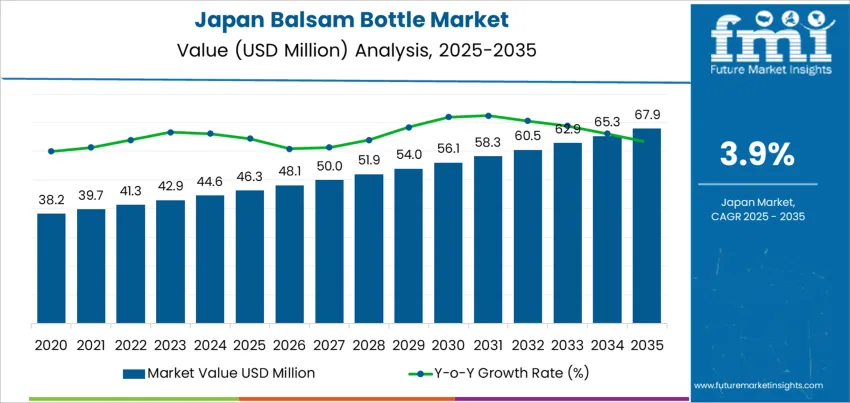

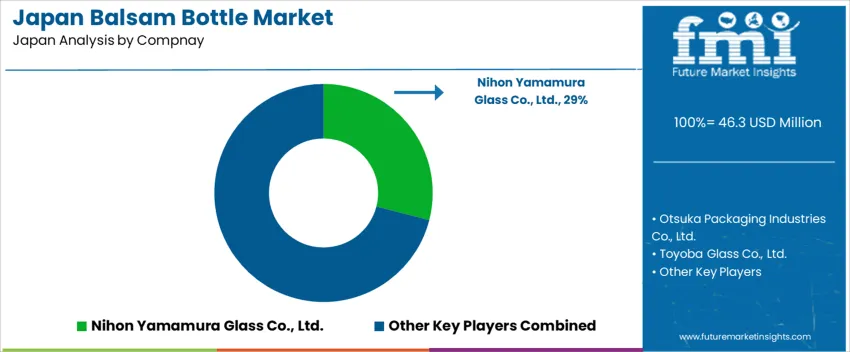

The Japan balsam bottle demand is valued at USD 46.3 million in 2025 and is forecasted to reach USD 67.9 million by 2035, reflecting a CAGR of 3.9%. Demand is influenced by steady production of medicinal balms, aromatherapy formulations, topical pain relievers, and herbal wellness products. Bottles designed for viscous liquid handling remain preferred in household and pharmacy channels. Adoption is supported by product safety requirements, leakage prevention features, and compatibility with dosage-control caps used in regulated therapeutic packaging.

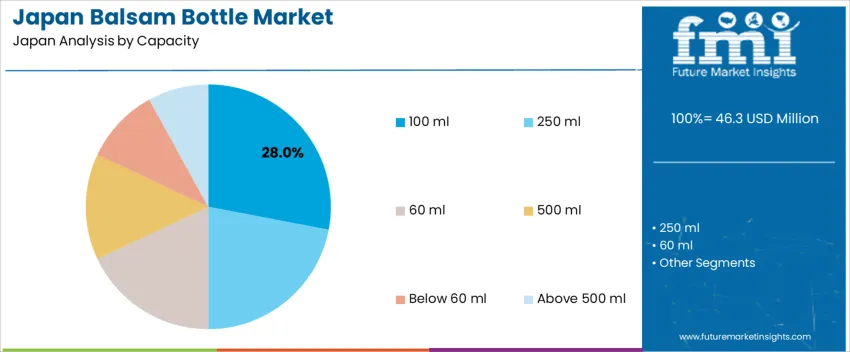

The 100 ml capacity segment leads procurement activity. This size is selected for consumer convenience, ease of handling, and suitability for retail display units. Small-format packs help maintain formulation stability while meeting dosing needs in over-the-counter segments. Advancements in glass clarity, surface finish, and compatibility with essential-oil formulations also influence material selection across private-label and branded production.

Kyushu & Okinawa, Kanto, and Kansai exhibit the highest utilization. These regions host pharmaceutical fillers, cosmetics manufacturers, logistics zones, and container decoration facilities that support continuous distribution to retail stores and healthcare outlets. Major suppliers include Nihon Yamamura Glass Co., Ltd., Otsuka Packaging Industries Co., Ltd., Toyoba Glass Co., Ltd., Mitsubishi Glass Co., Ltd., and SGD Pharma Japan. Their offerings include amber, clear, and coated balsam bottles designed for liquid pharmaceuticals, cosmetic balms, and aromatic oil formulations.

Demand for balsam bottles in Japan is moving toward a gradual saturation phase due to stable penetration in personal care and select food-grade applications. Many established shampoo, conditioner, and topical-treatment products already rely on balsam-style rigid containers, creating an industry where replacement demand outweighs new-user expansion. Product-line continuity in large consumer brands limits rapid packaging turnover, which reduces the frequency of significant volume surges.

Incremental growth continues in premium haircare and specialized dermatological formulations. These areas introduce updated ergonomics and controlled-dispensing features that support periodic refresh cycles. Ecofriendly programs encourage transitions to refill pouches and lighter packaging formats. This can reduce demand for full-bottle units, reinforcing a mature trajectory. Small batch and limited-edition launches contribute niche uplift but do not shift saturation dynamics at the broader level.

The approach toward saturation is therefore shaped by high installed use, slower replacement intervals, and selective format substitution. Growth persists, yet it is increasingly tied to design improvement and material-efficiency upgrades rather than widespread adoption, signaling a mature but resilient demand profile within Japan’s personal-care packaging environment.

| Metric | Value |

|---|---|

| Japan Balsam Bottle Sales Value (2025) | USD 46.3 million |

| Japan Balsam Bottle Forecast Value (2035) | USD 67.9 million |

| Japan Balsam Bottle Forecast CAGR (2025-2035) | 3.9% |

Demand for balsam bottles in Japan is increasing because food, household and personal care products use wide-mouth or squeezable containers that allow controlled dispensing and protect product texture. Condiments such as dressings, sauces and honey commonly use balsam-style bottles because they offer convenient handling and prevent spillage in home and foodservice settings. Growth in ready-to-use meal components and small household sizes supports use of easy-to-store bottles that maintain freshness after opening.

Personal care manufacturers adopt balsam bottles for shampoos, conditioners and body lotions where ergonomic design improves user comfort and portion control. Convenience stores and e-commerce distribution strengthen demand for containers that withstand transport while remaining compact enough for limited storage spaces in apartments. Retailers also value bottles that support clear branding and label visibility. Constraints include competition from flexible pouches that use less material and provide lower packaging cost for cost-sensitive products. Some companies reconsider balsam bottle usage to align with ecofriendly initiatives focused on lightweight materials and refillable formats. Tooling requirements and order volume minimums may also limit rapid design changes for smaller brands.

Demand for balsam bottles in Japan is supported by pharmaceutical and personal wellness product growth, including herbal extracts, essential oils, and topical solutions. Packaging decisions prioritize UV protection, safe dispensing, and break resistance to maintain product stability throughout storage and transport. Commercial users rely on standard dropper-compatible formats that align with Japan’s dosage safety regulations. Domestic consumers drive demand for smaller, easy-to-handle bottles within home care and aromatherapy routines.

The 100 ml category accounts for 28.0%, driven by dosage accuracy and compatibility with regulated pharmaceutical supply chains in Japan. 250 ml formats hold 22.0%, commonly used for spa-grade wellness liquids and herbal tonics. 60 ml bottles account for 18.0%, driven by premium aroma oils sold via retail and e-commerce. 500 ml sizes represent 14.0%, serving bulk refill needs in medical and cosmetic spaces. Compact containers below 60 ml hold 10.0%, supporting testers and travel-focused products. Above 500 ml variants hold 8.0%, serving controlled commercial storage environments. Capacity trends reflect precise dispensing requirements and compact shelf layout considerations in Japan.

Key Points:

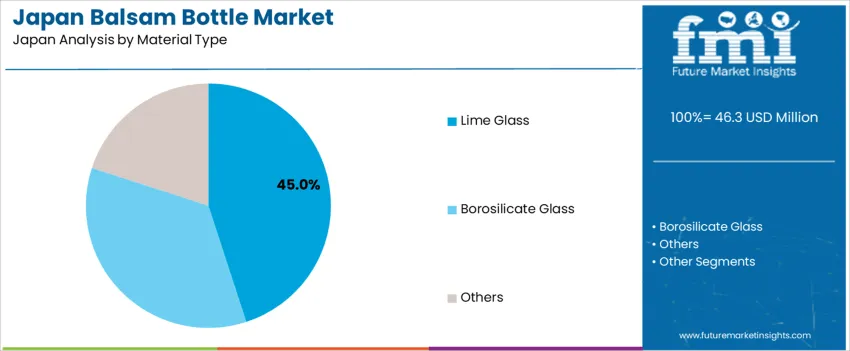

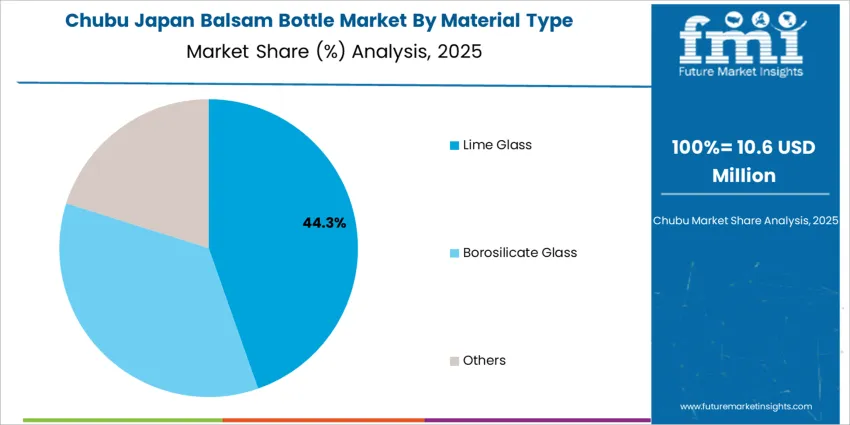

Lime glass holds 45.0%, driven by its strength, cost efficiency, and support for reliable sealing in medical packaging. Borosilicate glass accounts for 35.0%, used for products requiring chemical resistance and sterilization, including high-purity formulations. Other materials hold 20.0%, consisting of emerging lightweight glass blends and specialized protective coatings. Japanese manufacturers emphasize transparency, chemical neutrality, and sustainability. Glass remains preferred over plastics for balsam contents due to lower leaching risks and strong consumer trust associated with healthcare packaging.

Key Points:

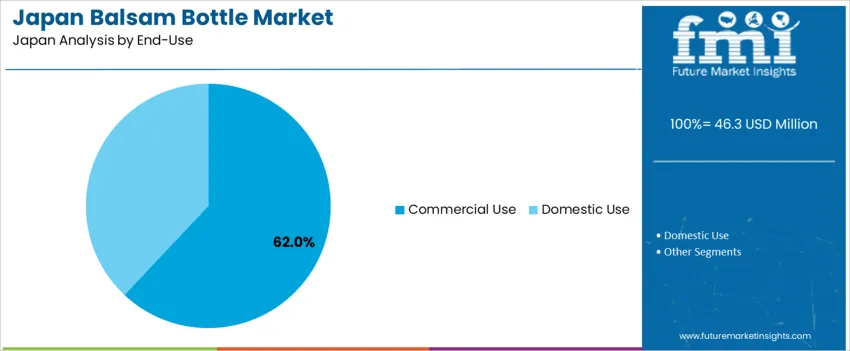

Commercial applications contribute 62.0%, supported by hospitals, pharmacies, aromatherapy producers, and cosmetic formulators requiring compliant and standardized packaging. Durable closures and calibrated capacities allow traceable distribution across Japan’s professional channels. Domestic use accounts for 38.0%, driven by rising wellness consumption and familiarity with essential oils and liquid supplements. Safety, material quality, and product lifespan remain central to consumer selection, especially for storage in compact residential spaces.

Key Points:

Growth of personal care packaging, expansion of fragrance and massage oil products, and rising demand for premium aromatherapy containers are driving demand.

In Japan, balsam bottles see consistent usage as domestic and international beauty brands expand product lines in essential oils, hair treatments and body care sold through drugstores and specialty retailers. Aromatherapy remains popular among urban consumers who purchase massage oils and diffuser blends for stress relief, particularly in Tokyo, Kanagawa and Osaka. Beauty salons and spa facilities in tourism regions such as Okinawa and Hokkaido procure balsam bottles for service products that require airtight storage and controlled dispensing. E-commerce platforms support the growth of small-scale craft brands that package handmade balms, serums and herbal extracts in amber or cobalt balsam bottles to reinforce natural positioning. These channels maintain stable demand across retail and professional environments.

Price sensitivity in mass-market channels, competition from plastic dispenser bottles and slower product rotation in niche segments restrain adoption.

Balsam bottles, often made from thick glass, carry higher production and transport costs compared with lightweight plastic containers. Mass-market shampoo, conditioner and lotion brands frequently choose squeeze bottles or pump dispensers that support rapid consumer use, limiting balsam bottle penetration outside premium categories. Niche aromatherapy and treatment oils have slower turnover rates, which reduces bottle replacement frequency for smaller brands. Some convenience-store channels avoid glass packaging due to breakage concerns during logistics, reducing visibility to commuters and impulse buyers. These dynamics create steady but controlled growth.

Shift toward higher recycled-glass content, increased compatibility with dropper and pump closures, and rising demand in refill formats define key trends.

Japanese packaging suppliers are developing balsam bottles that incorporate greater recycled glass without compromising clarity or durability, supporting ecofriendly goals in personal care. Many brands are adopting droppers and pump closures to improve dosing accuracy for oils and concentrated beauty products, expanding functional applications for balsam containers. Refill pouches promoted in drugstores encourage consumers to reuse durable glass bottles, improving alignment with household waste-reduction expectations. Limited-edition packaging collaborations for seasonal product launches reinforce premium brand positioning. These trends indicate continued, design-driven demand for balsam bottles within Japan’s beauty, wellness and aromatherapy sectors.

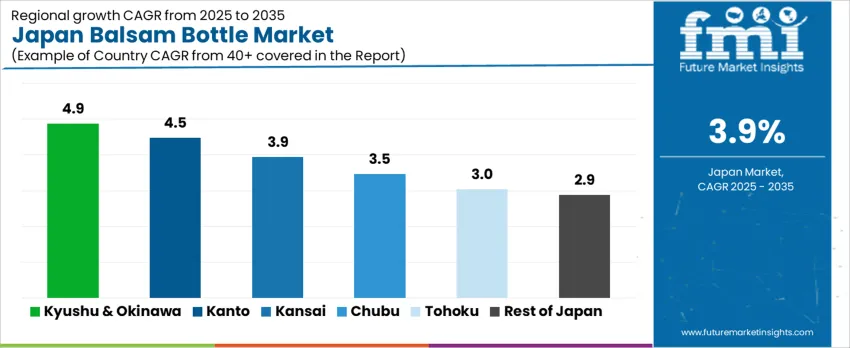

Demand for balsam bottles in Japan is linked to personal-care packaging, pharmaceutical supplies, concentrated liquid foods, and aromatherapy products. Compact storage convenience and controlled dispensing features support adoption across retail, e-commerce, and clinical channels. Growth is strongest in Kyushu & Okinawa at 4.9%, followed by Kanto (4.5%), Kansai (3.9%), Chubu (3.5%), Tohoku (3.0%), and the Rest of Japan (2.9%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.9% |

| Kanto | 4.5% |

| Kansai | 3.9% |

| Chubu | 3.5% |

| Tohoku | 3.0% |

| Rest of Japan | 2.9% |

Kyushu & Okinawa posts 4.9% CAGR, supported by local cosmetics filling operations, supplementary health products, and concentrated liquid food packaging. Okinawa’s tourism economy influences growth in compact aromatherapy products, wellness oils, and travel-friendly personal-care goods sold within hospitality stores. Beverage syrup and specialty condiment producers adopt balsam bottles for portion control in retail and catering channels. Healthcare providers in Fukuoka require pharmaceutical-grade HDPE and PET variants for applications such as antiseptic solutions and diagnostic fluid packaging. Regional manufacturers evaluate dropper-compatible neck designs that support precise usage in beauty and clinical products. Lightweight containers retain shipping efficiency during inter-island distribution, reducing breakage risk. E-commerce sellers in Kyushu rely on balsam formats due to bottle rigidity and leak-resistant closure performance during parcel handling.

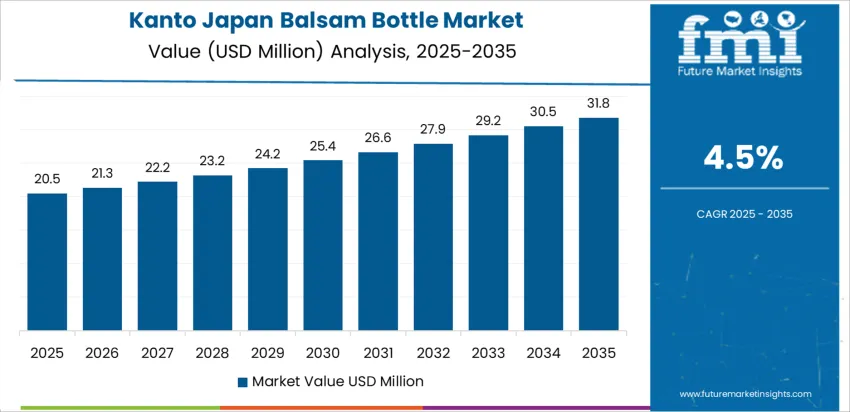

Kanto records 4.5% CAGR, influenced by major cosmetics and pharmaceutical companies operating in Tokyo, Kanagawa, and surrounding prefectures. Balsam bottles play key roles in skincare liquids, medicated serums, scalp treatments, and nasal or throat formulations distributed through pharmacies and convenience retail channels. Packaging design requirements prioritize transparency, shelf clarity, and handling safety in dense retail layouts. Hospitals and clinics in Kanto require compliant bottles for stored medical solutions with consistent closure torque control. Packaging converters in the region use high-precision molding equipment to deliver smooth surfaces suitable for printed-label application and tamper-evident sealing. Consumer products sold via online marketplaces depend on sturdy balsam bottles that protect viscosity-sensitive liquids from leakage. Manufacturers evaluate compatibility with automated filling lines to manage high SKU rotation in urban supply chains.

Kansai achieves 3.9% CAGR, driven by Osaka and Kobe facilities producing personal-care goods, over-the-counter health formulations, and liquid condiments requiring measured dispensing. Retailers focus on packaging ergonomics that support single-handed operation for everyday consumer use. Aromatherapy providers in Kyoto select smaller-volume balsam bottles suited to drop-based application and controlled diffusion devices. Beverage and sauce bottlers evaluate reinforced bottle walls to ensure shelf handling strength. Manufacturers adopt standard neck sizes compatible with common droppers and caps, reducing procurement complexity. Production workflows emphasize efficient mold changeovers due to frequent design revisions in branded lines. Packaging decisions reflect durability expectations in urban logistics pathways involving rail-based shipment.

Chubu posts 3.5% CAGR, supported by food-processing clusters in Aichi and Shizuoka producing condiments, syrups, and liquid seasonings packaged in controlled-pour bottles. Pharmaceutical distribution across Nagoya and nearby cities reinforces demand for compliant packaging able to withstand long transport distances. Packaging converters integrate manufacturing principles drawn from industrial sectors such as automotive plastics, improving neck-thread precision and side-wall alignment. Retail behavior in residential areas supports moderate volume growth for household personal-care liquids packaged in compact formats. Export-oriented producers evaluate balsam bottles for durability in maritime shipping environments.

Tohoku records 3.0% CAGR, centered around pharmaceutical and health-related liquid packaging distributed through regional hospitals and clinics. Agricultural beverage and specialty food producers select balsam bottles for extended product shelf presence. Cold-chain handling requires material performance that sustains clarity and sealing integrity at lower temperatures. Seasonal tourism creates short-term demand increases for wellness gift products requiring premium presentation. Manufacturers focus on cost-balanced adoption, choosing formats that match existing capping and labeling tools.

The Rest of Japan posts 2.9% CAGR, reflecting steady replacement-driven procurement in small-scale cosmetic workshops, regional food producers, and healthcare supply distributors. Packaging selections emphasize reliability and compatibility with multipurpose closures. Retail distribution across secondary cities relies on predictable inventory cycles, limiting sudden variation in bottle specifications. Localized freight distances reduce breakage risk, enabling adoption of glass and rigid PET variants. Seasonal specialty products contribute to limited-batch usage when branding requires packaging differentiation.

Demand for balsam bottles in Japan is driven by healthcare producers requiring rigid, light-protective containers for pharmaceuticals, herbal formulations, and liquid OTC treatments. Nihon Yamamura Glass Co., Ltd. holds an estimated 29.0% share, supported by controlled amber-glass composition, dimensional precision, and compatibility with child-resistant and dropper closures used by Japanese drug-product manufacturers. Its bottles ensure stable UV shielding and reliable structural integrity through national cold-chain and retail handling. Otsuka Packaging Industries Co., Ltd. maintains strong presence in regulated medical packaging, delivering consistent neck-finish accuracy and clean cosmetic appearance required for prescription and OTC drugs. Toyoba Glass Co., Ltd. contributes in traditional-medicine and essential-oil packaging, providing predictable size uniformity and surface quality aligned with small-batch filling operations.

Mitsubishi Glass Co., Ltd. supports demand in premium liquid supplements where higher clarity, break-resistance, and decoration compatibility are valued. SGD Pharma Japan adds targeted supply to multinational pharmaceutical companies operating in Japan, ensuring validated quality controls and serialization support. Competition in Japan focuses on light-barrier reliability, sealing precision, chemical-compatibility stability, regulatory compliance, and dependable national distribution for pharmaceutical-grade glass packaging used throughout Japanese healthcare and wellness channels.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Capacity | 100 ml, 250 ml, 60 ml, 500 ml, Below 60 ml, Above 500 ml |

| Material Type | Lime Glass, Borosilicate Glass, Others |

| End-Use | Commercial Use, Domestic Use |

| Sales Channel | Offline, Online |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Nihon Yamamura Glass Co., Ltd., Otsuka Packaging Industries Co., Ltd., Toyoba Glass Co., Ltd., Mitsubishi Glass Co., Ltd., SGD Pharma Japan |

| Additional Attributes | Dollar demand tracked by pharmaceutical packaging needs, aromatherapy and cosmetic storage formats; borosilicate segment supported by thermal resistance requirements; strong distribution networks through healthcare packaging suppliers and online B2B channels; increasing customization for branding and labeling; regional demand aligned with pharmaceutical hubs in Kanto and Chubu. |

The demand for balsam bottle in Japan is estimated to be valued at USD 46.3 million in 2025.

The market size for the balsam bottle in Japan is projected to reach USD 67.9 million by 2035.

The demand for balsam bottle in Japan is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in balsam bottle in Japan are 100 ml, 250 ml, 60 ml, 500 ml, below 60 ml and above 500 ml.

In terms of material type, lime glass segment is expected to command 45.0% share in the balsam bottle in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Balsam Bottle Market Analysis – Size, Growth & Forecast 2025 to 2035

Japan Aluminium Bottle Market Insights – Growth, Demand & Trends 2025-2035

Demand for Balsam Bottle in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bullet Bottles in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Glass Cosmetic Bottles in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Child Resistant Bottles in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA