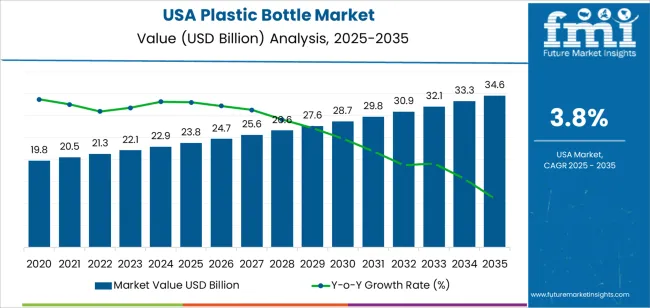

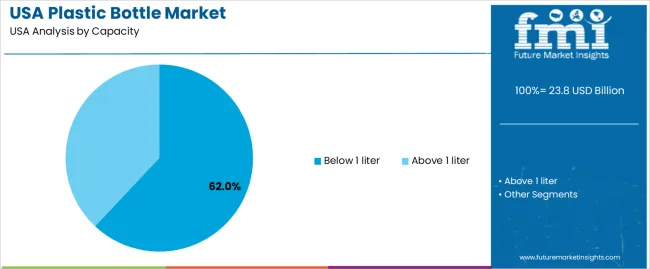

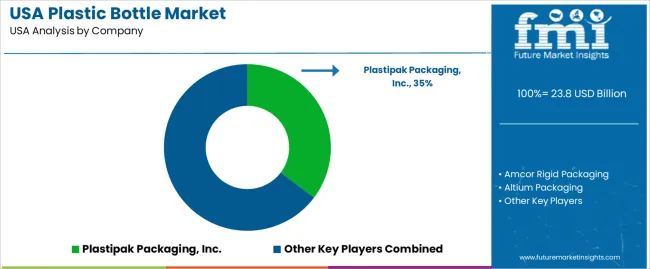

The USA plastic bottle demand is valued at USD 23.8 billion in 2025 and is forecasted to reach USD 34.5 billion by 2035, reflecting a CAGR of 3.8%. Demand is driven by extensive use of rigid plastic containers in beverages, household cleaning, packaged foods, pharmaceuticals, and personal care products. Lightweight formats, high production efficiency, and established compatibility with large-scale filling and distribution operations continue to reinforce adoption across consumer and industrial sectors. Bottles with capacities below 1 liter hold the leading share. These formats support convenience-driven consumption, portion-controlled packaging, and competitive pricing in bottled water, soft drinks, on-the-go beverages, and personal care fluids. Design improvements in closures, barrier layers, and recyclability performance also influence procurement decisions for brand owners.

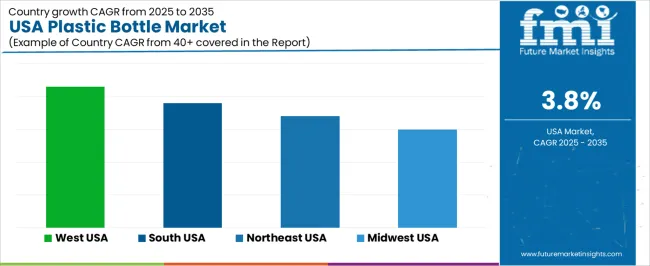

West USA, South USA, and Northeast USA account for the highest consumption due to strong beverage manufacturing clusters, high urban penetration, and active distribution networks linked to major retail chains. Sustainability initiatives, recycling mandates, and the transition toward food-grade recycled PET promote incremental shifts in procurement strategies while maintaining strong baseline demand. Key suppliers include Plastipak Packaging, Inc., Amcor Rigid Packaging, Altium Packaging, Silgan Plastics, and Berry Global Inc. These companies provide PET, HDPE, and PP bottles used for high-volume consumer packaging applications across national brand portfolios and private-label product lines.

Demand for plastic bottles in the United States demonstrates a defined peak-to-trough pattern shaped by shifts in packaging regulation, consumer behavior, and material substitution trends. The growth peak in the earlier forecast period is supported by strong volume consumption in beverages, household chemicals, and personal-care products. Lightweight characteristics, cost efficiency, and extensive bottling infrastructure sustain high adoption across mass-market distribution channels. Continued demand for bottled water and ready-to-drink beverages reinforces this upward segment.

The trough emerges in later years as ecofriendly imperatives intensify. State-level restrictions on single-use plastics, expanding bottle-return legislation, and retailer commitments to reduce virgin-plastic USAge contribute to deceleration. Increased penetration of aluminum, paper-based containers, and refill-package formats lowers demand elasticity. Consumer preference for eco-label alternatives, coupled with brand accountability targets, shifts procurement away from conventional PET and HDPE variants.

Recovery potential depends on circular-materials innovation, including food-grade recycled content, bio-resins, and chemical-recycling scale-up. Although demand does not contract sharply, the peak-to-trough curve reflects a structural adjustment from volume-driven growth toward value-driven, regulated consumption aligned with ecofriendly frameworks and environmental-compliance goals in the United States packaging landscape.

| Metric | Value |

|---|---|

| USA Plastic Bottle Sales Value (2025) | USD 23.8 billion |

| USA Plastic Bottle Forecast Value (2035) | USD 34.5 billion |

| USA Plastic Bottle Forecast CAGR (2025-2035) | 3.8% |

Demand for plastic bottles in the USA is increasing because beverage, personal care and household product companies rely on lightweight and durable packaging that supports high speed filling and nationwide distribution. Bottles made from PET and HDPE remain preferred options for water, carbonated drinks, juices, detergents and nutritional products because they offer clarity, strength and cost efficiency. Growth in on the go consumption and convenience packaging supports steady demand for single serve formats. The rise of e commerce grocery deliveries also encourages the use of shatter resistant bottles that withstand transportation handling. Manufacturers continue to develop improved resin grades and lightweight designs that reduce material use while maintaining performance.

Ecofriendly initiatives drive additional investment in bottles with recycled content and improved recyclability. Many USA brands commit to packaging targets that include higher use of post-consumer resin, which supports domestic recycling infrastructure. Constraints include environmental concerns related to single use plastics, policy shifts promoting waste reduction and competition from alternative packaging such as aluminum cans and cartons. Fluctuation in resin prices may also influence purchasing decisions for cost sensitive product categories.

Demand for plastic bottles in the United States is driven by high consumption of packaged beverages, personal care items, and chemical products that require lightweight, durable, and portable packaging. The industry remains supported by standardized filling lines, broad recycling infrastructure for common polymers, and compliance with food-contact regulations. Format selection depends on transport efficiency, barrier performance, compatibility with product formulation, and retailer shelf-fit requirements. Manufacturers focus on resin optimization, weight reduction, and enhanced recyclability aligned with ecofriendly policies.

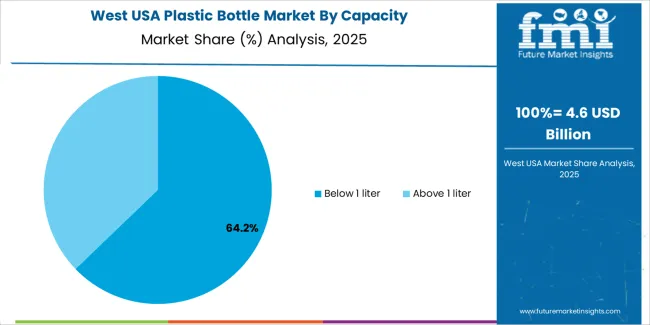

Bottles under 1 liter account for 62.0%, supported by mass-market beverage products, single-serve consumption patterns, and demand from household cleaners and toiletries. These packs align with USA retail expectations for portability, portion control, and ease of handling across logistics operations. Products above 1 liter hold 38.0%, largely servicing bulk formats for chemicals, edible oils, and family-size beverages in club-store channels. Design priorities include stacking strength, cap integrity, and compatibility with automated filling lines. Industry structure favors formats that suit refrigerators, vending, and on-the-go retail. Lower transport weight and high-volume SKU turnover reinforce dominance of the sub-1-liter format in everyday consumer purchasing.

Key points:

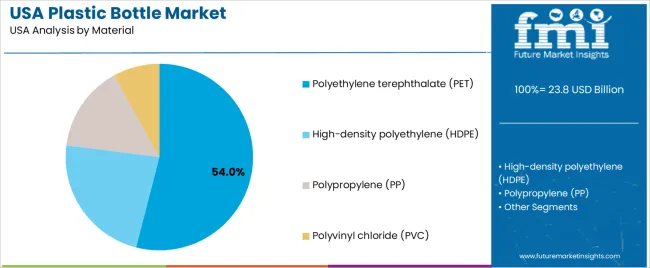

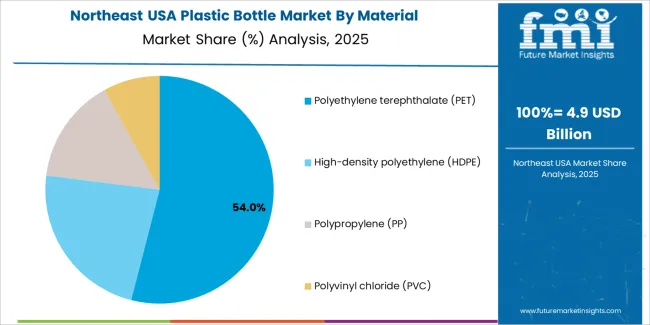

Polyethylene terephthalate (PET) holds 54.0% due to clarity, carbonation retention, and strength needed for beverages. HDPE (23.0%) supports opaque products such as detergents and dairy. Polypropylene (15.0%) serves heat-resistant uses in specialty food and healthcare packaging. PVC (8.0%) remains limited because of recycling challenges and regulatory caution. Material selection in the United States is influenced by recyclability under extended producer responsibility initiatives and contamination control for food-grade applications. PET lifecycle improvements support increased adoption of recycled PET feedstock. Procurement teams evaluate barrier needs, top-load strength, and resin availability, while brand owners optimize designs for lower emissions throughout logistics networks.

Key points:

Food and beverage applications represent 28.0%, driven by bottled water, ready-to-drink beverages, and cooking oil packaging with high purchase frequency. Chemicals account for 17.0%, covering industrial cleaning products and hazardous-material compliant formats. Pharmaceuticals hold 12.0%, requiring strict handling and traceability. Remaining segments, including agrochemicals, petroleum lubricants, paints, oleochemicals, industrial coatings, fragrances, and other uses, share the remainder with stability requirements based on product characteristics. Consumer-facing categories maintain streamlined supply chains through national retail networks and online fulfillment. Industrial sectors require specialized caps, internal coatings, and certifications to withstand active ingredients and transport conditions across the United States.

Key points:

Strong consumption of bottled beverages, expansion of household and personal care packaging lines and high retail demand for portable containers are driving demand. In the United States, plastic bottles remain a primary packaging format for bottled water, carbonated soft drinks, sports beverages and ready-to-drink teas produced in large manufacturing hubs across the Midwest and Southeast. Consumers prioritize portability and resealability in daily beverage use, reinforcing demand for PET and HDPE bottles in convenience and grocery channels. Household cleaners, laundry detergents and personal care products rely heavily on plastic bottles for dosing and safety requirements, keeping procurement steady among major CPG producers. Growth in warehouse club sales and multi-pack retail formats further supports high-volume production of plastic bottles for nationwide distribution.

Environmental regulation pressures, increased focus on refill systems and state laws limiting single-use plastics restrain adoption.Several USA states introduce mandates that target reductions in single-use plastics or impose recycled-content requirements, raising compliance costs for manufacturers. Public pressure to reduce plastic waste leads some consumers to prefer aluminum cans, cartons or reusable bottles, especially in coastal states where ecofriendly awareness is high. Retailers and municipalities promote refill programs for cleaning supplies and water stations in public spaces, which reduce reliance on disposable plastic bottles in specific categories. These influences create gradual shifts that temper long-term volume growth in certain product types.

Brands are increasing recycled PET USAge to meet corporate ecofriendly targets and state regulatory requirements that prioritize recycled content. Light weighting technology reduces resin use and shipping weight, supporting packaging efficiency in large national distribution networks. E-commerce channels for household and personal care liquids rely on durable plastic bottles that resist leakage during parcel transport, maintaining strong packaging demand in online fulfillment. Recyclable closures and simplified label removal are gaining focus to improve bottle recovery in USA recycling facilities. These trends support ongoing modernization of plastic bottle packaging while adapting to ecofriendly priorities in the United States.

Demand for plastic bottles in the United States is influenced by consumption patterns in beverages, household-care products, personal-care packaging, and pharmaceutical distribution. Industrial infrastructure, ecofriendly commitments, and resin availability affect regional growth. West USA leads at 3.2%, followed by South USA (2.8%), Northeast USA (2.5%), and Midwest USA (2.2%).

| Region | CAGR (2025-2035) |

|---|---|

| West USA | 3.2% |

| South USA | 2.8% |

| Northeast USA | 2.5% |

| Midwest USA | 2.2% |

West USA records 3.2% CAGR, shaped by beverage consumption intensity, advanced packaging converters, and proximity to recycling infrastructure. California and Washington retain strong distribution networks for bottled drinking water, ready-to-drink teas, and electrolyte beverages that rely on PET formats for portability and durability. High participation in outdoor and commuting activities results in stable demand for single-serve bottles, while retail club formats distribute multi-pack containers to family households. Personal-care brands concentrated in coastal metros produce HDPE and PET bottles for shampoos, soap, and skincare lines distributed nationwide. Access to maritime ports strengthens resin procurement and recycled PET supply stability, integrating circular-economy processes into manufacturing. The region experiences continuous investments in blow-molding and automated filling equipment supporting efficient changeovers for seasonal demand shifts. Municipal recycling programs improve bale availability for rPET supply, supporting gradual ecofriendly transitions.

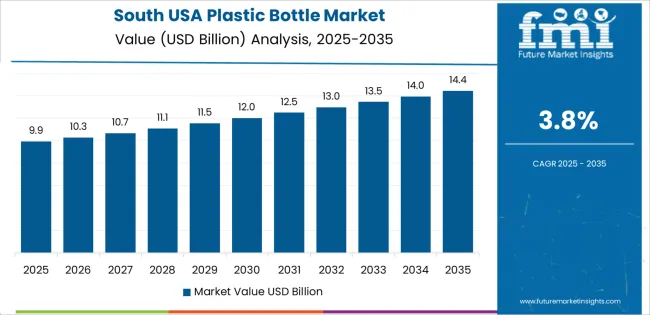

South USA grows at 3.8% CAGR, supported by high-volume beverage bottling, household-care manufacturing, and distribution activity across Texas, Florida, Georgia, and North Carolina. Warm climate zones sustain strong bottled-drink requirements throughout the year, affecting PET and HDPE procurement patterns. Regional consumer-goods plants package detergents, cleaners, and surface-care products using standardized plastic bottles compatible with large-scale filling systems. Inbound logistics through Gulf Coast ports facilitate resin availability, encouraging efficient supply chains for packaging converters. Growth in suburban populations increases demand for multi-serve beverage containers and economy pack household liquids. Distribution centers in Atlanta and Dallas support outbound transportation of packaged liquids to national retailers, reinforcing baseline volumes. Procurement decisions focus on bottle-strength performance, inventory stability, and compatibility with established capping and shrink-label workflows observed across major manufacturing lines.

Northeast USA expands at 2.5% CAGR, driven by convenience-driven beverage consumption and pharmacy-linked packaging requirements in New York, New Jersey, and Massachusetts. Compact living spaces and transit-oriented lifestyles support smaller packaged beverage formats intended for immediate use. Retailers in dense metros rely on PET bottles for water and functional drinks that move quickly through convenience and corner-store channels. Healthcare and pharmaceutical distributors require HDPE bottles for prescription medicines, liquid formulations, and medical-grade solutions deployed across hospital systems. Consumer-goods packaging suppliers operate smaller-footprint production sites designed for multi-SKU changeovers. Regional recycling frameworks supply rPET used in selected high-volume bottle lines, improving packaging ecofriendly alignment. Seasonal tourism activity increases bottled-water sales during peak travel months, supporting short-term volume surges in distribution networks.

Midwest USA grows at 2.2% CAGR, influenced by dairy packaging, processed-food distribution, and household-product manufacturing across Illinois, Ohio, Michigan, and Wisconsin. HDPE bottles maintain essential roles in milk, nutritional beverages, and refrigerated product lines widely consumed in the region. Local filling plants use established bottling infrastructure that supports operational continuity rather than rapid expansion. Household-cleaner and automotive-fluid packaging rely on durable bottle designs that deliver handling reliability and compatibility with high-speed manufacturing lines. Procurement cycles reflect cost-focused decision-making tied to long equipment life. Distribution corridors across Chicago and Indianapolis manage transportation of packaged liquids to national retail hubs, maintaining consistent baseline bottle movement. Buyers evaluate new materials only when performance matches legacy standards for sealing strength and shelf-life preservation.

Demand for plastic bottles in the USA is supported by converters supplying PET and HDPE containers to beverage, household-care, and personal-care manufacturers. Plastipak Packaging, Inc. holds an estimated 35.3% share, driven by controlled resin processing, light weighting technology, and extensive supply relationships with soft-drink, dairy, and water bottlers across the country. Its containers deliver consistent wall-thickness stability and production efficiency aligned with high-volume filling lines. Amcor Rigid Packaging maintains strong participation through PET bottle supply for beverages and food products that require reliable barrier performance and predictable throughput on USA packaging equipment. Altium Packaging contributes meaningful share with HDPE bottles manufactured for household cleaners and industrial products, emphasizing durability and nationwide service coverage.

Silgan Plastics supports domestic demand with containers designed for food, dairy, and personal-care categories that require tight dimensional control and secure closure compatibility. Berry Global Inc. adds capacity across personal care, healthcare, and nutraceutical applications with bottles delivering consistent molding precision and established USA distribution. Competition in the USA centers on light weighting, recyclability compatibility, resin-quality control, wall-thickness uniformity, and supply-chain reliability. Demand remains steady as consumer brands require rigid packaging that balances durability with reduced material consumption across USA filling and retail systems.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Capacity | Below 1 liter, Above 1 liter |

| Material | Polyethylene terephthalate (PET), High-density polyethylene (HDPE), Polypropylene (PP), Polyvinyl chloride (PVC) |

| End Use | Food and beverages, Chemicals, Pharmaceuticals, Agrochemicals, Petroleum and lubricants, Paints, Oleochemicals, Industrial coatings, Flavor and fragrances, Others |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Plastipak Packaging, Inc., Amcor Rigid Packaging, Altium Packaging, Silgan Plastics, Berry Global Inc. |

| Additional Attributes | Includes segmentation by capacity and polymer type, recyclability initiatives, light weighting trends, barrier properties enhancement for sensitive products, integration with eco-friendly packaging mandates, high adoption across beverages, household chemicals, and healthcare sectors, with volume demand influenced by FMCG consumption patterns and industrial packaging requirements across USA regions. |

The demand for plastic bottle in USA is estimated to be valued at USD 23.8 billion in 2025.

The market size for the plastic bottle in USA is projected to reach USD 34.6 billion by 2035.

The demand for plastic bottle in USA is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in plastic bottle in USA are below 1 liter and above 1 liter.

In terms of material, polyethylene terephthalate (pet) segment is expected to command 54.0% share in the plastic bottle in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

USA Bio-Plasticizers Market Report – Size, Share & Forecast 2025-2035

USA Flexible Plastic Packaging Market Insights – Trends, Demand & Growth 2025-2035

USA Aluminium Bottle Market Insights – Demand, Size & Industry Trends 2025-2035

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

Plastic Medicine Bottles Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Plastic Medicine Bottles Manufacturers

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Vietnam Plastic Bottle Market Analysis by Capacity, Material, End-use, and Region Forecast Through 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Demand for Bioplastics in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Balsam Bottle in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Conductive Plastics in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Glass Cosmetic Bottles in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Foldable Plastic Pallet Boxes in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Child Resistant Bottles in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in USA Size and Share Forecast Outlook 2025 to 2035

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA