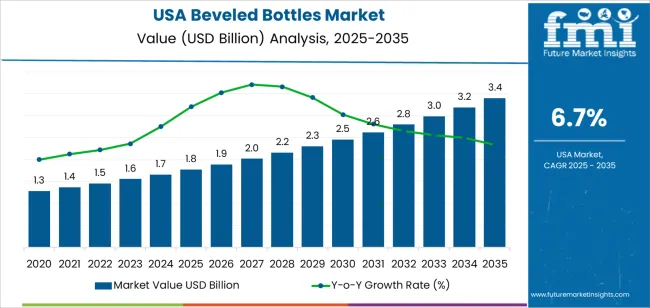

In 2025, demand for beveled bottles in the USA is valued at USD 1.8 billion and is projected to reach USD 3.4 billion by 2035 at a CAGR of 6.7%. Growth in the first half of the forecast is supported by steady expansion in packaging for personal care, food, and specialty beverages. Round shapes account for 34% of volume, followed by cylindrical at 28%, reflecting compatibility with high speed filling lines. PET holds the largest material share at 36%, driven by lightweight handling and cost efficiency, while tamper evident seals represent 33% of total closures due to regulatory and consumer safety requirements. The 3oz to 11oz capacity range leads with 38% share, serving mainstream retail packaging needs.

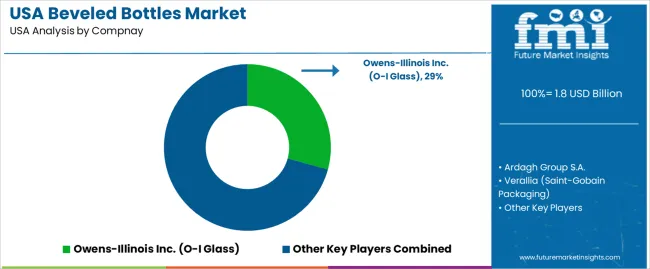

After 2030, demand growth is shaped by premiumization in packaging and wider use in storage and dispensing applications, which already account for 58% of end use. Water bottles contribute the remaining 42%, driven by private label and functional beverage formats. Bullet and oval bottle designs gain gradual share where brand differentiation and shelf visibility are prioritized. Glass retains a 17% material presence in premium segments, while HDPE at 26% supports household and industrial uses. Key suppliers active in the USA include Owens-Illinois Inc., Ardagh Group, Verallia, Saverglass Group, and Vitro Packaging. Competitive strategies focus on lightweighting, seal integrity improvement, and long term supply contracts with beverage and personal care brand owners.

The overall demand for beveled bottles in USA increases from USD 1.8 billion in 2025 to USD 2.5 billion by 2030, adding USD 0.7 billion in absolute value. This phase reflects rising adoption of premium and differentiated packaging formats across spirits, cosmetics, personal care, and high value food applications. Beveled bottle designs are increasingly used to enhance shelf visibility, brand positioning, and ergonomic handling. Growth during this period is supported by premiumization trends, wider use of custom glass packaging, and the expansion of small batch beverage brands that prioritize distinctive container formats. Demand remains structurally stable and design driven rather than volume driven.

From 2030 to 2035, the market expands from USD 2.5 billion to USD 3.4 billion, adding a larger USD 0.9 billion in the second half of the decade. This back weighted acceleration reflects deeper penetration of beveled formats into mainstream beverage packaging, including flavored spirits, ready to drink alcoholic beverages, and premium nonalcoholic products. Additional support comes from the cosmetics sector, where beveled glass bottles are adopted for luxury fragrances and skincare. As customization levels rise and decorative treatments increase, value per unit grows alongside volume, shifting demand from basic packaging replacement toward brand led value expansion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.8 billion |

| Forecast Value (2035) | USD 3.4 billion |

| Forecast CAGR (2025–2035) | 6.7% |

Demand for beveled bottles in the USA has emerged as beverage and consumer-packaged-goods brands seek packaging that stands out on crowded shelves and reinforces premium positioning. As competition intensifies across beverages, personal care, specialty condiments, and artisanal foods, companies increasingly view bottle shape not just as a container but as part of brand identity. Unique contours, bevelled edges or faceted surfaces help products differentiate visually on retail shelves and online marketplaces. Manufacturers leverage these bottles for premium sodas, craft beverages, specialty sauces, cosmetics and niche drinks where appearance and perceived value influence purchase decisions. The growth of glass packaging preference for its recyclability and inertness has supported demand for beveled-style bottles, as they pair functional benefits with design appeal.

Going forward, demand for beveled bottles in the USA will likely expand with growth in craft beverages, wellness drinks, premium condiments, and high-end personal care products. As consumer preference shifts toward premiumisation, natural ingredients, aesthetic appeal and packaging sustainability, beveled bottles offer an attractive package format combining design uniqueness, recyclability, and product protection. However, adoption may be moderated by cost considerations, increased competition from lightweight plastic or refillable packaging, and demands for sustainability or lower-cost formats in mass-market segments. Success will depend on balancing distinctive packaging design with manufacturing efficiency, supply-chain viability, and evolving regulatory or recycling pressures.

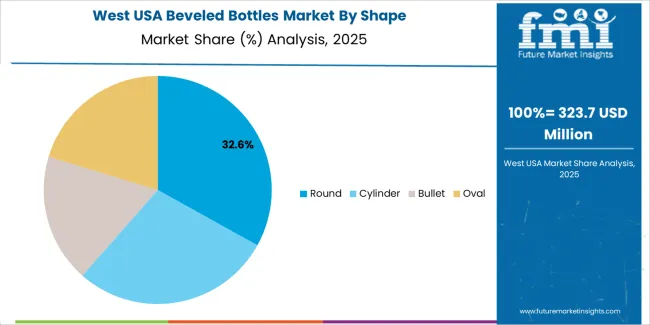

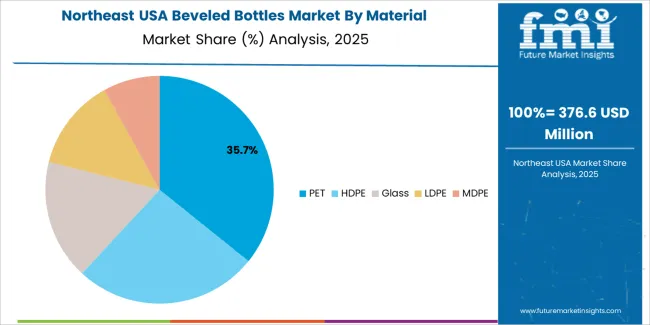

The demand for beveled bottles in the USA is structured by shape and material. Round shaped bottles account for 34% of total demand, followed by cylinder, bullet, and oval formats used across personal care, beverages, household chemicals, and health products. By material, PET leads with a 36.0% share, followed by HDPE, glass, LDPE, and MDPE. Demand patterns are shaped by visual appeal, stacking efficiency, impact resistance, and compatibility with filling technologies. These segments reflect how design preferences and material performance requirements guide beveled bottle adoption across food, personal care, and industrial packaging applications in the USA.

Round beveled bottles account for 34% of total demand in the USA. Their dominance reflects efficient load distribution, high structural stability, and ease of handling during filling, labeling, and storage. Round formats perform well under internal pressure for carbonated and semi viscous products, which makes them suitable for beverages, syrups, and personal care liquids. Uniform geometry also supports consistent label application and automated inspection performance on high speed packaging lines.

Round bottles also offer space efficient packing within cartons and pallets due to predictable contact points. Mold availability and tooling standardization reduce production cost across multiple volume ranges. Replacement demand remains strong through recurring reorder patterns in fast moving consumer goods categories. These production efficiency, logistics, and handling advantages sustain round beveled bottles as the leading shape segment in the USA.

PET accounts for 36.0% of total material demand for beveled bottles in the USA. This leadership reflects low weight, high clarity, strong barrier properties, and resistance to impact during transport. PET supports both hot and cold filling processes when properly engineered, which broadens its application across beverages, personal care, and household chemicals. Its transparency also enhances shelf visibility for retail packaged products.

PET also aligns well with high speed blow molding and labeling systems used across large scale packaging facilities. Recycling infrastructure for PET remains more developed than for other polymers, which supports recovery and reprocessing programs. Cost stability and flexible sourcing further strengthen PET adoption across regional packaging suppliers. These performance, processing, and recovery advantages position PET as the dominant material for beveled bottles in the USA.

Demand for beveled bottles in the USA is driven by brand competition in premium beverages, cosmetics, and personal care products where shelf appearance directly influences purchase decisions. Spirits, craft beverages, fragrances, serums, and specialty oils increasingly use beveled bottle designs to signal quality, precision, and visual depth. Beveled edges enhance light reflection and label visibility under retail lighting. Growth of private-label premium brands also contributes to demand as newer entrants rely heavily on packaging to establish identity. These branding and visual merchandising forces make beveled bottles a strategic packaging choice rather than a purely decorative upgrade.

In the USA, beveled bottles see strongest uptake in spirits, luxury skincare, haircare, and fragrance packaging. High-end whiskey, vodka, and tequila brands use thick-walled beveled glass to convey weight and stability. In cosmetics, beveled bottles support controlled dispensing and visual differentiation for serums, oils, and anti-aging products. Clean-label personal care brands use beveled geometry to pair minimal labels with sculpted packaging. E-commerce also amplifies this demand, as distinctive bottle profiles improve product recognition in digital marketing and influencer-driven promotion. These premium-led segments anchor consistent beveled bottle consumption.

Beveled bottle demand in the USA is limited by higher tooling, material usage, and production complexity compared with standard cylindrical bottles. Thick glass or molded plastic increases weight, which raises transport and breakage risk in long-distance shipping. Minimum order quantities restrict access for small brands. Automated filling lines optimized for standard bottles often require adjustment to handle angular profiles, adding operational cost. Recyclability challenges in complex geometries also affect sustainability metrics. These production, logistics, and cost pressures restrain beveled bottle use mainly to premium and mid-to-high price segments.

Beveled bottle design in the USA is shifting toward lightweight glass, recycled PET, and hybrid material formats to balance appearance with sustainability goals. Designers now use shallow bevels and structural contouring instead of heavy faceting to reduce material consumption. Teardrop shoulders, asymmetrical beveling, and embossed branding are gaining popularity for differentiation without excessive weight. Refillable cosmetic systems also apply beveled outer shells with replaceable inner cartridges. These trends show beveled bottles evolving from heavy luxury formats into more material-efficient, sustainability-aligned premium packaging solutions.

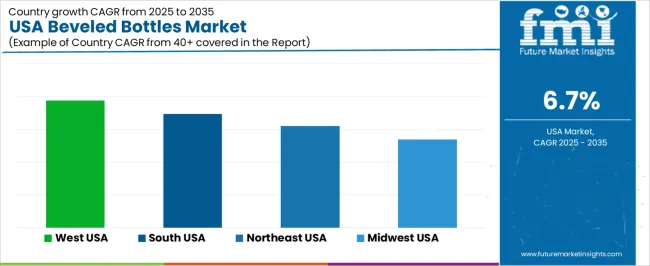

| Region | CAGR (%) |

|---|---|

| West | 7.8% |

| South | 6.9% |

| Northeast | 6.2% |

| Midwest | 5.4% |

The demand for beveled bottles in the USA is rising across all regions, with the West showing the strongest growth at 7.8% CAGR. This likely reflects expanding use of premium packaging in cosmetics, personal care, and gourmet food sectors along the western seaboard. The South, with a 6.9% rate, benefits from growth in manufacturing and distribution of packaged goods requiring distinctive bottle shapes. The Northeast at 6.2% sees steady uptake tied to urban consumer markets and demand for high-end packaging. The Midwest’s 5.4% growth suggests moderate adoption, potentially in industrial, food, or regional retail applications. Overall growth indicates increasing preference for differentiated packaging formats among producers and consumers.

Growth in the West reflects a CAGR of 7.8% through 2035 for beveled bottle demand, supported by strong premium beverage production, craft spirits, and luxury personal care packaging across coastal states. Distilled spirits, wellness drinks, and high end cosmetics favor beveled designs for shelf differentiation and brand identity. Urban consumer preferences emphasize visual appeal and upscale packaging formats. Contract fillers and glass processors maintain steady custom bottle orders. Demand remains design driven rather than volume driven, with higher unit value supporting stable revenue growth across food, beverage, and beauty packaging applications.

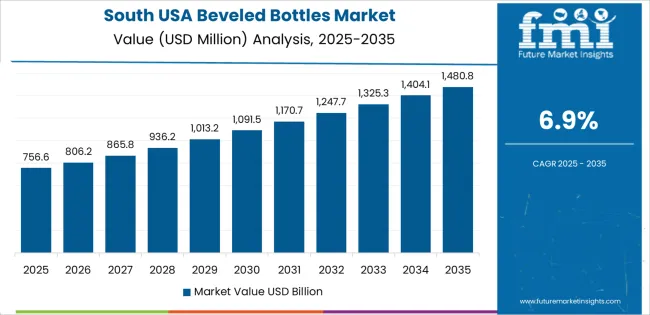

The South advances at a CAGR of 6.9% through 2035 for beveled bottle demand, driven by expanding beverage bottling capacity, flavored drink production, and growing personal care manufacturing. Craft whiskey, flavored spirits, and specialty syrups rely on decorative packaging to support retail branding. Regional glass converters supply mid volume custom runs for private label brands. Population growth fuels consistent packaged beverage consumption. Demand remains balanced between premium branding needs and cost control, with both mass and specialty bottle formats supporting steady adoption across southern food and beverage processing clusters.

The Northeast records a CAGR of 6.2% through 2035 for beveled bottle demand, shaped by premium beverage imports, specialty food packaging, and dense urban retail distribution. Wine, ready to drink cocktails, and gourmet sauces use beveled formats for brand elevation. High private label activity supports steady decorative bottle turnover. Urban shelf competition increases emphasis on visual packaging differentiation. Demand remains formulation and branding driven rather than volume led, with consistent reorder cycles from specialty beverage brands, boutique food producers, and personal care manufacturers serving metropolitan consumer markets.

The Midwest expands at a CAGR of 5.4% through 2035 for beveled bottle demand, supported by steady growth in regional beverage bottling, condiment manufacturing, and health supplement packaging. Decorative bottle usage remains selective and mostly tied to premium sub brands rather than core mass volume products. Manufacturing focused demand outweighs retail branding influence. Regional packaging suppliers favor standardized molds with limited customization. Demand remains stable and production led, guided by consistent output from food and beverage plants rather than lifestyle driven branding trends common in coastal markets.

Demand for beveled bottles in the USA is rising as beverage, spirits, cosmetics, and premium product makers seek packaging that combines aesthetic appeal and functional quality. Consumers increasingly associate glass bottles with purity, freshness, and premium positioning. This is particularly relevant for alcoholic beverages, craft drinks, perfumes, and high end cosmetics where presentation and product integrity matter. Trends toward sustainability and recyclability also support a shift back to glass packaging. As demand for craft beverages and boutique cosmetic products grows, producers favour distinctive beveled designs to differentiate on shelf and justify premium pricing.

Major firms supplying beveled and other glass bottles in the USA market include Owens Illinois Inc., Ardagh Group S.A., Verallia (Saint Gobain Packaging), Saverglass Group, and Vitro Packaging. Owens Illinois and Ardagh lead in scale and distribution of glass containers across beverages and food segments. Verallia and Saverglass offer specialized premium and custom bottle designs often used for spirits, wines, and luxury cosmetics. Vitro serves both mass market and niche clients with a range of glass container formats. Together these companies meet industry demand for durable, visually distinctive, and regulatory compliant glass bottles, shaping the bottle packaging landscape in the United States.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Shape | Round, Cylinder, Bullet, Oval |

| Material | PET, HDPE, Glass, LDPE, MDPE |

| Seal Type | Tamper Evident, White Fine Rib, Gold Fine Rib, Black Large Rib, White Coarse Rib |

| Capacity | 3oz–11oz, 0.5oz–3oz, Greater than 11oz, Less than 0.5oz |

| End Use | Packaging & Storage, Water Bottles |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Owens-Illinois Inc. (O-I Glass), Ardagh Group S.A., Verallia (Saint-Gobain Packaging), Saverglass Group, Vitro Packaging |

| Additional Attributes | Dollar-value distribution by shape, material, seal type, and capacity; regional CAGR projections; round bottles lead due to handling and filling efficiency; PET dominates material demand for weight, clarity, and recyclability; tamper evident seals required for regulatory compliance; 3oz–11oz bottles lead capacity segment for mainstream retail and personal care; packaging & storage end use dominates 58% of demand; post-2030 growth driven by premium spirits, craft beverages, cosmetic and luxury personal care adoption; decorative and functional designs increase unit value; supplier focus on lightweighting, seal integrity, and long term contracts with beverage and personal care brands. |

The demand for beveled bottles in USA is estimated to be valued at USD 1.8 billion in 2025.

The market size for the beveled bottles in USA is projected to reach USD 3.4 billion by 2035.

The demand for beveled bottles in USA is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in beveled bottles in USA are round, cylinder, bullet and oval.

In terms of material, pet segment is expected to command 36.0% share in the beveled bottles in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beveled Bottles Market Growth – Demand & Forecast 2025 to 2035

Demand for Glass Cosmetic Bottles in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Child Resistant Bottles in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Beveled Edge Jars Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA