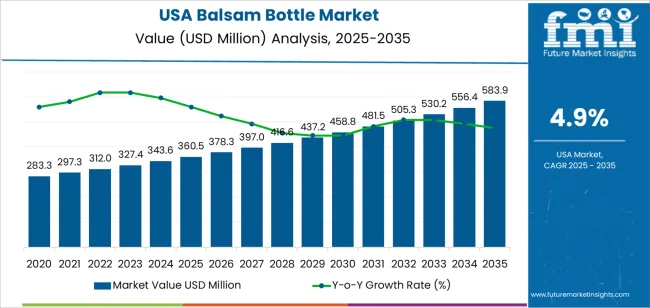

In 2025, the demand for balsam bottles in the USA is valued at USD 360.5 million and is projected to reach USD 583.9 million by 2035 at a CAGR of 4.9%. The growth contribution during the first half of the forecast period from 2025 to 2030 adds roughly USD 98.3 million in value as demand rises from USD 360.5 million to about USD 458.8 million. This initial contribution is driven by stable use across pharmaceutical syrups, essential oils, herbal extracts, and specialty food products. Retail packaging replacement cycles, steady health supplement demand, and controlled expansion in personal care applications form the core contributors during this phase.

From 2030 to 2035, the market contributes a higher absolute value of about USD 125.1 million as demand increases from roughly USD 458.8 million to USD 583.9 million. This later phase accounts for the larger share of total incremental growth under the growth contribution index. Value expansion during this block is supported by broader use in premium liquid supplements, therapeutic oils, and specialty wellness packaging. Higher unit pricing linked to design differentiation, improved seal systems, and material upgrades also strengthens value contribution. Distribution remains concentrated across pharmaceutical, nutraceutical, and specialty retail packaging supply chains within the USA.

Between 2020 and 2025, the acceleration pattern for balsam bottle demand in USA remains moderate and structurally smooth. Market value rises from USD 283.3 million in 2020 to USD 360.5 million in 2025, with annual additions gradually widening from about USD 14.0 million to roughly USD 16.9 million. This reflects a controlled acceleration phase driven by steady expansion in pharmaceuticals, wellness products, specialty liquids, and premium personal care packaging. The growth rate during this window strengthens incrementally but remains guarded, indicating that demand is expanding through consistent brand scaling and format upgrades rather than abrupt usage shifts. No deceleration appears in this phase, confirming stable procurement cycles and predictable channel growth.

From 2025 to 2035, the acceleration pattern becomes more pronounced in absolute terms even as the percentage growth stabilizes. Demand increases from USD 360.5 million to USD 583.9 million, adding USD 223.4 million over ten years. Annual absolute increments rise steadily from around USD 17.8 million to more than USD 27.5 million by the final years. This signals sustained acceleration rather than slowdown, driven by expanding use of balsam bottles in aromatherapy, nutraceutical liquids, herbal extracts, and premium personal care formulations. Deceleration is not structurally visible in the data set, as rising value per unit and broader product penetration continue to offset saturation risks.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 360.5 million |

| Forecast Value (2035) | USD 583.9 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

Demand for balsam bottles in the USA has grown as glass packaging demand expands in food, beverage, cosmetics, and specialty products. Glass bottles remain favored for their chemical inertness, recyclability, and premium appearance. Producers of craft beverages, natural personal-care products, essential oils, and aromatherapy items gravitate toward glass containers to preserve product integrity and reinforce brand value. As glass container demand in the US continues to rise across sectors, bottles designed for specialized contents such as balsam extracts benefit from the overall glass-packaging growth momentum. The trend toward sustainable packaging further supports this steady uptake of balsam-style bottles.

Looking ahead, the US market for balsam bottles could grow as consumers increasingly favour natural, clean-label, and environmentally friendly product formats. Growth in wellness, aromatherapy, botanical extracts, and premium personal-care segments will raise demand for glass containers that protect sensitive contents and offer aesthetic value. Balsam bottles may also see rising use in niche food and supplement applications where shelf stability and inert packaging matter. Adoption will depend on balancing cost of glass production, demand for lightweight logistics, and consumer readiness to pay for premium packaging.

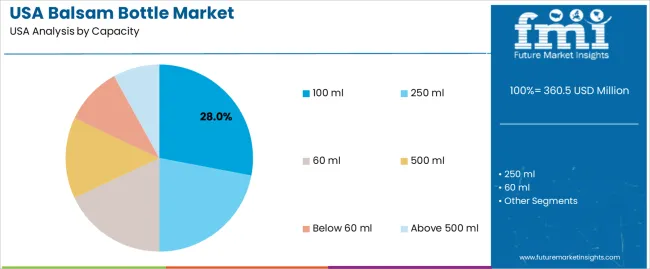

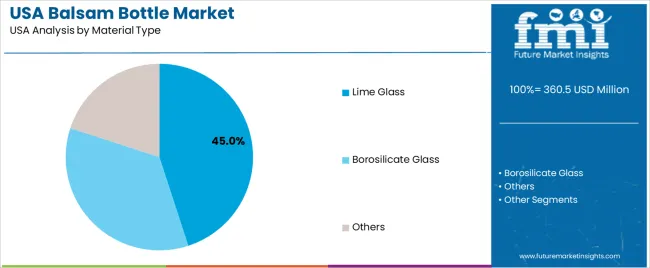

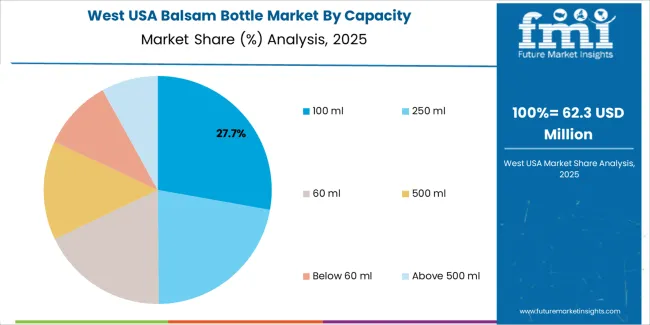

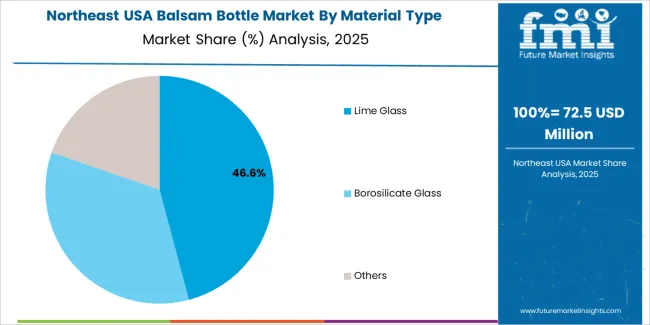

The demand for balsam bottles in the USA is structured by capacity and material type. The 100 ml capacity segment accounts for 28% of total demand, followed by 60 ml, 250 ml, 500 ml, below 60 ml, and above 500 ml formats used across pharmaceutical, personal care, aromatherapy, and cosmetic applications. By material type, lime glass leads with a 45.0% share, followed by borosilicate glass and other materials. Demand patterns reflect dosage requirements, product concentration, portability needs, and chemical compatibility. These segments show how filling volume preferences and glass performance characteristics guide balsam bottle selection across retail, clinical, and professional use in the USA.

The 100 ml capacity segment accounts for 28% of total balsam bottle demand in the USA. This leadership reflects its balance between portability and sufficient product volume for regular consumer use. The size is widely used for medicated balms, essential oil blends, massage formulations, and topical treatments sold through pharmacies, wellness stores, and online platforms. It suits consumer purchasing behavior that favors compact packaging without frequent repurchasing.

The 100 ml format also aligns with standardized filling lines and labeling equipment used by mid scale and large scale producers. Storage efficiency in cartons and retail shelving further supports its adoption. The size is accepted across both prescription and over the counter product categories. These retail handling, production efficiency, and consumer convenience factors sustain the 100 ml category as the leading capacity segment for balsam bottles in the USA.

Lime glass accounts for 45.0% of total material demand for balsam bottles in the USA. Its dominance reflects strong chemical resistance, good thermal stability, and cost efficiency for large volume production. Lime glass performs reliably with essential oils, ointments, and alcohol based formulations without leaching or container degradation under standard storage conditions.

Manufacturing scalability further supports lime glass adoption. It is compatible with automated forming, annealing, and decoration processes used in domestic glass packaging plants. Clear and amber lime glass variants offer flexibility for light sensitive products. Replacement demand remains steady from pharmaceutical refill cycles and wellness product turnover. These performance, processing, and cost control advantages position lime glass as the dominant material choice for balsam bottles across the USA.

Demand for balsam bottles in the USA is driven by steady consumption of balsamic vinegar, infused vinegars, and gourmet condiments across retail and foodservice channels. Home cooking trends, premium salad dressings, and Mediterranean-style diets support consistent retail movement. Specialty food brands use balsam bottles as both functional containers and visual identifiers for authenticity and quality. Growth in private-label gourmet ranges at large retailers increases volume demand for standardized balsam bottle formats. These food consumption and branding dynamics sustain baseline demand across both mass and premium condiment segments.

In the USA, balsam bottle demand is shaped by specialty grocery stores, restaurant supply chains, and direct-to-consumer food brands. Gourmet retailers favor tall, narrow glass bottles that signal premium positioning and controlled pouring. Foodservice kitchens require consistent bottle shapes for speed, storage efficiency, and portion control. E-commerce adds new performance expectations around leak resistance, cap security, and breakage reduction during shipping. Subscription food boxes and artisanal vinegar brands further expand smaller-batch bottle demand. These multi-channel distribution patterns broaden usage beyond traditional grocery shelf sales.

Balsam bottle growth in the USA is restrained by glass weight, transport cost, and breakage risk during long-haul distribution. Rising energy input cost for glass manufacturing affects pricing stability for bottle suppliers. Lightweight plastic alternatives compete in value-oriented segments, limiting full-category migration to glass. Minimum order volumes for custom bottle molds restrict adoption by small producers. Recycling standards and color sorting also influence material selection. These production, logistics, and cost factors constrain aggressive expansion outside mid-to-premium condiment price tiers.

Balsam bottle design in the USA is shifting toward lightweight flint glass, recycled content, and refill-friendly formats for sustainability alignment. Precision pour spouts and anti-drip closures gain importance as consumers use balsamic vinegar for finishing oils and table service. Premium food branding favors minimalist labels paired with sculpted glass for shelf differentiation. Reuse-driven consumer habits also boost demand for decorative bottles suited for refill from bulk vinegar formats. These trends show balsam bottles evolving from simple vinegar containers into repeat-use, presentation-driven components of gourmet food packaging.

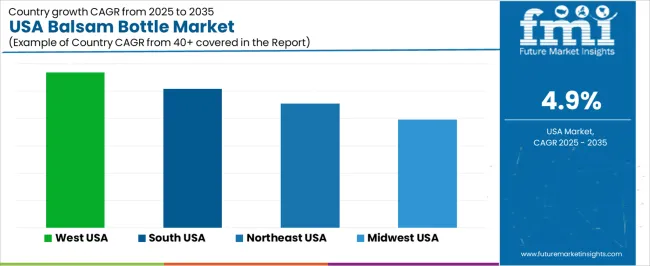

| Region | CAGR (%) |

|---|---|

| West | 5.7% |

| South | 5.1% |

| Northeast | 4.5% |

| Midwest | 4.0% |

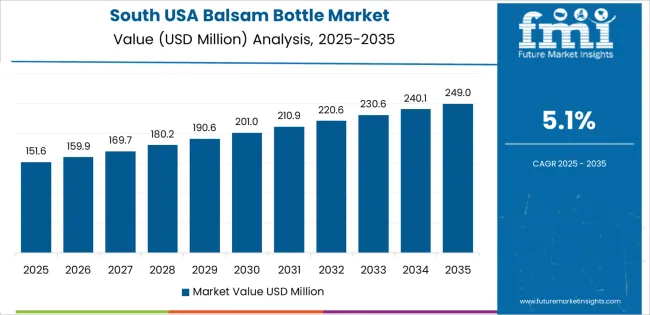

The demand for balsam bottles in the USA shows regional variation with the West leading at a 5.7% CAGR. This may reflect higher demand for balsam-based products such as personal care items, aromatherapy oils, or hair care solutions in western states. The South at 5.1% growth suggests rising usage in consumer goods and possibly increases in regional manufacturing or imports. The Northeast’s 4.5% growth indicates moderate demand, likely influenced by urban retail demand for bottled balsam products. The Midwest’s 4.0% growth reflects slower uptake, potentially due to lower market penetration of such niche products. Overall this trend points to steady growth in demand for packaging suited to balsam-based products across the USA, with stronger adoption in regions with robust consumer markets.

Growth in the West reflects a CAGR of 5.7% through 2035 for balsam bottle demand, supported by strong presence of natural wellness brands, premium herbal product packaging, and high consumer preference for glass based containers. Skincare serums, essential oils, and therapeutic balms rely heavily on small volume balsam bottles for controlled dispensing. Coastal personal care manufacturing clusters maintain steady custom packaging orders. Sustainability oriented retail positioning also favors reusable glass formats. Demand remains design and product positioning driven rather than volume led, with premium unit pricing supporting steady revenue growth across wellness and beauty categories.

The South advances at a CAGR of 5.1% through 2035 for balsam bottle demand, driven by expanding personal care production, herbal remedy packaging, and regional contract filling operations. Skincare creams, beard care products, and topical ointments represent major application segments. Warm climate conditions support year round retail movement of topical wellness products. Small and mid sized brands rely on regional packaging distributors for short run bottle supply. Demand remains balanced between cost control and aesthetic value, with steady growth supported by rising private label personal care manufacturing.

The Northeast records a CAGR of 4.5% through 2035 for balsam bottle demand, shaped by dense urban skincare markets, apothecary style wellness brands, and strong premium cosmetic consumption. Botanical balms, lip care products, and therapeutic salves rely on compact glass packaging formats. Pharmacy and specialty wellness retail support consistent reorder cycles. Cold weather conditions increase demand for moisturizing and skin protection products during extended seasonal periods. Demand remains stability driven, with repeat purchases from established wellness brands rather than expansion from mass market personal care producers.

The Midwest expands at a CAGR of 4.0% through 2035 for balsam bottle demand, supported by regional herbal producers, private label personal care manufacturing, and steady over the counter wellness product output. Aromatherapy blends, muscle relief balms, and medicated ointments account for most bottle consumption. Manufacturing led demand outweighs branding driven design requirements. Bottle sourcing remains standardized with limited customization. Demand stays production driven and predictable, aligned with stable output from regional personal care plants rather than fast changing beauty retail cycles seen in coastal markets.

Demand for balsam bottles in the USA is rising as producers of cosmetics, pharmaceuticals, essential oils, and premium personal care products increasingly seek glass or specialty bottles that combine visual appeal with chemical safety and storage integrity. Glass containers are preferred for their inertness, preservative free nature and ability to preserve fragrance, purity, and shelf life of sensitive contents. Growth in consumer interest toward natural, high quality, and artisanal products fuels use of balsam bottles for packaging perfumes, serums, tinctures, and boutique wellness items. The trend toward small batch, premium cosmetics and therapeutic products supports demand for bottles that deliver both functionality and perceived product value.

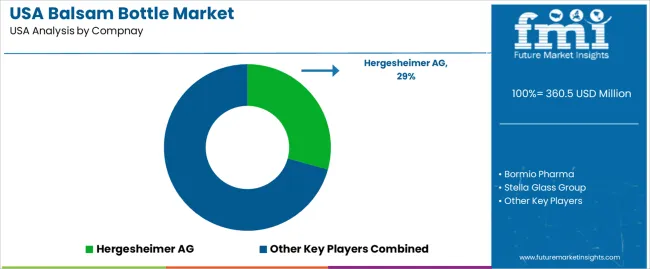

Key suppliers shaping the balsam bottle supply base in the USA include Hergesheimer AG, Bormio Pharma, Stella Glass Group, Berlin Packaging, and Beatson Clark. Hergesheimer AG leads among specialist glass bottle providers for pharmaceutical grade and cosmetic grade packaging. Bormio Pharma and Stella Glass Group supply bottles designed for niche cosmetics, essential oils, and luxury personal care items. Berlin Packaging serves broader markets with both glass and plastic balsam bottle options. Beatson Clark offers lightweight and recyclable glass bottles suited to eco conscious brands. Together these firms supply a range of bottle types from high barrier glass to design driven cosmetic containers supporting diverse end uses from wellness to luxury cosmetics and small batch pharmaceutical or aromatherapy packaging.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Capacity | 100 ml, 60 ml, 250 ml, 500 ml, below 60 ml, above 500 ml |

| Material Type | Lime Glass, Borosilicate Glass, Others |

| End-Use | Commercial Use, Domestic Use |

| Sales Channel | Offline, Online |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Hergesheimer AG, Bormio Pharma, Stella Glass Group, Berlin Packaging, Beatson Clark |

| Additional Attributes | Dollar-value distribution by capacity and material type; regional CAGR projections; 100 ml segment leads due to portability and usage convenience; lime glass dominates for chemical resistance and cost efficiency; commercial and domestic end use each anchor distinct consumption bases; growth between 2025–2030 driven by pharmaceuticals, essential oils, and personal care, adding USD 98.3 million; post-2030 expansion adds USD 125.1 million supported by premium liquid supplements, aromatherapy, and specialty wellness packaging; distribution anchored in US retail, pharmaceutical, and wellness supply chains; supplier focus on seal system improvements, material upgrades, and niche packaging solutions; sustained adoption in aromatherapy, herbal extracts, and nutraceutical segments; back-weighted value growth observed with higher unit pricing and premiumization. |

The demand for balsam bottle in USA is estimated to be valued at USD 360.5 million in 2025.

The market size for the balsam bottle in USA is projected to reach USD 583.9 million by 2035.

The demand for balsam bottle in USA is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in balsam bottle in USA are 100 ml, 250 ml, 60 ml, 500 ml, below 60 ml and above 500 ml.

In terms of material type, lime glass segment is expected to command 45.0% share in the balsam bottle in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Balsam Bottle Market Analysis – Size, Growth & Forecast 2025 to 2035

USA Aluminium Bottle Market Insights – Demand, Size & Industry Trends 2025-2035

Reusable Water Bottle Market Forecast and Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Demand for Plastic Bottle in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Glass Cosmetic Bottles in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Child Resistant Bottles in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA