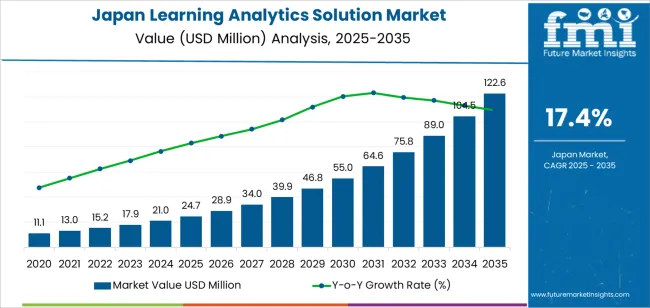

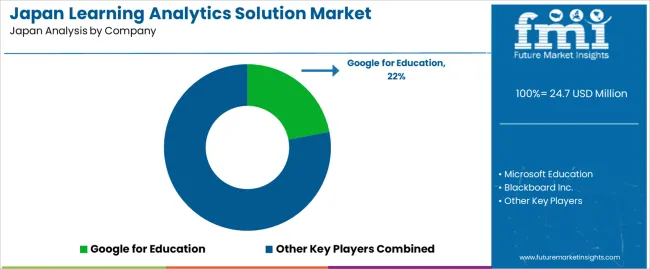

The demand for learning analytics solutions in Japan is expected to grow from USD 24.7 million in 2025 to USD 122.6 million by 2035, reflecting a CAGR of 17.4%. These solutions, which use data analysis to enhance educational outcomes and institutional effectiveness, are increasingly popular in both higher education and corporate training. Learning analytics helps institutions track and understand student performance, engagement, and learning behaviors, enabling more effective educational strategies. As Japan’s educational landscape continues to digitize, demand for these tools is growing, as they allow data-driven decision-making to improve learning outcomes and streamline administrative processes.

The adoption of EdTech and digital learning tools is rising, further driving the demand for learning analytics solutions in Japan. Educators and administrators are focused on personalized learning and improving student success, making data and analytics essential in identifying at-risk students and optimizing teaching strategies. With Japan’s emphasis on educational innovation, there is an increasing need for advanced tools to enhance educational experiences. This demand is especially critical as institutions seek to integrate AI-driven tools and data analytics into the classroom to improve learning outcomes. The rise of digital transformation in education is expected to fuel the rapid adoption of learning analytics solutions, as more organizations recognize their potential to improve both teaching and learning experiences.

Between 2025 and 2030, the demand for learning analytics solutions in Japan is expected to grow from USD 24.7 million to USD 28.9 million. This period will reflect steady growth, driven by the increasing recognition of the value of data-driven decision-making in education. Schools and universities will continue adopting learning analytics to improve learning outcomes and enhance the overall educational experience. Simultaneously, businesses will increasingly integrate learning analytics into employee training programs, leveraging data to optimize workforce development

From 2030 to 2035, the demand for learning analytics is projected to experience a sharp rise, growing from USD 28.9 million to USD 122.6 million. This growth phase will be marked by the widespread implementation of learning analytics across all educational levels and corporate sectors. The accelerated adoption will be fueled by the advancement of artificial intelligence (AI) and machine learning in education technology, enabling more personalized learning and sophisticated data insights. Japan's digital transformation in education and the push for a smart education system will drive the growing demand for analytics solutions, ensuring that institutions and organizations can provide tailored and efficient learning experiences.

| Metric | Value |

|---|---|

| Demand for Learning Analytics Solution in Japan Value (2025) | USD 24.7 million |

| Demand for Learning Analytics Solution in Japan Forecast Value (2035) | USD 122.6 million |

| Demand for Learning Analytics Solution in Japan Forecast CAGR (2025-2035) | 17.4% |

The demand for learning analytics solutions in Japan is increasing due to the growing emphasis on data-driven decision-making in education and the rising need to improve learning outcomes. Learning analytics tools help educational institutions and corporate training programs monitor and analyze student performance, engagement, and progress, enabling more personalized and effective learning experiences. As Japan’s education sector becomes more focused on technology integration and efficiency, the adoption of learning analytics is expanding.

A key driver of this growth is the ongoing digital transformation in education. With the increased use of online learning platforms, e-learning tools, and digital classrooms, educational institutions in Japan are increasingly turning to learning analytics to gather insights and optimize the learning process. These solutions help educators understand individual learning behaviors, identify areas where students are struggling, and tailor instructional content accordingly, resulting in more effective teaching and improved student outcomes.

The growing demand for data-driven strategies in corporate training and development is also contributing to the rise of learning analytics. Businesses in Japan are adopting these solutions to better track employee training progress, improve skill development, and enhance workforce performance. As Japan’s education and corporate sectors continue to prioritize efficiency, performance, and innovation, the demand for learning analytics solutions is expected to grow rapidly through 2035, driven by the increasing need for personalized and data-driven learning experiences.

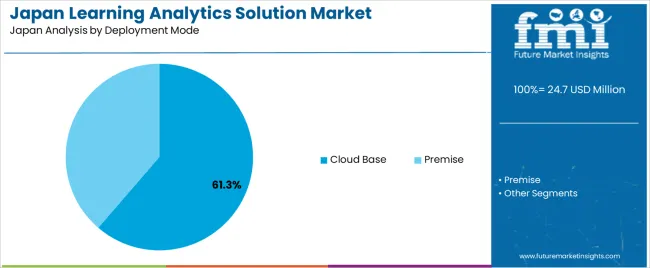

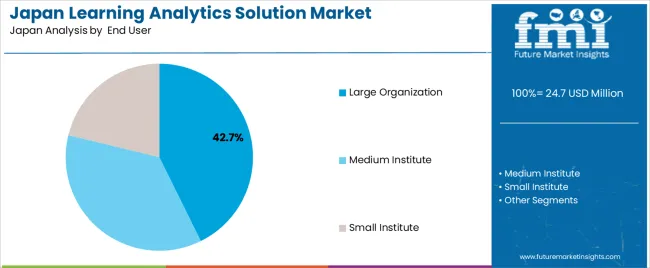

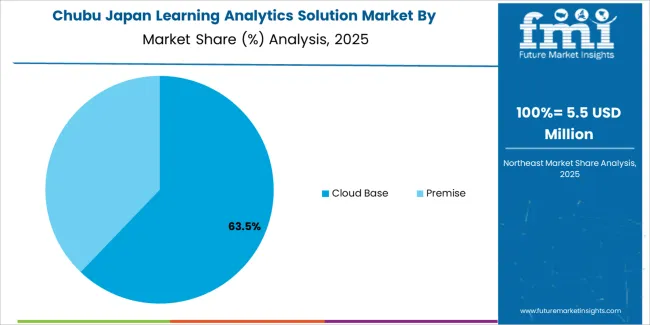

Demand for learning analytics solutions in Japan is segmented by deployment mode, end user, solution, and service. By deployment mode, demand is divided into cloud-based and on-premise solutions. The demand is also segmented by end user, including large organizations, medium institutes, and small institutes. In terms of solution, demand is divided into predictive analytics, content analytics, adaptive learning analytics, and social learning analytics. Regarding services, demand is divided into implementation & integration, consulting, and maintenance. Regionally, demand is divided into Kanto, Kansai, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Cloud-based solutions account for 61.3% of the demand for learning analytics solutions in Japan. Cloud deployment offers significant advantages in terms of scalability, flexibility, and cost-effectiveness. Cloud-based platforms allow educational institutions and organizations to access data and analytics from anywhere, promoting collaboration and real-time data processing. The cloud model reduces the need for costly infrastructure, offering an affordable alternative to on-premise solutions.

The growing adoption of digital learning platforms and the shift towards remote education are key drivers of the demand for cloud-based learning analytics. These platforms also provide the ease of integration with other cloud services, making them a preferred choice for organizations seeking efficient, low-maintenance solutions. As the trend toward cloud computing continues to grow, demand for cloud-based learning analytics solutions in Japan will remain strong, especially in the education and corporate training sectors.

Large organizations account for 43% of the demand for learning analytics solutions in Japan. These organizations, which include corporations and large educational institutions, require robust data analytics tools to track and improve employee or student learning outcomes. Learning analytics solutions help these organizations identify trends, improve personalized learning experiences, and optimize training and educational programs.

Large organizations also have the resources to implement complex learning analytics systems that can integrate with their existing infrastructure and scale to meet their needs. As organizations continue to focus on enhancing employee skills, training programs, and academic performance, the demand for learning analytics solutions in large organizations is expected to grow. The ability to leverage data for decision-making and performance improvement is increasingly important for large-scale operations, making learning analytics an essential tool in these environments.

Demand in Japan for learning analytics solutions is being fuelled by the dual pressures of academic institutions and corporations seeking data‑driven insight into learning outcomes, student engagement and workforce training effectiveness. With educational technology (EdTech) adoption accelerating, schools and universities increasingly use analytics platforms to track progress, identify at‑risk learners, tailor curricula and justify interventions.

Corporations likewise deploy tools for corporate training, skill gap analysis and performance monitoring. Regulatory drives towards digitalisation of education, government programmes supporting EdTech and the rise of lifelong learning further underpin uptake. Restraints include data‑privacy and security concerns, integration complexity with legacy Learning Management Systems (LMS) and cultural resistance to analytics‑based change in traditional settings.

In Japan, demand for learning analytics solutions is growing because educational institutions and firms are under pressure to enhance learning quality, retention and training ROI. The ageing population, shrinking student cohorts and increased competition for talent mean schools and organisations increasingly rely on analytics to improve outcomes and efficiency. Adaptive learning environments and personalised instruction are now key differentiators, making platforms that deliver real‑time dashboards, predictive insights and intervention‑recommendation engines attractive. Further, the corporate sector’s emphasis on upskilling, reskilling and digital transformation drives interest in analytics solutions that can map learner pathways, measure efficacy and optimise investment in training assets.

Technological innovation is a key driver of growth for learning analytics solutions in Japan. Advances in artificial intelligence (AI) and machine‑learning enable systems to process large volumes of learning‑behaviour data, provide predictive early‑warning signals for students or trainees, and generate prescriptive recommendations for educators and trainers. Cloud‑based deployments support scalability and remote access, while integration with LMS, virtual classrooms and mobile platforms enhances reach. Improved user interfaces, visualisation dashboards and real‑time feedback mechanisms make analytics actionable for non‑technical users. These innovations reduce friction in adoption and help institutions transition from descriptive reporting to proactive learning‑strategy management.

Despite strong growth potential, adoption of learning analytics solutions in Japan faces several challenges. Data‑privacy regulation and concerns about handling learner information slow procurement and deployment decisions. Many educational institutions and corporations still rely on legacy systems and lack interoperability, making integration of analytics platforms complex and expensive. Training staff to interpret analytics dashboards and translate insights into pedagogical or training action remains a barrier. Budget constraints, especially in smaller institutions, and a shortage of analytics‑talent or internal champions also limit scale‑up. Outcomes of analytics may be harder to quantify, which can reduce perceived ROI and inhibit further investment.

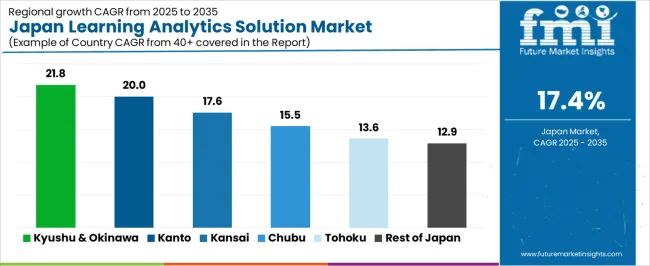

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 21.8% |

| Kanto | 20.0% |

| Kansai | 17.6% |

| Chubu | 15.5% |

| Tohoku | 13.6% |

| Rest of Japan | 12.9% |

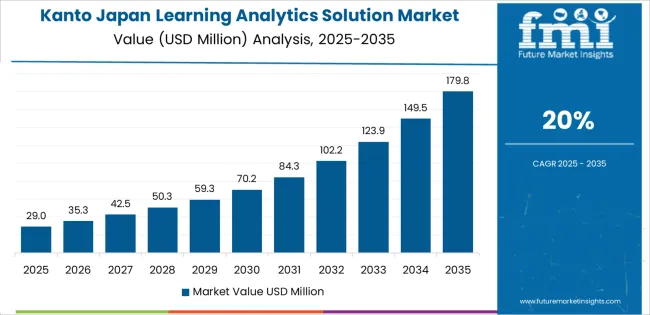

Demand for learning analytics solutions in Japan is growing rapidly, with Kyushu & Okinawa leading at a 21.8% CAGR. In Kanto, the demand follows closely with a 20.0% CAGR, supported by the region’s strong concentration of universities, research institutions, and e-learning platforms that are increasingly integrating learning analytics to improve educational outcomes. Kansai shows a 17.6% CAGR, fueled by innovation in education and the adoption of digital learning tools in both primary and higher education sectors.

Chubu experiences a 15.5% CAGR, with demand driven by regional education-focused technology companies and the integration of analytics in K-12 education. Tohoku sees a 13.6% CAGR, driven by efforts to modernize the educational system and incorporate data analytics into teaching methods. The Rest of Japan has a 12.9% CAGR, with growing adoption of learning analytics in smaller cities and rural areas.

Kyushu & Okinawa are seeing the highest demand for learning analytics solutions in Japan, with a 21.8% CAGR. The region’s educational institutions, particularly in Okinawa and Fukuoka, are increasingly adopting digital learning platforms and personalized learning solutions that require robust data analysis. Local schools and universities are embracing learning analytics to optimize teaching methods and improve student outcomes. Kyushu’s growing tech industry is contributing to the development of region-specific learning analytics tools that integrate local educational needs.

The regional government’s push for educational innovation, alongside increased investment in technology to modernize classrooms and foster digital literacy, further supports the rapid adoption of learning analytics. As personalized education and data-driven decision-making gain traction in schools and universities, Kyushu & Okinawa are expected to continue leading the country in the use of learning analytics to improve both teaching quality and student performance.

Kanto is experiencing significant demand for learning analytics solutions, with a 20.0% CAGR. The region’s demand is driven by its concentration of educational institutions, particularly in Tokyo, which is home to many top universities and research centers. These institutions are increasingly incorporating learning analytics to enhance academic performance and student retention. As Kanto leads in innovation and technology, the region’s e-learning platforms and digital education solutions are also incorporating analytics to personalize learning experiences.

The widespread adoption of blended learning models, where traditional methods are combined with digital platforms, is further driving the demand for analytics tools that track and analyze student progress. In addition, Kanto’s private sector, including educational technology startups, is investing heavily in developing customized learning analytics solutions for both the public and private education sectors. As data-driven education becomes a key focus for policymakers and educators, the region’s growing use of learning analytics is expected to continue at a rapid pace.

Kansai is seeing steady demand for learning analytics solutions, with a 17.6% CAGR. The region’s demand is primarily driven by the adoption of digital education tools in both higher education and K-12 institutions. Osaka and Kyoto, with their strong academic presence, are embracing learning analytics to improve student learning outcomes and teaching efficiency. The growth of private e-learning platforms and educational institutions in Kansai is another factor fueling the demand, as these platforms seek to leverage data to enhance personalized learning.

The region's focus on innovation in education, particularly in the fields of technology and research, has encouraged the integration of learning analytics in classrooms. Local educational authorities are prioritizing data-driven decision-making to monitor and improve educational performance. As Kansai’s educational institutions expand their use of digital tools and personalized learning approaches, demand for learning analytics solutions is expected to continue to rise steadily, supporting the region’s ongoing educational transformation.

Chubu is experiencing moderate demand for learning analytics solutions, with a 15.5% CAGR. The region’s demand is driven by the growing adoption of digital learning tools in the educational sector, particularly in cities like Nagoya. Local schools and universities are increasingly integrating learning analytics to enhance teaching strategies and monitor student progress in real time. Chubu’s large manufacturing and technology sectors are also fostering innovation in educational technologies, encouraging the development of analytics solutions tailored to industrial and vocational education.

As the region embraces digital learning, the need for solutions that help track academic performance and provide personalized learning experiences is increasing. The use of learning analytics is expanding in corporate training programs, where companies are leveraging data to improve employee skills and productivity. As Chubu continues to prioritize technological advancement and improve educational outcomes, the adoption of learning analytics solutions is expected to grow steadily, enhancing both academic and vocational education.

Tohoku is experiencing steady growth in demand for learning analytics solutions, with a 13.6% CAGR. The region’s adoption of learning analytics is primarily driven by the need to modernize educational infrastructure, particularly in rural and suburban areas where schools are looking to improve educational outcomes. Local schools and universities in Tohoku are increasingly turning to learning analytics tools to enhance teaching and personalize learning experiences for students.

As digital education continues to grow in importance, Tohoku’s educational institutions are focusing on integrating data analysis to track student progress, provide targeted interventions, and improve overall academic performance. The demand for learning analytics is also driven by the region’s efforts to improve educational equity, ensuring that all students, regardless of their location, have access to high-quality educational resources. While the adoption is slower compared to larger regions like Kanto, Tohoku’s steady embrace of data-driven education will contribute to the growing use of learning analytics solutions in the region.

The Rest of Japan is seeing moderate demand for learning analytics solutions, with a 12.9% CAGR. This growth is largely driven by the increasing digitalization of education in smaller cities and rural areas, where schools and educational institutions are adopting learning analytics to improve student performance and teaching quality. As part of Japan's nationwide push toward educational innovation, local school districts and universities outside major urban centers are incorporating data-driven tools to monitor academic progress, identify learning gaps, and personalize instruction.

Additionally, the growing popularity of online education platforms is fueling the need for analytics solutions to track student engagement and performance in virtual learning environments. While the adoption of learning analytics is slower in smaller cities compared to larger urban areas, the Rest of Japan’s steady shift toward modernizing education systems and improving student outcomes is driving the gradual rise in demand for these solutions across the country.

In Japan, the demand for learning analytics solutions is gaining momentum as educational institutions and corporate training programs increasingly leverage data‑driven insights to improve outcomes and efficiency. These solutions enable tracking of student engagement, curriculum effectiveness, and training performance through analytics platforms and dashboards. With growing digitalisation of education, heightened focus on workforce development, and government backing for EdTech, many organisations seek advanced learning analytics tools to personalise learning experiences, identify at‑risk learners, and optimise resource allocation.

Key providers in this space include Google for Education with approximately 22.0% share, Microsoft Education, Blackboard Inc., IBM Watson Education and D2L (Desire2Learn). Google for Education leads through its strong cloud‑platform presence, integration with multiple educational tools in Japan and ease of deployment in both K‑12 and higher education sectors. The other firms differentiate by offering specialised analytics modules, AI‑enabled insights, global experience, and localised support tailored to Japanese language and education system needs.

The competitive dynamics are shaped by several factors. A primary driver is the increasing push for personalised and adaptive learning, which places analytics solutions at the core of institutional strategies. A second driver is the adoption of digital learning platforms and cloud‑based infrastructure, enabling richer analytics and real‑time intervention capabilities. On the flip side, challenges include data‑privacy concerns, integration of analytics into legacy systems, and the need for educator training to fully utilise analytics insights. Vendors that combine robust analytics capabilities, seamless system integration, strong local service, and user‑friendly dashboards will be best positioned to lead in Japan’s learning analytics solutions field.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Solution | Predictive Analytics, Content Analytics, Adaptive Learning Analytics, Social Learning Analytics |

| Deployment Mode | Cloud Base, Premise |

| Service | Implementation & Integration, Consulting, Maintenance |

| End User | Large Organization, Medium Institute, Small Institute |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Google for Education, Microsoft Education, Blackboard Inc., IBM Watson Education, D2L (Desire2Learn) |

| Additional Attributes | Dollar sales by solution type and service; regional CAGR and adoption trends; demand trends in learning analytics solutions; growth in large organizations and educational institutions; technology adoption for predictive and adaptive learning; vendor offerings including analytics solutions and services; regulatory influences and industry standards |

The demand for learning analytics solution in Japan is estimated to be valued at USD 24.7 million in 2025.

The market size for the learning analytics solution in Japan is projected to reach USD 122.6 million by 2035.

The demand for learning analytics solution in Japan is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key product types in learning analytics solution in Japan are predictive analytics, content analytics, adaptive learning analytics and social learning analytics.

In terms of deployment mode, cloud base segment is expected to command 61.3% share in the learning analytics solution in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Learning Analytics Solution Market Analysis by Solution, Deployment Mode, Service, End User, and Region Through 2035

E-Learning Solution Market by Solution, Deployment, & Region Forecast till 2035

Japan Conference Room Solution Market Growth - Trends & Forecast 2025 to 2035

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Regulatory Reporting Solution Market Growth – Trends & Forecast 2023-2033

Demand for Energy Intelligence Solution in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Imaging Surgical Solution in Japan Size and Share Forecast Outlook 2025 to 2035

On-shelf Availability Solution Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Preoperative Bathing Solution in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Hydrocarbon Accounting Solution in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Analytics Of Things Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Solution Styrene Butadiene Rubber (S-SBR) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA