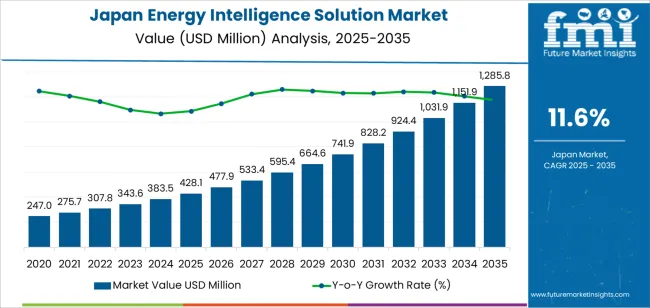

The demand for energy intelligence solutions in Japan is projected to grow from USD 428.1 million in 2025 to approximately USD 1,285.8 million by 2035, reflecting a CAGR of 11.6%. This significant growth will be driven by the increasing adoption of energy management systems across various sectors, including industrial, commercial, and residential. The growing emphasis on energy efficiency, sustainability, and the integration of renewable energy sources will continue to propel demand for energy intelligence solutions. Japan’s commitment to achieving net-zero carbon emissions and its strong focus on smart city initiatives will further support this trend. As more industries and consumers look for ways to optimize energy usage, the need for advanced solutions to monitor, analyze, and control energy consumption will become more crucial.

The energy intelligence solutions industry in Japan will benefit from innovations in data analytics, AI-driven insights, and the integration of Internet of Things (IoT) technology into energy management systems. These solutions provide real-time energy consumption data, predictive analytics for maintenance, and recommendations for energy optimization. The growing trend towards digitalization in energy systems, coupled with Japan's leadership in smart grid technologies and renewable energy adoption, will contribute to the expansion of energy intelligence solutions. Regulatory frameworks and government incentives promoting energy efficiency and the reduction of carbon footprints will drive both private and public sector investments in energy intelligence technologies.

From 2025 to 2030, the industry will grow from USD 428.1 million to USD 664.6 million, adding USD 236.5 million in value. This phase is expected to account for a significant portion of the industry's overall growth, as industries and consumers increasingly invest in energy-efficient solutions and energy management technologies. The need for more sustainable energy usage, combined with Japan’s efforts to incorporate more renewable energy into its national grid, will drive demand for energy intelligence solutions. Government policies aimed at reducing energy consumption in both industrial and residential settings will also play a crucial role in this phase.

From 2030 to 2035, the industry will grow from USD 664.6 million to USD 1,285.8 million, contributing an additional USD 621.2 million in value. This period will be characterized by further advancements in energy intelligence technology, including deeper integration of AI, machine learning, and predictive analytics. The demand for energy intelligence solutions will be further bolstered by Japan’s increasing commitment to smart cities, energy-efficient buildings, and the integration of distributed energy resources (DERs). As the industry matures, growth may moderate slightly, but the demand for energy intelligence will remain strong, driven by the ongoing focus on energy optimization.

| Metric | Value |

|---|---|

| Demand for Energy Intelligence Solution in Japan Value (2025) | USD 428.1 million |

| Demand for Energy Intelligence Solution in Japan Forecast Value (2035) | USD 1,285.8 million |

| Demand for Energy Intelligence Solution in Japan Forecast CAGR (2025 to 2035) | 11.6% |

The demand for energy intelligence solutions in Japan is rising as industries, utilities, and commercial buildings adopt advanced systems to monitor, analyze, and optimize energy usage. These solutions enable real time data collection, predictive analytics, and smarter decision making. With Japan’s focus on energy efficiency and operational cost reduction, energy intelligence tools are becoming essential for managing complex energy systems.

Rapid expansion in IoT deployment, smart meters, and digital platforms is contributing to the growth. Buildings and industrial facilities are increasingly integrating sensor networks and software platforms to track energy flows, detect anomalies, and execute automated controls. As Japan updates its energy infrastructure and seeks higher performance in manufacturing and large scale facilities, the demand for such digital solutions continues to increase.

Regulatory drivers and corporate targets focused on reducing energy consumption and greenhouse gas emissions are pushing adoption of energy intelligence. Companies face growing pressure to report energy performance, optimize asset lifecycles, and manage peak loads. As system complexity rises-from renewables, storage, EV charging, and microgrids energy intelligence solutions help stakeholders maintain visibility and manage diverse power sources. This convergence of digital transformation and energy system evolution positions energy intelligence solutions for strong growth in Japan through 2035.

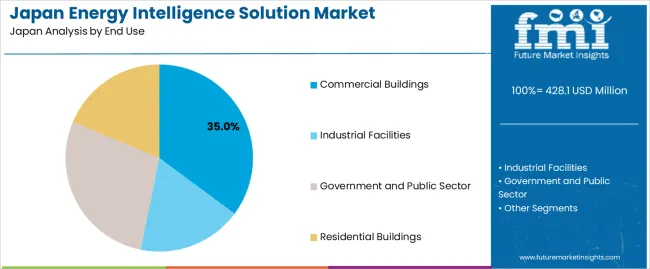

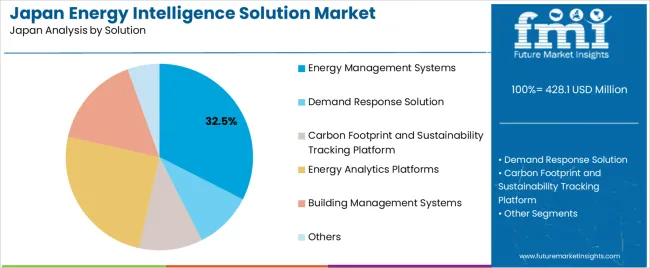

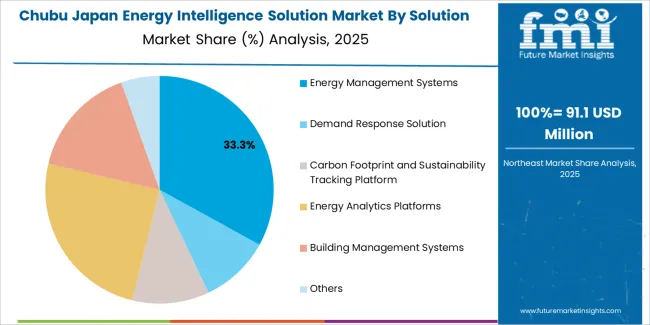

Demand for energy intelligence solutions in Japan is segmented by end use and solution type. By end use, the demand is divided into commercial buildings, industrial facilities, government and public sector, and residential buildings, with commercial buildings leading the demand. In terms of solution, the industry is categorized into energy management systems, demand response solutions, carbon footprint and sustainability tracking platforms, energy analytics platforms, building management systems, and others, with energy management systems holding the largest share. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Commercial buildings account for 35% of the demand for energy intelligence solutions in Japan. The demand is driven by the increasing need for businesses to reduce energy costs, enhance operational efficiency, and meet sustainability goals. Commercial buildings, which typically house office spaces, retail stores, and other business operations, require sophisticated energy intelligence solutions to monitor and optimize energy usage.

The rise in energy costs and the growing regulatory pressures to reduce carbon emissions have spurred the adoption of energy intelligence solutions in commercial buildings. Energy management systems (EMS) and building management systems (BMS) enable businesses to track energy consumption in real-time, optimize HVAC systems, lighting, and other energy-intensive equipment, and improve overall building performance. As more businesses focus on sustainability and green building certifications, energy intelligence solutions become essential tools for reducing operational costs and ensuring compliance with environmental regulations. The demand from commercial buildings will continue to grow as energy efficiency and sustainability become top priorities for businesses in Japan.

Energy management systems (EMS) account for 32.5% of the demand for energy intelligence solutions in Japan. These systems enable organizations to monitor, control, and optimize energy usage in real-time. EMS solutions are essential for identifying inefficiencies, improving energy consumption patterns, and reducing energy costs, making them a crucial tool for organizations seeking to improve operational efficiency and meet sustainability targets.

The demand for energy management systems is driven by the growing focus on reducing energy consumption and achieving carbon reduction goals across various sectors, particularly in commercial and industrial facilities. These systems provide detailed analytics and insights into energy usage, allowing organizations to identify areas for improvement and implement energy-saving measures. As businesses and public institutions in Japan increasingly focus on sustainability, EMS solutions are being integrated into smart buildings and facilities to improve energy efficiency and lower operational costs. With the rise of the green building movement and regulatory requirements for energy efficiency, the demand for energy management systems is expected to continue growing.

Energy intelligence solutions combine IoT monitoring, data analytics, AI‑driven forecasting and automation to deliver actionable insight on energy usage, costs and emissions. Key drivers include Japan’s push under its “Green Transformation (GX)” policy to accelerate digitalisation and carbon‑neutral growth. Commercial and industrial entities face rising electricity costs and regulatory pressure to improve efficiency, creating demand for sophisticated energy analytics. On the other hand, restraints include the high upfront cost of deploying integrated intelligence platforms, the complexity of retrofitting legacy energy systems, and challenges in integrating diverse data sources across manufacturing plants, buildings and utilities.

Why is Demand for Energy Intelligence Solutions Growing in Japan?

In Japan, demand is growing because both public and private stakeholders recognise that energy cost‑control, grid stability and sustainability are tightly linked to digital‑enabled insight. With data‑centres, AI‑driven industries and semiconductor production expanding, Japan forecasts significant electricity demand growth, which in turn forces utilities and large energy users to adopt intelligence tools to manage loads, interactive systems and emissions. Furthermore, as smart‑building technologies, renewable‑energy adoption and industrial digital‑transformation initiatives proliferate, the need for centralised platforms that provide predictive analytics, monitoring dashboards, and optimisation across multiple sites becomes essential. These dynamics support stronger uptake of energy intelligence solutions in Japan.

How are Technological Innovations Driving Growth of Energy Intelligence Solutions in Japan?

Technological innovations are accelerating adoption of energy intelligence solutions in Japan by enhancing capability and accessibility. Key innovations include AI and machine‑learning models for predicting energy demand, anomaly detection in energy consumption, and optimisation of renewable‑plus‑storage systems. IoT sensors and edge computing enable real‑time data capture across buildings, factories and utilities, while cloud‑native analytics platforms facilitate scalable deployment across sites. The convergence of energy‑tech, digital‑services and operational‑technology integration is making energy intelligence more value‑driven and practical in Japan’s evolving energy ecosystem.

What are the Key Challenges Limiting Adoption of Energy Intelligence Solutions in Japan?

Despite increasing interest, adoption of energy intelligence solutions in Japan faces several challenges. First, many infrastructures remain legacy and fragmented integrating diverse systems, equipment and protocols requires time and investment. Second, the demonstration of clear ROI can be difficult, especially for smaller facilities, which may delay investment decisions. Third, concerns about cybersecurity, data governance and vendor lock‑in complicate deployment of connected analytics platforms. While regulatory and policy drivers are strong, actual incentives or mandates for energy‑intelligence adoption are still maturing, which slows the rate of investment in some sectors.

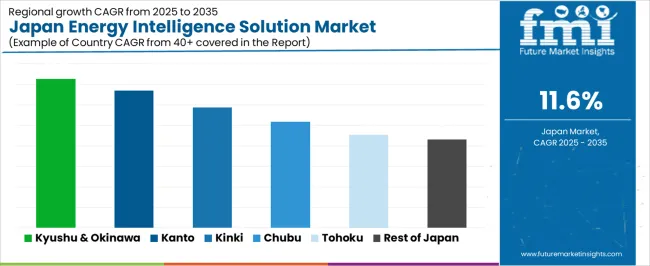

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 14.5% |

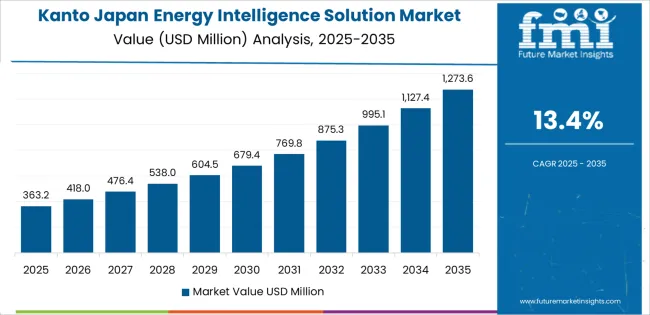

| Kanto | 13.4% |

| Kinki | 11.7% |

| Chubu | 10.3% |

| Tohoku | 9.1% |

| Rest of Japan | 8.6% |

The demand for energy intelligence solutions in Japan is growing across all regions, with Kyushu & Okinawa leading at a 14.5% CAGR. The region is focused on energy optimization and the integration of renewable sources into the grid. Kanto follows with a 13.4% CAGR, driven by urbanization, technological advancements, and high energy demand in metropolitan areas. Kinki shows an 11.7% CAGR, supported by industrial adoption of energy-efficient solutions. Chubu experiences a 10.3% CAGR, driven by energy management needs in manufacturing. Tohoku and the Rest of Japan show moderate growth at 9.1% and 8.6%, respectively, as regional demand for energy intelligence solutions increases in response to growing sustainability efforts and the need for efficient energy use.

Kyushu & Okinawa is experiencing the highest demand for energy intelligence solutions in Japan, with a 14.5% CAGR. The region has become a leader in energy optimization due to its commitment to renewable energy sources like solar and wind. Kyushu, in particular, is a focal point for clean energy initiatives, and Okinawa's growing focus on sustainability is accelerating the adoption of energy intelligence systems. These solutions are essential for managing the region's diverse energy production and consumption needs.

The growing interest in energy efficiency and smart grid technology is driving the demand for energy intelligence solutions in Kyushu & Okinawa. As local governments and industries prioritize reducing energy consumption and carbon emissions, there is a strong push toward integrating advanced energy management systems that can optimize energy distribution and usage. As renewable energy projects expand and the need for real-time energy monitoring increases, the region is expected to continue leading in the adoption of energy intelligence solutions.

Kanto is seeing strong demand for energy intelligence solutions, with a 13.4% CAGR. As the largest and most densely populated region in Japan, Kanto’s high energy demand drives the need for smarter energy management. Tokyo, the heart of Japan's economy, is a hub for technology innovation, and businesses are increasingly adopting energy intelligence solutions to optimize energy consumption and reduce costs. The region’s rapid urbanization, coupled with the growing demand for sustainable energy solutions, is further driving this trend.

The rise of smart cities and the expansion of digital infrastructure in Kanto are contributing to the growing adoption of energy intelligence systems. These solutions help monitor and manage energy usage in real-time, making them essential for both residential and industrial applications. As the region continues to prioritize sustainability and energy efficiency, Kanto will remain a key player in the growth of energy intelligence solutions in Japan.

Kinki is experiencing steady demand for energy intelligence solutions, with an 11.7% CAGR. The region’s strong industrial base, including cities like Osaka and Kyoto, is a key driver of this demand. Industries in Kinki are increasingly adopting energy-efficient technologies to reduce operational costs and meet sustainability goals. With a focus on manufacturing and commercial applications, energy intelligence solutions are essential for managing large-scale energy usage in this region.

The growing emphasis on smart factories, energy conservation, and sustainability within the industrial sector is propelling the adoption of energy intelligence solutions. As businesses in Kinki seek to optimize energy use and reduce their carbon footprints, the demand for real-time energy monitoring and optimization tools is increasing. The region’s commitment to integrating renewable energy sources into the grid also contributes to the growing demand for these solutions. Kinki is expected to continue seeing steady growth as industries embrace digital energy management tools.

Chubu is seeing moderate growth in demand for energy intelligence solutions, with a 10.3% CAGR. The region, home to major manufacturing industries, particularly in cities like Nagoya, has a growing need for energy-efficient solutions. As industries look to optimize their energy consumption, reduce operational costs, and improve sustainability, energy intelligence solutions are becoming a key component in their strategies.

Chubu’s focus on manufacturing and industrial applications is driving the demand for advanced energy management systems. The integration of renewable energy sources in the region, combined with the push for improved energy efficiency, further fuels the need for energy intelligence solutions. As businesses and local governments in Chubu continue to prioritize energy optimization, the demand for these solutions is expected to grow steadily. The region’s industrial sector remains a major driver of adoption, ensuring continued growth in energy intelligence solutions.

Tohoku is experiencing steady demand for energy intelligence solutions, with a 9.1% CAGR. The region, which has been historically focused on industrial and agricultural activities, is increasingly adopting energy-efficient technologies to optimize energy consumption. As Tohoku transitions to cleaner energy sources, such as solar and wind power, the need for energy intelligence solutions to monitor and manage energy usage is rising.

The region’s growth in energy intelligence is also supported by government initiatives aimed at reducing energy consumption and increasing the use of renewable energy. As the focus on sustainability continues to grow in Tohoku, both industries and consumers are adopting energy management systems that offer real-time data and energy optimization tools. The combination of renewable energy adoption and the region’s push for greater energy efficiency ensures that the demand for energy intelligence solutions will continue to rise.

The Rest of Japan is experiencing moderate growth in demand for energy intelligence solutions, with an 8.6% CAGR. This includes rural and smaller urban areas where the need for energy optimization is growing steadily. As businesses and local governments across Japan’s less densely populated regions focus on reducing energy consumption and integrating renewable energy sources, there is a growing adoption of energy intelligence solutions.

The increasing focus on sustainability, energy independence, and efficient energy use in these regions is contributing to the rise of energy intelligence systems. Rural areas, which traditionally had limited access to advanced energy solutions, are now adopting these technologies to improve grid stability and optimize energy distribution. As the government continues to push for the widespread adoption of renewable energy and digital solutions, the Rest of Japan will continue to see growth in the demand for energy intelligence solutions.

Demand for energy intelligence solutions in Japan has strengthened significantly, fueled by the country’s push toward decarbonization, infrastructure modernization, and digital transformation. Japanese industries and utilities are increasingly investing in solutions that enable real‑time energy monitoring, analytics‑driven optimization, and integrated infrastructure management. With initiatives such as the “Green Transformation (GX)” aiming to achieve carbon neutrality by 2050, and the projected rise in power demand driven by AI, semiconductor manufacturing, and data‑centers, the need for actionable energy‑intelligence tools has never been higher.

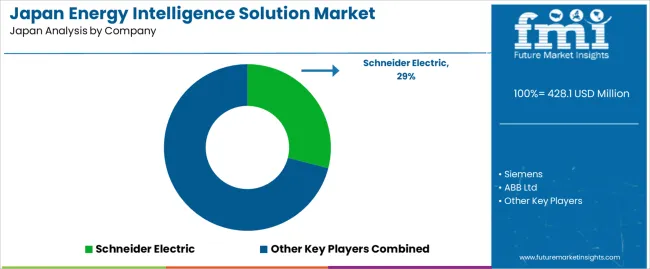

In the Japanese industry landscape, Schneider Electric is estimated to command a share of approximately 29.0%, underscoring its role as a leading provider of energy management, digital‑twins, and smart‑building platforms tailored for Japan’s industrial and utilities sectors. Other major players contributing to the demand include Siemens AG, ABB Ltd., Emerson, General Electric, and Honeywell International Inc., each offering integrated software‑hardware platforms, services for predictive maintenance, asset‑analytics, and demand‑response solutions.

Key drivers of demand in Japan include expanding renewable‑energy integration (solar, wind, hydrogen), tighter regulations on energy efficiency and emissions, the growth of smart manufacturing/facility automation, and increasing focus on operational cost‑savings in commercial and industrial facilities. Challenges persist, such as the complexity of retrofitting legacy systems, the need for skilled analytics talent, and the upfront cost of advanced solution deployment. Nonetheless, the outlook remains favorable: as Japan embarks on next‑generation infrastructure upgrades and accelerates its sustainability agenda, demand for energy intelligence solutions is poised to grow significantly.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| End Use | Commercial Buildings, Industrial Facilities, Government and Public Sector, Residential Buildings |

| Solution | Energy Management Systems, Demand Response Solution, Carbon Footprint and Sustainability Tracking Platform, Energy Analytics Platforms, Building Management Systems, Others |

| Deployment | Cloud-based, Web-based, On-Premises |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Schneider Electric, Siemens, ABB Ltd, Emerson, General Electric, Honeywell International Inc. |

| Additional Attributes | Dollar sales by end use, solution type, deployment model, and regional trends focusing on commercial, industrial, and government sectors. |

The demand for energy intelligence solution in Japan is estimated to be valued at USD 428.1 million in 2025.

The market size for the energy intelligence solution in Japan is projected to reach USD 1,285.8 million by 2035.

The demand for energy intelligence solution in Japan is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in energy intelligence solution in Japan are commercial buildings, industrial facilities , government and public sector and residential buildings.

In terms of solution, energy management systems segment is expected to command 32.5% share in the energy intelligence solution in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA