The demand for hydrocarbon accounting solutions in Japan is expected to grow from USD 26.8 million in 2025 to USD 40.2 million by 2035, reflecting a CAGR of 4.1%. These solutions are essential for industries involved in the energy, oil, and gas sectors, as they provide accurate tracking, reporting, and management of hydrocarbon production, transportation, and consumption. The increasing complexity of energy management drives the market for hydrocarbon accounting solutions, growing regulatory compliance needs, and the push for cost optimization and data accuracy in energy resource management.

As Japan continues to modernize its energy infrastructure and adopt digital solutions for better resource management, the demand for these accounting systems will expand. Advancements in data analytics, cloud-based solutions, and real-time reporting will also play a key role in boosting the market. The need for transparency and efficiency in energy transactions will continue to fuel the demand for advanced hydrocarbon accounting technologies.

The long-term value accumulation curve for hydrocarbon accounting solutions in Japan shows steady growth over the forecast period from 2025 to 2035, reflecting both steady incremental growth and cumulative market value increases. Starting at USD 26.8 million in 2025, the market will reach USD 40.2 million by 2035, contributing a total increase of USD 13.4 million over the 10-year period.

From 2025 to 2030, the market will grow from USD 26.8 million to USD 32.9 million, adding USD 6.1 million in value. This early phase will be marked by consistent and gradual growth driven by the increasing adoption of automated systems and improved energy management solutions. The need for accurate tracking and reporting in Japan’s complex energy sector, as well as the drive for efficiency improvements and regulatory compliance, will support steady market expansion during this phase.

From 2030 to 2035, the market will continue to grow from USD 32.9 million to USD 40.2 million, contributing USD 7.3 million in value. The second phase of growth will see stronger demand for advanced hydrocarbon accounting solutions as industries seek more sophisticated tools for real-time tracking, data analysis, and cost management. This phase will be characterized by higher value solutions and increased market penetration due to greater adoption of cloud-based accounting systems and the integration of artificial intelligence for predictive analytics and decision-making.

The long-term value accumulation curve shows a steady upward trajectory, reflecting the maturation of the market as more companies within the energy sector implement advanced digital accounting systems. The growth will be driven by the need for transparency, operational efficiency, and compliance within the hydrocarbon sector.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 26.8 million |

| Forecast Value (2035) | USD 40.2 million |

| Forecast CAGR (2025-2035) | 4.1% |

Demand for hydrocarbon accounting solutions in Japan is rising as energy and resource companies seek greater transparency, accuracy, and efficiency in tracking production, allocation and revenue across petroleum and natural gas operations. Japan’s reliance on imported hydrocarbons and its goals for energy security heighten the need for precise accounting systems that can manage complex flows, data reconciliation and regulatory compliance. Additionally, digitalisation initiatives within the energy sector and manufacturers’ requirements for real time operational oversight are supporting the uptake of advanced accounting platforms.

Another factor supporting growth is the evolution of software and cloud based solutions tailored to hydrocabons management, which offer Japanese operators access to scalable, flexible systems that integrate with upstream, mid stream and downstream operations. The domestic focus on automation, combined with strong IT infrastructure and demand for enhanced data analytics, aligns with these developments. However, growth is moderated by the high cost of implementation, challenges in migrating legacy systems and limited domestic hydrocarbon production. Despite these constraints, the demand for hydrocarbon accounting solutions in Japan is expected to grow steadily as energy companies and utilities continue to modernise their operational and financial systems.

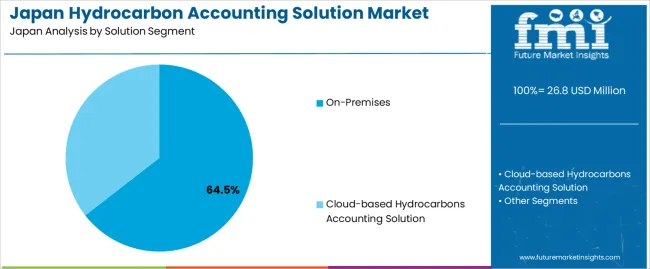

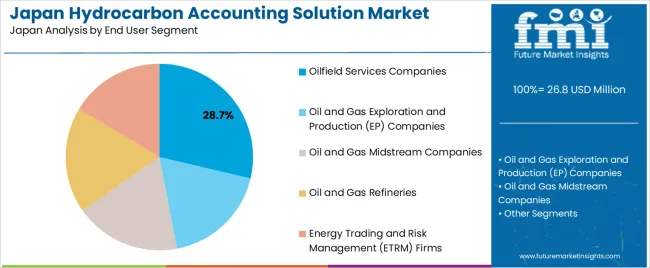

The demand for hydrocarbon accounting solutions in Japan is driven by solution segment and end-user segment. The leading solution segment is on-premises, capturing 65% of the market share, while the largest end-user segment is oilfield services companies, accounting for 28.7% of the demand. Hydrocarbon accounting solutions are essential for managing the complexities involved in the exploration, production, transportation, and trading of hydrocarbons, ensuring accurate reporting, regulatory compliance, and operational efficiency. As Japan’s oil and gas sector continues to innovate and grow, the demand for these solutions is increasing, driven by the need for improved data management and decision-making.

On-premises hydrocarbon accounting solutions dominate the market, holding 65% of the demand. These solutions are typically installed locally within an organization's own infrastructure, providing full control over data management, security, and system integration. On-premises solutions are preferred by large companies in the oil and gas industry, as they can be customized to meet specific operational needs and integrate seamlessly with other internal enterprise systems.

The preference for on-premises solutions is driven by factors such as data security, compliance requirements, and the ability to tailor the system to complex business processes in the oil and gas industry. Companies operating in the oilfield services, exploration, and production sectors, which handle sensitive data and need to ensure compliance with strict regulatory standards, rely heavily on on-premises hydrocarbon accounting systems. As data privacy concerns continue to be a priority, on-premises solutions are expected to maintain their dominance in Japan’s hydrocarbon accounting market.

Oilfield services companies are the largest end-user segment for hydrocarbon accounting solutions in Japan, capturing 28.7% of the demand. These companies provide essential support to the oil and gas exploration and production (EP) sectors, offering services such as drilling, well maintenance, logistics, and equipment supply. Hydrocarbon accounting solutions are crucial for these companies to track production levels, manage financial transactions, and ensure compliance with regulatory standards.

The demand from oilfield services companies is driven by their need to manage large volumes of data, including production reporting, material costs, and equipment usage. Accurate and real-time data is critical for making informed decisions and optimizing operations in the highly competitive and regulated oil and gas industry. As oilfield services companies continue to expand their operations, particularly in exploration and production, the need for reliable and efficient hydrocarbon accounting solutions will remain strong, making them a key driver of demand in the market.

Demand for hydrocarbon accounting solutions in Japan is driven by the country’s focus on energy security, strict regulatory frameworks, and the automation of upstream, midstream, and downstream operations. Japan’s oil and gas industry is adopting digital platforms to support production allocation, revenue reconciliation, and audit-ready reporting. However, growth is moderated by the limited size of domestic hydrocarbon output and the cost and complexity of integrating new accounting systems with legacy infrastructure.

Several drivers support the uptake of hydrocarbon accounting solutions in Japan. First, regulatory and environmental compliance pressures require precise monitoring and reporting of hydrocarbon flows, promoting the adoption of advanced accounting software. Second, Japan’s digital transformation push in the energy sector, leveraging cloud, IoT, AI, and analytics, creates demand for real-time accounting and production tracking platforms. Third, Japan’s dependence on imported gas and oil, combined with the need for efficiency in resource allocation, stimulates demand for tools that enhance visibility and optimize hydrocarbon value chains.

Despite positive market drivers, several constraints limit the demand for hydrocarbon accounting solutions. High implementation costs, particularly for software, integration, and services, pose a barrier for smaller operators in Japan. Another restraint is the relatively low domestic hydrocarbon production, limiting the scale and volume of accounting solution deployments compared to larger producing nations. Additionally, data security concerns, legacy system migration challenges, and a lack of skilled personnel may slow adoption in some Japanese energy firms.

Key trends in Japan include a shift toward cloud-based hydrocarbon accounting platforms, offering scalability, remote access, and lower upfront investment compared to traditional on-premises systems. The use of AI and analytics for predictive reconciliation, anomaly detection, and real-time visibility is gaining traction among Japanese energy companies seeking a competitive advantage. The convergence of hydrocarbon accounting with ESG and emissions monitoring, with Japanese firms looking to integrate production, financial, and environmental data, also shapes the market’s future direction.

The demand for hydrocarbon accounting solutions in Japan is driven by the country's robust energy sector, regulatory requirements, and the need for accurate tracking and reporting of hydrocarbon production, sales, and consumption. These solutions are essential for companies in the oil, gas, and energy sectors to ensure compliance with government regulations, optimize production efficiency, and manage financial transactions related to hydrocarbons.

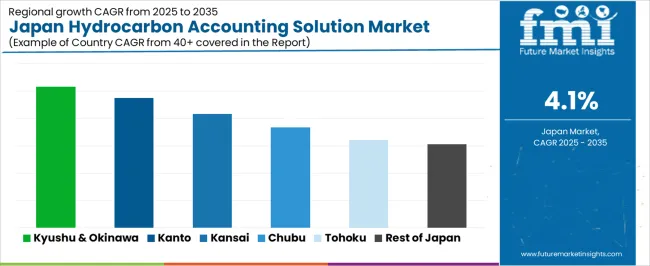

Japan, as one of the largest consumers and importers of energy, particularly petroleum and natural gas, requires efficient systems for managing hydrocarbon resources. Regional demand varies depending on the level of industrial activity, energy infrastructure, and technological adoption in each region. Below is an analysis of the demand for hydrocarbon accounting solutions across Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.2% |

| Kanto | 4.7% |

| Kinki | 4.2% |

| Chubu | 3.7% |

| Tohoku | 3.2% |

| Rest of Japan | 3.1% |

Kyushu & Okinawa leads the demand for hydrocarbon accounting solutions in Japan with a CAGR of 5.2%. The region is home to several key industrial areas, including oil refineries, petrochemical complexes, and natural gas terminals, all of which require robust systems to manage hydrocarbon resources. Kyushu, in particular, is a major hub for energy production and distribution in Japan, with numerous power plants and energy companies operating in the region.

Additionally, Kyushu & Okinawa's proximity to key ports and energy distribution channels ensures that the region continues to play a pivotal role in the country's energy sector. The demand for hydrocarbon accounting solutions is driven by the need for accurate and real-time tracking of production, supply chains, and regulatory compliance. As the region continues to invest in energy infrastructure and technological advancements, the demand for these solutions will remain strong.

What Factors Are Supporting the Growth of Hydrocarbon Accounting Solution Demand in Kanto?

Kanto shows strong demand for hydrocarbon accounting solutions with a CAGR of 4.7%. As Japan's economic and industrial center, Kanto, which includes Tokyo, has a large number of companies involved in energy production, distribution, and consumption. The region’s advanced technological infrastructure, coupled with a high concentration of energy-consuming industries, drives the demand for efficient hydrocarbon management systems.

The Kanto region is also home to major energy corporations and regulatory bodies, which further contributes to the adoption of hydrocarbon accounting solutions. The need for accurate reporting, optimization of energy consumption, and compliance with stringent regulations continues to drive market growth in the region. As Kanto continues to focus on sustainable energy practices and digital transformation, demand for these solutions is expected to remain robust.

The Kinki region, with a CAGR of 4.2%, shows steady demand for hydrocarbon accounting solutions. Kinki, which includes Osaka and Kobe, is a major industrial hub with a significant presence of energy-intensive sectors such as manufacturing, transportation, and chemicals. The demand for hydrocarbon accounting solutions in this region is driven by the need for efficient management of energy consumption, regulatory compliance, and optimization of supply chains.

While Kinki's growth rate is slightly slower than in Kyushu & Okinawa and Kanto, the region’s large industrial base and focus on energy efficiency contribute to the ongoing demand for these solutions. As more companies in the region seek to enhance their energy management systems and improve financial reporting, the market for hydrocarbon accounting solutions in Kinki is expected to remain steady.

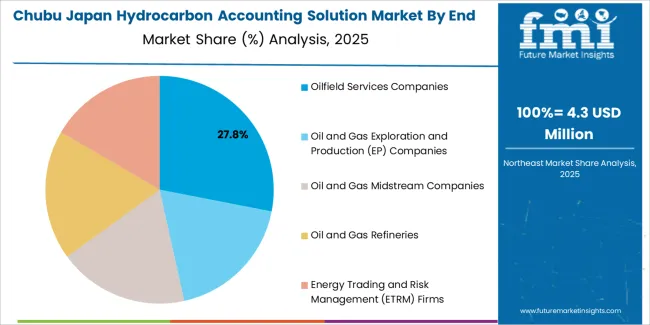

Chubu demonstrates moderate growth in the demand for hydrocarbon accounting solutions, with a CAGR of 3.7%. The region, which includes Nagoya and its surrounding industrial areas, has a strong presence in automotive, manufacturing, and energy sectors. While Chubu does not have the same concentration of energy companies as Kyushu & Okinawa or Kanto, the growing need for energy management in industrial processes drives the demand for hydrocarbon accounting solutions.

Chubu's large manufacturing base and its increasing adoption of automation and digital solutions in the energy sector contribute to steady growth in this market. As the region continues to develop its infrastructure and energy systems, the demand for efficient and reliable hydrocarbon accounting systems will likely grow at a moderate pace.

Tohoku and the Rest of Japan show slower growth in the demand for hydrocarbon accounting solutions, with CAGRs of 3.2% and 3.1%, respectively. These regions are less industrialized and have fewer large-scale energy production and distribution centers compared to the more industrialized areas like Kanto and Kyushu & Okinawa. While there is still a demand for hydrocarbon accounting solutions, it is driven more by the need to comply with local regulations and optimize energy usage in smaller industrial facilities.

The slower growth in these regions can also be attributed to their more rural characteristics, with a lower concentration of large energy-consuming industries. However, as Japan continues to invest in improving energy infrastructure and increasing the adoption of digital solutions in these areas, the demand for hydrocarbon accounting solutions is expected to grow steadily, albeit at a slower rate.

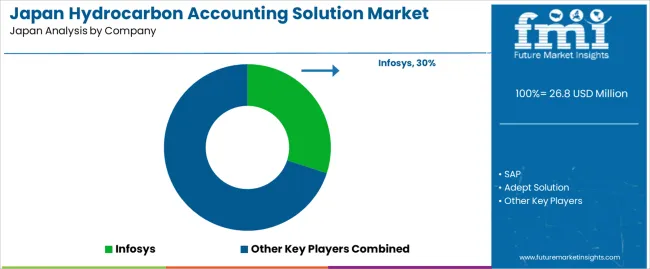

Demand for hydrocarbon accounting solutions in Japan is increasing as energy companies and the oil and gas industry seek more efficient and accurate ways to manage production data, financials, and regulatory compliance. Companies such as Infosys (holding approximately 30% market share), SAP, Adept Solution, P2 Energy Solution, and Tieto are key players in this market. The need for robust solutions to track hydrocarbon production and consumption, manage cost allocation, and ensure regulatory adherence is driving the adoption of specialized software in Japan, particularly within the oil and gas sector.

Competition in this industry is driven by system integration, scalability, and the ability to handle large volumes of data from multiple sources. Companies are focusing on providing comprehensive solutions that integrate hydrocarbon accounting with other enterprise resource planning (ERP) systems and financial software to streamline operations and improve data accuracy. Additionally, real-time reporting, enhanced data analytics, and cloud-based solutions are gaining traction as key competitive advantages.

Marketing materials often highlight features such as multi-currency support, regulatory compliance, customizable reporting, and system security. By aligning their products with the growing demand for accurate, real-time financial management and regulatory compliance in Japan’s energy sector, these companies are positioning themselves to strengthen their share in the hydrocarbon accounting solutions market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Solution Segment | On-Premises, Cloud-based Hydrocarbons Accounting Solution |

| End User Segment | Oilfield Services Companies, Oil and Gas Exploration and Production (EP) Companies, Oil and Gas Midstream Companies, Oil and Gas Refineries, Energy Trading and Risk Management (ETRM) Firms |

| Key Companies Profiled | Infosys, SAP, Adept Solution, P2 Energy Solution, Tieto |

| Additional Attributes | The market analysis includes dollar sales by solution segment and end-user segment categories. It also covers regional demand trends in Japan, particularly driven by the need for efficient and accurate hydrocarbon accounting in oil and gas industries. The competitive landscape highlights key software providers focusing on both on-premises and cloud-based solutions. Trends in the growing adoption of cloud technologies and the integration of advanced analytics in hydrocarbon accounting are explored, along with innovations in energy trading and risk management systems. |

The global demand for hydrocarbon accounting solution in Japan is estimated to be valued at USD 26.8 million in 2025.

The demand for hydrocarbon accounting solutions in Japan is projected to reach USD 40.2 million by 2035.

The demand for hydrocarbon accounting solution in Japan is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in Japan are on-premises and cloud-based hydrocarbons accounting solutions.

In terms of end user segment, oilfield services companies is expected to command 28.7% share in the demand for hydrocarbon accounting solution in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA