commerce ecosystems, competition from domestic platforms, a relatively slower shift among older consumers, and the need to localize payment, fulfilment and UX for Japanese culture.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| End User | Manufacturers and Distributors, Government and Public Sector, BFSI, Educational Institutions, Media & Entertainment, Others |

| Business Model | Business-to-Business (B2B), Business-to-Consumer (B2C) |

| Solution | Software, Services |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Shopify, Adobe, Salesforce, Microsoft, Oracle, SAP |

| Additional Attributes | Dollar sales by end user segments, business model (B2B/B2C), solution type (software/services), and regional trends with a particular focus on the manufacturing, government, BFSI, and education sectors. The growth in digital commerce is driven by increasing adoption of e-commerce platforms, rising demand for B2B/B2C solutions, and expanding digital transformation efforts in these industries across Japan. |

The demand for digital commerce in Japan is estimated to be valued at USD 252.3 billion in 2025.

The market size for the digital commerce in Japan is projected to reach USD 747.8 billion by 2035.

The demand for digital commerce in Japan is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in digital commerce in Japan are manufacturers and distributors, government and public sector, bfsi , educational institutions, media & entertainment and others.

In terms of business model, business-to-business (b2b) segment is expected to command 54.3% share in the digital commerce in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA