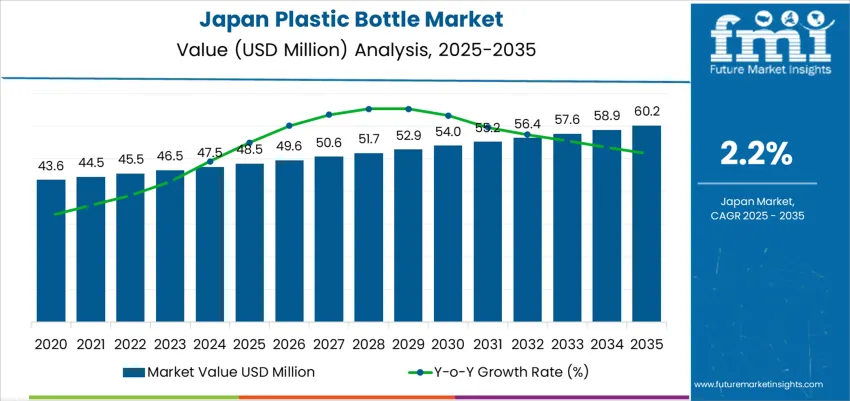

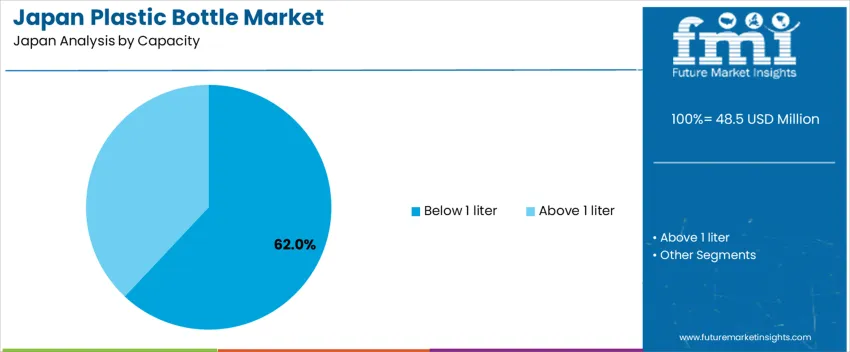

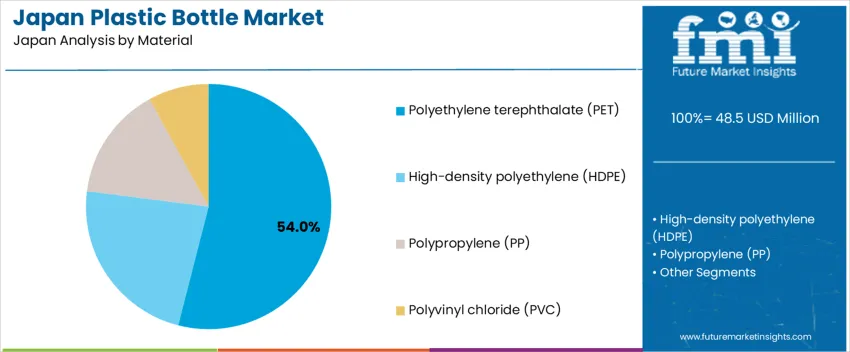

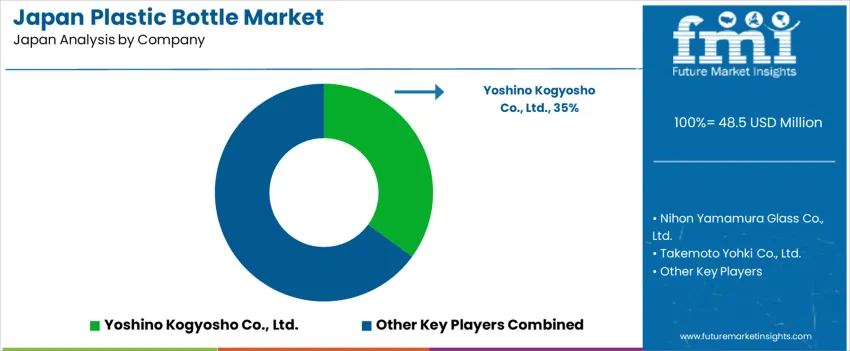

The Japan plastic bottle demand is valued at USD 48.5 million in 2025 and is forecasted to reach USD 60.2 million by 2035, reflecting a CAGR of 2.2%. Demand is influenced by steady consumption of packaged beverages, personal-care liquids, and household fluids across retail channels. Lightweight packaging preferences, coupled with container standardization for vending distribution and convenience retail, underpin ongoing use of rigid plastics. Bottles with capacities below 1 liter lead requirements. These formats support single-serve beverages, ready-to-drink tea, water, and health-focused formulations widely adopted in urban commuter lifestyles. Polyethylene terephthalate (PET) remains the preferred material. Its clarity, barrier strength, and suitability for bottle-to-bottle recycling reinforce compliance with national circular-packaging directives and corporate sustainability thresholds.

Kyushu & Okinawa and Kanto register the strongest consumption due to their population clusters, developed beverage-processing infrastructure, and high penetration of vending and convenience-store networks. These factors support recurring procurement from fillers and packaging converters. Key suppliers include Yoshino Kogyosho Co., Ltd., Nihon Yamamura Glass Co., Ltd., Takemoto Yohki Co., Ltd., Kureha Corporation, and Alpla Japan. Their portfolios focus on food-grade PET packaging with weight-reduction designs, standardised neck finishes, and compatibility with high-speed filling lines used in beverage and consumer-goods applications.

Demand for plastic bottles in Japan demonstrates a relatively low volatility pattern linked to established consumption within beverages, household products, and pharmaceuticals. Growth rates show limited fluctuation because underlying demand is driven by essential packaged goods with stable purchasing cycles. Variations in unit consumption remain modest, even when economic or seasonal shifts occur. Increased collection and recycling obligations contribute to gradual changes rather than sharp swings in annual demand.

Volatility risks arise from regulatory pressure, sustainability targets, and substitution trends toward refillable or paper-based packaging. These influences can temporarily slow growth, but compliance-led innovation, such as lightweight PET and chemical-recycling integration, supports consistent recovery. Industrial beverage distribution sustains baseline stability, particularly in ready-to-drink tea and functional beverages. Annual growth dispersion is therefore concentrated within a narrow band, reflecting predictable replacement demand rather than bulk expansion. The category maintains resilient volume fundamentals, with volatility driven more by packaging-material transitions than by consumption variability.

| Metric | Value |

|---|---|

| Japan Plastic Bottle Sales Value (2025) | USD 48.5 million |

| Japan Plastic Bottle Forecast Value (2035) | USD 60.2 million |

| Japan Plastic Bottle Forecast CAGR (2025-2035) | 2.2% |

Demand for plastic bottles in Japan is increasing because beverage companies, personal care brands and household product manufacturers rely on packaging that is lightweight, durable and suitable for automated filling lines. Bottles made from PET and HDPE remain widely used for bottled water, tea, soft drinks, hygiene products and detergents. Growth in single-person households and on-the-go consumption supports strong sales of single-serve formats through convenience stores and vending machines. E-commerce distribution also demands packaging that resists damage during transport and provides reliable leak protection.

Manufacturers in Japan invest in lightweight designs and bottles with recycled content to align with circular economy policies and corporate sustainability goals. Collection and sorting systems for PET bottles are well established across the country, which supports continued adoption of packaging compatible with national recycling infrastructure. Constraints include increasing consumer concern about single-use plastics, competition from aluminum cans and refill-pack formats and pressure from government regulations aimed at reducing plastic waste. Fluctuations in resin and energy prices can influence packaging costs, which may affect procurement decisions for lower-margin product categories.

Demand for plastic bottles in Japan is driven by packaged beverage consumption, regulated pharmaceutical distribution, and industrial fluid handling. Buyers prioritize lightweight strength, recycling compatibility under Japan’s container and packaging recovery framework, and barrier properties that protect product freshness or chemical stability. Manufacturers focus on clarity, formability, and automation suitability across high-speed filling systems. Adoption aligns with logistics efficiency, consumer handling convenience, and compliance with labeling and food-contact standards. Industrial users require consistent material performance in chemical transport and workplace storage conditions common across manufacturing regions.

Bottles below 1 liter account for 62.0%, used heavily in single-serve and multi-serve packaged beverages, condiments, and personal-care goods. Their lighter weight and ergonomic handling support frequent consumer purchases in convenience-focused retail formats common across Japan. Bottles above 1 liter represent 38.0%, used in bulk liquids such as household cleaners or industrial chemicals requiring stronger wall structure. Capacity selection reflects distribution ergonomics, shelf-space efficiency, and high-frequency replacement patterns within food and drink categories.

Key points:

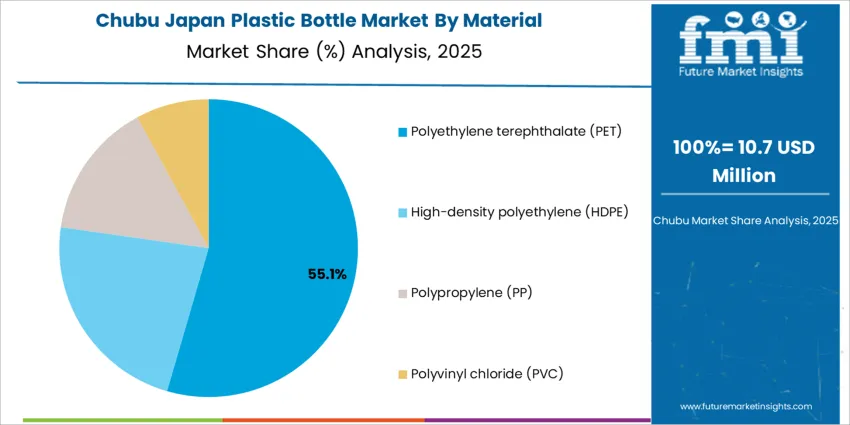

PET represents 54.0%, driven by clarity, rigidity, and strong recycling pathways in Japan’s bottle-to-bottle systems. HDPE holds 23.0%, supporting chemicals and household goods requiring impact resistance and stress-crack protection. PP accounts for 15.0%, valued for heat resistance in certain food and healthcare applications. PVC represents 8.0%, remaining in limited use where specific chemical-barrier characteristics are required. Material preferences align with sustainability requirements, food-grade performance, and standardized molding processes supporting domestic beverage distribution.

Key points:

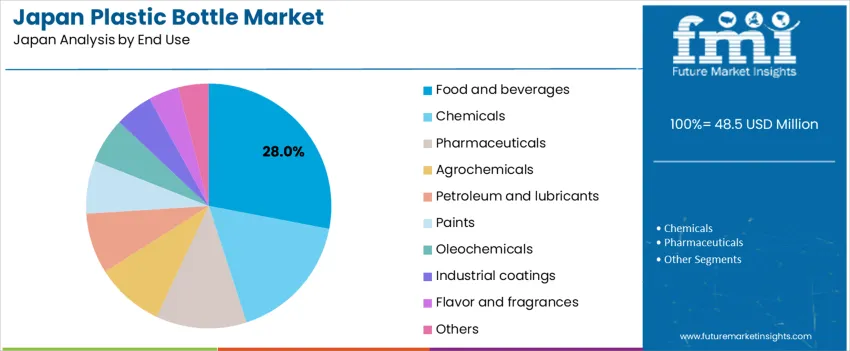

Food and beverages represent 28.0%, driven by bottled drinks, sauces, and high turnover in retail channels. Chemicals account for 17.0%, followed by pharmaceuticals at 12.0%, reflecting compliance with tamper-evident requirements. Agrochemicals hold 9.0%, petroleum and lubricants 8.0%, and paints 7.0%, where durability and chemical resistance are essential. Oleochemicals represent 6.0%, with industrial coatings at 5.0%. Flavors and fragrances total 4.0%, similar to other small-volume uses at 4.0%. End-use distribution reflects diversified handling needs across consumer and industrial supply chains in Japan.

Key points:

Strong consumption of bottled beverages, growth of convenience-store distribution and rising demand for single-serve formats are driving demand.

In Japan, plastic bottle usage remains high due to widespread consumption of bottled tea, water and functional drinks produced by major beverage companies. Convenience stores located densely across urban and suburban areas rely on PET bottles as the dominant format for on-the-go refreshment. Ready-to-drink teas, electrolyte beverages and flavored waters continue to expand shelf presence, supporting stable demand from beverage filling plants in prefectures such as Shizuoka and Fukuoka. Single-serve packaging fits the lifestyle of commuters and office workers who purchase drinks multiple times per day from vending machines and retail kiosks. Household and personal care brands also rely on plastic bottles for detergents, shampoos and cleaning products distributed nationally.

Municipal waste-reduction objectives, competition from aluminum and refill systems and elevated expectations for recyclability restrain adoption.

National and prefectural policies emphasize plastic waste reduction, encouraging beverage makers to review packaging usage. Refillable bottle programs and carton formats challenge PET bottles in selected product lines, especially in cafes and limited-service restaurants targeting sustainability-minded consumers. Some municipalities encourage shoppers to reduce purchasing of single-use plastics, placing behavioral pressure on high-frequency on-the-go consumption. Production costs can rise when companies introduce lighter bottles or alternative-resin formulations, which may delay rapid packaging transitions. These regulatory and consumer influences create gradual demand adjustments across categories.

Shift toward higher recycled content, increased tethered-cap adoption and rising demand for label-free bottles define key trends.

Japanese bottlers are incorporating greater post-consumer recycled PET to meet internal environmental targets and packaging guidelines tied to resource circularity. Tethered caps are being introduced to improve closure retention during disposal and increase recovery rates at material-sorting facilities. Label-free bottles are expanding within bottled water and tea categories, streamlining recycling by reducing contamination in collection streams. Vending machine operators are testing bottle-return bins that support closed-loop material recovery. These trends show continued evolution of plastic bottle demand in Japan as packaging aligns with sustainability expectations.

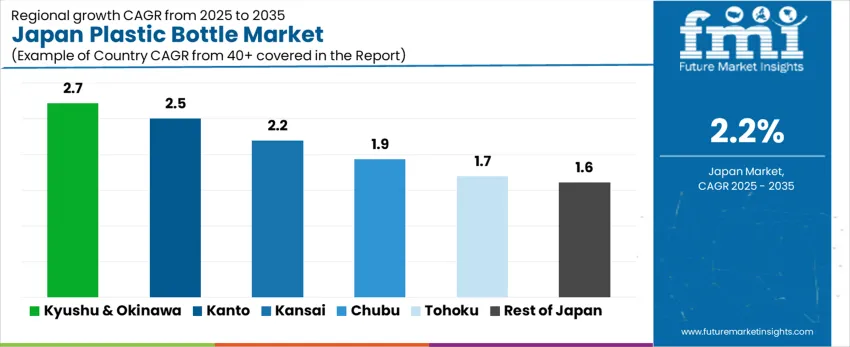

Demand for plastic bottles in Japan reflects requirements in beverage packaging, household liquid products, personal-care formats, and pharmaceutical applications. PET and HDPE usage patterns align with retail logistics, recycling frameworks, and consumer portability preferences. Growth remains steady but incremental due to ongoing packaging reduction policies and rising refill adoption. Kyushu & Okinawa leads at 2.7% CAGR, followed by Kanto (2.5%), Kinki (2.2%), Chubu (1.9%), Tohoku (1.7%), and Rest of Japan (1.6%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 2.7% |

| Kanto | 2.5% |

| Kinki | 2.2% |

| Chubu | 1.9% |

| Tohoku | 1.7% |

| Rest of Japan | 1.6% |

Kyushu & Okinawa records 2.7% CAGR, with beverage consumption, tourism-linked retail, and bottled water distribution supporting consistent plastic bottle requirements. Humid weather contributes to strong single-serve hydration product sales in convenience stores and vending machines positioned across travel routes. PET bottles remain essential for ready-to-drink teas, sports drinks, and flavored beverages distributed through compact retail formats. Household liquid products and cleaning supplies also maintain HDPE bottle demand. Port access supports resin imports and supply chain stability for packaging converters serving local filling operations. Regional recycling programs improve PET recovery, aligning packaging decisions with municipal waste rules. Procurement focuses on maintaining bottle robustness through varying transport conditions while meeting product visibility expectations.

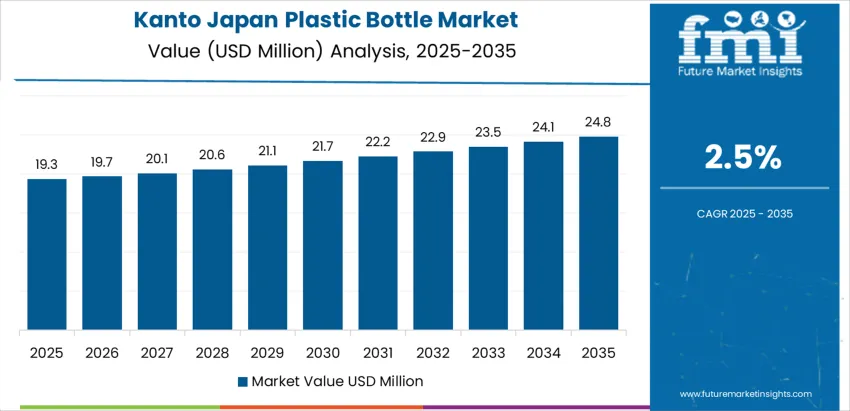

Kanto grows at 2.5% CAGR, driven by Tokyo-centered consumption where on-the-go beverage usage influences high PET bottle turnover across transit networks. Dense retail footprints rely on durable lightweight containers that withstand frequent shelf handling. Pharmaceutical distribution uses HDPE bottles for liquid medications and hygiene solutions circulated through extensive hospital networks. Brand owners test reduced-resin bottles to align with corporate sustainability targets without compromising sealing performance. Recycling infrastructure supports rPET integration into beverage packaging based on availability within sorted waste streams. Procurement teams monitor bottle clarity, dimensional consistency, and line-compatibility for high-speed filling operations in large metropolitan production sites.

Kinki posts 2.2% CAGR, supported by Osaka and Kyoto distribution hubs where bottled beverages and personal-care products maintain steady plastic bottle use. Convenience retail drives frequent purchases of compact bottles designed for repeated handling and refrigeration cycles. Processing facilities emphasize operational stability and incremental upgrades rather than major packaging redesigns. Cost sensitivity shapes procurement decisions for household and personal-care bottles that require consistent thread profiles for cap fit. Retailers emphasize clean product presentation with scuff-resistant surfaces suited for high-touch environments. Resin supply reliability and minimal bottling line downtime remain priorities for production planning.

Chubu advances at 1.9% CAGR, supported by food and drink distribution linked to automotive and industrial cluster workforces requiring packaged hydration. Bottled tea and water remain essential in workplace retail environments, encouraging stable PET procurement. Household liquid cleaners also support HDPE bottle volume through national shipment channels. Production efficiency guides packaging choices with emphasis on bottle weight reduction where feasible. Manufacturers evaluate compatibility with existing conveyors and blow-molding infrastructure to avoid processing disruption.

Tohoku records 1.7% CAGR, driven by packaged beverages distributed across wide geography requiring impact-resistant bottles for long-haul transport. HDPE bottle usage persists in local dairy and household packaging lines serving regional communities. Seasonal tourism boosts short-term bottled-drink demand in coastal areas. Procurement emphasizes strong sealing reliability to prevent leakage during colder climate storage. Municipal recovery programs encourage simplified packaging structures that integrate more easily into local recycling networks.

Rest of Japan posts 1.6% CAGR, reflecting limited production scale and controlled packaging expansion tied to local consumption volumes. Smaller beverage bottlers emphasize cost-stable PET bottles with reliable supply access. Community retail channels sell moderate packaging quantities where portability and leak prevention influence purchase stability. Waste handling guidelines encourage clear labeling and label-size control to ease sorting.

Demand for plastic bottles in Japan is supported by domestic converters supplying PET and HDPE containers for beverages, condiments, and personal-care goods. Yoshino Kogyosho Co., Ltd. holds an estimated 35% share, supported by controlled resin-processing capability, stable wall-thickness precision, and strong supply relationships with leading Japanese beverage bottlers. Its packaging solutions provide consistent sealing performance and reliable compatibility with high-speed filling operations. Nihon Yamamura Glass Co., Ltd. maintains strong participation through PET and hybrid packaging lines used for food and drink applications where dimensional accuracy and controlled barrier properties are required. Takemoto Yohki Co., Ltd. supports demand in cosmetics and personal-care categories with containers offering predictable molding quality and secure closure fit essential for retail handling.

Kureha Corporation contributes presence through high-barrier resin technology applied in specialized containers that preserve flavour retention and shelf-life stability. Alpla Japan provides PET bottle capacity through its regional operations, supplying global and domestic brands with lightweight rigid packaging that aligns with recyclability programs. Competition in Japan focuses on design precision, barrier stability, recyclability compatibility, light weighting, and dependable supply logistics as manufacturers rely on rigid plastic containers that meet product-quality expectations and sustainability requirements in Japanese distribution environments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Capacity | Below 1 liter, Above 1 liter |

| Material | Polyethylene terephthalate (PET), High-density polyethylene (HDPE), Polypropylene (PP), Polyvinyl chloride (PVC) |

| End Use | Food and beverages, Chemicals, Pharmaceuticals, Agrochemicals, Petroleum and lubricants, Paints, Oleochemicals, Industrial coatings, Flavor and fragrances, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Yoshino Kogyosho Co., Ltd., Nihon Yamamura Glass Co., Ltd., Takemoto Yohki Co., Ltd., Kureha Corporation, Alpla Japan |

| Additional Attributes | Demand influenced by Japan’s recycling mandates (PET bottle recycling initiatives), growth in convenience beverages and health drinks, adoption of lightweight and eco-efficient designs; sector-wise differentiation with stronger demand from food & beverages and pharmaceuticals; regional consumption driven by industrial clusters in Kanto and Chubu; shift toward bio-based and recycled polymers for sustainability compliance. |

The demand for plastic bottle in Japan is estimated to be valued at USD 48.5 million in 2025.

The market size for the plastic bottle in Japan is projected to reach USD 60.2 million by 2035.

The demand for plastic bottle in Japan is expected to grow at a 2.2% CAGR between 2025 and 2035.

The key product types in plastic bottle in Japan are below 1 liter and above 1 liter.

In terms of material, polyethylene terephthalate (pet) segment is expected to command 54.0% share in the plastic bottle in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Japan Bio-Plasticizers Market Analysis – Size, Share & Forecast 2025-2035

Japan Flexible Plastic Packaging Market Report – Demand, Trends & Industry Forecast 2025-2035

Japan Aluminium Bottle Market Insights – Growth, Demand & Trends 2025-2035

Plastic Medicine Bottles Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Plastic Medicine Bottles Manufacturers

Vietnam Plastic Bottle Market Analysis by Capacity, Material, End-use, and Region Forecast Through 2035

Demand for Plastic Bottle in USA Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Demand for Balsam Bottle in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bullet Bottles in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Conductive Plastics in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Glass Cosmetic Bottles in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Foldable Plastic Pallet Boxes in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Child Resistant Bottles in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA